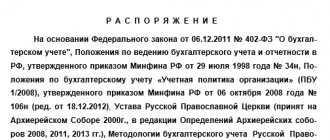

Each company operating in the Russian Federation must draw up and approve an accounting policy that will reflect all the accounting and tax accounting methods used in it.

The CP is usually developed by the person who will subsequently be involved in accounting. This could be an accountant, chief accountant, for small companies - a manager, as well as a specialized company providing accounting services. The UE must be approved using the Order. It does not have a standard form as such, but there are some requirements for it approved by law. In order to understand how to write it, we suggest that you familiarize yourself with the basic rules for developing the Order and show an example of a completed document.

AUDIT OF ACCOUNTING POLICIES

What is accounting policy

Accounting policy refers to a number of methods of accounting and tax accounting used in an enterprise. Each organization has the right to draw up its own accounting policies, which may depend on a variety of parameters. Factors influencing it include:

- federal and local laws and regulations;

- types of taxation of an organization;

- way of conducting business activities, etc.

There are three types of accounting policies enshrined in legislation:

- accounting policies for accounting purposes;

- accounting policies for tax purposes;

- accounting policies for reporting according to international standards.

Law No. 402-FZ on changes in accounting policies

The Law “On Accounting” dated December 6, 2011 No. 402-FZ lists a closed list of conditions under which changes may be made to the current accounting policy (clause 6 of Article 8):

- the emergence of new requirements in accounting legislation;

For example, from 2022, asset accounting will be regulated by two new Federal Accounting Standards 6/2020 and 26/2020. They largely change the approach and principles of accounting for a company's assets. ConsultantPlus experts told us exactly what innovations the new FSBU introduced. If you do not have access to the K+ system, get a trial online access for free.

- introduction by a business entity of changed accounting algorithms into its accounting process;

- radical changes in the activities of companies, significantly adjusting the conditions of their work.

Clause 7 art. 8 of this law defines additional important aspects:

- the calendar limit for introducing adjustments into the accounting process is from the beginning of the reporting year;

- the purpose of establishing this time limit is to ensure comparability of accounting records;

- an exception to the established rule - the introduction of innovations into the accounting process is carried out from a different date, if this is due to the reason for the change.

What issues does accounting policy address?

The list of issues that are addressed in the accounting policy is very extensive.

If we are talking about accounting, then here are working charts of accounts, methods of accounting for goods and materials, methods of income distribution, templates for primary documents, etc.

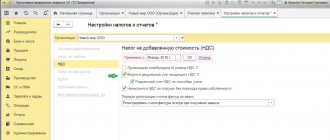

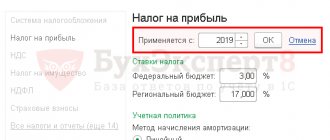

Tax accounting policies are also varied in content. It defines:

- system and structure of taxes paid by the organization;

- objects of taxation;

- ways to recognize expenses and income for calculating income tax;

- methods of calculating depreciation, determining the value of production and material assets;

- procedure for fulfilling tax obligations, etc.

When an accounting policy order is approved

Organizations operating and already having a management program can use their previously adopted policies for the next reporting year. There is no obligation to issue an order to extend the UP.

The order on accounting policies for 2022 must be adopted before December 31, 2020, if we are talking about a new UE.

If the organization is just starting its work, then the order on the accounting policy is approved for accounting purposes before the first reporting, but no later than 90 calendar days, and for tax accounting purposes - no later than 1 month from the date of state registration.

If the UE no longer meets the requirements of the accounting organization, then it can be supplemented or changed (clause 10 of PBU 1/2008; Article 313 of the Tax Code of the Russian Federation).

Changes to the UE will come into effect only from the new reporting year, if they do not require their application immediately after introduction (clause 12 of PBU 1/2008). The reason for the adjustment may be the following:

- there have been significant changes in the organization's work;

- the organization intends to use new methods of accounting;

- changes in the regulatory framework.

Organizations with a common accounting system make all changes related to the updated management program retrospectively, that is, when innovations are taken into account in previous periods, as if the changed management program had been applied from the very beginning of the activity. Companies that use a simplified method of maintaining accounting, including simplified accounting (financial) statements, can reflect in the accounting the consequences of changes in management policies that have had a significant impact on the financial position of the organization, prospectively, i.e., the changes are effective only from the period of introduction of the policy into force, unless otherwise required by the legislation of the Russian Federation or regulations on accounting (clause 15 of PBU 1/2008).

The role of the order

An order approving an enterprise's accounting policy, being a kind of link between the legislation of the Russian Federation on accounting and tax accounting and the company's regulations, is needed for internal use.

The order obliges all divisions of the company, regardless of their location, to comply with the rules of accounting policies, and also appoints persons responsible for monitoring this.

The order is usually written by the secretary of the organization, and he also gives it to the director for signature.

Approval of accounting policies: rules and terms

An order approving the accounting policy for accounting must be issued within 90 days from the date of registration of the newly created company (clause 9 of the Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n). In this case, it is considered that the policy begins to apply from the moment of state registration of the company.

