How is transport tax calculated for pensioners?

All citizens who own any type of transport, including people of retirement age, by virtue of the provisions of Article 35 of the Tax Code of the Russian Federation are recognized as payers of transport tax.

The authorities of the Federal Tax Service of Russia (FTS) are calculating the transport tax for pensioners in 2022. They send notices to payers with the amount due, which they are obliged to pay to the budget before December 1 of the year following the expired tax period. The tax is regional - all funds collected go to local budgets and are distributed for the repair and maintenance of roads and transport infrastructure. The rules and rates are set by regional authorities. The following are subject to tax:

- cars and trucks, with the exception of those specially equipped for use by disabled people or purchased through social protection authorities, with an engine power of up to 100 hp. With. (Clause 2, Clause 2, Article 358 of the Tax Code of the Russian Federation);

- buses;

- motorcycles, scooters;

- other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, with the exception of tractors and agricultural machinery (clause 5, clause 2, article 358 of the Tax Code of the Russian Federation);

- airplanes, helicopters and other air vehicles;

- motor ships and yachts (with some exceptions).

ConsultantPlus experts analyzed how individuals calculate and pay transport tax. Use these instructions for free.

Property tax benefits

The amount of property tax relief for pensioners in 2022 is fixed at both the local and federal levels. Not only pensioners, but also people of pre-retirement age count on this type of financial support.

The calculation scheme is familiar - the holder of the benefit can choose only one piece of real estate, which will not be subject to taxation. These include:

- House, part of a house;

- Apartment, part of it;

- Room;

- Garage or other place intended for parking cars;

- Construction on a summer cottage area of up to 50 square meters. m.;

- And other premises (including those where a person is engaged in creative or any other activity, but does not use it for commercial purposes).

That is, if a pensioner is the owner of a private house on land and an apartment in a new building, then he is completely exempt from tax payments. If, for example, there are two houses on land and an apartment, he can choose one of the private houses for state support. Notification of your choice must be submitted before December 31 of the current year, for which the tax is calculated.

In the event that a citizen for some reason has not applied for a benefit for the property he has chosen, the inspectorate will independently provide it for the largest tax amount of the property owned.

Any profit made using real estate deprives the pensioner of the right to financial support for tax payments.

If a benefit recipient purchases a new house or is engaged in construction on his own, then he can write an application to the tax authority for reimbursement of cash expenses - a tax deduction.

What benefits are provided for pensioners

There are no transport tax benefits provided at the federal level. But regional authorities have the right to independently establish benefits, so pensioners do not pay transport tax for 2022 in many Russian regions, especially if they belong to other preferential categories. The conditions for receiving preferences differ. In some places, they are completely exempt from payment, with minimal conditions, while in others, compliance with the established framework is required. The benefit is of a declarative nature; tax authorities do not automatically provide it. A pensioner-beneficiary is required to confirm his right to preferences, if any, with documents.

Registration of benefits

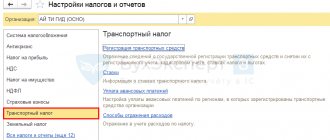

To apply for a transport tax benefit, you need to contact the tax authority at your place of registration. The application is filled out here; errors and corrections are not allowed. If you encounter difficulties filling out the form yourself, you can seek the help of a specialist.

Benefits are provided from the moment the inspection specialist accepts the full package of documentation.

The application form can usually be obtained directly from the Federal Tax Service; the document must include the required information:

- in the upper right corner the name of the body, position and full name of the specialist to whom the application is submitted is indicated;

- Full name is indicated just below. and the applicant’s date of birth, as well as TIN;

- applicant's telephone number;

- passport data;

- reference to the legislative act on the basis of which the benefit is provided;

- complete information about the car: registration date, power, make, etc.;

- an indication of the requirement to provide a benefit;

- list of attached documentation.

The date and signature of the payer are indicated under the text of the application.

How to get a vehicle benefit

- Personally appear at the inspection with the required package of documentation and hand it over to a specialist. You can do this through a representative, but you will additionally need a notarized power of attorney.

- Send a package of papers by mail. Then the photocopies will first have to be certified. It is not necessary to visit a notary; it is enough to sign, date and the phrase “true copy” on each sheet. Such documentation is sent by letter with notification. Be sure to include an inventory with a list of papers. The second copy of the inventory will remain on hand, and a delivery notification will also be returned. These documents can serve as proof that the letter was sent in the event of litigation.

Interesting information: Tax benefits for pensioners: what they are and how to get them

In your personal State Services account, you will additionally have to go through a confirmation procedure. It's free, but takes some time. You will receive an email with a code that you must enter to confirm your data.

Inspectorate specialists will help you register your personal account on the Federal Tax Service website. To do this, you need to contact them with your passport. They will give you a username and password, which you then need to change.

The applicant decides independently how to apply for the benefit. The optimal solution is considered to be a personal contact, since if any shortcomings are found, they can be corrected on the spot. Accordingly, registration does not take much time. If you send documents by mail, the procedure is delayed: until the item arrives, then the documents will be checked and sent back. These procedures will take a lot of time.

Important!

Review of the documentation takes place within ten days, after which the applicant receives a notification of the granting of the privilege.

