Where can I find the registration number and address of my FSS branch? This question is asked by entrepreneurs who need to get an appointment on one of the following issues:

- Opening of a separate division. In accordance with current regulations, it must be registered with the funds at its location;

- Submitting reports if done in person;

- If there are pregnant women in the organization, whose benefits are generated from the Social Insurance Fund;

- In the event of a work-related injury to an employee, to provide the necessary materials;

- When interacting on issues related to registration of sick leave.

If an accountant previously communicated with the Social Insurance Fund for you, or a lot of time has passed since registration and there were no reasons to contact you, it may turn out that no one knows the address of the required branch. Our instructions “How to find the Social Insurance Fund number using the TIN of an organization in Moscow in 4 steps”

.

The algorithm described below is intended for those who are already registered with the FSS. To find out what to do for individual entrepreneurs who are just planning to register, follow the link.

Most of the issues with the Social Insurance Fund can be resolved without a visit to the branch if you use the 1C:Fresh cloud service.

Explore the possibilities and try for free

Topic: How to find out the registration numbers of the Pension Fund and Social Insurance Fund using the Taxpayer Identification Number (TIN)

Vasily, thank you very much! We registered recently, but it’s time to print payments. And on the phone some pompous turkey refused to give me the number at the FSS. I checked other organizations for control - everything matches. Smack-smack for the right site!

In theory, by the tax office number with which you are registered, you can determine the number of the Pension Fund and the Social Insurance Fund. But in practice there are also non-coincidences. I'm talking about Moscow. In general, the second 2 digits in the TIN and KPP are the tax number. In which tax office the company is currently registered, it is necessary to look specifically at the checkpoint.

Name of the territorial body of the social insurance fund of the Russian Federation

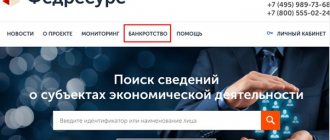

The legislator has made changes to the regulations for interaction with taxpayers: now firms and entrepreneurs can report through the State Services portal. In this article we will take a closer look at how to find out the FSS subordination code by registration number or TIN, and why it is so necessary.

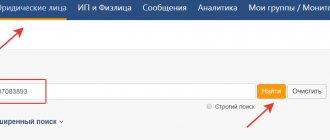

Algorithm for searching codes by TIN or FSS registration number

Information about the code and registration number is transmitted to the companies in a letter. When for some reason the necessary information is not available in the organization (the letter is not received or is subsequently lost in the organization), then filling out the 4-FSS reporting form becomes impossible, due to the fact that this code must be indicated at the top of each calculation sheet.

May 17, 2022 uristgd 333

Share this post

- Related Posts

- Benefits for the Low-Income Single Mother

- Okof Wall Panel Shock Absorption Group

- Reissue Student Card

- Criminal Code of the Russian Federation Hypothesis

Find FSS by reg number

The FSS registration number is a unique combination of numbers that is assigned to each policyholder upon registration. This usually occurs simultaneously with the registration procedure of a legal entity or individual entrepreneur.

Ensuring a high level of safety at an enterprise when performing labor functions is an important task. No matter how successfully it is solved, no one is immune from accidents. Therefore, the employer must provide guarantees to employees in such situations. We'll tell you how to pay insurance premiums for injuries in 2022, what changes have occurred and what an accountant should know about them. As for other types of insurance premiums, you may find the article “Changes in insurance premiums from 2022” useful.

We recommend reading: Do you need a parent’s passport to get a passport at 14?

What is FSS registration number

Unlike companies, whose data is entered into the FSS database automatically through interdepartmental interaction channels, an entrepreneur, as a person paying insurance premiums, is required to register with the fund only when forming a staff. The entire procedure for registering an individual entrepreneur is given 30 days from the date of registration of the first employee.

A package of documents is submitted, which includes:

- application (if you have an electronic signature, you can submit it electronically);

- entrepreneur's passport (copy);

- a copy of the work book, with a mandatory reflection of the page where the employment record is visible;

- a copy of the employment agreement.

According to the rules of the insurance fund, department specialists have the right to demand one of the last two documents, however, both types may be needed during registration.

Therefore, it is better to first call the FSS branch and find out the exact list.

