Written Disclaimer

First, about the shortcomings of the article, so that readers who waste time reading it do not curse me and spoil my karma.

- There is “soooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo-reading section there is no point on reading this article, you should read the entire article, but you can go to Conclusions and Prospects.

- The article will suggest using your head, especially with the question “Do you really need it?”

- The article will not analyze such an area as the exchange of electronic documents with counterparties, because, as one very smart friend of mine said, “not a single accountant of ours will willingly refuse the fabulous opportunity to correct documents retroactively.” So this analysis will happen when the state pushes everyone on this topic as efficiently and quickly as with VAT.

- And if you, the reader, are a representative/fan of any particular EDI system, don’t read, don’t spoil your mood))).

- The editors' opinion hardly coincides with the author's opinion and vice versa))).

Why choose electronic reporting?

Comfortable

Endless queues at the tax office are a thing of the past. To submit reports, you only need a computer and the Internet.

During

On the main page of the service there is a list of to-dos that will remind you of the deadlines for submitting reports and show an unanswered request from the Federal Tax Service. The date of submission of the report is considered to be the date of dispatch. Even if you send a document 5 minutes before the deadline, it will be submitted on time.

Compact

All sent and received documents are saved in cloud storage and do not take up space either in the office or in the computer memory.

Safely

When transmitting documents via TCS, the data is encrypted. Only the regulatory authorities to which the reports are sent have the key to protection. Therefore, viewing and adjusting data by unauthorized persons is excluded.

No mistakes

The editor always contains the latest approved report forms. The built-in assistant will tell you how to fill out a particular line and report errors. Some lines are filled in automatically. You can also reconcile VAT with counterparties so that there are no discrepancies.

Market overview or “whoo from where”. Big Four. Dealers. Notable integration projects

At the time of writing, there are 116 electronic document management operators in Russia, all of them are also certification centers. Of these, 4 operators control about 85% of the reporting market. These are (in descending order by number of subscribers): Tensor (the main product of Sbis, but there are other solutions), Kaluga Astral (products - Astral Report and a lot of integration projects), SKB Kontur (Kontur-Extern and sending in other products - Elbe and Accounting.Kontur), Taxcom (Dockliner, 1C-Sprinter and other products, remnants of the former monopoly luxury). I propose to conditionally call them the “Big Four”, since it is these 4 operators that determine the picture of electronic reporting.

In addition to the main products of the Big Four, you should pay attention to well-known integration projects, which are also supported by these operators. You can recall various systems, like 1C-Sprinter from Taxcom, but now only the integration projects of the Kaluga Astral company deserve real attention (probably compensation for the outdated and rather primitive main product - Astral Report).

- 1C: Reporting (everything is clear here, most accountants have probably already received an offer to connect, this project has already led to the fact that the number of connections of the main product - Astral Report - is the lowest in recent years and tens of times inferior to 1C-Reporting).

- Bukhsoft Online, Sending module (integration solution from Kaluga and 1C competitor Bukhsoft, actively promoting themselves).

- The Glavbukh program (an integration solution from Aktion - the leader in the b2b press market, judging by their success in the development of electronic products, deserves attention).

- MoeBusiness (of course, you shouldn’t believe the loud advertising that there are already more subscribers than 1C, but 20-25 thousand individual entrepreneurs probably use their sending services).

Separately, it is worth mentioning Accounting.Kontour and Elbe , which also allow you to send reports. But these solutions, in my opinion, create internal competition with the main product - Kontur-Extern.

Leaders in this market are changing. At one time, Taxkom lost its leadership to Kontur, Kontur to Tensor, and now Kaluga has supplanted Kontur (solely thanks to 1C-Reporting and other integration projects). Taking into account the fact that Kaluga has actually received the entire 1C-Franchisee network as dealers, another displacement of the leader is not excluded (the principle “less skill, number” always works!).

How to choose a reporting service

When choosing a service for submitting electronic reporting, you need to be guided by the needs of a specific business.

