Having founded a company and/or become its manager, it is important not to forget about a lot of issues related to both the business activities of the company (deadlines for filing reports, document flow, etc.) and changes in individual information about yourself as an individual. In this material, we will look at the procedure for changing the passport data of the founder and/or director of a company and answer the questions: is it now necessary to register this procedure with the tax office, and whether the situation is the same for the founder/director of a resident and non-resident of the Russian Federation. Narrated by Elena Lukina (Romanova), Firmmaker.

The procedure for submitting notifications about changing passport data has its own history. It must be said that this story literally consists of several stages, but practice shows that due to the abundance of materials on the Internet, a modern applicant is often guided by outdated data and wastes time and money on preparing and submitting unnecessary documents. Let's briefly look at changes in legislation on this issue over the past few years in order to understand where the legs of such discrepancies in the legislative framework come from.

As it was: Until 2009, information about the passport details of a company participant was included in the constituent documents; accordingly, when changing a passport, it was necessary to change the Charter of the Company, attach to it a Decision or Protocol of Changes and a receipt confirming payment of the state duty.

On July 1, 2009, the situation changed - a law on the re-registration of Limited Liability Companies was adopted. After these changes, there was no need to register the passport details of the founders in the Company's Charter. This, of course, has become more convenient, since now, when changing this data, it was not necessary to adopt a new edition of the Charter, but simply made changes to the founder’s passport data in the unified state register of legal entities. Thus, the procedure was somewhat simplified, and also exempted from paying state fees when making changes.

Thus, legal entities were required to report to the Unified State Register of Legal Entities about changes in the passport data of the director and founder to the Federal Tax Service within three days from the date of issue of the passport. If you didn’t meet the deadline, then according to the law, you were promised a fine in the amount of 5 (Five) thousand rubles. Frankly speaking, it was almost impossible to meet this deadline, because... To certify the applicant’s signature, the notary needed a fresh extract from the Unified State Register of Legal Entities, which also took time to obtain. But, let’s say thank you to the tax office staff - in cases familiar to the Firmmaker’s employees, when applications for changing passport data were submitted late, no fines were imposed. This practice was valid until June 1, 2011.

How it became:

Let us turn to the law on state registration of legal entities:

“In the event of a change in passport data and information about the place of residence of the founders (participants) of a legal entity - individuals, a person who has the right to act on behalf of the legal entity without a power of attorney, and an individual entrepreneur, the registering authority ensures that the specified information is entered into the appropriate state register on the basis of the information available of such body, information about passport data and places of residence of individuals received from authorities issuing or replacing identification documents of a citizen of the Russian Federation on the territory of the Russian Federation, or registering individuals at the place of residence in the manner established by the legislation of the Russian Federation on taxes and fees, no later than five working days from the date of their receipt ."

Now let's look at this issue in more detail. Let's start with something simple.

What passport changes do Belarusians need to notify about?

This is information about an individual - full name, date and place of birth, passport series and number, who issued it, when, department code, and that’s not all. It is often believed that registration does not relate to passport data, but this is a misconception. A change in the place of registration (the corresponding stamp in the passport has been received) certainly applies to the passport data of an individual, despite the fact that it is not the basis for replacing the document. So, with citizens of the Russian Federation living in the territory of the Russian Federation, the situation is more or less clear - if such a change occurred after June 1, 2011, then the tax office must independently make changes to the passport data of citizens of the Russian Federation in the appropriate register. If the passport data has changed before the specified date, then the changes must be made independently. Let us add that if earlier errors were made in the Unified State Register of Legal Entities in the passport data of the founder and/or director, then the director of the company must make the corresponding changes independently. This is stated in the corresponding Order of the Federal Tax Service of Russia MMV-7-6/25 “On approval of forms”. This is a rule that should work; information will be updated upon an interdepartmental request between the Ministry of Internal Affairs of Russia (the FMS is now a structure of the Ministry of Internal Affairs) and the Federal Tax Service of Russia. And this rule doesn't work. For various reasons, information is not always updated. We recommend submitting changes manually.

