Changing the TIN when changing your last name

So, if you decide to find out more detailed information about replacing documents when changing your last name, then you most likely have already gotten married, or are just about to get married, for which we congratulate you. To view the complete list of documents that should be replaced after marriage, we recommend that you visit this page. If you have difficulties with the fact that you do not know which personal documents should be changed first, then we recommend that you read the article “Replacing a passport when changing your last name.” And in this article we will consider in detail such an issue as changing the TIN after marriage: how the replacement procedure goes, when and how to write an application to change the surname in the TIN, deadlines and submission options.

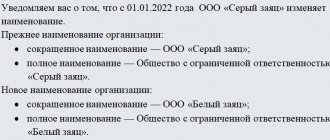

News on replacing SNILS and TIN

From April 1, 2022, instead of green plastic SNILS cards, regular paper forms will be issued. Now the document is needed not only for employment, calculation of pensions, but also registration on the State Services portal.

The meaning of the individual insurance certificate code has changed. It serves as a personal identifier in all areas of life.

Changes in legislation did not change the obligation of citizens to report to the Pension Fund about a change of surname within a month from the date of the event.

It is expected that in the near future information about a change of name will be received by the Pension Fund from the Ministry of Internal Affairs. An application for replacing the TIN can be filled out online on the official website of the Federal Tax Service. This allows you to save significant time.

What it is

The taxpayer identification number is a special codification that is assigned to each specific citizen of the Russian Federation. The relevant information must be relevant for carrying out accounting transactions for all income of persons, after which the amount is reported as part of the income tax levy. The certificate in question is also required for the calculation of pension payments.

The unique code includes twelve characters. The first two digits contain information about the citizen’s region code, and the next two – about the number of the territorial tax service. Thanks to this, tax control is carried out by competent services.

It is worth noting that the current legislation does not determine the obligation to change the TIN certificate after changing a person’s personal information - such an event can only occur on the basis of the personal initiative of the direct taxpayer. Registration of data on a change of surname is carried out by representatives of the registry office, who themselves send information about the changes to the tax office.

How and in what situations does an individual need to change the TIN certificate?

TIN is an individual identification number consisting of 12 digits, which is assigned to every taxpayer in Russia, any individual and legal entity. With the help of the TIN, tax officials control the payment of taxes by payers.

Information about the TIN is contained in a special Certificate issued by the tax office. The TIN is issued once and remains for life. However, there are situations when replacing the certificate is necessary. Remember, you can get a TIN not at your place of registration.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

How to get a TIN

To obtain an identification number, you must contact the tax office at your place of residence. Provide your civil passport and fill out an application in the prescribed form. Within five days, the certificate is issued in person.

If this document is lost, it can be restored. You need to submit a corresponding application to the tax office at your place of residence. A duplicate is issued within 2-3.

If necessary, a TIN can be assigned to a child, even before he receives a civil passport. The application is accepted from the child’s legal representative - parents, guardians or adoptive parents.

How to replace the TIN when changing your last name?

Definitely, all Russian citizens have more than once encountered the need to obtain and replace documents, these could be: passports, driver’s licenses, Taxpayer Identification Number and others. True, it is not always clear what is the basis for replacing a document.

Sometimes this needs to be done when you reach a certain age, after the document expires, or when you change your passport details, or maybe for other reasons. For example, a girl in the tower got married and changed her last name, the question arises: is it necessary to change the TIN?

When and where? If replacing a passport is a common procedure, then changing a TIN is much less common, and not everyone knows the procedure for changing a TIN when changing a surname. Therefore, in this article we will provide detailed instructions on how to replace the TIN.

First of all, let's take a closer look at what a TIN is, and why is this number needed? TIN is a taxpayer identification number. In other words, this is a unique taxpayer number that is given to all citizens of the Russian Federation.

This number is necessary in order to keep records of all income; subsequently, the amount of income tax is calculated from it. The document is also needed for calculating pensions.

The unique number consists of 12 digits, the first two are the citizen’s region code, the next two are the tax office number. Thus, with the help of the TIN, they control the payment of taxes. How to find out your TIN by last name? The law does not provide for a mandatory replacement of the TIN when changing a surname; this can only happen at the initiative of the taxpayer.

This procedure is optional, since registration of a change of surname is carried out at the registry office, which is obliged to inform the tax authorities about any changes in the data of an individual. Therefore, after notification from the registry office, the tax officer will make an entry about the change in the taxpayer’s personal data in the register.

