How to pass rent checks

An organization on OSN leases real estate to an individual. The rent consists of two parts. Settlements with individuals under the agreement are as follows:

How many checks should be issued, with what indication of the payment method? |

From July 1, 2022, cash register is used not only when receiving money, but also for non-cash payments, namely (Article 1.1, paragraph 1, Article 1.2 of the Law of May 22, 2003 No. 54-FZ; paragraph 4, Article 4 of the Law dated 07/03/2018 No. 192-FZ):

- when setting off an advance payment;

- when providing loans to pay for services. Moreover, by issuing a loan, tax officials mean deferment or installment payment (Letter of the Federal Tax Service dated October 25, 2018 No. ED-3-20 / [email protected] ).

The Federal Tax Service has developed guidelines for generating checks upon receipt of an advance payment, its subsequent offset, provision of a loan and its repayment (Letter of the Federal Tax Service dated February 20, 2019 No. ED-4-20 / [email protected] ).

The company needs to knock out three checks:

- July 25 - for 1000 rubles. with the sign of the payment method “ADVANCE PAYMENT”, since you know what the money was received for (Letter of the Ministry of Finance dated June 14, 2017 No. 03-01-15/36865);

- July 31 - by 2300 rubles. with the sign of the calculation method “PARTIAL SETTLEMENT AND CREDIT” (Table 28 of Appendix No. 2 to the Order of the Federal Tax Service dated March 21, 2017 No. MMV-7-20 / [email protected] );

- August 5 - for 1300 rubles. with the sign of the payment method “CREDIT PAYMENT”.

Note that it makes no sense to break the rent in the check into its components (“rent part 1” and “rent part 2”). Firstly, the cash receipt is not the only source of information for the tenant about the amount and composition of the rent. After all, the terms of rent payment must be specified in the contract, and if the rent consists of a fixed and variable part, then the details of the variable payment are usually attached to the invoice for payment. The check confirms the very fact of payment for rental services, and not the structure of the rent.

Secondly, it is important for controllers that the check complies with the requirements of Law No. 54-FZ, including the presence of mandatory details in it (Clause 1, Article 4.7 of Law No. 54-FZ). And if the name is indicated on the check), then the tax authorities should not have any claims against it. Moreover, the Law on Cash Register does not have specific requirements for the “Name of goods, works, services” detail, that is, the cash register user can independently determine how and with what level of detail to write services in the check (Letter of the Ministry of Finance dated September 25, 2018 No. 03-01 -15/68652).

Required cash receipt details: list

The list of cash receipt details has been changed several times. In 2021, the following list is relevant (Article 4.7 of Federal Law No. 54 on the use of CCP):

- Name of the document (“cash receipt”).

- The serial number within a shift is from 1 and higher, depending on the number of generated fiscal documents. With the opening of a new shift, the countdown begins anew.

- Time, date and place of settlements. If everything is clear with the time and date, then questions may arise regarding the address. For example, in traveling trade, when settlements are not carried out in one place. If the cash register is assigned to a vehicle, the check reflects its name and number, and indicates the address at which the legal entity or individual entrepreneur is registered. And if the activity is carried out online - the website domain.

- Full name of the entrepreneur, and if the business is carried out on behalf of a legal entity, you must indicate the name of the organization.

- TIN.

- Taxation system used in calculations. Please note that as of January 1, 2022, UTII has become invalid. In this regard, taxpayers who previously used this mode should have already updated their cash register settings in accordance with the current Tax Code.

- Sign of calculation. If the money is received from the client - “Receipt”. In the case of returning the amount of money to the buyer that he paid earlier - “Return of receipt”. If money is given to the client - “Expense”. Upon receipt from the buyer of funds that were issued to him earlier, a “Return of Expense” is issued.

- The nomenclature of goods, works or services, depending on the field of activity (the details became mandatory for “special regime officers” who do not participate in the circulation of marked and excisable goods from 02/01/2021). The concept of “nomenclature” is capacious and includes the name, quantity and price per unit of goods (works or services). But only if this information is known at the time of calculation. When making an advance, two checks are generated: in the first the item is not indicated, but it is displayed in the second, which is printed at the time of final payment. Discounts and markups are taken into account. If the taxpayer is required to pay VAT, indicate the tax rate and amount.