Registration events must be carried out only if the first employee is hired; when registering subsequent employees, there is no need to notify the fund.

It may happen that an individual entrepreneur without employees decides to register and start paying contributions voluntarily. This is required if there is a need for maternity benefits, etc. Then he has the right to submit an application to the MFC either through the State Services portal, or by personally visiting this institution. In addition to the application, you will need the original passport for identification and a copy of it to send to the FSS.

After 3 working days, the FSS must take the following steps:

- assign a 10-digit number and subordination code to the entrepreneur;

- enter this data into the register;

- issue the policyholder with a notice of entry into the register;

- research the insurance class and notify the individual entrepreneur about the amount of insurance fees.

The entire procedure with sending documents is completed within 5 working days from the moment the application is submitted and the package of papers is submitted. One copy of the notice is issued in person or by mail (the method is given in the application), the second is left in the fund. In the process of work, a situation may arise when the individual entrepreneur has already completed personal registration and received the policyholder number. But then he needed to hire hired personnel. In this case, how can an entrepreneur obtain a registration number in the employer’s Social Insurance Fund and is it necessary to do this at all?

The legislation does not regulate this conflict, but contains instructions for mandatory registration when hiring the first employee. Therefore, if circumstances arise in this way, you need to go through all the required procedures again. Most likely, the new numeric code will be different from the previous one.

The number in question will be needed by the entrepreneur to be reflected in reports submitted to the social insurance fund body.

If the information is lost, and only the data from the tax certificate is available, then there is a simple answer to the question of how to find out the registration number in the FSS of an individual entrepreneur using the TIN.

Insurance premiums for individual entrepreneurs for themselves

Having chosen personal voluntary insurance and registered as an individual entrepreneur, he must pay the appropriate fees before December 31 of the year in which he decided to become an insured.

You can pay either the entire amount one time, or split it into parts (once a month, every quarter, every six months).

You need to deposit money into the account of the Fund branch at your place of residence in a convenient way:

- in cash through the cash desks of financial institutions;

- transfer from a bank card, account or electronic wallet;

- transfer via mail.

The amount of insurance premiums payable to the Social Insurance Fund is determined at the government level and communicated to payers in advance.

For voluntary payments by individual entrepreneurs in 2022, the amount of contributions that must be paid in order to use benefits in the next year is 3302.17 rubles.

Whenever an individual entrepreneur receives commercial status, the amount of the fee to the Social Insurance Fund remains unchanged. Even if he is entered into the register as an entrepreneur at the end of December 2022, and he expresses a desire to become a social insurance payer, the obligatory condition is to pay the above amount in full.

The payment document with the details of the individual entrepreneur is generated by the territorial body of the social insurance fund. Payment is made in cash or by bank transfer. The principle of voluntariness means that such payments cannot be taken into account in expenses; it is not allowed to reduce the tax itself by the transferred amount.

Insurance premiums for employees

As soon as the entrepreneur hires his first employee, he must register with the social insurance fund and the Social Insurance Fund for individual entrepreneurs will generate a unique policyholder number. According to this indicator, in the future there will be

As an employer, an entrepreneur does not have preferences over organizations. Individual entrepreneurs pay contributions to the Social Insurance Fund at rates identical to those of legal entities - 2.9%.

The principle of contributions is as follows:

- The individual entrepreneur makes monthly contributions to the fund for employees;

- in case of illness, the employee receives money in an amount depending on the length of service;

- the entrepreneur reports to the fund about the money given to the employee;

- The Social Insurance Fund compensates the employer for his costs of paying for the certificate of incapacity for work.

An identical mechanism works when issuing maternity benefits, funds issued as part of child care, etc.

The rate for calculating insurance premiums for injuries is 2.9%.

Accrued contributions must be transferred by the 15th day of the following month following the payroll period. Late payment of fees will result in penalties. In addition to this obligation, the individual entrepreneur must carefully keep records of insurance premiums and report every quarter on the fees accrued and contributed to the Social Insurance Fund.

Enterprises with up to 25 employees can submit reports both on paper and electronically. Above this limit, reporting is submitted only via telecommunication channels.

Calculation and payment of individual entrepreneur benefits at the expense of the Social Insurance Fund

The fund transfers benefits for insured events as part of compensation if in the previous year the policyholder fully transferred the entire required social contribution for employees. The legislation of the Russian Federation aims at this.

