When is the PKO formed?

According to the law, a receipt order is documentary evidence that a certain amount of cash has been received at the company's cash desk. It is prescribed for the following operations:

- receiving income from the sale of goods and services;

- return of the balance of funds previously issued to accountants;

- implementation of operating systems that were at the disposal of the company;

- payment of shares in the authorized capital;

- withdrawing money by check from a bank account;

- transfer of funds from the “singles” of the organization to the head unit.

Moreover, it does not matter what the source of cash is. A cash receipt order is always issued for them (you can use the link above). This document may be required by representatives of the tax office when checking a commercial structure.

The company can issue one PKO at the end of the working day for the entire amount of funds accepted during this period, or, at its discretion, prepare a receipt for each settlement transaction. There are no strict legal rules in this regard. It all depends on the accounting policy adopted by the organization.

Registration procedure

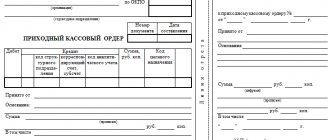

The standardized form of the PQS requires the presence of 2 parts:

- the order directly (stored in the company receiving the funds);

- tear-off element - receipt (returned to the cash depositor).

According to current regulations, the receipt is certified by the signature of the chief accountant (or other authorized person), visa and seal of the cashier. Then it is transferred to the depositor of funds.

The stamp is only placed on the receipt. It shouldn't be on the order itself.

There is an opinion that the edge of the seal should “reach” the body of the document. Many people use this approach in practice. However, controllers recognize this as a violation of the existing rules for filling out the PKO.

The law obliges the cashier (or accountant) to begin processing the document by filling out the order itself. The tear-off part is drawn up in the second place.

When accepting a cash receipt order (a sample form will be presented below), the responsible employee must:

- check the signatures of authorized persons with the samples available to him;

- clarify whether there are documents confirming the legality of the transaction;

- check whether the amount prescribed in the PKO corresponds to the actual amount of money deposited.

If the amount received at the company's cash desk corresponds to the value written on the order form, the cashier accepts the document and confirms all this with his signature and seal impression (stamp). If a discrepancy is found, the PKO is sent to the accounting department for re-registration.

The order executed in accordance with all the rules remains at the cash desk of the enterprise. An authorized employee must enter information about him in the journal for registering incoming documents (form KO-3).

How to draw up incoming and outgoing cash orders

Receipt cash order

When receiving money at the cash desk, you need to fill out a cash receipt order in form No. KO-1 (clause 4.1 of Bank of Russia Instructions dated March 11, 2014 No. 3210-U). This document is issued in one copy.

The cash receipt order form consists of two parts: the cash receipt order itself and the detachable part – the receipt. Give the receipt to the citizen who deposited the money.

In the receipt order and the receipt for it, in the line “Base”, indicate the content of the business transaction. For example, “payment of invoice No. 123 dated April 2, 2014.” In the “Including” line, indicate the VAT amount in numbers or write “Without VAT.” In the “Attachment” line, list the documents attached to the cash receipt order.

Such rules are established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The cash receipt order must be signed by the chief accountant or accountant, and in their absence - by the head of the organization (entrepreneur), cashier. Based on the administrative document, the responsibility to sign cash documents for the accountant may be assigned to another employee of the organization. The candidacy of an authorized employee is agreed upon with the chief accountant (if available). If the manager (entrepreneur) conducts cash transactions and draws up documents personally, then the cash documents are signed by him.

Such rules are established by clause 4.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U.

Entrepreneurs who keep records of income and expenses or physical indicators in accordance with tax legislation have the right not to issue cash receipt orders (paragraph 2, clause 4.1 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U).

Situation: how to correctly put a seal (stamp) on a cash receipt order?

Place a stamp on the part of the form marked with the letters “M.P.” so that its imprint is also on the receipt.

The cash receipt order form consists of two parts: the cash receipt order itself and the detachable part – the receipt. There are no special rules for the location of the seal imprint (for example, 60% of the imprint on the receipt, and 40% on the receipt order). Therefore, put a stamp in the part of the form indicated by the letters “MP.” Considering that this detail is located on the receipt, the seal imprint should be on it. This conclusion can be made on the basis of the resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The composition of the details that must be placed on the cashier’s seal (stamp) is also not established. Previously, regulations were adopted that regulated this issue, but now they have been canceled (see, for example, order of the mayor of Moscow dated August 25, 1998 No. 843-RM). Clause 6 of this document establishes a list of details that were previously mandatory:

— full name of the organization in Russian indicating the organizational and legal form; location;

— main state registration number.

