Whether a person gets an official job or opens his own business, receives some kind of benefit from the state, or creates a set of documents for organizing trade - in all these cases he cannot do without a tax registration certificate, more often called TIN.

Here you will learn:

- how the TIN code is formed,

- what needs to be done to receive it and restore it in case of loss,

- what documents will be needed for this procedure,

- as well as the nuances of using this concept in foreign language documentation.

Types of TIN

In the Russian Federation there are 4 (four) types of TIN:

- TIN of an individual . Consists of 12 Arabic digits, the first of which indicate the code of the subject of the Russian Federation, the next two - the number of the local tax office, the next six - the number of the taxpayer's tax record and the last two - “check digits” to check the correctness of the entry;

- TIN of an individual entrepreneur . Assigned upon registration of an individual as an individual entrepreneur;

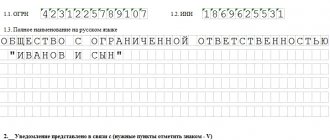

- TIN of a legal entity . Represents a record of a sequence of 10 Arabic digits: the first two are the code of the subject of the Russian Federation in accordance with Article 65 of the Constitution, the next two are the number of the local tax inspectorate, the next five are the number of the taxpayer’s tax record in the territorial section of the OGRN and the last is the check digit;

- TIN of a foreign legal entity . Assigned from January 1, 2005. The number always starts with the numbers “9909”, the next five digits correspond to the Foreign Organization Code, the last one is the check digit.

A legal entity, along with an INN, is assigned a reason for registration code (RPC), which makes it possible to identify each separate division of the organization.

How to find out whether a legal entity is resident or non-resident

Non-residents of the Russian Federation can be easily identified by bank account numbers: they start with the following combinations:

- 40804 (ruble accounts of type “T”);

- 40805 (ruble accounts type “I”);

- 40806 (conversion accounts “C”);

- 40807 (non-resident accounts);

- 40809 (investment accounts);

- 40812 (project accounts);

- 40814 (convertible accounts “K”);

- 40815 (non-convertible accounts “N”);

- 40818 (currency accounts).

Residents of Russia are not assigned such numbers.

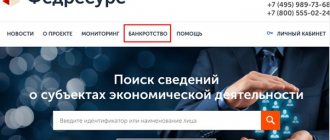

There are other verification methods.

Why do you need a TIN?

The meaning of the TIN is in its very name; the number is needed to identify the taxpayer. Tax authorities indicate taxpayer identification numbers in all notifications sent to them. All taxpayers indicate their TIN in declarations, reports, applications or other documents submitted to the tax authority. Thanks to the presence of a TIN, any individual can clarify data on available taxes payable to the budget, as well as on any debts on taxes and fees, and make payments online or at payment terminals, as well as at the cash desk of a credit institution through the taxpayer’s personal account. The service also allows you to:

- obtain up-to-date information about property objects and vehicles;

- monitor the status of settlements with the budget;

- receive and print tax notices and receipts for tax payments;

- download programs for filling out the declaration;

- fill out the declaration online;

- send a declaration to the tax office in electronic form (if there is an electronic signature), etc.

For legal entities, a TIN is also necessary because this information must be indicated on all financial documents of the organization, its details, as well as on reporting submitted to the tax authority.

What can you find out from your TIN?

All taxpayer identification numbers of non-resident companies begin with the same 4 digits. The TIN starts with 99 - this is the code of the interregional tax office. Next come the numbers 09. It would seem that if you see the tax number 9909 at the beginning, you can understand that you are dealing with a non-resident. However, this is not the case; some Russian companies also have a Taxpayer Identification Number (TIN), which begins with these numbers. Accordingly, this method of determining non-residents is not reliable.

It will also not be possible to check a foreign company using its tax identification number. The fact is that this is an internal Russian code that facilitates interaction with the tax service. A qualitative check of a foreign counterparty involves obtaining information from foreign registers. Such information is available upon written request or via the Internet. In this case, it is better to contact legal agencies that specialize in inspections of this kind.

How to find out TIN

How to find out the TIN for an individual

In order to find out the TIN for an individual, you need to go to a special service of the Federal Tax Service or the State Services website. Fill out the request form for registration with the assignment of a TIN (indicate your full name; date of birth; type of identification document from the proposed list, indicate the details of the document and date of issue). If an individual is registered with the tax authorities and has been assigned a TIN, the TIN will appear in the result line.

