Public sector accounting (financial) reporting

State organizations are divided into state-owned, budgetary, and autonomous. Depending on the type of organization, certain forms are submitted.

Budgetary and autonomous institutions

Budgetary and autonomous institutions are non-profit organizations that provide services in the fields of education, medicine, sports, culture, employment and others. They receive subsidies from the budget, which are calculated based on standard costs for a certain volume of services. The main difference between a budgetary and an autonomous institution is less financial independence and economic mobility.

Reporting of budgetary and autonomous institutions

The main document regulating the submission of reports is the Instruction on the procedure for compiling and submitting annual and quarterly financial statements of state budgetary and autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n.

Budgetary and autonomous organizations prepare accounting (financial) statements (BFO):

- monthly - on the first day of the month following the reporting month;

- quarterly - on April 1, July 1 and October 1 of the current year;

- for the year - as of January 1 of the year following the reporting year.

The BFO includes:

- balance (OKUD 0503730);

- certificate on consolidated settlements (OKUD 0503725);

- certificate on the conclusion of accounting accounts for the reporting financial year (OKUD 0503710);

- report on the institution’s implementation of its financial and economic activity plan (OKUD 0503737);

- statement of obligations (OKUD 0503738);

- report on obligations within the framework of national projects (OKUD 0503738-NP);

- financial performance report (OKUD 0503721);

- cash flow statement (OKUD 0503723);

- explanatory note to the Balance Sheet (OKUD 0503760).

In addition to these forms, institutions submit additional reporting if it is established by the founder or financial authority (clause 8 of Instruction No. 33n).

Report to government organizations via the Internet - on time and without errors.

To learn more

Reporting

State organizations report to the founder or, by decision of the financial authority - to this financial authority - in electronic form, and sign with an enhanced qualified electronic signature. The deadline for the organization to submit reports is set by the founder. Before submitting annual reports, an inventory must be taken.

To present the BFO, data is taken from the general ledger (OKUD 0504072) and other accounting registers; planning, analytical, and management indicators generated by period are also used. The reports include information on divisions, branches and representative offices.

In an autonomous institution, annual reporting is additionally approved by the supervisory board.

After the founder accepts the BFO, organizations publish it on the Internet on their website or other resource.

Reporting to the tax authority

Budgetary and autonomous organizations submit annual accounting reports to the tax office at their location. The list of forms is specified in the Letter of the Ministry of Finance dated March 28, 2013 No. 02-06-07/9937:

- balance sheet of a state (municipal) institution;

- a report on the institution’s implementation of its financial and economic activity plan;

- financial performance report;

- information on accounts receivable and payable;

- information about cash balances.

In accordance with Article 18 of Federal Law No. 402-FZ, public sector organizations are exempt from submitting a legal copy of reporting in the form of an electronic document.

Like commercial companies, government agencies report property taxes. If an organization has real estate, they pay tax and submit a declaration no later than March 31. They also submit calculations for insurance premiums, 6-personal income tax, and can submit profit declarations, VAT, and simplified taxation system.

State institutions

The purpose of creating a government organization is to provide state or municipal services. Financing is carried out on the basis of budget estimates from the federal or local budget.

The legislation provides for methodological support for federal government bodies, management bodies of extra-budgetary funds, and government institutions subordinate to the Federal State Property Fund. Government Decree No. 1084 dated October 20, 2014 determines standard costs for procurement plans and justification of budget allocations when forming a draft budget.

State institutions have the right to participate in commercial activities if this is provided for in the constituent document, but all income from commerce is transferred to the budget. All property belongs to the founder (RF, subject of the Russian Federation or municipality) and organizations use it with the right of operational management.

State institutions report on their activities in accordance with the Instructions on the procedure for compiling and submitting annual, quarterly and monthly reports on the execution of budgets of the Russian Federation, approved by Order of the Ministry of Finance dated December 28, 2010 No. 191n.

This instruction obliges organizations to submit interim reports (monthly, quarterly on an accrual basis) and annual reports.

