Export deduction rules for 2021 - 2022

From the 3rd quarter of 2022, VAT returns will be submitted using a new form.

For a sample of filling out a VAT return for the 4th quarter of 2022, see ConsultantPlus for free by signing up for trial access to the system.

Changes to the declaration form were made in connection with the introduction of a goods traceability system. Let's find out whether these changes affected section 4.

Currently (from July 1, 2016), the deduction of VAT on exports depends not only on the presence of documents confirming this activity, but also on what type of goods were shipped abroad:

- For non-commodity goods purchased after 01.07.2016, there is the right to deduct tax during the shipment period (paragraph 3, paragraph 3, article 172 of the Tax Code of the Russian Federation), i.e., to receive it, it is not necessary to wait for the collection of the full set of documents provided for in art. 165 Tax Code of the Russian Federation. Such deductions will not be shown in section 4. They should be reflected in section 3 (letter of the Federal Tax Service of Russia dated October 31, 2017 No. SD-4-3/ [email protected] ).

- For raw materials shipped for export, the deduction procedure has not changed; you can still claim it only after receiving the last document confirming the fact of export from the Russian Federation. The list of raw materials is determined by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466.

In the VAT return for taxes related to the export of raw materials that require confirmation, 3 special sections must be completed:

- 4 - for transactions with a confirmed right to apply a 0% rate;

- 5 - for transactions for which documents were collected earlier, but the right to deduction arose only now;

- 6 - for transactions that were found to have an incomplete package of supporting documents at the time of expiration of the period allotted for their collection.

A description of possible errors in the declaration can be found here .

page 030 Export of raw materials confirmed 180 days

Input VAT on raw materials, works and services can be deducted after confirmation (or non-confirmation) of the 0% rate. Wherein:

- separate accounting of incoming VAT is maintained;

- input VAT accepted for deduction on such goods is reflected in the VAT return: in Section 4 - if the documents are collected within 180 calendar days,

- in Section 6 (updated declaration) - if the documents are not collected within the period of 180 calendar days,

- in Section 5 - if the right to deduction arose after confirmation or non-confirmation of the 0% rate.

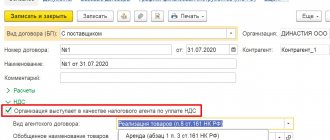

Changes in 1C regarding deductions:

- Accepted for deduction when purchasing non-commodity goods for export;

- Blocked until confirmation 0% - accounting for input VAT only for transactions at a rate of 0% for which confirmation is required (export of raw materials, works, services);

- Distributed – maintaining separate accounting of incoming VAT for general expenses. The share of input VAT related to the 0% rate in the VAT Distribution and when it is carried out, the input VAT also acquires the methods Accepted for deduction and Blocked until 0% is confirmed.

VAT deductible on export:

- when the rate is confirmed as 0% - accounting for input VAT only for export transactions is carried out on account 19 using the method Blocked until confirmation of 0% ;

- as a result of separate accounting of VAT on total expenses - the share of incoming VAT related to exports is determined in the VAT Distribution and when it is carried out, the incoming VAT also acquires the method Blocked until confirmation 0% .

It is reflected in Section 4, page 030 and Section 8 in the usual manner, as are deductions in the domestic market (column 16 of the Purchase Book).

page 010 Operation type code:

- code “01” Shipment or purchase of goods, works, services, rights, incl. transactions taxed at a rate of 0%;

- code “25” Registration of invoices in the purchase book in relation to tax amounts previously restored when performing transactions taxed at a rate of 0%. In the purchase book in gr. 9 our organization must be indicated, not the supplier (Letter of the Federal Tax Service dated September 20, 2016 N SD-4-3/17657).

Document Formation of purchase ledger entries – checkbox Submitted for deduction of VAT 0% .

Cost of purchases according to the invoice (column 15 of the Purchase Book):

- the total amount of the invoice indicated in gr. 9 invoices on the “Total payable” page (including VAT).

p. 180 Amount of tax accepted for deduction (column 16 of the Purchase Book):

- amount of VAT to be deducted.

