Entrepreneurs become entrepreneurs to create their own business, earn big money and finally become independent from their bosses. Entrepreneurs really don’t have bosses, but control over their activities is still carried out, and at a multi-level level. And instead of a call to the carpet and a reprimand with a record of labor, another effective tool is used - individual entrepreneur fines.

What are the penalties for late submission of reports?

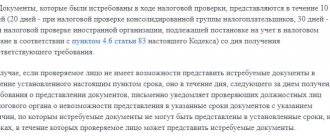

Penalties are provided for failure to submit documents. Responsibility for failure to provide reporting is regulated by the Tax Code and the Code of Administrative Offenses of the Russian Federation. The size of the sanction depends on the type of document not submitted on time. If the submission of information falls on a weekend or holiday, the submission is postponed to the next working day.

Organizations may be subject to various sanctions. The fine may be imposed on the entire company or on an official. For example, the responsible accountant or director may receive an administrative fine for failure to submit an advance report on time. The Federal Tax Service has the right to suspend activities and block the bank account of an enterprise.

Failure to submit reports on time is a serious violation that will entail punishment. But there are conditions that mitigate liability for committing a tax crime. Such cases are regulated by clause 1 of Art. 112 of the Tax Code of the Russian Federation.

Circumstances are recognized as mitigating if:

- committed due to a combination of difficult family or personal circumstances;

- made under duress;

- the individual who violated the law has a difficult financial situation;

- the court or the Federal Tax Service recognized them as such.

If the provision of information falls on holidays or weekends, then the sending of documents is postponed to the next working day. This procedure is regulated by clause 7 of Art. 6.1 of the Tax Code of the Russian Federation.

Let's take a closer look at what fines are provided for violating tax laws in 2022.

Violation of tax rules

An entrepreneur must pay taxes on time and in full. Payment deadlines for different taxation systems are also indicated in our calendar. The fine for non-payment of taxes by individual entrepreneurs under Article 122 of the Tax Code of the Russian Federation is 20% of the amount of unpaid tax.

In addition, an entrepreneur, if he has employees, becomes a tax agent, and therefore must withhold personal income tax from their income and transfer it to the budget. For violation of the deadlines for transferring this tax, a fine is imposed on the individual entrepreneur according to the same rules, i.e. 20% of the amount not transferred.

Fines for late submission of tax returns and DAM

Failure to submit tax returns on time threatens to bring liability not only to the organization, but also to officials.

The declaration is submitted to the Federal Tax Service, along with payment of the appropriate tax, these include:

- annual income tax;

- VAT;

- transport tax;

- property tax;

- excise taxes;

- water tax;

- single tax under the simplified tax system;

- Unified Agricultural Sciences;

- land tax;

- gambling tax.

In some cases, an organization may submit a single simplified declaration.

| Type of punishment | Consequences | Base |

| Fine for the organization | The organization is charged 5% of the amount of tax that is not paid on time. Maximum - 30 percent of this amount, but not less than 1000 rubles. The amount of the fine is calculated for each full or partial month of delay from the day established for filing a declaration or calculating contributions. | Art. 119 NK |

| Responsibility of officials | Warning from 300 rubles to 500 rubles | Art. 15.5 Code of Administrative Offenses |

| Additional consequence | Blocking of the account after 10 working days from the date of submission of the declaration or settlement | subp. 1 clause 3, clause 3.2 art. 76, paragraph 6 of Art. 6.1 NC |

Lack of tax accounting

Entrepreneurs do not keep accounting, but in addition to accounting, there is another accounting – tax. This type of accounting includes not only declarations, but also special books for recording income and expenses, developed for all modes.

Books of income and expenses are tax accounting registers, and for their absence a fine of 10 to 30 thousand rubles is imposed under Article 120 of the Tax Code of the Russian Federation (if failure to keep records did not lead to an understatement of tax). If, during the audit, it turns out that as a result of lack of accounting, the tax payable was underestimated, then the fine will be 40 thousand rubles.

In addition to accounting books and declarations in modes that require confirmation of expenses (OSNO, Unified Agricultural Tax, Simplified Tax System Income minus expenses), it is necessary to correctly draw up primary documents. An error in their execution may result in tax authorities not recognizing the amount of the calculated tax and, accordingly, charging a fine.

If you hire staff or work in a mode that requires confirmation of expenses, we advise you to entrust accounting to 1C:BO specialists. This is much cheaper than hiring an accountant on staff.