Therefore, errors or failures in calculating taxes and deducting income tax are excluded, and the tax authority will promptly learn that your last name has changed. But there are still circumstances in which it is better to obtain a new TIN sheet. For example, you will need it when applying for a job, because here it is important to provide the correct TIN to avoid confusion; besides, it is better to show yourself to the future manager as a responsible citizen, and not run into additional document checks.

If you do not have the opportunity to quickly replace the TIN, then since there are no deadlines for replacement and no fine has been determined, you can do this as soon as you have free time. You need to come to the tax authority in person, or send documents and an application by mail, and now you can use special services on the Internet.

Thus, the Federal Tax Service does not insist on obtaining a new TIN when changing your last name; this can only happen at the request of the citizen. No middle name.

Place of Birth:. Send a request. According to the information you provided, the Individual Taxpayer Identification Number assigned upon registration with the tax authority was not found in the Unified State Register of Taxpayers (USRN).

If the individual currently has a new identification document, it is recommended that you fill out the request form again, indicating the details of the individual's previous identification document. If an individual has a document confirming registration, in order to clarify the information available to the tax authorities regarding such an individual, it is recommended that the specified individual contact the tax authority at his place of residence, he must have an identification document and a document confirming registration. - certificate or notification.

If an individual does not have a document confirming registration, such an individual may, in order to register and obtain a TIN, contact the tax authority at his place of residence and must have an identification document with him.

The information you provided was not clearly identified according to the Unified State Register of Taxpayers of the Unified State Register of Taxpayers. To clarify the information available to the tax authorities regarding an individual, such individual is recommended to contact the tax authority at his place of residence.

You must have with you an identification document and a document confirming registration - a certificate or notification if such a document is available.

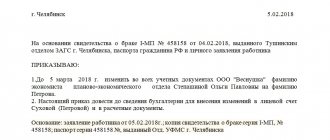

As we said earlier, control over the issuance of a TIN is carried out by the tax office, where data, including the change of surname, is sent from the registry office in order to eliminate the possibility of errors. Therefore, to obtain a new document, you need to contact the territorial office of the Federal Tax Service at your place of registration.

At the same time, you can pick up the finished TIN either at the same branch or by mail by letter to the address specified in the application. In addition to the application to the tax authority, it is necessary to submit documents confirming the identity of the citizen, his registration and change of data.

In this case, it is necessary to submit originals in person or notarized copies of the required documents. After 5 working days have passed since the documents and application were submitted, the citizen must come to the tax authority and pick up a new TIN sheet if the application was submitted in person.

If the new TIN sheet was not taken, then you can provide everyone with the previous TIN number, since it has not changed, only the last name. An identification number can be obtained not only from the Federal Tax Service during a personal visit, but also by using Internet services.

Government services where you can submit a corresponding application are gosuslugi. After registering for them, you can issue many documents, including a new TIN; you can apply for a new TIN due to a change of surname. In addition, these services allow you to track the receipt of an application, its consideration and receive information about the results of consideration of the submitted application.

Speaking about how much a new TIN will cost, it is worth noting that it is issued free of charge. This way, you will only spend money on a trip to the tax office, there will be no further costs.

The procedure is free due to the fact that the TIN number does not change; changes occur only in the entry of a new name in the tax register, so there is simply nothing to charge state duty for. Typically, a TIN number is given to every citizen of the Russian Federation for life and cannot be replaced, even if the person’s data changes.

Therefore, changing your last name does not require creating a new personal number, and it is saved. The TIN number can only be changed if there are changes in the structure of the document at the legislative level, entailing a change in the unique code; there cannot be other reasons.

In addition to replacing the TIN when changing your last name, you will need to replace many documents; we will list them in order: Not all of these documents require urgent replacement after marriage, but many of them provide for penalties for late application for a replacement document.

Be vigilant and do not miss the established replacement deadlines. The main document to replace after changing personal data is, of course, a passport.

From the date of change of surname, usually from the date of marriage, one month is given to replace the passport. The fine for late payment can cost two thousand rubles.

One year of experience as a lawyer. Graduated from the Moscow State Open University with honors. Private practice, specialization – migration and civil law. Add a comment Cancel reply.

Your email will not be published. Save my name, email, and website in this browser for the next time I comment. Notify me of new comments. Laws and documents. How to replace the TIN when changing your last name?

Share on social media Contents of the article: What is a TIN? Is it necessary to change? When does it change? What other documents are changed after marriage?

Request results According to the information you provided, the Individual Taxpayer Identification Number assigned upon registration with the tax authority was not found in the Unified State Register of Taxpayers (USRN). Return to search. TIN query results: Return to search.