With separate accounting, as a rule, VAT will be partially deducted. Verification algorithm in the Federal Tax Service: “VAT charged by the seller may exceed the VAT declared by the buyer for deduction.”

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

When to fill out section 4 and when to fill out section 6 of the VAT declaration

Section 4 is completed if, within 180 days from the date of shipment, they managed to collect a complete package of documents confirming the export. Information about the amount of the tax deduction and the volume of the base with a 0% rate to which it relates is included in the declaration for the period in which the documents are collected, regardless of whether or not this day coincides with the end of the tax period (letters from the Ministry of Finance dated 02/15/2013 No. 03-07-08/4169, dated 02/16/2012 No. 03-07-08/41).

If the deadline for confirming the export has expired and all the necessary supporting documents have not been collected, the taxpayer must fill out section 6 of the VAT return, charging tax payable at the usual rate on the volume of shipment.

NOTE! In this case, the tax is calculated for the period in which the export shipment occurred. Accordingly, section 6 is filled in in the updated declaration for the shipment period.

When collecting late supporting documents in the next reporting period, the taxpayer has the opportunity to reflect these transactions, previously included in section 6, already in section 4 of the current tax return. At the same time, the right to a refund of additional VAT accrued and paid to the budget appears. Its amount is reflected in line 040 of section 4.

All documents were collected on time: fill out section 4

You fill out Section 4 for the quarter in which you collected a complete set of documents confirming export. In it you reflect the proceeds from the sale of goods for export and claim a deduction. At the same time, even if you collect documents earlier, you can take your time and not reflect export transactions in the declaration until the end of the period - 180 days (Letter of the Ministry of Finance of Russia dated 02/15/2010 N 03-07-08/38). For example, if there are a lot of documents and you do not have time to prepare them for submission to the tax office.

Note Keep in mind that the amounts of input VAT on goods (works, services) that are used for export transactions must be taken into account separately from the input VAT on transactions subject to VAT at other rates (for example, you can enter separate sub-accounts in accounting or create special tax registers) (Clause 1 of Article 153, paragraph 6 of Article 166, paragraph 1 of Article 173, paragraph 3 of Article 172 of the Tax Code of the Russian Federation). The procedure for maintaining separate accounting is not established by the Tax Code of the Russian Federation, so you determine it yourself and reflect it in your accounting policy (Clause 10 of Article 165 of the Tax Code of the Russian Federation; Resolution of the Federal Antimonopoly Service of the Moscow Region dated April 2, 2010 N KA-A40/2846-10).

Documents confirming the sale of goods for export must be submitted simultaneously with the VAT declaration (Clause 10 of Article 165 of the Tax Code of the Russian Federation). Let's consider possible situations. Situation 1. The deadline for submitting documents has expired earlier than the deadline for submitting the declaration . For example, the last day for collecting documents is 03/28/2011. And by this moment you have collected all the documents. But you can submit a declaration for the first quarter only after 03/31/2011. Is it possible to submit documents along with the declaration in such a situation? There are court decisions that say that the zero rate can be confirmed only within 180 days and the submission of documents cannot be delayed (Resolution of the Federal Antimonopoly Service ZSO dated July 16, 2008 N F04-4348/2008(8866-A27-14)). That is, you need to either submit documents within 180 days, or charge tax payable to the budget on the 181st day. At the same time, other courts and regulatory authorities are of the opinion that documents must be submitted along with the declaration (Letters of the Ministry of Finance of Russia dated 06/03/2008 N 03-07-08/137, dated 04/01/2008 N 03-07-08/81). We decided to clarify the position of the Ministry of Finance on this issue.

From authoritative sources Anna Nikolaevna Lozovaya, Advisor to the Indirect Taxes Department of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia “Since the tax base for export transactions is determined on the last day of the quarter in which the full set of documents is collected (Clause 9 of Article 167 of the Tax Code of the Russian Federation), then you can claim the right to apply a 0% rate only after the end of this quarter by submitting a VAT return with the relevant sections completed (Article 163 of the Tax Code of the Russian Federation). And since the taxpayer cannot submit a declaration to the tax authority earlier than the corresponding tax period has expired, the documents are submitted simultaneously with the VAT declaration (Clause 10 of Article 165 of the Tax Code of the Russian Federation), that is, before the 20th day of the month following the expired quarter.” .

