Filling out your own organization's payment details

First of all, you need to fill out the payment details of our organization. To do this, go to the “Main Menu-Organizations” menu.

Fig.1 Filling out payment details of your own organization

In the list of organizations, select the one for which you need to set bank details, and go to the “Bank Accounts” tab.

Fig.2 Go to the “Bank Accounts” tab

If the organization has several current accounts, fill in the data for each of them, and also select the main one, which can only be one.

Fig.3 Select the main account

After entering all the data, you must click “Save and close”.

Filling out payment details of counterparties

Access to the payment details of counterparties is carried out through the menu “Main Menu-Directories-Counterparties”.

Fig.4 Access to payment details of counterparties

In the list that opens, select the counterparty for whom you need to fill out payment details, or enter a new one. These payment details are filled in by analogy with the details of your own company.

Fig.5 Select the counterparty for whom you need to fill out payment details, or enter a new one

Bank statement

In the 1C 8.3 program, the document reflecting the movement of funds across accounts is a bank statement. It simultaneously reflects income and expenses, and also shows balances at the beginning and end of the day. After entering all payment orders into the program, as well as debit documents, you need to generate a bank statement to check receipts and expenses for the day, as well as control the balance of funds at the end of the day.

Fig.6 Bank statement

In the bank statement, we can select the period for which we want to take transactions, select a specific organization, or a current account for a more detailed consideration.

Find out details:

In accordance with paragraph 1 of Art. 1.2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making cash payments and (or) settlements using electronic means of payment” (hereinafter referred to as Law No. 54-FZ) by all organizations and individual entrepreneurs when carrying out They make payments on the territory of the Russian Federation without fail using cash register equipment (CCT), with the exception of certain cases listed in Art. 2 of this law. For the purposes of applying the provisions of Law No. 54-FZ, settlements mean the acceptance or payment of funds using cash and (or) electronic means of payment, in particular for goods sold, work performed, services provided (paragraph eighteen of Article 1.1 of Law No. 54-FZ ). According to paragraph 1 of Art. 4.3 of Law No. 54-FZ, cash register equipment, after its registration with the tax authority, is used at the place of settlement with the buyer (client) at the time of settlement by the same person who makes settlements with the buyer (client), with the exception of settlements made by electronic means payment on the Internet. Please note that cash register is not used when making payments using an electronic means of payment without its presentation between organizations and (or) individual entrepreneurs (clause 9 of article 2 of Law No. 54-FZ) (letter of the Federal Tax Service of Russia dated 02.02.2017 No. ED- 4-20/ [email protected] ). Law No. 54-FZ does not contain a definition of the concept of an electronic means of payment. According to paragraph 19 of Art. 3 of the Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System” (hereinafter referred to as Law No. 161-FZ), an electronic means of payment is a means and (or) method that allows a client of a money transfer operator to create, certify and transfer orders for the purpose of transferring funds within the framework of applicable forms of non-cash payments using information and communication technologies, electronic storage media, including payment cards, as well as other technical devices. Clause 1.9 of Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds” (hereinafter referred to as Regulation No. 383-P) stipulates that money transfers are carried out by banks on the orders of clients, fund collectors, banks (senders of orders) in electronic form, including using electronic means of payment, or on paper. Clause 1.1 of Regulation No. 383-P provides for the transfer of funds within the framework of the following forms of non-cash payments: – settlements by payment orders; – settlements under a letter of credit; – settlements by collection orders; – payments by checks; – settlements in the form of transfer of funds at the request of the recipient of funds (direct debit); – settlements in the form of electronic money transfer.

Thus, the user (Organization or individual entrepreneur using cash register equipment when making payments (paragraph seventeen of Article 1.1 of Law No. 54-FZ).) is obliged to issue the buyer (client) a cash receipt or a strict reporting form if the payment is for goods (work, services) are carried out in cash or using electronic means of payment (letter of the Ministry of Finance of Russia dated July 5, 2017 No. 03-01-15/42408).

Consequently, when the buyer (client) uses forms of non-cash payments that do not involve the use of electronic means of payment to pay for goods (works, services), the user is not obliged to use cash register systems.

Admission

In the course of its business activities, the enterprise receives funds from customers into its bank account and accepts them for accounting.

To see receipts to the company’s current accounts, the 1C system provides the document “Receipts to Account”.

Fig.7 Receipts to the account

When you select this menu, a complete list of documents “Receipt to account” opens. From this interface, existing documents are visible, new documents for receipt of funds are created manually, and statements from the client bank are also downloaded, while the 1C system will automatically create the necessary documents.

