Why tax authorities don't like losses

The main task of inspectors is to collect taxes to replenish the budget. According to the Federal Tax Service, any commercial enterprise is created for the systematic purpose of making a profit.

If there is no profit for several tax periods, and the company continues to operate, then the tax authorities begin to suspect that the matter is dirty. After all, working at a loss is unprofitable. And, perhaps, the company violates the law: it inflates expenses, hides income, etc., that is, in one way or another it receives an unjustified tax benefit.

How best to explain a loss to tax authorities

The Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 24, 2006 No. 18 states that making a profit is the goal of entrepreneurial activity, and not its obligatory result.

You can substantiate losses by collecting evidence that the organization conducted ordinary business activities, the purpose of which was to make a profit, and explain why this activity did not bring profit.

The reasons that led to the loss determine which “exculpatory” documents are needed in each specific case. Let's look at them:

- Development of new types of activities. Here, the supporting document will be a business plan, which will show that losses are related to the specifics of the new activity and are planned in advance for the first few years. The business plan should also show when the investment will begin to pay off.

- Unprofitable sale of goods. In any organization, situations may arise when goods are sold at a price below cost. The fact of such sales must be confirmed by an act of the inventory commission and an order from the manager to reduce prices, drawn up on the basis of this act. The act must provide data on the quality of the product, its properties and characteristics, as well as the reasons why this product cannot be sold at a profit; cite the conclusions of the inventory commission that in these circumstances the organization has to make a sale at a loss.

- Dumping policy. Let's say a company decides to oust competitors and expand its sales market through a temporary reduction in prices, planning to significantly increase future sales volumes due to this. These intentions must be substantiated through the organization’s marketing policy, through a business plan and a sales market development plan. The expected effect of these activities must be shown in numbers.

- Changes in supplier prices. Let's assume that a long-term contract with fixed prices (let's say in rubles) has been concluded with the customer. According to the terms of the contract, upward price revisions are not provided. And the contract with the supplier is in foreign currency (imported products). A loss here may arise due to fluctuations in exchange rates. If the question arises about why the organization did not terminate the contract, which suddenly became unprofitable, it is necessary to provide the tax authorities with evidence that, by terminating the contract, the organization would have suffered even greater losses in fines. And a profitable customer, with whom there may be other contracts or prospects for contracts, would be lost.

- The customer (buyer) refused the previously concluded contract. Or, a similar situation, when the termination of economic relations occurred due to a change in the owner of the customer. In these situations, it is necessary to present to the tax authorities an agreement to terminate the contract, correspondence with the former counterparty in connection with a change of owner, and correspondence with counterparties regarding the conclusion of new contracts.

- Force majeure (flooding, fire, office destruction, etc.). In this case, you need to have a certificate from the government agency that recorded this situation, and be sure to draw up an inventory list in connection with the losses.

Well, if the income tax loss ended not in the year, but in any of the intermediate periods, it is important to convince the tax authorities that since the final calculation is made based on the results of the year, and the organization has to close a large contract at the end of the year, then there is no reason to doubt that the year ends with a profit.

What happens if you show a loss in the declaration?

If the declaration for the reporting (tax) period shows a loss, tax authorities can send to the taxpayer a request for clarification in the form KND 1165050 (Appendix No. 4 to the order of the Federal Tax Service of Russia dated November 7, 2018 No. MMV-7-2 / [email protected] ).

More often, the attention of tax authorities is drawn to losses in income tax reporting. Taxpayers who work under the simplified “income minus expenses” regime may also attract attention with an unprofitable declaration. But they report to the Federal Tax Service only once a year, while income tax payers report quarterly or monthly.

By the way, the size of the loss does not matter. For inspectors, the very fact of its presence is sufficient.

It is important to respond to the request in a timely manner. You should not ignore it, as the sanctions can be severe, including the appointment of an on-site tax audit.

Option 2. Send explanations

If you are not going to revise the declaration, you need to draw up a convincing justification for the amount of losses. It is drawn up in any form, indicating the reasons that resulted in the losses.

Let's look at typical situations in which the tax office requests clarification and provide sample responses to the request.

Based on the results of the reporting (tax) period, a loss was received

This often happens with newly registered businesses or organizations that are developing a new direction and investing a lot of money in the purchase of equipment, real estate, materials, etc.

“Oldies” are also not insured against losses. The reason may be a seasonal drop in demand, a large one-time expenditure, bankruptcy of a counterparty, changes in contract terms, etc.

