From January 1, 2022, changes will occur in the field of electronic signatures - the provisions for the issuance and use of an enhanced qualified electronic signature will be updated. The Federal Tax Service of Russia is entrusted with the functions of issuing a qualified electronic signature for legal entities (persons who have the right to act on behalf of a legal entity without a power of attorney), individual entrepreneurs and notaries.

From July 1 to December 31, 2022 - a transitional stage to updated criteria for issuing and using an electronic signature.

“In order to ensure a “seamless” transition from a paid to a corresponding free state service for issuing an electronic signature, from July 1, it will be possible to obtain a qualified electronic signature at the Certification Center of the Federal Tax Service of Russia,” warns the Federal Tax Service.

Which electronic signatures will work after July 1, 2022

, nothing will change for owners of valid electronic signatures . You will have to master the new rules by January 1, 2022, or earlier if the signature expires before January. Also, the electronic signature will become invalid before January 1, 2022, if the accreditation of the CA ends before this date.

Registration in ERUZ EIS

From January 1, 2020 , in order to participate in tenders under 44-FZ, 223-FZ and 615-PP, registration in the ERUZ register (Unified Register of Procurement Participants) on the EIS (Unified Information System) portal in the field of procurement zakupki.gov.ru is required.

We provide a service for registration in the ERUZ in the EIS:

Order registration in the EIS

From July 1, managers, employees and authorized persons will still be able to receive electronic signatures at SKB Kontur. Certification center SKB Kontur is accredited according to the new requirements of 63-FZ

How to send an electronic power of attorney to the Federal Tax Service

In Externa, in the “Payer Details” in the “Signing of Documents” block, you can select an individual’s certificate and then click on the “Add power of attorney” button.

Then there will be options:

- “Fill” - a window will appear where you need to enter data.

- “There is an accepted electronic power of attorney” - if you have previously worked in another reporting system with an individual’s certificate, you can simply enter the data of a valid electronic power of attorney.

The manager will be able to issue the rights to send reports to a specific Federal Tax Service Inspectorate, and not all at once, but by default Extern will consider that the power of attorney is valid in all Federal Tax Service Inspectors.

What to do with an electronic signature

Until July 1, 2022, the electronic signature must be reissued at any CA upon expiration.

From July 1, 2022 to January 1, 2022, if it is necessary to purchase a new signature, this can only be done at a CA that has passed the accreditation procedure in accordance with the updated provisions. Managers of individual entrepreneurs have the opportunity to contact the Federal Tax Service.

By January 1, 2022, the procedure for the functioning of electronic powers of attorney for employees will become clear, and a register of authorized representatives of the Federal Tax Service will also appear. Possible assumptions about further operations:

- If you are not a manager, obtain the signature of an individual at a CA accredited according to the new rules. But first, check that the services and portals where you work accept electronic power of attorney.

- If you are the head of a legal entity or individual entrepreneur, contact the Federal Tax Service CA or its trusted CAs to obtain an electronic signature of the legal entity.

What is required to obtain a certificate from the Federal Tax Service Center and start working

To receive an electronic signature through the Federal Tax Service, you must first fill out and send the application:

- for heads of legal entities - in the personal account of the individual entrepreneur or;

- individual entrepreneurs - in the personal account of the individual entrepreneur.

In your personal account with the Federal Tax Service, an electronic signature is not required to sign an application.

Let's consider a real example of obtaining an electronic signature at the Federal Tax Service Center:

- Having entered his personal account, the individual entrepreneur selected.

- The system asked you to go through three steps to verify the data for the issued certificate.

- After passing the verification, the entrepreneur sent the application.

- The next step was to make an appointment - you could choose from the next day starting at 9:00 in 30-minute increments.

- After the individual entrepreneur has successfully selected the date and time, he received a PIN code - he needs it to get a coupon at the reception point in the Federal Tax Service terminal.

- Before going to the inspection, the entrepreneur bought Rutoken Light, a secure electronic signature medium. Without a token, a signature will not be issued; you can buy any other certified media, for example, JaCarta SE.

- In the department where the entrepreneur went, a separate reception had not yet opened, so he went to the window without a coupon, where he presented his documents - a passport and SNILS. I also had to go through identification - the taxpayer was photographed on a webcam.

- After filling out all the documents, the entrepreneur received an electronic signature for his token and detailed instructions for installation and operation by email.

The result was not long in coming: a couple of minutes later a notification arrived that the test was successful.

