Chapter 25 of the Tax Code of the Russian Federation provides for the possibility of accounting for income and expenses on an accrual basis and a cash basis, that is, when funds are received into a current account or into the organization’s cash register/

The vast majority of organizations use the accrual method when calculating income tax. But there are those who, for one reason or another, prefer the cash method, to which Art. 273 Tax Code of the Russian Federation.

What is the essence of this method? Who has the right to use it? What conditions must be met by organizations using the cash method? How to switch to the accrual method if such conditions are violated?

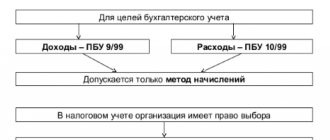

Differences between the cash method and the accrual method

The difference between the two methods is the period in which income and expenses are recorded.

Income is recognized:

– with the accrual method – in the reporting (tax) period in which they occurred, regardless of the actual receipt of funds and other property ( clause 1 of Article 271 of the Tax Code of the Russian Federation );

– with the cash method – on the date of receipt of funds to bank accounts and (or) to the cash desk, receipt of other property, repayment of debt to the taxpayer in another way ( clause 2 of Article 273 of the Tax Code of the Russian Federation ).

| Operations | Revenue recognition period | |

| With cash method | With the accrual method | |

| Goods were shipped in the third quarter. Payment received in Q4 | IV quarter | III quarter |

| The advance payment was received in the third quarter. Goods shipped in Q4 | III quarter | IV quarter |

Expenses are recognized:

– with the accrual method – in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment (clause 1 of Article 272 of the Tax Code of the Russian Federation );

– with the cash method – after actual payment ( clause 3 of Article 273 of the Tax Code of the Russian Federation ), taking into account some features.

Conditions for applying the cash method

To begin with, let's name those organizations that do not have the right to use the cash method by virtue of paragraph 1 , 4 of Art. 273 Tax Code of the Russian Federation . This:

– banks, credit consumer cooperatives and microfinance organizations;

– organizations recognized as controlling persons of controlled foreign companies;

– organizations specified in clause 1 of Art. 275.2 of the Tax Code of the Russian Federation (carrying out activities related to the production of hydrocarbons in a new offshore hydrocarbon field);

– participants in property trust management agreements, simple partnerships or investment partnerships.

Other organizations have the right to use the cash method if, on average, over the previous four quarters, the amount of their revenue from the sale of goods (work, services) excluding VAT did not exceed one million rubles for each quarter.

In this case, revenue from the sale of goods (work, services) for the purposes of calculating corporate income tax is determined in accordance with Art. 249 of the Tax Code of the Russian Federation (see letter of the Ministry of Finance of Russia dated December 16, 2016 No. 03-03-06/1/75488). That is, the calculation of revenue includes all receipts for sold goods, works, services, property rights in cash and (or) in kind without VAT and excise taxes; non-operating income is not included in the calculation.

Please note that compliance with the revenue limit must be verified at the end of each quarter.

Example 1

We will show the calculation of the amount of revenue (excluding VAT) on average for the previous four quarters (the original data is given in the first row of the table).

(million rubles)

| Calculation date | 2017 | 2018 | |||||

| I quarter | II quarter | III quarter | IV quarter | I quarter | II quarter | III quarter | |

| – | 0,7 | 0,5 | 0,9 | 1,8 | 0,6 | 0,65 | 0,98 |

| 01.01.2018 | (0,7 + 0,5 + 0,9 + 1,8) / 4 = 0,975 | ||||||

| 01.04.2018 | (0,5 + 0,9 + 1,8 + 0,6) / 4 = 0,95 | ||||||

| 01.07.2018 | (0,9 + 1,8 + 0,6 + 0,65) / 4 = 0,9875 | ||||||

| 01.10.2018 | (1,8 + 0,6 + 0,65 + 0,98) / 4 = 1,005 | ||||||

From the table above it is clear that the organization had the right to use the cash method from 01/01/2018, since over the previous four quarters its revenue averaged 0.975 million rubles.

This right was retained in the second and third quarters. After the third quarter ended, it turned out that revenue for the previous four quarters (IV quarter of 2022 and I, II, III quarters of 2022) exceeded the established limit, so in October 2022 the organization loses the right to use the cash method.

In paragraph 4 of Art. 273 of the Tax Code of the Russian Federation stipulates that if a taxpayer who has switched to determining income and expenses using the cash method, during the tax period exceeded the maximum amount of revenue from the sale of goods (work, services) established by clause 1 of this article, then he is obliged to switch to determining income and expenses on the accrual basis from the beginning of the tax period during which such an excess was allowed (the transition to the accrual method from the beginning of the tax period is also provided for the situation when the taxpayer during the year became a party to a property trust management agreement or a simple partnership agreement, an investment agreement partnership).

