What does electronic sick leave mean for an employer?

Sick leave is the basis for the appointment and payment of benefits for temporary disability or pregnancy and childbirth (Part 5 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ). A certificate of incapacity for work can be issued either on paper or electronically.

What should an employer do with electronic sick leave in 2021?

Employers using electronic sick leave do not need to ensure the safety of sick leave certificates. After all, all information from the moment the electronic certificate of incapacity is opened is stored in the Social Insurance Fund system, and the employer can request it repeatedly. And when the FSS conducts an inspection of the employer, there will be no need .

To start working with electronic sick leave, you need to enter into an agreement with the Social Insurance Fund. And only in this case, and also with the employee’s consent, can electronic sick leave be accepted (clause 2 of the Rules, approved by Decree of the Government of the Russian Federation of December 16, 2017 No. 1567).

Preparing for work

Step 1. Register in the system

To work with electronic sick leave certificates, an organization will need to create a personal account in the Unified Integrated Information System “Sotsstrakh” of the FSS at cabinets.fss.ru (hereinafter referred to as the UIIS “Sotsstrakh”).

You can log in through your legal entity account on the State Services portal. If your organization does not have a confirmed account on State Services, create one in the Unified Identification and Authentication System (USIA):

- On esia.gosuslugi.ru go to the “Organizations” tab.

- Create a verified account using a qualified electronic signature issued in the name of an executive or a person authorized to act without a power of attorney.

- Fill out the card with the details.

If you have an accounting service, read about how to receive sick leave for employees in the article.

After registering in your UIIS “Sotsstrakh” personal account, fill out information about your company and read the instructions.

Each participant in the system has its own personal account functions:

- Hospitals will upload electronic forms into the system, signing them with a qualified electronic signature.

- The accountant will see employee sick leave, receive the necessary information for calculating benefits and fill out the employer section.

- The insured will be able to check whether the sick leave certificate has been filled out correctly and whether the benefits have been accrued correctly.

- Federal Law No. 86-FZ provides that a doctor will be able to issue an electronic sick leave for temporary disability, pregnancy or maternity if these two conditions are met:

- The medical institution and the employer of the insured person are registered in a special automated system of electronic forms.

- The patient agreed in writing to issue a certificate of incapacity for work in electronic form.

A list of data required for conducting a medical and social examination of the insured and calculating benefits, as well as the deadlines for their submission, have been approved (Resolution of the Government of the Russian Federation dated December 16, 2017 No. 1567).

Step 2: Redistribute responsibilities

Appoint an accountant responsible for working with electronic sick leave, obtain an electronic signature for it and provide access to the Social Insurance Unified Information System. If necessary, teach new work rules to those accountants who previously worked only with paper sick leave.

Many services are developing new capabilities for working with electronic sick leave. To work with electronic sick leave, you can also use a free program that the Social Insurance Fund offers to download in the employer’s personal account.

Create registers based on ENL data and send them to the Social Insurance Fund via Extern

Step 3: Tell employees about the changes

Once the company has connected to the system, tell employees that they have the right to file sick leave electronically. You can issue an order against signature or send it by email.

The employee himself decides in what form he wants to draw up the document: paper or electronic. But electronic sick leave has advantages, convey them to your employees:

- It is easier to complete; there is no need to additionally certify it with seals at the registry office.

- It cannot be spoiled, forgotten, or lost. If the insured person loses his sick leave number, he will be able to restore it in his personal account using the SNILS number and the State Services password.

- An electronic sick leave does not need to be carefully stored and transferred to an accountant, like its paper counterpart. It is enough to provide the sheet number by phone or by mail. This is especially true for companies with branches, different offices or separately located accounting departments.

Tatyana Ogorodnikova, accountant at Agency Bonus :

— The FSS itself sent us a letter inviting us to become a participant in the system and entered into an agreement with us on information interaction. We plan to notify employees about the possibility of filing sick leave electronically in mailings on behalf of department directors. From the introduction of electronic certificates of incapacity for work, we definitely expect only positive changes in work: for example, we will no longer have to send an employee to the doctor to reissue the document due to an error. This has happened before.

What does an electronic certificate of incapacity for work look like?

What does electronic sick leave look like in 2022? Where can I see the photo?

The form of electronic and paper certificates of incapacity for work is essentially the same . The form of the certificate of incapacity for work was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. And the procedure for generating electronic certificates of incapacity for work is by order of the Ministry of Health of Russia dated September 1, 2020 No. 925n. It’s just that the electronic sick leave is issued in the form of a file , and not on paper.

When will electronic sick leave be issued in 2022, and when will paper leave be issued?