Along with the token, the entrepreneur received a certificate of conformity, which is also needed to obtain an electronic signature.

Who is issued a free signature from the Federal Tax Service?

From July 1, the Certification Center of the Federal Tax Service of Russia provides free qualified certificates exclusively for legal entities (usually the general director acting on behalf of the enterprise in the absence of a power of attorney), individual entrepreneurs and notaries.

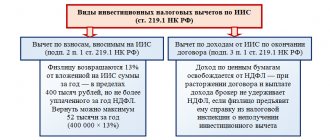

From January 1, 2022, the following restrictions come into force:

- CEP of credit institutions , payment system operators, non-credit financial organizations and individual entrepreneurs will be available at the Certification Center of the Central Bank of the Russian Federation;

- CEP of officials of state bodies , local government bodies or organizations subordinate to a state body or local government body can be obtained from the Certification Center of the Federal Treasury;

- CEP of individuals , as well as persons acting on behalf of a legal entity by proxy, can be obtained from commercial certification centers after their re-accreditation.

The validity period of the free electronic signature provided by the Federal Tax Service certification center will be 15 months .

The nuances of working with the signature of the Federal Tax Service

For an electronic signature from the Federal Tax Service to function, the computer must have a valid cryptographic protection tool (for example, the CryptoPro CSP program and a license for it). The program can be purchased from a CA, from authorized representatives or from the manufacturer.

The Federal Tax Service allows managers to obtain only one signature per legal entity . Since its key cannot be copied, it is impossible to create a copy for an accountant or tender specialist . All employees and authorized persons signing documentation on behalf of the enterprise must have their own signature of the individual and an electronic power of attorney.

How to install an electronic signature

To install the digital signature on your computer, we downloaded and installed all the necessary programs. Let's start installing an electronic signature. Let's look at how to do this step by step.

- Insert the electronically signed media into the computer.

- Launch CryptoPRO CSP.

- Go to the Service tab.

- Click View certificates in the container.

- Click Review.

- In the list that opens, select the required electronic signature certificate.

- In the certificate viewing window, click Install .

- After completing all the steps for installing the digital signature, a window will appear on the computer screen with the notification The certificate has been installed in the “Personal” storage of the current user .

- Click OK .

The basic installation and configuration of the electronic signature was successful.

For advanced work with digital signatures, it is necessary to configure each site/portal separately.

Who and how to receive ES from 2022: summary table

| Who signs the document | What is needed for signing | Where to get EP |

| Private individual | EP individual (FL) | Accredited CA (AUC) |

| An employee of the organization or an authorized person | ES of the individual + power of attorney signed by the ES of the legal entity (LE) | AUC |

| Head of a commercial organization | Electronic signature of the legal entity, which indicates the director | Federal Tax Service and authorized representatives |

| Individual entrepreneur (IP) | EP IP | Federal Tax Service and authorized representatives |

| Individual entrepreneur | ES FL + power of attorney signed by ES IP | AUC |

| Notary | ES of a notary | Federal Tax Service and authorized representatives |

| Automatic signing from the organization | EP legal entity without instructions from the manager | Federal Tax Service and authorized representatives |

Algorithm for obtaining UKEP from the Federal Tax Service of Russia

In May 2022, the Federal Tax Service clarified who and how can receive free CEP. The agency warned that from January 1, 2022, it will begin issuing such a signature for legal entities (general directors who act on behalf of the company without a power of attorney), individual entrepreneurs and notaries.

The certification center of the Federal Tax Service of Russia is accredited by the Ministry of Digital Development, Communications and Mass Communications of the Russian Federation, and it also requires the document “Procedure for the provision of services of an accredited certification center...” (hereinafter referred to as the Procedure).

The procedure for obtaining the signature of the Federal Tax Service:

- Make an appointment at the Federal Tax Service of Russia;

- Fill out an application for a qualified certificate;

- Purchase a key information carrier certified by the FSTEC of Russia or the FSB of Russia;

- The manager must personally visit the tax office at the place of registration at the specified hour with a package of documents, which includes an application, passport and SNILS, and a carrier of information to undergo the personal identification procedure and obtain an electronic digital signature certificate.

To obtain UKEP from the certification center of the Federal Tax Service of Russia, you must first draw up and send an application.

From July 1, 2022, persons who have the right to act without a power of attorney on behalf of an organization and individual entrepreneurs can submit an application using the “Personal Account of a Taxpayer – Individual”, or in person at the territorial tax authority and “in other information systems”, according to paragraph .22 Order.