To switch to the accrual method from the cash method (if you lose the right to use the latter), you must perform the following actions:

– recalculate income and expenses from January 1 using the rules of the accrual method;

– recalculate the amounts of advance payments for income tax from the beginning of the year;

– submit an updated income tax return.

Article 273 of the Tax Code of the Russian Federation. The procedure for determining income and expenses using the cash method

Article 273 of the Tax Code of the Russian Federation with comments and amendments for 2020-2021

1. Organizations (except for banks, credit consumer cooperatives and microfinance organizations, organizations recognized in accordance with this Code as controlling persons of controlled foreign companies, and taxpayers specified in paragraph 1 of Article 275.2 of this Code) have the right to determine the date of receipt of income (realization expenses) on a cash basis, if on average over the previous four quarters the amount of revenue from the sale of goods (work, services) of these organizations, excluding value added tax, did not exceed one million rubles for each quarter.

Organizations that have received the status of a participant in a project for the implementation of research, development and commercialization of their results in accordance with the Federal Law “On Innovation and keeping records of income and expenses in the manner established by Chapter 26.2 of this Code, determine the date of receipt of income (expenses) using the cash method without taking into account the restrictions specified in paragraph one of this clause.

2. For the purposes of this chapter, the date of receipt of income is the day of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt to the taxpayer in another way (cash method ).

2.1. Funds in the form of subsidies received by organizations, with the exception of cases of receiving subsidies within the framework of a reimbursable agreement, are recognized as part of non-operating income in the following order:

- subsidies received to finance expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account for no more than three tax periods, counting the tax period in which these subsidies were received, as they are recognized expenses actually incurred from these funds. At the end of the third tax period, subsidies received that are not included in income are recognized as non-operating income as of the last reporting date of this tax period;

- subsidies received to finance expenses associated with the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights are taken into account as expenses actually incurred using these funds are recognized. When selling, liquidating or otherwise disposing of the specified property, property rights, subsidies received that are not included in income are recognized as non-operating income on the last date of the reporting (tax) period in which the sale, liquidation or other disposal of the specified property, property rights took place;

- subsidies received to compensate for previously incurred expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, or lost income are taken into account at a time on the date of their enrollment;

- subsidies received to compensate for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account at a time on the date of their enrollment in the amount corresponding to the amount of accrued depreciation for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights. The difference between the amount of subsidies received and the amount included in income on the date of their crediting is reflected in income in a manner similar to the procedure provided for in paragraph three of this paragraph.

In case of violation of the conditions for receiving subsidies provided for in this paragraph, the amounts of subsidies received are reflected in full as part of the income of the tax period in which the violation was committed.

2.2 - 2.4. No longer in force on January 1, 2015. — Federal Law of December 29, 2014 N 465-FZ.

3. Expenses of taxpayers are recognized as expenses after their actual payment. For the purposes of this chapter, payment for goods (work, services and (or) property rights) is recognized as the termination of the counter-obligation of the taxpayer - the purchaser of the specified goods (work, services) and property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services , transfer of property rights).

In this case, expenses are taken into account as expenses, taking into account the following features:

- 1) material expenses, as well as labor costs, are taken into account as expenses at the time of repayment of the debt by writing off funds from the taxpayer’s current account, making payments from the cash register, and in the case of another method of repaying the debt - at the time of such repayment. A similar procedure applies to payment of interest for the use of borrowed funds (including bank loans) and when paying for services of third parties. In this case, the costs of purchasing raw materials and materials are taken into account as expenses as these raw materials and materials are written off for production;

- 2) depreciation is taken into account as expenses in the amounts accrued for the reporting (tax) period. In this case, depreciation is allowed only for depreciable property used in production, paid for by the taxpayer. A similar procedure applies to capitalized expenses provided for in Articles 261, 262 of this Code;

- 3) expenses for paying taxes, fees and insurance premiums are taken into account as expenses in the amount of their actual payment by the taxpayer. If there is a debt to pay taxes, fees and insurance premiums, the costs of its repayment are taken into account as expenses within the limits of the actually repaid debt and in those reporting (tax) periods when the taxpayer repays the specified debt.

4. If a taxpayer who switched to determining income and expenses using the cash method during the tax period exceeded the maximum amount of revenue from the sale of goods (work, services) established by paragraph 1 of this article, then he is obliged to switch to determining income and expenses using the method accruals from the beginning of the tax period during which such excess was made.

