There are often cases when a company's fixed assets require modification, completion or technical repurposing. This happens, for example, when operating equipment cannot comply with the new technologies introduced, but with appropriate reconstruction it will serve for a very long time. The issue of saving money is also important here, which is always acute in any organization: as a rule, modernizing production is cheaper than completely replacing equipment. Naturally, reconstruction costs are exclusively capital in nature and increase the initial cost. Let's consider how the cost of a modernized object increases, and we will learn how to calculate depreciation after modernization in accounting .

Depreciation after modernization

Companies have the right to modernize fixed assets that are either fully depreciated or still have a residual value. In both situations, it is necessary to take into account reconstruction costs and calculate depreciation. How to do it? The algorithm of actions is as follows:

- Accumulation of all modernization costs, i.e. collection of documented expenses and drawing up the total amount. Modernization work can be carried out by attracting third-party specialized companies, or on your own (if there is appropriate potential). The document confirming the commissioning of the facility modernized by the contractor is the acceptance certificate signed by representatives of the company and the contractor, and the scope of work and the amount of costs is the act f. KS-2 and certificate of cost of work f. KS-3. Work on the reconstruction of the facility using economic means (on our own) is confirmed by a whole block of documents: requirements-invoices for the release of goods and materials, limit cards, work orders. Completion of work and commissioning is recorded by an internal acceptance certificate indicating the full cost of the work;

- Registration of the protocol of the inventory commission for the commissioning of a modernized facility with a decision to increase the cost of the facility and increase the useful life after modernization, if the capital work carried out actually increased the SPI. In accounting, there is no procedure for determining a new SPI if an object with an expired term is being modernized, however, clause 20 of PBU 6/01 and clause 60 of the Guidelines for fixed assets accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, allow the extension of SPI if As a result of the work carried out, the functional characteristics of the facility improved. At the same time, changing the SPI of the reconstructed OS in accounting is a right and not an obligation of the company. Note that most often the SPI is extended by the amount of time necessary to write off capital costs.

- According to the Ministry of Finance, the amount of modernization costs increases the initial cost (IC) of the fixed assets, and the depreciation rates for writing off these costs are those that were initially applied when the property was put into operation. This opinion also works in practice.

By what amount is the initial cost increased?

Completion, additional equipment, reconstruction, modernization, technical re-equipment - all this is capital work.

Their cost cannot be written off at a time (clause 5 of Article 270 of the Tax Code of the Russian Federation). It increases the initial cost of the fixed asset (clause 2 of Article 257 of the Tax Code of the Russian Federation). And then written off gradually through depreciation. The amount of increase in the initial cost is determined from all the costs of modernizing the facility. To do this, you need to collect all supporting documents:

- invoice requirements for the transfer of materials to the unit carrying out the modernization;

- acts for write-off of materials;

- work orders;

- acceptance certificate, which indicates the completion date of the work and its full cost.

If the work was carried out by third-party organizations, a bilateral acceptance certificate will serve as documentary evidence of the costs incurred.

Thus, after modernization it follows (see letter of the Ministry of Finance of Russia dated July 13, 2022 No. 03-03-06/1/60600):

- add the amount of costs for its implementation to the initial cost of the operating system;

- use the depreciation rates that were initially determined when the fixed asset was put into operation.

Depreciation of the modernized OS based on the changed initial cost must begin from the date of change in value, that is, from the date of completion of the modernization work, and not from the next month (Decision of the Federal Tax Service dated January 26, 2022 No. SA-4-9 / [email protected] ). That is, if, for example, according to the taxpayer’s accounting data, the modernization was carried out in February, depreciation should be calculated in a new way in February, and not in March.

Please note: when calculating depreciation for modernized or reconstructed objects, you have the right to apply bonus depreciation.

Depreciation after modernization

An example of calculating depreciation for a fully depreciated object

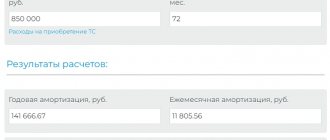

In 2022, the company completed the modernization of the production line belonging to the 4th depreciation group with SPI from 5 to 7 years. Substation lines upon commissioning (January 2010) – 500,000 rubles. The SPI was set at 80 months. Depreciation rate (RA) – 1.25% (1/80 month). Depreciation was calculated from February 2010 to September 2016, and at the end of 2016, when it was decided to reconstruct the line, the facility was completely depreciated. In March 2022, the corresponding work was completed, the amount of reconstruction excluding VAT was 350,000 rubles. From April 2022, the company begins to write off modernization costs, using the mechanism for calculating depreciation as follows:

C after modernization is 850,000 rubles. (500,000 + 350,000). The NA should be the same as at the time the line was entered, i.e. 1.25%. Consequently, the amount of monthly depreciation will be 10,625 rubles. (RUB 850,000 x 1.25/100). The costs of the completed modernization should be written off over 32 months at 10,625 rubles. (340,000 rubles), in the 33rd month the amount of depreciation will be 10,000 rubles.