Request results The information you provided was not clearly identified according to the Unified State Register of Taxpayers of the Unified State Register of Taxpayers. We apologize for the inconvenience caused! Sorry, the service is temporarily unavailable.

Please try again later. Alexander Eremeev Experience as a lawyer - one year. No ratings yet. Add a comment Cancel reply Your e-mail will not be published. Publics on social networks.

What is a TIN and how to decipher it

The practice of assigning an identification number to taxpayers has been introduced since 1999 , when Part 1 of the Tax Code of the Russian Federation came into force.

TIN or Taxpayer Identification Number is a mandatory document for every individual or legal entity. This identifier contains encrypted information about a citizen or organization and is used to record taxpayers.

Note! Individuals are assigned a code at the time of registration with the tax office at their place of residence or stay. It is valid throughout life, and after the death of a person it is transferred to the archive.

- 1-2 numbers are used to indicate the area or region in which the document was received.

- 3-4 digits - the unique number of the tax office that issued the certificate.

- 5-10 digits - directly the serial number of the taxpayer in the general register.

- The last 2 digits are important for data verification to avoid errors.

You can get a number as soon as a person becomes a tax payer (usually at the time of first employment). Specifically, the Tax Code does not have a clear age at which a person is recognized as a taxpayer.

Therefore, even a child has the right to receive a taxpayer identification number if transactions requiring payment of taxes are carried out on his behalf.

Who needs an identification number and why?

An individual in Russia cannot do without a TIN. It is necessary in a number of cases:

- When applying for a job and for declaring income.

- In the process of applying for benefits or benefits to receive a tax deduction.

- For full use of government Internet portals ( State Services ).

- Registration of purchase and sale transactions of real estate or movable property.

- If you need to apply for a loan from a bank.

- To receive information about fines or debts.

An INN is essentially an analogue of a personal account, which is used to transfer payments to the treasury, eliminating confusion and allowing an individual to be accurately identified.

Legal entities cannot do without it . It is necessary for the following purposes:

- execution of contracts with counterparties;

- submission of reports to regulatory authorities;

- obtaining credits or loans .

Additional Information! In some cases, a TIN is required for children. A minor can also act as the owner of a share of an apartment or any other property. He is not exempt from paying tax; his parents or guardians do it for him.

How and where to obtain an identification number for an individual

There are several ways to obtain a certificate of registration in 2022:

- in the territorial body of the Federal Tax Service ;

- through the MFC ;

- send the completed application by mail ;

- fill out the form on the tax website .

Note! The official resource https://service.nalog.ru/addrno.do will help you find the tax office at your place of stay or residence. The service will automatically determine the inspection details for submitting documents.

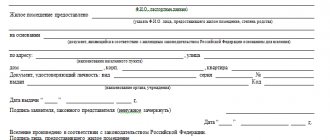

An individual who is not yet registered has the right to contact the tax office in person or use the help of a representative, subject to having a notarized power of attorney. Be sure to take with you the completed application form according to the approved Form No. 2-2-Accounting.

Official TIN application forms can be downloaded for free from the link.

The procedure is similar by contacting the MFC. When choosing this method, first check by telephone whether the selected branch provides a similar service.

You can fill out the form by hand or in printed format.

Sample of filling out the application form for TIN

1 page

2 page

3 page

The option of sending documents by mail will take a little more time. The application for registration will need to be printed, attached copies of identification documents and sent by registered mail. All documents must be certified by a notary.

The completed certificate will be sent by mail to the address specified in the application. If the applicant has a qualified electronic digital signature, the completed document can be received at the e-mail specified in the application.

Important! The certificate issuance period is 5 days, regardless of the chosen method. The countdown begins from the moment the application is received.

If there is no opportunity to contact the tax authority, the solution would be to use the official portal nalog.ru. To fill out the form, you will need to log in to your profile (if you don’t have an account, create one). The service will select an inspection agency to obtain the document depending on the citizen’s place of registration or residence.

What documents are needed to obtain a TIN?

Preparing documents before applying to the tax office will not take much time, since you only need:

- an application form filled out manually or using a PC;

- applicant's passport;

- If the place of registration is not indicated in the passport, a temporary registration document is needed.

In the event that documents are submitted on behalf of the applicant by his legal representative, a notarized power of attorney is added to the list. A copy of the applicant’s passport is also attached to the application. According to paragraph 2 of Art. 84 of the Tax Code of the Russian Federation, the time frame for registration and issuance of a certificate is 5 working days .

Important! A nice bonus is that the registration option is free. You just need to prepare the papers and submit them for verification using any available method.