The situation in the regions of the Russian Federation: Moscow, St. Petersburg and the Moscow region

Regional legislation in different regions of the Russian Federation differs. In this regard, the transport tax by region for 2022 for pensioners is established according to various regulations issued on the basis of the Tax Code of the Russian Federation. In Moscow there are no separate transport tax benefits for citizens of retirement age. Article 4 of Moscow Law No. 33 dated 07/09/2008 states that owners of one vehicle with an engine power of up to 200 hp are exempt from paying transport tax. With. (up to 147.1 kW), if they are:

- veterans and disabled people of the Great Patriotic War;

- veterans and disabled combat veterans;

- Heroes of the Soviet Union, Heroes of the Russian Federation or awarded the Order of Glory of three degrees;

- disabled people of groups I and II;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis during the Second World War;

- one of the parents (adoptive parents), guardian, trustee of a disabled child;

- one of the parents (adoptive parents) in a large family;

- a person exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant, the accident at the Mayak production association and the discharge of radioactive waste into the Techa River, nuclear tests at the Semipalatinsk test site, or a person who was directly involved in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations on weapons and military facilities;

- a person who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

- one of the guardians of a disabled person since childhood, recognized by the court as incompetent.

In this regard, transport tax in 2022 in Moscow for pensioners is calculated on a general basis if they do not fall into one of these categories. Even for veterans of labor there are no benefits.

In the Moscow region, benefits are regulated by several legal acts:

- Article 3 of Law MO No. 129/2002-OZ;

- Articles 25, 26.8, 26.19, 26.31 and 26.32 of the Law of the Ministry of Defense No. 151/2004-OZ;

- Articles 1, 2 of the Law of the Ministry of Defense of December 24, 2020 No. 295/2020-OZ.

But there are no preferences for ordinary pensioners. Full exemption for one passenger car with an engine power of up to 150 hp. With. (up to 110.33 kW) inclusive or a motorcycle (motor scooter) with an engine power of up to 50 hp. With. (up to 36.8 kW) participants and disabled people of the Second World War, Heroes of the USSR and Russia, disabled people from childhood of groups I-II, citizens exposed to radiation at the Chernobyl nuclear power plant have the right. 50% is paid by group III disabled people and combat veterans. According to the law, transport tax for pensioners in the Moscow region in 2022 will be charged in full if they do not belong to preferential categories.

In St. Petersburg, preferences are regulated by the St. Petersburg Law of November 4, 2002 No. 487–53. The city has more comfortable conditions for older car owners. In addition to the preferential categories listed above (for Moscow and the Moscow region), men and women who have reached the age of 60 and 55 years, respectively, and pensioners of all categories are exempt from paying for one vehicle. The Federal Tax Service does not charge transport tax for 2022 in St. Petersburg for pensioners who have confirmed their desire to receive an exemption from payment for a specific car with an application and documents.

Who gets transport tax benefits in Moscow and the Moscow region?

In Moscow and the region, different categories of citizens can take advantage of transport tax benefits, including military veterans (hereinafter referred to as VBD) or the Great Patriotic War.

The title of VBD is assigned to citizens on the basis of Federal Law No. 5-FZ dated January 12, 1995, if they meet the established requirements:

- Current or former military personnel transferred to the reserve, members of the National Guard troops, employees of the penitentiary system and other persons sent to other countries on behalf of the authorities of the USSR or the Russian Federation to perform official duties and participate in combat operations;

- Persons traveling to Syria since 2015 to ensure the implementation of special tasks;

- Citizens participating in work to clear mines from the territories of the USSR and other states after the end of the Patriotic War until the end of 1951;

- Military personnel participating in special operations in Dagestan in August-September 1999;

- Employees of motor vehicle battalions sent during military operations to Afghanistan to perform official tasks;

- Flight personnel who participated in operations in Afghanistan.

Thus, the title of VBD is assigned to almost all citizens who took part in military operations on the territories of different states, defined by the annex to the above Federal Law No. 5.

The VBD certificate is issued by decision of the command and a special commission. Subsequently, it can be used to apply for various benefits, incl. and payment of transport tax.

In addition to UBI, veterans of the Great Patriotic War are also entitled to privileges. This title is awarded on the basis of Art. 2 and 4 Federal Law No. 5 for certain categories of citizens:

- Military personnel, incl. and those transferred to the reserve, who served in military units and headquarters: partisans, members of underground institutions in the temporarily occupied territories of the USSR, participants in combat operations;

- Persons of command and rank and file of the fire service, army, penal system, state security;

- Citizens who took part in collecting military supplies and clearing mines in the period from June 22, 1941 to the end of 1951;

- Participants of the Second World War;

- Intelligence officers, counterintelligence officers who carried out special assignments;

- Awarded the medal “For the Defense of Leningrad”, the badge “Residents of besieged Leningrad”;

- Those who worked behind the lines during the war.

The assignment of veteran rank was carried out with the participation of the Ministry of Defense, the Ministry of Internal Affairs, the FSB and other institutions. Until 2000, many citizens received it, but even now those who were not issued a certificate can apply to the military registration and enlistment office with documents. But if there are such people, they are few and far between.

If they have certificates, veterans of the Great Patriotic War or military operations can enjoy benefits in paying transport tax. They are determined by regional authorities, and in some cases limits are set on the number of hp.

Benefits are provided only for one unit of equipment owned by the beneficiary. If a veteran has several cars, he can only apply for privileges for one.

In addition, if there are several grounds for obtaining a benefit, only one can be used. Full or partial addition of tax benefits is not provided.