Free accounting services from 1C

Penalty for failure to submit tax calculations

Tax calculations include:

- interim profit declaration;

- tax calculation of income paid to a foreign organization;

- certificate 2-NDFL;

- information on the average number of employees.

| Type of punishment | Consequences | Base |

| Fine for the organization | 200 rubles for each document not submitted | clause 1 art. 126 NK |

| Responsibility of officials | from 300 to 500 rubles | Art. 15.6 Code of Administrative Offenses |

| Additional consequence | Inspectors do not have the right to block an account for unsubmitted advance payment calculations | Supreme Court ruling dated March 27, 2017 No. 305-KG16-16245; letters of the Ministry of Finance dated 08/19/2016 No. 03-11-03/2/48777, dated 07/12/2007 No. 03-02-07/1-324 and the Federal Tax Service dated 12/11/2014 No. ED-4-15/25663 |

IMPORTANT!

Late submission of tax calculations is not regulated by Art. 119 of the Tax Code of the Russian Federation, it is impossible to fine an organization under this article.

Penalty for failure to submit 6-NDFL

| Type of punishment | Consequences | Base |

| Fine for the organization | 1000 rubles for each full or partial month, from the date for submitting the 6-NDFL certificate | clause 1.2 art. 126 NK |

| Responsibility of officials | from 300 to 500 rubles | Art. 15.6 Code of Administrative Offenses |

| Additional consequence | Failure to submit a certificate leads to blocking of the bank account if 10 working days have passed from the date of submission of 6-NDFL | clause 3.2 art. 76 NK |

Fine for failure to submit 4 FSS

| Type of punishment | Consequences | Base |

| Fine for the organization | For failure to provide the form, the organization will pay 5% of the amount of the contribution that was not paid on time. The maximum is 30 percent of this amount, but not less than 1,000 rubles. The amount of the fine is calculated for each full or partial month of delay from the day established for filing a declaration or calculating contributions | clause 1 art. 26.30 of the Law of July 24, 1998 No. 125-FZ |

| Responsibility of officials | Warning or fine in the amount of 300 to 500 rubles | Part 2 Art. 15.33 Code of Administrative Offenses |

Conducting activities without a license

Of the licensed areas, only road transportation of passengers, pharmaceutical, medical, educational and private detective activities are available to entrepreneurs. The absence of a license, if it is required, is punishable under Article 14.1 of the Code of Administrative Offenses of the Russian Federation - in the amount of 4 to 5 thousand rubles with possible confiscation of manufactured products, production tools and raw materials.

As for strong alcohol, the sale of which is prohibited by entrepreneurs, there is a special article 14.17.1 in the Administrative Code for this purpose. According to this norm, sanctions for individual entrepreneurs for selling alcohol without a license range from 100 to 200 thousand rubles with mandatory confiscation of alcohol and alcohol-containing products.

An individual entrepreneur is not punished for selling alcohol without a license only if he sells beer, not strong alcohol. At the same time, certain requirements have been established for the sale of beer, which must also be observed.

Confirmation of OKVED in the FSS

To confirm OKVED, you must provide the following documents to the FSS:

- a certificate confirming the main type of economic activity of the policyholder for compulsory insurance against occupational diseases and accidents at work;

- a statement confirming the main type of economic activity of the policyholder for compulsory insurance against occupational diseases and accidents at work;

- explanatory note to the reporting - does not apply to small enterprises and individual entrepreneurs.

| Type of punishment | Consequences | Base |

| Fine for the organization | No | |

| Responsibility of officials | No | |

| Additional consequence | For an unsubmitted document, the FSS sets the tariff that is provided for activities with the highest class of professional risk | clause 13 of the Rules, approved. Government Decree No. 713 dated December 1, 2005 |