In the case of concluding a property trust management agreement or a simple partnership agreement, an investment partnership agreement, the participants in these agreements, determining income and expenses on a cash basis, are obliged to switch to determining income and expenses on an accrual basis from the beginning of the tax period in which such an agreement was concluded.

5. Lost power. — Federal Law of April 20, 2014 N 81-FZ.

Features of accounting for expenses using the cash method

According to paragraph 3 of Art. 273 of the Tax Code of the Russian Federation , under the cash method, expenses of taxpayers are recognized as expenses after their actual payment.

For the purposes of applying Sec. 25 of the Tax Code of the Russian Federation, payment for goods (work, services and (or) property rights) is recognized as the termination of a counter-obligation by the taxpayer - the purchaser of the specified goods (work, services) and property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services, transfer of property rights).

In this case, expenses are taken into account as expenses, taking into account the following features.

Material costs, labor costs and third party services

Subclause 1, clause 3, art. 273 of the Tax Code of the Russian Federation provides for a unified write-off procedure:

– for material expenses;

– for labor costs;

– for expenses on paying interest for the use of borrowed funds (including bank loans);

– for expenses when paying for third party services.

At the same time, there is one more condition for paid raw materials and supplies: they are taken into account as expenses as they are written off for production.

Depreciation deductions

According to paragraphs. 2 p. 3 art. 273 of the Tax Code of the Russian Federation , depreciation is taken into account as expenses in the amounts accrued for the reporting (tax) period. In this case, depreciation is allowed only for depreciable property used in production, paid for by the taxpayer.

A similar procedure applies to capitalized expenses provided for in Art. 261 (expenses for the development of natural resources), 262 of the Tax Code of the Russian Federation (expenses for R&D).

In practice, the question arises about the possibility of taking into account depreciation charges in expenses for a partially paid object. As a rule, tax inspectors insist that depreciable property must be paid in full.

As for judicial practice, there is no consensus among arbitrators on this matter. Thus, the Resolution of the Federal Antimonopoly Service No. F09-3409/10-C2 states that the implementation of depreciation deductions by the legislator is not made dependent on the volume of payment made.

The arbitrators of the Arbitration Court of the Far Eastern Military District in the Resolution of December 29, 2015 No. F03-5773/2015 in case No. A04-5768/2015 concluded that the right to reduce expenses through depreciation charges (under the cash method) is associated with the moment of payment or termination of the obligation for payment in another way, therefore, the taxpayer has the right to include in expenses the amount of these charges in the case of full payment of the cost of depreciable property, regardless of the form and type of payment.

Tax expenses

Expenses for paying taxes, fees and insurance premiums are taken into account as expenses in the amount of their actual payment by the taxpayer. If there is a debt to pay taxes, fees and insurance premiums, expenses for its repayment are recognized as expenses within the limits of the actually repaid debt and in those reporting (tax) periods when the taxpayer repays the specified debt (clause 3, clause 3, article 273 of the Tax Code of the Russian Federation ).

Tax Code of the Russian Federation Article 273 The procedure for determining income and expenses under the cash method

1. Organizations (except for banks, credit consumer cooperatives and microfinance organizations, organizations recognized in accordance with this Code as controlling persons of controlled foreign companies, and taxpayers specified in paragraph 1 of Article 275.2 of this Code) have the right to determine the date of receipt of income (realization expenses) on a cash basis, if on average over the previous four quarters the amount of revenue from the sale of goods (work, services) of these organizations, excluding value added tax, did not exceed one million rubles for each quarter.

Organizations that have received the status of a participant in a project for the implementation of research, development and commercialization of their results in accordance with the Federal Law “On Innovation and keeping records of income and expenses in the manner established by Chapter 26.2 of this Code, determine the date of receipt of income (expenses) using the cash method without taking into account the restrictions specified in paragraph one of this clause.

2. For the purposes of this chapter, the date of receipt of income is the day of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt to the taxpayer in another way (cash method ).

