- March 5, 2020

- Trade

- Elena Surikova

Currently, any business must produce reports to the tax service. Cash flow is controlled at the federal level by authorized bodies and requires strict compliance with the law. To systematize the data, a CCP was created. Almost everyone has seen this tool in action, but not everyone knows what it is. In this article, we will look at how CCT stands for, what it is, and how knowledge helps to avoid a number of questions on both sides of the transaction.

What is CCP

Often people do not understand the importance of control over business activities. Tax evasion and concealment of income are punishable by punishment, including criminal liability. To avoid this and not have problems with the law, a device was introduced that remotely transmits data from the seller to the appropriate authority. Let's consider this activity control tool.

The abbreviation KKT stands for cash register equipment. Depending on the area of use (wholesale and retail trade, service sector, restaurant business, etc.), this mechanism may look different, but, regardless of the form, the function is the same - sending data about the sale made or service provided to the tax service.

What a CCT looks like:

- Example No. 1. A cash register used mainly in chain stores. Comes with a compartment for storing cash.

- Example No. 2. Simplified version of CCP. Used in small shopping pavilions and public transport. Distinctive features are mobility and lightness.

- Example No. 3. A similar technique is often found in the restaurant business. The touch screen is extremely functional and convenient when entering an order.

The cash register machine decrypts the completed sale. There is no need for additional documents (for example, a cash receipt order) confirming the transaction; all information is “printed” on the receipt.

Each cash register comes with a fiscal drive, which encodes all cash register decryptions in the form of a receipt for subsequent transmission to the Federal Tax Service. A special feature of this equipment is the presence of memory, as a result of which all transaction data is stored for a long time.

If the document is lost or damaged, you can request it on the tax service website or ask the company where the purchase was made to duplicate the receipt on your mobile phone (provide a copy, not re-punch it).

Step-by-step instructions for registering a cash register on the tax website

Let's look at how to register an online cash register with the tax office step by step.

Step 1. Registration of individual entrepreneurs on the tax service website

If you have never logged into your taxpayer’s personal account on nalog.gov.ru, you will have to register. This is done in three ways:

- Using the login and password of the registration card. It can be obtained by physically visiting the territorial body of the Federal Tax Service with an identity document.

- Using a qualified electronic signature.

- Using your State Services account. At the same time, only those who have visited the center of the Unified Identification and Authentication System in person at least once will be able to enter their personal account.

Reminder about types of digital signature

If there is no CEP or registration for public services, you should take care of the opportunity to log into the Federal Tax Service LC in advance.

Step 2. Submitting an application for registration with the Federal Tax Service

Let's look at the step-by-step actions in the taxpayer's personal account , which are necessary for the initial registration of an online cash register:

1. Select the menu item “Cash Accounting”.

2. Click the blue “Register cash register” button and then select “Fill in the application parameters manually.”

3. A page with an electronic application form opens in front of us, the fields of which must be carefully filled out.

The address of the CCP installation is selected from an exhaustive list , so it must be in the FIAS register and coincide with the place of business activity. If there is no address, there is only one way out - contact the local administration so that they enter it into the federal address information system.

This field may also change when you select a specific type of activity below the “Select CCP model” button.

The name of the installation location is specified arbitrarily. This could be the name of the shopping center, car number (when providing taxi services), the name of your own store, or something else that allows you to identify the outlet.

The CCP model is selected from an exhaustive list. Please note that the list includes only cash registers approved at the time of registration from the state register. If you bought a cash register a year ago, but decided to register only now, then this model may not be on the list. There is only one way out - buy a new online cash register.

Next to the model name input field, you must enter the serial number of the device. It is usually indicated on the equipment body and in the documentation.

After entering the name of the cash register, a field for selecting the fiscal drive and its factory (serial) number appears. Let's fill them out.

It should be noted that all names and serial numbers of cash registers and fiscal drives are in the tax database and are checked upon entry. Therefore, enter the data carefully, and if you receive an error, double-check it.

The next step when filling out the application is to indicate whether the entrepreneur is engaged in any specific type of activity from the specified list . If yes, put a tick in front of the corresponding item, if no, do nothing.

In the “Fiscal data operator” field, select the OFD company with which you signed an agreement in advance. The value “TIN OFD” is filled in automatically.

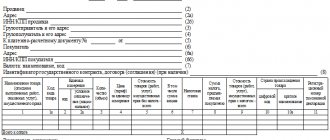

The application with all fields filled in looks like this.