For this purpose, a service https://service.nalog.ru/inn.do has been created on the official portal of the Federal Tax Service. To find out your taxpayer identification number remotely, you will need to fill out a form with personal data:

- FULL NAME.

- Date and place of birth.

- The type of identity document (passport or birth certificate), as well as its series and number.

- The date of issue of the passport is filled in as desired.

Additional Information! You can use the service to check your TIN online only if you are already registered with the tax authorities.

You can use the TIN online check service on the State Services portal if you have a profile. Log in to the system, fill out the form with your personal and passport information, and then receive the result in a couple of minutes.

Note! The service is provided by the tax service, so after logging into your State Services account, the service will redirect you to fill out a form on the Federal Tax Service website.

All options described are free, information is provided in real time. If there is no registration on the above sites, the easiest method of obtaining information is a visit to the nearest tax office. All you need is a passport.

How to get a TIN for a child

Parents can contact the tax authority at any time after the birth of a child. The basis for registration is a birth certificate.

Important! The parents of the child have the right to receive an identification number immediately after his birth. However, the law does not require this to be done urgently. There are no sanctions or fines for a child under 14 years of age not having a document.

Parents have three options: contact the tax office or MFC in person, send documents by mail, or fill out an application remotely. To save time, it is better to sign up in advance using the service https://order.nalog.ru/appointment.

In any case, you need to collect a package of certificates:

- Application in approved form No. 2-2-Accounting .

- Original passport of the child (acts as the applicant on whose behalf the application is being filled out).

- birth certificate .

- Documents on registration of place of residence.

You will have to come to the Federal Tax Service or MFC office to get the completed form in 5 days.

The procedure includes 3 stages:

- collect documents;

- submit for consideration;

- get a ready-made taxpayer number.

The key point of the procedure is the correct execution of the application form.

Remember: there should be no errors or corrections; please indicate the child’s details as the applicant. One of the parents signs the document.

A child can be recognized as a taxpayer at any age, however, until he reaches his 18th birthday, the responsibility to pay taxes for him falls on the shoulders of his parents (guardians or representatives). The application for an identification number is filled out by parents; the child’s personal presence when submitting documents is not required.

Important point! Once a child reaches 14 years of age, he or she has the right to fill out an application on their own and submit it to the tax office at their place of residence to receive a certificate.

If the child is over 14 years old, he already has a passport. Therefore, the procedure for assigning an identification number follows the same pattern as for adults:

- Filling out the application.

- Preparation of documents (passport and information about the place of registration).

- Contacting the territorial tax authority, sending documents by mail or completing the procedure remotely.

Is it necessary to change the TIN when changing a passport?

A tax identification number is assigned to citizens of the Russian Federation only once in their life. That is why many may be interested in the question of whether it is necessary to change the TIN when changing a passport. Representatives of the territorial civil registry office send a special notification to the Federal Tax Service about a change in a person’s personal information independently.

Current information is entered into a single database without the participation of the citizen himself. The legislation defines certain parameters for the implementation of the procedure in question

. It is not necessary to issue a new certificate, but it is recommended to do so to minimize risks the next time you present a new passport to regulatory authorities.

To understand the characteristic features of changing the TIN when replacing a civil passport, it is imperative to familiarize yourself with the legislative regulation, the necessary documentation, the available options, some additional points, as well as the main reasons for refusal.

TIN and religion

Many believers, due to their religious beliefs, would like to refuse a tax number. But current legislation does not provide for a procedure for canceling or destroying a TIN.

The leadership of the Federal Tax Service comments on this issue as follows. If a believer has received a tax receipt that contains his identification code, he may not pay this document. He needs to go to the bank branch and fill out the payment document himself. It is not necessary to indicate the TIN. But payments must be made to the budget within the established time frame.

But the payer must understand that without a TIN, the payment risks being lost. Full name is not unique information. There is a risk that money will be credited to the wrong taxpayer.

A tax identification number is mandatory for all citizens of the Russian Federation, regardless of their religious beliefs. Whether you want it or not, it will be assigned to you automatically when taxes are calculated. Persons who are officially employed pay income tax, so they must have a code.

It is advisable to contact your local tax office and receive a certificate. It may be useful in the future when applying for loans, concluding financial transactions, or contacting budgetary structures.

5 / 5 ( 2 voices)

about the author

Evgeniy Nikitin Higher education majoring in Journalism at Lobachevsky University. For more than 4 years he worked with individuals at NBD Bank and Volga-Credit. Has experience working in newspapers and television in Nizhny Novgorod. She is an analyst of banking products and services. Professional journalist and copywriter in the financial environment [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Why is this necessary?