Fine for failure to submit a declaration on payment for environmental pollution

| Type of punishment | Consequences | Base |

| Fine for the organization | Late submission of the form, distorted or incorrectly transmitted information - 500 rubles for each insured individual. If an error is made in the SZV-M and SZV-STAZh forms, 5 working days are given for correction from the date of receipt of the protocol from the Pension Fund. The company may be charged from 30 thousand to 50 thousand rubles if the employee is not issued an extract from SZV-M and SZV-STAZH within:

| Art. 17 of the Law of 01.04.1996 No. 27-FZ; clause 38 of the Instructions, approved. by order of the Ministry of Labor dated April 22, 2020 No. 211n, clauses 2 and 4 of art. 11 of the Law of 04/01/1996 No. 27-FZ, part 1 of Art. 5.27 Code of Administrative Offenses |

| Responsibility of officials | Late submission and presentation of distorted data - from 300 to 500 rubles. | Art. 15.33.2 Code of Administrative Offenses No. 90-FZ dated 04/01/2020 |

| Type of punishment | Consequences | Base |

| Fines for the organization | Late submission of the declaration - from 20 thousand to 80 thousand rubles | Art. 8.5 Code of Administrative Offenses |

| Responsibility of officials | Late submission of the declaration - from 3 thousand to 6 thousand rubles |

Failure to use a cash register

After the changes on the procedure for using cash registers came into force, there are very few situations left when the absence of a cash register is allowed. They are listed in Article 2 of Law No. 54-FZ of May 22, 2003. The sanction for the absence of a cash register is established by Article 14.5 of the Code of Administrative Offenses of the Russian Federation. This is from ¼ to ½ of the sale amount, but not less than 10 thousand rubles.

For example, if a sale in the amount of 30 thousand rubles is recorded, then the fine may be 15 thousand rubles. And if the purchase was a penny, 100 rubles worth, then they will still charge 10 thousand rubles. That is, in this case, the fine for the absence of an online cash register for individual entrepreneurs will be 100 times greater than the sale amount!

Fines for failure to submit financial statements

| Type of punishment | Consequences | Base |

| Fines for the organization | The company will pay 200 rubles for each report not submitted on time. Organizations that need to submit reports to the GIR BO - from 3,000 to 5,000 rubles | clause 1 art. 126 NK art. 19.7 Code of Administrative Offenses |

| Responsibility of officials | From 300 to 500 rubles for each document not submitted | Art. 15.6 Code of Administrative Offenses Art. 19.7 Code of Administrative Offenses |

| Additional consequence | The Federal Tax Service does not have the right to block a bank account for an unsubmitted accounting report | letter of the Ministry of Finance dated July 4, 2013 No. 03-02-07/1/25590; letter of the Federal Tax Service dated November 16, 2012 No. AS-4-2/19309; letter of the Ministry of Finance dated May 23, 2013 No. 03-02-07/2/18285 |

To ensure that tax reporting is submitted to government agencies on time and without errors, we recommend using Astral Report 5.0. Using the service, documents are sent from any PC and from anywhere in the world with Internet access.

Navigation menu

Marking

- Who is involved in labeling

- Working with Chestny ZNAK

- Fines

EDS bearers

- JaCarta authentication server

- JaCarta Management System

- JaCarta SecurLogon

- Jacarta Webclient

- Drivers for JaCarta

- How to format JaCarta

- How to unblock JaCarta

- How to install a JaCarta certificate

- CryptoPro does not see the JaCarta key

- Rutoken control panel

- Pin code for JaCarta

- Working with JaCarta

- Comparison of JaCarta and Rutoken

Fiscal data operator

- If you increase the time offline OFD

- How to conclude an agreement with Astral.OFD

- How to view revenue in Astral.OFD

- How to check communication with OFD

- The cash register does not send checks to the OFD, what should I do?

- Data is not transferred to the office, what to do?

- Sending an electronic receipt to a client

- OFD reports

- OFD does not answer what to do

- OFD errors

- Repeated OFD check

- OFD details

- Correction check or refund

Electronic trading

- Advancement of contracts under 44-FZ and 223-FZ

- Anti-dumping measures under 223-FZ

- Auction list according to 44-FZ and 223-FZ

- Declaration of conformity with procurement requirements

- Splitting of purchases under 44-FZ and 223-FZ

- Conclusion of a contract under 44-FZ

- Purchases from SMP and SONKO under 44-FZ

- Purchasing commission under 223-FZ

- Request for quotation

- Request for clarification on 44-FZ and 223-FZ

- Government Contract ID

- How is collective participation in procurement carried out under Federal Law 223?

- How to amend and terminate a contract under Federal Law 223

- How does a change of customer take place according to 44-FZ?

- How are penalties calculated under 44-FZ and 223-FZ?

