Retained earnings (RE) is a common accounting concept that many businesses encounter. This term stands for funds received through the business activities of a company and available to it after paying tax deductions, dividends, fines, etc. Simply put, all mandatory payments.

An alternative name for retained earnings is retained surplus. In some cases, the concept of “profit retention ratio” is used.

The main difference between retained earnings and net profit is that it is always calculated not only for a specific period, but also for the total life of the enterprise. Whereas net profit is determined only for the reporting period. But at the end of the year, which is logical, both indicators may be the same.

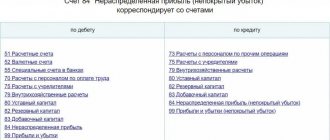

Retained earnings (uncovered loss) in the Chart of Accounts for accounting of financial and economic activities of organizations.

Retained earnings in the balance sheet relate to the passive part of funds. By default, it is believed that it should be distributed among the owners and used to optimize the company’s business model. Until this point, such profit can only be called the company’s debt to its owners. Refers to long-term sources of financing, therefore the goal of the company’s financial strategy should be its mandatory accumulation.

What to do with retained earnings

There are several main ways to refer an NP. Among them:

- payment of dividends to owners/shareholders;

- compensation for earlier losses;

- accumulation of reserve fund funds;

- other goals agreed upon by managers.

IMPORTANT! Regarding the last point, it is worth making a small clarification. In this case, managers do not mean nominal officials, but business owners. As a rule, they resolve such issues during the final annual meeting, at which the corresponding minutes are drawn up.

What can you spend the retained earnings of an LLC on?

The procedure for distribution of profits is established by the Laws on JSC and LLC. Thus, for accounting purposes, expense items of undistributed funds are specified only in an annotation to account 84 in the Chart of Accounts. There are no other references in accounting to possible ways of using this financial indicator. This means that unallocated funds can be used in such areas as:

- Reserve fund.

By law, JSCs are required to invest net profits in the formation of a reserve fund. Moreover, the size of the latter cannot be less than 5% of the authorized capital of the company. These funds are used to cover losses, repurchase public shares, and repay own bonds.

Unlike joint stock companies, LLCs have the opportunity to create a reserve fund on a voluntary basis. The size of the reserve, the amount of contributions made to it each year and the purposes for which this money can be directed are established by the Charter of the company.

The reserve fund is created by posting:

Debit 84 “Retained earnings (uncovered loss)” Credit 82 “Reserve capital”.

It is reflected in the balance sheet in section II “Capital and reserves” on page. As a result, part of the net profit is actually transferred to another item of capital. At the same time, the structure of the balance sheet improves, because the owners are deprived of the right to withdraw funds from the turnover of the enterprise in the amount of the formed fund. In other words, the reserve fund is a kind of financial safety net for the company.

- Dividends.

The amount not spent on the formation of the reserve fund can be used to pay dividends. Let us note that this is the most typical and frequently used method of spending such funds. Retained earnings are reduced when dividends are paid, and when dividends are paid, the company's assets are reduced.

When calculating dividends in accounting, the following entry is used:

Debit 84 “Retained earnings (uncovered loss)” Credit 75 “Settlements with founders.”

This entry allows you to reflect the payment of dividends in cash:

Debit 75 “Settlements with founders” Credit 51 “Current accounts”.

If cash issuance is preceded by withdrawal of funds from the current account, the following entry is used:

Debit 75 “Settlements with founders” Credit 50 “Cash”.

Let us note that the law does not prohibit the payment of dividends in both money and property. According to the norms of the Federal Tax Service of Russia, in the second case, VAT must be charged. However, judicial practice knows examples when arbitrators do not recognize the transfer of property through the payment of dividends as a sale, which means that this procedure is not subject to VAT.

Therefore, if a company does not include in the VAT base the value of property transferred as dividend payment, there is a high probability that such a position will have to be defended in court. But is it worth it?

The organization decides to pay dividends in cash, but to do this it will have to sell the property, subject to VAT on its sale, after which funds can be transferred to shareholders. Thus, in the absence of funds, in any case, you will have to pay VAT before making payments to the owners.

Another situation is possible when dividends are goods or fixed assets that are not subject to VAT. In this case, no tax is charged.

The transfer of property to pay off debt on dividend payments is reflected in accounting in accordance with the following standards:

When transferring goods or finished products:

When transferring a fixed asset:

Retained earnings. Check

All NP for the past years is summarized in accounting account 84, the balance credit balance is placed in line 1370 of the balance sheet. The same line contains the amount of uncovered loss (if any), which is indicated in parentheses. Uncovered loss means the difference between the company's expenses and income during the year, according to which the first point exceeds the second.

