At the end of last week, the Pension Fund of the Russian Federation posted for public discussion a draft Resolution “On approval of the Procedure for electronic document flow between policyholders and the Pension Fund of the Russian Federation when submitting information for individual (personalized) accounting.”

Let's figure out together what rules accountants will have to submit reports to the Pension Fund.

The document, among other things, describes the procedure for interaction between the Pension Fund and EDF operators. But we will consider only those rules that relate to interaction with policyholders.

A new way to submit reports

The Pension Fund provides the policyholder with two ways to provide individual information electronically:

- through the “Policyholder's Account” of the portal of electronic services of the Pension Fund of Russia (KS);

- through telecommunication channels.

As is known, the first method is not currently used.

This will be new for accountants. How to submit reports through the Account? The document provides an algorithm.

Authorization of the policyholder to use the “Policy Account” on the portal of electronic services of the Pension Fund of Russia is possible if he has an account as the head of the organization or an authorized representative of the organization in the Unified Identification and Authentication System.

To access the services of the Account, the policyholder must accept an agreement on the use of the policyholder’s account for electronic document management with the Pension Fund of the Russian Federation.

The agreement is signed electronically by the UKEP of the manager or other persons authorized to do so by order or power of attorney on behalf of the policyholder.

Due dates

As for the deadlines for submission, there is a specific date when to submit the SZV-M - no later than the 15th day of the month following the reporting month.

Read more: Filling out SZV-M upon dismissal of an employee

Let us remind you that the report is one of the documents that must be given to employees upon dismissal. In this case, the form includes data only for the current month about a specific citizen. The accountant independently chooses in which program to make SZV-M - in a specialized accounting system, in the electronic service of the service company, or on the Pension Fund of Russia website. SZV-M is filled out, printed, signed and given to the employee.

EDI PFR

The document describes the procedure for connecting to the electronic document flow of the Pension Fund of Russia (EDO PFR). To do this you need:

- conclude a service agreement with the operator;

- receive the UKEP of the head of the organization or other persons authorized to do so by order or power of attorney on behalf of the policyholder, and a certificate of the electronic signature verification key;

- send to the operator an electronic document “Application for connection to the PFR EDF ”, which is subsequently sent by the operator to the PFR system authority.

Thus, instead of paper agreements with the Pension Fund of Russia there will be electronic applications that will be sent through the operator.

The Pension Fund of Russia, within two working days after receiving the application, will send the policyholder an electronic document “Notification of the result of the review” .

After receiving this document with a mark indicating that the application has been satisfied, the policyholder is considered connected to the Pension Fund of the Russian Federation EDI.

To disconnect from the EDF of the Pension Fund of Russia, you must send to the Pension Fund an electronic document “Application for disconnection from the EDF of the Pension Fund of the Russian Federation” .

New fines

As amended by Law 27-FZ, in force since January 1, 2017, the following fines apply to the policyholder for violating the established rules for submitting individual information:

- If an electronic report is not provided to the Pension Fund, the fine may be 1,000 rubles. (paragraph 4 of article 17 of Law No. 27-FZ).

- If the deadline for submitting the report is not met or it is submitted with incomplete information, the fine for the policyholder will be 500 rubles. for each insured person (paragraph 3 of article 17 of Law No. 27-FZ).

- Administrative liability for failure to provide, violation of the deadline for provision, provision of incomplete or distorted information to the Pension Fund is the imposition of a fine on officials in the amount of 300 to 500 rubles. (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

Reports through representatives

To grant the right to submit individual information to a representative of the policyholder, it is necessary to submit an electronic document “Notification of granting authority to the representative” , signed by the UKEP of the head or other persons authorized to do so by order or power of attorney on behalf of the policyholder.

If the policyholder is not a participant in the information exchange within the framework of the EDI of the Pension Fund of Russia, then in order to submit individual information through a representative, he must personally or through a representative notify the territorial body of the Pension Fund of the Russian Federation about the right of the representative to generate and sign the individual information of the policyholder, providing original documents confirming the authority.

To revoke the right of a representative, the policyholder must submit an electronic document “Notice of termination of powers of the representative” , signed by the UKEP of the head or other persons authorized to do so by order of the organization or power of attorney on behalf of the policyholder.

