What are cash and cash equivalents?

Cash and cash equivalents include all cash and highly liquid assets with short maturities (typically 90 days or 3 months). This item is always classified as current assets on line 1250 of the balance sheet.

Take our proprietary course on choosing stocks on the stock market → training course

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

However, cash equivalents often do not include shares or shareholdings because they can fluctuate in value.

Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with maturities of three months or less. Marketable securities and money market assets are considered cash equivalents because they are liquid and not subject to significant fluctuations in value.

Currency account - asset or liability on the balance sheet

Cash in foreign currency is reflected in active account 52 “Currency accounts”. Analytics is carried out on sub-accounts provided for in the working chart of accounts and accounting policies for each open account.

In accounting, currency is always shown in ruble equivalent. According to the requirements of PBU 3/2006 (clause 7), conversion into national currency is carried out:

- immediately after completing a foreign exchange transaction or operation in order to record this movement in accounting;

- when preparing reports, so that the final documentation shows up-to-date information;

- when the official exchange rate changes to comply with the principle of reliability and objectivity of accounting.

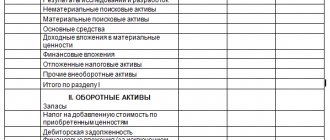

A foreign exchange account is an asset on the balance sheet. For an enterprise, cash expressed in rubles, foreign currency or monetary documents is an element of working capital, which is shown in the reporting as part of assets (the second section of the balance sheet).

Concept and understanding of the category

Cash and cash equivalents are a group of assets owned by a company. For ease of understanding, this is the total value of cash on hand and cash-like assets. If a company has cash or cash equivalents, the totality of these assets is always shown on the top line of the balance sheet. This is because cash and cash equivalents are current assets, which means they are the most liquid of the short-term balance sheet items.

Important! Companies with significant amounts of cash and cash equivalents may have a positive view of their ability to meet short-term debt obligations.

Difference between cash and cash equivalents

The key differences are presented in the table below.

| View | Characteristics and distinctive features |

| Cash | Cash in the form of currency. They include all bills, coins and banknotes. |

| Cash equivalents | For an investment to qualify as equivalent, it must be readily convertible into cash and be subject to negligible value risk. Therefore, an investment usually qualifies as a cash equivalent only if it has a short maturity, say three months or less. |

The importance of using these categories

There are several main reasons why these categories are significant. They are reflected in the table below.

| No. | Cause | Characteristics and description | Clarification |

| Source of liquidity | Cash equivalents are held to satisfy short-term cash obligations and not for investment or other purposes and are an important source of liquidity. Thus, companies want to have a cash cushion to withstand unforeseen situations such as revenue shortfalls, equipment repairs or replacements, or other unforeseen circumstances not budgeted for. | Liquidity ratio calculations are important in determining the rate at which a company can pay off its short-term debt. Various options for liquidity ratios include: total liquidity ratio, current ratio, quick ratio. Total liquidity ratio: (cash and cash equivalents + marketable securities) ÷ current liabilities Current ratio: current assets ÷ current liabilities. Quick ratio: (Current asset - stock) ÷ Current liabilities. | |

| Speculative acquisition strategy | Another good reason to save is to make an acquisition in the near future. | As an example, consider the cash balance on Apple Inc's balance sheet: · Cash = $13.844 billion · Total assets = $231.839 billion Cash as % of total assets = 13,844 / 231,839 ~ 6% · Total sales in 2014 = $182,795 Cash as % of Total Sales = 13,844 / 182,795 ~ 7.5% Investments of $13.844 billion (cash) + $11.233 billion (short-term investments) + $130.162 billion (long-term investments) amount to $155.2 billion. The combination of all this indicates that Apple may be looking for some kind of acquisition in the near future. |

Pros and cons of availability

Positive aspects of having:

- maturity and ease of conversion. They are beneficial from a business perspective because a company can use them to meet any short-term needs;

- financial repository. Retained equity is a way of storing money until a business decides what to do with it.

Negative aspects of having:

- loss of income: sometimes companies set aside an amount in equivalents that exceeds the amount needed to cover immediate obligations, depending on market conditions. When this happens, the company loses potential income because money that could have generated higher profits elsewhere has been transferred to a cash account;

- low yield: many equivalents have yield. However, the interest rate is usually low. A low interest rate makes sense given that equivalents are low risk.

The most common options and types

Cash and cash equivalents help companies in meeting their working capital needs as these liquid assets are used to pay off current liabilities, which are short-term debts and bills.

Cash is money in the form of currency and includes all bills, coins and notes.

A demand deposit is a type of account from which funds can be withdrawn at any time without notifying the institution. Examples of demand deposit accounts include checking and savings accounts. All demand account balances at the date of the financial statements are included in total cash.

Foreign currency. Companies holding more than one currency conduct transactions such as currency exchange. Currency for foreign countries must be converted into reporting currency for financial purposes. The conversion must provide results comparable to those that would have occurred if the business had completed operations using only one currency. Foreign currency revaluation losses are not reflected in cash and cash equivalents. These losses are reflected in a separate document.