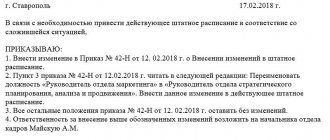

The policy is valid for an unlimited time - there is no need to approve a new document annually or renew the validity of an existing one. The policy may change if (clause 10 of Order No. 106n):

- the legislation regulating accounting procedures has changed;

- the organization has developed a new way of maintaining records to increase transparency of transactions and make accounting more accurate;

- The conditions in which the organization operates have changed significantly.

Changes made to the accounting policy must be formalized by a separate order - it is drawn up on the same principle as the order approving the policy for the first time and is signed by the director of the organization.

The changes made take effect:

- from January 1 of the year following the year of entry into force of the order to amend the current document - if the reason for adjusting the accounting policy was an internal decision of the company;

- from the moment changes in accounting rules come into force - if the reason for the change in accounting policy was changes in legislation.

The accounting policy for tax purposes must be approved no later than the end of the tax period in which the organization is registered (clause 12 of Article 167 of the Tax Code of the Russian Federation).

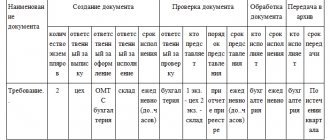

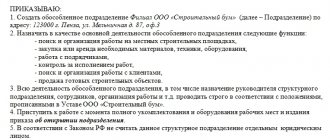

How to create an order

Since 2013, the use of unified standard forms of primary personnel and accounting documents has been abolished. Now any orders can be written in any form or, if the organization has its own document template, based on its sample.

In this case, in any case, it is necessary that the order in its structure corresponds to certain parameters of office work, and in its content includes a number of mandatory information. These include:

- Title of the document;

- date of its compilation and number;

- the name of the company where it is produced.

Then comes the main part:

- the essence of the order is described, that is, the fact of approval of the accounting policy is recorded, indicating the exact date from which it is put into effect;

- a link is given to the appendices to the order - documents that, in fact, determine the main provisions of the accounting policy;

- the obligation of department heads to familiarize their subordinates with it is prescribed.

Finally, the order should designate the employees responsible for its implementation. If the administration of the organization believes that the order needs to be supplemented with some other information, it should also be included in the form in separate paragraphs.

Orders on core activities - what are these documents?

Orders for core activities are included in one of the enlarged documentary groups of orders issued within the company in the course of its business activities.

The general grouping of orders is as follows:

- POD (orders for main activities);

- PLS (personnel orders);

- PAD (orders on administrative and economic activities).

This gradation is generally accepted in office work, but for those who are not familiar with it, it is difficult to distinguish between those areas of the company’s activity for which one or another group of orders is used.

To clarify, below we provide a brief description of each group in order to highlight the scope of activity of the company for the organization of which orders are issued:

- PLS is a group of orders directly related to the company’s personnel. It includes orders for hiring, dismissal, relocation of employees, “vacation” and “incentive” orders, orders for disciplinary punishment, sending employees on business trips, etc.;

- PAD is a set of orders of the company administration related to resolving issues regarding the operation of property, transport support, internal communications and security;

- POD - other orders not included in the first 2 groups.

ConsultantPlus experts spoke about the nuances of processing orders. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Get to know the PLS group using materials from our website:

- ;

- ;

- “Unified form No. T-8 - form and sample filling”.

We will decipher the AML group in detail in the next section.

How to fill out a form

An order approving a company’s accounting policy can also be drawn up freely: it can be written on an ordinary blank sheet of paper or on the company’s letterhead, both on a computer and in handwritten form.

After the contents of the order have been formulated, it must be signed by the director or his deputy/representative, who has the power of attorney to sign documents (in this case, the use of facsimile, i.e. printed by any method, autographs is unacceptable, i.e. the signature must be “live”).

In addition, the employees responsible for its implementation should be familiarized with the order against signature.

Today, it is only necessary to certify an order using stamps (stamps and seals) in one case - if this rule is enshrined in the local regulatory documents of the organization. The order is always written in one copy, but if necessary, you can make additional, properly certified copies. The completed order must be registered in the administrative documentation journal.

***

An order on the accounting policy of an organization must be present in both organizations and individual entrepreneurs. The organization develops the order form independently and publishes it on company letterhead after passing state registration. After this, the organization may not approve the management program annually - until changes occur in work or legislation. If there is a need to supplement or make necessary adjustments to sections that affect the reliability of accounting, then an order is issued to change or supplement the CP.

Even more materials on the topic can be found in the “Accounting Documents” section.

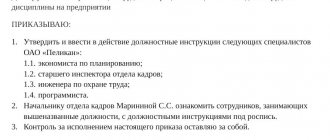

How to assign the duties of the chief accountant to the director: sample order

To assign the powers of the chief accountant to the director of the enterprise, you will need to issue a corresponding order (see Letter of the Ministry of Finance on accounting dated August 27, 2014 No. 03-07-09/42854). After this, he will be able to independently sign all accounting documents: both as a director and as a chief accountant.

Download a sample order on accounting by director (option 1)

Download a sample order on accounting by director (option 2)

On our website you can order an order to use it in your work with changes - the proposed document can be revised taking into account the document flow rules in force at the enterprise.