Fig.8 Complete list of documents “Receipt to account”

When generating receipts manually, in the first step we indicate the type of operation to be performed. The set of fields in the document and the formation of accounting entries depend on this.

Fig.9 When generating receipts “by hand”, in the first step we indicate the type of operation to be performed

After selecting the type, a window for a new receipt document will open.

In the header of the document we indicate:

- The name of the company to which the receipt of funds will be reflected. If the program keeps records for several organizations, select the one you need. Current account and bank information will be filled in automatically;

- Organization account;

- Buyer;

- Amount of payment;

- Incoming number and date of the bank payment document.

Fig. 10 Filling out the header

Information for financial accounting in the company is entered into the tabular part of the document:

- Contract number;

- DDS article;

- Buyer's order (if orders are kept track of);

- Amount of payment;

- VAT amount.

Fig. 11 Filling out the tabular part of the document

After filling out all the data, the document can either be recorded or posted.

How is the receipt of proceeds from sales into the current account reflected in accounting?

In practice, most often, proceeds from sales are transferred to the company's bank account via non-cash means.

Counterparties pay for the goods received (products, semi-finished products, services, etc.) by the usual transfer of funds from their current account to the seller’s current account. This is the simplest, most economical and safest way to transfer proceeds to the company’s account. How to record an operation in accounting if non-cash proceeds from sales are received in the current account - what entry should be used for this?

At the time of shipment, the seller reflects the proceeds from the sale of goods (works, services) and the buyer’s receivables. This debt is paid off as soon as the money from the buyer arrives in the seller's account. The following entries are made in accounting:

Postings for recognizing revenue in accounting are made on the basis of shipping documents (invoices, acts, etc.). A document confirming the receipt of money into the account is a bank statement.

When reflecting the receipt of revenue in foreign currency into a bank account, account 52 “Currency accounts” is used instead of account 51 “Currency accounts”.

Learn about the nuances of accounting for foreign currency account transactions in this article.

Creating “Account Receipts” based on an invoice for payment

The 1C system provides the ability to create receipt documents based on a previously issued invoice to the buyer. To do this, go to the “Sales-Invoices” menu.

Fig. 12 Creation of “Account Receipts”

In the list of accounts, find, select and open an account for which you need to create a payment document and click “Enter based on - Receipt to account”.

Fig. 13 Enter based on - Receipt to account

In this case, all the details filled in in the invoice will be automatically added to the receipt. If necessary, they can be adjusted manually. After filling out all the fields, the document can be recorded or posted.

Making payments through a bank branch using a payment order

According to clause 5.1 of Regulation No. 383-P, when making payments by payment orders, the payer's bank undertakes to transfer funds through the payer's bank account or without opening a bank account of the payer - an individual to the recipient of the funds specified in the payer's order.

The payment order is drawn up, accepted for execution and executed electronically, on paper (clause 5.4 of Regulation No. 383-P).

An order to transfer funds can be transmitted, inter alia, using an electronic means of payment (clause 5.8 of Regulation No. 383-P). At the same time, for the purpose of transferring funds without opening a bank account, a credit institution may accept cash from a payer - an individual (clause 1.4 of Regulation No. 383-P).

In our opinion, the buyer (client) depositing cash into the bank's cash desk with the transfer of a payment order to the bank to transfer funds to the seller is not equivalent to a cash settlement carried out between the seller and the buyer. In the situation under consideration, cash is accepted not by the seller, but by the bank, and payment is made non-cash by crediting funds to the seller’s bank account. In this case, electronic means of payment are not used either, since the buyer contacts the bank in person and does not draw up an order for the transfer of funds using information and communication technologies, electronic storage media, including payment cards, as well as other technical devices.

In such circumstances, the seller has no obligation to use cash register when receiving payment from the buyer.

A similar conclusion can be reached with regard to such a payment method as a transfer from an individual’s bank account by personally contacting the bank serving the individual.

Additionally, we note that the letter of the Ministry of Finance of Russia dated August 25, 2017 No. 03-01-15/54800 states the following: the issue of using cash register systems when an individual buyer pays for goods by submitting an order (instruction) from the buyer of a credit organization on paper is currently being studied Ministry of Finance of Russia.

That is, at present, the Russian Ministry of Finance does not connect the buyer’s execution of a paper payment order to transfer funds to the seller by depositing money in a bank or disposing of funds in a bank account with the need for the seller to use cash register equipment.