Cash equivalents are investments that can be easily converted into cash. Investments must be short-term, usually with a maximum duration of three months or less. If the investment period exceeds 3 months, it should be classified in an account called “other investments”. Cash equivalents must be highly liquid and easily traded in the market. Buyers of these investments must be easily accessible.

All cash equivalents must have a known market price and should not be subject to fluctuations in value. The value of cash equivalents cannot be expected to change significantly prior to maturity.

Certificates of deposit may be considered cash equivalents depending on their maturity date.

Preferred shares may be considered cash equivalent if they are purchased close to the maturity date and are not expected to fluctuate significantly in value.

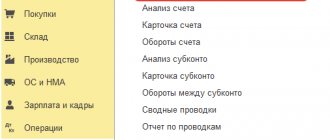

Accounting accounts

In relation to accounting accounts, line 1250 is the sum of the debit balance on the following accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n):

- 50 “Cash” (except for the balance of subaccount 50-3 “Cash documents”, reflected not in line 1250, but as part of line 1260 “Other current assets”);

- 51 “Current accounts”;

- 52 “Currency accounts” (at the Central Bank exchange rate as of the reporting date);

- 55 “Special accounts in banks” (except for the balance of subaccount 55-3 “Deposit accounts”, reflected not on line 1250, but as part of lines 1170 “Financial investments” or 1240 “Financial investments (except for cash equivalents)”, depending on whether these investments are long-term or short-term);

- 57 “Translations on the way.”

What cash and equivalents do not include

There are some exceptions for current assets and current assets classified as cash and cash equivalents.

Credit collateral. Exceptions may exist for short-term debt instruments such as Treasury bills if they are used as collateral for an outstanding loan or line of credit. Prohibited T-bills must be identified separately. In other words, there may be no restrictions on the conversion of any of the securities listed as cash and cash equivalents.

Inventories. The inventory that a company has in stock is not considered cash equivalent because it cannot be easily converted into cash. In addition, the value of inventory is not guaranteed, meaning there is no certainty as to the amount that will be received for the liquidation of these assets.

What is DE?

Cash equivalent is an asset that can be converted into money in the shortest possible time. The amount of funds accumulated from asset transactions is predictable. That is, it is easy to determine. The cost of equivalents may vary slightly. Equivalents include:

- demand deposits;

- short-term bills;

- securities of a similar type;

- various deposits from which funds can be withdrawn.

For example, shares of the enterprise itself are considered a highly liquid form of securities. They have all the characteristics of cash equivalents: they can be sold at any time at a predetermined cost. The equivalent are also shares of other enterprises acquired by the company.

Which accounting accounts reflect information about cash balances and cash equivalents ?

Calculation example

Example No. 1. For example, suppose that the opening balance of the cash account was 10,000 rubles, the total amount of debits for the year was 15,000 rubles, and the total amount of credits for the year was 8,000 rubles.

Let's add each account's total debit to its opening balance. For example, let's add 15,000 tr. to the total amount of debits to the initial balance on the cash account of 10,000 tr., which is equal to 25,000 tr.

We subtract the total number of credits of each account from each result to calculate the year-end balance for each account.

For example, we subtract 8,000 rubles. in the total amount of loans on the cash account from the result of 25,000 tr. This equals a final cash balance of 17,000 rubles.

We will calculate the ending balance of each account to determine the balance at the end of the year in cash and cash equivalents.

For example, if the year-end balances for cash, wages, petty cash investments and money market investments are respectively 17,000, 5,000, 1,000 and 4,000 TR, then their amount should be calculated. It is equal to 27,000 tr. as the balance of cash and cash equivalents at the end of the year.

Indicate the balance of cash and cash equivalents at the end of the year in line 1250 of the balance sheet in the current assets section.

How to show foreign currency accounts on the balance sheet

To include in the balance sheet information about the financial resources available to the enterprise, it is necessary to focus on the debit balances of several accounting accounts:

- account 50, recording cash balances in the company's cash register;

- account 51, reflecting non-cash money stored in current accounts in banks;

- account 52, which accumulates data on foreign currency converted into rubles;

- account 55, showing the amounts in special accounts;

- count 57, indicating money in transit.

From the resulting total value of monetary resources, it is necessary to exclude the cost of monetary documents (subaccount 50.3), which are included in other current assets (balance sheet line “1260”) and deposit accounts (subaccount 55.3), reflected as financial investments (lines “1170”, “ 1240"). The foreign exchange account in the balance sheet and other cash accounts are reflected on line “1250”.

In accordance with PBU 3/2006, information in the reporting is entered from accounting registers. Foreign currency funds are reflected in registers only in ruble equivalent by all Russian business entities, regardless of where business activities are conducted - within the Russian Federation or in other countries. An exception is made only for situations where reporting is required for foreign users - in this case, the data is shown in foreign currency without conversion to the ruble equivalent. Exchange differences are recorded in other income or expenses on account 91, so they are not reflected independently in the balance sheet, but are included in the financial result.

