When a company offers food to customers, it should always automate its business, no matter how it operates. And we want to introduce you to the solutions that will help you do this. Let's look at what programs for public catering are relevant today, with all their main pros and cons, and figure out what kind of opportunities they provide their owners. From the review you will receive maximum useful information, on the basis of which it will not be difficult to decide and choose the software that is best suited for your purposes.

Please note that specialized software is convenient at literally all stages of service. With its help, you can simplify the reception and transmission of orders, control of food and drink consumption, the payment process, and tracking of completed operations in the database. Its implementation and proper use is the key to the absence of “human factor” errors, a step towards optimizing staff interaction, and therefore a powerful prerequisite for increasing the number of regular customers.

Specifics of accounting in public catering

According to GOST 30389-2013 (put into effect by order of Rosstandart dated November 22, 2013 No. 1676-st), catering establishments include:

- Restaurants.

- Bars.

- Cafe.

- Buffets.

- Dining rooms.

- Snack bars.

- Fast food establishments.

- Cafeterias.

- Cooking.

Accounting at these enterprises is not regulated by separate regulatory acts of accounting legislation. In this regard, companies can independently develop an accounting algorithm, using various methods and industry instructions that do not contradict current laws (Letter of the Ministry of Finance dated April 29, 2002 No. 16-00-13/03).

For information about what provisions are used when drawing up accounting policies, read the article “Accounting Regulations and Accounting Policies of the Organization” .

At the same time, the specifics of the industry are such that a number of accounting features are present in almost all catering enterprises:

- nuances of inventory accounting;

- nuances of production accounting (where accounting is very close to factory production with complex technology);

- some specific types of expenses and write-offs.

Let's consider the main nuances and features of their use in public catering establishments.

How do accountants calculate the profitability of an establishment?

Option 1:

Divide the establishment’s net profit by the sum of all expenses and multiply by 100% (return on costs).

Option 2:

divide the amount of book profit by the value of assets and multiply by 100% (return on assets).

Entrust accounting in a restaurant, cafe or bar to Finguru!

You will have at your disposal three accountants (salaries, primary and taxes) with experience in the catering industry and an understanding of all the important nuances. Online accounting with a million ruble guarantee!

Accounting for inventory items in public catering

Traditionally, a restaurant or cafe has 3 main divisions: a warehouse (pantry), a kitchen and a visitor's room. Some catering companies additionally highlight bar accounting and takeaway sales, as well as organizing entertainment for visitors. In this case, inventory items are characterized by internal movements from one division to another.

- Accounting in the pantry.

A feature of accounting for inventory items in the pantry (warehouse) at catering enterprises is that such an enterprise simultaneously has both commodity items and items that should be classified as raw materials. For example, bottled drinking water:

- can be sold in factory bottles, that is, at the catering outlet itself they do nothing additional with it - then it is a product;

- may be used in the preparation of à la carte drinks, in which case the water should be classified as a cooking raw material.

In practice, distinctions are laid down at the stage of forming technological maps (more on this later) and creating a list of warehouse items: water that is planned to be used for cooking is accounted for as a separate item in the item and by volume, and water goods are accounted for individually, at the cost of each bottle. At the same time, when inventorying balances, regrading is allowed between accounts 41 and 10 for such items. This is due to the fact that during the operation of the kitchen, one position may be replaced by another. For example, if you have run out of water purchased by volume (usually in a larger container of 2–5 liters), and you have opened a small “commodity” bottle to prepare your order.

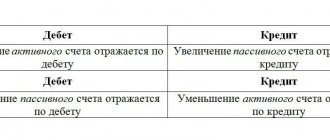

When goods and materials are received, standard records are generated:

- Dt 41 (10) Kt 60 - goods (raw materials) from suppliers arrived at the warehouse.

- Dt 41 (10) Kt 71 - goods (raw materials) were purchased by an accountable person.

- Dt 19 Kt 60 (71) - VAT allocated (if required).