After filling out all the fields, click “Sign and Send”, sign the application with a digital signature and wait for a response from the tax office. After processing the application, the registered cash register will appear in the list.

As a result, the online cash register will be assigned a registration number, which will be useful to us in the future.

Step 3. Fiscalization and setting up the cash register

After receiving the registration number, we proceed to fiscalization and setting up the cash register. The ultimate goal of this step is to provide the CCP with the opportunity to interact with the OFD and the Federal Tax Service on behalf of the entrepreneur.

The procedure for setting up an online cash register differs between different manufacturers and even models. The algorithms are described in detail in the corresponding instructions for the equipment. We will look at setting up a CCP using the example of one of the most popular manufacturers - ATOL:

1. Connect the online cash register to a computer with the software installed and run the installation program. Internet access is required. The device should be detected automatically. Click “Next”, enter the time and select “Register”.

2. We fill out in the appropriate windows the registration data about the individual entrepreneur or legal entity, the fiscal data operator, the cash register, and the taxation system.

The name of the legal entity or individual entrepreneur is indicated in full in accordance with the unified register of small and medium-sized businesses. If there is a discrepancy, fines may be incurred due to incorrectly specified data on the check.

Select FDF version 1.2. It is no longer possible to sell fiscal drives with other formats.

Please check your tax number especially carefully. If it is entered incorrectly, you will have to spend several thousand rubles on a new fiscal drive.

3. Check the entered data and click “Run”. After this, the online cash register contacts the OFD, checks the correctness of the entered data and generates a “Registration Report”. It is advisable to print it and save it.

After this, the cash register is ready for operation, but the registration process is not yet completed.

Step 4. Registering an online cash register in the OFD

At this stage, you need to log into your personal account on the OFD website with which the agreement was signed.

Then we find in the menu the item about connecting the cash register and enter the necessary data from the registration report received earlier. Here is an example of a registration form from the website of one of the popular OFDs.

After completing the registration of the online cash register on the OFD website, the check data will be able to be redirected to the Federal Tax Service.

Step 5. Complete registration of the online cash register on the tax website

The step-by-step procedure for registering an online cash register with the tax office is coming to an end.

At the last stage you need to do the following:

1. Log in to your personal FTS account again.

2. Go to the “Cash Accounting” section of the website.

3. Open the registered cash register card.

4. Click “Complete registration”.

5. Enter the details of the cash register registration report.

6. Click “Sign and send”.

After processing the application, a cash register registration card will be generated in the “Information about documents sent to the tax authority” menu, which should be saved in digital or printed form. Before receiving this document, punching receipts at the cash register is prohibited.

The importance of having a cash register in trading activities

In the field of sales, the cash register is very common and implies the legal activity of the seller. Let's try to figure out what decoding cash registers in trading is and what it gives. The sphere of sale of goods and services is one of the most widespread, therefore significant cash turnover, requiring total control of the Federal Tax Service, is located here. Similarly with the general system of providing services in trade, the decoding of cash registers is as follows - cash register equipment (or regular cash register).

Let's consider several options for devices:

- The first, the simplest, consisting of the machine itself and a cash register tape, is found in small pavilions and buses. The advantages are obvious - compactness and instant transfer of data to the Federal Tax Service.

- This one is technically more difficult. It includes a compartment for storing money and can be paired with a scale, barcode scanner. Relevant for large stores.

Check

Regardless of where exactly the service was provided or the sale was made, the cash register (cash register) displays a cash receipt upon completion of the transaction (remember, at the time the check is generated, the data on its decryption by the cash register is transferred to the tax office).

The document may look different depending on the area of use, but the basic information does not change.

To understand what kind of document this is, below we will decipher the cash register receipt. I would like to note that most companies refuse requests to receive a sales receipt, citing the fact that all the necessary information is contained in the sales receipt.

The cash receipt contains all the necessary information:

- The place where the product or service was purchased.

- Time of the transaction.

- Legal details of the company with a contact phone number that you can call if you have any questions.

- List of names. If a service receipt or an extra item is found on the receipt, you must contact the person in charge on the spot to correct the error.

- The price for each type of service, taking into account the amount of collected tax deductions. If the service is provided by bank transfer (payment by bank card), there is a line for the signature of the person responsible for the transaction and the client.