At the same time, some letters from the Federal Tax Service of Russia, with reference to the position of the Ministry of Finance of Russia, emphasize that Law No. 54-FZ does not provide for exceptions regarding the need to use cash register systems when making payments by electronic means of payment through a credit institution, including by means of a payment order (letters from 08/30/2017 No. AS-4-20/17256, dated 07/06/2017 No. ED-3-20/ [email protected] ).

Moreover, the Ministry of Finance of Russia in its clarifications indicated that Law No. 54-FZ does not provide for special conditions (exceptions) regarding the use of cash register systems for the user (seller) when the buyer pays for goods through a payment order through a credit institution (letters dated August 15, 2017 No. 03 -01-15/52356, dated 04/28/2017 No. 03-01-15/26324).

In a letter dated 08/15/2017 No. 03-01-15/52356, representatives of the Russian Ministry of Finance noted, in particular, that cash register is used in the case of payment for goods (work, services) by buyers (clients) - individuals (subject to the exception specified in paragraph. 9 Article 2 of Law No. 54-FZ dated 22.05.2003) by submitting instructions (instructions) to a credit institution to transfer funds in favor of an organization (individual entrepreneur). In this case, the organization (individual entrepreneur) sends a cash receipt to the subscriber number or email address specified by the buyer before payment (hereinafter referred to as the buyer’s data), except in cases where the organization (individual entrepreneur) does not have the opportunity to receive the specified buyer data. In this case, the organization (individual entrepreneur) must take all measures to obtain the buyer’s data. One of such measures may be reaching an agreement with a credit institution to request the buyer’s data when the buyer (client) submits an order to the credit institution.

From these clarifications, it is not entirely clear whether financial department specialists consider it necessary to use cash registers by the seller in the event that the buyer (client) pays for goods (works, services) by issuing a payment order only using electronic means of payment or in any other situations.

It seems that when the buyer transfers funds through a bank with the preparation of a payment order in paper form, the seller does not have an obligation to use cash registers, since the scope of application of Law No. 54-FZ does not extend to non-cash payments, except those made using electronic means of payment.

However, we do not exclude the possibility of disputes with regulatory authorities if CCP is not used in such a situation.

Let us note that in their explanations, representatives of the Russian Ministry of Finance do not mention the possibility of not using cash registers in the case of depositing cash at the bank’s cash desk before July 1, 2022 (as, for example, in relation to the use of cash register systems when making payments via Internet banking). At the same time, if we accept the logic of the tax authorities and the Ministry of Finance of Russia, set out in the above letters, the obligation to use cash registers when depositing cash into the bank’s cash desk should arise no earlier than 07/01/2018, since the old version of Law No. 54-FZ did not require the use of cash registers in the event when the buyer - an individual deposits cash into the bank's cash desk to transfer funds to the current account of the seller organization (Part 9 of Article 7 of Law No. 290-FZ).

The answer was prepared by: Olga Tkach, expert of the Legal Consulting Service GARANT The answer passed quality control

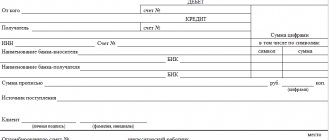

Money orders

To prepare payment documents and send them to the bank, the 1C system provides the “Payment Order” document.

Fig.14 Payment order

When you select this menu, a complete list of “Payment orders” documents opens. From this interface you can view existing payments, create new ones manually, and send the prepared ones to the client bank.

Fig. 15 Complete list of documents “Payment orders”

To create a payment order, you must click “Create” and select the type of operation – “Payment to counterparty” or “Transfer to the budget”.

Fig. 16 Select the type of operation - “Payment to the counterparty” or “Transfer to the budget”

After selecting the type of operation, a new document will open in which you need to fill in the details of the payer, recipient, amount, VAT, purpose of payment.

Fig.17 New document

To save the entered data in the payment order, you need to click the “Save” button, or “Save and close”.

Ready payments are uploaded to the client bank. To do this, select in the list of documents those that need to be sent and click the “Upload from 1C to bank” button.

Fig. 18 Ready payments are uploaded to the client bank

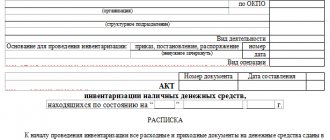

Debiting funds from a current account

To reflect expense transactions on a current account, the 1C system provides the “Account Expense” document.

Fig. 19 Document “Account Expense”

When you select this menu, a complete list of “Account Expense” documents opens. From this interface you can view existing documents, create a new debit document manually, or download statements from the client bank, and the 1C system will automatically create the necessary documents.