NOTE! The vast majority of modern catering enterprises use the simplified tax system (UTII has been abolished since 2022). Among other things, this frees the accountant from organizing complicated VAT accounting, which can also be attributed to the nuances of the industry - for purchased products you will probably encounter 10% (for food products under clause 2 of Article 164 of the Tax Code) and 20% (for goods not included in the 10% list, for example, gourmet meat and fish products). What nuances need to be taken into account when maintaining accounting in a cafe using the simplified tax system, read here.

According to clause 9 of FSBU 5/2019 “Inventories” (until 01/01/2021 - clause 5 of PBU 5/01), inventory items are accounted for at actual cost, that is, their cost is the sum of the supplier’s price and additional overhead costs. The latter are documented by posting:

- Dt 10 (41) Kt 60 - delivery services (or other direct costs).

- Dt 19 Kt 60 - input VAT is reflected.

- From the storeroom, inventory items are sent either to the sales floor for sale (for example, finished goods that do not require processing), or to the kitchen for subsequent preparation.

Features of accounting for raw materials for the manufacture of dishes (products) and goods for resale according to the rules of the new accounting standard are discussed in detail in ConsultantPlus. Get free trial access to the system and proceed to the material.

Movements of inventory items between departments are documented with an internal movement document. An enterprise can develop forms for such documents independently. In practice, analogues of a limit-fence card or a fence sheet are often used, in which each item of goods and materials transferred from the warehouse to the kitchen or bar is noted against the receipt of financially responsible persons. Responsibility for the safety of inventory items in public catering usually lies with the department in which the inventory items are located during the production cycle. If there is a position as a storekeeper, he is responsible for receiving and storing food in the pantry; when taking food into the kitchen, responsibility passes to the kitchen workers; when handing out the finished dish to the waiters, the waiters are responsible for the proper “delivery” of the dish to the visitor. However, we note that such a division of responsibility is not mandatory, although it is often taken into account by accounting when conducting inventory results and determining the guilt of those responsible for shortfalls.

At catering enterprises, audits of inventory items are carried out much more often than in other sectors of economic activity (usually at least once a month). This is due to several reasons:

- Most inventories are perishable and require special storage conditions and prompt write-off procedures in case of spoilage;

- due to the duality of the use of inventory and materials, it is necessary to timely regulate the regrading between accounts 41 and 10;

- For many types of products, intermediate semi-finished products are formed, which should also be promptly taken into account (see below for more on this).

Read about existing methods of cost formation in the material “The concept of cost in accounting (nuances).”

Features of accounting activities for an accountant

The catering industry can include many unexpected expenses that are not related to food.

Among them there may be the following:

- Purchase of consumables for decorating halls and premises in case of themed events (weddings, banquets, buffets, negotiations, holidays, anniversaries).

- Organization and conduct of an entertainment program.

- Payment for invited artists and groups.

- Carrying out various promotions.

- Printing of leaflets, menus, business cards and other promotional materials.

- Remuneration for promoters, animators and other specialists invited for temporary work as needed.

The catering sector includes the purchase of supplies for organizing weddings.

DMO liability agreement

It consists in the process of labor relations with the employee (and together with the conclusion of an employment contract). Depending on the type of material liability, it can be individual (Article 242 of the Labor Code of the Russian Federation), collective (Article 245), full (Article 243) or limited (Article 241).

It is concluded in order to keep the employer’s property safe and to achieve a trusting relationship between the employee and the employer.

The forms of the agreement are approved by Resolution of the Ministry of Labor of the Russian Federation No. 85 of December 31, 2002.

Sample includes:

- rights and obligations of the parties;

- subject of the contract;

- the procedure for determining the amount of damage and the method of compensation;

- requisites;

- signatures of the parties.

Commodity report of financially responsible persons

A document that allows you to control the movement of goods. This report is made in 2 copies. It reflects information about the receipt of goods and their disposal in total terms. The document has the TORG-29 form.

The commodity report in public catering controls the movement of goods.

The form must indicate:

- Information about the organization, department, position, full name, personnel number of the employee.

- Information about incoming and outgoing documents (filled out in chronological order).

- Information about goods receipts.

- Total amount of receipts.

- Expense transactions as sales occur.

- Displaying the balance of the value of material assets at the end of the month.

- Signature of the financially responsible person and accountant.

