Origin of the term “quarter”

The word is of Latin origin and has become part of the German language. It is literally translated as “quarter”. The very meaning of the term seems to carry the answer to the question of how many quarters there are in a year. There are four of them, because we are talking about the fourth part.

In the Russian Federation, this period is usually denoted by Roman numerals: IV, III, II, I. And in English-speaking countries (including the USA) - by Arabic numerals, preceded by the Latin letter Q. For example, Q4. This unit of measurement is used in economic statistics and accounting to summarize the interim results of the year.

How long is a quarter?

There are also four seasons, and each lasts 3 months. Does this mean that the concepts of “season” and “quarter” are identical? And under what circumstances is this possible? Indeed, a quarter also lasts 3 months. But he counts from the beginning of the year and further - in order, regardless of the season. We would observe a complete coincidence when celebrating the New Year, for example, on the first of March.

This could also have been the case among the ancient Slavs, who celebrated the transition of the calendar in the fall. For them, the New Year began on the first of September.

So how many quarters are there in a year? There are four of them, let's call them by month (there are three of them) and compare them with the seasons.

| I (Q1) | January March | December – February (winter) |

| II (Q2) | April June | March-May (spring) |

| III (Q3) | July – September | June – August (summer) |

| IV (Q4) | October December | September – November (autumn) |

When does Q1 2022 end?

for the first quarter of 2022 - April 26, 2022; for the second quarter of 2021 - July 26, 2022; for the third quarter of 2022 - October 25, 2021.

Interesting materials:

How to connect a tablet via Wi-Fi? How to connect Galaxy Tab A to TV? How to connect a Huawei tablet to a laptop? How to connect a Huawei tablet to a TV? How to connect a tablet to the Internet via a smartphone? How to connect a tablet to the Internet via a Wi-Fi router? How to connect your tablet to the Internet via Wi Fi? How to connect a tablet to a computer via HDMI? How to connect a tablet to a computer via USB Samsung? How to connect a tablet to a computer as a modem?

What is a quarter? How many months are there in each quarter?

Translated from Latin, this word means “quarter”. Accordingly, a quarter is ¼ of a year. Thus, it becomes clear that we have only four quarters in a year. Knowing that a year consists of twelve months, you can calculate the number of months in one quarter. How many months are there in each quarter of the year? Through simple mathematical calculations we arrive at the following: 12 / 4 = 3. In total, we have 4 quarters in a year, each of which has three months. Quarters are numbered with Latin numerals. In English-speaking countries, this time period is indicated by Arabic numerals. Each of them is preceded by the letter Q.

How to make a formula with a date in Excel?

If you prefer to enter dates directly into a formula, enter them using the DATE function and then subtract one date from another. The DATE function has the following syntax: DATE(year, month, day). For example, the following formula subtracts May 15, 2015 from May 20, 2015 and returns the difference - 5 days.

Interesting materials:

What is needed to apply for Russian citizenship? What does a foreign citizen need to renew a patent? What is needed to renew the registration of a foreign citizen? What is needed for registration of a foreign citizen? What is needed for Russian citizenship? What is needed to renounce Ukrainian citizenship? What does a citizen of Ukraine need to enter Russia? What does it take to renounce citizenship? What is citizenship in Russia? What is migration registration of citizens?

What are the months in each quarter?

The year has a similar division into seasons. There are also four of them, each lasting three months. However, there are differences between quarters and seasons. Seasons represent the seasons of the year. There are four seasons in total: winter, spring, summer and autumn.

However, the winter season does not begin with the beginning of the year. The first month of winter is the last month of the year – December. The quarter is characterized by division from the beginning of the year. That is, the first quarter begins on January 1. Further, both in seasons and in quarters, the months are counted in order.

This way we can find out which months are in the first quarter. These are January, February and March. The total is 31 + 28 (29) + 31 = 90 (91) days in the first quarter of the year. The number of days can only change in the first quarter, because February does not have 28 days in a leap year, but once every 4 years it consists of 29 days.

Q2 – what months are these? The second quarter of the year includes the next three months - April, May and June. Total number of days: 30 + 31 + 30 = 91. This number of days is constant from year to year.

