Do I need to store Z reports?

In fact, the shift closure report is a Z-report, which is automatically transmitted to the Federal Tax Service. It is not necessary to store such a report in paper form - its data is stored in the memory of the fiscal drive.

Interesting materials:

How to connect broadcast from phone to TV? How to connect a trackpad to iPad? How to connect tricolor without a receiver? How to connect tricolor through a router? How to connect Tricolor TV via the Internet? How to connect Tricolor TV to an old TV? How to connect the troika to the phone? How to connect digital cable TV to your TV? How to connect digital television for free without a set-top box? How to connect digital television without an antenna?

What is a Z-cash report?

The term "Z-report" does not exist in modern interpretation. In Federal Law No. 54, the concept of “shift closing report” (with cancellation) is used instead. It is removed from the CCP at the end of the working day. The document contains information on all operations that were performed during the shift. The cashier is obliged to generate it no later than 24 hours from the date of the first payment. Otherwise, the FN will be blocked and will resume work only after the report is removed.

The cash desk transfers all the data reflected in the document to the Federal Tax Service. They are stored in the device memory for no more than 30 days. And if Internet access fails, information is transmitted automatically when the connection is restored. If the tax service does not receive data within a month, it is blocked.

The letter of the Ministry of Finance No. 03-01-15/3482 dated January 25, 2017 contains an explanation: the primary forms of documents for control of trade operations have lost their validity and are now optional. Due to the use of online cash registers, there is no need to keep a cashier log. Receipt and expense orders remain, as does the cash book (in accordance with Resolution of the State Statistics Committee of the Russian Federation No. 88 of September 18, 1998, according to f. KO-4, can be found here).

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Details of the shift closing report

Let's look at the list of details contained in the shift closure report. The data was approved by order of the Federal Tax Service of Russia dated September 14, 2020 No. ED-7-20/ [email protected] Please note that the set of details is slightly different when working with FFD 1.05, 1.1 and 1.2. Contents of the report when working with FFD 1.05:

- Title of the document;

- FD form code;

- FDF version number;

- user name;

- User's TIN;

- cashier;

- Cashier's TIN;

- address and place of payment;

- date, time of document generation;

- shift number;

- CCP registration number;

- number of cash receipts per shift;

- total number of fiscal documents per shift;

- number of documents not submitted to the Federal Tax Service, date of the first;

- signs of exceeding the waiting time for an OFD response, the need for an urgent replacement of the FN, full memory of the FN, exhaustion of the FN resource (indicated only when the corresponding events occur);

- resource of fiscal attribute keys (remaining validity period of the FN);

- Document Number;

- fiscal storage number;

- fiscal sign of the document;

- fiscal sign of the message.

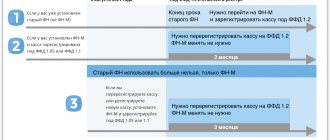

When using FFD 1.1, in addition to the above details, in the report on closing a shift, you need to indicate the counters of the shift totals and the fiscal accumulator, and the operator’s message. In the document generated by FDF 1.2, additionally enter data on the number of untransmitted notifications.

- 3 reviews

Training to work on CCP

1,000 ₽ Add to favorites

1 000₽

https://online-kassa.ru/kupit/obuchenie-rabote-na-kkt/

OrderMore details In stock

- 9 reviews

Technical support

6,000 ₽ Add to favorites

6 000₽

https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie/

OrderMore details In stock

Correction check in the shift closing report

A correction check is made if errors are made in the calculations on the cash register. Probable reasons:

- cashier's error - when performing a transaction, he incorrectly indicated the amount;

- making payments without using cash registers;

- breakdown or malfunction of the cash register at the time of payment.

If an error is discovered during the working day, the correction check must be submitted before the end of the same shift. If later, you can form it on another day. Let's look at how to do this, using the Evotor smart terminal as an example:

- Go to “Settings”.

- Go to the cash service section, then “Additional operations”.

- Select the operation to perform a correction check.

- Specify the payment type.

- Enter the amount.

- Select the type of correction: independently or as prescribed by the Federal Tax Service.

- Indicate the reason for the correction. Click OK.

Next, the cashier draws up an act or memo for the tax service. The document indicates the reason for the erroneous operation.

