Requirements for an online cash register receipt and 18 new fields

The client chooses which document he will receive: paper, electronic or both. The paper one, as before, is printed on a cash register, and the electronic one is sent to the client by mail or SMS. The contents of both types of checks are the same and differ only in a few details.

This message comes to your phone

- 3 reviews

Training to work on CCP

1,000 ₽ Add to favorites

1 000₽

https://online-kassa.ru/kupit/obuchenie-rabote-na-kkt/

OrderMore details In stock

Technical support for 3 months.

3,600 ₽ Add to favorites

3 600₽https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie-na-3-mes/

OrderMore details Out of stock

Previously, there were 7 mandatory fields in fiscal documents, but after the introduction of new cash registers there were 25 of them. But for different types of activities, the number of mandatory details may increase or decrease.

This is what should be on an online cash register receipt

- The name of the document - for example, “cash receipt” or “shift closing report.”

- Name of the organization or full name of the entrepreneur.

- TIN.

- Cashier - position and last name (not indicated for automatic payments on the Internet and vending).

- Document number for the shift.

- Date and time of payment.

- Place of payment:

- postal code and address where the cash desk is located;

- if you trade on the road - the model and state number of the car, the address of the LLC or the registration address of the individual entrepreneur;

- when working on the Internet - the site domain.

If you moved the cash register to another store, re-register it at the new address. Otherwise, the company will be fined 5,000–10,000 rubles, and the individual entrepreneur 1,500–3,000 rubles.

- Shift number.

- Name of goods or services.

- Price including discounts.

- Quantity and cost of goods.

- VAT rate and amount.

- Taxation system (for example, “patent” or “STS income”).

- Calculation form. How the client pays: in cash or electronic money (card, Qiwi, Webmoney, Yandex.Money).

- Payment amount - how much was paid in cash and how much electronically.

- Calculation sign:

- arrival (client paid);

- return of receipt (the client returned the goods, and you gave him money);

- expense (for example, they gave out a lottery winnings);

- return of expense (the client returns the amount received).

If you live in a hard-to-reach area, some online cash receipt details are optional for you. You do not have the ability to send documents over the Internet, so you don’t have to indicate the address of the tax office website, your email and the buyer’s contacts.

To compare old and new check fields, download them as a separate file in Word format.

If at least one required detail is missing, the check is invalid. This is equivalent to the fact that you did not issue a payment document at all. The company will be fined 10,000 rubles, and the entrepreneur 2,000 rubles.

In paragraph 1 of Art. 4.7 of Law 54-FZ, the list of required fields does not include a QR code. But in paragraph 1 of Art. 4 states that the cash register must print a two-dimensional code in which data is encrypted to verify the authenticity of the document. Also, a QR code is required on a paper check according to the order of the Federal Tax Service dated March 21, 2017 No. ММВ-7-20/ [email protected]

A QR code is not needed for electronic documents.

You can print additional details - logos for branding or information about promotions.

An example of printing a promotion on a receipt from the Magnit network

Product code - a new detail in the online cash register receipt

A bill was introduced to the State Duma to add another mandatory field to fiscal documents - “Product code”. This will reduce the amount of counterfeit products on the market. And the tax office will be able to track the payment of VAT. The bill is planned to be approved in January 2019.

Innovations in current legislation

There are really a lot of amendments made to the main law “On the use of cash register equipment”. Here are the main ones:

- A paper version of the receipt, as before, must be issued to each buyer without fail, but if he wishes, as an additional option, an online version of the receipt must also be sent to his email or mobile phone. At the same time, their legal force will be equivalent.

- All data received from cash registers is transmitted to the tax service automatically via the Internet.

- The procedure for registering a new device can be carried out either in the classical way, by going to the Federal Tax Service office, or online, which will greatly simplify it.

- A fiscal drive must be installed in the cash register, which collects and transmits information to the operator responsible for storing the data.

- The list of required details has changed slightly. This was discussed in detail above.

In addition, penalties for violations in the field of cash services have changed. Fines for non-compliance with established rules have increased and can reach up to 100 thousand rubles for a legal entity.

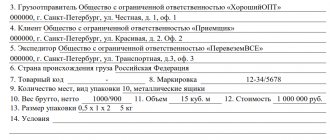

Sample of an online cash register receipt

Paper check

Issued to the customer in the store and printed on the cash register. When trading on the Internet it is not needed at all. It is not necessary to issue it if you sent an electronic version and the buyer did not ask for a paper version.

This is what an online cash register receipt looks like.

Document printed on an online cash register

Electronic check

To receive an electronic receipt, the client says his mobile number or email before paying. Such a document is equivalent to a paper document and replaces it.

Electronic payment document

If the buyer did not provide a number or email address, issue a paper check. If you punch a fiscal document, but do not hand it over and send it to the client, you will be fined.