Now this list has been canceled (Decree of the Moscow government of February 8, 2005 No. 65-PP), but it is advisable to publish this information in print. Typically, the cashier does not use the main seal of the organization, but the seal for documents or the cash register. Therefore, on such seals they make the appropriate inscription “For documents”, “Cash desk” or “For cash documents”, etc. (clause 6.2 of the order of the mayor of Moscow dated August 25, 1998 No. 843-RM).

Account cash warrant

Issue money from the cash register using a cash receipt order in form No. KO-2 (clause 4.1 of Bank of Russia Instructions dated March 11, 2014 No. 3210-U). This document is drawn up in one copy.

If money is given to an employee on account, then issue a cash receipt order based on his written application, drawn up in any form. Accept the application only if it is signed by the manager and contains the following entry:

- about the amount of cash issued on account;

- about the period for which cash is issued;

— signature of the manager;

- date of.

This procedure is established by clause 6.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U.

On the line of the cash receipt order “Base”, indicate the content of the business transaction. For example, “reimbursement of overexpenditure according to advance report No. 321 dated June 2, 2014.”

In the “Appendix” line, list the attached primary and other documents, indicating their numbers and dates of preparation (invoices, applications for the issuance of money, etc.). The procedure for filling out an expense cash order is established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Corrections cannot be made to cash documents (clause 4.7 of Bank of Russia Instructions No. 3210-U dated March 11, 2014).

The expense cash order is signed by the head of the organization (entrepreneur), as well as the chief accountant or accountant, and in their absence - by the head (entrepreneur), cashier. In the case of conducting cash transactions and drawing up cash documents by the manager (entrepreneur), the cash receipt order is signed by him.

Such rules are established by clause 4.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U.

Entrepreneurs who keep records of income and expenses or physical indicators in accordance with tax legislation have the right not to issue cash receipts (paragraph 2, clause 4.1 of the Bank of Russia Instructions dated March 11, 2014 No. 3210-U).

The procedure for issuing money under an expenditure cash order is established by paragraphs 6.1–6.3 of Bank of Russia Directives No. 3210-U dated March 11, 2014 and includes the following steps.

1. The cashier checks:

— availability of necessary signatures and their compliance with available samples;

- correspondence of the amount in figures to the amount in words;

— availability of documents listed in the cash receipt order;

- correspondence of the last name, first name, patronymic in the cash receipt order with the data of the identification document presented by the recipient of the money.

2. The cashier prepares the amount of cash to be issued and passes the cash order to the recipient.

3. The recipient in the cash receipt order indicates the amount of money received (the number of rubles in words, kopecks in numbers), puts a date and signature.

4. The cashier recalculates the amount of money prepared for issue so that the recipient can observe his actions, and gives him money in the amount indicated in the cash receipt order.

5. The recipient of cash counts the money he received under the supervision of the cashier. If the recipient does not do this, he will not be able to subsequently make claims to the cashier for the amount of cash received.

6. The cashier signs the debit order.

The cashier issues cash directly to the recipient specified in the cash order upon presentation of a passport or other identification document, or upon presentation by the recipient of a power of attorney and identification document (clause 6.3 of the Bank of Russia Instructions dated March 11, 2014 No. 3210- U).

If money is issued by power of attorney, then check the correspondence of the recipient's last name, first name, and patronymic indicated in the cash order with the principal's last name, first name, and patronymic indicated in the power of attorney, as well as the correspondence of the last name, first name, and patronymic of the trustee indicated in the power of attorney and cash order. and the data of the document proving his identity, the data of the document presented by him.

Attach the power of attorney to receive money to the cash receipt. If the power of attorney is issued for several payments or to receive money from different organizations (entrepreneurs), then attach a copy of it to the cash receipt order. Certify a copy of the power of attorney in the manner established by the manager (entrepreneur). The original power of attorney (if any) is kept by the cashier and is attached to the cash receipt at the last cash disbursement.

Journal of registration of incoming and outgoing orders

To control cash transactions, before transferring them to the cash register, register incoming and outgoing cash orders in the journal in form No. KO-3 (Part 1, Article 19 of the Law of December 6, 2011 No. 402-FZ). Register expense cash orders issued on pay slips for the payment of salaries (other similar payments) in the journal after the money has been issued. Such rules are established by instructions approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Situation: for what period is the journal for registering incoming and outgoing cash orders opened (form No. KO-3)?