The following data is filled in the application (clause 23 of the Procedure): full name of the applicant, name of the applicant, details of the applicant’s identity document, TIN of the applicant (an individual who has the right to act without a power of attorney on behalf of a legal entity), TIN of a legal entity (for legal entities) , SNILS of the applicant, OGRN or OGRNIP number, email address.

The application is signed by the person who sent the application to obtain the UKEP, in accordance with clause 24 of the Procedure.

The signed application must be sent to the issuing point of the Federal Tax Service certification center. At the time of submitting the application, the process of identifying the applicant is carried out.

Personal identification is carried out in one of several ways (clause 25 of the Procedure):

- In personal presence using an identification document of the applicant.

- Without personal presence using the current UKEP and biometric personal data.

When receiving the UKEP for the first time at the Federal Tax Service Center of Russia, identification of the applicant’s identity is carried out only in his personal presence at the place of receipt (clause 25 of the Procedure).

As a result of accepting an application for the purchase of UKEP, all information listed in the application is verified in the departmental systems of the Federal Tax Service, the Pension Fund of the Russian Federation and the Ministry of Internal Affairs. Only after passing positive checks, the Federal Tax Service CA will provide a UKEP certificate within 5 calendar days (clause 26 of the Procedure).

The application should be accompanied by a certified secure medium for UKEP, which meets the requirements of the Federal Tax Service of Russia (clause 22 of the Procedure). The qualified certificate is recorded on the key data carrier proposed by the applicant, which has been certified by the FSTEC of Russia or the FSB of Russia. The Federal Tax Service Center of Russia supports key USB Type-A format media, for example: Rutoken EDS 2.0, Rutoken S, Rutoken Lite, JaCarta GOST, JaCarta-2 GOST, JaCarta LT, ESMART Token, ESMART Token GOST and others that comply with the requirements.

The applicant independently records the electronic signature keys on a secure medium either at his workplace or at the point of issue on a “special computer” (clause 11 of the Procedure) after the personal identification procedure (clause 12 of the Procedure).

As a result of verification, confirmation of data in the application and identification of the individual (clause 26 of the Procedure), the Federal Tax Service of Russia provides a UKEP certificate within 15 minutes and issues it to the applicant (clause 27 of the Procedure).

Upon receipt of the UKEP certificate, the applicant familiarizes himself with the guidelines for ensuring the safe use of UKEP, in accordance with clause 29 of the Procedure.

Users who received the CEP from the Federal Tax Service of Russia have the opportunity to contact the Technical Support Service or call the Unified Contact Center of the Federal Tax Service of Russia: 8-800-222-2222.

Obtaining CEP from commercial certification centers

From July 1 to December 31, 2022, you can obtain an electronic signature for individual entrepreneurs and legal entities at commercial certification centers that have passed the accreditation procedure “according to the new requirements” of the Russian Ministry of Telecom and Mass Communications (See “A new electronic signature can be obtained at the SKB Kontur Certification Center”)

Moreover, the Federal Tax Service Center issues free electronic signatures exclusively to legal entities, individual entrepreneurs and notaries. The CEP of an individual or a person planning to act on behalf of a legal entity by proxy is issued only by commercial accredited CAs.

At the same time, individuals who represent an enterprise or individual entrepreneur by power of attorney, for example, full-time employees, from January 1, 2022, are obliged to provide signed documentation along with an electronic machine-readable power of attorney (MRP) , which is signed by the individual entrepreneur or the head of the legal entity.

The list of such certification centers is on the platform of the Ministry of Telecom and Mass Communications in the list of accredited CAs with an accreditation date after July 1, 2022 .

Electronic powers of attorney for reporting to the Federal Tax Service

An electronic power of attorney confirms that an individual has the authority to submit any documents to the Federal Tax Service for the organization. It must be signed by a valid manager’s certificate issued by the Federal Tax Service CA or an accredited certification center, for example, the Kontur CA.

An electronic power of attorney will replace the current paper power of attorney with the signature of the director.

The format of the electronic power of attorney of the taxpayer’s representative for sending documents to the Federal Tax Service is specified in the draft order. However, the entire new work scheme - with the transition to individual certificates and electronic powers of attorney - will become mandatory from January 1 or later - the exact date has not yet been officially approved. At the same time, if you have a valid Contour certificate in your hands in 2022, you can continue to use it until the end of its validity period.