- Barcode or QR code. Having a special program on your phone, you can check the authenticity of the check with a transcript of the actions performed.

- Full name of the person who received the payment (the form - cash or bank card - does not matter).

If, when performing a transaction (selling a product or providing a service), an organization cannot provide the appropriate document (with the exception of technical problems that do not allow the check to be processed right now, and not at all), there is a high probability that the seller has not registered with the tax authorities, and in the event of an In a controversial situation, it will be impossible to prove a completed transaction. This is especially true for guaranteed goods (for example, complex technical equipment). In this case, it is necessary to report the violation to the relevant authorities.

In addition to basic information about the organization and services provided, the receipt contains information confirming the legal activities of the seller.

Let's look at the basic notation below.

How to check check details?

The Tax Service provides this opportunity on its official website for those who have installed the appropriate mobile application. With it you can:

- receive and store online cash register receipts;

- check their authenticity;

- inform tax authorities about detected violations.

To use this application you will have to register your data. You will be prompted to do this the first time you access the program.

For verification purposes, the user can enter the check details required by the program manually or scan the QR code of the check. After sending the data and processing it by the application, the user will be provided with the results of the verification. After reviewing the corresponding results, the user will be able to inform the tax authorities about the violation. It is also possible to send a violation report in cases where:

- the receipt was not issued by the seller;

- the check details are incorrect;

- e-receipt from the seller was not received.

The address of a website on the Internet where the user can check the existence of a record of this calculation and its authenticity must be indicated on the receipt.

In addition, we suggest that you read the article “How to indicate the name of services on a cash receipt?”

CCP registration number

The check contains the abbreviation RN, which is often ignored. Let's look at what it is.

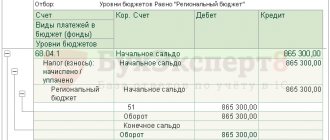

The decoding of the RN of the cash register is as follows - the registration number of the cash register equipment. What does it mean? These data are recorded for the organization that has passed the audit and registered for tax purposes, and is established according to the KND form 1110066, i.e. this is actual confirmation of the registration of the cash register. RN, along with other system settings and details, are entered into the fiscal registrar.

Why do you need the RN KKT details in the check?

Article 4.7 of Law No. 54-FZ contains a list of values to be indicated on the check. Among them is the registration number. It is, among other things, reflected in the list of fiscal data details attached to the Order of the Federal Tax Service of Russia dated March 21, 2017 No. ММВ-7-20/ [email protected]

Registration of cash register with the tax office is accompanied by an indication of this value:

- first by the owner of the online cash register when submitting an application;

- then by an authorized official in the registration card (every owner of a cash register should have such a document).

The owner of the cash register is obliged to reflect the RN details in the fiscal storage of the cash register. This number must be indicated on each document punched by the cash register. The presence of this number on the receipt gives the buyer the opportunity to check the fact of registration of the cash register.

The registration number of the cash register, in addition to the receipt, is reflected in the following reports:

- on registration and modification of relevant data;

- about the beginning of the shift;

- about the end of the shift;

- about the correction check, etc.

The owner of the cash register will need to indicate this number to enter into a contract for the indication of the relevant services by the fiscal data operator. While obliging the RN to be punched in the check, the current legislation does not indicate the specific place in the document where this number should be reflected.

Violation of duties in this area is punishable by a warning or a fine for officials and individual entrepreneurs from 1.5 to 3 thousand rubles, for organizations from 5 to 10 thousand rubles. (Part 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Serial number of KKT

In addition to RN, the letters ZN are also found on cash registers. The decoding of the abbreviation ZN KKT is as follows - the serial number of cash register equipment. This is a unique combination of numbers that is assigned to each device at the manufacturer (the data is printed on the terminal body itself). Required to enter into an agreement with an operator who will act as an intermediary in the transfer of data from the seller to the tax service.

Such data looks like in the photo below.

Upon completion of registration, this data is entered into the application, and subsequently displayed on each punched check.

There cannot be two cash register terminals with the same sign; if this happens, you have a fraudster in front of you, but such cases are rare; it is virtually impossible to fake a cash register.

In general, deciphering the CCP ZN and CCP RN makes it possible to understand where and when the device was manufactured and to simplify the process of concluding a contract.