If the loss was incurred due to coronavirus and the self-isolation regime, there are no specific explanations. The lack of income is understandable, since many companies could not work, but still paid wages, rent, utilities, etc. In the explanation, describe the circumstances and refer to decisions of federal, regional and local authorities, for example, Presidential decrees on non-working days dated March 25. 2020 No. 206, dated 04/02/2020 No. 239.

Loss from the sale of purchased goods

Explanations may also be requested when the loss in the declaration is shown only on the sale of purchased goods. In this case, the tax authorities suspect that the company violated the rules for accounting for expenses when selling goods (Article 268 of the Tax Code of the Russian Federation) or incorrectly distributed expenses into direct and indirect (Article 320 of the Tax Code of the Russian Federation).

First of all, check whether you really sold the goods for less than you bought. If you find an error, please correct it. If everything in the declaration is correct, prepare an explanation.

Reducing the tax base due to losses from previous years

When checking a profitable declaration, the tax office may also require an explanation of losses. This happens if the tax base is reduced in the report due to losses from previous years. This right of tax authorities is not directly stated in the law, but arbitration practice shows that courts can support the desire of tax authorities to interpret clause 3 of Art. The Tax Code of the Russian Federation is expansive (Resolution of the Arbitration Court of the Eastern Military District dated January 18, 2016 N F01-1806/2015 in case No. A11-372/2015).

Report on profits and other taxes via Extern for free

Deadlines for responding to a request

The period must be counted from the date of receipt of the request.

If the taxpayer reports to the Federal Tax Service on paper, then the tax authorities will send the request by registered mail. The date of its receipt is considered to be the 6th day from the date of sending the letter.

If the taxpayer interacts with the Federal Tax Service electronically, then the request will be received electronically. And the deadline for responding to a request must be counted from the day the receipt of its acceptance is sent. However, delaying the sending of the receipt and thereby gaining time for the taxpayer will not work. The Tax Code of the Russian Federation also gives only 6 days to send the receipt (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

Important: we remind you that if a clause of the Tax Code of the Russian Federation does not indicate that calendar days are meant, you need to count the period according to working days.

If the tax authorities do not receive the receipt within the prescribed period, then within 10 days they can block the taxpayer’s current account (clause 2, clause 3, article 76 of the Tax Code of the Russian Federation).

Next, after sending the acceptance receipt, you have 5 days to respond to the requirement (clause 3 of Article 88 of the Tax Code of the Russian Federation).

In the Astral Report 5.0 , unanswered requests from the Federal Tax Service are displayed directly on the main page. And the auto-confirmation function will protect the user from account blocking.

Limitations when carrying forward losses

The Tax Code defines a number of restrictions that are imposed on the transfer of losses to the future. The following losses cannot be transferred:

- If they were received by the taxpayer in the period when an income tax rate of 0% was applied on the grounds set out in paragraphs 1.1, 1.3, 5, 5.1 of Article 284 of the Tax Code of the Russian Federation.

- If they are received from the sale or disposal in another form of shares of Russian companies that have been continuously owned by a legal entity for more than five years, and if these losses meet at least one of the criteria that are named in paragraph 2 of Art. 284.2 Tax Code of the Russian Federation. However, the income tax rate on such transactions is also, according to clause 4.1 of Art. 284 of the Tax Code of the Russian Federation, equal to 0%.

- If the loss was incurred under the simplified tax system or unified agricultural tax, and in the new period the taxpayer switched to the general taxation regime. These restrictions are determined by the rules contained in paragraph. 9 clause 5 art. 346.6, para. 8 clause 7 art. 346.18 of the Tax Code of the Russian Federation, and by letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-03-06/1/617.

- If an organization participates in the Skolkovo project, then the loss received before tax exemption is for the future, in accordance with clause 9 of Art. 246.1 of the Tax Code of the Russian Federation, is not transferred.

ConsultantPlus experts explained how to correctly reflect the transfer of losses in the income tax return. Learn the material by getting trial access to the system for free.

How to respond to a request

The taxpayer has two options:

1. Send an updated declaration in response.

For example: if an error has crept into the initial reporting, and in fact there is no loss.

It is not necessary to attach explanations to the clarification. But it is worth transferring taxes and penalties to the budget before submitting corrective statements in order to avoid a fine.

2. Provide an explanation and justify the reasons that led to the loss.

Explanations are drawn up in any form. Write that the loss was the result of ordinary business activities and is temporary.

