An advance report (form AO-1) is a unified document for accounting for employee expenses during a business trip. When returning from a business trip, the employee is required to report, for which he submits a completed travel certificate, which you can download here, and an advance report, the form of which is in the unified form AO-1.

Advance report AO-1 is the primary document necessary to account for the amount of cash issued to an employee for certain purposes, such as:

- travel expenses;

- administrative or production costs.

The issuance of the accountable amount is formalized at the enterprise's cash desk using an expense cash order (RKO). The money received must be spent only for the purposes that were specified in the RKO. The cashier is obliged to hand out amounts of money in person only to an employee who has entered into an employment contract with the organization, and his name is included in the list of the order about persons who can take money into account. Also, the basis for issuing the amount will be an order to be sent on a business trip or a travel certificate.

After the accountant has spent the issued funds, an advance report must be drawn up and submitted to the accounting service within three working days.

How to fill out AO-1 correctly? We offer you the expense report, which you will find at the end of the article. You can also download a blank advance report form below.

If the travel certificate confirms the very fact that the employee is on a business trip, then the advance report is confirmation of the travel expenses incurred by the employee. Documents confirming the expenditure of the issued amounts are attached to the advance report.

An advance report is also filled out when issuing funds against the report to employees for various needs. At the same time, you need to remember that money can be given to an employee on account only if he is included in the order on accountable persons.

The procedure for drawing up an advance report (form AO-1)

The document is drawn up by both the employee and the accounting department employee. The accountable person must fill in the following information: 1. Name of the organization; 2. Date of compilation; 3. Assignment of advance payment (production, entertainment, travel expenses, etc.); 4. Personal data, namely: last name and initials, structural unit in which the accountant works, personnel number, position; 5. Information about the amount of the last advance; 6. The amount of the report issued by the cashier; 7. The columns “Spent”, “Balance/Overexpenditure”, as well as information on the number of documents that are attached to AO-1, are filled in after writing and calculating the necessary data on the other side of the report; 8. Tabular part about the funds spent, namely:

- serial number. All documents attached to the expense report must be numbered according to the list compiled;

- number, date of each document confirming the intended use of funds;

- the name of the documents attached to JSC-1 (sales (cash) receipt, receipts for PKO, travel certificate, invoice, etc.), what the money was spent on;

- the expense amount is copied from each document. The reporting person fills out only column 5 or 6 (this depends on the currency of settlement);

- calculation of the final amount. Next, the total is rewritten in the “Spent” column (point 7).

After the accountant has passed AO-1, the accounting service employee needs to check the presence of each document that confirms the amount of funds spent, their correct expenditure for the intended purposes, and also needs to fill out the remaining sections. To confirm that the report in Form AO-1 has been submitted to the accounting department, the employee is given a receipt. After reviewing all the documents in the original that confirm the expense, checking the correctness of filling out, the advance report AO-1 is signed by the chief accountant, accountant and director, and then accepted for accounting.

Rules for writing a report

Today there is no unified report template that is strictly required to be filled out, however, most accountants, in the old fashioned way, prefer to use a previously generally applicable form. This is understandable: it includes all the necessary information, including -

- information about the organization that issued the money,

- the employee who received them,

- exact amount of funds

- the purposes for which they were intended.

- The expenses incurred are also reflected here, along with all supporting documents. In addition, the report contains the signatures of the accounting employees who issued the money and accepted the balance, as well as the employee for whom the accountable funds were registered.

It is not necessary to put a stamp on a document, since it is part of the company’s internal document flow; moreover, since 2016, legal entities, as previously and individual entrepreneurs, have the full legal right not to use seals and stamps to endorse papers.

A document is created in a single original copy, and there is no need to delay filling it out - according to the law, it must be issued a maximum of three days after the money is spent.

Since the expense report relates to the primary accounting documentation, you should be very careful when filling it out and try to avoid mistakes. In cases where this could not be avoided, it is better to fill out a new form.

Advance report AO-1. Sample filling

The advance report form is a two-sided form, it is filled out by both the accounting department and the employee himself.

What should an accountable person fill out in Form AO-1?