What you need to pay attention to when choosing a reporting service:

- where tax and accounting records are maintained.

If you work in the 1C program, then it is better to purchase a service that can be integrated with this program. For example, the 1C-Reporting service; - volumes and directions of reporting.

Not all services interact with all regulatory authorities. Determine where and what reports you submit and compare the capabilities of different services; - list of service functions.

Check the composition of the reporting forms, find out if there is technical support, work instructions, or training opportunities for employees. Get acquainted with the interface - many e-document flow operators provide a trial period; - prices

. Not always “very expensive” = “very good”; a high price may be due to a large number of unnecessary functions. A low price may indicate that you will have to purchase the necessary functions separately. Also pay attention to discounts, promotions, and special offers.

Schemes for sending reports. Direct scheme. Representative scheme. Portals. Advantages and disadvantages

The shipping schemes are as follows:

1. Direct scheme. This is when a subscriber (taxpayer/insurer - organization or individual entrepreneur) enters into an agreement with an electronic document management operator (usually from the Big Four) or an operator’s partner. As a result, the subscriber is provided with software for sending reports, and an Electronic Signature - ES (qualified, enhanced, everything as required by law) is issued to the manager or other authorized person.

Disadvantages of the scheme:

— you have to pay small, but still money, annually (7-12 thousand rubles, if there is only one organization);

- you need to have a qualified employee who not only knows how to work with a computer and does not faint at the word “browser”, but is also at least somehow interested in accounting work: knows what reports to send where and when, understands the difference between XLS and XML, if he makes reports manually, he sometimes reads the instructions for filling out the corresponding report, and does not send the report, which during preliminary testing produced 28 errors.

The advantage of the scheme: if the specified costs are acceptable and there is an adequate specialist (or it’s you) - then this is the only correct scheme, since it guarantees normal control of the work on submitting reports and the absence of sudden surprises, such as blocking a current account.

When connecting several organizations (usually five or more) according to the above scheme, you can save significantly. This is called "group etc." An ES is issued for each organization or individual entrepreneur for a year; when working in the program, the accountant selects the desired organization (using the appropriate ES) and sends reports for it. You cannot send reports for unconnected organizations/individual entrepreneurs; this is a straightforward scheme.

2. Representative scheme. The essence of the representative scheme is that there is a subscriber (we will call him a tax representative - NP) who has a software package that allows him to send reports to other organizations or individual entrepreneurs. An organization or individual entrepreneur comes to the tax office with paper reports, but the inspector does not accept the reports (just like that, out of lawlessness), sending them to the “girl” - an individual entrepreneur, who sits in the same inspectorate or in the building next door. An organization or individual entrepreneur comes to the IR with its reporting, the IR uploads it into its system (if it is not in electronic form, then it generates the reporting of the Organization or individual entrepreneur for additional money). After this, the NP sends the reports (prices from 100 to 600 rubles per report), signing it with his electronic signature based on the power of attorney of the Organization or individual entrepreneur whose report is being sent. The power of attorney is also issued on site at the NP.

Pros of the scheme:

— low price for one-time shipment;

— a “tick” for the inspector that the next taxpayer is reporting electronically.

Minuses:

— complete dependence on the integrity of the NP. Whether the report was submitted or not – you will only find out if the NP tells you about it. Does he have to? Have you read the agreement with the NP? Is this really written there? Usually - no, he is only obliged to send for 100 rubles. That is, “the main thing is to crow - and then at least it’s not dawn.” And this is not the only negative. Let's imagine that everything went well. But a requirement comes (for example, related to the clumsy reporting of your counterparty). Who will answer it and how? According to the law (Tax Code), a response to a request is given within 6 days; no response means blocking the current account of yours, not your tax representative;

— in a number of regions (including Moscow), authorities are already trying to displace representative schemes (due to the fact that fictitious reporting for VAT reimbursement is usually submitted through NPs);

— by law, the representative scheme works only with the Federal Tax Service, with other areas it depends on the region and local characteristics.