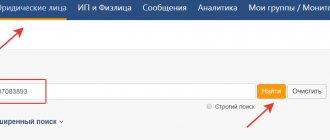

How to find out the TIN of a legal entity

In order to find out the TIN for a legal entity, use any Unified State Register of Legal Entities service. For example, go to the Unified State Register of Legal Entities service of the Federal Tax Service. Indicate the name and region of interest, receive an extract, it will contain the TIN.

TIN number for different types of taxpayers

The number assigned to the taxpayer is entered into the Federal Tax Service database and is not subject to changes since the tax authorities first came to the attention of this person - be it an individual or a legal entity.

The number of characters that make up the TIN depends on the legal form of business.

Individuals - both ordinary citizens and individual entrepreneurs - receive a TIN number consisting of 12 characters (Arabic numerals), each position has a specific meaning:

- a two-digit number at the beginning – the code of the subject of the Russian Federation to which the fixing tax authority belongs;

- the next two digits are the number of a specific branch of the Federal Tax Service;

- six digits following the territorial designation provide information about the entry number under which the person is entered in the relevant state register (USRN);

- the final two characters are verification numbers calculated using a special algorithm; using them you can verify the authenticity of the entire code.

Legal entities receive a TIN code shorter than that of ordinary citizens, by two digits. The position values are similar:

- the subject of the Russian Federation is encoded in the initial two characters (the interregional tax office is designated by the numbers 99);

- the second two digits also means the tax office number that carries out the registration;

- the adjacent five-digit sequence is the number of the entry under which the organization is entered in the Unified State Register of Taxpayers;

- the final position is control.

How to obtain a TIN for an individual resident of the Russian Federation

The TIN certificate can be obtained on paper (by personally contacting the tax authority at your place of residence or by registered mail) and electronically in PDF format. The option for obtaining a TIN depends on the presence or absence of an electronic signature of an individual.

There are two options for obtaining a TIN.

Independently at your place of residence

To do this you need:

- Contact the government agency (IFTS or MFC) at your place of residence;

- Fill out an application for obtaining a TIN according to the sample based on your passport data;

- Submit an application along with your passport and its copy;

- Receive information about the date of receipt of the TIN - no more than 5 days (Article 84 of the Tax Code of the Russian Federation);

- Within the specified period, obtain the TIN Certificate in person or with the help of a legal representative on the basis of a notarized power of attorney.

Independently via the Internet

In a special section of the official website of the Federal Tax Service, you can form an application for a TIN. To do this, you must submit an application using one of the following methods:

- in the absence of an electronic signature, the application screen form is filled out directly on the website of the Federal Tax Service of Russia in accordance with the form fields and is sent from the website to the tax authority. In this case, the TIN Certificate is obtained upon a personal visit to the tax authority at the place of residence (at the place of residence - in the absence of a place of residence on the territory of the Russian Federation);

- if you have an electronic signature and want to receive the Certificate in electronic form or by registered mail, you must install the “Legal Taxpayer” program; fill out the Application using it; prepare a transport container containing an encrypted Application signed with the applicant’s electronic signature; send the finished transport container for processing. Working in the system allows you to find out the results of processing and receive a Certificate.

Receipt

- The TIN of an individual is issued by the tax office at the place of residence of the individual after presenting a passport, a copy of the passport and submitting an application. The issuance of a certificate (an A4 form containing information about the surname, name, patronymic of an individual, his date and place of birth, as well as the TIN itself) is carried out within no more than five days. Individual entrepreneurs are issued with other documents. You can also receive a TIN by power of attorney, which must be notarized.

- For individuals, at their request, on page 18 of the passport, along with the payer identification number, the name of the tax authority, its code and the date of entry are indicated.

- The TIN of a legal entity is assigned to an organization upon its registration with the tax office that registers legal entities.

The first four digits of the TIN in the aggregate always identify the institution of the Federal Tax Service, representing a code from the SOUN directory (Directory of codes for designating tax authorities for taxpayer accounting purposes).

How to obtain a TIN for an individual non-resident of the Russian Federation

There are no particular differences in obtaining a TIN certificate by non-residents. For example, a citizen of the Republic of Belarus temporarily staying on the territory of the Russian Federation can apply to the tax authority at his place of residence with an application to register with the tax authority. A non-resident individual obtains a TIN independently from the tax authority at the place of residence. The application procedure is the same as for residents. Only the list of submitted documents differs.

A foreign citizen must provide the following documents (Order of the Ministry of Finance of Russia dated September 11, 2020 No. 188n):

- application for registration;

- identification document of a foreign citizen in the Russian Federation;

- a residence permit of a foreign citizen with a mark of registration at the place of residence in the Russian Federation, a detachable part of the notification of arrival form or a temporary residence permit.

