Article 93 of the Tax Code of the Russian Federation: who is it for?

All tax payers (and from 2022 this includes insurance premium payers) are faced with tax audits, which cannot be done without requesting documents from the inspectors. If a desk audit is carried out and no discrepancies or contradictions are identified in the declaration, then the tax office will not have any questions and there is no need to submit anything to it as explanations or documents. But if inspectors find errors and contradictions in the declaration, a request for documents will follow. You can’t do without requests during on-site tax audits.

Read more about tax audits in the article “What types of tax audits are there? ”

Based on this, Article 93 of the Tax Code of the Russian Federation is intended primarily for all taxpayers, since its provisions contain information about the time frame for submitting documents (clause 3 of Article 93 of the Tax Code of the Russian Federation), as well as in what form and in what way (clause 2 of article 93 of the Tax Code of the Russian Federation).

But tax officials must also be guided by the provisions of this article: it regulates their actions to extend the deadlines for submitting documents (paragraphs 5, 6, paragraph 3, article 93 of the Tax Code of the Russian Federation) and regulates the methods of serving a demand (paragraphs 2, 3, paragraph 1, article 93 Tax Code of the Russian Federation).

The same article provides controllers with certain rights and establishes prohibitions:

- the right to seize documents if the taxpayer refuses to submit them (paragraph 1, 2, paragraph 4, article 93 of the Tax Code of the Russian Federation);

- the right to familiarize yourself with the originals of the submitted copies (paragraph 7, paragraph 2, article 93 of the Tax Code of the Russian Federation);

- prohibition on repeated requests for requested documents (clause 5 of Article 93 of the Tax Code of the Russian Federation).

You can find out how judicial practice develops on the issue of the legality of tax authorities requesting documents and submitting or failing to submit documents by a taxpayer using a selection from ConsultantPlus. Learn the material by getting trial access to the system for free.

Next, we will consider the most concerning questions for taxpayers, the answers to which they look for on the Internet using the queries “Art. 93 of the Tax Code of the Russian Federation”, “TC 93”, etc.

Can inspectors request documents under Art. 93 of the Tax Code of the Russian Federation, if a tax audit is not carried out?

If a desk or field tax audit is not carried out against the taxpayer, then a requirement to submit the primary report and explanations under Art. 93 of the Tax Code of the Russian Federation, tax authorities do not have the right (resolution of the Federal Antimonopoly Service of the Moscow District dated March 13, 2014 No. A40-71892/13). If a request is nevertheless received, it can be contested.

In paragraph 27 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, the judges came to the conclusion that controllers have the right to demand documents only during the period of a tax audit or additional tax control measures.

How is a request made under Article 93.1 of the Tax Code of the Russian Federation?

In order for inspectors to have the right to demand documents from a taxpayer as part of a meeting, the order to obtain documents and the requirement to provide documents must comply with all the standards established by tax legislation.

When requesting documentation from counterparties or other persons, tax authorities are guided by:

- Tax Code of the Russian Federation (clauses 3–4 of Article 93.1);

- by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/;

- letter of the Federal Tax Service of Russia “On recommendations for carrying out tax control measures related to tax audits” dated July 17, 2013 No. AS-4-2/12837.

These regulations establish the following rules for requesting documentation:

- The tax authority (let's assign it No. 1), which carries out control procedures in relation to the taxpayer, is allowed to request documents from its counterparty not independently, but only through the tax authority with which this counterparty is registered (let's call this inspection No. 2). True, there is one exception - when the counterparty and the taxpayer being audited are registered with the same inspectorate.

Tax authority No. 1 must send a special order to tax authority No. 2 to request documents (information).

- The order must contain:

- date and place of compilation;

- names of two tax authorities - No. 1 and No. 2;

- name of the taxpayer (let's call him “K” - counterparty) from whom you need to request documentation: his name (for individuals - last name, first name, patronymic); TIN, checkpoint, location (or place of residence);

- lists of required documents and information information, and their individualizing characteristics must be indicated;

- data about the transaction that allows it to be identified;

- name of the person in respect of whom the inspection is being carried out;

- the name of the control procedure within which the need arose to request documents and information;

- signature of the head of the tax authority (or his deputy) indicating the rank;

- stamp of the tax authority.

Having received the order, tax authority No. 2, within 5 working days, is obliged to send a request for the provision of documents (information) to person “K”, who is registered with him. To this requirement, tax authority No. 2 is obliged to attach a copy of the order to request documents issued by authority No. 1. The request must contain the same list of information as the order.

Let's note a few important nuances:

- According to Art. 93.1 of the Tax Code of the Russian Federation, tax authorities do not have the right to demand from “K” documentation that he had already provided earlier as part of verification activities (letter of the Ministry of Finance of the Russian Federation dated February 11, 2015 No. 03-02-07/1/5991).

- Even if the number of documents requested from “K” is huge, and significant sums are spent on sending and copying them, it will not be possible to reimburse these expenses. This follows from the letter of the Ministry of Finance of the Russian Federation dated May 10, 2012 No. 03-02-07/1-116.