Q3 – what months are these? July, August, September - these are the three months that make up the third quarter of the year. Total number of days: 31 + 31 + 30 = 92.

And finally, the last quarter of the year consists of the following months: October, November and December. Total days: 31 + 30 + 31 = 92.

Changes in accounting policies for 2022

From January 1, 2022, several new accounting standards are required:

- FSBU 6/2020;

- FSBU 26/2020;

- FSBU 25/2018.

The transition to new standards requires a revision of the accounting policies of almost everyone. Even if it is possible to keep records in the old way. Information that a decision has been made not to apply certain provisions of the new Federal Accounting Standards still needs to be reflected in the accounting policies.

In addition, certain provisions of the 6th and 26th standards require the accountant to analyze and plan further methods of accounting. For example, independently setting a cost criterion for classifying an object as a fixed asset.

We have already discussed in detail the provisions and the transition to the new Federal Accounting Standards from 2022 and will consider them in separate articles. Here we also mention that, in accordance with the updated accounting policy, by December 31, 2022, it may be necessary to carry out a number of preparatory measures for the successful transition to the new FAS. For example, inventory of fixed assets, capital investments, rental and leasing agreements.

Also see:

How the accounting procedure for fixed assets is changing: comparison of the new FAS 6/2020 and PBU 6/01

Accounting for capital investments according to the new FAS 26/2020

What you need to know about the new FSBU 6/2020 “Fixed Assets” and FSBU 26/2020 “Capital Investments”

Lease accounting according to FAS 25/2018

Why is it necessary to divide the year into quarters?

Having dealt with the question: how many months are there in a quarter, it is worth paying attention to why it is generally necessary to divide the year into quarters, because there are months and half-years. Dividing the year into quarters is most often used for reporting in various institutions. This allows you to systematize the recording of documentation, especially in the field of accounting and statistics, as well as track the implementation of certain work plans.

The year is evenly divided into quarters of months, but they are not all the same length and usually last 90, 91 or 92 days. It all depends on the number of days in a month, because a quarter is 3 months of the year, which means its duration is equal to the sum of all the days of the three months of which it consists. For example, the first quarter in a normal (non-leap) year consists of 90 days (31+28+31), the second quarter consists of 91, and the last two are 92 days each. The difference in the length of quarters causes inconvenience when preparing quarterly reports. To cope with this problem, the project of creating a new, more stable and convenient calendar than the current one has been discussed for more than 100 years. However, the strongest minds on the planet have not yet been able to solve this problem, since the Gregorian calendar, which we use now, despite all the disadvantages, is the most accurate in the entire known history of mankind and was created on the basis of astronomical data, taking into account all the features of the Earth’s movement around the Sun.

Astronomical year

For chronology, a period of time is used that corresponds to the phase of revolution of the planet Earth around the Sun. This period is equal to 365 days, 5 hours, 48 minutes, 51 seconds. In the Julian and Gregorian calendars, the duration of the time cycle is 365 days.

Once every four years, it is customary to add a day to avoid shifting the day of the vernal equinox. The extra hours, minutes and seconds add up to make a leap year. Then a new date appears on the calendar - February 29.

The year is divided into 12 months. During the Earth's revolution, due to the inclination of its axis to the ecliptic plane, a change of seasons occurs. For convenience, in Russia they are counted from the first day of a specific month: autumn - from September 1; winter - from December 1, spring - from March 1, summer - from June 1.

How many quarters are there in a year, and for what purpose did this unit of measurement appear?

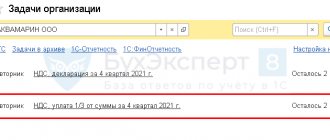

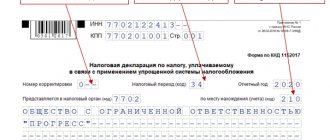

The VAT reporting period coincides with the tax period and is a quarter. This means that VAT reporting is prepared quarterly (that is, data is entered into the form not on an accrual basis, but separately for each quarter). In other words, the VAT return is submitted to the Federal Tax Service at the end of each quarter of the year and contains only data related to that specific quarter.