Re-registration of an online cash register

In what case may it be necessary to re-register a cash register? The answer is quite simple: for any change in the data specified in the registration card: the individual entrepreneur’s residential address, the number of the fiscal drive when replacing it, the place of business, warranty replacement of the cash register, and so on.

Let's consider two fundamental options for re-registering an online cash register: with and without replacing the fiscal drive.

With replacement of the fiscal drive

The procedure for re-registration of cash register equipment with replacement of the FN is as follows:

1. According to the instructions for the cash register, we generate a “Report on closing the fiscal drive” on it.

2. Go to the cash register accounting section in your personal account on the website nalog.gov.ru.

3. Click on the registration number of the online cash register and then select “Re-register”. The re-registration application form will open.

4. Select the reason for re-registration.

5. We indicate the data from the generated report on closing the financial fund.

6. We change the fiscal drive and generate a “Report on changes in the parameters of registration of financial funds” on the cash register.

7. Enter information from the report on changes in parameters into the form on the Federal Tax Service website. Then we indicate the model of the new FN and its serial number.

8. Click “Sign and send”.

After processing the application, the status of the online cash register will change to “KKT re-registered”.

Without replacing the fiscal drive

Depending on the reason for re-registration, the necessary actions on the Federal Tax Service website may differ slightly. As an example, let's look at what needs to be done when changing the OFD.

The first three steps correspond to those described above when re-registering a cash register with a change of FN.

The next steps are:

1. We generate a “Report on changes in the registration parameters of the FN” on the cash register.

2. Select the reason for re-registration – change of OFD.

3. Select a new OFD.

4. Click “Sign and send”.

After processing the application, the status of the online cash register will change to “KKT re-registered”.

An important point: any cash register will not allow you to make more than 12 re-registrations in a row without changing your FN . Therefore, enter the data carefully to avoid errors. After the 12th re-registration, you will have to spend money and replace the fiscal drive.

Didn't give me a check? What to do

You may encounter a situation where the seller cannot provide the client with a document confirming the payment made. Often it is not required and is disposed of, but when purchasing a warranty item, it is necessary.

Since the document contains complete information about the place and method of purchasing an item or service, deciphering the cash register for return issues will help confirm that the purchase was made here. If the seller refuses to confirm the transaction (for example, with the phrase: “You did not buy from us,” or “This is not our product”), you should report this to the relevant authorities.

In what cases an organization cannot provide a check:

- if at the time of the transaction there is no connection with the tax office due to a technical problem;

- The cash register is being checked by the tax service and is not present at the place of sale of goods or provision of services.

What to do in this case? An employee of an organization providing services (seller) can offer several options for solving the problem:

- Postpone the transaction until a later time, after technical problems have been resolved.

- Ask to come back for a check later (if the product or service is needed now and does not require delay). If for some reason beyond the control of the seller, a document confirming payment cannot be provided at the moment, the client will be asked to provide the service or sell the goods now and come back for a receipt later. Often, technical problems or checking registration with the tax office does not take more than 2-3 hours, after which a check will be provided.

- Send a duplicate check to your phone or email. If the buyer does not want to refuse to provide services, and it is not possible to return for the original check, the seller can send the document via electronic means. At the same time, the significance of the check does not decrease, and it will have the same legal force as the original.

Why do you need an online check and how to get it

Another innovation for consumers is the ability to receive a fiscal receipt in electronic format. Benefit for buyers:

- storing the receipt on an electronic storage device safe from damage for a long time;

- optimization of cost accounting for services and goods - a self-created database on gadgets frees you from the need to store paper coupons and makes viewing them faster;

- If any troubles arise - the return of goods, accusations of non-payment of services, the buyer can at any time provide the authorities or the entrepreneur with a complete copy of the payment document.

Any consumer can receive a receipt in several ways:

- When checking out, the buyer indicates his email or mobile phone number. The seller sends a check electronically by letter or SMS message.

- Applications on a smartphone. Installed programs help you read the barcode on a paper ticket using the camera. Free services from PlayMarket help collect and organize received electronic copies. This method is convenient, it helps to save coupons from different organizations, stores, etc. in one place.

- The official portal of the fiscal data operator on the network. This option can be used if the consumer knows the address of the operator’s page from an existing receipt. There is a search system on the site through which you can get a copy after entering the number of the payment receipt, FP, ZN of the online cash register.

An entrepreneur may not provide a printed document to the consumer if the product or service was paid for via the Internet. Also, you don’t have to print out the receipt if vending equipment is used for sales.

