Document year: 2019

Document group: Acts

Type of document: Act

Download formats: DOC, EXCEL, PDF

Accounting, storage and write-off of an organization's material assets is carried out in accounting using special documentation. To determine the person responsible for inventory items, write off or transfer valuables for storage, special acts are drawn up.

These are primary accounting papers, which are drawn up in two or three copies (depending on the purpose of preparation) and signed by at least two participants: the one who transfers the goods and materials and those who accept.

Let's talk in more detail about the document flow regulating the accounting of material assets. A sample act can be downloaded at the end of the article.

Act of acceptance and transfer of material assets

To transfer valuables from one person to another, an act of acceptance and transfer of goods and materials is drawn up. This is the simplest example of document flow in the accounting of material assets.

In life, drawing up a deed form is required:

- when changing the financially responsible person. The act assigns financial responsibility to a certain employee: if he resigns and someone else is hired in his place, a transfer and acceptance certificate must be drawn up;

- when making transactions involving the purchase (or sale) of valuables;

- when transferring inventory items for temporary or safekeeping

The form of documentation is not enshrined in legislation, so entities use their own developed templates. Samples and rules for accounting for inventory items are fixed in the accounting policy.

Regardless of the forms and templates, according to the Law “On Accounting”, any primary document, including the acceptance and transfer act of goods and materials, contains:

- mandatory identification details (name, date of compilation, information about the company);

- information about the transferred valuables (description, size, quantity, cost, codes and numbers assigned in accounting);

- information about employees who transmit and receive values.

The employee who receives and the one who transmits must put a handwritten signature.

The act is drawn up in triplicate. In addition to the participants in the acceptance and transfer, the paper is signed by the head of the company (or an authorized person).

When changing the materially responsible person, acceptance and transfer can be carried out through the mediation of the organization itself:

- the replaced MOL transfers goods and materials to the company;

- the company assumes financial responsibility;

- When hiring a new employee, the organization transfers inventory and materials according to the act to him.

The act is drawn up in two copies:

- when issued to an employee who abdicates responsibility (upon dismissal, change of position or transfer to another branch);

- when issuing a certificate to an employee who accepts responsibility.

The documentation is used for accounting of inventory items.

Opened form:

The act of acceptance and transfer of inventory items for storage (form MX-1 ) is a document of primary accounting documentation drawn up by authorized persons of the depositor and custodian (both organizations and individual entrepreneurs) on the basis and in accordance with the storage agreement. A sample act of acceptance and transfer of goods and materials for storage MX-1 is included in the Album of unified forms of primary accounting documentation for recording products, inventory items in storage locations, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 9, 1999 No. 66. The use of unified forms of primary accounting documentation is regulated by the “Regulations on maintaining accounting and reporting in the Russian Federation”, approved by the Ministry of Finance of the Russian Federation dated July 29, 1998 N34n, as well as Instructions for the use and completion of forms of primary accounting documentation for accounting of products, inventory valuables in storage places (Resolution of the State Statistics Committee of the Russian Federation dated August 9, 1999 No. 66).

According to the Directions, the act of acceptance and transfer of material assets for storage in the MX-1 is used both for household storage and for storage carried out with the participation of professional custodians. Professional custodians can be banks, warehouses, pawnshops, hotels - any commercial and non-profit organizations that store material assets on a paid basis as one of their activities. The storage agreement is concluded for a certain period or “on demand”. Non-professional custodians are clinics, theaters, educational institutions, libraries, etc. institutions that provide storage free of charge.

Legal relations arising during the acceptance and transfer of material assets for storage are regulated by Chapter 47, Part 2 of the Civil Code of the Russian Federation. From the moment of transfer of material assets for storage, the custodian organization, in accordance with Art. 401 of the Civil Code of the Russian Federation (clause 1 of Article 901 of the Civil Code of the Russian Federation), bears full responsibility for the loss, shortage or deterioration in the quality of material assets accepted for storage and must compensate the depositor for all losses, unless otherwise provided by law or contract (Article 393, paragraph .1 Article 902 of the Civil Code of the Russian Federation).