Automatic assignment of a TIN to a non-resident of the Russian Federation at the location of the employer

If a foreign citizen, a stateless person who is not an individual entrepreneur, does not have a place of residence (place of stay) in the territory of the Russian Federation, real estate and (or) a vehicle, and also if he is not registered with the tax authorities, then he is subject to tax registration at the location of the employer (clause 7.4 of Article 83 of the Tax Code).

How does this happen?

- Tax registration occurs with the tax authority at the location of the organization/individual entrepreneur that is the source of income payments to a foreign citizen;

- If a foreign citizen has several sources of income payments in the Russian Federation, then he is subject to registration on the basis of the first information provided by tax agents;

- The tax authority is obliged to register a foreign citizen on the basis of the information provided by the tax agent within 15 days from the date of receipt of this information, and must also send the tax agent a notification about the registration of the foreign citizen for tax registration;

- A tax agent who has received a notification from the tax authority about the registration of a foreign citizen is obliged to send this notification to the foreign citizen within 5 days, and also provide the tax authority with a document confirming that he sent such a notification to the foreign citizen;

- The tax authority deregisters a foreign citizen with the tax authority if, during the three calendar years following the year in which information about the foreign citizen was last provided, the tax agent did not provide any information about such a foreign citizen, and also, the foreign citizen did not submit tax returns to this tax authority. Notification of deregistration with the tax authority is not sent to a foreign citizen.

What is a TIN and why does a non-resident legal entity need it?

Regulates the registration of foreign organizations with the tax authorities of the Russian Federation Order of the Ministry of Finance dated September 30. 2022 No. 117n. This document obliges foreign legal entities operating in the Russian Federation to register with the Russian tax authorities. Tax inspectors are required to register such companies within 5 days and enter the relevant information about them into the Unified State Register of Legal Entities (USRLE) after receiving the relevant documents.

Simultaneously with registration, the tax payer is assigned a taxpayer identification number. It is not necessary to submit a separate application to obtain a TIN of a foreign legal entity on the territory of the Russian Federation.

The TIN is valid for the entire life of the organization and cannot be replaced, for example, when the address changes, etc.

In general, the TIN of a legal entity is a combination of 10 Arabic digits, in which:

- the first 4 digits indicate the place of registration of the organization, the initial 2 are the region code, the next 2 are the tax inspectorate code of the Federal Tax Service;

- the next 5 digits are OGRN (main state registration number), that is, the number of the entry in the state register made when registering a legal entity;

- the tenth digit is a verification digit and does not carry specific information.

For reference, let us inform you that the TIN of individuals is longer: it consists of 12 digits.

How to obtain a TIN for an individual entrepreneur

An individual entrepreneur needs a TIN. It is important to understand that an individual entrepreneur is the status of an individual who already had a Taxpayer Identification Number (TIN) before its opening. The individual entrepreneur will use the usual TIN of the individual obtained earlier. In this case, there is no need to assign a new TIN for individual entrepreneurs. The number is assigned only once. If an individual who wishes to become an individual entrepreneur did not previously have a TIN, then when registering as an individual entrepreneur with the Inspectorate of the Federal Tax Service, a TIN Certificate will be issued simultaneously with the Certificate confirming the registration of the individual entrepreneur. In this case, an application for issuance of a TIN Certificate is not submitted. The procedure for registering an individual entrepreneur is quite simple. You need to submit a package of documents:

- Application for state registration of an individual as an individual entrepreneur (form P21001);

- Receipt of payment of the state duty for registration of an individual entrepreneur;

- Application for transition to a simplified tax system (form No. 26.2-1). This document is submitted when choosing the simplified tax system;

- A copy of the passport of an individual who is registered as an individual entrepreneur.

If all documents are in order, after 3 (three) business days you can receive a USRIP entry sheet from the tax office. It will contain your taxpayer identification number as an individual entrepreneur (IP).

How to restore TIN

A certificate is a material thing, and therefore is subject to unforeseen events: it can get lost, be stolen along with a bag or purse, be damaged, torn, dilapidated, etc. This does not mean that you lost your TIN number along with the paper form.

The code is assigned to the taxpayer once, it is stored in the Federal Tax Service database, so it is enough to contact the tax office to obtain a duplicate certificate. You can do this in any convenient way:

- appearing in person;

- by sending the principal;

- by sending a postal item with notification;

- online.

