List of conditions for obtaining disability and the amount of deduction

Tax compensation for children with disabilities of groups 1, 2, 3 depends not only on the presence of disability, but also on other reasons, which will be discussed below. A decision to recognize a person as disabled can only be made on the basis of a medical and social examination. The decision-making commission is guided by the following factors:

- persistent disorder of many body functions under the influence of diseases, congenital or acquired defects, consequences of injuries;

- loss, partial or complete, of the ability to self-service and self-control, the ability to navigate, communicate, move, study and work;

- need for social protection and rehabilitation.

Minors are assigned the status of “disabled child”, and adult citizens are given the status of group 1, 2, 3 disabled people. The key point in determining a group is the degree to which a person’s current state limits his life activity. To confirm the disability group, a person must undergo re-examination according to the following scheme:

- Group 1 – once every two years;

- Groups 2 and 3 – once a year;

- children - once during the period assigning them the status of “disabled”.

Important! A decision to recognize a person as disabled can only be made on the basis of a medical and social examination.

What deductions are due to a disabled person?

Citizens of the Russian Federation who have been assigned a disability group have the right to receive a tax benefit in the form of a deduction .

Disabled people are primarily eligible for the standard deduction. It is issued in a fixed amount and is accrued monthly. It can be received for the current year, and its amount is not included in the limits for other benefits.

Therefore, in addition, a disabled person has the right to use:

- A property deduction that is provided when a citizen carries out transactions for the purchase or sale of property (apartment, house, etc.).

- Deduction for participation in charity. The state allows the reimbursement of 13% of all donations, but no more than 25% of a citizen’s income available during a particular year.

- Social deductions. A citizen of the Russian Federation is entitled to personal income tax compensation if:

- undergoing treatment or paying for medications for yourself and your immediate family members. The taxpayer must have income during the tax period withholding 13% of personal income tax. These incomes must exceed the costs of treatment. The deduction limit is set at 120 thousand rubles - therefore, it will not be possible to receive compensation in excess of 15.6 thousand rubles (with the exception of expensive therapy);

- payment for educational services for yourself and your siblings (the same limit: no more than 120 thousand rubles) or children (maximum deduction of 50 thousand rubles per year per 1 child in total for both parents).

- when paying for an insurance policy. A citizen has the right to include VHI expenses in the deduction amount and even receive reimbursement from pension contributions to a non-state pension fund.

Important! When planning benefits, it is necessary to provide not only for the correspondence of the amount of expenses to be included in the deduction with the amount of income. It is important to take into account the established limits. If you paid for medications, treatment and education during the year, then these payments must be within the total limit of 120 thousand rubles. This limit does not apply to the standard disability deduction.

Permanent disability: features of assignment

This type of disability is assigned to a citizen subject to the following conditions:

| Feature of disability | Assignment condition |

| Men > 60 years old | Malignant forms of cancer of various stages |

| Women > 50 years old | Benign brain tumor |

| Group 1 or 2 with unchanged condition or worsening for 15 years | Incurable mental defects |

| Disabled people of the Great Patriotic War or citizens who were disabled before participating in the Second World War | Diseases of the nervous system affecting motor skills and sensory organs |

| Military personnel recognized as disabled due to injuries received during the war | Severe nervous system disorders |

| Degenerative brain diseases | |

| Steadily progressing diseases of internal organs | |

| Absolute loss of hearing and vision | |

| Limb amputation |

However, if a citizen has been assigned permanent disability, it can be re-examined upon his application or upon the direction of the attending physician, who has noted changes in the patient’s health status.