On the front side of the form the following lines are written:

- name of company;

- date of the report;

- the structural unit in which he works;

- your full name, position, personnel number;

- the purpose of the advance, that is, what it is planned to spend the issued money on (household needs, stationery, travel expenses, etc.);

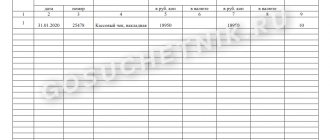

On the back of the form, the accountable person fills out a table indicating how the money was spent. For each available supporting document, a table line is filled in, in which the number, date, name of this document and the amount spent reflected in this document are written sequentially in the columns. Having filled out the entire table of the advance report form, the results are summed up at the end, the total amount spent is calculated, which is written in the “total” line. After this, the accountable person submits the advance report form to the accounting department, attaching all supporting documents.

Opened form:

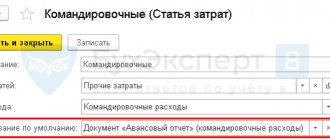

An advance report is a primary accounting document confirming the expenditure of accountable amounts issued in advance with supporting documents attached. The advance report is initially filled out by the accountable person (who received the cash) and submitted by him to the accounting department for further verification, approval by the manager and write-off of expenses incurred. The advance report form is located in the album of unified forms for recording cash transactions and cash inventory results called Form No. AO-1 .

The issuance of cash on account is carried out through the organization's cash desk using an expense cash order, which indicates the intended purpose of this amount. The organization's accounting department must have an order containing a list of persons who have the right to receive funds to report for business expenses (including the purchase of fuels and lubricants). The corresponding order must also approve the terms for which such advances are issued (they are not limited by law). The basis for issuing funds for travel expenses is a travel certificate or an order from a manager to send an employee on a business trip.

No later than 3 working days from the date of expiration of the period for which the advance was issued, or return from a business trip, the accountable person is obliged to submit an advance report to the accounting department with the attachment of documents confirming the expenses and make the final payment. The advance report form is drawn up in a single copy.

The advance report form is double-sided. On the front side, the accountable person must indicate the name of the organization, the number of the advance report and the date it was completed, his full name, the department in which he is registered, and his personnel number, if any, as well as his position and the purpose of the advance. Below, on the left side of the front form of the advance report, the accountable person fills out a table in which he indicates information about the previous advance, funds currently received, their expenditure, overexpenditure or balance.

On the reverse side of the AO-1 form, the accountable person writes down a list of documents confirming the expenses incurred (travel certificate, receipts, transport documents, cash register receipts, sales receipts and other supporting documents), and the amount of expenses for them (columns 1 - 6). Documents attached to the expense report are numbered in the order in which they are recorded in the report. Line 1a of the front side, forms and columns 6 and 8 of the back side of the advance report form are filled out if the advance was issued in foreign currency (for example, for a business trip abroad), in accordance with the rules and current legislation.

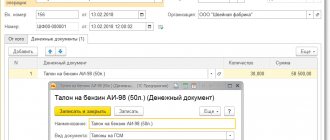

Further preparation of the advance report is carried out by an accountant. In the “Accounting entry” table on the front side, he enters the numbers of corresponding accounts and amounts; on the reverse side of the form, the amounts of expenses accepted for accounting are indicated (columns 7 - 8), and the accounts (sub-accounts) that are debited for these amounts (column 9) . After checking the correctness of filling out the expense report, drawing up supporting documents and the intended use of funds, the accountant must mark that the report has been verified and approved in the appropriate amount (in numbers and words), fill out a receipt on the front side of the form and hand it over to the accountable person. Next, the signatures of the accountant and the chief accountant with their transcripts are placed on the front part of the advance report form; if necessary, the amounts of the balance or overexpenditure and details of the expense or receipt cash orders for which the final payment is made are entered.

The verified expense report must be signed (with transcript) by the head of the organization or an authorized person, for which a corresponding line is provided at the top of the front side of the expense report form. After approval, the document is accepted for accounting for writing off accountable funds. The balance of the unused advance must be credited to the cash desk, and the overspent amount must be issued to the accountable person in the prescribed manner.

It is not allowed to issue cash to an accountable person who has a debt on a previous advance, and to transfer the cash issued on account to another person.

See also:

Submit an expense report Sample expense report - pdf Sample expense report - gif

Questions and answers on the form

What does the accountant fill out in the expense report?