What can increase cash on the balance sheet?

Companies can increase cash through increased sales, collection of overdue accounts, control of expenses, and financing and investment. These options are reflected in the table below.

| Growth option | Characteristic |

| Sales growth | Increased sales usually mean higher levels of cash on the balance sheet. When a company makes a cash sale, the accounts must increase the sales account on the income statement and the cash account on the balance sheet. When it receives cash payments on credit accounts, the company converts the amounts from accounts receivable to cash. Innovative and quality products, targeted marketing and superior customer service are some of the ways to consistently achieve higher sales and gain a competitive advantage in the market. |

| Accounts receivable management | Some sales are cash and others are on credit. The accounts receivable balance in the current assets section of the balance sheet contains outstanding credit accounts. Although a business may receive most payments during the billing period, some bills are past due while others are not due for collection. More stringent credit control procedures, such as reducing credit limits for customers who have fallen behind in the past or waiving loans to customers experiencing financial difficulties, can reduce the number of overdue accounts and increase cash flow. Sending automatic email reminders, following up with overdue customers, and offering discounts for early payment of invoices are some of the other ways to manage accounts receivable and increase cash on your balance sheet. |

| Cost control | Controlling expenses increases cash levels. Sales growth is an important but not sufficient condition for increasing cash flow. For example, if a five percent increase in sales requires a seven percent increase in marketing spending, cash levels may actually decrease rather than increase. Companies incur variable costs such as direct labor and raw materials. The companies also recorded overhead costs such as administrative staff salaries and advertising. Negotiating better terms with suppliers and adjusting production shifts to accommodate rising or falling demand are ways to manage variable costs. Streamlining business processes, reducing travel, and using contractors instead of in-house employees are some ways to reduce overhead costs. |

| Financing and investment activities | Companies can increase cash levels through financing and investing. Financing activities include proceeds from bank loans and from issuing shares or bonds to investors. For small businesses that may not have easy access to financial markets, an infusion of cash from founding partners, venture capitalists and angel investors will increase cash on the balance sheet. Paying dividends and interest from investments in stocks and bonds also increases cash levels. Selling excess capital investments, such as regional offices, distribution centers, excess equipment or unused vehicles, increases cash on the balance sheet. |

| Other | Other ways to increase cash include selling investments in subsidiaries or spinning off business units. |

FAQ

Question No. 1. What is included in cash?

Answer. These include such means as:

- money;

- currency;

- cash in current accounts;

- cash in savings accounts;

- bank amounts;

- Money transfers.

Question No. 2. What is considered cash equivalents?

Answer:

Answer. These include such means as:

- short-term government bonds;

- bills;

- securities;

- money market funds;

- treasury bonds.

Question No. 3. What are the main criteria for classifying cash and cash equivalents?

Answer. The two main criteria for classification as a cash equivalent are that:

- the asset can be easily converted into a known amount of cash;

- it must be so close to the maturity date that there is little risk of changes in value due to changes in interest rates at the time of maturity.

Question No. 4. In what situations is cash and cash equivalents analysis used?

Answer. Information about cash and cash equivalents is sometimes used by analysts in comparison to a firm's current liabilities to assess its ability to pay its bills in the short term. However, this analysis may be flawed if there are accounts receivable that can be easily converted into cash within a few days.

Question No. 5. What is included in cash?

Answer. In economic terms, cash is the form of exchange for all business transactions and activities of a company. In other words, it is a standard payment method for businesses. This is a banknote that is legal tender for all public and private debts.

Question #6 : Are certificates of deposit included in this category?

Answer. Yes, certificates of deposit are short-term securities that are easily converted into a known amount of money in a short period of time. Certificates of deposit are always included in cash equivalents.

What information is indicated in line 1250

This column relates to current assets, its name is “Cash” and their equivalents. As you can understand, this line displays balances in ruble currency, foreign currencies, as well as available cash equivalents owned by the organization.

The amount indicated in this line consists of several accounts that are taken into account when generating reports:

- Cash account, with the exception of the sub-account called “Cash documents” - this includes cash and non-cash funds that are in the company’s cash register.

- The current accounts the company has and the funds that are in them at the time of drawing up the report.

- Currency accounts of the organization - in this case, calculations are carried out taking into account the current exchange rate of the Central Bank on a specific date.

- Special bank accounts - deposits that are not included in the category of cash equivalents are not taken into account.

- Transfers in transit - this part includes funds given to collectors for depositing into a current account and not yet credited at the time of reporting.

The line indicates both cash and non-cash funds available to the organization at the time of reporting. All kinds of data that reveal the movement of funds - receiving income and making expenses - are additionally indicated in the corresponding report.

The amount of the cash balance is calculated based on the data in the cash book. There are also certain rules regarding cash transactions and the allocation of proceeds that can be used for certain purposes.

Filling out reports must comply with established requirements, as this is enshrined in law. Indicating codes when drawing up documentation is mandatory, so you need to know their decoding. To fill out, you can use special samples that are freely available and can serve as a hint.