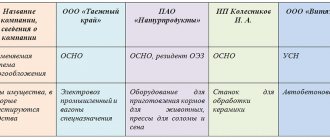

Organizational taxation systems

For tax purposes, organizations use one of the systems established by the Tax Code of the Russian Federation.

If a legal entity does not show a desire to use the special regime, then it will have to work for OSNO and pay all taxes established by the Tax Code of the Russian Federation if there is a tax base for them. Read about the fundamental differences between existing tax systems in the article “What are the features of combining OSNO and simplified tax system?” .

Read about the cancellation of the UTII regime from 01/01/2021 here.

Types of taxes and fees paid by legal entities

Organizations using OSNO are tax payers:

- at a profit;

- property;

- water;

- land;

- transport;

- gambling business;

- use of animal objects.

In addition, they pay VAT, personal income tax, excise taxes, mineral extraction tax, trade tax, state duties and insurance premiums, payments for negative impact on the environment, and environmental tax.

The use of special regimes (STS, Unified Agricultural Tax, production sharing agreement) either exempts the organization from paying basic taxes (profit, VAT, property), replacing them with a single corresponding tax (STS, Unified Agricultural Tax), or allows the use of a system of benefits that applies to almost everything paid by the organization taxes (production sharing agreement). The special PSN regime can only be used by individual entrepreneurs.

When applying the simplified tax system, a legal entity must (if there are grounds) pay all taxes, except those that are replaced by a single tax. According to the Unified Agricultural Tax, the situation is somewhat different. Under it, no trade tax is paid (clause 2 of Article 411 of the Tax Code of the Russian Federation), and excise taxes, mineral extraction tax, gambling tax and fees for the use of wildlife are incompatible with this regime by definition.

The deadlines for paying taxes are established by the Tax Code of the Russian Federation. They are subject to the rule of paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation: if the established payment deadline falls on a weekend, then it is postponed to the next working day closest to it. In accordance with this rule, the last days of tax payment deadlines in 2022 are reflected in our tables.

In our article we will not consider payments that are quite rare among ordinary organizations: gambling tax, tax on income on state and municipal securities, fees for the use of wildlife and the tax system when implementing a production sharing agreement.

Important! Explanations from ConsultantPlus Each tax has its own deadlines, BCC, procedure, and place of payment. They may differ even for the same tax. For example, VAT has different BCCs and payment deadlines for domestic transactions, when importing from the EAEU countries and from other countries. The place of payment may also differ... Read more about the payment of taxes by legal entities in K+. This can be done for free with trial access.

Where and how to pay taxes

Long gone are the days when you had to stand in line at a cash register to pay taxes. Now, for the convenience of taxpayers, there are many services that allow you to pay taxes without leaving your home.

Thus, an individual can pay any of the personal taxes:

- through your bank’s mobile application;

- through online services posted on the Federal Tax Service website: “Taxpayer Personal Account for Individuals”, “Pay Taxes”, application for mobile devices “Taxes for Individuals”.

Through which banks you can pay taxes in the “Taxpayer’s Personal Account for individuals” on the Federal Tax Service website, you can find out in the “ConsultantPlus” system. If you don't have access to K+, get it for free on a trial basis.

Those who prefer to pay taxes the old fashioned way can do this at the cash desk of any bank branch or at any branch of Russian Post.

The last day for paying taxes for 2022 is December 1, 2021 (Clause 1, Article 409 of the Tax Code of the Russian Federation). This date falls on Wednesday - a working day. Consequently, no postponements are provided for this year.

Those who do not fulfill their obligation on time will have to pay a penalty. They will be accrued from the next day, from 12/02/2021. The debt to the state will grow up to and including the date of payment of the debt.

Also, if there is a tax debt, an individual may face a ban on traveling abroad and seizure of bank accounts.

If the tax has to be collected from the debtor by force, the individual will also have to pay the state duty and pay the bailiff (enforcement fee).

Features of paying income tax

Income tax is the only tax that has a fairly complex system for determining and paying advance payments for the payer organization. Possible options for advances for profit are as follows:

- quarterly advances with payment of monthly advance payments;

- only quarterly advances - subject to certain requirements;

- monthly advance payments from the actual profit received.

