Upper part of the Invoice (header)

- Number and Date . The number must correspond to the numbering of documents approved in the accounting policy of your organization. The date indicated is current at the time of creation of the Invoice.

- Correction and Date . The correction number must correspond to the document numbering approved in the accounting policies of your organization. The date indicated is current at the time the Invoice is corrected. When drawing up an Invoice, before making corrections to it, a dash is placed in this line.

- Column Seller , the full and abbreviated name of the legal entity or individual entrepreneur (seller) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (seller) is indicated.

- The seller's TIN/KPP column indicates the TIN and KPP of the legal entity (seller). An individual entrepreneur indicates only the TIN.

- The column Shipper and his address indicates the full and abbreviated name of the legal entity or individual entrepreneur (shipper), as well as his full address (with index). If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column Consignee and his address , the full and abbreviated name of the legal entity or individual entrepreneur (consignee), as well as his full address (with index) is indicated. If the Invoice is drawn up for services performed (rendered) or property rights, then a dash is placed in this line.

- Column For payment and settlement document No. , indicates the number and date of the payment and settlement document (payment order) or cash receipt.

- Column Buyer , the full and abbreviated name of the legal entity or individual entrepreneur (buyer) is indicated.

- Column Address , the full address (with index) of a legal or individual entrepreneur (buyer) is indicated.

- The TIN/KPP column indicates the TIN and KPP of the legal entity (buyer). An individual entrepreneur indicates only the TIN.

- Column Currency: name, code , indicates the name of the currency and its code in accordance with the OKV classifier. The specified currency must be the same for all listed goods (works, services), property rights.

- Column Identifier of government contract, agreement (agreement) , indicates the identifier of the government contract, agreement or agreement. If there is no government order in the invoice, then a dash is added.

Invoice for services If the Invoice is drawn up for services performed (rendered) or property rights, then the two columns “ Consignor and his address ” and “ Consignee and his address ” are not filled in, you can put a dash (“–”) or a triple dash (“- — -“). If, when drawing up an invoice for services, you still fill in these two columns, then this will not be a mistake. In this case, this information will be additional information to the required details and cannot serve as a basis for refusing to deduct VAT.

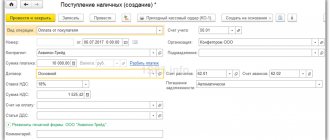

Filling example

The invoice form must be completed by all VAT payers. Based on the document, the tax is deducted or reimbursed. When using the simplified tax system, you do not need to issue an invoice.

The document is prepared in two copies - for each of the parties to the transaction - and certified by the supplier. and it must be filled out by the seller who released the inventory items. You can use both paper and electronic media.

Instead of an invoice, you can use a universal transfer document (UDD). If you are more accustomed to working with invoices, you don’t have to change your usual practice: using UPD does not limit or cancel it.

List of goods and services in the Invoice

The table with the list of goods and services is filled with data in accordance with the column headings.

- Column 1 - Product name , indicates the name of the product, work and service.

- Column 1a - Product type code , when exporting goods abroad, indicates the HS code, otherwise a dash is added.

- Column 2 and 2a - Unit of measurement , indicate the name and code of the unit of measurement of the product or service, in accordance with the OKEI classifier. If there are no indicators, a dash is added.

- Column 3 - Quantity (volume) , indicates the quantity of goods, works and services. If there are no indicators, a dash is added.

- Column 4 - Price (tariff) per unit of measurement , indicates the price per unit of goods without VAT. If there is no indicator, a dash is added.

- Column 5 - Cost of goods (work, services), property rights without tax - total , indicates the amount of goods without VAT.

- Column 6 - Including the amount of excise tax , indicates the amount of excise tax on excisable goods. If there is no indicator, “without excise tax” is indicated.

- Column 7 - Tax rate , indicates the tax rate (for example, 0%, 10%, 18%). For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 8 - Amount of tax presented to the buyer , indicates the amount of VAT. For operations specified in clause 5 of Art. 168 of the Tax Code of the Russian Federation is indicated “without VAT”.

- Column 9 - Cost of goods (work, services), property rights with tax - total , indicates the amount of goods, work, services including VAT.

- Column 10 and 10a - Country of origin of the goods , indicate the name and code of the country of origin of the goods in accordance with the OKSM classifier. For goods produced in the Russian Federation, a dash is added.