The deadline for filing VAT reports in 2020-2021 is no later than the 25th day of the month following the tax period (Clause 5, Article 174 of the Tax Code of the Russian Federation). This provision applies to both VAT taxpayers and tax agents for this tax.

The declaration must be submitted electronically.

Important! ConsultantPlus warns: An exception to this rule are some tax agents, as well as foreign organizations that pay the “Google tax.” If you are a tax agent, you can submit a VAT return on paper only if the following conditions are simultaneously met. Read the explanations of K+ experts after receiving trial demo access to the system. It's free.

Types of quarterly tax reporting

Limited liability companies (hereinafter referred to as LLC) on the general taxation system (hereinafter referred to as OSNO) are required to submit quarterly tax reports to the Federal Tax Service at the place of registration of the company.

Let us remind you that the tax reporting quarters are as follows:

- 1st quarter (January, February, March);

- 2nd quarter – also called half-year (April, May, June);

- 3rd quarter – also called 9 months (July, August, September);

- 4th quarter – also called the year (October, November, December).

| Preparation and submission of reports for individual entrepreneurs and LLCs Cost of reporting

|

The VAT declaration is submitted by the 25th day of the month following the reporting month (reporting period quarter). The declaration is prepared quarterly. Compiled on the basis of books of purchases and sales, a journal of issued and received invoices.

The Profit Declaration is submitted by the 28th day of the month following the reporting month (reporting period quarter). The declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of the balance sheet.

Payments for insurance premiums are due by the 30th day of the month following the reporting month (reporting period quarter). Such a declaration is drawn up on an accrual basis for the quarter. Those. When preparing a declaration for the quarter, it is necessary to take into account the indicators of the previous quarter. Compiled on the basis of accrued insurance premiums from the payroll.

Tax calendar for individual entrepreneurs

Read more about individual entrepreneur taxation. The simplest tax calendar for individual entrepreneurs who do not have employees:

| Tax | 1st quarter | 2nd quarter | 3rd quarter | 4th quarter or year-end | NPA |

| simplified tax system* | Advance payment for the first quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Annual declaration under the simplified tax system and payment of tax no later than April 30 | Art. 346.21, 346.23 Tax Code of the Russian Federation |

| Unified agricultural tax | — | Advance payment for agricultural tax for the half-year - no later than July 25 | — | Annual declaration under Unified Agricultural Tax and payment of agricultural tax no later than March 31 | Art. 346.9, 346.10 Tax Code of the Russian Federation |

| VAT** | Submit your declaration no later than April 25 and pay tax by June 25 inclusive | Submit your declaration no later than July 25 and pay tax by September 25 inclusive | Submit the declaration no later than October 25 and pay tax until December 25 inclusive | Submit your declaration no later than January 25 and pay tax by March 25 inclusive | Art. 174 Tax Code of the Russian Federation |

| Personal income tax | Advance payment for the 1st quarter - no later than April 25 | Advance payment for half a year - no later than July 25 | Advance payment for nine months - no later than October 25 | Personal income tax at the end of the year - no later than July 15. Declaration for the year in form 3-NDFL until April 30 inclusive | Art. 227 – 229 Tax Code of the Russian Federation |

| Single simplified declaration*** | Submit no later than April 20 | Submit no later than July 20 | Submit no later than October 20 | Submit no later than January 20 | Art. 80 Tax Code of the Russian Federation |

*STS payers who have no income in the reporting period do not pay advance payments in the corresponding period.

**VAT is paid in a special order: 1/3 of the amount for the expired quarter no later than the 25th day of each of the three months following the expired quarter. For example, VAT accrued for payment for the first quarter is paid in equal installments no later than April 25, May 25 and June 25.

***A single simplified declaration is submitted for several taxes at once, provided that during the reporting period there was no movement in accounts and cash and there were no objects of taxation.

Individual entrepreneurs working for PSN do not file a declaration. The tax, in the form of the value of the patent, is paid as follows:

- A patent issued for a period of up to six months must be paid in full no later than its expiration date;

- If the patent validity period is from six months to a year, then one third of its full cost must be paid no later than 90 days after the start of validity, and two thirds - no later than the expiration date of the patent.

Entrepreneurs also have a specific payment that is not related to taxes, but is required to be paid. These are insurance contributions for your pension and health insurance.