Read more about advances on profits in the article “Advance payments on income taxes: who pays and how to calculate?” .

Features of personal income tax payment

The deadline for paying personal income tax, for which legal entities are tax agents, is linked to the deadline for paying income to employees (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, it is impossible to specify the timing of its payment and it is not reflected in our tables. Only the deadline established for payment of this tax on vacation and sick pay, corresponding to the last day of the month in which the corresponding income was paid, is shown there.

Read about the specifics of personal income tax payment in the material “When to transfer income tax from salary?” .

Features of paying regional and local taxes

The deadlines for paying “property” taxes (property, transport and land) from 01/01/2021 are the same for all territories and are fixed at the federal level. Regional and local authorities no longer have the authority to determine payment dates. Taxes for the year must be paid no later than March 1 of the following year, and advances must be paid no later than the last day of the month following the reporting period. The new procedure began to apply with annual payments based on the results of 2022.

To find out how different transport tax rates are in the regions, read the article “Transport tax rates by region - table.”

Deadline for payment of land tax

From 2022, the deadlines for paying land taxes will also change. Tax/advance payments must be paid no later than the following dates:

| Period for which tax/advance is paid | Payment deadline |

| For 2022 | No later than 03/01/2021 |

| For the first quarter of 2022 | No later than 04/30/2021 |

| For the second quarter of 2022 | No later than 08/02/2021 |

| For the third quarter of 2022 | No later than 01.11.2021 |

| For 2022 | No later than 03/01/2022 |

Features of paying a single tax under the simplified tax system and unified agricultural tax

The deadlines for payment of the simplified tax system and unified agricultural tax established by the Tax Code of the Russian Federation are applied with one caveat: if a legal entity has lost the right to use these special regimes or voluntarily abandoned them, then in the month following the month of termination of the application of the special regime, by the 25th day it must pay according to a single tax.

Find out what kind of reporting and in what time frame you need to submit under the simplified tax system from the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

Quarterly payments

Based on Art.

346.21 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs that work on a simplified basis pay quarterly advances no later than the 25th day of the month following the quarter. But the rule applies: if the payment date falls on a non-working day or weekend, then the payment date is postponed to the next working day. Taking into account the rules from the Tax Code of the Russian Federation, the quarterly deadlines for paying tax on the simplified tax system in 2021 are as follows:

| Reporting period | Date by which to pay the simplified tax system (advance payments) |

| 1st quarter | 25th of April |

| 2nd quarter | 26 July |

| 3rd quarter | the 25th of October |

IMPORTANT!

Due to the coronavirus, officials introduced some relaxations and postponed the dates of advance payments. The government has extended the deadline for paying the simplified tax system for 2022 for individual entrepreneurs and organizations from a special list (annex to the Decree of the Government of the Russian Federation dated 04/02/2020 No. 409) by providing installments until January 2022.

If no other changes appear, the deadline for paying the simplified tax system for the 4th quarter of 2022 for individual entrepreneurs and organizations is different: legal entities report no later than March 31, and individual entrepreneurs - until April 30, 2022.

Tax payment table for the 1st quarter of 2022

| date | Tax | Payment | BASIC | simplified tax system |

| 17.01.2022 | Insurance premiums | Payments for December 2022 | + | + |

| Excise taxes | Advance for January 2022 | + | + | |

| 20.01.2022 | Water | Tax for the 4th quarter of 2022 | + | + |

| Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for December 2022 | + | + | |

| 25.01.2022 | VAT | Tax (1/3) for the 4th quarter of 2022 | + | — |

| Excise taxes | Tax for December 2022 | + | + | |

| Tax (alcohol) for October 2022 | + | + | ||

| Tax (petrol) for July 2022 | + | + | ||

| MET | Tax for December 2022 | + | + | |

| Trade fee | Payment for the 4th quarter of 2022 | + | + | |

| 28.01.2022 | Profit | Advance (1/3) for the 1st quarter of 2022 | + | — |

| 31.01.2022 | Personal income tax | Vacation and sick leave tax for January 2022 | + | + |