Including the cost of work and spare parts in the cost of the OS

When the modernization work is completed, fill out the OS Modernization (section OS and intangible assets - OS Modernization).

Let's look at filling out the document using an example.

Document header

- The location of the fixed asset is the division in which the fixed asset being modernized is listed;

- OS event - Upgrade , is indicated automatically.

Construction object tab :

- Construction object - the name of the modernization object, where all modernization costs are collected (in our example - Multifunctional machine );

- Account - 08.03 “Construction of fixed assets”.

Calculate amounts button, the following fields will be automatically filled in with account balances on 08.03:

- Cost - the amount of costs for modernization in a used unit (in our example - 36,000 rubles),

- The cost of the NU is the amount of costs for modernization in the NU (in our example - 36,000 rubles).

Let's check the calculation performed by the program:

- engine cost - 30,000 rubles;

- the cost of installation work is 6,000 rubles. 30,000 + 6,000 = 36,000 rub.

The calculation was done correctly.

Fixed assets tab :

- Fixed asset - the fixed asset being modernized, selected from the Fixed Assets a;

- Amount - filled in automatically by clicking the Distribute ;

- Expiration date — the original SPI is set by default, manually set the useful life taking into account the change (in our example: 48 + 8 = 56 months).

Postings according to the document

The document generates the posting:

- Dt 01.01 Kt 08.03 - modernization costs are included in the cost of the fixed asset.

Calculation of depreciation during modernization

If an object with an existing residual value is being reconstructed, then monthly depreciation is calculated according to accepted standards throughout the entire period of capital work. Clause 23 of PBU 6/01 dictates the suspension of the accrual of depreciation if it continues for more than 12 months. The Tax Code of the Russian Federation in this case agrees with a similar approach (clause 3 of Article 256 of the Tax Code of the Russian Federation). After the modernized facility is put into operation, the amount of monthly deductions changes, since both the SPI and the cost of the operating system change.

The calculation of depreciation for an asset begins on the first day of the month following the month in which this object was accepted for accounting; for example, for an object put into operation in March, depreciation will begin to be calculated according to the adjusted calculation on April 1. And it doesn’t matter whether depreciation accumulations were suspended due to exceeding the legally established reconstruction period or not.

When using the linear method, depreciation in accounting is calculated using the formula:

A = (OS + M) / SPI, where:

- OS - residual value of fixed assets;

- M - modernization costs;

- SPI - new SPI after modernization or the remaining one if it has not been changed.

Calculation of depreciation during reconstruction of real estate objects.

Guided by the principles of saving production costs, in most cases the organization decides to restore production assets. And as practice shows, numerous problematic issues arise in the classification of costs incurred and the organization of accounting.

The classification of restoration costs is carried out according to the following types of work performed: repair, reconstruction, modernization or technical re-equipment.

Repair

- work to restore or replace individual parts of buildings (structures) or entire structures, parts and engineering equipment due to their physical wear and tear with more durable and economical ones that improve their performance (clause 3.8 Resolution of the State Construction Committee of the Russian Federation dated 05.03. 2004 No. 15/1 “On approval and implementation of the Methodology for determining the cost of construction products on the territory of the Russian Federation”);

Reconstruction

- this is a change in the parameters of capital construction projects, their parts (height, number of floors, area, production capacity indicators, volume) and the quality of engineering and technical support (Article 1 of the Town Planning Code of the Russian Federation dated December 29, 2004 N 190-FZ: reconstruction).

At the same time, the concept of “reconstruction” is given in paragraph 2 of Article 257 of the Tax Code of the Russian Federation for profit tax purposes. Thus, reconstruction includes the reorganization of existing fixed assets, associated with the improvement of production and increasing its technical and economic indicators and carried out under the project for the reconstruction of fixed assets in order to increase production capacity, improve quality and change the range of products.

completion, retrofitting and modernization work

according to paragraph 2 of Article 257 of the Tax Code of the Russian Federation, work is caused by a change in the technological or service purpose of equipment, a building, a structure or other object of depreciable fixed assets, increased loads and (or) other new qualities.

Thus, the result of modernization, reconstruction and technical re-equipment is an improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset object (in particular, useful life, capacity, quality of use).

