Receipt of advance payment

To make this example clear, we will first register the receipt of the advance in the program. Let’s assume that we receive funds from our counterparties in two ways: through a cash register and through a bank account.

We will not consider filling out these documents in detail. You can read about this in another article.

The receipt of cash is documented by a cash receipt order. You can find it in the “Bank and Cash Office” section, “Cash Documents” item. Make a new document by clicking on the “Receipt” button in the list that opens.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

The document generated a posting in the amount of 10,000 rubles from account 62.02 to account 50.01. Now this DS amount is listed in our cash register.

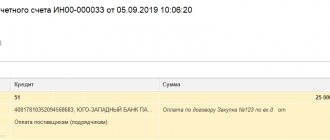

Non-cash payment is registered by the document “Receipt to the current account”. You can also find and do it in the “Bank and Cash Office” section in the “Bank Statements” item.

The document generated a similar posting, only the DS arrived at Dt 51.

We deal with invoices for advance payments in 1C: Accounting 8.3

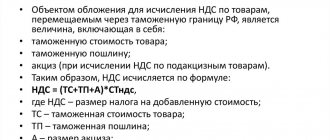

Every accountant sooner or later encounters advance payments (whether to their suppliers or advances from buyers) and in theory knows that according to the requirements of the Tax Code of the Russian Federation (Article 154, paragraph 1; Article 167, paragraph 1, paragraph 2 ) VAT must be calculated on the advance payment on the date of its receipt. Our article today is about how to do this in practice with advance invoices in the 1C 8.3 program.

You can order setup and support for 1C:Accounting here or by phone

Making the initial settings of the 1C 8.3 program

Let's take a look at the company's accounting policy and check whether the tax regime we have indicated is correct: OSNO. In the “Taxes and Reports” section in the “VAT” tab, the program gives us a choice of several options for registering advance invoices (Fig. 1) (we need this setting when we act as a seller).

We may not register advance invoices in 1C if:

- the advance was credited within five days;

- the advance was credited until the end of the month;

- the advance was credited until the end of the tax period.

Our right is to choose any of them.

Let's analyze the offset of advances issued and advances from the buyer.

Accounting in 1C for advances issued.

For example, let’s take the trading organization Buttercup LLC (we), which entered into an agreement with a wholesaler for the supply of goods. According to the terms of the contract, we pay the supplier an advance of 70%. After which we receive the goods and pay for them completely.

In BP 3.0 we draw up a bank statement “Debit from current account” (Fig. 2).

Please pay attention to important details:

- type of transaction “Payment to supplier”;

- contract (when posting goods, the contract must be identical to the bank statement);

- VAT interest rate;

- offset of the advance payment with VAT automatically (we indicate a different indicator in exceptional cases);

- When posting a document, we must receive correspondence of 51 invoices with the supplier's advance invoice, in our example it is 62.02. Otherwise, an invoice for the advance payment in 1C will not be issued.

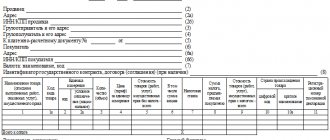

Having received payment, OPT LLC issues us an advance invoice, which we must also post in our 1C program (Fig. 3).

On its basis, we have the right to accept the amount of VAT on the advance as a deduction.

Thanks to the “Reflect VAT deduction in the purchase book” checkbox, the invoice automatically goes into the purchase book, and when posting the document, we receive an accounting entry with the formation of invoice 76.VA. Please note that the transaction type code 02 is assigned by the program independently.

Next month OPT LLC ships the goods to us, we receive them in the program using the document “Receipt of Goods”, and register an invoice. We do not correct accounts for settlements with the counterparty; we select “Automatic” for debt repayment. When posting the “Goods Receipt” document, we must receive a posting for the advance payment offset (Fig. 4).

When filling out the document “Creating sales book entries” for February, we receive automatic completion of the “VAT Restoration” tab (Fig. 5), and this amount of restored VAT ends up in the sales book for the reporting period with transaction code 22.

To reflect the final payment to the supplier, we can copy and post an existing document “Write-off from the current account”, indicating the required amount.

We create a purchase book, which reflects the amount of our VAT deduction on prepayment with code 02, and a sales book, where we see the amount of restored VAT after receiving the goods with transaction type code 21.