- 5 days are given to fulfill the requirement. If too many documents are requested, you can send a request to the tax authority to extend the deadline for responding to the request. But it is worth considering that this possibility is enshrined in Art. 93.1 of the Tax Code of the Russian Federation as the right of the tax authority, and not as its obligation.

In what form to submit a notification about the impossibility of submitting documents (information) on time, find out from the publication.

How will a company be punished for failure to provide documents and can this be avoided?

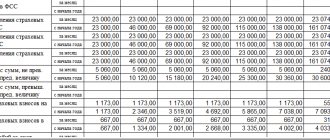

The obligation of the inspected person to submit documents to controllers within 10 days after receiving the request (20 days for a consolidated group, 30 days for a foreign organization) is enshrined in clause 3 of Art. 93 Tax Code of the Russian Federation. If this deadline is violated, tax authorities have the right to punish the taxpayer under Art. 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. for each document not submitted.

Important! If the documents were not submitted, when determining the measure of liability, tax authorities are required to take into account the presence of mitigating circumstances (clause 4 of Article 112 of the Tax Code of the Russian Federation) and circumstances excluding guilt (clause 1 of Article 111 of the Tax Code of the Russian Federation). If such circumstances occurred, the fine can be reduced by half (clause 3 of Article 114 of the Tax Code of the Russian Federation) or canceled altogether (clause 2 of Article 111 of the Tax Code of the Russian Federation). This has been confirmed by the courts (see, for example, the resolution of the Federal Antimonopoly Service of the Volga Region dated July 7, 2009 No. A12-19285/2008, etc.).

If a company does not have time to prepare documents in full within the deadlines established by the Tax Code of the Russian Federation, it should promptly contact the tax authorities with a request to extend this period (clause 3 of Article 93 of the Tax Code of the Russian Federation).

If the inspection unlawfully refused to extend the period to the company, the fine can be challenged in court. Examples of positive decisions are the resolutions of the Federal Antimonopoly Service of the West Siberian District dated April 5, 2011 No. A45-12306/2010, and the Volga-Vyatka District dated July 30, 2007 No. A29-8736/2006.

If the documents are slightly late, the fine can also be challenged (resolution of the Federal Antimonopoly Service of the Moscow District dated October 13, 2009 No. KA-A41/10782-09, etc.).

When do tax authorities seize documents?

Seizure of documents is possible only during an on-site tax audit and is carried out on the basis of clause 3 of Art. 31 of the Tax Code of the Russian Federation in compliance with the procedure described in Art. 94 Tax Code of the Russian Federation.

The right to seize documents is enshrined in paragraph. 1, 2 p. 4 tbsp. 93 of the Tax Code of the Russian Federation: in the case when the taxpayer refused to submit them.

Moreover, if inspectors violated the procedures established by the Tax Code of the Russian Federation for requesting documents or seizing them, the decision based on the results of the inspection can be challenged in court (Resolution of the Administrative Court of the Ural District dated July 29, 2015 No. F09-4467/15).

For more information on whether the requirement to submit documents without the tax authority’s seal is legal, read the article “Requirement without the inspection seal is the norm .

Legal essence of the claim

It does not clarify what specific checks may be the basis for requesting documents. Therefore, it is also applied during desk audits, but in this case, tax officials must act within the framework of Art. 88 Tax Code of the Russian Federation. It contains clause 7, which establishes the rule that during a desk audit, the tax authority cannot request additional information and documents, unless otherwise provided by the article itself or the submission of some of the requested documents together with the declaration is not provided for by other articles of the Tax Code. RF.

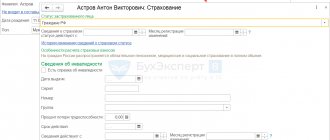

Documents may be requested and provided in electronic format. The method is not suitable for all taxpayers, but only for those who have an electronic digital signature and a certificate of its keys, and the tax authority must have the appropriate software.

Sending documents that have legal force differs from the usual sending of scans by email. Read more about this in the legislation on digital signature.

Request for documents can occur not only during any inspection, but also from a wide variety of groups of people related to the case. All this is quite logical, for example, according to the tax legislation of the Russian Federation, employers become tax agents. Of course, you need to contact them for documents, since employees are not required to keep any financial statements and do not keep them. All they have is a salary card and sheets with information about accruals and deductions, which, according to the Labor Code of the Russian Federation, employers must give to all employees on the day the salary is transferred to their accounts. Tax authorities are interested in other documents.

It is prohibited to require notarization of copies of documents submitted to the tax office, but with the caveat that a different procedure may be provided for by the legislation of the Russian Federation. Tax authority employees are allowed to request original documents for review. They are not withdrawn, but are needed only in order to have complete confidence that the copy corresponds to the original.

The taxpayer is obliged to provide documents within 10 days from the date of receipt of the request from the tax authority.