Situation 2. We collected documents after the end of the quarter, but before submitting the declaration . For example, export proceeds arrived to you on 04/04/2011. All other documents have already been collected. Many organizations believe that since they have not yet submitted a declaration, they can confirm the 0% rate in the declaration for the first quarter. However, this is not true. The extract confirming the receipt of revenue dates back to the second quarter, and at the time of determining the tax base (03/31/2011) you did not yet have it, and therefore, you did not have a complete package of documents either. So in this situation, exports can be shown no earlier than in the declaration for the second quarter of 2011. Situation 3. Documents were submitted after submitting the declaration, but before the expiration of 180 days . For example, on 04/20/2011 you submitted a declaration for the first quarter of 2011, in which you declared export operations, but did not have time to prepare the documents and submitted them only on 04/25/2011. Or another scenario is possible: you submitted some of the documents with the declaration, and the rest were reported later. However, 180 days have not yet expired. In such a situation, tax inspectors will most likely decide that you did not confirm the zero rate because you did not submit documents at the same time as the declaration. Thus, the tax office will deny you the application of a 0% rate and, accordingly, export tax deductions. And if, as a result, the final amount on the declaration turns out to be “payable,” you may also be charged a fine and penalties for the amount of the underpayment. However, if you submitted documents within 180 days and before the end of the desk audit, the courts will most likely side with you (Resolutions of the FAS SZO dated 09.22.2010 in case N A42-4038/2009; FAS VSO dated 02.02.2010 in case N A74-2766/2009). In order not to argue with the inspectors, you can submit a clarification and attach all the necessary documents to it. The main thing is that at the time of its submission the 180-day period has not yet been missed. Let's look at an example of the procedure for filling out section. 4.

Example 1. The procedure for confirming a zero tax rate in a situation where documents are collected on time

Condition

Organization A entered into a contract to supply goods to Poland. According to the contract, the price of the goods is 15,000 euros. Title to the goods passes at the time of shipment. Organization A purchased goods supplied to Poland on September 24, 2010 from organization B for 413,000 rubles. (including VAT - 63,000 rubles). The goods are paid for and the invoice is received on the same day. On September 28, 2010, the goods passed customs clearance (the o is stamped on the customs declaration). The foreign company paid for the goods on 10/01/2010. The exchange rate of the Central Bank of the Russian Federation was: - as of September 28, 2010 (shipment date) - 41.2220 rubles/euro; — as of October 1, 2010 (date of payment) — 41.4392 rubles/euro. All necessary documents were collected on February 11, 2011.

Solution

The procedure for organization A will be as follows. Step 1. 09/24/2010 we register the invoice of organization B in the journal of received invoices. Step 2. 09/28/2010 we issue an invoice for the cost of goods sold for export with a tax rate of 0%, and register it in the journal of issued invoices (Clause 3 of Article 168 of the Tax Code of the Russian Federation; clauses 1, 2 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved by Decree of the Government of the Russian Federation dated 02.12 .2000 N 914). We can indicate the amounts in the invoice in foreign currency (Clause 7, Article 169 of the Tax Code of the Russian Federation). Step 3. Determine the deadline for collecting documents. Since the goods were placed under the customs export procedure on September 28, 2010, we can collect documents confirming the legality of applying the 0% rate until March 28, 2011 inclusive. Step 4. The tax base must be determined based on the results of the first quarter of 2011 (Clause 9 of Article 167 of the Tax Code of the Russian Federation). Therefore, on March 31, 2011, we register in the sales book the invoice that we compiled earlier (Clause 17 of the Rules for maintaining the purchase book and the sales book). At the same time, in column 7 of the sales book we reflect the amount of 621,588 rubles. (15,000 euros x 41.4392 rubles/euro (euro exchange rate on the date of payment)), since for the purpose of calculating VAT, foreign currency earnings received from a foreign buyer are recalculated into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of payment for shipped goods (Clause 3 of Article 153 Tax Code of the Russian Federation). Step 5. VAT deductions for export transactions can be declared in the same quarter when all documents are collected (Clause 3 of Article 172 of the Tax Code of the Russian Federation). Therefore, on March 31, 2011, we register in the purchase book an invoice received from organization B in the amount of 413,000 rubles, including VAT - 63,000 rubles. Step 6. Fill out section. 4 VAT returns for the first quarter of 2011