Trustees of the CA of the Federal Tax Service of Russia

Under the terms of Federal Law N63-FZ and the “Procedure for the provision of services of the Federal Tax Service Certification Center”, in addition to the territorial tax authority, it is possible to contact authorized representatives of the Federal Tax Service CA of Russia .

Authorized representatives on behalf of the Federal Tax Service of Russia will be able to accept applications, identify individuals and transfer the UKEP certificate to the applicant.

To obtain the status of a CA trustee you must:

- Obtain accreditation according to updated regulations;

- Prove compliance with additional conditions established by Decree of the Government of the Russian Federation dated December 31, 2020 No. 2409.

SKB Kontur plans to obtain the status of an authorized representative of the Federal Tax Service. There are no such proxies yet, but once they appear, the Federal Tax Service Center will compile a list on its own official page.

Work through proxies of the Federal Tax Service Center of Russia will be carried out from January 1, 2022.

Our recommendations

- Set up an alternative way to log in to Extern. This will avoid a situation where you will not be able to enter Extern with a new certificate. Fill in your email, password and phone number (instructions) in Extern’s personal account in “Login Settings”. We recommend that you indicate your phone number, so you can always log in to Extern, even if you forget your login login.

- So that even during the transition period when changing the certificate you have access to your documents from reporting to the Federal Tax Service and Rosstat, enable the “Storage of decrypted reports” setting. And also install Kontur.Archive on your computer, which saves and decrypts documents from reports to the Federal Tax Service, Social Insurance Fund, Rosstat, as well as the requirements of the Federal Tax Service, formalized responses to them and primary (supporting) documents for reports. Kontur.Archive downloads and decrypts documents for the selected period, and then continues to download new documents from Extern. This way, you will always have a complete, up-to-date reporting archive at your fingertips.

- No need to worry. Until January 1, 2022, there are two scenarios for working in Externa: with certificates issued by commercial CAs, and with certificates issued by the Federal Tax Service CA. And in 2022, you will also be able to continue working at Externa with valid certificates from Contour or other commercial CAs accredited under the new rules. Follow the notifications in Externa - we will tell you what to do to make the transition to new certificates smooth.

Certification center SKB Kontur

The Kontur Certification Center has already received accreditation that meets the new requirements of the law on electronic signatures.

The new accreditation allows Kontur to continue issuing electronic signature certificates to individuals and organizations after July 1, 2022.

Now we are planning to cooperate with the Federal Tax Service Center to obtain the status of an authorized representative, with the help of which the issuance of electronic signatures to the heads of legal entities and individual entrepreneurs will be established.

Moreover, Kontur is taking part in the development of regulations governing the use of electronic powers of attorney, and it is also planned to prepare a system of these powers of attorney. And Contour’s services support the work of such powers of attorney and information structures with which interaction has been established.

How to sign and send an electronic power of attorney

There can be two situations here.

- If you have access to the manager’s certificate, you need to select the “Sign and Send” button. For example, the manager is in the next room and you can ask him to come up with his certificate.

- If you do not have access to the manager’s certificate, click on the “Request signature” button, in the window that opens, enter the manager’s e-mail, you can leave a comment and click “Submit”.

The “Payer Details” will reflect the date on which the signature request was sent to the manager, and the status “Power of Attorney awaiting signature” will appear in the list of organizations.

When the manager signs the power of attorney using the link from the received letter, you will see the changed status of the power of attorney in the “Payer Details” and will be able to send the power of attorney to the Federal Tax Service. After this, you will need to wait for a response from the Federal Tax Service.

If you receive a refusal from the Federal Tax Service, you can look at the reason for the refusal and reissue the power of attorney.

If the Federal Tax Service has accepted the power of attorney, you will be able to report for the organization; the data from the power of attorney will be included in the message about the representation, which is sent along with reports and other documents to the Federal Tax Service.

Responsibility for crimes related to digital signature

The principle of using a qualified electronic signature is clear, but for its full operation it is necessary to assign responsibility for violations.

The Ministry of Internal Affairs has prepared a bill that tightens liability for crimes related to digital signatures. The agency has published a proposal to tighten liability for violations related to the illegal use of electronic signatures. They want to increase the fine for this to 300 thousand rubles and establish criminal liability up to imprisonment.

The violator may face imprisonment for up to 3 years for illegal possession of a key or an electronic signature key certificate. In case of violation by an employee of a certification center that issues digital signatures, a penalty of up to 4 years is possible.