Due to the specifics, the composition of annual budget reporting differs from that presented by budgetary and autonomous institutions:

- balance (OKUD 0503130);

- certificate of availability of property and liabilities on off-balance sheet accounts (f. 0503130);

- financial performance report (OKUD 0503121);

- certificate on consolidated settlements (OKUD 0503125);

- information on the movement of non-financial assets (OKUD 0503168);

- information on accounts receivable and payable (OKUD 0503169);

- information on changes in balance sheet currency (OKUD 0503173);

- information on accepted and unfulfilled obligations of the recipient of budget funds (OKUD 0503175);

- information on budget execution (OKUD 0503164);

- explanatory note to the Balance Sheet (OKUD 0503160).

All reports are listed in paragraphs 11, 23, 49, 60, 68, 68.1, 146 of the Instruction, approved by Order of the Ministry of Finance dated December 28, 2010 No. 191n.

The reporting procedure is indicated in paragraph 10 of Instruction No. 191n:

- recipients of budget funds submit reports to the manager or chief manager of budget funds (BS);

- budget revenue administrators - to the superior chief administrator;

- Administrator of the source of financing the budget deficit (IFSD) - to the superior chief administrator of the IFDS

- managers of the BS, chief managers of the BS, chief administrators of the budget deficit and chief administrators of the IFDB - the financial body of the corresponding budget.

Deadlines for submitting financial statements to the Federal Tax Service by budgetary institutions

The annual accounting records of a budgetary organization are compiled as of the reporting date, January 1 of the next year after the reporting year, on an accrual basis, in rubles, accurate to hundredths.

The reporting is signed by the manager and chief accountant; if it contains planned and analytical indicators, then the signature of the head of the financial and analytical service (if there is one in the organization) or the person responsible for these indicators is also required.

Reporting is prepared on the basis of data from the general ledger and other accounting registers after preliminary reconciliation of analytical and synthetic accounting indicators and verification of reporting indicators against control ratios published on the Federal Treasury website. Reporting must include data on the activities of all branches and divisions, regardless of where they are located.

As a general rule, the company's annual financial statements must be submitted to the tax office no later than 3 months after the end of the calendar year.

The fine for failure to submit accounting reports to the tax office is 200 rubles. for each form (Article 126 of the Tax Code of the Russian Federation). An administrative fine for officials of 300-500 rubles is also possible.

State employees submit tax returns on a general basis. The delivery schedule can be viewed here.

Late submission of tax reports is a reason for a fine from the tax authorities. Read more about this in our material “Amounts of fines for failure to submit tax reports.”

Regulatory framework for reporting by government agencies

- Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ,

- Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”,

- Federal Law of December 6, 2011 No. 402-FZ “On Accounting”,

- Instructions on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2010 No. 191n,

- Instructions on the procedure for drawing up and submitting annual and quarterly financial statements of state budgetary and autonomous institutions, approved by Order of the Ministry of Finance dated March 25, 2011 No. 33n,

- Federal Accounting Standard for Public Sector Organizations (FSBU) “Presentation of BFO”, approved by Order of the Ministry of Finance dated December 31, 2016 No. 260n,

- FSBU "Conceptual basis of accounting and reporting of public sector organizations" dated December 31, 2016 No. 256n,

- FSBU “Cash Flow Report” dated December 30, 2017 No. 278n,

- FSBU “Revenues” dated February 27, 2018 No. 32n,

- FSBU “Fixed Assets” dated December 31, 2016 No. 257n,

- FSBU “Rent” dated December 31, 2016 No. 258n,

- FSBU “Impairment of Assets” dated December 31, 2016 No. 259n,

- FSBU “Events after the reporting date” dated December 31, 2017 No. 275n,

- FSBU “Accounting policies, estimates and errors” dated December 31, 2017 No. 274n,

- FSBU “The Impact of Changes in Foreign Currency Rates” dated May 30, 2018 No. 122n,

- FSBU “Reserves” dated December 7, 2018 No. 256n,

- FSBU “Reserves. Disclosure of information about contingent liabilities and contingent assets" dated May 30, 2018 No. 124n,