Step 7. We submit the declaration to the Federal Tax Service no later than April 20, 2011 (Clause 5 of Article 174 of the Tax Code of the Russian Federation) along with a full package of documents confirming the 0% rate (Clause 10 of Article 165 of the Tax Code of the Russian Federation). The accounting entries will include the following entries.

| Contents of operation | Dt | CT | Sum |

| As of the date of purchase of the goods (09/24/2010) | |||

| The purchased goods have been capitalized | 41 "Products" | 60 “Settlements with suppliers and contractors” | 350 000 |

| Input VAT included | 19 “VAT on acquired assets”, subaccount “VAT on unconfirmed exports” | 60 “Settlements with suppliers and contractors” | 63 000 |

| As of the date of sale of goods for export (09/28/2010) | |||

| Sales of goods for export are reflected (15,000 euros x 41.2220 rubles/euro) | 62 “Settlements with buyers and customers” | 90 “Sales”, subaccount 1 “Revenue” | 618 330 |

| The value of the exported goods is determined on the date of transfer of ownership of the goods. In our example, this is the day the goods are shipped | |||

| The actual cost of goods sold is written off | 90 “Sales”, subaccount 2 “Cost of sales” | 41 "Products" | 350 000 |

| On the date of receipt of payment from a foreigner (01.10.2010) | |||

| Payment received from a foreign buyer (15,000 euros x 41.4392 rubles/euro) | 52 “Currency accounts” | 62 “Settlements with buyers and customers” | 621 588 |

| A positive exchange rate difference is reflected (RUB 621,588 - RUB 618,330) | 62 “Settlements with buyers and customers” | 91 “Other income and expenses”, subaccount 1 “Other income” | 3 258 |

| As of the date of determination of the tax base for export VAT (03/31/2011) | |||

| Accepted for deduction of input VAT | 68 “Calculations for taxes and fees”, subaccount “VAT” | 19 “VAT on acquired assets”, subaccount “VAT on unconfirmed exports” | 63 000 |

When to fill out section 5 of the VAT return

If the taxpayer has previously documented the validity of using a zero value added tax rate, but the right to apply VAT deductions for these transactions arose only in the current period, Section 5 of the VAT return is completed.

At the same time, it is no longer necessary to document the right to apply a 0% rate (clause 1 of Article 164 of the Tax Code of the Russian Federation).

ConsultantPlus experts provided a line-by-line algorithm for filling out the VAT return for the 4th quarter of 2021. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

How to avoid tax consequences for errors in your VAT return

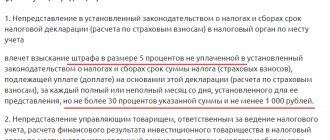

Please note that the consequences for mistakes made in the VAT return depend on:

- deadline for filing an updated VAT return;

- the one who discovered the violation;

- time of payment of tax arrears and penalties for late transfer of VAT to the budget.

If an updated VAT return is submitted during the period when the deadline for filing the reporting declaration has not yet expired, then it is considered not updated, but filed on time (clause 2 of Article 81 of the Tax Code of the Russian Federation).

If a clarifying return is submitted after the end of the period allotted for filing the report, but before the end of the tax payment, then the taxpayer can avoid liability if this error was not discovered earlier by the tax authority.

You can avoid being held liable when filing an updated VAT return after the end of the tax payment period if:

- before filing such an amended declaration, the arrears of tax and penalties on the amended VAT declaration were paid;

- the tax authority did not detect this error if an audit was carried out before filing an updated VAT return.

In this case, the payment order for additional payment of VAT on the updated declaration is drawn up in the usual form.

