Features of the procedure

In order not to waste time and effort, it is better to study the rules for obtaining a document in advance. The certificate is valid for one month from the date of issue and is provided upon a written application signed by the manager and stamped.

The document on open current accounts indicates:

- name of the company or full name of the individual entrepreneur;

- legal address;

- details of the enterprise or individual entrepreneur - OGRN and TIN;

- Goal of request;

- the nature of the provision of information and its features (about fund balances, debts or lack thereof).

There are two ways to get a certificate. It is issued by a bank or the Federal Tax Service (in accordance with Law 59-FZ, Article 64 of the Tax Code of the Russian Federation). It is necessary to indicate the date of drawing up the application, since legal norms set aside a certain time for its issuance, and if there are violations, the applicant has the right to contact the prosecutor’s office.

There is no established or unified format. If you need a sample certificate or example, you can download it and view it on the Internet.

Who can request a certificate from the tax office about open accounts?

Information about the accounts and financial condition of the organization (entrepreneur) is not publicly available. A limited number of persons can request them from the tax authority:

- The owner of the account;

- Bailiffs (bailiffs);

- Representatives of the Accounts Chamber;

- Employees of the Pension Fund and Social Insurance Fund;

- Representatives of the judiciary;

- Representatives of the Investigative Committee.

It is allowed that a certificate from the Federal Tax Service regarding open current accounts can be obtained by an authorized person. It is drawn up and signed by the owner of the account, and then notarized. The last step is not mandatory, however, there are cases where the paper was refused to be issued due to missing certification. In addition, persons collecting debt from an organization (entrepreneur) through the court can request a certificate. They request the document through any branch of the Federal Tax Service.

As for firms and enterprises, the following are entitled to receive an extract from the tax office:

- CEO;

- Chief Accountant;

- Other employees specified in the constituent documents.

Please note that you should not initiate the issuance of a document too early: the certificate has a validity period of one calendar month, after which it becomes unusable.

Certificate of turnover on current account - sample form

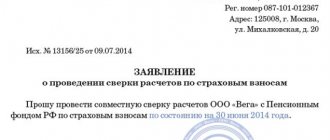

A certificate from the tax office about open current accounts is unified and includes the following items:

- List of all accounts opened in the name of a legal entity or individual entrepreneur;

- The currency in which transactions are carried out on this account;

- Names of financial institutions or other organizations in which current accounts were opened.

A sample form from the Federal Tax Service looks like this:

By law, tax authorities are required to monitor the status of legal entities’ accounts. In addition to them, information about the account can be obtained at the place of their opening - in banking institutions. The advantage of applying to the Federal Tax Service is that the document is official. Sealed, it will be accepted by any commercial and government entity. A certificate from a bank will not be accepted by every organization, and its coverage is local: it reflects the status of only those accounts that were opened in a given bank. The tax document is universal and includes information about all accounts of a legal entity.

How to obtain a certificate of availability of current accounts

Let's consider both options for obtaining help. To apply for paperwork through a financial institution, provide the following information:

- Name of legal entity/full name for entrepreneurs;

- Certificate of registration with the tax authorities;

- Contact details for communication;

- Address for issuing the document;

- Information about the person applying for the certificate.

Tax authorities need less information:

- Identity document (passport);

- Extract from the Unified State Register of Individual Entrepreneurs/Unified State Register of Legal Entities;

- Application for issuance of a certificate made in free form.

Please note that sometimes a banking institution also requires a written request. For both the inspection and the bank, the application should indicate:

- Name of organization/full name for entrepreneurs;

- TIN and OGRN of the legal entity;

- The “body” of the request indicating the reason why you needed the certificate;

- Contact details and legal address of the organization;

- Information about employees who have the right to receive the finished document;

- Date of application.

If you decide to contact the bank, your application will be recorded in a special journal under the incoming number, and the request will be transferred to the department for working with LLCs and individual entrepreneurs. Tax authorities act in a similar way: they assign a number to the request, and then entrust it to a specialist in legal entities and individual entrepreneurs.

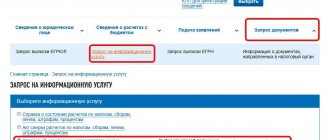

How to order a certificate of current account status through your personal account?

An important innovation affected the work of the Federal Tax Service. Now an application for a certificate can be submitted through the official website of the tax service (www.nalog.ru). After following the link, a person just needs to fill out the empty forms. Moreover, a document received electronically is not inferior to a paper copy in legal force.

So, to order a certificate online, you should go through several steps:

- Go to the Internet portal of the Federal Tax Service;

- Go through the authorization procedure and submit a request through the taxpayer’s personal account;

- If you do not have an account, register on the site and receive an electronic signature;

- Fill in the data requested by the system;

- Confirm the issue of the document with an electronic digital signature;

- Wait for a response from tax authorities.

In addition to significant time savings, working with the Federal Tax Service will help you save money: tax authorities issue certificates about the status of your current account free of charge.