Contributions are divided into two groups:

- mandatory in a fixed amount, which is the same for all individual entrepreneurs;

- additional, in the amount of 1% of the amount of annual income exceeding 300,000 rubles.

Insurance premiums for yourself in a fixed amount must be transferred no later than December 31 of the current year, and an additional contribution, if any, is transferred no later than July 1 of the next year. Thus, individual entrepreneur contributions in the amount of 43,211 rubles must be paid no later than December 31, 2022, and the additional contribution must be paid no later than July 1, 2023. There is no reporting on contributions for yourself.

In addition, individual entrepreneurs who have the corresponding object of taxation have responsibilities for other taxes: land, water, transport, mineral extraction tax, excise taxes. For information about these taxes, see the end of the article.

Division into quarters

Dividing the year into quarters is a division into four equal periods of time. Thus, each quarter represents three months. The first quarter begins on January 1 and continues until March 31. The second quarter is the period from April 1 to June 30, the third from August 1 to October 31, and the last quarter from November 1 to December 31. Roman numerals are used to designate the quarters of the year: I, II, III and IV quarters. The length of the quarters varies and varies from 90 to 92 days. Today we use the Gregorian calendar, which is quite accurate from an astronomical point of view. However, its reform has been talked about for decades in order to regroup the days of the year. In this case, it would be possible to equalize the length of months, quarters and half-years and correct the fact that the week begins in one month and ends in another. In 1923, a special committee on reform issues was created at the League of Nations, and after World War II, this problem began to be discussed in the UN Economic and Social Council. With all the number of calendar projects, the main attention is paid to the option proposed by Gustave Armelin in 1888. According to his project, the calendar year has 12 months, as now, the year is divided into 4 quarters of 91 days. The first month has 31 days, the other two have 30. The first day of the year and quarter is Sunday, each quarter ends on Saturday and contains 13 weeks. The calendar project was approved in the USSR, France, India, Yugoslavia and several other countries. However, the UN General Assembly postponed its consideration and approval, currently ceasing activities on this issue.

How are the blocks numbered?

Quarters are usually designated by Latin numerals (IIIIIIIV). In countries where English is used as the official language, quarters of the year are usually designated in Arabic numerals. The numbers are preceded by the letter Q.

Quarter as a period of time

Most often, the word QUARTER means a time period. It is equal to:

- Three months;

- Half term;

- The fourth part of the year.

There are four quarters . They are usually designated by the Roman numerals I, II, III and IV. And each consists of three months:

- The first is January, February and March;

- The second is April, May and June;

- Third – July, August and September;

- The fourth is October, November and December.

As you may have noticed, the quarters do not exactly coincide with the seasons, since the year does not begin with the first month of winter. But there is one more nuance - they are not equal to each other and differ in the number of days :

- The first is 90 days (in a leap year it increases to 91 days);

- Second – 91 days;

- Third – 92 days;

- Fourth – 92 days.

This small difference in days is very inconvenient from the point of view of calculating various economic indicators and statistics. But no one has figured out how to equalize them.

Property tax

Company property tax is a regional tax, so you will not find deadlines for its payment in the Tax Code. But the legislation states that the reporting periods for this tax are quarters. This means that it is also quarterly. Exact data on its payment and reporting should be looked at in the regulations of a particular region. The declaration form is unified and is mandatory for use.

I would also like to note that previously property tax was paid only by organizations on special tax purposes. Starting from the third quarter of 2014, the government of the Russian Federation obliged organizations that are on UTII to calculate and pay it.

Reporting on contributions to extra-budgetary funds

Quarters are reporting periods for submitting reports to the Social Insurance Fund and the Pension Fund. Thus, any organization that accrues cash payments to its employees is required to submit reporting forms to the funds.

To the Pension Fund of the Russian Federation, organizations submit the RSV-1 Pension Fund form once a quarter. The maximum deadline for submission is the 15th day of the second month following the reporting period. Therefore, this form for the first quarter must be in the Pension Fund office by May 15, for the first half of the year - by August 15, for 9 months - November 15, for the year - February 15. However, if the reporting date falls on a weekend, then the deadline for reporting is moved to the working day following the weekend. Payment of advance payments occurs within the same time frame as the submission of reports.