The package of documents will be the same as upon initial receipt, only a receipt for payment of the state duty will be added to it - re-issuance of the certificate is paid (in 2016 the cost is 300 rubles)

How to obtain a TIN for a legal entity resident of the Russian Federation

Previously, a tax registration certificate indicating the TIN was issued to legal entities upon registration or upon restoration after loss. From January 1, 2022, the Federal Tax Service of Russia abandoned the use of forms of certificates of state registration and registration, which are secure printing products. State registration certificates were canceled altogether. The Certificate of registration of a Russian organization with the tax authority at its location and the Certificate of registration of an individual with the tax authority provided for by tax legislation remain as documents, but will not be printed on secure printing forms (see Registration Forms).

And why do you need a TIN certificate? Information about the TIN of a legal entity is contained in the Unified State Register of Legal Entities extract, as well as in the registration record sheet.

For information. In case of reorganization of a legal entity in the form of separation and merger, the TIN remains the same. Organizations that separated from the reorganized company receive a new TIN.

Identification code in Russia

General information:

- TIN is a special code consisting of Arabic numerals that helps streamline the tax accounting of citizens.

- Today, an identification number is assigned both to organizations and companies, and to ordinary citizens.

- Moreover, for the former they began to do this since 1993, for the latter – since 1999.

There are the following types of TIN:

- For individuals , this is a sequence of 12 Arabic numerals. In them, the first 2 are the code of the subject of the Russian Federation, the next 2 are the code of the local tax police, then there is a combination of 6 digits indicating the entry number in the book and the last 2 are control characters.

- For individual entrepreneurs, a code is assigned if it did not exist before. Otherwise, it is customary to use an existing TIN.

- For companies and organizations , this sequence consists of 10 digits. The decryption is similar to the code for an individual. The difference is the entry number: for legal entities - 5 characters and one check digit instead of two.

- For foreign companies - the entry begins with “9909”, followed by a combination of five digits and the last control.

How to obtain a TIN for a legal entity non-resident of the Russian Federation

10.1 A non-resident legal entity opened a division

If a foreign legal entity operates on the territory of the Russian Federation (branch, representative office, department, bureau, office, agency, any other separate division), it is required to register with the tax authorities of Russia (Order of the Ministry of Finance of Russia dated December 28, 2018 N 293n).

The procedure is like this.

An application for registration with the tax authority of a foreign organization is submitted to the tax authority no later than 30 calendar days from the date of commencement of its activities in the territory of the Russian Federation, along with the documents:

- constituent documents of a foreign organization;

- extract from the register of foreign legal entities;

- a certificate from the tax authority of the country of origin of the foreign organization regarding its registration as a taxpayer in that country, indicating the taxpayer code (or an analogue of the taxpayer code);

- the decision of the authorized body of a foreign organization on the creation of a Branch on the territory of the Russian Federation and the regulations on this Branch;

- an agreement (agreement, contract) on the basis of which a foreign organization operates on the territory of the Russian Federation - in the absence of a decision from the authorized body of the foreign organization to establish a Branch on the territory of the Russian Federation;

- power of attorney to vest the head of the Branch of a foreign organization on the territory of the Russian Federation with the necessary powers;

- documents confirming the accreditation of a Branch of a foreign organization on the territory of the Russian Federation, if such accreditation is provided for by the legislation of the Russian Federation;

- a document granting the right to a foreign organization to use natural resources - for a foreign organization recognized as a user of subsoil in accordance with the legislation of the Russian Federation.

Deregistration of foreign organizations with tax authorities is also carried out upon application accompanied by documents:

- applications for deregistration;

- decisions of the authorized body of a foreign organization on termination of activities;

- extracts from the register of foreign legal entities of the relevant country of origin or another document of equal legal force confirming the termination of the activities of a foreign organization in this country - if the activities of a foreign organization are terminated;

- tax returns (calculations) for taxes drawn up as of the date of termination of the activities of a foreign organization.

10.2 A non-resident legal entity opens only a current account

Foreign legal entities - non-residents on the territory of the Russian Federation have the right to open bank accounts in foreign currency and the currency of the Russian Federation only in authorized banks (Article 13 of the Federal Law of December 10, 2003 No. 173-FZ). If a foreign organization plans to open only a current account, it needs to register for tax purposes (obtain a tax identification number) at the place of tax registration of the bank (at the location of the branch) in which the account is opened. The following documents are submitted to the tax authority with which the bank (branch) opening an account for a foreign organization is registered (Order of the Ministry of Finance of Russia dated December 28, 2018 No. 293n):

- application for registration;