Legislative regulation of changes when changing a manager’s passport

The procedure for changing the passport of the governing bodies of an LLC is reflected in the change of documents of the organization and is based on the following regulations:

- Civil Code of the Russian Federation

- Decree of the Government of the Russian Federation dated 07/08/1997 N 828 outlines the information that must be indicated in the passport

- Federal Law No. 14-FZ dated 02/08/1998, which reflects the procedure for establishing an LLC

- Federal Law No. 129-FZ dated 08.08.2001 determines the content of information in the Unified State Register of Legal Entities

- Order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ [email protected] determines the procedure and forms for processing documents for registering a legal entity

- Articles of Association of the LLC (if originally introduced)

- Memorandum of Association (plays a role provided that the LLC is established by 1 person)

A non-resident is required to notify the tax authority about a change of passport

What is the situation if the founder and/or director of the company is a non-resident, for example, a Belarusian? Amendments to Federal Law No. 383-FZ dated December 3, 2011 did not affect this category of individuals. Accordingly, the procedure for notifying tax authorities about changes in passport data remains the same. By the way, Belarusians have several more reasons for changing their passports than residents of the Russian Federation. The main reason is the lack of a foreign passport. All visas for Belarusians are affixed to the general passport, and in case of numerous trips abroad and all the sheets are completed, the passport must be replaced. In addition, the reasons for changing passport data are the same as for citizens of the Russian Federation: a possible change of the surname of the founder and/or director upon marriage - one of the most common situations, damage or loss of the passport, change of registration.

Thus, being a founder and/or director who is a non-resident of the Russian Federation, you are required to notify the tax authorities of a change in passport data. If you ignore this point, you may be able to avoid penalties, but when submitting documents due to any changes in the legal entity, the data contained in the tax database will differ from those that you indicate. In this case, you risk receiving a refusal due to the unreliability of the information provided about the founders (participants) of the legal entity - individuals, and the person who has the right to act on behalf of the legal entity without a power of attorney.

Therefore, we strongly advise non-residents not to tempt fate - to avoid such situations and promptly notify the tax office about changes in passport data in order to save time and money during subsequent registration changes.

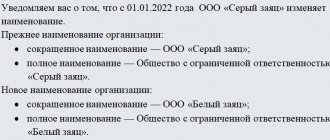

Example text of an information letter about changing the director’s passport details

With this letter we bring to your attention the change of passport data of the director of our organization Alpha and Omega LLC, who is Maria Ilyinichna Alexandrova, formerly Ivanova.

An extract from the protocol is attached.

Amendment of the Charter in case of change of passport data of the founders

In some cases, changes in the passport data of the founders, and sometimes also the director (if specified in the Charter), lead to the need to amend the LLC Charter.

When amending the Charter, information is provided to the Federal Tax Service directly by the organization.

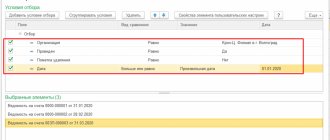

The Federal Tax Service is informed about the inclusion of information in the Charter by application in form No. P13001. To form it you need:

- edit the Charter (when one change is made, as a rule, certain points change)

- make a decision on amending the Charter by the Minutes of the General Meeting (Decision of the sole participant)

- fill out application P13001

- certify the application by a notary on the basis of the Protocol (Decision)

- draw up 2 copies of the new edition of the Charter or changes

- pay the state fee

From the moment the decision on changes to the Charter is made, the Federal Tax Service must be notified within 3 days.

What documents to submit to the registration authority when changing your passport?