| Subsoil use | Payment for the 4th quarter of 2022 | + | + | |

| 15.02.2022 | Insurance premiums | Payments for January 2022 | + | + |

| Excise taxes | Advance for February 2022 | + | + | |

| 20.02.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for January 2022 | + | + |

| 25.02.2021 | VAT | Tax (1/3) for the 4th quarter of 2022 | + | — |

| Excise taxes | Tax for January 2022 | + | + | |

| Tax (alcohol) for November 2022 | + | + | ||

| Tax (petrol) for August 2022 | + | + | ||

| MET | Tax for January 2022 | + | + | |

| 28.02.2022 | Personal income tax | Tax on vacation and sick pay for February 2022 | + | + |

| Profit | Advance (1/3) for the 1st quarter of 2022 | + | — | |

| Advance (actual) for January 2022 | + | — | ||

| Fee for negative impact | Payment for 2022 | + | + | |

| 01.03.2022 | Property taxes | Payment of land, property and transport taxes for 2021 (organizations) | + | + |

| 15.03.2022 | Insurance premiums | Payments for February 2022 | + | + |

| Excise taxes | Advance for March 2022 | + | + | |

| 21.03.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for February 2022 | + | + |

| 25.03.2022 | VAT | Tax (1/3) for the 4th quarter of 2022 | + | — |

| Excise taxes | Tax for February 2022 | + | + | |

| Tax (alcohol) for December 2022 | + | + | ||

| Tax (gasoline) for September 2022 | + | + | ||

| MET | Tax for February 2022 | + | + | |

| 28.03.2022 | Profit | Tax for 2022 | + | — |

| Advance (1/3) for the 1st quarter of 2022 | + | — | ||

| Advance (actual) for February 2022 | + | — | ||

| 31.03.2022 | Personal income tax | Tax on vacation and sick pay for March 2022 | + | + |

| simplified tax system | Tax for 2022 (organizations) | — | + |

The deadline for payment of transport tax is 2022

From 2022, the deadlines for payment of transport tax and advance payments on it will change. If until 2022, payment deadlines were established by the laws of regional authorities, then from 2022, specific deadlines have been established in the Tax Code. So, the transport tax/advance payment in 2022 is paid within the following terms:

| Period for which tax/advance is paid | Payment deadline |

| For 2022 | No later than 03/01/2021 |

| For the first quarter of 2022 | No later than 04/30/2021 |

| For the second quarter of 2022 | No later than 08/02/2021 |

| For the third quarter of 2022 | No later than 01.11.2021 |

| For 2022 | No later than 03/01/2022 |

Tax payment table for the 2nd quarter of 2022

| date | Tax | Payment | BASIC | simplified tax system |

| 15.04.2021 | Ecological fee | Environmental fee | + | + |

| Insurance premiums | Payments for March 2022 | + | + | |

| Excise taxes | Advance for April 2022 | + | + | |

| 20.04.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for March 2022 | + | + |

| Water | Tax for the 1st quarter of 2022 | + | + | |

| Negative Impact | Payment for the 1st quarter of 2022 | + | + | |

| 25.04.2022 | VAT | Tax (1/3) for the 1st quarter of 2022 | + | — |

| simplified tax system | Advance for the 1st quarter of 2022 | — | + | |

| Excise taxes | Tax for March 2022 | + | + | |

| Tax (alcohol) for January 2022 | + | + | ||

| Tax (gasoline) for October 2022 | + | + | ||

| MET | Tax for March 2022 | + | + | |

| Trade fee | Payment for the 1st quarter of 2022 | + | + | |

| 28.04.2022 | Profit | Tax for the 1st quarter of 2022 | + | — |

| Advance (1/3) for the 2nd quarter of 2022 | + | — | ||

| Advance (actual) for March 2022 | + | — | ||

| Subsoil use | Payment for the 1st quarter of 2022 | + | + | |

| 04.05.2022 | Personal income tax | Tax on vacation and sick pay for April 2022 | + | + |

| Property taxes | Advance payment for land, property and transport tax for the 1st quarter of 2022 | + | + | |

| 16.05.2022 | Insurance premiums | Payments for April 2022 | + | + |

| Excise taxes | Advance for May 2022 | + | + | |

| 20.05.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) on imports from EAEU countries for April 2022 | + | + |