Procedure for filling out reports for beginners

When filling out an accounting report, it is important to pay attention to the following points:

- Write negative and subtracted exponents without the minus sign.

- Do not fill out the fields “Indicators to be entered” and “Explanations”. They indicate additional data (changes in capital, unexpected expenses, etc.).

- If the reporting will be audited, make a note in a separate field on the form with the name of the auditing company.

In the process of filling out the report, pay attention to the transcripts.

For a restaurant business, there are several basic reports that need to be completed at least once or twice a year.

The order of filling them out is as follows:

- Balance sheet.

- Income statement.

- Report on the intended use of funds.

- Statement of changes in capital (movement of funds, assets, adjustments).

- Explanations for reports.

Nuances of accounting in production

Raw materials released into production (Dt 20 Kt 10) and used in preparing dishes are written off from Kt 20 to Dt 90 based on calculations. At the same time, the formation of the cost of the food set in the finished dish usually takes place in several stages with the formation of intermediate semi-finished products. Cost formation is perhaps the most important specificity of the catering industry. Let's look at it in more detail using a practical example.

Example

You need to calculate the current cost of the finished dish - a portion of California rolls. There is information on the cost of purchasing initial products (invoices from suppliers).

The peculiarity is that not all components of the dish can be taken into account the cost of purchase according to the invoice and immediately included in the cost of the finished dish in the required proportion.

Let's take a closer look at such a component as avocado. Avocados have a tough skin and a large pit. Only the pulp is used in cooking, which is approximately half the weight of the raw fruit that was purchased. To correctly calculate the cost, you must first bring all the components of the future dish to the state in which they will actually be used (cleaned, cooked, etc.). Figuratively speaking, the stages of preparation in the kitchen should coincide with the stages of reflection in accounting.

Therefore, we begin the calculation by preparing a semi-finished avocado product (taken as an example). We will “cook” for accounting purposes according to the technological map for the semi-finished product (hereinafter referred to as the technical map). A technical card is an internal document that records the necessary ingredients and their quantity in a dish, and also calculates the products “input” - gross and “output” - net. It is the “gross-net” ratio that is primarily of interest when calculating for semi-finished products, since during the cooking process the weight or volume of the original product changes. It is worth noting here that for accounting purposes, units of measurement for calculation are usually immediately established. Usually these are kilograms and liters.

NOTE! There are so-called collections of recipes, which can be used to create technical maps. However, in practice, cooking options for the same dish still vary at different enterprises. Not to mention signature dishes from restaurant menus (where technical maps may generally be a trade secret). Therefore, to draw up working technical maps, it is best to take a series of measurements in “your” kitchen while the cook is preparing a particular dish and draw up an individual version of the technical map for this enterprise.

Through preliminary measurements and screenings, we have information: with a gross weight of an unprocessed avocado of 2 kg, the net pulp yield is 1 kg, i.e. losses during primary processing are 50%.

Knowing the purchase price of raw avocado - 325 rubles / kg (according to the last invoice from the supplier), we can calculate the price for 1 kg of the semi-finished product that we will prepare from it - 650 rubles / kg.

NOTE! As an example, we looked at a one-component semi-finished product. But they can also be multi-component, for example, dough for baking or broth for soups. Calculation in this case follows the same principle - first, the cost of the semi-finished product is calculated according to the technical card for the semi-finished product, and then the cost of the entire dish, which includes this semi-finished product.

This is what the technical map of the finished dish looks like (servings of 6 rolls):

And now, looking at the technical map of the finished dish, we can say that the cost of avocado in one serving of California rolls will be: 0.015 × 650 = 9.75 rubles.

Please note that there is more than one semi-finished avocado product in the card. Everything that requires pre-processing according to technology is first counted as a semi-finished product. This means that for the final calculation it is necessary to “prepare” all the remaining semi-finished products in order to obtain the cost of each.

NOTE! Some products that, at first glance, do not require semi-finished products (for example, fresh frozen caviar for Japanese cuisine) require special handling, including slow thawing. When thawing, the weight of the product also changes. Food technologists are best familiar with such nuances. Therefore, during the initial compilation of technical maps (for example, for a new menu), it is advisable to at least invite a technologist to participate in the process, if it is not possible to maintain such a staff unit.