2.1. Funds in the form of subsidies received by organizations, with the exception of cases of receiving subsidies within the framework of a reimbursable agreement, are recognized as part of non-operating income in the following order:

subsidies received to finance expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account for no more than three tax periods, counting the tax period in which these subsidies were received, as they are recognized expenses actually incurred from these funds. At the end of the third tax period, subsidies received that are not included in income are recognized as non-operating income as of the last reporting date of this tax period;

subsidies received to finance expenses associated with the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights are taken into account as expenses actually incurred using these funds are recognized. When selling, liquidating or otherwise disposing of the specified property, property rights, subsidies received that are not included in income are recognized as non-operating income on the last date of the reporting (tax) period in which the sale, liquidation or other disposal of the specified property, property rights took place;

subsidies received to compensate for previously incurred expenses not related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, or lost income are taken into account at a time on the date of their enrollment;

subsidies received to compensate for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights, are taken into account at a time on the date of their enrollment in the amount corresponding to the amount of accrued depreciation for previously incurred expenses related to the acquisition, creation, reconstruction, modernization, technical re-equipment of depreciable property, acquisition of property rights. The difference between the amount of subsidies received and the amount included in income on the date of their crediting is reflected in income in a manner similar to the procedure provided for in paragraph three of this paragraph.

In case of violation of the conditions for receiving subsidies provided for in this paragraph, the amounts of subsidies received are reflected in full as part of the income of the tax period in which the violation was committed.

2.2 - 2.4. No longer valid on January 1, 2015

3. Expenses of taxpayers are recognized as expenses after their actual payment. For the purposes of this chapter, payment for goods (work, services and (or) property rights) is recognized as the termination of the counter-obligation of the taxpayer - the purchaser of the specified goods (work, services) and property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services , transfer of property rights).

In this case, expenses are taken into account as expenses, taking into account the following features:

1) material expenses, as well as labor costs, are taken into account as expenses at the time of repayment of the debt by writing off funds from the taxpayer’s current account, making payments from the cash register, and in the case of another method of repaying the debt - at the time of such repayment. A similar procedure applies to payment of interest for the use of borrowed funds (including bank loans) and when paying for services of third parties. In this case, the costs of purchasing raw materials and materials are taken into account as expenses as these raw materials and materials are written off for production;

2) depreciation is taken into account as expenses in the amounts accrued for the reporting (tax) period. In this case, depreciation is allowed only for depreciable property used in production, paid for by the taxpayer. A similar procedure applies to capitalized expenses provided for in Articles 261, 262 of this Code;

3) expenses for paying taxes and fees are taken into account as expenses in the amount of their actual payment by the taxpayer. If there is a debt to pay taxes and fees, expenses for its repayment are taken into account as expenses within the limits of the actually repaid debt and in those reporting (tax) periods when the taxpayer repays the specified debt.

4. If a taxpayer who switched to determining income and expenses using the cash method during the tax period exceeded the maximum amount of revenue from the sale of goods (work, services) established by paragraph 1 of this article, then he is obliged to switch to determining income and expenses using the method accruals from the beginning of the tax period during which such excess was made.

In the case of concluding a property trust management agreement or a simple partnership agreement, an investment partnership agreement, the participants in these agreements, determining income and expenses on a cash basis, are obliged to switch to determining income and expenses on an accrual basis from the beginning of the tax period in which such an agreement was concluded.

5. Lost power

On the return to the buyer of amounts received in excess as payment for goods

In practice, situations often arise similar to the one considered by the Ministry of Finance in letter No. 03-03-06/1/374 dated June 30, 2008: the seller and buyer use the cash method, the buyer transferred an amount greater than that specified in the contract. The question arises of how to correct the error in the tax accounting of both parties, if on the date of transfer of funds the seller reflected the entire amount in income, and the buyer - in expenses.

According to the financial department, this should be done. The seller will take into account the amount of overpayment returned to the buyer as expenses that reduce the income tax base in the manner prescribed by paragraphs. 1 clause 3 art. 273 Tax Code of the Russian Federation .

The buyer will not take into account the funds erroneously transferred to the seller and returned by the latter when calculating income tax as part of his income. At the same time, he must adjust the tax base for the reporting (tax) period in which the expense associated with the purchase of goods is reflected, make the necessary changes and submit an updated income tax return to the tax authority.

Example 2

In June 2022, LLC “Seller” entered into an agreement with LLC “Buyer” for the supply of goods in the amount of 100,000 rubles. (hereinafter, for convenience, we will not take into account VAT).

In the same month, Buyer LLC transferred 120,000 rubles. to the bank account of Seller LLC. The latter returned the erroneous overpayment in the amount of 20,000 rubles. in August 2022.

The following transactions will be reflected in the tax accounting of the parties.

Seller LLC will reflect the amount of 120,000 rubles in income in June 2022, and 20,000 rubles in expenses in August.

LLC "Buyer" will reflect the amount of 120,000 rubles in expenses in June 2022. In August, having received 20,000 rubles, the company will not reflect this amount in income, but will submit an updated declaration for the first half of 2022, where the amount of 100,000 rubles will be reflected in material expenses.