The process of submitting reports on TKS

Submission of individual information in electronic form via TKS is possible if the policyholder has software that performs:

- generation of individual information in accordance with the formats, procedures and conditions established by the Pension Fund of Russia, for their subsequent transfer in the form of electronic documents via TKS;

- reception and sending of technological electronic documents accompanying electronic document flow between the policyholder and the bodies of the Pension Fund system;

- encryption when sending and decryption when receiving information using CIPF;

- signing electronic documents when transmitting information and checking the electronic electronic signature.

The Pension Fund of Russia sends an electronic document “Delivery Notification” within one business day .

Within three working days from the date of sending the delivery notification, the Pension Fund performs the following actions:

1) checks the Operator’s electronic digital signature and the composition of the package;

2) decrypts incoming documents.

If errors are detected in the first two points, an electronic document “Notification of refusal to accept the package” .

3) checks the policyholder’s UKEP.

4) checks individual information by Pension Fund programs for compliance with the form, format and filling procedure;

Based on the results of these two checks, the Pension Fund of the Russian Federation generates and sends to the policyholder an inspection protocol or “Notification of the elimination of errors and (or) inconsistencies between the information provided by the policyholder and the information available to the Pension Fund of Russia .

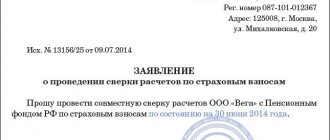

The policyholder will have the right to send to the Pension Fund an appeal (application, objection, request, etc.), the direction of which is provided for by the legislation of the Russian Federation and falls within the competence of the Pension Fund, in the form of an electronic document.

EDF participants must check the receipt of documents electronically on a daily basis

The date of provision of the policyholder’s documents is considered to be the date specified in the document “Inventory of the contents of the package” , which is generated and sent by the operator to the Pension Fund of the Russian Federation in a package with prepared electronic documents with individual (personalized) accounting information.

The date of receipt of documents from the Pension Fund of Russia by the policyholder (representative) is considered to be the date specified in the electronic document “Delivery Notification” , which is generated automatically when they are received by the Operator’s transport service and sent simultaneously to the addresses of all participants in the information exchange.

The representative informs the policyholder about the receipt of documents from the Pension Fund no later than the business day following the day of receipt of these documents.

EDF participants are required to notify the Pension Fund of the change of the UKEP no later than one calendar day from the date of receipt and no later than 7 days before the expiration date of the UKEP.

How do you submit reports to the Pension Fund?

The subjects of compulsory pension insurance are both employees (insured persons) and employers acting as policyholders. Organizations and individual entrepreneurs that have employees are required to make insurance contributions for them to the Pension Fund for the formation of a future pension.

The amount of contributions is tied to the salary of a particular employee and amounts to 22% of it. Important! Insurance premiums are paid both for full-time employees with whom labor relations have been established, and for private individuals carrying out work or providing services on the basis of civil contracts.

Accordingly, every employer has an obligation to submit appropriate reports. It includes information related to the calculation of accrued and paid insurance premiums, as well as other personalized accounting data.

Reporting is submitted by the employer personally, but it is possible to involve specialized accounting organizations on the basis of an agreement. Documents are submitted within strictly regulated deadlines.

It should be noted that the Pension Fund of the Russian Federation is vested with the right to issue acts providing for the prosecution of persons who violate the legislation on legal security . In practice, this means that a legal entity or individual entrepreneur may be fined for late submission of reports.

In general, for 2022, reporting to the state pension fund consists of 5 unified forms that employers must submit. Let's briefly look at each of them

SZV-M

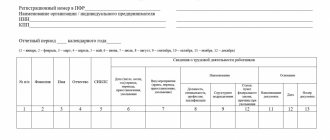

This report is submitted by all organizations. It contains information about insured persons located in the state for a specific reporting period. SZV-M contains information that is necessary for maintaining personalized records.

The form must contain the following information:

- data of the insurer;

- reporting period;

- information about persons insured in the OPS system (full name, SNILS, INN).

For more information about the program, watch the video:

SZV-STAZH

This form is a report that is submitted to the state pension authorities every year. It must necessarily reflect information about all employees with whom the organization has concluded employment contracts, as well as persons with whom there are civil relations.

SZV-STAZH is necessary to provide information about the employee’s existing insurance experience . Let us recall that the insurance period has a direct impact on the possibility of applying for an insurance pension in the future, as well as on the size of the pension itself.