However, the article contains a caveat: if the taxpayer cannot provide the necessary documents to the tax authority, then he is obliged to send a notification about this, doing this no later than the day following the day of receipt of the request for documents. The notification shall indicate the reasons and circumstances that are an obstacle to the provision of documents within the prescribed period. Then the tax authority must extend the deadlines or make a different decision on this situation and inform the taxpayer accordingly.

A taxpayer can also refuse to provide documents, but the Code directly states that refusal is an offense. If the taxpayer refuses to provide documents or goes beyond the 10-day period, the tax authority has the right to carry out a seizure based on the provisions of Art. 94.

When can documents be requested under Art. 93.1 Tax Code of the Russian Federation?

Unlike Art. 93 Tax Code of the Russian Federation Art. 93.1 applies when requesting documents outside of tax audits in relation to the taxpayer himself. Information may be requested by controllers in connection with conducting an audit of its counterparties (clause 1 of Article 93.1 of the Tax Code of the Russian Federation), as well as if, when considering the tax audit materials, the head of the tax authority decided to carry out additional control measures.

In addition, if, outside the tax audit procedure, controllers need to obtain information (documents) on a specific transaction, they have the right to request them from the participants in this transaction and other persons (clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

Read more about document requests according to the rules of Art. 93.1 read the material “Requesting tax documents according to the rules of Art. 93.1 Tax Code of the Russian Federation" .

Important! When requesting documents, tax authorities are required to comply with the provisions of paragraphs. 3, 4 tbsp. 93.1 Tax Code of the Russian Federation.

As practice shows, tax authorities often abuse their right to request documents under Art. 93.1 of the Tax Code of the Russian Federation: they do not indicate the specific transaction for which documents are requested, they do not provide information in the requirements about what tax control measures the documents are required for, etc.

Such actions of controllers are recognized by the courts as unfounded and illegal (resolutions of the FAS Far Eastern District dated November 2, 2012 No. F03-5016/2012, FAS Volga-Vyatka District dated June 22, 2012 No. F01-2249/12, etc.).

The procedure for requesting documents from taxpayers

The procedure for tax authorities to request documents and information necessary for carrying out control activities is regulated in accordance with Art. 93 of the Tax Code of the Russian Federation and Art. 93.1 Tax Code of the Russian Federation. Tax authorities conducting tax audits have the right to request such documents and information from organizations and individual entrepreneurs. Request form approved. by order of the Federal Tax Service dated November 7, 2018 No. ММВ-7-2/ [email protected]

The reason for requesting documents/information may be:

- desk or field tax audit of the taxpayer;

- verification of the taxpayer's counterparty;

- verification of a transaction to which the tax authorities have any complaints.

Thus, documents may be required from taxpayers even in the absence of a tax audit. Article 93.1 of the Tax Code of the Russian Federation allows you to request documents from taxpayers about a particular transaction outside the framework of tax audits, if there is a justified need for this. Therefore, the use by the tax authority of evidence obtained outside the scope of the audit does not indicate the inadmissibility of such evidence (letter of the Ministry of Finance dated December 23, 2020 No. 03-02-07/1/113553).

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. Tax authorities have the right to request from organizations documents and information necessary for carrying out control activities.

2. Documents may be requested both within and outside the framework of tax audits.

3. The norms of the Tax Code of the Russian Federation do not contain an exhaustive list of documents that the tax authorities have the right to request.

4. Courts usually believe that the right of the INFS to request documentation can only be limited by law. And if the Tax Code of the Russian Federation does not contain a prohibition on requesting a particular document, then the payer is obliged to provide it at the request of the tax inspectorate.

5. As a general rule, documents that were requested during a tax audit must be submitted within 10 days. If the audit is carried out in relation to a consolidated group of taxpayers, then the documents are submitted within 20 days, and if in relation to a foreign company - no later than 30 days.

6. Failure to submit documents or violation of the deadline for their submission entails a fine of 200 rubles for each unsubmitted document.

7. Failure to provide information about the counterparty or refusal to provide documents available to the company regarding the activities of the counterparty entails a fine from the organization and individual entrepreneur in the amount of ten thousand rubles.

Also, the Tax Code of the Russian Federation does not oblige the submission of requests for documents/information to those tax authorities with which the payer is registered at his location. The requirement can be sent by the tax authority (letter of the Ministry of Finance dated 08/06/2019 No. 03-02-08/59105):

- at the location of the organization;

- at the location of its separate divisions;

- at the location of the real estate and vehicles belonging to it.

The specific method of sending requirements depends on how and where tax control activities are carried out. If the inspection takes place directly on the payer’s territory, the requirement to submit documents is transferred directly to the head of the organization/individual entrepreneur or their authorized persons personally against signature.

If the tax authorities cannot submit the request directly to the payer’s management, they can send it by registered mail, or in electronic form via TKS, or through the taxpayer’s personal account on the website of the Federal Tax Service (clause 4 of Article 31 of the Tax Code of the Russian Federation).