And as a result of repairs, faults are eliminated and worn elements are replaced, which does not entail a change in the technical and economic indicators of the facility.

Despite the apparent difference in the concepts used, it is sometimes quite problematic to distinguish between repairs and modernization or reconstruction. The solution to this problem in the case of restoration work on real estate is a work permit issued by an authorized executive body, which determines the type of work performed (construction, reconstruction or major repairs).

If, as a result of modernization and reconstruction, the initially accepted indicators of the operation of the facility are improved (useful life, power, quality of use, etc.), the costs of restoration work are included in the increase in the initial cost of the facility. This requirement applies both for accounting and tax accounting purposes (clause 27 of PBU 6/01; clause 2 of Article 257 of the Tax Code of the Russian Federation). At the same time, in practice, disagreements arise regarding the determination of the service life and, accordingly, the calculation of depreciation for accounting and tax purposes.

Accounting:

According to the requirements of clause 20 of PBU 6/01, in cases of improvement in the initial performance indicators of the operation of a fixed asset object, as a result of reconstruction or modernization, the useful life of the object is revised.

The criteria for increasing the service life of a restored facility are not defined by current legislation. The assessment of the required increase in service life is carried out by the organization independently, based on changes in the technical operation indicators of the facility. As a justification for the actions of the accounting service, it is possible to use a report from the technical service or the relevant specialist.

Subsequently, depreciation is calculated using the straight-line method in the following order:

Amount of depreciation

= (Initial cost before restoration + Costs of restoration) / (Initial useful life + Increase in useful life in connection with restoration)

When carrying out restoration work lasting more than 12 months, the accrual of depreciation charges is suspended (clause 23 of PBU 6/ 01).

Tax accounting:

In contrast to accounting requirements, increasing the useful life of an object after restoration work (modernization, reconstruction) is a right and not an obligation of the organization. Regulations (paragraph 2, clause 1, article 258 of the Tax Code of the Russian Federation.

The application of this right requires careful assessment. At first glance, it may seem that charging depreciation when only the cost of an object increases is quite profitable, since it allows you to reduce the period of recognition of capital investments as expenses accepted for tax purposes, and, consequently, the amount of tax liabilities accrued for income tax and property tax. At the same time, the exercise of this right may lead to disputes with regulatory tax authorities. And the need to provide evidence that changes in the technical indicators of the operation of the facility (reconstruction, modernization) do not entail a change in the useful life. And this will require some effort, taking into account the direct dependence of these indicators.

It is possible not to increase the useful life and avoid disagreements only in the case of reconstruction (modernization) of objects that initially had a maximum life in the corresponding depreciation group.

So according to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, if a decision is made to increase the useful life, the increase in the period may be

carried out within the period established for the depreciation group in which the object was previously included.

The most typical example is given in the letter of the Ministry of Finance of Russia dated November 10, 2006 N 03-03-04/2/235. The bank has a car on its balance sheet. According to the classification, it is assigned to the fourth depreciation group (with a useful life of over 5 years and up to 7 years). If, when calculating depreciation, the bank established a useful life of 5 years for it in tax accounting. After modernization, the bank has the right to increase the useful life of this property by only 2 years. If the period has already been set at 7 years, then, despite the modernization, the bank does not have the right to increase the useful life of this depreciable property.

Thus, the procedure for calculating depreciation charges for tax purposes is based on the principle of applying the depreciation rate only within a certain depreciation group, regardless of changes in the value of the object. In relation to the example under consideration, the bank can calculate depreciation on a car using a depreciation rate ranging from 0.0164% (1/61 month x 100%) to 0.0119% (1/84 month x 100%).

As a result of the implementation of this principle, when carrying out modernization (reconstruction), in practice, cases of under-writing off and, conversely, premature writing-off of the original cost of an object during a certain useful life arise.

Based on the data in the above example, we will calculate depreciation if the useful life is increased and the useful life remains unchanged:

Example:

The car was accepted for accounting at an original cost of RUB 300,000. and a useful life of 61 months (fourth depreciation group). Depreciation is calculated using the straight-line method. Before reconstruction, the facility was in operation for 27 months. Reconstruction costs amounted to 50,000 rubles.

1. Calculation of depreciation before reconstruction:

The amount of depreciation per month is 4,920 rubles. (RUB 300,000 x 0.0164%: 100%), where:

0.0164%= 1: 61 months. x 100% (depreciation rate).

From the moment of commissioning until the moment of reconstruction, depreciation accrual is 132,840 rubles. (RUB 4,920 x 27 months).

The initial cost after reconstruction will be 350,000 rubles. (RUB 300,000 + RUB 50,000).