In such situations, the seller retains the opportunity to use the cash register without a printed supplement. Such machines are automated, some of them can be mounted directly into the casing of vending equipment. They can also be used for online payments between consumers and sellers, as they have specially installed software. The transfer of the receipt in electronic form occurs automatically after payment for the goods, provided that the buyer indicates a mobile phone number or email address.

Return of goods/services provided

The most common phrase after purchasing a product is: “Keep your receipt during the warranty period.” Why is this necessary? Let us remind you that the check displays complete data about the transaction, down to the full name of the person who accepted the payment. Without this data, the search may drag on indefinitely (especially typical for large chain stores).

Refunds are made strictly according to the original cash receipt. Why? From the moment the transaction is completed until the return period, the price may change. In this case, the transaction is canceled according to the price indicated on the receipt. Upon completion of this procedure, sales and return receipts are attached to the report and are also transferred to the tax office.

If a long period of time has passed from the date of purchase to the day of return and the document confirming payment has not been preserved, you must write a statement (a sample is always available at the point of sale).

How to fill out the application form for registering a cash register

Registration application forms, accounting books and registration cards were approved by order of the Federal Tax Service dated May 29, 2017 No. ММВ-7-20/ [email protected]

The paper application for registration of a cash register contains 10 pages. Its form (numbered 1110061) is used not only for registering cash registers with the tax office, but also when re-registering cash register devices. Applications can be made on our website.

Filling out the application form will be easier if you have a sample with comments from experts. You can download this from ConsultantPlus by getting free trial access to the system:

Cases of violation of the law

There is a list of organizational activities that do not require the installation of a cash register. It can be found on the official website of the tax service.

For all other companies not included in this list, a number of penalties are provided for the lack of a terminal.

For individual entrepreneurs:

- in case of a primary violation - a fine of 25-50% of the amount of revenue, but not less than 10,000 rubles;

- in case of repeated violation, the penalty amount is from 1 million rubles to the suspension of business activities for up to two years.

For organizations:

- in case of a primary violation - a fine in the amount of 75-100% of the amount of revenue, but not less than 30,000 rubles;

- if repeated - suspension of activities for up to 90 days (provided that the amount of income exceeds 1 million rubles).

After identifying a violation, a period (1 month) is provided during which it is necessary to pay the fine and eliminate the defect. If the conditions are not met, the tax service has the right to sue the violator.

The seller, in turn, has the right to file an appeal if he is confident that his data is provided correctly. If there are indisputable facts confirming legal activity (often photo and video recording), the court often takes the side of the seller. In this case, you can file a counterclaim with payment of a penalty.

Who issues a sample card for registration of cash register equipment

Before receiving a cash register registration card, you need to:

- obtain the registration number of the cash register. It is assigned by the Federal Tax Service and transferred to the user no later than one business day following the day the application was submitted;

- generate and send to the tax office a report on the registration of cash registers.

Important! Recommendations from ConsultantPlus After receiving the registration number, you are required to generate a CCP registration report. This must be done no later than the next day after receiving it. To generate a report, write down the following information in the fiscal drive... You can view the entire procedure in K+ by receiving a free trial access.

An online cash register registration card is issued by the tax office within 10 working days (clauses 7 and 11 of Article 4.2 of Law No. 54-FZ dated May 22, 2003) from the date of filing the application for registration. It is sent to the user electronically through the cash register account or through the fiscal data operator and exists as an electronic document signed with an enhanced qualified electronic signature. If necessary, a user who has an electronic version of the card can receive it from the Federal Tax Service on paper (Clause 12, Article 4.2 of Law No. 54-FZ of May 22, 2003).

Changes to the cash register registration card are made not only when changing the parameters specified during registration, but also when replacing the fiscal drive.

The importance of cash register technology

The presence of a cash register for the seller is a “guarantor” of calm activity:

- there is no need to be afraid of sudden inspections by regulatory authorities;

- the system of reporting and filing documents in the archive is simplified;

- organization of consistency in trade turnover and simplified search for completed transactions.

Having documents confirming payment gives the buyer peace of mind: in case of disputes, by presenting a receipt, a number of questions can be avoided.

Detailed information allows the consumer to obtain a guarantee of the seller's responsibility for the services provided. Failure to comply with the agreement on the part of the seller gives the buyer the right to contact the appropriate authorities for assistance in resolving the issue.