- FSBU “Budget information in the Baltic Federal District” dated February 28, 2018 No. 37n,

- FSBU “Concession Agreements” dated June 29, 2018 No. 146n,

- FSBU “Long-term contracts” dated June 29, 2018 No. 145n,

- FSBU “Joint Activities” dated November 15, 2019 No. 183n,

- FSBU “Payments to personnel” dated November 15, 2019 No. 184n,

- FSBU “Intangible assets” dated November 15, 2019 No. 181n,

- FSBU “Borrowing costs” dated November 15, 2019 No. 182n,

- FSBU “Information on related parties” dated December 30, 2017 No. 277n,

- FSBU “Non-produced assets” dated February 28, 2018 No. 34n,

- FSBU “Financial Instruments” dated June 30, 2020 No. 129n.

Tax reports: calendar

Let us indicate when to submit the main tax forms to the Federal Tax Service. The full list of forms depends on the chosen taxation regime. Let's present the current calendar of an accountant of a budgetary institution for 2020 in the table.

| Type of tax reports | For what period is it provided? | Deadline for submission to the Federal Tax Service |

| Submission of financial statements Including simplified forms | For 2022 | Until 31.03.2020 |

| Unified calculation of insurance premiums | Final for 2022 | Until 01/30/2020 |

| For the first quarter of 2022 | Until 04/30/2020 | |

| For the first half of 2020 | Until July 30, 2020 | |

| For 9 months 2020 | Until 30.10.2020 | |

| For 2022 | Until 02/01/2021 (January 30 and 31 - Saturday and Sunday) | |

| Information on the average number of employees | For 2022 | Until 01/20/2020 |

| For 2022 | Until 01/20/2021 | |

| Income tax return provided that the institution reports quarterly | For 2022 | Until March 30, 2020 (March 28 and 29—Saturday and Sunday) |

| For the first quarter of 2020 | Until 04/28/2020 | |

| For the first half of 2020 | Until July 28, 2020 | |

| For 9 months 2020 | Until October 28, 2020 | |

| For 2022 | Until 03/29/2021 (March 28 - Sunday) | |

| Income tax return provided that the institution reports monthly | For 2022 | Until March 30, 2020 (March 28 and 29—Saturday and Sunday) |

| For January 2020 | Until 02/28/2020 | |

| For February 2020 | Until 30.03.2020 | |

| For March 2020 | Until 04/28/2020 | |

| For April 2020 | Until 05/28/2020 | |

| For May 2020 | Until June 29, 2020 | |

| For June 2020 | Until July 28, 2020 | |

| For July 2020 | Until 08/28/2020 | |

| For August 2020 | Until September 28, 2020 | |

| For September 2020 | Until October 28, 2020 | |

| For October 2020 | Until 30.11.2020 | |

| For November 2020 | Until 12/30/2020 | |

| For 2022 | Until 03/29/2021 (March 28 - Sunday) | |

| Value Added Tax (VAT) Declaration | For the fourth quarter of 2019 | Until 01/27/2020 (January 25 and 26 - Saturday and Sunday) |

| For the first quarter 2020 | Until 04/27/2020 | |

| For the second quarter 2020 | Until July 27, 2020 | |

| For the third quarter 2020 | Until October 26, 2020 | |

| For 2022 | Until 01/25/2021 | |

| Journal of received and issued invoices | For the fourth quarter 2019 | Until 01/20/2020 |

| For the first quarter 2020 | Until 04/20/2020 | |

| For the second quarter 2020 | Until July 20, 2020 | |

| For the third quarter. 2020 | Until October 20, 2020 | |

| For the fourth quarter 2020 | Until 01/20/2021 | |

| Certificate 2-NDFL, submitted by an organization - tax agent | For 2022 | Until 03/02/2020 - a new general deadline for all categories of certificates! |