There are no restrictions on the period during which the journal is kept in form No. KO-3.

Therefore, the chief accountant must decide on his own the question of what period to start a journal for. This period can be a month, a quarter or a year. When making your decision, consider the number of cash transactions.

Required elements

By law, a sample cash receipt order must contain the following details:

- name of the host organization in accordance with the statutory documentation;

- serial number (according to the registration journal, in which the numbering starts from the beginning of the year);

- Date of completion;

- information to be reflected in accounting (debit and credit of accounts, intended purpose, etc.);

- the amount of money received at the cash desk (with kopecks);

- details of the person who deposited the funds;

- the basis for accepting money with a supporting document attached (if necessary);

- signatures of responsible employees of the organization (director, chief accountant of the receiving party and depositor of money);

- the detachable part of the document (receipt), which proves the fact that cash was accepted by the cash register;

- indication of the presence or absence of VAT.

Below is a sample of filling out a cash receipt order in 2022.

Receipt cash order: sample filling-2022

The PQR can be filled out by hand or on a computer. It’s easy to arrange. You can download a sample cash receipt order that is current in 2022 for free and simply fill in your data.

Download a free sample cash receipt order-2022

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in

- Fill out and print the document online (this is very convenient)

You need to start processing a cash receipt order from the first part of the form. You need to enter there:

- The name of the organization indicating its organizational and legal form (IP, LLC, CJSC, OJSC).

- Structural subdivision. This field must be filled out if the money comes from an employee of the organization; if from another legal entity, put a dash.

- OKPO code.

- Order number and date of completion.

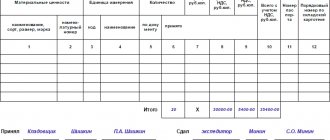

In the second part, enter information about the receipt of funds:

- In the columns “Debit” and “Credit” - the account numbers through which cash flows.

- In the field “Amount rubles, kopecks” - the amount of money received in numbers. Separate rubles and kopecks with a comma (for example, “100.50”).

- In the “Destination code” cell - the destination code of the accepted money, if it is used in the company.

- Write the full name of the person from whom the money came.

- Indicate the basis for receipt of money, for example, return of advance payment, payment under contract, etc.

- In the “Amount” line, again enter the amount of money received, but in words, kopecks in numbers.

Place a dash in the empty space of this line after indicating the amount in words - then nothing can be added to the document.

- If you do not work with VAT, in the “Including” line write “Without VAT”. Otherwise, the appropriate amount of tax.

- Indicate the documents on the basis of which the PQR was filled out. For example, a cashier's report or an advance report.

The PKO is signed by the chief accountant and the cashier who accepted the money. It is not necessary to put a stamp. We have prepared a sample for filling out a cash receipt order required in 2022 - it highlights all the required columns and fields.

The cashier has the right to draw up a general cash settlement at the end of the day for the entire amount. The main thing is to confirm it with cash receipts or BSO. For example, the accountant repaid the debt for the advance. In this case, a check is not issued, which means that this money cannot be included in the general PKO.

In addition to the main part of the cash receipt order (form KO-1), you also need to issue a receipt. It is filled out in the same way. The receipt for the PKO must contain:

- Company name,

- number and date,

- Full name of the person who deposited the money into the cash register,

- basis and amount (in words and figures).

After the receipt has been signed by the chief accountant and the cashier, you need to tear it off along the cut line and give it to the person who handed over the money.

If the receipt order was issued electronically, the cashier can send a receipt at the request of the person who deposited the money to his e-mail.

We recommend that you fill out the 2022 cash receipt order, print it out and give it to the cashier. Please also include instructions for filling it out. Then an example of filling out the PQS will always be before your eyes.

Errors, blots and corrections must not be allowed. If this happens, reissue the cash receipt order. PKO in word or excel can be here >>

You can fill out a cash receipt order online in MySklad - it’s fast, convenient, free and guaranteed to be error-free.

On a note

| 1 | The PKO must be formed in one copy. Copies should not have the same legal force. |

| 2 | Corrections and shortcomings are unacceptable: if they exist, the document should be destroyed and rewritten |

| 3 | In columns where data is missing, dashes are added. |

| 4 | The PQR is signed by the company’s chief accountant or other authorized official |

Drawing up a form for a cash receipt order in 2020 is the responsibility of the cashier and accountant who receives funds. If authorized employees are absent, the form is filled out by the head of the organization.

Also see “How to register in accounting the delivery of money to the collector.”