The minimum period for document preparation is five working days. In practice, the wait lasts up to two to three weeks. At the same time, you can file a complaint with the prosecutor's office only after the expiration of a calendar month - this is the maximum period determined by law. Commercial banks, as a rule, provide faster service, but for a fee. An urgent order for a certificate will cost the most. Otherwise, the price tag varies from bank to bank. On average, issuing a document costs 3–10 thousand rubles. In order for the certificate to be delivered to the office, you need to pay an additional 250-300 rubles, depending on the place of registration of the legal entity and the internal regulations of the bank.

Receiving documents from the Federal Tax Service

Here you will need to present:

- statement;

- passport;

- extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

You can get a certificate of open current accounts anywhere in our country. You can contact any branch of the Federal Tax Service. The nuances of territorial reference are explained in letter No. GD-4-14/10122 dated 05.28.19. Submitting documents to the Federal Tax Service is free of charge.

Purposes of issuing certificates

Information about bank accounts is necessary for a reliable assessment of the financial stability and solvency of the company. Data may be required both by the organization itself and its counterparties. The most common cases are:

- participation in government or corporate procurement;

- processing loans or credits;

- receiving subsidies;

- struggle for grants;

- attracting investments;

- procedures for reorganization, liquidation, bankruptcy;

- litigation;

- sale of an enterprise, etc.

Bailiffs may request information about current accounts opened by the company in banks. The document becomes the basis for foreclosure on funds. Law enforcement agencies are analyzing the current state of the company. This is done as part of criminal investigations. The tasks of investigators are to identify crimes related to the laundering of criminal proceeds, the illegal withdrawal of capital from the country, and the sponsorship of terrorist and extremist groups.

In what cases may it be necessary to provide a certificate of opening a bank account to account openers?

Providing a certificate of opening a bank account may be required not only by banking organizations, but also by account openers. In particular, when registering a separate unit with the FSS, the provision of the specified document may be required due to the clarifications given in the letter of the FSS of the Russian Federation dated March 23, 2010 No. 02-03-13/08-2496.

In addition, information that an organization or individual entrepreneur has opened accounts may be needed:

- when concluding agreements with counterparties;

- participation in tenders, competitions and other auctions;

- submitting an application to open a credit line for an organization or individual entrepreneur;

- implementation of organizational measures, including reorganization or liquidation;

- receiving requests from competent authorities, etc.

In addition to the certificate, the existence of a bank account is evidenced by a corresponding agreement concluded between a credit institution and a business entity or individual.

Who can receive the document

In accordance with the legislation of the Russian Federation, financial information is provided:

- their owners or those who have a power of attorney (preferably notarized);

- managers or chief accountants of the company;

- representatives of judicial authorities (in the process of bankruptcy of an LLC or search for its property);

- bailiffs (if enforcement proceedings are ongoing);

- specialists from the Pension Fund of Russia and the Social Insurance Fund;

- employees of the investigative committee;

- debt collectors.

In accordance with confidentiality regulations (Law 395-1, Art. 26), provision of information to third parties is prohibited.

Request from the Federal Tax Service regarding the availability of accounts

The Federal Tax Service can send a request for the availability of accounts both electronically and on paper through its employee or by registered mail with notification.

The request form was approved by Order of the Federal Tax Service of Russia dated 07/19/2018 No. ММВ-7-2/ [email protected] (from 03/14/2021 it is amended by Order of the Federal Tax Service dated 07/19/2018 No. ММВ-7-2/ [email protected] ). The application form contains:

- name of the bank, its details;

- name (full name) of the person whose accounts are of interest to the Federal Tax Service;

- the motivational part, for example, an indication of the details of the decision of the Federal Tax Service on the collection of tax;

- signature of the head of the tax authority, seal.

Note! The Federal Tax Service has the right to request information not only about the presence/absence of accounts, but also information about cash balances and transactions made through these accounts. For each type of required information, the same order established different forms of requests.

Production time

To understand how much information about open accounts is issued, you need to refer to Law 59-FZ. Article 12 states that the maximum period for processing paper is one month. Exceeding the period is grounds for contacting the prosecutor's office. If information is needed during enforcement proceedings, the document must be issued within 7 days.

But how many days it takes to issue a certificate depends on the characteristics of the institution and its internal situation. It is usually prepared within 3-5 days. If the recipient has a difficult financial situation, the issuance period may increase; the certificate will be ready in 7–14 days. The electronic version is generated almost instantly.

Why do you need a certificate of current account status?

A current account (s/c) is a special account that is assigned to a legal entity to record monetary transactions. With it, the client freely manages capital: makes payments and transfers, pays taxes, cashes out funds and accepts payment through the acquiring system.

Information about settlement accounts is collected by tax authorities in order to exercise control over Russian organizations and individual entrepreneurs. They also issue certificates upon request - written confirmations of open accounts in Russian banks. When might the owner of a personal account need such a document?

Loan against acquiring turnoverTochka, Person. No. 2209

from 10%

rate per year

up to 1 million

for up to 1 year

Apply now

- When participating in government procurement, tenders, competitions or auctions;

- When developing a business strategy;

- When applying for a loan;

- To contact the judicial authorities;

- In a situation of negotiations with a potential investor;

- During the period of reorganization or liquidation of an enterprise (firm).

Obviously, situations where a legal entity needs a certificate occur regularly. That is why their registration is one of the most popular requests from tax authorities.