Fig. 20 Complete list of documents “Account Expenses”

To create a new document “Account Expense”, you must click the “Create” button and select “Operation Type”. The composition of the fields in the document and the formation of accounting entries depends on this.

Fig.21 Select “Type of operation”

In the new document we enter the details of the payer, recipient, amount, VAT, date and number of the bank document, as well as the tabular part, which contains detailed information on payment for financial accounting.

Fig.22 Filling out a new document

The prepared document can be recorded or posted.

BASIC

If an organization uses the accrual method, then the receipt of money in the current account will not affect the calculation of income tax in any way. This is due to the fact that the recognition of income in this case does not depend on the receipt of money in the organization’s current account (clause 1 of Article 271 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation the receipt of money into a current account when making payments using collection orders. The organization uses the accrual method

On July 2, Alpha LLC entered into a long-term agreement for the provision of . According to the agreement, Hermes pays for the provided communication services on a monthly basis. The agreement provides for a collection form of payments (collection orders).

The agreement between Hermes and the bank servicing it contains a provision regarding the bank’s right to write off funds from the client’s account without his order.

In July, Alpha provided RUB 59,000. (including VAT – 9000 rubles). The Alpha accountant issued a collection order for this amount.

On August 1, Hermes submitted the following information to the bank servicing it:

- about the recipient of funds (“Alpha”), who has the right to issue collection orders to write off money in an indisputable manner (full name, legal and actual address, telephone number, INN, KPP, OGRN, bank details, information about the manager and chief accountant);

- on the agreement for the provision of communication services (agreement No. 344 dated July 2, concluded with Alfa).

Money to pay for services arrived in Alpha’s bank account on August 3.

For the services of executing a collection order, the bank servicing the organization wrote off a fee in the amount of 1,800 rubles from Alpha’s current account.

Alpha's accountant recorded the transactions as follows.

July 31:

Debit 62 Credit 90-1 – 59,000 rub. – revenue from the provision of communication services is reflected, and at the same time a collection order is issued to pay for them;

Debit 90-2 Credit 20 – 30,000 – the cost of sold communication services is taken into account as expenses;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 9000 rubles. – VAT is charged on revenue from the provision of communication services.

August 3rd:

Debit 51 Credit 62 – 59,000 rub. – money has been received from the buyer (collection order executed);

Debit 91-2 Credit 51 – 1800 rub. – reflects the bank’s remuneration for services rendered when making payments by collection orders.

Alpha uses the accrual method, so the receipt of revenue from the sale of services into the current account did not affect the calculation of income tax.

If an organization calculates income tax using the cash method, the reflection of received money in the current account depends on its purpose. This is due to the fact that income under the cash method is recognized at the moment the money is received in the current account (clause 2 of Article 273 of the Tax Code of the Russian Federation).

For example, if an organization receives proceeds from the sale of goods (work, services) into its current account, then it must be taken into account when calculating income tax at the time the funds are received (clause 2 of Article 273 of the Tax Code of the Russian Federation). This rule also applies to advance payments received (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

When money arrives in the current account as an advance for upcoming deliveries of goods (work, services), the organization may have an obligation (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Expense from account based on payment order

The “Account Expense” document can be created based on a previously created payment slip. Open it, click the “Create based on-Account Expense” button. In this case, all the details filled out in the payment order will be automatically inserted into the new document. They can also be adjusted manually. Otherwise, the execution of the “Account Expense” document is carried out in the same way as described above.

Fig. 23 Expense from an account based on a payment order

Cashless payments

When making non-cash payments to customers, funds can be transferred to the current account on the basis of the following documents:

- payment orders;

- letters of credit;

- checks;

- payment requests;

- collection orders;

- payment orders.

These types of settlement documents are provided for in Article 862 of the Civil Code of the Russian Federation and paragraph 1.1 of the Regulations approved by the Bank of Russia on June 19, 2012 No. 383-P.

For information on how to process and make payments using payment orders and checks, see:

- How to account for debiting funds from a current account;

- How to reflect transactions on special accounts in accounting.

Posting control

To control the correct formation of transactions, you can view the “Document Movements” and adjust the movement of the document according to the accounting accounts.

Fig.24 Wiring control

Fig.25 Wiring control

In this article, we looked at the mechanisms for reflecting receipts and write-offs, and got acquainted with the possibilities of fast and error-free operation that the 1C 8.3 program offers to its users.