The account contains information about the denomination and changes in the amount for the reporting year. At the end of the year, the amount is credited to account 84, while the loss is written off as a debit. The main task of this account is to store information about the purposes for which the funds were used.

An uncovered loss is sometimes called a deficit profit. The loss can be fully or partially compensated using reserve capital funds. In the case of compensation, data on the initial loss is not filled in (in case of partial compensation, only the remaining amount of the loss is indicated in parentheses).

IMPORTANT! At the request of the accounting department, additional lines – 1371 and 1372 – can be entered in the balance sheet to differentiate the figures for the reporting and previous years.

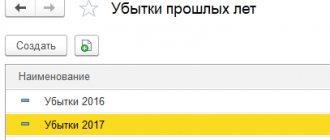

Uncovered loss

The decision on how to pay off the resulting loss is also made by the owners (founders) of the organization (general meeting of shareholders or meeting of participants in an LLC).

The loss can be repaid through:

- targeted contributions from shareholders (participants) of the organization;

- reserve capital funds;

- funds of retained earnings from previous years.

In the first two cases, entries are made to the credit of account 84:

Debit 75 (70) Credit 84 sub-account “Uncovered loss” - targeted contributions from the organization’s shareholders (participants) were sent to repay the loss.

Debit 82 Credit 84 subaccount “Uncovered loss” - reserve capital funds were used to repay the loss.

If the owners of the organization decided to pay off the loss using retained earnings from previous years, an entry is made in the accounting to the subaccounts of account 84:

Debit 84 subaccount “Retained earnings” Credit 84 subaccount “Uncovered loss” - retained earnings from previous years are used to repay the loss.

The loss can also be written off from the balance sheet if the general meeting decides to reduce the authorized capital to the amount of the organization’s net assets.

After the corresponding changes in the constituent documents have been registered, make the following entry:

Debit 80 Credit 84 subaccount “Uncovered loss” - the authorized capital is reduced to the amount of the organization’s net assets.

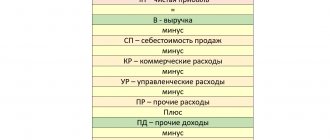

Calculation of retained earnings. Detailed formula

So, we found out that retained earnings are the amount of funds remaining at the disposal of the company’s owners after all taxes and other mandatory deductions. This indicator can be calculated using the formula:

HPk = HPn + ChP – D

Where:

- HPc – surplus of funds at the end of the reporting period;

- HPn – the same indicator at the beginning of the period;

- PE – net profit minus income tax;

- D – dividends distributed for the reporting period, based on the RR of the previous periods.

Note: The standard reporting period is one year.

If during the current period the company received a net loss instead of profit, the formula takes on a slightly different form:

NPk = NPn – CHU – D

Where:

- HPc – surplus of funds at the end of the reporting period;

- HPn – the same indicator at the beginning of the period;

- NL – net loss;

- D – dividends distributed for the reporting period, based on the RR of the previous periods.

The remaining indicators are similar to the previous formula.

Question: Does an LLC have the right to make incentive payments to employees from retained earnings and how to formalize this, and are they taken into account when calculating the average salary? View answer

Where else can you direct the retained profits of an LLC?

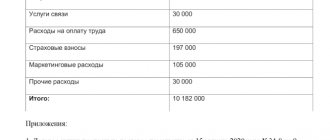

Often, answering the question of where to spend the retained profits of an LLC, the owners of the enterprise use these amounts to pay bonuses to staff, purchase fixed assets, provide financial assistance, and create consumption and savings funds. Are all of the above approaches correct?

Let's start by discussing the features of expenses at the expense of profit. The current laws on joint-stock companies and LLCs call the only possible payments from profits payments to the owners. We also note that the Ministry of Finance of the Russian Federation has repeatedly expressed this position: account 84 cannot be used to reflect various types of charitable and social expenses, including payments of material assistance and bonuses.

Costs for holding sports, entertainment, cultural and educational events, organizing recreation, etc., as well as transferring funds to charity from the position of the financial department, are considered other expenses and are recorded in account 91 “Other income and expenses.” In other words, the organization’s expenses do not include only the payment of dividends, while any other investment of assets is considered an expense of the current period.

Therefore, financial assistance, bonuses, and charity expenses can affect the company’s net profit, but only during the period when these expenses are incurred. Please note that they in no way relate to last year's net profit.