List of mandatory deductions for disabled people

What deductions can a disabled person receive? There are several types of compensation, each of which has its own characteristics:

| Standard | Property | Social |

| This type of compensation is fixed For the categories of disabled people under discussion for 2022, the deduction amount is 500 rubles. per month The only downside to the refund is that you can only take it for the current year. Last year's deductions in this category are not paid. | Applies to the following types of operations: Alienation of property Purchasing an apartment, residential building Construction of a property or purchase of land for construction Purchase of property for state or municipal needs There are subtleties here. If the property has been at the owner’s disposal for more than three years, then transactions on its sale are not subject to tax. Therefore no refund will be given Tax refund applies to the amount from the sale of property if it has been in possession for less than 3 years This amount should be < 1 million for housing and land holdings and < 250 thousand for everything else. Refund will be 13% | Charity |

| Only monetary assistance to such organizations is taken into account: religious, educational, scientific, sports. Moreover, they must be financed from the budget at least partially. Here the deduction is equal to 25% of the total amount for the year | ||

| Education | ||

| A deduction can be issued for: Personal training of any type (full-time, evening, additional, foreign) Full-time education for children under 24 years of age Full-time training for wards Full-time education for sisters/brothers up to 24 years of age Compensation does not exceed 120 thousand/year for yourself and 50 thousand/year for other persons. This amount includes all social services. deductions | ||

| Treatment | ||

| To calculate the deduction, the cost is included: treatment on the territory of the Russian Federation, medications prescribed by the attending doctor, contributions for voluntary insurance programs (for yourself, spouse, parents, children). The conditions are the same as for deductions for education - no more than 120 thousand per year, taking into account all social deductions | ||

| Voluntary pension insurance | ||

| Receive deductions for themselves, parents, spouses, and disabled children Total with all other social benefits. with deductions the amount does not exceed 120 thousand rubles/year |

Tax benefits

For people with disabilities, the state provides various social programs and benefits, including tax benefits for disabled people of group 3. In general, all citizens of the Russian Federation can be provided with deductions when paying personal income tax:

- standard (Article 218 of the Tax Code of the Russian Federation);

- social (Article 2022 NNK of the Russian Federation);

- on property (Article 220 of the Tax Code of the Russian Federation).

A tax deduction should be understood as the amount by which the amount of a citizen’s taxable income is reduced.

A citizen can take advantage of these financial benefits at the same time, but their amount should not exceed the established annual limits and exceed the taxes paid during the tax period.

From these articles of the Tax Code of the Russian Federation, the following conclusions can be drawn regarding tax benefits in the form of deductions for disabled people with disability group 3.

- Standard.

They rely on persons with a certain status, for example, disability. On the territory of the Russian Federation, a citizen can count on a standard deduction in the amount of 3,000 rubles. or 500 rub. In 2022, disabled people of group 3 can receive these tax benefits, but there are restrictions for them:

- reduction of the taxable amount by 3,000 rubles. per month applies to disabled people of group 3 from the category of military personnel if they received disability due to injury, injury, concussion, illness while performing military service or defending the Russian Federation or the USSR;

- a deduction corresponding to the amount of 500 rubles can be received monthly by disabled people if they have been disabled since childhood.

Personal income tax deduction is not allowed for disabled people of group 3 of general or occupational disease.

Some citizens, according to Art. 218 of the Tax Code of the Russian Federation (clause 1, clause 1), have the right to a standard deduction, regardless of the extent to which their health is impaired. These are, for example, participants in military operations and liquidators of the Chernobyl accident.

Thus, if a person received the 3rd disability group during the liquidation of the consequences of the Chernobyl accident and continues to work, then when determining personal income tax, 3,000 rubles are deducted from the tax base of his salary.

- Social deduction.

On a general basis, disabled people of group 3 have the right to receive a social tax deduction for personal income tax if the income received during the year was spent on the following purposes:

- treatment and purchase of medicines for yourself or relatives;

- education;

- charity;

- contributions to non-state pension funds;

- passing a qualification assessment.

If during the year there were expenses in this category in different areas, then you can claim several types of social deductions, for example, for a child’s education and personal treatment.

A citizen, including a disabled person, can apply for a social deduction within 3 years following the year in which such expenses arose.

- Property.

This type of privilege can also be granted to a citizen of the Russian Federation, regardless of whether he or she has a disability. Thus, a disabled person of the category in question may qualify for a personal income tax deduction if during the year he:

- purchased or built housing on the territory of the Russian Federation, including with a mortgage;

- sold movable or immovable property;

- sold a share in the authorized capital of any organization;

- assigned rights under a share participation agreement in construction.