Citizens of the Russian Federation can update their passport data independently using one of two options:

1. Free - a simple written statement from a legal entity that the founder/participant/director - a citizen of the Russian Federation - has changed his passport details with a copy of the new passport attached. The information must be updated within 5 working days. The application is submitted to the office by the director. 2. Paid - an application in form P14001, notarized, with new information about the passport. For individual entrepreneurs - an application in form 24001, also notarized. Cost: certification of the application (500 rubles) + extract from the Unified State Register of Legal Entities for presentation to a notary (200-400-600 rubles) = from 700 to 1100 rubles. The information must be updated within 5 working days. The head of the legal entity can submit such an application. persons or any third party on the basis of a notarized power of attorney.

In both options, a Unified State Register of Legal Entities is issued. If you submit both applications at the same time, then all information on the first will be changed, and on the second you will be refused registration.

Non-residents are required, within 3 (three) days from the date of receiving a new passport, to fill out an Application for making changes to the information about a legal entity in the Unified State Register of Legal Entities that are not related to changes in the constituent documents (Form N P14001): only those application sheets are filled out to the application, which contain information subject to change. You need to make changes to information about persons who have the right to act on behalf of a legal entity without a power of attorney (here we are talking about the director) and information about the participants of the legal entity - individuals (we are talking about the founder, respectively). The director of a legal entity needs to certify the signature on the completed application in the presence of a notary and submit the application to the tax office at the place of registration (this can be done either to the director or to a person with a power of attorney). Submission of blank attachment sheets to the application is not required. Also, when submitting documents to the tax office, you do not need to attach other documents to the application - neither a Decision nor a copy of your passport is needed.

Changing passport data for external users

Let us divide into several categories those who receive data about the manager and for whom it matters:

- government agencies;

- banks;

- EIS, State services, electronic platforms, EDI operators - i.e. various electronic services;

- counterparties.

Government bodies: Federal Tax Service, Pension Fund, Social Insurance Fund

The Federal Tax Service will receive new data automatically; you do not need to submit any applications. It is enough to order an extract electronically and make sure that the information in it is updated. This can be done through the Transparent Business service. Because exchange between departments does not always occur quickly, then in the Unified State Register of Legal Entities the data may remain out of date for some time.

If you find an error in the Unified State Register of Legal Entities , then you should first contact the FMS, which sends information about passports to the tax office. Perhaps the issue can be resolved over the phone, but it is better to send a written request. In order to speed up the process, you can also send an application to the Federal Tax Service on form 13014, but it must be certified by a notary or sent electronically with an electronic signature through the organization’s personal account on the Federal Tax Service website.

For most external users, an extract from the Unified State Register of Legal Entities is the main source of information about your company; if the information about the director in the extract and the documents you submitted (for example, an agreement) do not match, in terms of the same last name, for example, then you may be denied cooperation.

Similarly, if there is a difference in the information on the extract and in the documentation, you will be rejected when submitting an application to participate in the auction.

There is no need to send information to the FSS.

There is an important nuance with the Pension Fund - changes in SNILS. When changing the surname, an employee (not only the director) must contact the Pension Fund of the Russian Federation to replace the information; this can be done either personally or through the employer (see paragraph 1, paragraph 3 of Article 9 of Federal Law No. 27-FZ “On Individual (personalized) ) registration in the compulsory pension insurance system").

Until the data in the Pension Fund is changed, reports containing full name and SNILS, such as SZV-M or Calculation of insurance premiums, will show an error during control. Therefore, the employer should independently send information to the Pension Fund, having secured an application from the employee.

Banks

The bank also has information about the director and, of course, you need to notify him of the changes, but it is not always necessary to replace the electronic signature, just like the signature card.

If the passport number changes, but the full name remains the same, then it is enough to submit a form to the bank with new information along with a covering letter. The bank records this data in its system and will identify the manager using it.

But if the last name has changed, then you will have to change the card with signature samples and replace the digital signature.

In addition, if the director is a founder , then you need to submit additional information about him in this capacity, as well as as a beneficiary, also in the form of a questionnaire. The director must personally appear at the bank to complete the paperwork, although the forms themselves can be filled out in advance. The director will present a new passport and sign the documents in person; not all banks agree to receive data electronically and require the personal presence of the director.