The existence of NP is still due to three reasons:

— the unwillingness of the Big Four to agree among themselves and abandon this scheme;

— fear of inspectors for the loss of percentage indicators of subscribers who report electronically;

— corruption connections in the field of inspectors and representatives of operator dealers.

Conclusion - I categorically do not recommend it, as the shop will be closed, and, as always, suddenly and very painfully.

3. Portals. The essence of the scheme is that you buy an electronic signature from any accredited certification center and submit reports through portals (https://www.nalog.ru/, https://fss.ru/, etc.).

Plus: the lowest costs are only for electronic devices, which are inexpensive.

Minuses:

— registration on each portal;

— different logic of work on different portals;

— there are no really convenient reporting preparation tools;

— the main thing is that there is no help and support if something goes wrong;

— there are no additional services that all electronic document management operators provide to their users.

Conclusion: at the moment, the only adequate scheme seems to be a straight line. Portals are fine, but not convenient. The representative scheme is not even a pig in a poke, but a monkey with a grenade; blocking an account will cost several times more than connecting.

In what situations do you have to choose an EDF operator?

The company will have to resort to the services of an EDF operator if the parties to the exchange of documents have not found a technical solution for direct exchange, as well as for the exchange of invoices. By law, the exchange of this type of document in electronic form must take place through an operator who provides users with a ready-made service and automatically performs important functions:

- Ensures the confidentiality of information exchange using secure data transmission channels;

- Monitors formats and regulations, ensuring compliance with Russian legislation;

- Notifies the Federal Tax Service about a new exchange participant (this is necessary when exchanging invoices);

- Guarantees delivery of ED to the counterparty along a given route;

- Checks the electronic signature for validity at the time of signing;

- Implements the exchange of invitations.

Technologies. Off-programs, online programs. Features of online projects

Various portals have “smart” comparisons with the terminology “thick” (offline) or “thin” (online) client. Depending on who makes the comparison, the superiority of installation versions (Astral-Report, 1C-Reporting, Sbis++) or web versions (Kontur - all products, Bukhsoft Online, MoeDelo, Glavbukh Program, Sbis Light, etc.) is proven. .). I will not repeat such comparisons here, since the main thing is user preferences, and not the ability of marketers to cheat a competitor. And users may have two preferences in terms of technology: either “I carry everything I have with me” (the system is not only on the computer, but it is also advisable to duplicate everything on a flash drive), or “I am free, like a bird in the sky” (cloud technologies, work from any place, etc.).

With the first ones everything is clear, VLSI++, 1C-Reporting, Astral - they should go there (if everything else suits them). But with the latter, “everything is complicated” (there is such a status in one social network when a citizen cannot decide what he wants). And it’s difficult because users usually think that online is really online, that is, the ability to work from any computer with Internet access, but the devil is in the details. Let's take the most famous "thin client" - Kontur-Extern. Indeed, all reporting is created/downloaded on the Kontur portal, but... CIPF must be installed on the workplace - a means of cryptographic information protection. And without local cryptography, the system no longer works. Therefore, from the many online solutions, you need to choose, first of all, focusing on a simple question - will I need to install CIPF on my computer or not. If necessary, it is not online, but “as if online”; you will not have the freedom to work from any machine. If you don’t need it and everything works, it’s real online. In my experience, I can include Accounting as one of these. Kontur and Kaluga integration solutions - Bukhsoft, MoeDelo, Glavbukh.

About prices - what you pay for and why you need it

As one of my friends said, who once connected about 80 subscribers to electronic reporting in one day, all these systems differ only in price and interface. Essentially, she's right. The interface is a matter of taste, and a person will get used to anything. But the list of possibilities and for what money is important.

So, we come to the most interesting part. In general, price comparisons are quite difficult to make, because due to different approaches to pricing policies, one operator may have, for example, inadequate prices for connecting one subscriber and at the same time better conditions compared to competitors if there are, for example, 10 subscribers. Therefore, if you are planning to choose a system (of course, we are talking strictly about a direct scheme) - immediately indicate how many potential subscribers you have (organizations and individual entrepreneurs in total), and then answer the remaining questions, if necessary.