- The amount of money that is recorded by the cash register (deposit or withdrawal). Separately indicate the rate and amount of VAT if the taxpayer is required to pay it.

- Method of performing the calculation. The client pays in cash or by non-cash method (money is debited from a bank card, electronic wallet and other means of electronic payment).

- The name and position of the person responsible for making payments to the client. If a check is issued through a vending machine, this detail is not indicated in it, since the transaction is not carried out by a living person, but through an automatic device.

- CCP number assigned by the tax office when registering the equipment.

- The unique number of the used FN, assigned at the manufacturer's factory.

- Fiscal sign of the document. This is information generated by the Federal Tax Service and necessary to verify fiscal data.

- The address of the Internet portal where you can go to check the calculation data and the reliability of the fiscal indicator.

- Email or telephone number of the client, which he indicated for sending an electronic check by the cashier. The buyer provides contact information before making a payment.

- Email of the sender of the cash receipt, subject to the transfer of the fiscal document to the buyer in electronic form.

- Check number in order.

- Fiscal message sign. Identifier when sending an OFD check.

- QR code. It contains information about the performed operation in encrypted form. Control on the part of the buyer occurs through the “Checking Receipts” application by reading the QR code using the camera of a mobile device.

If one of the specified details is missing, the fiscal document is invalid. Such an offense is equivalent to dishonor of a check.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Certain types of calculations

In some cases, relaxations apply. Thus, if calculations are carried out in an area remote from Internet communications, the transfer of data to the OFD and the operator of the marking system is not carried out at the time of the operation. This is permitted by law. Since the cash register is not connected to the Internet at the time of settlement, its functions are limited, and sending electronic documents to the buyer is impossible. Accordingly, the contact details of the sender and recipient of the check are not indicated. As well as the website address for checking the operation.

Additional details are provided for checks that are generated at the time payment agents accept funds from individuals:

- the amount of remuneration that is paid by the payer (when collected);

- telephone number of the person responsible for accepting funds from an individual.

Moreover, it is not necessary to indicate VAT.

- 3 reviews

Training to work on CCP

1,000 ₽ Add to favorites

1 000₽

https://online-kassa.ru/kupit/obuchenie-rabote-na-kkt/

OrderMore details In stock

- 9 reviews

Technical support

6,000 ₽ Add to favorites

6 000₽

https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie/

OrderMore details In stock

When making settlements with payment agents acting on behalf of banks, checks with additional details are generated:

- name of the operation;

- the amount of remuneration paid by the client (if charged);

- the name and location of the operator who carries out the money transfer;

- TIN;

- telephone number of the recipient of the funds (in this case we are talking about the paying agent).

As in the previous case, the VAT rate and amount may not be indicated.

If a cash register receipt is generated in a cash register installed in a vending machine, the document displays the number of the device itself, assigned at the manufacturer’s factory, and information about the installation location.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

If payments are made between individual entrepreneurs and/or legal entities, the list of details is supplemented with the following data:

- Full name of the client or the name of the organization (as indicated in the accounting documents), if the buyer is a legal entity;

- Buyer's TIN;

- information about the country where the goods that are the subject of calculation were manufactured;

- the amount of excise tax (indicated in cases where the payment is made for excisable goods);

- customs declaration registration number, where applicable.

If a lottery winning is paid out in the amount of 15 thousand rubles or more, the check additionally indicates one of the details:

- TIN of the recipient of the money;

- Full name, passport details of the recipient, if he acts as an individual.

The same details are displayed in checks issued in casinos and slot machine halls when using the exchange marks of a gambling establishment. In addition, from October 1, 2020, such organizations indicate the “attribute of the subject of calculation.”

It is important that the contents of the check are clear and readable for at least six months from the date the data is printed.

We will solve any problems with your equipment!

Leave a request and receive a consultation within 5 minutes.

What sign of the payment method should be indicated on the receipt for goods in foreign currency?

| The organization sells equipment to individuals. The cost of equipment is determined in foreign currency, payment is made at the Central Bank exchange rate on the day of settlement. We work on an advance payment of 10, 20 or 50%. What type of payment method should we indicate on the check: advance or prepayment? Now we are processing checks with the sign “ADVANCE”, but we have doubts. After all, we know the name and quantity, but we do not know the final price of the product. Can we be fined for an incorrect calculation method? |

We asked a Federal Tax Service specialist to comment on your situation.