| 25.05.2022 | VAT | Tax (1/3) for the 1st quarter of 2022 | + | — |

| Excise taxes | Tax for April 2022 | + | + | |

| Tax (alcohol) for February 2022 | + | + | ||

| Tax (petrol) for November 2022 | + | + | ||

| MET | Tax for April 2022 | + | + | |

| 30.05.2022 | Profit | Advance (1/3) for the 2nd quarter of 2022 | + | — |

| Advance (actual) for April 2022 | + | — | ||

| 31.05.2022 | Personal income tax | Vacation and sick leave tax for May 2022 | + | + |

| 15.06.2022 | Insurance premiums | Payments for May 2022 | + | + |

| Excise taxes | Advance for June 2022 | + | + | |

| 20.06.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) on imports from the EAEU countries for May 2022 | + | + |

| 27.06.2022 | VAT | Tax (1/3) for the 1st quarter of 2022 | + | — |

| Excise taxes | Tax for May 2022 | + | + | |

| Tax (alcohol) for March 2022 | + | + | ||

| Tax (gasoline) for December 2022 | + | + | ||

| MET | Tax for May 2022 | + | + | |

| 28.06.2022 | Profit | Advance (1/3) for the 2nd quarter of 2022 | + | — |

| Advance (actual) for May 2022 | + | — | ||

| 30.06.2022 | Personal income tax | Vacation and sick pay tax for June 2022 | + | + |

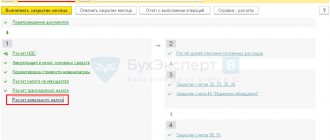

Checking the 1C database for errors with a 50% discount

Remotely in 1 hour 2000 ₽ 4000 ₽ We will provide a written report on errors. We analyze more than 30 parameters

- Incorrect indication of VAT in documents;

- Errors in mutual settlements (“red” and expanded balances according to settlement documents or agreements on accounts 60, 62, 76.);

- Lack of invoices, checking duplicates;

- Incorrect accounting of inventory items (re-grading, incorrect sequence of receipts and expenses);

- Duplication of elements (items, currencies, counterparties, contracts and accounts, etc.);

- Control of filling out details in documents (counterparties, contracts);

- Control (presence, absence) of movements in documents and others;

- Checking the correctness of contracts in transactions;

Read more Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Tax payment table for the 3rd quarter of 2022

| date | Tax | Payment | BASIC | simplified tax system |

| 15.07.2022 | Insurance premiums | Payments for June 2022 | + | + |

| Excise taxes | Advance for July 2022 | + | + | |

| 20.07.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for June 2022 | + | + |

| Water | Tax for the 2nd quarter of 2022 | + | + | |

| Negative Impact | Payment for the 2nd quarter of 2022 | + | + | |

| 25.07.2022 | VAT | Tax (1/3) for the 2nd quarter of 2022 | + | — |

| simplified tax system | Advance for the 2nd quarter of 2022 | — | + | |

| Excise taxes | Tax for June 2022 | + | + | |

| Tax (alcohol) for April 2022 | + | + | ||

| Tax (gasoline) for January 2022 | + | + | ||

| MET | Tax for June 2022 | + | + | |

| Trade fee | Payment for the 2nd quarter of 2022 | + | + | |

| 28.07.2022 | Profit | Tax for the 2nd quarter of 2022 | + | — |

| Advance (1/3) for the 3rd quarter of 2022 | + | — | ||

| Advance (actual) for June 2022 | + | — | ||

| 01.08.2022 | Personal income tax | Vacation and sick leave tax for July 2022 | + | + |

| Subsoil use | Payment for the 2nd quarter of 2022 | + | + | |

| Property taxes | Advance on land, property and transport taxes for the 2nd quarter of 2022 | + | + | |

| 15.08.2022 | Insurance premiums | Payments for July 2022 | + | + |

| Excise taxes | Advance for August 2022 | + | + | |

| 22.08.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for July 2022 | + | + |

