If anyone is interested in reading horror stories in full, you can open Chapters 15 and 16 of the Tax Code of the Russian Federation, and also look through the Code of Administrative Offenses. It describes in detail who is being held accountable and for what, and what the cost of playing hide and seek with the state is.

We will focus on the most common fines for individual entrepreneurs for failure to submit reports.

Did you get fined by the tax authorities?

We’ll fix everything: we’ll do a reconciliation, smooth out the damage, and prevent it from happening in the future!

Submit your application

Failure to file a tax return

This includes all declarations of entrepreneurs under different regimes - OSNO, simplified tax system, UTII, Unified Agricultural Tax, as well as calculations of insurance premiums submitted by employers.

If you do not submit any of this on time, be prepared to pay 5% of the tax on your return for each month that is overdue, even if it is incomplete. Maximum – 30%, minimum – 1,000 rubles. The minimum is worth paying attention to for those who were supposed to submit and did not submit a zero declaration.

The same sanctions are provided for failure to submit calculations for insurance premiums.

A fine for failure to submit reports is not everything.

10 days after the delay, the Federal Tax Service has the right to block the current account and most likely it will use this right.

To free your money from seizure, you will first need to make amends, that is, send a declaration, and then go to the Federal Tax Service inspectorate with an application to unblock the account. And until all this is done, you will not be able to use the money in your accounts, and this paralyzes your work.

And that is not all. The Code of Administrative Offenses also provides for liability for those who ignored the obligation to submit a declaration - from 300 to 500 rubles.

Tax liability for late filing

According to Art. 119 of the Tax Code of the Russian Federation, the late fee is calculated as a percentage of the amount of tax not paid on time, reflected in the “late” declaration. Its value is 5% of this amount for each full or partial month from the day established for submitting the declaration, but not less than 1000 rubles. and no more than 30% of the amount.

EXAMPLE of calculating the amount of a fine from ConsultantPlus: The organization filed a return for 2022 late - April 6, 2022 and paid the tax on the same day. The deadline for submitting the declaration is March 29, 2022. The additional tax on the declaration is 40,000 rubles. Of these, 6,000 rubles go to the federal budget, and 34,000 rubles go to the regional budget. Thus, the delay amounted to: one incomplete month - from March 30 to April 6. The amount of the fine will be: ... Read the continuation of the example in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

When calculating the fine, the unpaid amount of tax must be determined on the expiration date of the tax transfer.

Minimum fine of 1000 rubles. can also be presented if there is no arrears or the amount of tax payable, but the declaration is submitted late (paragraph 3, paragraph 18 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03- 02-08/47033, Federal Tax Service of Russia dated 08/22/2014 No. SA-4-7/16692).

See also: “Amounts of fines for failure to submit tax reports.”

IMPORTANT! Fined under Art. 119 of the Tax Code of the Russian Federation can only be used for a declaration based on the results of the tax period. If a tax requires the submission of interim reporting for reporting periods (as, for example, for income tax), for late reporting it is not Article 119 that is applied, but Art. 126 of the Tax Code of the Russian Federation. That is, the fine is 200 rubles. (Clause 17 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692). But for the intermediate DAM, Art. should be applied. 119 of the Tax Code of the Russian Federation. This is what the Federal Tax Service thinks (see decision dated August 19, 2019 No. SA-4-9/ [email protected] ).

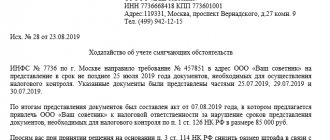

Taxpayers have the right to apply for a reduction in the amount of penalties. To do this, you need to submit an application to the Federal Tax Service if the tax authorities issued a fine. Or file a petition in court if sanctions are issued by the Pension Fund.

ConsultantPlus experts told us how to draw up a petition to reduce penalties. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Non-payment or incomplete payment of taxes

This includes all taxes, workers' compensation and sales tax. The fine is quite large - 20% of the unpaid amount. If Federal Tax Service employees can prove that you did not pay intentionally, then it will increase to 40%. Confirmation in Art. 122 NK.

There are also penalties that begin to “drip” from the day of delay until the day preceding the day of payment of the debt. They are calculated based on a rate of 1/300 of the Central Bank refinancing rate.

Simply put, to calculate penalties for one day, you need to divide the refinancing rate by 300 and multiply by the amount of the debt. The total payment will depend on the number of days overdue.

If you do not pay the tax on time, then you will face both a fine and penalties, and if you make advance payments, then only penalties.

Another trouble for non-payment of taxes is the seizure of the current account for the amount of the debt. The tax authorities will give such an order to the bank if you do not comply with the requirement to pay taxes within 8 days.

Failure to pay on an especially large scale is subject to the Criminal Code and the threat of imprisonment. There we are talking about millions, so this rarely concerns individual entrepreneurs, but we still voiced it. Just in case.

Punishment for failure to submit zero reports

Is there a penalty if an individual entrepreneur does not submit zero reporting under the simplified tax regime? Yes, in this case the fine for failure to submit an individual entrepreneur’s declaration will be imposed in a minimum amount of 1000 rubles. The absence of activity and income does not exempt the taxpayer from submitting reporting documents to the Federal Tax Service as a separate obligation under the Tax Code of the Russian Federation.

This responsibility is provided for all taxpayers: the fine of an individual entrepreneur for failure to submit a declaration under the simplified tax system is similar for a legal entity using a simplified taxation system.

Gross violations of accounting rules

Serious Article 120 of the Tax Code of the Russian Federation with serious sanctions. What exactly is meant by gross violations is listed in the same article (lack of primary documents, etc.).