Reference! Individual entrepreneurs with employees are required to submit a report on the form in question only for their employees. If an individual entrepreneur does not have employees, then filing a SZV-STAZH report is not necessary for him.

SZV-TD

This form contains information about the employee’s work activity. This report is new and was put into circulation in connection with the transition to “electronic work books”. In this regard, many policyholders had many questions regarding its filing.

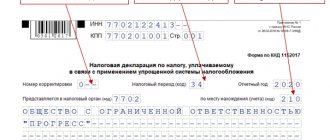

Thus, the following information is entered into the SZV-TD form:

- information about the policyholder (registration number, name, TIN, KPP);

- information about the insured (full name, date of birth, SNILS);

- a note indicating that the insured person has chosen a new form of recording work activity;

- information about periods of work.

It should be noted that a report in the SZV-TD form is submitted only when there are grounds for this, which include:

- hiring;

- dismissal (regardless of the reason);

- transfer to another workplace;

- submitting an application to choose a form of recording work activity.

SZI-TD

SZI-TD is inherently a more detailed form of the SZV-TD report. It contains, among other things, information about the employee, dates of hiring and dismissal, position, type of work and structural unit of the organization where the employee worked.

Important! A document in this form will be issued to the employee upon dismissal for presentation at the place of request.

The SZI-TD form is submitted by policyholders to the Pension Fund of the Russian Federation upon dismissal of an employee. It should be noted that the information in the document in question must directly correspond to the information contained in the SZV-TD form.

EDV-1

At its core, EDV-1 is an inventory of all documents that are transferred to the pension fund by the policyholder. In practice, this means that this form is submitted along with other reporting documents.

It should be noted that the above reporting forms are mandatory. However, in certain circumstances, the employer is required to submit additional forms, including upon direct request from the state pension fund.

The process of submitting reports through the Account

Submission of individual information in electronic form through the CS is possible if the policyholder has:

- means of access to ITCS "Internet";

- software for signing electronic documents UKEP.

Individual information provided by the policyholder (representative) using the KS services must be signed by the UKEP of the authorized person of the policyholder (representative).

The Pension Fund of Russia, within three working days, checks the UKEP of the authorized person of the policyholder (representative) and checks individual information using the Pension Fund of Russia programs for compliance with the form, format and filling procedure, based on the results of which a verification protocol or “Notification of elimination of errors and (or) inconsistencies between information provided by the policyholder and information available to the Pension Fund of Russia .

The policyholder has the right to send to the PFR body at the place of registration an appeal (application, objection, request, etc.), the direction of which is provided for by the legislation of the Russian Federation and falls within the competence of the PFR, in the form of an electronic document.

The date of provision of the policyholder’s documents is considered to be the date recorded in the electronic document “Registration Receipt” generated by the Constitutional Court.

The date of receipt of documents from the Pension Fund of Russia by the policyholder (representative) is considered to be the date of their placement in the Constitutional Court.

“Delivery Notification” is automatically generated and placed in the KS .

When submitting persucheta information through the CS on the portal of electronic services of the Pension Fund of Russia, to organize a secure remote connection of policyholders (representatives), encrypted transport mechanisms and security certificates used on the portal of electronic services of the Pension Fund of the Russian Federation must be used. Submission of individual (personalized) accounting information for policyholders without establishing a secure remote connection is not permitted.

How to submit online through the Pension Fund website

We’ll help you figure out how to submit your SZV-M electronically via the Internet for free to the Pension Fund and what you need for this. Some companies offer to install paid programs. But it is advisable to use such programs if you submit a set of reports to various government agencies over the same period. If we are talking only about personalized accounting, we recommend using the Pension Fund service - the policyholder’s personal account. To register in it, you will need an electronic digital signature or a personal application to the Pension Fund for a registration card.

An easier way to send SZV-M through the portal is to download one of the special programs on its website: “PU 6 Documents”, “Spu_orb”, “PD SPU”, “PsvRSV”. To provide correct data and avoid penalties, the site provides verification using the CheckPFR and CheckXML programs. These programs can be easily downloaded to a personal computer without entering into any contracts, and all data can be verified before being sent to the Pension Fund. Very convenient: click “Check” and, if the program does not detect any errors, send it calmly. If, as a result of the check, the message “Error” or “Warnings” appears, review the information again - perhaps you missed something or made a typo somewhere. A missing number or letter, an extra space or brackets, Latin letters - all these are errors due to which the program reports that the report has been filled out incorrectly.