According to the compulsory pension insurance system (SOPS), which has been operating in Russia since 2002, every able-bodied member of society must be registered in it. On the basis of Federal Law No. 27 (04/01/96), everyone who registers in the SOPS opens a personal account, and accordingly, is assigned an individual personal account insurance number (SNILS).

The citizen is given an insurance certificate in the form of a green plastic card with personal data, where the following must be entered:

- individual SNILS number;

- FULL NAME.;

- floor;

- Date and place of birth;

- date of registration in SOPS.

As you can see, data is entered into the system based on passport data. The employer or the employee himself is obliged to transfer monthly contributions to the account opened in the SOPS, which will be taken into account when calculating the retirement pension.

In addition to citizens who have reached the working age of 14 years, minor children can also register in the system. Their legal representatives must complete the registration procedure. Foreigners and stateless persons living on the territory of the Russian Federation are also allowed to register with SOPS.

Do citizens applying for a job need to provide a “green card” to their employer? Mandatory if the employment is official.

In addition to the fact that an insurance number is needed to transfer labor pension contributions, it must be provided when a citizen needs to:

- receive state or municipal services for which he wishes to submit an application through the State Services portal;

- visit the official website of the Pension Fund as an insured person and find out information about yourself, for example, what is the length of his work experience, how many pension points he already has, etc.;

- apply for government benefits or social services provided free of charge, such as receiving vouchers, medications, etc.

When replacing SNILS, it is assumed that only the plastic card will be replaced, where the citizen’s new personal data will be entered if, for example, his last name changes, but the insurance number itself will remain unchanged. After replacing the certificate, it can be provided upon request along with a passport and other documents, since the citizen’s personal data will match in them.

What is a TIN for an individual and why is it needed?

The individual taxpayer identification number in the Russian Federation includes 12 digits. This is not a simple set of random numbers - it contains important information:

- about the region in which the citizen lives/stays - the first two digits;

- about the tax authority where the number was obtained - the third and fourth digits;

- about the taxpayer himself - his code in the State Register is six digits (from fifth to tenth).

The eleventh and twelfth digits serve as a verification code. Thus, TIN is a unique number that is assigned to a specific taxpayer.

Many believe that every Russian citizen must have a certificate with this number, although this is not entirely true. When it comes to legal entities-taxpayers or individual entrepreneurs, the presence of this document is mandatory for them. There are some reservations regarding individuals who are not self-employed.

Yes, Art. 83 of the Tax Code of the Russian Federation indicates that the registration of such citizens will be carried out by the tax authority without any statements on their part. Whether or not to receive an official document about the assignment of a code is a matter for citizens to decide for themselves. The law gives them freedom in this.

Instead of a code, those citizens who, for religious or other reasons, do not have a certificate, have the right to indicate their passport data when submitting declarations, applications, or in other cases (Clause 1 of Article 84 of the Tax Code of the Russian Federation). An exception is admission to the civil service: providing a TIN is mandatory here.

If they wish to obtain a certificate with a TIN, citizens simply need to contact the nearest tax authority, submit an application and receive the document within 5 working days (clauses 22, 23 of Order No. 114n of the Ministry of Finance of the Russian Federation dated 05.11.2009).

This number can also be entered into a Russian passport (again, at the request of the citizen).

An individual taxpayer number not only helps the state control the payment of taxes, but it greatly simplifies life for citizens. TIN allows you to:

- receive a number of government services, for example, use your personal account on the Federal Tax Service website;

- simplify obtaining a tax deduction;

- make it easier for children to enter kindergarten, school, and obtain loans.

Without an individual taxpayer code, difficulties are likely when registering and calculating a pension.

Why does a foreigner need a TIN in Russia?

A tax identification number is assigned to all individuals who are required to pay taxes. It is necessary for accounting taxpayers, calculating tax fees and monitoring their payment.

A foreign citizen must receive a number if:

- He is a foreign specialist working in Russia.

- Resides in the Russian Federation temporarily or permanently.

- Issues a temporary residence permit.

- Represents a foreign legal entity.

- He is a private entrepreneur and his business is located in Russia.

- Issues a patent or work permit.

- Has real estate, a car or other taxable objects in the Russian Federation.

- Conducts transactions and transactions for which tax is provided.

Read more about how a foreigner in Russia can obtain a TIN

But is it necessary to re-register a TIN when obtaining Russian citizenship? We’ll talk about this later.

When changing your last name, the TIN remains the same, you just need to change the certificate!