You must also report to the Social Insurance Fund for all quarters of the year. This structure monitors the correctness of the calculation of social insurance contributions and the payment of larger amounts of sickness benefits. Reports to this fund are submitted quarterly no later than the 15th day of the month following the reporting period. It turns out that the reporting dates for this type of contribution are April 15, July 15, October 15 and January 15. Just like for pension contributions, amounts are transferred before reporting dates. Reporting form – 4-FSS.

For failure to submit or late submission of reporting forms, a fine of 1,100 rubles is imposed on the enterprise. If there is a repeated violation, the case is sent to court.

Tax paid depending on the tax regime

In Russia, all commercial organizations pay their tax depending on the tax regime they choose. However, only OSN and UTII are paid by organizations once a quarter. There are four payments and four reporting dates in a year. Also, the income tax of an organization located on the OSN can be paid once a month.

Thus, reporting on UTII is submitted on the twentieth day of the month following the reporting period according to the tax return form approved by order of the Federal Tax Service of the Russian Federation. This form is filled out in accordance with the regulations and submitted to the tax authority to which the organization is attached. Failure to submit or late submission entails an administrative penalty in the form of a fine.

The tax for OSN is paid once a quarter. There are three months in a quarter, therefore, an enterprise can also submit three tax returns per quarter, since the reporting period for this tax is not precisely specified. Organizations determine it independently. This declaration is mandatory for use; Order of the Ministry of Finance No. 55n approved its form.

Other special regimes submit tax reports only once a year, although they pay advance payments every 3 months.

Deadlines for submitting reports for the 4th quarter and year 2017

We have prepared a taxpayer calendar for the 4th quarter of 2017. This list also includes annual reporting. Please note that annual reporting forms are subject to change!

Save it for yourself so you don’t have to look for it at the end of the year. For example, share on social networks. To the right of the table there are buttons for Facebook, VKontakte, Odnoklassniki and other social networks. Or save it to your blog on “Clerk” by clicking on “class” below the social media buttons. You can also print the table.

Table.

Deadlines for submitting reports for the 4th quarter of 2022 and for 2022 Tax return for personal income tax (form 3-NDFL)

| Declaration form, calculation, information | Approved | Deadline |

| Information on the average number of employees | ||

| Information on the average number of employees for the previous calendar year | Order of the Federal Tax Service of the Russian Federation No. MM-3-25/ [email protected] dated March 29, 2007 | January 22 |

| Social Insurance Fund | ||

| Form 4 FSS of the Russian Federation. Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | FSS Order No. 381 dated 09/26/2016 (as amended by Order No. 275 dated 06/07/2017) | January 22 (hard copy) January 25 (in the form of an electronic document) |

| Personal income tax | ||

| Providing tax agents with information about the impossibility of withholding personal income tax from individuals (form 2-NDFL) | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | March 1 |

| Calculation of personal income tax amounts calculated and withheld by the tax agent (6-NDFL) | Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | April 2 |

| Certificate of income of an individual (form 2-NDFL) | Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 10.30.15 | April 2 |

December 15

January 15

DSV-3 Register of insured persons for whom additional insurance contributions for a funded pension are transferred and employer contributions are paid Resolution of the Board of the Pension Fund of the Russian Federation 06/09/2016 N 482p January 22 Calculation of insurance premiums Order of the Federal Tax Service of Russia N ММВ-7-11/[email protected] dated 10.10.2016 January 30 Calculation of insurance premiums for peasant farms without employeesOrder of the Federal Tax Service of Russia N ММВ-7-11/[email protected] dated 10.10.20129 January Personalized reporting to the Pension Fund (forms SZV-STAZH and EDV-1) Resolution of the Board of the Pension Fund of the Russian Federation dated 11.01.2017 N 3p March 1 VAT, excise taxes and alcoholPresentation of the log of received and issued invoices in the established format in electronic form for the fourth quarter of 2022. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. Clause 5.2. Article 174 of the Tax Code of the Russian Federation January 22 Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of the member states of the Eurasian Economic Union Order of the Ministry of Finance of the Russian Federation No. 69n dated July 7, 2010 (for October-November)Order of the Federal Tax Service of Russia dated September 27, 2017 N SA-7-3/ [email protected] (for December)