Having received the report, the accountant must check the correctness of completion and compare the data given in the table with that specified in the attached documents. The document is assigned an individual number.

At the bottom of the front side, the accountant fills out the “receipt” lines: from whom the report form was received, its number and date, the amount spent, the number of attached documents, the date the report was accepted and the accountant’s signature. The receipt completed in this way is torn off from the main part of the AO-1 form and handed over to the accountable person as a sign that the report has been accepted and verified.

On the reverse side of the form, the accountant fills out lines 7 and 8, which reflect the amount accepted for accounting, and line 9, in which the debit of the account is written where expenses incurred are written off.

Then you need to go back to the front side and fill out two small tables:

- the first reflects the amount of the balance or overspending on previous advances, if any, in the “total received” field the issued advance amount is written, in the “spent” line – the amount actually spent. If the employee spent less of the money issued, then the “balance” is filled in, if more, then the “overspend”. If there is a balance, they are transferred to the cash register using a cash receipt order; if there is an overexpenditure, then the employee is given the missing amount from the enterprise’s cash register using a cash receipt order. In case of a balance/overexpenditure, you must also fill in “the balance is paid/the balance is issued in the amount” under the tables on the front side.

- the second table complements the first; in it, the corresponding corresponding accounting accounts are placed opposite the completed lines of the first table.

Next, the expense report is approved by the manager.

How to confirm expenses

Every company manager, when giving cash to an employee for any purpose, wants to receive confirmation that the money was actually used for its intended purpose.

This confirmation is provided by official documents: checks, invoices, passenger tickets, boarding passes. Each supporting document must meet certain requirements. The name of the document, the date of its execution, and the signatures of the responsible persons must be indicated here. Surely many are familiar with the significant disadvantage of a cash receipt. The text printed on this document does not last long. It can fade and simply wear off. This makes the information on the check impossible to read. Naturally, in this state it is not a document that can be attached to the expense report. To avoid such problems, it is recommended to make a photocopy of the cash receipt. And if we are talking about a large sum, it would be useful to certify the copy with a seal.

In addition, you should pay attention to other nuances that you may encounter in the process of preparing an expense report:

- If supporting documents are in a foreign language, they must be translated into Russian. There is no urgent need to translate all data. Only essential information that is important for drawing up the expense report should be translated.

- There are situations when the provision of services, the purchase of goods or other expenses occur on a weekend. It must be remembered that the labor inspectorate monitors the work of employees on weekends, because this time is intended for rest. To avoid problems, it is better to make transactions on weekdays.

- The expense report form can be developed by the company independently. Naturally, it must be approved in the accounting policy. Let us remind you that since 2013 the use of the unified form AO-1 has been abolished. However, practice shows that many are quite satisfied with it, so this form is still used today to prepare an advance report.

- Legal entities have the right to settle accounts with private entrepreneurs under one agreement for an amount of up to one hundred thousand rubles. Thus, if the transaction involves the use of larger amounts, the responsible person must take care to conclude the required number of contracts with the supplier, each of which will not exceed the specified amount. But this only applies to situations where payments are made in cash. This restriction does not apply to transactions for which non-cash payments are made. As a rule, organizations use a special account or corporate card for such payments. It must be remembered that if the accountable person receives funds in this way, the procedure for preparing an advance report remains the same.

- The company can issue absolutely any amount to the accountable person. As a rule, any restrictions are established only by corporate rules. Don’t forget, even a small amount should be taken into account in the advance report.

Hotline for citizen consultations: 8 (800) 200-46-92

What to do if there are no supporting documents

After returning from a business trip, an employee may attach to the report documents with irreparable defects (for example, damaged, wet, etc.), or not provide them at all (a cash receipt is lost, it is impossible to obtain a duplicate).

But such events do not mean that the employee’s report cannot be accepted. Although he cannot provide supporting documents, the product or service itself may actually be received.

After submitting the form, the accountant must still check it, and the manager must then decide whether to approve the advance report for the business trip or not.

In the case when the director decides to approve this document and reimburse expenses, you need to remember that without supporting documents it will not be possible to include these amounts in the base for calculating income tax.

Important: if the company is a VAT payer, it will not be possible to deduct VAT on purchased materials.