| 25.08.2022 | VAT | Tax (1/3) for the 2nd quarter of 2022 | + | — |

| Excise taxes | Tax for July 2022 | + | + | |

| Tax (alcohol) for May 2022 | + | + | ||

| Tax (gasoline) for February 2022 | + | + | ||

| MET | Tax for July 2022 | + | + | |

| 29.08.2022 | Profit | Advance (1/3) for the 3rd quarter of 2022 | + | — |

| Advance (actual) for July 2022 | + | — | ||

| 31.08.2022 | Personal income tax | Vacation and sick leave tax for August 2022 | + | + |

| 15.09.2022 | Insurance premiums | Payments for August 2022 | + | + |

| Excise taxes | Advance for September 2022 | + | + | |

| 20.09.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for August 2022 | + | + |

| 26.09.2022 | VAT | Tax (1/3) for the 2nd quarter of 2022 | + | — |

| Excise taxes | Tax for August 2022 | + | + | |

| Tax (alcohol) for June 2022 | + | + | ||

| Tax (gasoline) for March 2022 | + | + | ||

| MET | Tax for August 2022 | + | + | |

| 28.09.2022 | Profit | Advance (1/3) for the 3rd quarter of 2022 | + | — |

| Advance (actual) for August 2022 | + | — | ||

| 30.09.2022 | Personal income tax | Vacation and sick leave tax for September 2022 | + | + |

Tax payment table for the 4th quarter of 2022

| date | Tax | Payment | BASIC | simplified tax system |

| 17.10.2022 | Insurance premiums | Payments for September 2022 | + | + |

| Excise taxes | Advance for October 2022 | + | + | |

| 20.10.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for September 2022 | + | + |

| Water | Tax for the 3rd quarter of 2022 | + | + | |

| Negative Impact | Payment for the 3rd quarter of 2022 | + | + | |

| 25.10.2022 | VAT | Tax (1/3) for the 3rd quarter of 2022 | + | — |

| simplified tax system | Advance for the 3rd quarter of 2022 | — | + | |

| Excise taxes | Tax for September 2022 | + | + | |

| Tax (alcohol) for July 2022 | + | + | ||

| Tax (petrol) for April 2022 | + | + | ||

| MET | Tax for September 2022 | + | + | |

| Trade fee | Payment for the 3rd quarter of 2022 | + | + | |

| 28.10.2022 | Profit | Tax for the 3rd quarter of 2022 | + | — |

| Advance (1/3) for the 4th quarter of 2022 | + | — | ||

| Advance (actual) for September 2022 | + | — | ||

| 31.10.2022 | Personal income tax | Tax on vacation pay and sick leave for October 2022 | + | + |

| Subsoil use | Payment for the 3rd quarter of 2022 | + | + | |

| Property taxes | Advance on land, property and transport taxes for the 3rd quarter of 2022 | + | + | |

| 15.11.2022 | Insurance premiums | Payments for October 2022 | + | + |

| Excise taxes | Advance for November 2022 | + | + | |

| 21.11.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from the EAEU countries for October 2022 | + | + |

| 25.11.2022 | VAT | Tax (1/3) for the 3rd quarter of 2022 | + | — |

| Excise taxes | Tax for October 2022 | + | + | |

| Tax (alcohol) for August 2022 | + | + | ||

| Tax (gasoline) for May 2022 | + | + | ||

| MET | Tax for October 2022 | + | + | |

| 28.11.2022 | Profit | Advance (1/3) for the 4th quarter of 2022 | + | — |

| Advance (actual) for October 2022 | + | — | ||

| 30.11.2022 | Personal income tax | Tax on vacation and sick pay for November 2022 | + | + |

| 15.12.2022 | Insurance premiums | Payments for November 2022 | + | + |

| Excise taxes | Advance for December 2022 | + | + | |

| 20.12.2022 | Indirect taxes | VAT and excise taxes (excise taxes on labeled excisable goods) for imports from EAEU countries for November 2022 | + | + |

| 26.12.2022 | VAT | Tax (1/3) for the 3rd quarter of 2022 | + | — |

| Excise taxes | Tax for November 2022 | + | + | |

| Tax (alcohol) for September 2022 | + | + | ||

| Tax (petrol) for June 2022 | + | + | ||

| MET | Tax for November 2022 | + | + | |

| 28.12.2022 | Profit | Advance (1/3) for the 4th quarter of 2022 | + | — |

| Advance (actual) for November 2022 | + | — |