20 November20th of December

January 22

Tax return for value added tax Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/[email protected] dated 10/29/2014 (as amended on 12/20/2016) January 25 Tax return on excise taxes on ethyl alcohol, alcohol and (or) excisable alcohol-containing products Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/[email protected] from 01/12/2016 November 27December 25

The 25th of January

Tax return on excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, passenger cars and motorcycles Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/[email protected] from 01/12/2016 November 27December 25

The 25th of January

Submission of declarations on alcohol (with the exception of declarations on the volume of grapes) Decree of the Government of the Russian Federation of 08/09/2012 N 815 (as amended on 05/13/2016) January 20 UTIITax return for UTIIOrder of the Federal Tax Service of the Russian Federation No. ММВ-7-3/[email protected] dated 07/04/2014 (as amended on 10/19/2016) January 22 Unified (simplified) tax returnUnified (simplified) tax return Order of the Ministry of Finance of the Russian Federation No. 62n dated 02/10/2007 January 22 Single tax paid in connection with the application of the simplified tax systemTax return for tax paid in connection with the application of the simplified taxation system Approved by Order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/[email protected] April 2 (organizations)May 3 (IP)

Unified agricultural taxTax return for the unified agricultural tax Approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/[email protected] dated 07/28/14 (as amended on 02/01/2016) April 2 Income taxTax return for income tax of organizations calculating monthly advance payments on actually received profitOrder of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/[email protected] November 28December 28th

March 28

Tax return for corporate income tax, for all taxpayers of this tax Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/[email protected] March 28 Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld (when calculating monthly payments) Order of the Federal Tax Service of Russia dated 03/02/2016 N ММВ-7-3/[email protected] November 28December 28th

March 28

Tax calculation (information) on the amounts of income paid to foreign organizations and withheld taxes Order of the Federal Tax Service of Russia dated March 2, 2016 N MMV-7-3/[email protected]March 28 Tax return on income tax of a foreign organization Order of the Ministry of Taxes of the Russian Federation dated January 5, 2004 No. BG-3-23/1 March 28 Tax return on income received by a Russian organization from sources outside the Russian Federation Order of the Ministry of Taxes of the Russian Federation dated December 23, 2003 No. BG -3-23/[email protected] November 28December 28th

March 28

Property taxDeclaration on property tax of organizationsOrder of the Federal Tax Service of the Russian Federation No. ММВ-7-21/[email protected] from 03/31/17 March 30 MET Tax return for mineral extraction tax Order of the Federal Tax Service No. ММВ-7-3/[email protected] from 05/14/2015 November 30January 9

January 31

Water taxTax return for water tax Order of the Federal Tax Service No. ММВ-7-3/[email protected] from 09.11.2015 January 22 Gambling taxTax return on gambling tax Order of the Federal Tax Service of Russia dated December 28, 2011 N ММВ-7-3/[email protected] January 22 Information on the average number of employeesInformation on the average number of employees for the previous calendar year Approved by Order of the Federal Tax Service of the Russian Federation dated March 19, 2007 No. MM-3-25/[email protected] January 22 Transport taxTax return for transport tax Order of the Federal Tax Service of Russia dated February 20, 2012 N ММВ-7-11/[email protected] (as amended on April 25, 2014) February 1 Land taxTax return for land tax Approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/[email protected] from 10.28.11 (in ed. Order of the Federal Tax Service of Russia dated November 14, 2013 N ММВ-7-3/ [email protected]) 1st of February Financial statementsAccounting statements Approved by order of the Ministry of Finance No. 66n dated 07/02/10 (in ed. Order of the Ministry of Finance No. 57n dated 04/06/2015

) April 2 Environmental paymentsCalculation of fees for negative impacts on the environment Order of the Ministry of Natural Resources of Russia dated 01/09/2017 N 3 March 10 Calculation of the amount of environmental fees Approved by Order of Rosprirodnadzor dated 08/22/2016 N 488 April 14

We have also collected reporting deadlines for the 3rd quarter of 2022 in a convenient table.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up