Russian citizens receive an identification number once. It remains with them throughout their lives until their death or renunciation of Russian citizenship. Therefore, anyone who is wondering whether the TIN number changes when changing the last name should know that the number is not replaced. In any case, the document that indicates the assignment of a TIN changes. The replacement of such a document itself is desirable, but not mandatory, and can be carried out at the discretion of the citizens themselves at any time.

This is due to the fact that if there are changes in the personal data of taxpayers, regardless of citizens’ appeal to the tax authorities with a request to issue a new certificate, corresponding changes will be made to the personal data of the TIN holder. Tax officers receive information about changes in the names of citizens from employees of internal affairs bodies, who are obliged to transmit such information to the tax authorities for amendments. Therefore, the TIN number, when changing the surname after the marriage of its owner, will remain the same and continue to identify this citizen with the tax authorities.

If the decision to replace the old certificate is made, the citizen must contact the tax authorities to replace or re-issue the document. Before this, you should decide: firstly, where you can change the TIN in connection with a change of name and, secondly, how to do this in the optimal way - in person or via the Internet, the Federal Tax Service or the MFC, or use State Services.

Russian legislation allows you to replace the document on assignment of an identification number using postal services. In this case, the set of papers does not change, but the necessary copies (passports, certificates and other documents) must be notarized.

The TIN exchange takes place not in person, but remotely. The entire package of papers, including a completed and signed application (form No. 2-2-Accounting), should be sent by registered mail (with notification) to the tax authority that issued the previous certificate. The new document will also be sent to the applicant by registered mail.

Replacement by proxy is another answer to the question of whether it is necessary for the applicant to change the TIN personally. This is a method in which the replacement of a certificate occurs without the personal presence of a citizen. The role of intermediary is performed by a trusted person (to do this, it is necessary to issue a power of attorney in his name in advance).

In addition to the official power of attorney, the legal representative must present his passport as a citizen of the Russian Federation to the tax authority.

The authorized representative has the right to submit all official papers and receive completed documents instead of the applicant.

Multifunctional centers have greatly simplified the lives of Russian citizens. Obtaining and replacing certificates of TIN assignment is one of the government services that MFCs must provide.

It is convenient to use the services of the centers: you can come to an appointment after work, an MFC employee will give advice, accept documents, set an appointment date... However, now the question of whether it is possible to change the TIN at the MFC when changing your last name does not have a clear answer. Everything will depend on the specific MFC: many institutions in Moscow and St. Petersburg refuse their clients and refer them to the Federal Tax Service of the Russian Federation.

The procedure for obtaining a new certificate consists of the following steps:

- preparation of papers;

- writing an application;

- submitting documents to the MFC;

- consideration of the application by employees;

- confirmation of data changes and receipt of a new certificate.

Another alternative to replacing a document is to submit an application online on the website of the Federal Tax Service. The procedure involves filling out a simple form and takes minimal time.

Before using the services of the tax service website, you must first register on it.

As mentioned earlier, in order not to have to pay a state fee, you do not need to mark the fact that the document is being issued a second time. You can get a certificate at the Federal Tax Service office.

How long will it take to wait for a new document? The period for processing a document with an individual’s code depends on the chosen method. The certificate is usually made two to five days after the application is submitted. In addition, the length of time you wait for a certificate depends on the workload of the institution’s staff. Some lucky ones manage to receive the paper immediately or on the day of application.

As for the fixed deadlines for changing the taxpayer certificate, there are none. However, you should not delay this process, because the document may be needed at any time.

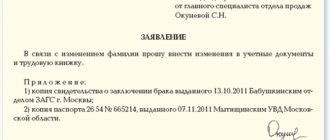

My last name has changed, is there a need to change my TIN?

Now let's figure out whether there is a need to replace this document in the case when you changed your last name. So, Russian legislation tells us the following - “Replacing a document such as a TIN in connection with a change of name is not the direct responsibility of the taxpayer,” that is, we can submit an application to change the TIN, but it is not necessary.

Why is this happening? Everything is very simple. The surname always changes through the registry office, whose duty is to inform the tax authorities about a change or change in the surname, first name or patronymic of any individual. In turn, tax services change the data in the register. Therefore, there is no need to fear that your income taxes will no longer be deducted or will be deducted incorrectly after your last name has officially changed.

It would seem that this is the answer to the question: you don’t have to change your TIN after changing your last name and move on with your life in peace. However, it is better to worry about replacing this document, because you will show it every time you apply for a job. To avoid unnecessary and unnecessary questions, as well as mistrust and checks on the part of a potential employer, it is better to replace the TIN in a situation where your last name is changed. Moreover, everything is not as complicated as it seems, and in this case there is no need to pay state duty.