Let's summarize: all kinds of payments from net profit are illegal - the only exception is dividends.

Separately, it is worth mentioning the investment of net profit in the formation of a consumption fund. This approach is an echo of Soviet accounting rules, when it was customary to transfer money held in the bank separately from company funds into production development funds. These amounts were spent on the purchase of fixed assets. Today, this answer to the question of where to spend the retained profits of an LLC has lost its relevance.

Nowadays, a company's fixed assets are purchased from a current account by changing one asset to another (fixed asset). We emphasize that account 84 is not used in the postings. This means that the decision of business owners to direct funds to the development of production with the accountant’s entry in the account Debit 84, subaccount “Profit for distribution”, Credit 84 “Reserved profit” does not affect the final balance on the credit account 84.

This entry indicates that this year the owners refused to receive dividends without withdrawing money from circulation. As a result, the company was able to modernize its balance sheet structures, while simultaneously ensuring a more stable financial position. Since the final balance on the credit of account 84 does not change, there are no difficulties in the future distribution of profits by the owners when they are reflected in the company’s balance sheet as undistributed.

Retained earnings upon liquidation of an LLC with a single participant

When all payments to creditors are completed, there may be undistributed funds on the balance sheet of the closing company. Therefore, the question immediately arises as to whether it is possible to close an LLC with retained earnings. These amounts must be paid to a single participant.

However, it is necessary to begin with the payment of distributed profits, if any remain. After this, the undistributed amount is paid - if possible, it is done in cash. If for some reason this option turns out to be unacceptable, the sole participant of the company is given the property of the LLC.

That is, the property of the liquidated organization is listed as an asset on the balance sheet, and retained earnings and authorized capital are listed as liabilities.

In order to terminate its activities, the enterprise submits a zero liquidation balance sheet to the Federal Tax Service. This will not be possible without issuing retained earnings to the sole participant in the form of LLC property.

If the value of the property received by the participant turns out to be less than that specified in the authorized capital, these funds are not subject to VAT, and an 18% fee is charged on the balance.

Increasing the authorized capital of an LLC using retained earnings

If the authorized capital is increased at the expense of the company’s property, its participant does not actually receive funds, goods (work, services) or any other property. Thus, this method of increasing the authorized capital of an LLC does not entail the emergence of income that should be subject to personal income tax.

Let us turn again to judicial practice: there are cases where courts have come to the conclusion that the participants of the company have no income associated with the increase in the nominal value of their shares. This conclusion was considered the only correct one until a company participant exercised any of his property rights, certified by the corresponding share in the authorized capital.

But it is worth noting that this is not the only possible conclusion. According to the position of the Ministry of Finance of the Russian Federation, when the authorized capital increases due to retained earnings, an individual receives income at the time of his state registration. These funds should be subject to personal income tax on a general basis (see, for example, Letter of the Ministry of Finance of the Russian Federation dated May 22, 2017 N 03-04-06/31351).

This position is supported by clause 19 of Art. 217 of the Tax Code of the Russian Federation, which provides for non-taxable income representing the difference between the new and original nominal value of a share in the authorized capital, obtained as a result of the revaluation of fixed assets. At the same time, in Art. 217 of the Tax Code of the Russian Federation, which defines the list of non-taxable personal income tax income, there is no income resulting from an increase in the nominal value of the participant’s share due to retained earnings of previous years.

If an LLC decides to follow the clarifications of the Ministry of Finance of the Russian Federation, it is considered a tax agent for personal income tax, whose responsibilities include: calculating the amount of personal income tax, withholding it from its income upon actual payment, transferring the corresponding amount to the budget (clauses 1, 2, 4 of Art. 226 of the Tax Code of the Russian Federation).

Since in this case the company does not pay the company member any money in the current year, withholding the calculated amount of personal income tax is impossible. Then, according to paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, the enterprise must inform the taxpayer and the tax authority at the place of registration in writing about the impossibility of withholding the tax, the amount of the tax itself and the funds from which it was not withheld. This is given until March 1 of the year following the expired tax period in which the corresponding obligations arose. More detailed information on this topic can be obtained in the “Practical manual on personal income tax”.

When increasing the authorized capital of an LLC using funds from retained earnings, an entry is made in accounting to the debit of account 84 “Retained earnings (uncovered loss)” and the credit of account 80 “Authorized capital” after state registration of changes made to the organization’s Charter. This is required by the instructions for using the Chart of Accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n.