If a disabled person of the 3rd group is a private entrepreneur and a payer of the single social tax (UST), he may also be granted a privilege. With an annual income of up to 100 thousand rubles. he is exempt from paying the Unified Tax. If the established amount of income is exceeded, then tax is paid on a general basis for an amount exceeding 100 thousand rubles.

Who is entitled to tax refunds in the Russian Federation?

Who can and cannot receive a refund can be seen in the table:

| Are entitled to benefits | Not eligible for benefits |

| Tax residents (citizens, including foreigners, who spent 183 days in the country during the year) receiving income subject to a 13% rate. | Unemployed people registered with the employment center and receiving benefits there. Business entities that do not have income subject to the 13% rate. |

Who can take the standard deduction for children?

Standard deductions for children are prescribed in the Tax Code of the Russian Federation in Art. 218. The standard children's deduction can be received by all resident employees of the Russian Federation who support children. The following categories of employees can receive a deduction:

- natural and adoptive parents;

- spouses of such parents;

- adoptive parents, guardians and trustees.

The deduction applies to children under 18 years of age. If the child is older, but is a graduate student, resident, intern, student or full-time student, the employee can receive a deduction until the child turns 24 or finishes his studies.

An employee can receive a deduction monthly until his taxable income reaches the maximum level. In 2022, the amount of income within which deductions are provided for children will remain the same as in 2022 - 350 thousand rubles . The deduction does not need to be provided from the month in which the employee’s income exceeded the specified amount.

The amount of income must include only income from which personal income tax is withheld at a rate of 13%. Only dividends are not taken into account. Also, income listed in Article 217 of the Tax Code of the Russian Federation, which is exempt from tax in whole or in part, is not taken into account. If your income is partially subject to personal income tax, only include the taxable amount in your income. For example, tax is not withheld from the amount of daily allowance for business trips within the Russian Federation up to 700 rubles, but above 700 rubles is withheld. You only need to count the amount of daily allowance over 700 rubles into the income limit.

Where to submit documents for deduction?

There are several ways to submit an application - through the Federal Tax Service, State Services, or the employer. The table will help determine the pros and cons of each method.

| Name | Advantages | Flaws | Peculiarities |

| Federal Tax Service | The inspector can advise you in detail and immediately point out errors in the documentation if any were made. | Waste of time The inspection may request additional documents that are not required by other methods. | To avoid queues, it is better to sign up for a convenient time on the State Services portal |

| Public services | The entire process takes place virtually—no need to attend an inspection. | To submit an application, a digital signature is required, the use of which costs about 1.5 thousand rubles. in year | If the applicant has an electronic signature, then it is safer and easier to submit an application through the taxpayer’s account on the Federal Tax Service website |

| Employer | You don't have to wait until the new calendar year to get your deduction. Receiving income without deductions Simplification of the procedure for submitting a package of documents - income certificates are not needed | There is a possibility that information about the refund will be “made public” among colleagues | The deduction is returned in small amounts every month |

Standard tax deductions are not burdened with strict deadlines for filing an application - you can submit it on a business day that is convenient for the applicant.

An application for a deduction for the current year is submitted in 2022, i.e. after the end of the tax year.

How accounting departments prepare a standard tax deduction

Application from an employee

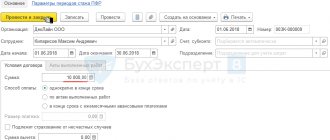

An organization can provide a standard tax deduction in the amount of 3,000 or 500 rubles to an employee based on his application.

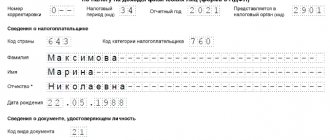

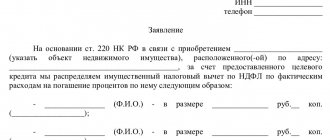

Sample application to the accounting department at the place of work for the provision of a standard personal income tax deduction

To the director __________________ (name of employer) ____________________________ (full name of the manager) from __________________________ (full name of the applicant) Taxpayer Identification Number_______________________ residing at the address: ____________________________ ____________________________

statement.