The “number of cash receipts” detail in the shift closing report includes data on the number of correction documents with the calculation attribute “Incoming” and “Expense”. It is not displayed as a separate line. The correction check may not be reflected in the shift closing report if, during its generation, there was a malfunction in the operation of the cash register.

We will solve any problems with your equipment!

Leave a request and receive a consultation within 5 minutes.

How to make Z-report and X-report

After it has become clear what an X report is, you can move on to considering withdrawals. Reporting on cash register equipment is generated automatically. The cashier does not have to enter any data himself. All that is needed is to perform a certain manipulation, which consists of pressing buttons in the desired sequence.

X-report on Agat 1K

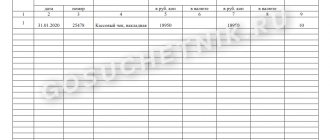

Which buttons should be pressed depends directly on the type of device, its model and manufacturer. First of all, it is recommended that you read the instructions for using the specific device. After its removal, the printed receipt is sewn by the cashier working that shift into the book “Cashier Operator's Certificate Report”. The following information can be entered separately into the cash journal from the report:

X-report on Alpha-400K

- Date and time of withdrawal;

- Check number;

- The amount of cash at the beginning and end of the shift, called the gross total;

- Amount of discounts and returns.

It is necessary to take into account that the X report is generated only before the Z report. Z is printed once a day, while X is generated by each cashier when depositing proceeds. The X-report is generated in a similar way using certain combinations with the keys of the device, on which this sequence and the type of the final report in electronic and paper form will depend. Below are several images of the X-report decoding on different cash registers

X-report on Kasbi 02 MK

Important! In both cases, the cash register at the end of the shift, along with the posted revenue, must be handed over to the senior cashier, accountant or manager. It depends on the internal order of the organization adopted by its founder.

Comments

By clicking on the “Submit” button you confirm that your comment does not contain personal data in any combination.

Questions and answers in the comments are provided by site users and are not in the nature of legal advice. If you need legal advice, we recommend that you obtain it by calling the numbers listed above or using this form

.

| Kissundra_5 |

Good morning everybody! Tell me, maybe someone has encountered the following problem. Configuration 1C: Retail 2.1. When printing a z-report by the fiscal registrar, in the line “cash at the cash desk” an amount is printed that in fact does not exist. The amount accumulates every day. I looked, for some reason (the contractors set it up) when closing a shift, the document “Removal of DS from the cash register cash register” is not created. I retroactively created the missing documents for the seizure, after which, when closing, the document began to be created automatically and the amount stopped accumulating, but the amount that was formed until the correction was frozen. Now I don’t know how to remove it now? Maybe someone knows in which direction to think? Thank you in advance.

TurboConf 5 - expanding the capabilities of the 1C Configurator

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The topic has not been updated for a long time and has been marked as archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

| Kissundra_5 | I thought that somewhere in the memory of the fiscal registrar this amount was stuck, but the equipment specialist said no. The DF stores only the amount at the beginning of the shift, the amount at the end and that’s it, i.e. |

How to make a Z-report at the cash register

Before making a Z-report at the cash register, you need to read the instructions for the device. The formation of the document depends on the cash register model. A shift closing report is needed to:

- display all operations for a shift;

- summarize the cash turnover for the working day;

- systematize data for saving in the CCP memory.

If you do not remove the report within 24 hours from the opening of the shift, the cash register will be blocked. The tax office will definitely notice the violation and the OFD will notify it about it.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

How to make a report on the closure of a shift on the Evotor cash register

Smart terminal Evotor is a device for making payments in accordance with the requirements of 54-FZ. The cash register provides accounting of financial flows, is easy to install, makes it possible to work in the EGAIS system, and generates various forms of reporting. How to make a report on closing a shift on an Evotor cash register:

- In the menu, select the “Reports” → “Cash Report” section.

- The screen will display sales, returns, withdrawals and deposits, and the amount of money at the beginning of the day. Click on the “Close shift” button.

- In the next window, click “Print report”.

A window with a zero score will open.