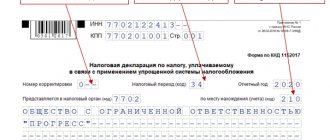

As a basic condition, I decided that I have one organization on the generally accepted taxation system (OSNO), I must, of course, submit VAT, and at the same time all other reporting. Directions 4 - Federal Tax Service, Pension Fund, Social Insurance Fund, Rosstat. There are no special features. The minimum requirements for the system (except for sending in the specified directions) are letters, reconciliations, a system for preparing and checking reports, the ability to download report files from other programs. This is the minimum that should be. The rest is from the evil one.

Let's start with Taxcom (https://taxcom.ru/shop/). Taxcom is simply a wonderful “online store” operating under the slogan “If you want to work with us and find out prices, take the quest.” I didn’t pass, so I turned to the girl in the chat, giving out in one sentence all the information about who and how I wanted to connect. This turned out to be difficult for the Taxcom employee, and I had to write it all again, only in a column. As a result, a price was obtained that did not appear in any of the 100,500 tariff plans posted on the site - 12,440 rubles. But when I used the pricing wizard, I was given 3 more prices. In general, after talking with Taxcom, I still don’t know how much and what I should pay for. The employees also showed no interest in making me a client. From the point of view of initial acquaintance, I am absolutely not ready to communicate further. The qualifications of the specialists who created such a site and answer in chats clearly raises questions.

Contour (https://kontur.ru/extern/price). The price list is clear and transparent. What I didn’t like about the price list was the huge gap between the Report.ru solution and the Optimal one. The gap both in price and in the content of the tariff is not clear. Objectively, the Report.ru service is not full-fledged, since it does not include correspondence, therefore, the subscriber will not see the requirements. Consequences - see above. There remain 2 tariffs that are quite expensive with a bunch of additional services, such as a regulatory framework and an accountant school. Just look at the list of additional goodies and answer the question for yourself, just honestly - do you need it, will you use everything? No? And pay for everything. And, by the way, I forgot to write about the Kontur reporting preparation service (however, I separately highlighted the books of purchases and sales for VAT). But they have preparation, and this is valuable.

In terms of communication with specialists, the rating is excellent. They immediately find out the tax identification number, carry out diagnostics, and clearly answer questions. When I tried to troll and ask difficult questions, they check with their colleagues and call back quickly. There is no doubt about the experts; this is immediately captivating. They don’t try to dump if they find out that I work with a competitor. We tried to offer other services (checking counterparties, etc.). The conclusion of the first acquaintance is an excellent customer-oriented service with an inappropriately high price for a bunch of dubious goodies.

Accounting. Contour (https://www.b-kontur.ru/). The site is convenient, understandable, prices can be seen immediately. 9,000 rubles is not only sending, but also part of the accounting capabilities. And in connection with this, the question is - why do I need Kontur-Extern for 21300, if there is a solution for 9000. However, for 9000 we get a minus of the main functionality - you can only send what was done using Accounting. Circuit.

Tensor (https://sbis.ru/ereport). According to the price list on the website, everything is clear and transparent. I really liked the explanation “what we charge money for.” The consultants are competent, they know the equipment well, they don’t say nasty things about competitors, they want to sell. The price of 12,000 seems adequate. It's boring, there's nothing to criticize.

Kaluga Astral (https://astralnalog.ru/). The only site that immediately CORRECTLY identified my location. In general, the site is beautifully made, but the path to prices is made through a standard universal interface through which you can do everything - that is, through your ass. Taxkom’s sclerosis is, of course, far away, but you won’t be able to figure out the prices on your own without half a liter and an hour of time. But there are advantages - forms for contacting company specialists are posted anywhere: Shall I call you back? Did you find what you were looking for? It’s free to connect, and we’ll pay you extra ourselves... All this is definitely useful for promotion. And it is obvious that Astral Report has become secondary compared to 1C Reporting. The level of consultations is satisfactory, significantly inferior to Tensor and Kontur. There is no sense of interest in the client.