The payment slip should indicate the period for which the additional payment is made and the type of payment corresponding to the repayment of the debt (ZP instead of TP). In the case of filing an updated VAT return and paying arrears, but not paying penalties, a fine is imposed on the taxpayer (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 26, 2011 No. 11185/10). The tax inspectorate may schedule a second on-site audit when the taxpayer submits an updated VAT return that reduces the amount of VAT after completing the previous on-site audit and drawing up a report on its results (subclause 2, clause 10, article 89 of the Tax Code of the Russian Federation, Letter from the Ministry of Finance of Russia dated December 21, 2009 No. 03-02-07/2-209 and Resolution of the Presidium of the Supreme Arbitration Court dated March 16, 2010 No. 8163/09).

In relation to taxpayers whose control is carried out in the form of tax monitoring, when they submit an updated VAT return with a reduction in the amount of tax payable, an on-site inspection may also be assigned (subclause 4, clause 5.1, article 89 of the Tax Code of the Russian Federation).

Thus:

- the taxpayer submits an updated VAT return if errors are discovered after the end of the tax period, which led to a decrease (or increase) in the tax amount;

- the updated VAT return is drawn up on the form that was in effect in the adjusted period and submitted to the Federal Tax Service in electronic format;

- if, as a result of correcting an error, a tax arrears have arisen, then it must be repaid along with the payment of penalties until the time of filing an updated VAT return;

- If, when submitting an updated VAT return, an overpayment of tax occurs, the possibility of a desk or field audit cannot be ruled out.

Rules for filling out sections 4–6 of the declaration

How to fill out section 4 of the VAT return? In section 4 of the declaration, the codes of transactions carried out using a 0% rate must be indicated line by line, and for each code - the tax base, the amount of deductions corresponding to it, as well as the amount of tax accepted for deduction with a delay, and the amount of tax previously accepted for deduction, subject to restoration. Moreover, the set of these 5 lines is repeated exactly as many times as required, depending on the number of types of operations.

This section also contains blocks of information:

- for the return of goods (lines 060–080) with information about the transaction code, the size of the tax base and the amount of tax for recovery;

- adjustment of the tax amount due to a change in the sales price (lines 090–110), in which the transaction code and data on the adjustment of the tax base when the price increases/decrease is entered.

Lines 120 and 130 reflect the amount of VAT to be reimbursed/paid based on the results of section 4.

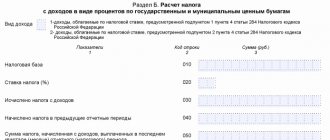

Section 5 states:

- confirmed tax bases and related deductions with a breakdown of this data by transaction codes - in lines 030–050;

- undocumented bases and deductions on them - in lines 060, 070;

- the totals generated according to the section data are in lines 070, 080.

In section 6, regarding the calculation of VAT on transactions with an unconfirmed zero rate, the information is divided into groups of lines 010–040 with information about the transaction code, the size of the tax base, the amount of VAT charged and applicable deductions. The total lines 050, 060 indicate the amounts of calculated tax and deductions. Lines 070–100 display information on goods return transactions, and lines 110–150 display information about tax base adjustments due to changes in product prices. The final lines for the section - 160 and 170 - determine the amount of VAT payable or refundable, respectively.

You can see an example of filling out section 4 of the VAT return of the new form for free in K+ by clicking on the picture below and getting trial access to the system:

To learn how to organize VAT accounting when exporting, read the article “How is separate VAT accounting carried out when exporting?” .

Registration

Using the initial data, we will consider how to fill out the VAT return for the fourth quarter.

The title page of the declaration is drawn up by everyone, regardless of which sections will be presented. The procedure for filling out the title page of the declaration is given in the section “Payment and reporting” → subsection “VAT Declaration” → situation “Cover page”.

Let's consider filling out section 4 of the declaration.

Line 020 for each transaction code reflects the tax base for the reporting period. In our case, using transaction code 1011410, show the proceeds from the sale of goods to Germany. Since the goods were shipped in the first quarter, revenue received in euros must be converted into rubles at the rate prevailing on the date of shipment, that is, on October 14. It will be 2,310,000 rubles (30,000 euros × 77 rubles/euro).

On line 030, reflect the amount of VAT charged by suppliers when purchasing goods in Russia, sold to Germany, in the amount of 130,000 rubles.