- How to draw up a protocol of disagreements under 44-FZ

- What is the payment period under Federal Law 223

- Procurement Commission

- Life cycle contract 44-FZ in 2022

- Evaluation criteria for open competition 44-FZ

- Leasing under 223-FZ

- National treatment in government procurement

- Ensuring warranty obligations under 44-FZ

- Securing the application. Special account and bank guarantee

- Public discussion of procurement under 44-FZ

- Restriction of competition under 223-FZ

- Description of the procurement object under 44-FZ and 223-FZ

- Refusal to participate in the tender

- Rebidding: forms and procedure

- Procurement plan under 223-FZ

- Planning of purchases according to 44-FZ

- Confirmation of good faith according to 44-FZ

- Acceptance of goods, works and services under 44-FZ

- Customer acceptance committee according to 44-FZ

- Conducting an auction under 44-FZ: step-by-step instructions

- Conducting a two-stage competition under 44-FZ

- Carrying out claims work under 44-FZ

- Checking a bank guarantee

- Prosecutor's office and verification of customers under 44-FZ and 223-FZ

- Direct contract under 44-FZ and its features

- Work on ETP for any business

- Decoding IKZ according to 44 Federal Laws

- Register of contracts under 44-FZ

- Certificate of origin of goods ST-1 in government procurement

- Composition of the application under 223-FZ

- Methods of procurement and justification for them

- Deadlines for concluding and amending the contract under Federal Law 223

- Contract payment terms under 44 Federal Laws

- Terms of procurement under 44-FZ

- Tender guarantee under 44-FZ

- Tender outsourcing

- Terms of reference for the tender

- Improved product characteristics under 44-FZ

- What is NMCC: calculation of the initial maximum contract price

- Expertise under 44-FZ

- Electronic request for quotations under 44-FZ

Electronic document management

- Security of electronic document management

- Laws on electronic document management of the Russian Federation

- How to specify electronic document management in a contract

- How to log in to EDF

- How to upload documents to EDF

- How to negotiate with counterparties on the transition to EDI

- How to connect to EDF

- How to check a counterparty’s EDI

- How to work with electronic documents: compiling instructions

- How to register documents in EDF

- How to approve documents in EDF

- How to delete documents in EDF

- How to find out the ID of an EDF participant

- General questions: what is electronic document management and how does it work?

- Organization of electronic document management. Registration in the EIS

- Features of the EDF regulations

- Transfer of documents via EDI

- Transition to EDI: where to start

- Regulations on electronic document management: why is it needed?

- Agreement on electronic document management

- Electronic document format

- EDI with counterparties

- Stages of implementation of electronic document management in an organization

Alteration

- Application on form P24001

- How to amend a patent

- How to change OKVED for individual entrepreneurs

- How can an individual entrepreneur change the tax system?

- How to re-register an individual entrepreneur

- Letter about changing the details of an individual entrepreneur

- What should an individual entrepreneur do when changing registration?

- What should an individual entrepreneur do when changing his last name?

Electronic Reporting

- Reporting to the Social Insurance Fund

4-FSS in 2022: completion and submission deadlines

- How to fill out table 5 in the 4-FSS report

- Zero report to the FSS

- Error 508 in the 4-FSS report

- Fines for failure to submit reports to the Social Insurance Fund

- How to avoid a fine for late submission of SZV-M

- Statistical reporting of small enterprises

- All about personal income tax in 2022

- LLC annual report

- Should an individual entrepreneur submit a balance sheet?

- Analysis of the enterprise balance sheet

Electronic signature

- General issues

Extract from the Unified State Register of Real Estate

- Extract from the Unified State Register of Legal Entities

- Application for obtaining digital signature

- What does an electronic signature look like?

- How to register in the EIS

- How does an electronic signature work?

- How to make an electronic signature for trading

- EDS root certificate

- Certificate renewal

- ES key certificate

- Creating an application for an electronic signature

- Certificate validity period

- Structure of digital signature: what does an electronic signature consist of?

- What to do if your digital signature is stolen

- What is an EDS certificate

- What is digital signature

- Time stamp in electronic signature

- Electronic signature for EGAIS

- Digital signature carrier: Token

- Replacing an electronic signature

- CriptoPro CSP for Windows 10

- PIN codes of Rutoken digital signature

You have questions?

Products by direction

1C-Reporting Service for transmitting reports to regulatory authorities from 1C:Enterprise programs

Astral Report 4.5 Program for sending reports and organizing document flow with counterparties

Astral Report 5.0 Online service for transmitting reports to regulatory authorities