The price of the property transferred for storage, which must be indicated in column 8 of the act of acceptance and transfer of material assets for storage in the MX-1 form, is established on the basis of the storage agreement by agreement of the parties. The accounting documents of the depositor organization, reflecting the book value of inventory items transferred for storage, are not taken into account.

The sample act of acceptance and transfer of goods and materials for storage MX-1 is recommended and can be modified for ease of placement and processing of information. In particular, it is allowed to expand or narrow columns and lines taking into account the significance of indicators, to include additional lines, as well as loose-leaf sheets. It is also allowed to include additional details in the document, if necessary. However, changing or deleting details approved by the State Statistics Committee of Russia in the form is prohibited. The number of copies of the act of acceptance and transfer of material assets for storage is not limited by law and is established based on the conditions of a specific business transaction.

Fill out the form of the MX-1 acceptance certificate Sample of the MX-1 acceptance certificate - pdf Sample of the MX-1 acceptance certificate - gif

Questions and answers on the form

The act of gratuitous transfer of material assets

The main task of the act of acceptance and transfer of valuables free of charge is to determine the complete list of goods and materials and the fact of their transfer. Often such a document is attached to a gift or donation agreement, and the recipients of the values are various budget organizations:

- hospital and various medical institutions;

- schools, kindergartens;

- social institutions;

- religious organizations;

- charitable foundations;

- other subjects.

Like a standard act of transfer of goods and materials, on a free basis, it is necessary to indicate on the paper the basic details:

- information about the document (date of signing and drawing up, name of the act and its number in the document flow);

- information about the parties;

- information about transferred values;

- signatures of the parties.

If organizations have seals, you can put them in the place for seals.

Why do you need an acceptance certificate for the transfer of goods and materials?

Let's consider under what circumstances an acceptance certificate is drawn up:

- Discrepancy in numbers and inventory parameters.

- Arrival of goods and materials without documents.

- Transfer of inventory items for safekeeping.

- Transfer of assets by agreement of the commission.

- Transfer of inventory items within an institution between departments or financially responsible employees.

- Transfer of inventory items into temporary storage.

The example document below can be used together with the acceptance certificate for storage (form MX-1).

Receipt of products against an invoice implies the possibility that the goods delivered do not correspond to the quantity displayed on the invoice. However, there are circumstances when the actual quantity of products does not coincide with the declared quantity. To make a claim to the seller, it is necessary to reflect this circumstance in the acceptance certificate with recording of the identified discrepancies.

Acceptance of some types of goods and materials (for example, equipment) is carried out according to an act, since this is required by the procedure for its acceptance: inspection, determination of serviceability, etc. When sending inventory items for safekeeping, documents are drawn up describing the condition of inventory items, determining the conditions for their placement and appointing a materially responsible employee.

When signing an agreement for the supply of goods, the parties can write into the agreement a clause on the need to draw up an act of acceptance of the products upon transfer to the buyer.

Inventory act of inventory items

The inventory procedure is carried out to take into account the safety of inventory items. The manager independently determines the need for an inventory, usually in the following cases:

- at the end of the year before the preparation and submission of the annual balance sheet and reports;

- when changing MOL;

- during reorganization and liquidation of the company;

- in case of damage to assets in case of emergency;

- when selling, buying or leasing.

Based on the results of the audit, an inventory act is drawn up, which is signed by members of the inventory commission.

There are no unified forms, but there are recommendatory samples. Companies are allowed to develop their own, but many use developed forms: INV 3, 4, 5 or 6 (depending on the situation).

In the standard act, you need to indicate the number of the inventory order, members of the commission and a list or in tabular form indicate the available inventory items with quantities and units of measurement. At the end - calculate the total and sign.

The act of installing material assets

The final stage of installing material assets, which confirms that the installation work has been completed in full, is the act of installing material assets. A commission is hired to compile it. Your own sample act is enshrined in the company’s accounting policies. Conventionally, any installation act is divided into three parts:

- introductory or identifying (name and number of the document, date of preparation and signing, information about the company and members of the commission);

- main The installed assets and installation location are described. If several names are used, you can arrange this part in the form of a table;

- final. These are the signatures of the commission members and the head of the organization.

Like any act, the installation is documented in printed or written form on plain or branded paper.