Accounting in 1C for advances received

For example, let’s take an organization familiar to us, LLC Buttercup (we), which entered into an agreement with for the provision of goods delivery services. According to the terms of the agreement, the buyer of Atlant LLC pays us an advance of 30%. After which we provide him with the necessary service.

The method of working in the program is the same as in the previous version.

We formalize the receipt of an advance in 1C from the buyer with the document “Receipt to the current account” (Fig. 6), followed by registration of an advance invoice, which gives us accounting entries for calculating VAT on the advance (Fig. 7).

You can register an invoice for an advance payment in 1C directly from the document “Receipt to the current account”, or you can use the processing “Registration of invoices for an advance payment”, which is located in the “Bank and cash desk” section. In any case, it immediately goes into the sales book.

At the time of the document “Sales of services”, the buyer’s advance will be credited (Fig. 8), and when the document “Creating purchase book entries” is executed (Fig. 9), the amount of VAT on the advance received will be deducted, account 76.AB is closed (Fig. . 10).

You can see how to remove amounts accepted for accounting in previous periods from the “Creation of purchase ledger entries” here.

To check the fruits of his work, an accountant usually only needs to create books of purchases and sales, as well as analyze the “VAT Accounting Analysis” report.

Work in 1C with pleasure!

If you still have questions about advance invoices in 1C 8.3, feel free to ask us on the dedicated 1C Consultation Line. Experts work 7 days a week and will help in the most difficult situations in tax and accounting.

If you liked the article, click like below and share with your friends!

Creating invoices

An invoice can be created either manually based on the documents we created earlier, or automatically. The second method is convenient when there are a large number of these documents.

From DS receipt documents

Go to any of the above documents upon receipt of the DS, and click on the “Create based on” button and select the “Invoice issued” menu item.

The created invoice will be filled in automatically. Check that the details are filled out correctly and click on the “Submit” button.

The document will create a VAT movement to account 76.AB (“VAT on advances and prepayments”).

Issuing an invoice for advance payment by the supplier

In accordance with paragraph 3 of Article 168 of the Tax Code, an advance invoice must be issued no later than 5 days from the date the supplier receives the advance payment. The document must be drawn up in two copies, one of which should be sent to the buyer, and the second one should be registered in your sales book.

It would seem that everything is extremely simple. However, accountants often make annoying mistakes when creating an advance invoice .

The first of them is failure to issue a document every time an advance is received from a buyer within the period. Accountants sometimes believe that an invoice can be issued once a month or quarterly for the total amount of the advance payment received from the buyer. However, this is not true - for each amount received there must be an invoice issued no later than 5 days from the date of receipt.

Another common mistake is failure to issue an advance invoice if the shipment occurs in the same quarter. Articles 168 and 169 of the Tax Code of the Russian Federation require that an “advance” invoice be issued within a 5-day period after receiving an advance payment, and a “shipment” invoice must be issued within the same period after shipment.

By the way, there are clarifications from the Ministry of Finance ( letters dated October 12, 2011 No. 03-07-14/99, dated March 6, 2009 No. 03-07-15/39 ) regarding the situation when the shipment occurred within 5 days after receiving the advance payment . Officials believe that in this case there is no need to issue an advance invoice - it is enough to issue a document upon shipment. At the same time, the Federal Tax Service in its letters ( dated 03/10/2011 No. KE-4-3/3790, dated 02/15/2011 No. KE-3-3/ [email protected] ) expressed the opposite position . Therefore, just in case, many accountants prefer to issue an advance invoice even when no more than 5 days pass between receiving the advance payment and shipment.

When an advance invoice is not issued

An advance invoice is not issued in the following cases:

- if the transaction is not subject to VAT in accordance with Article 149 Code of the Russian Federation;

- if the supplier applies tax exemption in accordance with Article 145 of the Tax Code of the Russian Federation;

- if the transaction is subject to VAT at the “ zero ” rate;

- if the advance was transferred towards the future supply of goods with a long production cycle ( more than 6 months ) in accordance with paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

Crediting an advance to your account

Let's consider an example when an advance in the amount of 100 rubles was transferred to the organization's account. This operation should be reflected through “Receipts to account”:

This transaction will reflect the crediting of received funds to the advance account 62.02