This means the following payments:

- on sick leave;

- for pregnancy and childbirth;

- child care;

- for burial.

Regardless of whether the individual entrepreneur (voluntarily or obligatory) received an insurance number from the Social Insurance Fund or not, the fund will pay him and his employees one-time benefits of two types: those due to women during pregnancy and at the birth of children. The size of such amounts is the same for everyone.

The calculation of all the above payments (except for two fixed ones) is based on the length of service and the average monthly salary of an employee who has received, for example, a certificate of incapacity for work. For individual entrepreneurs, the starting point for insurance is different - the minimum wage, and the one established for the year in which the insured event occurred. For 2022, this figure is set at 9,489 rubles.

To receive timely compensation for yourself or your employees, the individual entrepreneur must meet the time frame.

For all insured events, you must contact the fund within 6 months:

- After closing the certificate of incapacity for work or registering disability.

- Since the closure of sick leave related to pregnancy and childbirth.

- From the day the child reaches one and a half years of age.

If the individual entrepreneur does not fit within the given framework, there will be no violation, but then the costs of insurance payments will fall entirely on the businessman.

As a result, an individual entrepreneur must register with the Social Insurance Fund as soon as he starts hiring workers. The fund assigns him a policyholder number, which is then indicated in all payment documents and reports. In addition, he can voluntarily register himself personally. To find out the assigned policyholder number by TIN, you need to go to the portal of the social insurance fund or visit its territorial branch.

How to find out the FSS address by the policyholder number

Moscow, Triumfalnaya Square, 1, building 1, Mayakovskaya metro station, entrance from 1st Brestskaya street 13/14 tel.: 8(499)251-5132; 8(499)251-5140; 8(499)251-5109; 8(499)251-5515 (financial issues) TIN 7710030933, checkpoint 770701001 119002

The simplified taxation system has undeniable advantages over the general one. It significantly reduces the tax burden legally, significantly simplifies the preparation and submission of reports, etc. How to switch to a special regime from 2022 and which tax object to choose - read our article.

How to find out the FSS address by the policyholder number

2. Fill in all the necessary data in the “Social Insurance Fund” section, which contains the opportunity to indicate the payment details of the Social Insurance Fund. Injury rate - the rate is differentiated based on your type of activity, from 0.2% to 8.5%.

policyholders For the insured / workers: For victims at work: For the insured / workers: For victims at work: For the insured / workers: For the insured / workers: For victims at work: For the insured / workers: For victims at work: For the insured / workers : For victims at work: (499) 250-20-07 (financial issues) For the insured / employees: For victims at work: To clarify your branch For the insured / employees: Department for the appointment and implementation of insurance payments to insured citizens - (ON QUESTIONS OF PURPOSE ONE-TIME AND MONTHLY INSURANCE PAYMENTS) For victims at work: Department of Rehabilitation of Victims - (ON PAYMENT OF ADDITIONAL COSTS FOR REHABILITATION OF VICTIMS, OBTAINING Vouchers FOR SANATORIUM TREATMENT, TECHNICAL REHABILITATION EQUIPMENT, PROSTHETICS -ORTHOPEDIC DEVICES, EXECUTION OF OTHER MEASURES PRP)

When is an individual entrepreneur required to register with the fund?

In the Social Insurance Fund, registration of an individual entrepreneur as an employer is carried out if a businessman hires employees with official registration through an employment contract. The same applies to concluding civil agreements that provide for the payment of contributions. An individual entrepreneur without employees can go through the registration procedure to pay contributions for himself. This provides insurance against disability.

After concluding the first contract with an employee, the individual entrepreneur is given 30 days to submit an application for registration with the Social Insurance Fund. It should be remembered that an entrepreneur does not need to send a notice of hiring an employee to the Federal Tax Service and the Pension Fund of the Russian Federation. Government agencies obtain this data from official documentation, which is submitted by individual entrepreneurs at certain intervals.

Important! Since a businessman does not have the right to enter into an employment agreement with himself, there will be no registration with the Social Insurance Fund as an employer if he does not have employees. To receive payments, an application for voluntary insurance of an individual is submitted.