| For 2022 | Until 01.03.2021 | |

| Calculation of 6-NDFL | For 2022 | New deadline until 03/02/2020! |

| For the first quarter of 2020 | Until 04/30/2020 | |

| For the first half of 2020 | Until July 31, 2020 | |

| For 9 months 2020 | Until 02.11.2020 | |

| For 2022 | Until 01.03.2021 | |

| Annual tax return for corporate property tax | For 2022 | Until 30.03.2020 |

| For 2022 | Until 30.03.2021 | |

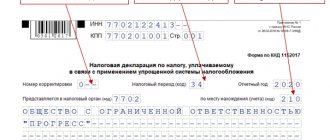

| Tax declaration under the simplified tax system for autonomous institutions and non-profit organizations | For 2022 | Until 31.03.2020 |

| For 2022 | Until 31.03.2021 | |

| Tax return for UTII | For the 4th quarter of 2022 | 20.01.2020 |

| For the 1st quarter of 2022 | 20.04.2020 | |

| For the 2nd quarter of 2022 | 20.07.2020 | |

| For the 3rd quarter of 2022 | 20.10.2020 | |

| For the 4th quarter of 2022 | 20.01.2021 | |

| Transport tax declaration | For 2022 | Until 02/03/2020 |

| Land tax declaration | For 2022 | Until 02/03/2020 |

IMPORTANT!

Since the beginning of the new year, an important change has come into effect. Now neither final nor quarterly reports of budgetary institutions in 2020 are submitted to Rosstat. Accountants send registers only to the Federal Tax Service.

Reporting of government organizations submitted to statistical authorities

The procedure for conducting federal statistical observations and submitting reports is established by Law No. 282-FZ of November 29, 2007. The conditions for the presentation of primary statistical and administrative statistical data are enshrined in Decree of the Government of the Russian Federation dated August 18, 2008 No. 620.

State institutions submit reports to Rosstat using the forms of the statistical authority (Part 4 of Article 6 of Law No. 282-FZ of November 29, 2007) in electronic form. The composition of the forms is different for organizations; this is due to the type of activity, organizational and legal form, and powers. To compile reports, indicators and information are used, which are then needed by statistical authorities for further analysis.

Rosstat annually publishes a report card and an album of current forms, as well as a calendar for their submission. The data can be found on the official website of the Federal State Statistics Service of the Russian Federation. Reporting can be urgent, monthly, quarterly, semi-annual and annual, the deadlines for submission are different for each form.

If a government agency does not submit reports on time, fines are provided for this in accordance with the Code of Administrative Offenses of the Russian Federation.

If an organization has discovered an error in documents previously sent to Rosstat or has received a notification from a regulatory authority, it can submit correction forms or explain the reasons for making corrections.

The Federal State Statistics Service of the Russian Federation is also obliged to inform organizations free of charge if it plans to conduct statistical observation on specific reporting forms.

Until April 15, 2022, government organizations will have to submit a new form No. TZV-budget to the territorial body of Rosstat at the place of actual activity. The form “Information on the expenses of budgetary, autonomous and government institutions for 2022” was approved by Order No. 420 dated July 15, 2021. The report should include data on all separate divisions.

Get everything you need to report for a government organization: up-to-date forms, notifications about the status of reports, explanations for Federal Tax Service refusals.

More details

Basic accounting rules

A feature of accounting in government institutions is the numbering of accounts. They consist of 26 characters in which information is encoded. Coding allows you to correlate data from different subjects of the budget system.

For detailed information about the composition and structure of the budget accounting account in the CG, see the article “Budget Account Codes”.

Entries in budget accounting accounts are maintained using the double entry method. Appendix No. 1 to the chart of accounts instructions No. 162n contains a large set of standard entries that an accountant can use in his work.

In addition, for an example of making entries for an educational institution, see the article “Typical entries for budget accounting (examples).”

How government organizations can report quickly and without errors

You can submit reports in accordance with all the rules electronically through the Kontur.Extern system. This saves time, helps identify errors before sending reports, corrects them and then tracks the fate of each one. In Externa you will find only current forms that comply with the law. You can fill them out in the system or upload ready-made documents from any accounting program. You will see the entire reporting cycle: from sending to acceptance by the regulatory authority. If your report is not accepted, you will receive a notification and an explanation of the reasons for the rejection.