Mandatory receipt details

The receipt printed at the cash register is a fiscal document. Its main task is to fiscalize financial information for further use within the framework of official government policy. To do this effectively, it must contain a wealth of information, including:

- Seller's TIN.

- Company name from the registration certificate.

- Serial number of the receipt.

- The position of the person who carried out the sale and his change.

- The number of the cash register that issued the document, or rather, the fiscal drive.

- The full cost of the purchase and the method of payment.

- Date and time of the transaction.

- Sign of a fiscal regime.

The required details of an electronic check differ slightly from those of a paper check. All the information presented above must also be indicated. Additionally, the address of the website of the fiscal data operator, who is responsible for servicing the device, the FDF version number, and the document form code are written here.

Check verification service - application from the Federal Tax Service

The Federal Tax Service has released a mobile application. Through it, the buyer checks fiscal documents for authenticity. If they are illegal, the client can immediately complain to the tax office.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

There are two ways to check your receipt:

- manually enter the fiscal attribute, time of purchase, amount, document number and transaction type (expense, receipt);

- read a QR code from a paper receipt.

The application will compare the information entered by the client with that received by the tax office from the OFD. If the data differs, the Federal Tax Service will look into it.

Application for checking receipts

Design rules

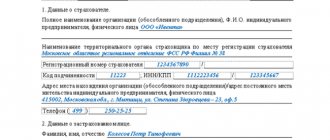

New devices capable of issuing electronic checks require proper tax registration. To register it, you will need a fiscal drive and a special cash program that meets the norms and requirements. You can purchase it from, which specializes in the development of mobile accounting systems.

In addition, it is necessary to find a fiscal data operator who will process the information and transfer it to the Federal Tax Service. The registration itself can be carried out either through the Internet portal or in the classic way - by personally coming to the tax office. A representative of the OFD can also become a mediator. This will save time and ensure that the registration process is completed correctly.

Strict reporting form = cash receipt

Now BSO and check are one and the same. They are equal in value, contain identical fields, and look identical. The strict reporting form can be sent to clients electronically. A copy of the BSO is sent to the OFD.

Forms can only be printed at the checkout counter and not at a printing house or printer. By law, BSOs must be formed on a special automated system. But the tax office said that you can use a regular online cash register.

Connection, cash register setup

4,400 ₽ Add to favorites

4 400₽https://online-kassa.ru/kupit/podklyuchenie-nastrojka-kassy/

OrderMore details In stock

Cash register registration 2019

1,500 ₽ Add to favorites

1 500₽https://online-kassa.ru/kupit/registratsiya-kassy-2019/

OrderMore details In stock

- 9 reviews

Technical support

6,000 ₽ Add to favorites

6 000₽

https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie/

OrderMore details In stock

Popular questions about checks and 54-FZ

What is a correction check under 54-FZ?

According to 54-FZ, the correction check is processed if there is a shortage or, conversely, an excess amount at the checkout. For example, the cashier ordered an item for 1,000 rubles. instead of 800. If an error is discovered at the end of the shift, run a correction check. In the attribute, indicate “receipt” for 200 rubles. (1000 - 800). At the same time, the cashier writes a memo and explains the reasons for the correction.

If you find an error after a few days, also fill out a correction check. For example, on June 13, correct the error for the 7th.

If you notice an error immediately or the buyer returns the product, do not generate a correction receipt. In this case, try “return receipt”.

Sample of a correction receipt printed on a new cash register

When can you omit VAT?

If you work without a VAT rate, do not indicate it or write “0%”. Courier services may not write VAT, since they do not sell goods, but only deliver.

Is it possible not to indicate the name of the product?

Until January 1, 2022, the name of the product or service is not indicated by the individual entrepreneur on the simplified document, patent, UTII and UST. Only if they do not sell excisable goods.

The name is not written if the exact list of goods and their volume is unknown at the time of payment, for example, when making an advance payment.

Remember

- The client chooses himself - a paper document, an electronic one, or both.

- A QR code is required only in paper documents.

- Missing at least one requisite means a fine. Individual entrepreneur up to 3,000, LLC up to 10,000 rub.

- BSO and cash receipt are now one and the same thing.

- The client returned the goods or noticed an error immediately - issue a “return receipt”.

- If you notice an error at the end of a shift, run a correction check.

- The buyer made an advance payment, but did not decide how much goods he needed - do not write the name.

Equipment for any type of business! Delivery throughout Russia.

Leave a request and receive a consultation within 5 minutes.

What other information may be on the receipt?

The information presented above is not exhaustive. If desired, as well as the appropriate software, you can additionally enter other information. For example, not only the final purchase price is written here, but also information about the receipt of a certain amount of money and the change issued to the buyer or the product item code.

This is done solely for practical purposes, to ensure easier but more competent analysis by the organization’s accounting and logistics services. Data about the store’s special loyalty program, promotional offers and other information useful for the buyer are also indicated here. They are not included in the list of what a cash receipt must contain by law, but are helpful in operations and customer service.