2. If the useful life is increased to 7 years (84 months):

The amount of depreciation per month is 4,165 rubles. (RUB 350,000 x 0.0119%: 100%), where:

0.0119%= 1: 84 months. x 100% (depreciation rate).

From the moment of reconstruction until the end of its useful life, depreciation will amount to RUB 237,405. (4,165 rub. x (84 months - 27 months)) = (4,165 rub. x 57 months).

The amount of accrued depreciation over a certain period will be 370,245 rubles. (RUB 132,840 + RUB 237,405). The excess of the original cost is 20,245 rubles. (350,000 rubles - 370,245 rubles), which is not acceptable. Consequently, the period for writing off the initial cost will not be 57 months. (84 months - 27 months), and 52 months. (RUB 217,160/RUB 4,165).

3. If the useful life remains unchanged:

The amount of depreciation after reconstruction per month is 5,740 rubles. (RUB 350,000 x 0.0164%: 100%).

After reconstruction until the end of its useful life, depreciation will amount to RUB 195,160. (5740 rub. x (61-27 months).

The amount of accrued depreciation over the established useful life will be RUB 328,000. (RUB 132,840 + RUB 195,160).

At the end of the period, the initial cost is 22,000 rubles. (350,000 rubles - 328,000 rubles) remains not written off.

According to the Russian Ministry of Finance, the amount of depreciation is subject to write-off after the expiration of the useful life within 4 months (RUB 22,000 x RUB 5,740). So 17,220 rubles. (5,740 rub. x 3 months), subject to write-off within 3 months, and 4,780 rub. (RUB 22,000 – RUB 17,220) in the fourth (last) month.

Reducing the depreciation period as a result of premature write-off does not contradict the requirements of the Tax Code of the Russian Federation. In accordance with the requirements of clause 5 of Article 259.1 of the Tax Code of the Russian Federation, the accrual of depreciation stops on the 1st day of the month following the month when the cost of the depreciable property was completely written off, or when this object was removed from the taxpayer’s depreciable property for any reason.

Accrual of depreciation in case of underwriting of the original cost, according to the Ministry of Finance of Russia, is quite justified due to the need to include in expenses the entire amount of capital investments made (Letters of the Ministry of Finance of Russia dated November 10, 2006 N 03-03-04/2/235; dated 02.03 .2007 N 03-03-06/1/146, dated 06/15/2007 N 03-03-06/1/380, dated 04/04/2007 N 03-03-06/1/219). At the same time, the conclusions of the Russian Ministry of Finance are not unambiguous. A literal reading of clause 5 of Article 259.1 of the Tax Code of the Russian Federation indicates that there is no basis for recognizing depreciation on objects with an expired useful life, due to the fulfillment of the second of the listed conditions, namely the disposal of the object from the depreciable property.

In accordance with the requirement of paragraph 1 of Article 258 of the Tax Code of the Russian Federation: “ For the purposes of this chapter, depreciable property is recognized as property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by this chapter) and are used by him to generate income and the cost of which is repaid by depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 20,000 rubles.”

Accordingly, the procedure for writing off the amount of depreciation not written off during a certain useful life remains unclear, and whether it is worth following the letters of the Ministry of Finance of Russia remains the choice of the organization.

The procedure for calculating depreciation in the event of reconstruction of an object previously in operation by the previous owner is subject to separate consideration.

In accordance with the requirement of paragraph 12 of Article 259 of the Tax Code of the Russian Federation: “An organization purchasing used fixed assets has the right to determine the depreciation rate for this property taking into account the useful life reduced by the number of years (months) of operation of this property by the previous owners . If the period of actual use

the previous owners of this fixed asset will be equal to or exceed

its useful life,

determined by the classification of fixed

assets approved by the Government of the Russian Federation in accordance with this chapter,

the taxpayer has the right to independently determine the useful life of this fixed asset, taking into account safety requirements and other factors

.”

Based on the data from the initially given example, a calculation of depreciation was carried out in the case of purchasing a used object.

Example:

The company accepted the car for accounting at an initial cost of 300,000 rubles. According to the tax records of the previous owner, the car belonged to the fourth depreciation group, which assumes the use of property from 5 to 7 years. And it was in operation for 8 years, at the time of sale it was completely depreciated. Depreciation is calculated using the straight-line method. Before the reconstruction, the facility was in operation for 2 months. Reconstruction costs amounted to 50,000 rubles.