- 4 reviews

Connection to OFD

1 800 ₽ Add to favorites

1 800₽

https://online-kassa.ru/kupit/podklyuchenie-k-ofd/

OrderMore details In stock

- 1 review

Item programming

3,000 ₽ Add to favorites

3 000₽

https://online-kassa.ru/kupit/programmirovanie-nomenklatury/

OrderMore details In stock

- 5 reviews

Registering a cash register with the Federal Tax Service

1,500 ₽ Add to favorites

1 500₽

https://online-kassa.ru/kupit/registratsiya-kassy-v-fns/

OrderMore details In stock

How to make a report on the closure of a shift at different cash registers

Depending on the cash register model, different combinations of buttons are used to generate a document. We'll tell you how to make a report on the closure of a shift on different cash registers.

"Mercury 185F":

- Press the “MODE” button several times. The indicator should display the words “FN Reports”.

- Select “IT”, then log in with administrator rights and enter the password. The default secret code is 22.

- After the message “Close shift” appears, click on the “IT” button.

"Mercury 180F":

- Press “AN/RE” several times. The indicator will display the words “FN Reports”.

- Select “IT”, enter 22 (administrator password).

- Select “Close shift”, and then click on the “IT” button.

"Orion 110F":

- Press the “Mode” button several times.

- “Choice 3” will appear on the screen.

- Click on the “Result” button twice.

"Pioneer 114F":

- Select “CCP reports” in the mode window.

- Press "Enter".

- Select "Close shift".

- Press "Enter" twice.

If you have a different cash register, use the instructions from the manufacturer (included in the kit).

We restore the lost receipt and Z-report from EKLZ to FR Shtrikh using the “Driver Test” utility.

In this article we will look at how to print control tape stroke M, FR K, light, PTK, Combo, Mini, NCR yourself. Follow the procedure according to the instructions, otherwise you may damage the recorder without receiving the lost receipt or Z-report.

Important information! Do not click the “Close ECLZ archive” button. Otherwise, you will have to replace the ECLZ unit.

Secure electronic control tape - EKLZ contains all sales and cancellation receipts for the period from the last replacement to the current moment. We can print an analogue of a check or Z-report, but only until the date the block is replaced with a new one. Typically, the date of replacement is noted in the call log, the cashier's log, on the registration card, and on the additional sheet of the version passport. You can get this near replacement date from the driver, but due to the fact that this button is located next to the closing of the ECLZ block, we will not do this.

If in the window with a line of driver errors, after pressing the print buttons described below, the message “No requested data” is displayed, then either you entered incorrect dates - numbers, or the data you requested was contained in the replaced ECLZ block. It is not possible to pull out the data in the usual way - print it out, only with the help of the central processing center.

Z-report: how it is taken

Before taking a Z-report, you will need to carefully study the instructions for the equipment. Different device manufacturers and models may generate reports differently. Typically, you must press keys in the correct sequence to perform an action.

Why is such a report needed?

- It displays all returns, discounts and purchase cancellations.

- It contains summary information regarding the daily turnover.

- It organizes information for storage in the equipment’s memory.

If the report is not taken within 24 hours from the start of the shift, the cash register will be blocked. Naturally, the fiscal data operator will transmit the information to the tax office.

Cashier errors when making a Z-report

When making calculations using cash registers, a subjective factor often interferes. The cashier may deviate from the instructions for the procedure, which results in an error. Situations include:

- Lack of journal entry for each of the reports taken during the shift.

- The basis for journal entries is not the report data, but the indicators of one’s own calculations.

- Entry to a journal line in the absence of a Z-report on a day when no cash transactions were performed. A common entry is to indicate a day off on the line.

- A shift that falls on 2 calendar days is withdrawn once (a double withdrawal is required to obtain the entry in chronological order).

A number of cashier errors do not constitute a violation that results in a fine. Consider common examples of cashier mistakes

| Action | Solution of a problem | Consequences |

| The report was erroneously taken on the next day after the cash register shift. | The entry is made on the day the report is taken, the cashier submits an explanatory note | An administrative fine will be imposed upon an inspection initiated within 2 months after the untimely withdrawal of the report |

| The report was erroneously taken 2 times during the cash register shift | A journal entry is made for each report separately. | No violation |

| Lost timely paid Z-report | It is necessary to remove data on ECLZ with the help of a specialist from the central service center, draw up a report or submit an explanatory note to the cashier and fill out a log with copies of reports for the previous and subsequent days attached. | No violation |