So, all semi-finished products participating in the dish have been calculated. Knowing the cost of all semi-finished products and other components according to recent purchases, you can formulate the current cost of a serving of California rolls for the current day - 78.19 rubles.

In the example, a 2-stage calculation was obtained. In practice, 3- and even 4-step calculations can occur, when one semi-finished product is included not in the finished dish, but in another semi-finished product. For example, guacamole sauce, which includes avocado pulp. The sauce itself is a component of other dishes. There will be a 3-step chain: semi-finished avocado - semi-finished guacamole sauce (which includes semi-finished avocado) - ready-made dish (for example, nachos with guacamole).

For costing transactions with semi-finished products, it is more convenient to use a temporary account, for example, 21:

- Dt 10 Kt 60 - 650 - 2 kg of avocado were purchased at a price of 325 rubles.

- Dt 21 Kt 10 - 325 - 1 kg of avocado transferred for processing.

- Dt 20 Kt 21 - 325 - 0.5 kg of semi-finished avocado product was transferred to the production of ready-made dishes.

- Dt 90 Kt 20 - 195 - the cost of avocados was written off as part of the cost of 20 servings of California rolls sold (9.75 × 20 = 195).

Balances at the end of the day:

- Dt 20 / Sushi bar.

Semi-finished avocado - 130 - 0.2 kg (0.5 - 0.015 × 20) at a cost of 130 (0.2 × 650).

- Dt 10 / Warehouse.

Avocado - 325 - 1 kg at purchase price.

To complete the example, it can be noted that it is better for a restaurateur to automate the process of calculating and writing off costs. Currently, there are a sufficient number of good programs for public catering, the purchase of which is more profitable and convenient than having a staff of accountants involved only in daily calculations, since all our calculations are valid exactly on the date on which they were made. Tomorrow, products will arrive from another supplier at a slightly different price, or there will be something missing in the kitchen, and they will buy the same avocado individually at the nearest supermarket - and all calculations need to be done again, starting with semi-finished products.

Read about the nuances of calculating the cost of a dish in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

Tax accounting and different forms of ownership

The main regulatory document in the field of tax accounting is the Tax Code of the Russian Federation.

The principles of tax accounting depend on the form of ownership: individual entrepreneur (IP) or limited liability company (LLC) and the chosen taxation regime. IP characteristics:

- simple and fast registration;

- no authorized capital required;

- It is not necessary to keep accounting records;

- easy profit withdrawal

- restrictions on types of economic activity - in any case, to sell strong alcoholic beverages, you must open an LLC;

- the business cannot be transferred to another person;

- payment of insurance premiums for employees even during a break in business (unprofitable for seasonal business);

- personal liability for debts and other risks;

- is not a legal entity.

LLC characteristics:

- is a legal entity;

- there are no restrictions on types of economic activity;

- you can sell your part;

- no need to pay insurance premiums and taxes for employees during a break in their activities;

- limited liability of the participant for debts and other risks;

- complex procedures for registration, withdrawal of profits, liquidation;

- authorized capital is required;

- compared to individual entrepreneurs, the highest rate of profit;

- Accounting is required;

- For LLCs, either a simplified or a general taxation system is suitable, but in the case of the former there are some restrictions.

How is revenue accounted for?

Most catering establishments operate on a menu - a list of dishes available for purchase in a given establishment. Selling prices in the menu are approved once for a long period of time, and, unlike costing, are not revised every time purchase prices change. For example, tomatoes cost 150 rubles in winter, and 80 rubles in summer. per kg. The price of a ready-made tomato salad may remain the same regardless of the time of year. In this case, the house margin changes. But if the spread of purchase prices has increased steadily, then this is a reason to reconsider the prices on the menu.

When selling finished products, catering enterprises should also use cash register systems, since almost all of their revenue comes from cash payments to the population. Sales revenue is recognized as income from ordinary activities and is recorded in the following entries:

- Dt 50 Kt 90.1 - cash proceeds received at the cash desk.

- Dt 57 Kt 90.1 - revenue received from the card (acquiring).