Prices:

- Astral Report - 10500;

- 1C-Reporting - 4900.

Let's also consider integration projects.

Bukhsoft (https://www.buhsoft.ru/). Despite the too bright colors and unclear pictures, I saw the price of 2938 right away. Section Prices (https://www.buhsoft.ru/priceopt/) too. They sell not only their Online, but also the Astral Report at Kaluga prices, 1 in 1. 2938 is the price of sending Online, Kaluga integration project. There are forms for contacting specialists, but fewer than on the Kaluga website. The downside is that they called on the application the next day, but the call was from a very strong specialist, most likely an accountant. I tried to sell very actively, but the most interesting thing is that it’s not shipping, but full accounting with sending as a gift. But upon refusal, they agreed to sell electronic reporting. The downside is that they too actively offer not what I came to them for, but everything at once. Also, I did not find group tariffs from Bukhsoft; the price does not change for any number of organizations. However, this disadvantage is outweighed by the advantages - the qualifications of specialists and the ability to administratively configure rights. In Bukhsoft, without changing the price, you can set up any number of workstations with precise rights settings (up to the possibility, for example, of assigning one accountant to work with the Federal Tax Service for connected organizations, and another with the Pension Fund of Russia, etc., and for large organizations such convenience is more important prices). Well, the price for one organization/individual entrepreneur is, of course, a definite plus, especially considering that Bukhsoft has a real online service.

MyDelo (https://www.moedelo.org/). Prices are visible immediately if you scroll through the site. The site itself is pleasant, with a minimal amount of useful information (in fact, the MoeDelo product itself is not distinguished by wide capabilities and is not accounting in the normal sense of the term), the influence of the site https://www.b-kontur.ru/ is very felt (or vice versa, do not know). I can only get what I need in a package with several of their additional services for more than 19,000 rubles. Again, please evaluate - do you need it? The specialists know their stuff, know how to communicate, they suggest not bothering with accounting issues and outsourcing to them (from 100 thousand per year, but we’ll see). Conclusion: the service is strictly for individual entrepreneurs; the issue of purchasing a reporting system cannot be resolved. Plus, the required functionality is limited - there is no way to send files from other programs.

Chief Accountant (https://1pgb.ru/). The tariffs section is immediately visible. There is no separate solution for sending, only within the program (web solution), in this it is similar to MoeDelo (only there is accounting functionality). There is no functionality for OSNO yet, so we can close the issue. If prices for simplified taxation system start from 15,000, then solutions for OSNO, I believe, will be at least 25,000 or at the price level of 1C. And also a limitation of the necessary functionality - there is no possibility of sending files from other programs and there is no possibility of manually “typing” reports.

Conclusion

In terms of price/quality ratio, the leaders are:

- from off-solutions - 1C-Reporting;

- from online - Bukhsoft.

Both projects are from Kaluga.

Technical support, pros, cons, established standards

We can say that a truly qualified specialist does not need technical support when working with sending reports. But there can be technical problems: the operator’s specialists will be too clever, the FSS server will go down, the management of twenty-something tax authorities will run away with the stolen goods and shut down the servers of the said tax office to hell - anything has happened. Therefore, it is necessary to understand what is happening with reporting and for what reasons. Just to save nerve cells.

Below is an assessment of the technical support of the Big Four and some integration projects. This assessment is not the truth, but is a combination of value judgments from real users with whom I discussed these issues. And my personal opinion surprisingly coincided with the assessments that I heard.

Contour , all products. 24/7 support. Ratings: good and excellent.

VLSI and other Tensor products. 24/7 support. Fine.

Taxcom . 24/7 support. Badly. It is difficult to get through by phone during the reporting period, unqualified specialists. Failure to fulfill promises to subscribers.

Astral Report . 24/7 support. Fair/Poor. It’s easy to get through, but: they “football” to partners who previously sent them, so it’s not clear who is responsible for what, failure to fulfill promises to subscribers.