- a certificate from the tax authority of the country of origin of the foreign organization regarding its registration as a taxpayer in that country, indicating the taxpayer code (or an analogue of the taxpayer code);

- constituent documents of a foreign organization (Charter, Memorandum of Association, etc.). If a participant (shareholder) of a foreign organization is a legal entity, a certificate or extract from the register of shareholders of this legal entity is also submitted;

- an extract from the register of foreign legal entities of the relevant country of origin or another document of equal legal force confirming the legal status of the founder - a foreign person - for a foreign organization that is not a foreign non-profit non-governmental organization or an international organization;

- power of attorney from a foreign legal entity - non-resident to an authorized person to conduct business on the territory of the Russian Federation, with the right to delegate part of the powers to other persons if necessary. In the power of attorney, the signatures and powers of the signatories must be notarized, and the notary’s signature must be certified with an apostille. You will also need to provide the name of the bank in the Russian Federation in which the foreign legal entity intends to open an account.

Delivery time is 5 (five) working days. Documents are accepted only with genuine marks of consular legalization or apostille certification, unless exemption from these procedures is provided for by international agreements of the Russian Federation. A notarized translation into Russian is attached to the originals of foreign documents. The required number of notarized copies (at least 2) are made from the originals with the filed translation.

If a foreign organization opens a new account in the same bank (bank branch) or an account in another bank (bank branch) registered with the tax authority, which previously registered this foreign organization in connection with the opening of a bank account for it ( bank branch), re-registration of such a foreign organization with the specified tax authority is not carried out. The deadline for setting is the same as in the previous case.

Obtaining a TIN for individuals is not a mandatory procedure, but it greatly facilitates control over accrued and paid tax payments by a citizen. The registration procedure for legal entities and individual entrepreneurs is necessary; now it is significantly simplified and does not require much time.

Firm maker, November 2022 (monitor the relevance) Elena Zhitushkina (Karpova) When using the material, a link is required

TIN: what is it and why is it needed?

The document in question contains a unique sequence of numbers that makes up an identification number . According to the Tax Code, every person engaged in labor activity is required to pay taxes. Many government agencies use TIN numbers to obtain information about the taxpayer himself. It is with the help of this system that government agencies exercise control over the procedure for paying taxes . The same system is used to verify the integrity of entrepreneurs. In addition to all of the above, information from the TIN allows you to track the amount of contributions to the Pension Fund.

To obtain the document in question, a citizen must contact the tax service.

There are many examples of different situations where a TIN may be required. As a rule, this form is included in the required package of documents for employment, filling out a tax return and starting your own business . In addition, information from this form is indicated during the registration procedure on the State Services portal. From all of the above, we can conclude that the absence of this document may result in the impossibility of employment and interaction with government agencies.

It is important to note that the form in question may be required to be completed by a minor. In most cases, the reason for the need to obtain a TIN for a minor is closely related to the process of registering taxable property. The basis for initiating the TIN registration procedure may be the fact of receiving an inheritance or first employment.

The issue related to the TIN of a legal entity deserves special attention. This form is a documentary confirmation of the fact of registration with the regulatory authorities. The absence of this document is a serious obstacle to doing business, since the lack of registration is a gross violation of the law. As practice shows, the information contained in the tax certificate is necessary for interaction with business partners and regulatory authorities. In addition, the fact of having a TIN allows legal entities to take part in various tenders, competitions and trades. It should be noted that many financial institutions require entrepreneurs to provide evidence when applying for loans . You can also use this document to find out the tax debt of a particular organization.

The TIN is intended to streamline the accounting of taxpayers in the Russian Federation

Under what conditions is the TIN replaced?

Many taxpayers are interested in the question of whether it is possible to replace the issued certificate. According to the eighty-fourth article of the Tax Code, this document cannot be replaced. The current legislation does not contain regulations obliging individuals and legal entities to contact the tax service in order to inform about changes in personal data (change of first name, last name or patronymic). It should also be noted that the form of the document itself does not imply making adjustments. Based on the above, we can conclude that there is no need to replace the certificate in the event of a change in personal information.

However, there are situations in which it may be necessary to obtain a new certificate. An example of such a situation is damage or loss of the original form. In order to receive a duplicate, you must fill out a special application, a sample of which can be found on the tax office website. The applicant must also provide a document confirming his identity and pay the state fee. The fee for issuing a duplicate is three hundred rubles. According to the established procedure, the applicant can apply independently, send all the necessary documents via mail or use the services of an authorized representative.

In addition to the TIN, organizations are assigned a KPP - a code that characterizes the reason for registration with the tax office