KUKOVSKAYA Julia Alexandrovna. Advisor to the State Civil Service of the Russian Federation, 2nd class:

— If the seller knows the name and quantity of the goods for which he receives an advance payment, then the payment method must indicate “ADVANCE PAYMENT.” In this case, in the “price per unit of goods” detail in the “prepaid” check, you must indicate not the price of the product itself, but the amount of the prepayment made (in this case, calculated based on the Central Bank exchange rate on the day of payment).

For incorrect formation of a cash receipt, a fine is possible under Part 4 of Art. 14.5 Code of Administrative Offences.

Advance or prepayment?

There are no clear recommendations when to use “ADVANCE” and when to use “PREPAYMENT”. But law enforcement practice recommends using “prepayment” in the event that the product or service for the sale of which the payment is made is known in advance. Receipt of an advance payment is part of the transaction (condition) for the transfer of a previously known product or provision of a service. It is also recommended not to use “Advance” with 100% prepayment - the advance is usually only part of the total transaction amount. “Advance” makes sense to use if the composition of the goods being shipped or the service being provided is not known in advance.

Examples:

- The dentist determines the upcoming treatment (services) only after diagnosis. Prepayment made before diagnosis is an advance payment.

- payment for goods in an online store. Receipt of payment precedes the receipt of a previously known product, therefore this type of payment is “100% ADVANCE PAYMENT”

- deposit in a restaurant - it is not known in advance what kind of dishes or drinks will be sold to the client, therefore such a deposit must be reflected as an “advance”

A separate example of the correct reflection of an advance or prepayment is prepayment for a banquet in a restaurant. If the composition of the banquet menu is known and agreed upon in advance and will not change in the future, then the advance payment made for it is “Advance Payment”. If the banquet menu has been partially agreed upon and guests can order something additional during the event, then the advance payment will be considered an “advance payment”.

The new payment rules according to FFD 1.05 relate not only to the rules for working with the cash register, but also affect the business processes of the enterprise. The fine for violating the rules for processing such payments is comparable to the fines for not using cash registers, and the Federal Tax Service will be able to detect such violations automatically when analyzing data in the OFD. Therefore, we recommend working out in advance all possible payment schemes at your enterprise and training cashiers to reflect them correctly.

How to issue a check for payment for marked goods to order

| On his website, the individual entrepreneur sells goods (fur coats) to order with full prepayment. A person places an order, he is given an invoice, which he pays. According to Law No. 54-FZ, the seller must punch the check when he learns about the payment. At the same time, the receipt must contain information about the barcode of the labeled product. But since the individual entrepreneur sells to order, at the time the check is punched he has no information about the code for a specific fur coat. This information will appear when the fur coat is purchased from the supplier. How to punch a check in such a situation? |

According to the Ministry of Finance, if, when the buyer deposits money, it is impossible to determine what goods and in what quantities he will order with these funds, then the check is issued for an advance payment, and not for an advance payment (Letter of the Ministry of Finance dated June 14, 2017 No. 03-01-15/36865 ).

In your case, the buyer pays for an already formed order, that is, when receiving money, you know the list of goods sold and their quantity, so you need to punch a check with the sign of the payment method “ADVANCE PAYMENT 100%” indicating the available information about the subject of payment (Table 28 of Appendix No. 2 to the Order of the Federal Tax Service dated March 21, 2017 No. ММВ-7-20/ [email protected] ).

Note also that the product code is not indicated in the “prepaid” check, because in fact the product has not yet been sold (when scanning the product code at the checkout, the OFD reports to the labeling system that the product has been disposed of - sold to the buyer).

If your cash register cannot “pull up” a specific product, since it is not yet registered, then when you receive money, you can punch a check with the sign of the payment method “ADVANCE”.

When the goods are transferred to the buyer, the previously made prepayment will be offset. For this operation, you need to run another check for the same amount with the sign of the payment method “FULL SETTLEMENT”, in which you need to list all the transferred goods. In this case, in the lines “amount for a cash check” and “amount for a non-cash check”, enter zeros, and in the corresponding line indicate the amount of the offset overpayment. This receipt should already contain a code that allows you to identify a specific instance of the marked product (tag 1162).