- Column 11 - Registration number of the customs declaration , indicates the number of the customs declaration. For goods produced in the Russian Federation, a dash is added.

Total payable - the sums of the numbers in columns No. 5, 8 and 9 are summed up.

Types of invoices found in accounting

There are only two of them. The first is called the standard SF. It is created when a shipment has been shipped or work has been completed for which the buyer now owes money. It is necessary when the products are fully paid for. Time for preparation and sending is 5 calendar days from the date of transfer. The same is given if the products were returned back to the supplier.

The second type is advance payment. It should be prepared if prepayment is required or has been credited to the account for future shipments. Here you do not need to fill out fields such as:

- shipper;

- cargo receiver;

- volume of goods or services received;

- units in which everything will be measured.

But be sure to include everything that will be needed later for calculations.

Bottom of the Invoice (footer)

The lower part contains the signatures of the responsible persons:

- Head of the organization or other authorized person - the full name is indicated and the signature of the head of the organization or other authorized person is affixed.

- Chief accountant or other authorized person - the full name and signature of the chief accountant or other authorized person is indicated.

- Individual entrepreneur - the full name and signature of the individual entrepreneur are indicated, and the details of the certificate of state registration of the individual entrepreneur are indicated.

In organizations, in addition to the manager and chief accountant, a “other” authorized person can sign, but only with a valid intra-organizational order with the right to sign accounting documents.

An individual entrepreneur signs only one column, Individual Entrepreneur .

VAT

When the transaction is paid, the seller charges value added tax. SF will be considered as confirmation of the transaction for payment for products; this is recorded in a specialized book. Based on the received invoice, the relevant data in the declaration will be filled in.

If there are no errors in all the papers and everything is done correctly, then the buyer has the opportunity to request a tax deduction under this article.

There are situations when VAT will not be charged. For example, entrepreneurs who work under the simplified tax system do without this. But quite often, without looking at these circumstances, the buying party asks to be given an invoice, even if VAT is not included in it.

Of course, this is not an obligation that the seller must fulfill. But usually they meet halfway and draw up a SF. The only peculiarity is that the document immediately states that the purchase was without value added tax. Accordingly, this line in the form will remain blank.

An important nuance - if the selling party is not a VAT payer, then it cannot enter 0% in this field. This is a separate category of enterprises to which defaulters do not belong. Even 0% is a realistic rate that these firms are not entitled to. If you need to enter something, it is better to indicate “Without VAT”. This will be true and will not invalidate the document, unlike 0%.

If you enter inappropriate data, then this will become a problem for the recipient of the paper. Inspection authorities issue a fine or charge the standard 18-20%.

Invoice “Without VAT”

Goods and services not subject to VAT From January 1, 2014, when performing transactions that are not subject to VAT, in accordance with Art. 149 of the Tax Code of the Russian Federation, there is no need to issue Invoices, keep logs of received and issued Invoices, purchase books and sales books. Changes have been made to clause 5 of Art. 168 of the Tax Code of the Russian Federation and clause 3 of Art. 169 of the Tax Code of the Russian Federation.

Please note that 0% VAT and “No VAT” are not the same rate, and each is applied for its own purpose. When performing transactions with a zero rate, indicating 0% VAT in the Invoice is mandatory.

Thus, there is no need to issue invoices for goods from January 1, 2014. But at the request of the counterparty, you can issue an Invoice “Without VAT”; this is not a violation. The requirement to issue an Invoice “Without VAT” can be presented by budgetary and government institutions. According to the specifics of their work, the treasury cannot make a payment without presenting an invoice.

What is an invoice, why is it needed and who does it belong to - sample

This is a document that is kept by accountants. It confirms that the goods were actually shipped to the buyer or services were provided, and the cost of the products is also stated there.

This paper is sent to the buying party simultaneously with the shipment sent for sale or by mail. Another option is to bill after the products or services have been accepted.

It is important to respect the format in which the invoice will be created and offered. It was approved by a government decree, so you cannot swap fields or create your own spellings, even if they are enshrined in the charter and order of the director of the enterprise.

Why do we need paper such as an invoice in the purchasing department and in the accounting department?

First of all, it will be needed to confirm the output VAT when services and products are sold. And later it will be useful to write off the input value added tax at the time of purchase. It will serve as proof of the transaction that took place.

When an outgoing SF is registered, it is entered into the Sales Book. When incoming - from the seller - then in the Purchase Book. As a result, the data in the declaration will be filled out based on the information that is generated in these documents.