If you are sorely short of time to change your TIN, you don’t have to worry; you can submit an application to change this document at any time convenient for you, without worrying about being fined or being denied the change of document.

Is it necessary to change the TIN when changing your last name after marriage?

The first thing to note is the following: the taxpayer identification number remains forever the same as it was issued by the Federal Tax Service department upon first application.

Relevance is an important feature and a necessary feature of the taxpayer register, so it is updated regularly.

In turn, civil registry office employees are required to submit information about a change in the name of citizens.

Changing your TIN when changing your last name is a voluntary process. Therefore, the changed full name is not always indicated on the Certificate. It contains the personal data that was specified at the time of registration.

Important! Changes regarding the full name will necessarily be reflected in the register, regardless of the person’s application.

The update procedure is optional, but Federal Tax Service employees still recommend doing it to avoid potential misunderstandings.

There are several authorities where you can contact: the State Services portal, the Federal Tax Service and the MFC.

Are there any deadlines for replacing the TIN or fines?

Since replacing the TIN when changing a surname occurs at will, there are no set deadlines.

There are also no penalties for delay or refusal to update the Tax Registration Certificate.

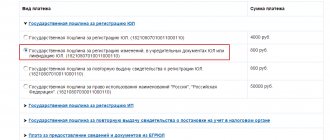

Replacement and issuance of a new document are often confused (for example, in case of loss). There is a fee for loss and no fee for renewal.

After contacting the appropriate authority, the application must be reviewed and registered. After this, a new Certificate is prepared within 5 working days, which the citizen can pick up at the place of issue.

If an individual sends an application by registered mail or by e-mail, then the Federal Tax Service registers the citizen. A new document is also produced within 5 working days. However, before this, the Federal Tax Service must verify the veracity of the data. The certificate is issued both electronically and in paper form (the latter is sent by registered mail).

It happens that the inspectorate does not have time to consider the application. Therefore, the deadlines may be postponed indefinitely, and the application is queued according to requests received.

But the opposite also happens - a new Certificate can be issued on the day you contact the inspectorate. At the same time, you will not have to pay any additional payment for expedited work - it all depends on the workload of the inspection.

Important! The date of tax registration does not change when changing your full name.

Updating your Taxpayer Identification Number (TIN) is a completely voluntary process. However, it is recommended to carry out the procedure in order to avoid troubles due to differences in personal data in different documents.

Replacing the TIN in person, what documents are needed and how to proceed?

If you do not want to use the Internet to change the TIN when changing your last name, then you will have to go to the tax office in person and change the TIN this way. First, collect all the documents you may need. This package includes:

- passport of a citizen of the Russian Federation;

- a document confirming your registration at your place of residence or stay, if there is no such mark in your passport.

Otherwise, the entire procedure remains unchanged. You just need to go to the tax office (inspectorate) at your place of residence, write a statement about the desire to change the TIN due to a change in your last name and receive a new document.

How to replace your TIN if you are in another city?

An application for the issuance of documents can be sent by mail. This is most relevant for people who are temporarily staying in another city, but do not want to delay the process of replacing documents or cannot for some reason.

When submitting your application by mail, you need to do the following: First, we collect documents - a notarized (official) copy of a document that can serve as an identity document (passport) and a notarized copy of the document confirming your registration at your place of residence.

Next, you collect all the listed documents, write an application for a new TIN (a sample of it can also be found on the official websites of government agencies or ask at any tax office in any city of the Russian Federation), and send everything listed by letter with acknowledgment of delivery.

You can receive a ready-made TIN either in person or by mail.

Updating information about personal data in the register of payers at the initiative of a citizen

Making changes to the personal data of a taxpayer occurs without the participation of a citizen, however, the law does not exclude the initiation of this procedure by the taxpayer independently

. If for some reason an automatic change in the data in the register of tax payers due to a change in personal data has not occurred, the citizen has the right to independently submit an appropriate application to Federal Tax Service division at the place of registration.

The deadline for filing an application for entering new personal data of the taxpayer and issuing a new certificate of registration is unlimited by law.

Documents that must be submitted to the tax office:

- passport with new data;

- if there is no information about registration at the place of residence in the passport - a document confirming registration;

- statement.

We invite you to read: Instructions: how to accept an apartment in a new building

There is no state fee for entering information about changes in the taxpayer’s personal data into the register and issuing the corresponding certificate. However, it should be remembered that re-issuing a certificate (if it is lost, for example) is subject to a state fee.