1C-Reporting. 24/7 support. In essence, this is the same support as Astral Report, with all the pros and cons (see above). So those who plan to connect 1C-Reporting will have to take this into account. If you know how to work well in 1C - great, you’re lucky, if you don’t know how - you understand everything yourself...

My Business . 24/7 support. Service within their service. Fine.

Bukhsoft. Support from 07-00 to 19-00. Fine . The lower rating is due to the lack of a 24-hour line. In terms of quality of support, issues of any complexity, including those related to reporting preparation.

Chief Accountant. Not known. There are no familiar subscribers.

It can also be added that Kontur and Bukhsoft have the greatest competence in assessing reporting files, analyzing mistakes made and issuing correct recommendations for correction. Also, these 2 providers offer the most advanced reporting testing systems with enough hints.

Signs of a good EDS

When choosing an electronic document management system, it is first of all important to pay attention to the following characteristics:

- Information Security. Communication channels must be protected; a digital signature of the user is required during operation. It is possible to set different types of access for employees of certain categories and positions. Thanks to such measures, it will be possible to prevent data leakage and third-party interference.

- Support for smartphones and other mobile devices. Almost all programs are installed on a computer or operate through a browser. A big plus is the ability to deal with work issues remotely from a mobile phone, laptop or tablet using the application.

- Integration. It is desirable that the EDMS be integrated with accounting systems, for example, with 1C. This will help automate regular reporting, and employees will not have to spend a lot of time on manual processing.

- User-friendly interface. All employees should be comfortable, regardless of their level of computer literacy. Otherwise, large financial losses on training cannot be avoided.

- 24/7 technical support. Operators are ready to promptly respond to user requests at any time.

conclusions

Let's summarize the results in a small table. Let me emphasize once again that the comparison is conditional, since we are considering one organization in a general mode. We ignore the other. We exclude MoeDelo and Glavbukh from the table, since these projects do not yet meet the requirements.

| Taxi | Contour Extern | Accounting Contour | Sbis | Astral Report | 1C-Reporting | Bukhsoft Online | |

| Price (one organization, OSNO) | 12440 | 21300 | 9000 | 12000 | 10500 | 4900 | 2938 |

| Possibilities | All | All | restrictions | All | All | All | All |

| Technology | off | Online + CIPF | Online | off | off | off | Online |

| Support (rated on a 5-point scale) | 2 | 5 | 5 | 4,5 | 3 | 3 | 4,5 |

| Additional services | — | a lot of | — | average | few | — | — |

| Mobile application | + | + | + | + | — | — | + |

| Total delivery directions (possible) | 7 | 7 | 3 | 7 | 7 | 5 | 5 |

| Access if the digital signature/license has expired | — | + (needs third party program) | + | — | — | + | + |

Total:

- The best off-line solution in terms of price/quality ratio is 1C-Reporting, but you get all the delights of 1C, from the “ease” of connection to further work.

- The best online solution in terms of price/quality ratio is Bukhsoft Online, “cheap and cheerful” for small organizations and at the same time expensive and incredibly convenient for large ones.

- Maximum additional features - Kontur Extern, but expensive.

- Maximum customer support competencies - Kontur and Bukhsoft.

Advantages of reporting services from Kaluga Astral

Kaluga Astral offers clients several services for submitting electronic reports. “Astral Report 5.0” is a convenient online service, “Astral Report 4.5” is a PC program that has everything for submitting reports online, and “1C-Reporting” can be used in the familiar 1C interface.

Our services have a number of advantages:

- all data is stored on a secure server and will not fall into the hands of intruders. Only the client has access to the service;

- all systems have a simple, intuitive interface;

- all organizations are available in one office;

- reporting forms are constantly updated;

- flexible tariffs - you can choose one or several areas for submitting reports and not overpay for unnecessary functions;

- support is available around the clock, every day, and there are official representatives in every subject of the Russian Federation.

To connect, leave on connect. A manager will contact you, help you fill out the contract and issue an invoice for payment.