- Dt 51 Kt 57 - acquiring proceeds are credited to the account (minus the bank commission).

- Dt 91 Kt 57 - the bank’s acquiring commission is taken into account.

- Dt 62 Kt 90.1 - non-cash revenue from certain persons.

- Dt 90.2 Kt 20 (41) - write-off of the cost of products sold.

Payroll accounting

Accounting includes recording the number of employees, hours worked and output.

First, you need to determine the number of workers who will be employed at each site, based on the area and occupancy of the establishment. In addition, do not forget about compliance with labor safety standards .

As a rule, this is a work schedule of 2 every 2, 40 hours per week with separate payment for evenings, nights, holidays, and weekends in accordance with the Labor Code.

There are two forms of remuneration that are most often used in catering:

- Time-based form of payment : calculation of wages based on the salary or tariff rate for the time actually worked.

- Time-bonus wage system : wages consist of wages for actual time worked and bonuses (monthly or quarterly) for high-quality performance of work and provision of services.

A separate topic is the official registration of vacations and sick leave. It is necessary to draw up a vacation schedule for each employee, issue a vacation order and pay vacation pay three days before the start of the vacation.

So we are gradually approaching the most labor-intensive task that requires the special attention of an accountant - warehouse accounting (inventory).

Nuances of expense accounting

Cost accounting is regulated by PBU 10/99 (approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n). However, they provide only general rules for accounting for expenses and do not reflect the specifics of the industry. Therefore, the cost accounting algorithm is developed by the company independently and recorded in the accounting policy.

According to PBU 10/99, costs are divided into direct and indirect.

Direct costs include all costs directly attributable to the production of products: raw materials, wages, depreciation, etc. Direct costs are accounted for on account 20.

Indirect costs include other costs not related to production: wages of administrative personnel, accruals for it, rent of premises, etc. Indirect costs are accounted for using accounts 25, 26.

However, often companies in account 20 take into account only the cost of raw materials used for preparing dishes, and the remaining costs are included in debit 44 “Business expenses”. It's connected:

- with the peculiarity of forming the cost of production on account 20;

- with regular changes in purchase prices for raw materials, affecting the turnover on account 20.

At the end of the month, account 44 is also closed to the cost of sales: Dt 90.2 Kt 44.

In addition to the usual expenses in the form of, for example, salaries of regular staff, account 44 in public catering may include:

- expenses for decorating a hall for events (for example, a wedding banquet);

- expenses for organizing entertainment (for example, purchasing drawing paper, pencils and paints for competitions at a children's party);

- remuneration for invited artists or event presenters;

- depreciation of equipment of the hall, bar, permanent advertising signs;

- costs of carrying out various promotions - printing of seasonal menus, leaflets, expenses for promoters;

- other similar expenses.

Other specific costs, for example, write-off of food spoilage and broken dishes, are taken into account as follows:

- Dt 94 Kt 10 (41) - based on inventory results.

- Dt 73 Kt 94 - damage, damage is attributed to the perpetrators (if they can be identified).

- Dt 91 Kt 94 - expenses that reduce the tax base are written off within the limits of natural loss of products during storage (established by orders of the Ministry of Agriculture of the Russian Federation), within the limits of operational losses of tableware, cutlery, table linen (the order of the USSR Ministry of Trade dated 12/29/1982 No. 276).

- Dt 91 Kt 94 - expenses in excess of the norm are written off, which do not reduce the tax base, for which it is not possible to identify the perpetrators.

Read about the rules for recovering damages from the guilty party in the material “Sample claim to an employee for compensation for material damage.”

Accounting for raw materials, goods, containers in the warehouse and in the accounting department

Accounting in restaurants and cafes also includes recording receipts of goods and raw materials and their evaluation. It all starts with the execution of contracts upon request from the establishment to the supplier.

The supplier must send to the customer:

- two copies of the agreement;

- statutory documents of the enterprise;

- price;

- sanitary certificates for products;

In the contract with the supplier it is important to indicate:

- delivery time after application;

- Delivery time;

- the procedure for compensation in case of violation of these deadlines;

- terms of payment and deferment of payment for products;

- procedure for compensation in case of late payment;

- conditions for the return of illiquid products and compensation in such cases.