Application form

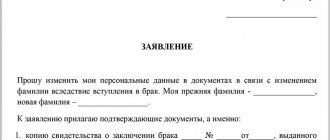

The law does not provide for a special application form for the situation under consideration. In practice, if it is necessary to replace information about the taxpayer’s personal data, he writes an application on form No. 2–2-Accounting (this form is also used for initial registration).

To change personal data in the taxpayer register, a citizen submits an application using form No. 2–2-Accounting (the form consists of three pages)

The application will need to indicate:

- TIN assigned upon registration;

- Taxpayer's full name (new);

- contact details - phone, email;

- information about the representative (if the application is submitted by a representative by proxy);

- information about changes in personal data - last name, first name, patronymic;

- floor;

- Date and place of birth;

- details of the identity document;

- registration information.

Methods of submitting documents to the Federal Tax Service: by power of attorney, via the Internet and others

Today you can contact the Federal Tax Service via the Internet.

You can request to update information in the register of tax payers in several ways:

- By personally appearing at the tax authority, the Federal Tax Service employee is provided with only the original passport.

- Through a representative. The representative must provide a copy of the applicant's passport, certified by a notary, his own passport and a power of attorney. The power of attorney is also certified by a notary. Both a general and a special power of attorney will be suitable, which will indicate the right of the authorized person to contact the Federal Tax Service with a corresponding request.

- Via postal service. The applicant attaches a photocopy of the passport certified by a notary to the completed and signed application form. The letter is sent by registered mail with acknowledgment of delivery to the addressee.

- Through the Internet. The opportunity to submit an application is implemented on the government services portal and on the website of the Federal Tax Service of Russia. Having submitted an application through the government services website, the citizen must subsequently appear for a certificate of registration in person or send a representative. You must have a passport with you (for a representative - a notarized copy of the applicant’s passport, a power of attorney and your own passport). The Federal Tax Service website has the ability to send an application with an electronic signature (if the citizen has one). In this case, the certificate can also be sent by email.

https://www.youtube.com/watch?v=channelUCAKEnrDsOc9nmxfv-duhmgA

Changing the taxpayer’s personal data or residential address does not entail the need to change the TIN. This number, assigned once, remains with the citizen for life. However, the tax registration certificate must be replaced. Replacement occurs automatically in most cases.

Is it possible to restore the TIN in the MFC?

Many users are interested in whether it is possible to restore a TIN if it is lost? If your ID is lost or damaged, you can restore the document by ordering a duplicate of the certificate. The taxpayer number is stored in the database and will remain the same. To replace a damaged or lost certificate, a duplicate is issued, for which you must pay a fee of 300 rubles and attach a receipt to your application.

How can I restore my number? The application is sent to the Federal Tax Service at the place of registration by mail, through a representative, or submitted during a personal visit. It is convenient to restore the TIN through the MFC if it issues identification numbers to taxpayers. You can visit the nearest multifunctional center and take a coupon for the electronic queue or sign up in advance through the MFC website.

To make a pre-registration, go to the website of the local MFC and make an appointment online. In this case, in addition to the receipt and application for restoration, you will need to provide identification.

In what cases is it necessary to replace the TIN?

The TIN number is unique and is issued once and for life. The twelve-digit number itself cannot be changed; it will remain the same. However, in some cases it is possible to replace the form of the Certificate of Registration.

Cases when it is necessary to change the TIN certificate:

- its loss or damage;

- change of surname, first name or patronymic.

Replacement is not required if you change your place of registration.

Remember, even the slightest mistake when filling out will either lead to you being immediately asked to fill out the form again, or the documents will be accepted, and later a refusal to assign a TIN will come.

What is TIN

First, you need to decide what kind of document this is. Its decoding is simple - taxpayer identification number. Everyone connected with the tax office has it, that is, all citizens and organizations that must pay taxes to the state fund. This is what the tax code says.

It turns out that everyone should have it, but for some reason some don’t even suspect its existence. They issue it at the place where you are registered, at the regional Federal Tax Service. What to do with this document after changing your registration?

Sources

- Anastasia Vasilievna Ustinova Lawyer's Handbook: Corporate Disputes. Educational and practical manual; Prospect - M., 2012. - 794 p.

- Andreevsky Sergey Case of Naumov; Mechanical engineering - Moscow, 1986. - 150 p.

- Alexander Ivanovich Stakhov Administrative control and supervisory proceedings; Mir - Moscow, 1999. - 471 p.

- Anatoly Nikolaevich Kuznetsov Criminal procedural acts 2nd ed. Textbook for open source software; Yurayt - M., 2022. - 539 p.

- Alexander Ivanovich Travnikov Legal regime of airspace. Air navigation and safety. Monograph; Prospect - M., 2001. - 984 p.