Sick leave in electronic form is issued at the request of the person. To do this, he writes consent to receive a certificate of incapacity for work electronically. There is no obligation - no .

The electronic sick leave is certified with an enhanced qualified electronic signature and placed in the FSS information system - the Unified Integrated Information System "Sotsstrakh". Paper equivalent - not issued .

Read more about this on the official website of the FSS here.

To receive a sick leave certificate in electronic form, the medical organization and the employer must be participants in the Sotsstrakh information interaction system.

The employee can find out whether the employer is connected to this system from the accounting or human resources department.

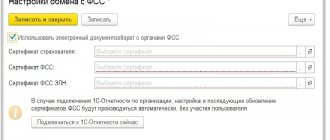

To connect to the Social Insurance system, employers can use their own modified software, as well as the policyholder’s personal account.

Liability for violations committed in cooperation with ELN

We can say that the transition to electronic sick leave certificates is completely completed. The end of the transitional phases is crowned by new sanctions introduced in January 2022:

Russian legislators have planned a complete transition to electronic sick leave from 2022, which will certainly be accompanied by many questions from policyholders and beneficiaries. We hope that resolving the difficulties that have arisen will not take much time, and the subsequent improvement of electronic interaction between all government agencies and employers will allow working citizens to receive money for days of incapacity for work, maternity leave and birth benefits in a timely manner and in the correctly calculated amount.

The employee reported that he has an electronic sick leave: what should the employer do?

If the sick leave is generated electronically, the employer will receive from his employee only the number of the electronic certificate of incapacity for work. information from the Social Insurance system about the issued certificate of incapacity for work.

The employer cannot find out the specific diagnosis from the certificate of incapacity for work. The sheet contains only the code. It will also not be possible to view sick leave certificates that the employee received while working for other employers.

Since 2022, the FSS pilot project “Direct Payments” has been extended to all regions of Russia (Federal Law No. 401-FZ dated November 30, 2016). This means that employers must continue to pay only :

- the first 3 days of sick leave;

- additional days off to care for a disabled child;

- funeral benefit.

The FSS pays the rest of the benefits itself .

In 2022, an electronic sick leave benefit must be assigned for temporary disability and maternity leave within 10 calendar days from the date the employee applies with an electronic sick leave number. And the payment of benefits must be made on the day closest to the date established for the payment of wages .

If an employee brings an electronic sick leave certificate, and the employer has not switched to electronic interaction with the Social Insurance Fund, the employee will be asked to replace the electronic certificate of incapacity for work with a paper one.

Previously, a register of information was transferred to the FSS for calculating benefits by offset. It also indicated in what form the sick leave certificate was received from the employee - paper or electronic.

KEEP IN MIND

In 2022, FSS employees called organizations and demanded that they switch to electronic sick leave as soon as possible. However, the employer has the right to refuse to use electronic sick leave. This rule applies to all companies.

If the employer does not want to deal with electronic sick leave, you do not have to connect to the Unified Integrated Information System of the Social Insurance Fund “Sotsstrakh”. Then employees will continue to be issued sick leave on paper. And even if the medical institution issues an electronic form to the employee, he will have to return for a paper form. This does not threaten the employer in any way (FSS letter dated 08/11/2017 No. 02-09-11/22-05-13462).

How does the electronic sick leave system work?

An employee who is convinced of his incapacity for work is sent to a medical institution to receive sick leave. After examination and diagnosis, the patient selects the sick leave option and signs consent. The doctor fills out an electronic disability form and gives the patient a twelve-digit identification number of the electronic disability form. The patient gives it to the employer.

When treatment ends, the electronic sheet is signed by doctors and the medical institution using a unique digital signature. Next, the file is sent to the FSS. From the FSS it goes to the employer, who checks the file and confirms it with a personal cryptographic signature. As a result, the employee receives sick pay.

The virtual sick leave database is linked to the patient card database. Patient information entered into the database:

- Full name, place and year of birth;

- employment;

- blood type and Rh factor;

- congenital and chronic diseases;

- information about allergic reactions.

Information from the medical record is used to automatically fill in some of the fields; the remaining fields are filled in by the physician, working in the program with an image of the sheet. After filling out, registering and closing the form, the attending physician signs it with a personal cryptographic signature. Finally, the sick leave image is sent to the public health department information environment for storage.

Technical features of working with electronic sick leave in 2022

The introduction of ENL allows you to immediately correctly create a register in accordance with the requirements of the Social Insurance Fund. In your personal account, you can immediately draw up an application for payment to the employee and give it to him for signature. Also, the program will automatically update the details of the clinic and the bank, so errors for the benefit recipient are excluded .