Do not fill out lines 040 and 050 of the tax return.

On the final line 120, indicate the total amount of VAT to be refunded from the budget in the amount of 130,000 rubles.

Now let's fill out section 5 of the declaration.

Since the “Exporter” in the first quarter acquired the right to include input VAT in tax deductions on two export supplies - to Belarus and China - section 5 will consist of two pages.

Fill out the first page according to the declaration for the fourth quarter of the previous year, according to which the export of goods to the Republic of Belarus was documented. Therefore, in the “Reporting year” cells, write down the number 2022, and in the “Tax period (code)” indicator – 24 (according to Appendix No. 3 to the Procedure for filling out the declaration).

On line 030, enter transaction code 1010421 when selling goods to the Republic of Belarus.

On line 040, reflect the proceeds from the sale of these goods in the amount of 1,200,000 rubles.

In line 050, indicate the amount of VAT when purchasing goods in Russia in the amount of 140,500 rubles. The right to include this amount in tax deductions arose only in the fourth quarter.

On line 080, reflect the total amount of VAT accepted for deduction - 140,500 rubles.

Fill out the second page of section 5 according to the declaration data for the second quarter of the reporting year. This quarter there was an export shipment of goods to China, which has not yet been confirmed by documents.

Fill in the “Reporting year” and “Tax period” indicators based on the information in the VAT return for the second quarter of the current year. That is, in the “Reporting year” cells, indicate the number 2022, and in the “Tax period (code)” indicator - 22 (according to Appendix No. 3 to the Procedure for filling out the declaration).

On line 030, write down the transaction code 1011410.

Do not fill in lines 040 and 050.

In line 060, reflect the proceeds from the sale of goods to China in the amount of 2,200,000 rubles.

In line 070, indicate the amount of VAT when purchasing goods in Russia in the amount of 240,000 rubles. The right to include this amount in tax deductions arose only in the fourth quarter. On line 070, write down the total tax amount - 240,000 rubles.

After filling out all the “export” sections of the declaration, you can begin to draw up section 1. It provides generalized information about the amounts of tax that should be paid to the budget (reimbursed from the budget).

In our example: (line 200 of section 3, line 130 of section 4, line 160 of section 6) - (line 210 of section 3, line 120 of section 4, line 080 of section 5, line 090 of section 5, line 170 of section 6) is less than zero. Therefore, “Exporter” reflects on line 050 the amount of VAT to be reimbursed from the budget for the first quarter - 510,500 rubles (130,000 rubles + 140,500 rubles + 240,000 rubles).

In the remaining lines of section 1, put dashes.

For unconfirmed exports to Finland, Exporter JSC submits an updated VAT return for the third quarter. In it, the accountant fills out the title page, section 1 and section 6.

In section 6, reflect all indicators using code 1011410. On line 020, indicate revenue from the sale of goods to Finland in the amount of 5,000,000 rubles.

On line 030, reflect the VAT calculated on revenue in the amount of 1,000,000 rubles (5,000,000 rubles × 20%).

On line 040, write down the amount of input VAT in the amount of 540,000 rubles, which the Exporter can deduct. Reflect this amount on the final line 170. Since the value of line 030 exceeds the value of line 040, fill out line 160 and indicate in it the amount of VAT payable to the budget in the amount of 460,000 rubles (1,000,000 rubles - 540,000 rubles). In this case, do not fill in line 170.

In section 1 of the updated declaration for the third quarter, in line 040, indicate VAT payable in the amount of 460,000 rubles. Do not fill in line 050.

Sections 4 and 5 (2 sheets) of the VAT declaration for the fourth quarter, as well as section 6 from the updated declaration for the third quarter, are given below.

Results

To reflect data on transactions taxed at a 0% VAT rate and requiring documentary confirmation of the fact of export, sections 4–6 are intended in the declaration. The main volume of data (it relates to confirmed exports) falls into section 4. Section 6 provides information on transactions for which documents have not been collected justifying the right to apply a preferential rate, and section 5 contains information on transactions that have received documentary confirmation in earlier periods, and the right to apply deductions is only in the current period.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.