1. Calculation of depreciation before reconstruction:

The life of the car by the previous owner was 8 years and its useful life was determined by the classification of fixed assets. Therefore, in accordance with paragraph 12 of Art. 259 of the Tax Code of the Russian Federation, the company has the right to independently determine the useful life of the purchased vehicle. Guided by the requirements of clause 1 of article 258 and clause 12 of article 259 of the Tax Code of the Russian Federation, the minimum useful life, in the case of acquiring an object that has been in operation for a long period exceeding the maximum period determined by the classification of fixed assets, should be 13 months ( over 12 months). At the same time, the period must be determined taking into account the period of possible use of the property in the company’s activities in the future, its ability to generate income and technical characteristics (clause 1 of article 258 of the Tax Code of the Russian Federation, clause 4 of PBU 6/01). Which in turn serves as the basis for disputes with regulatory tax authorities, especially with a significant level of capitalization carried out and the amount of accrued depreciation.

The amount of depreciation per month is 23,070 rubles. (RUB 300,000 x 0.0769%: 100%), where:

0.0769%= 1: 13 months. x 100% (depreciation rate).

The accrued amount of depreciation before reconstruction is 46,140 rubles. (RUB 23,070 x 2 months).

2. The initial cost after reconstruction will be 350,000 rubles. (RUB 300,000 + RUB 50,000).

As noted earlier, after reconstruction, the company was given the right to increase the useful life. At the same time, an increase in the useful life of fixed assets can be carried out within the time limits established for the depreciation group in which such fixed assets were previously included (clause 1 of Article 258 of the Tax Code of the Russian Federation). An increase in the period cannot be carried out for a period exceeding the maximum established by the classification for this group of fixed assets (Letter of the Ministry of Finance of Russia dated November 10, 2006 N 03-03-04/2/235).

In the case under consideration, the company is given the right to extend the useful life of the car for a period not exceeding 7 years. In this case, the depreciation rate is determined taking into account the increase in useful life (clause 2 of Article 259.1 of the Tax Code of the Russian Federation).

Let’s assume that the useful life is increased by 2 years (24 months):

The amount of depreciation per month will be 9,450 rubles. (RUB 350,000 x 0.0027%: 100%), where:

0.0027%= 1: (13 months + 24 months) x 100% (depreciation rate).

Subsequently, depreciation will be charged in the amount of RUB 303,860. (350,000 rubles – 46,140 rubles) for 33 months, taking into account the write-off of 1,460 rubles. in the last month.

3. If the company accepts the existing tax risk and applies the initial depreciation rate applied before the reconstruction of the facility, depreciation is calculated in the following order:

The amount of depreciation after reconstruction per month is 26,915 rubles. (RUB 350,000 x 0.0769%: 100%).

Before the expiration of the useful life, the amount of accrued depreciation will be written off in the amount of RUB 303,860. within 12 months, so 296,065 rubles. within 11 months and 7,795 rubles. in the last month.

As can be seen from the above example, writing off the costs of reconstruction without changing the useful life of the object is the most profitable and the most risky, depending on the level of materiality of the costs incurred.

In addition to the above-mentioned features of accounting for the costs of reconstruction (modernization) of objects owned by an organization, in practice the question of the procedure for calculating depreciation for an object (building) that has been partially under reconstruction for more than 12 months often arises.

According to the opinion of the Ministry of Finance of Russia set out in a letter from the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation dated November 2, 2007. No. 03-03-06/1/765, depreciation of the part of the building actually in operation is allowed only if the building is divided into separate premises.

Taking into account the above, in order to minimize tax risks, in the case of reconstruction of only part of the object, it is necessary to first divide the object into separate inventory objects. In relation to a building, it is necessary to register and take into account individual premises.

Auditor of CJSC "Siberian Legal Company - Audit"

Mozgovaya Nadezhda Valentinovna

Depreciation after modernization

An example of a calculation for an object with an existing residual value:

The machine was retrofitted at an initial cost of RUB 220,000. and SPI 5 years after 3 years of operation in the amount of 50,000 rubles. The machine has been in operation since February 2013, depreciation has been calculated since March 2013. The modernization of the machine began in January 2016 and ended in February 2016 inclusive. Depreciation was accrued in the amount of RUB 132,000. (220,000 / 60 x 36). After retrofitting, SPI was increased by 2 years, and depreciation, taking into account the increase in cost and SPI, began in March 2016.

Monthly depreciation amount:

(220,000 – (220,000: 60 months x 36 months) + 50,000) / 48 months = 2875 rubles , i.e. PS is reduced by the amount of accrued depreciation of 132,000 rubles. (220,000 / 60 x 36) and increases by the amount of modernization. The resulting cost of the operating system is divided by 48 months, i.e. by the established SPI.

Based on this calculation algorithm, it is easy to determine deductions for other methods of calculating depreciation.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.