If an advance payment is transferred, and the product arrives to the buyer later than 5 days, then an advance SF should be issued. It will confirm the fact of the transaction and will prove to the buying party that they purchased the product or service. If errors are later identified in it, then an additional, corrective SF can be written out.

For an accountant, these are papers that help keep records, confirm current business transactions and are an opportunity to receive a deduction.

Verification of documents

To analyze and find documents for which there are no invoices, you can use a special processing in the program called “Express check”. It is located under the “Reports” menu.

The figure below shows an example of displaying errors for a problem of interest to us, as well as recommendations proposed by the program.

Nuances of processing some invoices

When making a delivery to a branch of a legal entity, the name of this structural unit is written in the line “Consignee”, and the name of the parent organization is written in “Buyer”

Advance invoices should only use the estimated tax rate and should not include quantities.

By virtue of the concluded agreement, a legal entity can act as a tax agent for VAT. These are agreements for the lease of state and municipal property, as well as the acquisition of goods and materials on the territory of the Russian Federation from foreign partners who are not registered. In this case, the document is issued on behalf of the seller by the buyer, who also signs it.

Dashes are placed in the lines “Consignee” and “Consignor”; the payment details indicate the data of documents with past payment. Tax agents draw up declarations on their own behalf and pay the calculated VAT.

If non-excise goods are sold or work is performed, the provision is indicated “without excise tax”.

List of design changes from July 1, 2022

The changes are conditionally divided into 2 groups:

- Amendments affecting all taxpayers who issue invoices in the course of their activities.

- Changes affecting only those taxpayers who sell traceable goods.

Changes in the new form for all persons:

- Line 5a appears, designed to display the number and date of the corresponding shipping document (for example, an invoice). If the S/F records information about several shipments at the same time, the numbers/dates of the corresponding shipping documents (invoices) are listed separated by a semicolon in this line.

- Column 1, which relates to the tabular part of the new form, has been expanded. This column will display the serial number of the item being entered. At the same time, the product names are recorded in column 1a, and special codes that are assigned to these goods are recorded in column 1b.

- The name of column 11 has changed. It reflects the RNPT. If the imported products are not traceable, the registration number of the corresponding goods declaration is reflected in this column.

Changes in the new form for persons selling traceable goods:

- Column 11, which has changed its name, should reflect the corresponding RNPT for the batch of traceable goods.

- Column 12 has appeared. It is used to reflect the code of the unit of measurement of the traceable product.

- Column 12a appeared. It is used to indicate the corresponding symbol assigned to the unit of measurement of a specific product according to the OKEI system.

- Column 13 has appeared. It is intended to reflect the quantity of goods calculated in the appropriate unit of change used for traceability purposes.

In addition, in the new form for the above columns 11-13, a certain number of substrings can be formed to one line. This option is useful if the goods that are being tracked have the same name/price/unit of measurement, but different RNPT.

When and how to fill

Invoices are generated if goods (services) that are subject to VAT taxation are sold. The relevant rules are clearly regulated by paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, and some exceptions are specified by the content of Art. 149 of the Tax Code of the Russian Federation. From July 1, 2021, SFs are required to be issued when selling traceable goods.

Law No. 371-FZ of November 9, 2020 stipulates that sellers of traceable goods compile the necessary s/f only in electronic form. Paper media is allowed to be used if traceable products are sold to an ordinary citizen or self-employed person (NPD payer), sold through re-export, as well as in cases where these products are exported from Russia to other countries participating in the EAEU.

Thus, the new form will include the following lines from 07/01/2021:

- 1 – identifying details of the s/f (its number/date).

- 2/2a/2b – information about the seller (name, address, details).

- 3/4 – information about the sender/recipient of the cargo.

- 5/5a – details of the payment/shipment document.

- 6/6a/6b – information about the buyer (name of the legal entity, address, his INN/KPP).

- 7 – designation/code of the currency used.

- 8 – information about the government contract (if concluded).

The tabular part of the new form contains the following information:

- Record number/name/code of the item sold.

- Information about the unit of measurement.

- Quantity/price of goods sold.

- Price.

- Availability/amount of excise tax.

- VAT rate/amount.

- Price including VAT.

- Country of origin data.

- RNPT.

- Unit of measurement (if traceable product).

- Quantity of products (if traceable).

Columns 12/12a/13 must be filled out only in cases where the goods sold are classified as traceable.