You can attach supporting documents if it is in your interests. In this situation, attaching documents is a right, but not an obligation, of the taxpayer.

If the loss is shown in the income tax return for the reporting period, and the year has not yet ended, note in the explanations that you expect the situation to improve at the end of the year.

For example: final payment from a client under a major contract.

What reasons can be indicated in the explanations:

1. Development or launch of new activities.

For example: a company opened a new store or purchased expensive equipment, but the expenses did not have time to pay off during the tax period.

2. Selling goods at a loss.

For example: we sold a seasonal product with discounts at a price lower than the purchase price, since it was expiring.

3. Changes in supplier prices due to currency fluctuations.

For example: an enterprise has entered into a long-term contract with a customer at a fixed price. And materials purchased from a foreign supplier have increased in price due to increased exchange rates. But it is not profitable for the company to terminate the contract with the customer, since losses on penalties and fines will be even higher.

4. Insolvency of the counterparty.

For example: the customer’s financial condition sharply deteriorated, and he refused the deal, while some of the work had already been completed, and funds had also been spent on materials and components.

5. Unprofitability of the industry as a whole.

Many industries suffered significant losses and losses during the pandemic and were never able to recover.

Submit your reports through Astral Report 5.0 . In the service you can not only receive notifications from the Federal Tax Service, but also send response letters with attachments.

“Easy” profit will save reporting

Wanting to get a loan, the accounting department strives to create reporting acceptable to the borrower, creating disagreements between the accounting department and the accounting department. A similar result can be obtained by forming a permanent tax asset (PTA), which is formed when receiving property assistance from business owners.

A defining feature of the crisis situation in the market was the frequent occurrence of operations to invest funds of the parent company in a subsidiary. If we use the provisions of Article 27 of the Law “On LLC” dated February 8, 1998 No. 14-FZ, then the constituent documents of the company may stipulate the rights or obligations of company participants to make contributions without increasing the capital. In other words, money can be transferred from business owners to the company, for example, for development or to cover losses.

As for the reporting of Strelka LLC, there are two options for accounting for the listed amounts: one of them is through additional capital (account 83). But when the owner participates in the capital by more than 50 percent, as in the described case, then nothing will prevent you from showing the money allocated for financial support in the 91st account, since they are transferred in order to improve the financial result. These funds are not a contribution to the authorized capital and do not increase the parent company’s share in the subsidiary. Rather, it is gratuitous assistance related to the owner’s desire to keep the “daughter” afloat. While in BU financial assistance for the company that received it will be income, NU is structured somewhat differently: in the Tax Code there is Article 251 (subclause 11, clause 1, Article 251 of the Tax Code of the Russian Federation), which allows you not to take into account the contribution of property by persons owning shares in the management company exceeding 50 percent. Therefore, the accountant will have to reflect permanent tax differences in the form of PTA.

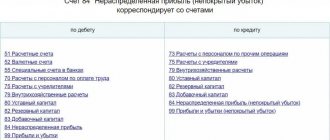

In order to comply with the methodology and show deferred tax, the organization’s accountant should reflect the posting through account 68 - multiply the accounting profit by the income tax rate and calculate the conditional expense. In this case, the amount will be 200,000 rubles. (RUB 1,000,000 x 20%). Next, the differences are reflected - IT and PNA. Since the difference between the expenses accounted for in accounting and accounting records is equal to 700,000 rubles, the deferred tax liability will be 140,000 rubles. (700,000 x 20%). Since, according to the conditions of the case, funds in the amount of 900,000 rubles were received from the parent company, the amount of the permanent tax asset will be 180,000 rubles. (RUB 900,000 x 20%). It is worth recalling Article 283 of the Tax Code, which states that a tax loss can be recognized in subsequent tax periods within ten years. Thus, if a tax loss occurs, posting D 09 K 68 will appear, reflecting IT for the amount that can be used to reduce income tax in subsequent tax periods (RUB 600,000 x 20%). That is, in the future, income tax will be reduced by this amount. Having reflected IT, we get “0” on account 68, which should have ultimately arisen due to the fact that income tax was not charged (see Table 2).