How to draw up a check when working under agency contracts

| An organization based on the simplified tax system provides tourism services and works under agency agreements. We transfer the money received for the sale of tours to the tour operator (principal) minus our remuneration. How to correctly generate a cash receipt so that the entire settlement amount is not recognized as our revenue? Do I need to separately highlight the agency fee on the check? |

If an agent is involved in settlements with buyers of tourism products, then he must use cash register transactions (Letter of the Ministry of Finance dated July 4, 2018 No. 03-01-15/46377). In this case, a cash receipt is issued for the entire amount received from the individual. There is no need to include agency fees. After all, the buyer should not care about your agency income at all. He pays the entire amount for the tour package and must receive a document confirming this particular payment.

To prevent the tax authorities from recognizing the money received from an individual in full as your proceeds, in the structure of the check you must indicate additional details “attribute of the agent” or “attribute of the agent for the subject of payment”, “supplier data”, as well as “TIN of the supplier” (Letters of the Ministry of Finance dated June 15 .2018 No. 03-01-15/41171, No. 03-01-15/41174).

We learned from a Federal Tax Service specialist what the difference is between the details “agent’s attribute” and “agent’s attribute for the subject of payment”, and at the same time we clarified the procedure for reflecting the agent’s remuneration on the check.

KUKOVSKAYA Julia Alexandrovna. Advisor to the State Civil Service of the Russian Federation, 2nd class:

— The difference between the details “agent attribute” and “agent attribute for the subject of settlement” is, first of all, their mandatory nature for the supported version of fiscal document formats. Thus, the “agent attribute” is required for FFD version 1.05, and the “agent attribute for the subject of calculation” is required for FFD version 1.1.

In addition, indicating the value in the “agent attribute” attribute means that all goods (work, services) listed in the check are sold by an intermediary (agent, commission agent, etc.) and, accordingly, the income received from the sale is the income of the principal, and not intermediary

The attribute “attribute of agent for the subject of payment” is applied to a separate product item and means that a specific product is sold by an intermediary, and the remaining goods (work, services) indicated in the same check are the own goods (work, services) of the cash register user.

The agency fee cannot be highlighted separately in the check, since it is a contractual relationship between the agent and the principal. The agency fee is paid to the agent by the principal on the basis of an agency agreement, and not by the buyer of the goods. The entire sales price, regardless of the method of calculating the agency fee (whether the agent receives it directly from the principal for each transaction or based on the results of a certain period, or withholds it independently from money received from clients), is the principal’s revenue.

Case:

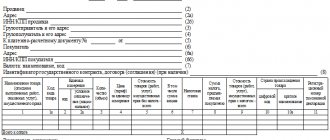

Providing and repaying a loan to pay for goods (providing installment plans for payment for goods).

Romashka LLC INN 1234567891, which applies the general taxation system, uses a cash register with the registration number of the cash register 1234567890123456 and the serial number of the fiscal drive instance 8710000109811542 in the mode of transmitting fiscal data in electronic form to the tax authorities through a fiscal data operator. Romashka LLC is engaged in trade and opens a shift every day.

Cashier Ivanov Ivan Ivanovich, having TIN 123456789012, is an employee of the specified organization. January 9, 2022 at 13:45 the specified cashier at the address: 127381, Moscow, st. Neglinnaya, 23, 9th floor, sells to a client (individual) goods owned by the seller:

1. Monitor Product 1 - 1 pc. — in the amount of 16,459 rubles.

To pay for goods, Romashka LLC provides the client with an installment plan until January 21, 2019 in the amount of 10,000 rubles. Agreement No. 978 dated 01/09/2019 was concluded. The remaining funds amount to RUB 6,459. paid by the client in cash on 01/09/2019 at 13.45.

During the sale, the 2nd cash receipt for the shift was generated with fiscal document number 133. The cash receipt was issued on paper.

The final payment was made on January 15, 2019 at 12:55 p.m. in the amount of 10,000 rubles. by bank card in the same place on the same cash register with the cashier Ivanov I.I. for the same product. During settlement, the ninth cash receipt for the shift with fiscal document number 1124 was generated and issued to the client on paper (the email address was not provided by the client until the time of settlement).