If such facts are discovered in one tax period, they will impose a fine of 10 thousand rubles, and if more than one period, then 30 thousand. Well, if these violations also lead to an underestimation of the taxable base, then you will have to fork out 20 percent of the unpaid tax or insurance premiums.

But don’t be happy if 20% of your arrears is only a few hundred, because the minimum you will pay is 40 thousand.

The Code of Administrative Offenses prescribes a penalty of 5 to 10 thousand rubles for such violations, and up to 20 thousand for repeated violations.

What tax penalties are provided for individual entrepreneurs upon registration?

To open your own business, you first need to register as an individual entrepreneur. Citizens running their own business without registering as an individual entrepreneur face a fine of five hundred to two thousand rubles. The law does not say how often such sanctions can be applied, so you should not think that by paying the required amount once, you will be able to continue illegal activities.

Registration of an individual entrepreneur must be carried out in accordance with all the rules, because for failure to comply with them you will be responsible with your own funds and property. Thus, for violations of this procedure, the following tax fines are provided for individual entrepreneurs:

- For providing false information to the registration authority within an unspecified time period - 5 thousand rubles. If such actions are intentional, a ban on business activity may be imposed for up to three years.

- For late notification of the tax authority about the opening or closing of a current account - 5 thousand rubles.

- For failure to notify the FSS and the Pension Fund of the Russian Federation about the use of hired labor within a month: in case of minor delay (up to 90 days) - 5 thousand rubles, in case of significant delay (over 90 days) - 30 thousand rubles.

- For violation of the deadlines for registration with the tax service, for example, changing the address of residence and, as a result, the need to change the Federal Tax Service department, as well as failure to notify about activities under UTII in another region - 10 thousand rubles.

Types of tax returns and deadlines for filing them

The classification of documents submitted by entrepreneurs to the territorial inspectorates of the Federal Tax Service of the Russian Federation is based on several criteria. The main parameter is the content:

- Zero reports. Declarations are submitted in the absence of income from commercial activities. By submitting the established forms to the regulatory authority, the businessman maintains his status and protects himself from fines.

- Single simplified declaration. EUND is a legal alternative to numerous zero reports. The form, approved by order of the Ministry of Finance of Russia No. 62n dated July 10, 2007, is filled out when business operations are completely stopped. The declaration is submitted quarterly within 20 days after the end of the next period.

- Standard tax reports. If the business is active, you will need to send information to the Federal Tax Service according to the rules of the selected taxation system. Entrepreneurs in the general regime must regularly fill out VAT and personal income tax returns. Payers of the simplified tax system and unified agricultural tax annually submit reports on their taxes and maintain registers of all receipts. Merchants on UTII send declarations quarterly. Only patent holders are completely exempt from formalities.

The legislator divides declarations according to the deadlines for submission. Thus, documents can be annual, monthly and quarterly. Based on their forms, they are classified into paper and electronic. The virtual format of interaction is being introduced gradually. Thus, in 2022, VAT payers completely switched to digital technologies.

A foreign citizen without a patent was hired

If an individual entrepreneur employs a citizen of another country who does not have permission to work in the Russian Federation (residence permit or patent), this entails serious consequences.

The fine for illegally hiring a foreign citizen will be (Article 18.15 of the Code of the Russian Federation on Administrative Offences):

- from 25,000 to 50,000 rubles;

- in Moscow and the Moscow region, St. Petersburg and the Leningrad region - from 35,000 to 70,000 rubles.

If an employee from another country has a work permit in the Russian Federation, this is still not enough. When employing such a person, the individual entrepreneur is obliged to inform the FMS within three days from the date of signing that he has entered into an employment contract with a foreign citizen.

The fine imposed for failure to notify the FMS of the conclusion of an employment contract (each) with a citizen of another country (former article):

- From 35,000 to 50,000 rubles.

- In Moscow and the Moscow region, St. Petersburg and the Leningrad region - from 35,000 to 70,000 rubles.

Practical examples.

- An individual entrepreneur from St. Petersburg hired two employees with Turkish citizenship who did not have permits. He did not send the required notification to the FMS. This entrepreneur must pay a fine:

- For illegal employment of two foreign citizens - from 70 to 140 thousand rubles.

- For failure to notify the FMS - from 70 to 140 thousand rubles.

- An individual entrepreneur from Yekaterinburg entered into an employment contract with a citizen of Moldova. His patent to work in the Russian Federation was issued as expected. However, the entrepreneur forgot to notify the FMS about concluding an employment contract with a foreigner. A fine of 25 to 50 thousand rubles will be assessed.

Activities are carried out without a license

There is a list of labor areas that are subject to licensing. These include educational activities, maintenance of medical equipment, production of medicines, communication services, replication of software (if it does not belong to the seller) and more.

An individual entrepreneur conducting activities of this kind in the absence of an issued license risks receiving a fine in accordance with paragraph 2 of Art.

14.1 of the Code of the Russian Federation on Administrative Offences, which will amount to 4000–5000 rubles, as well as confiscation of products and means of production. Get a savings estimate

Recommendations from experts

Representatives of the Federal Tax Service of Russia in information letters repeatedly reminded entrepreneurs of the need to submit reports. Declarations should be sent to the inspectorates even if operations are completely stopped and there is no commercial income. Otherwise, violators face fines.

If it is not possible to run a business, lawyers recommend officially liquidating the individual entrepreneur. The legislator does not limit citizens in the number of registrations. You can resume activity at any time. Freezing your own business will not free you from formal responsibilities. Late submission of declarations will result in sanctions.