Table 2. Formation of PNO, ONO and ONA when reflecting profit in accounting and loss in NU

| Indicators | Tax accounting | Accounting | ||

| Calculation of amounts | Sum | Wiring | ||

| Conditional income tax expense | – | 1,000,000 rub. x 20% | 200,000 rub. | D 99 K 68 |

| IT was formed | – | 700,000 rub. x 20% | 140,000 rub. | D 68 K 77 |

| PNA shown | – | 900,000 rub. 20% | 180,000 rub. | D 68 K 99 |

| ONA has been formed (we assume profit in the future) | – | 600,000 rub. x 20% | 120,000 rub. | D 09 K 68 |

| Profit | 600,000 rub. | RUB 1,500,000 + 900,000 rub. – (RUB 2,100,000 – RUB 700,000) | 1,000,000 rub. | — |

| Current income tax | 0 rub. | – | – | – |

What happens if the explanations don’t help?

There are several options for further developments:

- The head (representative) of the company will be called to the inspection for a loss-making commission (we will tell you more below).

- Based on the results of the desk audit of the company’s declaration, additional taxes will be assessed.

- Tax officials will include the enterprise in the on-site inspection plan.

Let us immediately make a reservation that this is the most negative scenario that can work if the company shows a loss over several tax periods. According to the Concept of planning tax audits (Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06/ [email protected] ), a loss that “migrates” from declaration to declaration over two or more periods is one of the risk criteria.

However, an organization’s compliance with only one criterion does not constitute grounds for its inclusion in the inspection plan. Since the company’s activities are considered by tax authorities comprehensively and comprehensively.

What happens when filing an income tax return if there is a loss?

A tax loss is a negative result that arises in line 100 of sheet 2 of the declaration when the income of the reporting period does not cover the expenses taken into account for tax purposes. It is not prohibited by law. But tax authorities, as a rule, do not trust information about losses, suspecting that the organization, for example, has inflated expenses, or has hidden part of the proceeds, or is using other schemes to artificially reduce income taxes. Therefore, tax services not only send the taxpayer requests for additional explanations on such a declaration, but also create special commissions to verify unprofitable reports.

For more information about what a tax loss is and how its amounts will be used, read the article “Tax loss is...”.

So if a taxpayer has filed a tax return with a loss, then he may well be called to the so-called loss commission by the Federal Tax Service.

To learn about the form used to prepare the 2020 return, read the material “How to fill out an income tax return for the year.”

If you have access to ConsultantPlus, check whether you correctly reflected the loss in your income tax return. If you don't have access, get a free trial of online legal access.

What is a loss commission

Officially, unprofitable commissions were abolished. But tax officials continue to call officials, since in practice this method has proven to be effective.

Unprofitable commissions, as a rule, threaten organizations specifically, since they are focused on replenishing the budget through income taxes. Therefore, the reasons themselves that led to the loss do not particularly concern the tax authorities. It is important for them to persuade the taxpayer to submit an updated return and pay additional tax.

It is worth preparing for a visit to the Federal Tax Service. The company official will have to give a clear and reasonable explanation as to why the declaration shows a loss. And the voiced arguments need to be supported by documents. Competent taxpayers who have qualitatively prepared the evidence base may well be able to fight off claims and defend their right to reflect the loss in the declaration.

If a company representative behaves insecurely, is confused in his answers, and evidence is not presented, or is presented but does not convince the tax authorities, the company will be asked to submit an amendment and pay additional tax to the budget.

How to endure losses: basic rules

If a company suffered a loss based on the results of past periods, in the future it can reduce the tax base of the reporting periods by these amounts (Article 283 of the Tax Code of the Russian Federation).

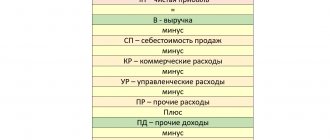

The amounts of loss in tax and accounting most often do not coincide due to the fact that the financial result is formed differently. There are a number of expenses that are reflected in accounting in full, and in tax accounting - within limits. For example, when calculating income tax, restrictions are established for advertising expenses, compensation to employees for the use of personal vehicles, entertainment expenses, and losses from the assignment of claims (clause Article 264 of the Tax Code of the Russian Federation, clause 264 of the Tax Code of the Russian Federation). And in accounting, the costs incurred are reflected in full.

To cover losses, reserve and additional funds or retained earnings from previous years are used in accounting. In tax accounting, losses from activities are carried forward to the future, thereby reducing the tax base of subsequent periods.

The loss can be written off in the tax (reporting) period when the company made a profit.

Carrying forward losses from previous years to future periods is a right, not an obligation. To exercise this right, you need to decide at the general meeting of founders or shareholders whether you include previously received losses in the calculation of the current year’s tax. This decision of the founders will be the basis for accounting entries. If there is only one founder, he makes the decision alone.

But there are also a number of rules.

Report profit via Extern