Account details in 5 minutes - it's real!

Open an account with Ak Bars Bank as quickly as possible.

Electronic services

The EDF operator must also be notified of the change in passport data, because this may affect the use of electronic signatures, as we wrote above. Now managers receive digital signatures from the tax office for free, so if the data changes, if the director is already using a new signature from the Federal Tax Service, he will have to contact the inspectorate for a replacement. A new certificate will also be issued free of charge.

The Unified Information System (UIS) stores information about the manager. This system is used to participate in procurement under 44-FZ and 223-FZ. Information from it goes to electronic trading platforms - ETC (included in the list of selected ones). If the data in the UIS is not up to date, it will be out of date at all of these accredited sites.

For commercial ETCs you will have to make changes yourself.

Open a special account to participate in procurement under 44-FZ

Counterparties

It is not at all necessary to inform them about changes, although you can write a simple information letter, something like this:

“Dear counterparty, we inform you that due to a change in the passport details of the head of the organization, a new name will be indicated in the documents - instead of I.I. Ivanov. — Petrenko I.I. At your request, we are ready to provide an extract from the Unified State Register of Legal Entities with updated data.”

Some companies ask to provide a copy (scan) of the director’s passport to conclude an agreement, so they may request a new copy of the document. In this case, the organization should also pay attention to the law on personal data. If the employee has given his permission to transfer data to third parties , transfer it; if not, it is necessary to obtain consent from the manager. If he does not agree, refer to the law and refuse to provide a copy. In most cases, the counterparty will ultimately only need the data itself.

Fine for late notification of passport change

There is a fine for late notification of a passport change. And it concerns, first of all, non-residents. Art. 14.25 Code of Administrative Offenses of the Russian Federation warning or fine of 5,000 - 10,000 rubles. for the head of legal faces. The statute of limitations for these compositions is 1 calendar year, so if 3 working days have passed, it is advisable to wait until the end of the calendar year and only then make changes to the information in the Unified State Register of Legal Entities.

Do not forget. The next step should be the bank where the company's current account is opened. The director of a company whose passport data has changed is also obliged to inform the bank about his changes in his passport; if this is necessary, he will need to reissue a bank card there (sample signature and seal).

Notices to government funds and banks

Filling out form P14001 in the event of a director changing his passport may not be enough. Financial institutions often provide for notification obligations in bank account servicing agreements. The agreement makes the company responsible for the timely disclosure of information about all controlling persons. Since the general director belongs to this category, the bank must be notified in writing about the new passport. Otherwise, the security service will have questions for the client, and the legality of transactions on the account will be called into question.

But there is no requirement to report the replacement of the manager’s identity card to extrabudgetary funds. Information in the Unified State Register of Legal Entities is open. In addition, tax inspectorates independently send new data to the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund and the Federal Social Insurance Fund of the Russian Federation.

In conclusion, we note that untimely introduction of amendments to the state register will create many problems. Notaries refuse to certify transactions. Counterparties are afraid to enter into contracts. Failures in the system of interdepartmental interaction can become an obstacle to reorganization, liquidation, and amendments to the constituent documents. The director will not be able to speak on behalf of the company in court, the customs service and other structures.

Answers to common questions

Question No. 1 : Is it necessary to make changes to the Unified State Register of Legal Entities if the employment contract with the director has been extended?

Answer : Changes to the Unified State Register of Legal Entities need to be made if a new person is hired as a director (an application is submitted on form P14001); when renewing an agreement with the same person, no changes need to be made.

Question No. 2 : Is there a need to change the Charter of an LLC, which does not indicate the passport details of the founders and does not contain information about the director (if the passport details are changed)?

Answer : In this case, no changes are made to the Charter and there is no need to submit application P13001 to the Federal Tax Service. In the event of a change in the passport data of the founders and director, it is necessary to track the change of data in the Unified State Register of Legal Entities, which is carried out on the basis of interdepartmental interaction between the Ministry of Internal Affairs and the Federal Tax Service.