How to fill out a form for issuing inventory items in a budget institution?

We start filling out the form from the title (first) page:

- In the header of the form, information about the institution itself (for which we are filling out), the department issuing the MC, and the financially responsible person is entered. There is also a place in the upper right corner for the manager’s approval letter.

IMPORTANT! Each statement drawn up in the institution is subject to approval by the head.

- In the “Accepted for accounting” section, an entry for the disposal of MC is entered in accordance with the chart of accounts by order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

- At the bottom of the first sheet, the following data and signatures must be affixed: the chief accountant of the institution;

- the person who actually issued the goods and materials;

- the person who prepared the form (performer).

The second sheet of the form is informative. The table presented in it records:

- name of issued MC;

- accounting code of issued MCs;

- unit of measure MC;

- Full name of persons who received the MC on the statement and a place for their handwritten signature on receipt;

- number of issued MCs in declared units of measurement;

- accounting value (purchase price) of the MC.

Based on the results of filling in the lower part of the table, a calculation is made of all issued according to the MC statement by quantity and cost.

NOTE! If the statement is filled out using technical means (for example, on a computer), the remaining empty lines are removed. If the statement is in paper form, you must put a dash in the unfilled lines.

The finished statement is transferred to the accounting department of the institution.

An example of writing off inventories in a budgetary institution is posted in the article “Accounting for materials in budgetary institutions (nuances).”

A current sample of a completed statement for the issuance of material assets for the needs of the institution in the OKUD form 0504210 can be downloaded on our website.

Act of disposal of material assets

After the valuables are written off, they are disposed of. For this purpose, a commission is assembled that evaluates and analyzes the need for disposal, and with an act confirms the implementation of this procedure.

The recycling act is drawn up according to the template established by the company or in free form, handwritten or printed, on plain A4 paper or letterhead. The document must be signed by all members of the commission.

Important! Some categories of materiel must be disposed of in a certain order because they contain harmful substances. Then the disposal is carried out by a specialized company, and before that a disposal agreement is signed with it.

The main part of the act states:

- valuables that are subject to disposal, the cause of defects and malfunctions, the lack of feasibility of repairs;

- Based on the results, it is stated that the specified valuables have been disposed of and no valuables were capitalized during the procedure.

The act is signed by members of the commission and, if necessary, by the head of the company.

The act of registering material assets

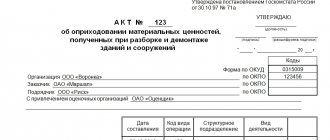

The unified form M-35 is used to confirm the capitalization of valuables that the company receives during the dismantling and dismantling of buildings and structures. Capitalization occurs if the materials obtained during analysis are still suitable for use in the future activities of the organization.

The header of the act contains information about the organization, the customer and the contractor, as well as the appraisal organization (if involved).

By the way! The act is approved by the head.

Next, enter the date, the name of the structural unit and the type of activity.

The table states:

- correspondent accounts;

- information about material assets;

- what was obtained during analysis;

- which is transferred to the contractor for repeated work.

At the end, the paper is signed by the customer and the contractor.

What is a TORG-12 consignment note?

The TORG-12 consignment note is a document for processing operations for the transfer or receipt of inventory items, which is the primary accounting document.

TORG-12 is drawn up in two copies, of which the first copy remains with the organization handing over the inventory and is the basis for their write-off, and the second copy is transferred to a third party and is the basis for the receipt of goods (inventory).

Act on theft of material assets

The theft report is the final stage of the procedure for conducting an official investigation into the loss of valuables.

The documentation contains information about the members of the commission (there must be at least 2-3 people), then it indicates what was missing and in what quantity, and the damage caused is calculated. The following are the attachments: an explanatory note from the employee, an order to conduct an internal investigation, an inventory and reconciliation report, and economic calculations of the damage caused.

The theft report, together with the attached package of papers, is the evidence base for the judicial investigation of the case.

The act must be familiarized to the suspect (or thief), and also signed by all members of the commission. The theft report is drawn up in free form or according to the template established by the company.

If you have any questions, ask them to a lawyer in the chat. Don't forget to download sample acts for free.