Also, in your personal account, you can send several e-numbers and registers at once (relevant for large companies with a large staff) . The register and electronic login can also be sent by a company serving your business or a remote accountant.

The digital signature certificate automatically checked for authenticity, and the registry is checked for errors. If you made mistakes, you can see them in the protocol and correct them immediately .

If you have already sent the register to the Social Insurance Fund via electronic tax record and noticed an error (for example, in determining the length of service), this can be easily corrected: you need to create a new register with updated data and send it again in your personal account to the Fund.

Benefits for employers from 2021

Working with sick leave on the principle of direct payments allows the employer not to have a reserve of funds to pay benefits. This improves the financial stability of policyholders.

When electronically processing sick leave certificates, it takes significantly less time to fill them out. Also, when filling out it is almost impossible to make mistakes (except for the calculation part).

When preparing reports to the Social Insurance Fund, you do not need to calculate the amounts that should have been offset against the amount of insurance premiums and benefits paid. This greatly simplifies the work of an accountant.

Child care allowance up to 1.5 years old

The same employer will inform the Social Insurance Fund about the need to pay benefits for child care up to 1.5 years, on behalf of which employees will continue to write applications for parental leave and the appointment of the appropriate benefit. Within 3 working days from the date of receipt of the application, the Insured must send the “Information for the assignment of benefits” form to the Social Insurance Fund. Please note that the submission is a one-time submission; There is no need to fill out and submit it to the Social Insurance Fund every month.

Upon receipt of the register, social insurance assigns benefits and pays them for the entire period. The fund transfers the money allocated by social insurance to provide for a child under 1.5 years old to the MIR card.

Benefits for employees from 2021

As for employees, from 2022, the widespread use of electronic tax nomenclature excludes violations in the assignment of benefits. The employee is no longer dependent on the employer in this regard.

Payments have become more transparent , which has increased the social security of all residents of the Russian Federation.

An employee can easily check information about the timing and amount of the upcoming sick leave payment in his FSS personal account by gaining access through the State Services website. If there is no Internet, this can always be done directly through FSS employees.

The introduction of electronic sick leave allows you to receive benefits in several ways:

- postal transfer;

- to a bank account;

- to a payment card.

That is, this part is not tied to the salary project.

If the employee only knows the card number, the benefit can be received by indicating only this detail in the application (ideally, the bank’s BIC or correspondent account).

Flat rate of maternity benefit

To receive benefits at the birth of a child, parents no longer need to write an application and confirm that one of the parents has not submitted it previously. Since 2022, the FSS becomes aware of the appearance of a child from the registry office, after making the appropriate registration in the Unified State Register of Legal Entities.

As soon as the report appears, the FSS will send a request to the Pension Fund to obtain information about the parents’ place of work and check whether child benefits were paid. Receipt of benefits depends on the profession of the parents:

- If both parents work under an employment contract, the benefit is paid to one of them, most often the mother.

- If only one parent works, he will receive benefits.

- If the parents are not dependent on any employer, benefits will be paid through social security institutions.

- If there is no data to assign a benefit (for example, according to the regional coefficient), the Social Insurance Fund may contact the employer. The latter must respond within two working days from receipt of the request.

conclusions

So, the following points will help you understand the issue of payment for electronic sick leave in 2022:

- Electronic sick leave completely replaces paper ones. An employee can be prescribed it only if both the employer and the medical institution are connected to the Social Insurance Unified Information System;

- In the UIIS, an electronic sick leave appears after it is discharged by a medical institution. There the employer fills out his part of the document. to print and store electronic sick leave ;

- to work with the Unified Personal Information System, an organization needs a personal account on the State Services website;

- You can work with the UIIS through the policyholder’s personal account on the FSS website or the FSS software, or through an accounting program that allows this.

How the procedure for calculating electronic sick leave will change from 2022

From January 1, 2022, there will be no global changes in the calculation of benefits based on electronic sick leave. When calculating amounts for the first three days of illness, employers will have to take into account the following legislative changes that affect the amount of benefits:

- Increasing the minimum wage to RUB 13,617.

- Maximum sick leave has been increased. Since in 2022 the benefit will be paid based on earnings in 2022 and 2022, to calculate the maximum sick leave you will need to take the figures 912,000 rubles and 966,000 rubles. – the main maximum limits established for these years. For 2022, legislators set the bar at 1,032,000 rubles. From a base above this indicator, contributions to VNiM are not accrued and, therefore, the excess amount should not be taken into account when calculating benefits.

- The general procedure for calculating benefits paid by both the employer and the Social Insurance Fund remains in accordance with Law no. 255-FZ in the latest edition.