Based on subparagraph (subparagraphs) _____2 and 4 of paragraph 1 of Article 218___________________________________________ (indicate the corresponding subparagraphs of paragraph 1 of Article 218 of the Tax Code of the Russian Federation)

Tax Code of the Russian Federation, I ask you to provide me with a standard tax deduction for personal income tax.

I am attaching to the application the following documents confirming the right to receive a tax deduction:

Date ___________

Signature ______________ _____________________

Download Application for a tax deduction at the place of work

Documents confirming the right to deduction

To process the deduction, the accounting department needs to obtain documents from the employee that confirm his right to the deduction. These may be copies of documents confirming the grounds for issuing a deduction: for example, certificates of disability of group I or II, a certificate of a combat veteran, and so on.

Those who receive a deduction immediately after employment must provide a Certificate in form 2-NDFL from their previous place of work or a statement of lack of income.

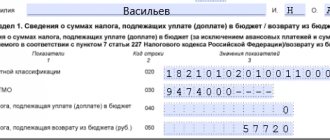

How to calculate deduction

The deduction is presented by reducing the tax base from which the accounting department withholds personal income tax on a monthly basis.

The tax period for personal income tax is one year. Standard tax deductions are provided for each month of the tax period.

If an employee has a document-confirmed right to a deduction in the amount of 3,000 or 500 rubles, the organization’s accounting department provides this deduction on a monthly basis while the employment contract or civil law contract is in effect.

Deduction for part-time worker

If we are talking about a part-time worker, he can only claim a deduction from one employer.

Therefore, the part-time worker must also obtain a certificate from the second place of work stating that he was not provided with a deduction there.

Restriction on payment of deduction

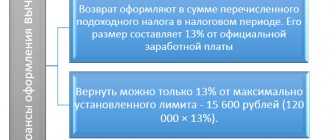

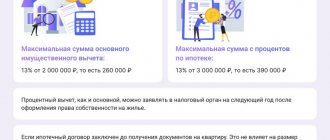

How many times can I use the refund? An unlimited number of times from the moment a citizen is recognized as disabled. However, social deductions are limited to one calendar year. Having paid, for example, for treatment in 2022, you cannot apply for a new payment of compensation. Property deductions are limited to an amount of 2 million rubles.

Calculation and crediting of deductions occurs solely at the request of the interested person or his representative. The government does not make payments automatically.

Who can receive a double deduction for children?

The deduction for a child is provided in double amount to the only parent, adoptive parent, adoptive parent, guardian or trustee. The provision ceases from the month following the month of his marriage.

Also, one of the parents (adoptive parents) can receive a double deduction if the second refuses to receive the deduction in favor of the other.

A double deduction is provided starting from the month following the month in which the parent, adoptive parent, guardian or trustee became the only one.

Tax refund deadlines

As practice shows, you will have to wait about 4 months for a refund from the date of application. There are cases when the wait lasted up to one year. This is explained by the deduction system:

- three months after filing an application, the tax service has the right to conduct an audit of the applicant;

- after a positive decision on the calculation of the deduction, the applicant receives a special notification about this by mail at the place of registration;

- compensation has the right to be calculated one month after receipt of the letter by the addressee.

Important! If the deductions arrived late, the applicant may demand that the Federal Tax Service pay a penalty, naturally providing evidence of the delay.

Reasons for refusal to receive a tax deduction

It must be said that the prevailing number of refusals are for social and property benefits. However, there is a list of reasons why people with disabilities may be denied a standard deduction:

- incomplete list of documents;

- lack of signature of the person;

- submitting an application to an inspection department other than your place of permanent registration.

How to speed up receiving your tax refund? Unfortunately, there is no specific algorithm for this - it all depends on the workload of the tax service. All that remains is to do everything in your power so as not to delay this process - prepare a bank account number, fill out the application correctly and provide the necessary documents, so as not to receive a refusal after three months of verification.