Working with the buyer, he needs to be given money only on account. At the end of the day, the buyer fills out an advance report based on receipts and invoices, after which he hands over the balance or the overspend is returned to him.

As the practice of many successful establishments shows, you can work with both suppliers and buyers. From time to time, suppliers fail to deliver products on time and the buyer can save the situation. In addition, sometimes it is more profitable to buy the necessary items at the market or in a supermarket.

Along with supplies, your accountant or you, if you are not going to trust anyone with your accounting, will have to take write-offs into account. It can be:

- damage;

- staff meals;

- treating the guest;

- elaboration of dishes for the waiters to familiarize themselves with, photographs, and so on;

- checking the taste of the dish;

- checking the weight of the dish;

- checking compliance with sanitary standards (for SES), etc.

Calculation of food costs

The main documents that are used when calculating the cost of dishes are the technological map and the calculation card (form OP-1).

A technological map is essentially a recipe for preparing a dish. It contains a list of components in natural units per serving (or several servings). There is no established form for this document, so each catering enterprise develops its own forms.

The cost card calculates the cost of the dish in rubles. Form OP-1, along with other documents used in the accounting of public catering enterprises, was approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. Although the use of this document is not mandatory today, most businessmen prefer not to “reinvent the wheel”, but to use proven forms .

The production of many dishes consists of several stages. First you need to make a semi-finished product, and then use it in the production of the final product.

For example, if a recipe requires sauce, then you first need to draw up a separate flow chart for it and calculate the cost. Then the cost of the finished sauce should be included in the costing card of the “final” dish.

When preparing complex dishes, for ease of accounting, additional account 21 “Semi-finished products of own production” is usually used.

DT 10 – KT 60 (71) – purchase of “initial” products

DT 21 – KT 10 – transfer of products for processing

DT 20 – KT 10 (21) – products and semi-finished products used in the production of dishes

DT 90.2 – KT 20 – cost of sold dishes written off

How to calculate the cost

Let's look at the example of chicken Kiev.

A calculation card is drawn up for each name of the finished dish. There are standard calculation cards, the forms can be easily downloaded on the Internet.

Fill it out like this. You need to indicate the name of the dish, write out the required quantity of products from the technological map, indicate purchase prices and calculate how much you spend on each serving. Usually the calculation card is made up for 5, 10 or 100 servings. This is necessary to average the cost of one serving of the dish: one cutlet from another, however, may differ slightly in weight.

For example, let's look at the calculation of the usual chicken Kiev. We take the cost of products as an example only.

Ingredients:

- peeled chicken fillet: 29.82 grams, let’s say 1 kilogram of fillet costs 180 rubles;

- butter: 14 grams, 1 kilogram costs 240 rubles;

- chicken egg: 3.27 grams, 1 kilogram costs 120 rubles;

- bread made from premium flour: 8.88 grams, 1 kilogram costs 60 rubles;

- cooking fat for frying: 5.21 grams, 1 kilogram costs 80 rubles;

- side dish bean or potato (indicate the numbers of technological cards for these dishes): 52.08 grams, 1 kilogram costs 50 rubles.

For 100 grams we need to spend:

- chicken fillet for 5.37 rubles;

- butter - 3.36 rubles;

- chicken egg - 0.4 rubles;

- bread - 0.54 rubles;

- cooking fat - 0.42 rubles;

- side dish of beans or potatoes - 3.12 rubles.

Total: 13 rubles 20 kopecks. Let’s say the serving size according to the technological map is 300 grams. Then the cost of one portion of cutlets is 39 rubles 60 kopecks.

Of course, costing indirectly affects the selling price of the dish. To make money in business, an entrepreneur must take into account average prices in the market, the capabilities of his audience and the resources that the restaurant spends on its work: bills, salaries, taxes.

But maps are needed to correctly structure the process of moving and writing off raw materials and to prevent theft or overestimation of food loss rates during cooking. Jowi, like any reliable automation system, helps to simplify the creation and maintenance of costing cards and food cards, track the movement of raw materials and carry out inventory. In the second part of the article we will look at how Jowi works.