Who is paid the benefit?

Monthly child care benefits are paid only until the child turns 1.5 years old. The recipient of the benefit may be:

- mother;

- father;

- grandma or grandpa;

- any relative;

- another person who is raising a child without a mother.

The most common situation is when a woman, the mother of a child, receives care benefits. In second place are fathers. A father can receive a monthly allowance for a child under one and a half years of age if it is confirmed that the child’s mother does not receive this allowance. This is prescribed by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” This fact can be confirmed by a certificate from the employee’s place of work or from social security (if the mother does not work).

If the benefit is assigned to another relative, both parents must confirm the non-receipt of the subsidy and non-use of leave.

The care allowance is available to both employed and non-employed persons. However, if the caregiver is employed, the benefit is calculated at 40% of average earnings. And the unemployed are paid a fixed minimum. Despite the fact that this minimum is indexed annually, its size is usually less than benefits calculated based on average earnings.

Even more about the payment of benefits and nuances can be found in the course of the same name. Right now it's 40% off.

Maternity capital in 2022

Maternity capital in 2022 is paid in the following amounts:

- RUB 483,881.83 for the first child born or adopted after January 1, 2022;

- RUB 639,431.83 for a second child if he was born or adopted after January 1, 2022 in a family where the first child was born in 2022 or earlier;

- RUB 639,431.83 for a third or subsequent child born or adopted in 2022 or later. Provided that the family did not have the right to receive maternity capital until January 1, 2020.

Maternity capital is annually indexed taking into account inflation in accordance with Part 2 of Art. 6 of the Law of December 29, 2006 No. 256-FZ.

Maximum and minimum amount of care benefit in 2022

From January 1, 2022, the maximum monthly allowance for child care up to 1.5 years is set at 29,600.48 rubles per child.

In general, the amount of childcare benefits for children up to one and a half years old is set at 40% of the employee’s average salary. However, if the recipient’s earnings are very high, the payment is made based on the maximum allowable amount.

If the recipient has more than one child (for example, children of the same age, twins or triplets were born), the benefit is given to each in the same maximum amount.

But there is one more limitation: the total amount of benefits paid should not exceed the amount that is obtained using a standard calculation based on average earnings.

If the mother of triplets before going on vacation had an average salary of 35,000 rubles per month, then her maximum allowance for caring for two children will be a maximum of 35,000 rubles, and not 120% of the average earnings (40% for each child), as many people mistakenly believe.

The law also establishes a minimum amount of monthly child care benefits. From February 1, 2022, the minimum amount is 7082.85 rubles. The benefit cannot be lower than this amount.

Monthly benefits for children under 3 years old 2022

The right to receive child benefits up to 3 years of age depends on several parameters:

- level of family poverty;

- age and order of appearance of the child (children);

- region of residence of the family.

Payments for the first and second child 2021

The first and second children born from 01/01/2018 are entitled to a monthly payment until the child reaches the age of three years.

What you need to know:

1. The payment is assigned if the income per person in a family (including children) is less than 2 subsistence minimums for the working population (hereinafter referred to as PMTN) established in the region of residence. The minimum for comparison is taken for the 2nd quarter of the year preceding the year the benefit was assigned.

EXAMPLE

PMTN in Moscow in the 2nd quarter. 2022 was 20,361 rubles. The family has two adults and two children aged 7 and 1. The monthly income is made up of the husband’s salary (100,000 rubles) and the wife’s care allowance for up to 1.5 years - 10,000 rubles. So, per capita income:

110,000 / 4 = 27,500 rubles.

This is less than double the PMTN in the region. A family can apply for benefits for a child under 3 years of age.

2. The payment is received by the woman who gave birth (adopted) a child. And only if something happened to her (she died, was deprived of parental rights), the payment can be made by the father or guardian.

3. The amount of the assigned payment is equal to the subsistence minimum established for children in the region of residence of the family. The minimum value is also taken for the 2nd quarter of the previous year.

EXAMPLE (CONTINUED)

When a payment is assigned for a child under 3 years of age in 2022, the mother will receive 15,450 rubles (children's cost of living in Moscow in the 2nd quarter of 2022).

4. The payment is scheduled for a year. If you have the right to receive it in the future, you must submit a separate application for renewal. The general order has been changed due to coronavirus in 2022. If government agencies do not have information about a change in the situation in the family (for example, moving to another region), the due payments are automatically extended. This procedure will remain in effect until March 1, 2021.

ADVICE

To determine your right to payment, you can use a special calculator on the Pension Fund website.

Allowance for caring for a disabled child

A monthly allowance for caring for a disabled child is provided in case of caring for him under the age of 18 years. To receive this benefit, the parent or adoptive parent must be able to work, but not work. Only in this case will a benefit be assigned.

The amount of this benefit in 2022 for parents depends on the region and on the type of family relationship between the disabled person and the caregiver. For example, in Moscow, the parent or adoptive parent of a disabled child is paid 10,000 rubles, and another relative or non-family member is paid 1,200 rubles.

These benefits are paid not by the Social Insurance Fund, but by the Pension Fund. Therefore, you should apply for them in 2022 directly to the Pension Fund.

Payments for children from 3 to 7 years old 2022

This payment is like a continuation of the previous one. However, it is only available to even less wealthy families.

If families where the income per member does not exceed 2 times the minimum subsistence level can count on payment for a child up to 3 years of age, then after the child is 3 years old, the income should be invested only in 1 subsistence minimum.

Otherwise, the calculation rules are the same as for benefits for a child under 3 years of age. In the same way, the PMTN value is taken for the 2nd quarter of the previous year. If the family's per capita income is less than 1st monthly wage in the region, then for each child from 3 to 7 years old a payment is due in the amount of ½ of the child's subsistence level.

From 01/01/2021, some families will have the right to a double benefit from 3 to 7. That is, the full cost of living in the region.

To receive double benefits, you need to calculate your family income again. But already taking into account the amounts received after the previous appeal. If the income per family member, even taking into account half the benefit, does not exceed the MTSI, the child benefit will be increased.

EXAMPLE

PMTN in St. Petersburg in the 2nd quarter. 2022 was 12,796.90 rubles. The family has two adults and two children aged 8 and 4 years. The monthly income consists of the husband’s salary (35,000 rubles) and the wife’s salary (working part-time) - 8,000 rubles. So, per capita income:

43,000/4 = 10,750 rubles

This is less than the PMTN in the region. A family can apply for benefits for a 4-year-old child.

The child minimum in St. Petersburg in the 2nd quarter of 2022 was 11,366.10 rubles. The usual benefit amount will be equal to half the child minimum - 5,683 rubles.

That is, the new income per family member, taking into account benefits, will be:

(43,000 5683) / 4 = 12,170 rubles

Which is still less than the subsistence level of 12,796.90 rubles. That is, in 2022, a family can qualify for a payment per child in the amount of the full child subsistence level of 11,366 rubles.

To determine your right to payment, use the calculator on the State Services website.

In 2022, benefits for children from 3 to 7 years old were not paid to guardians. However, the Ministry of Labor has already submitted a bill to legislators for consideration that would allow low-income custodial families to apply for benefits in 2022.

Maternity benefit in 2022

The amount of maternity benefit is equal to the average daily earnings multiplied by the number of days of maternity leave.

To calculate the amount of the payment, you need to take the average daily earnings and multiply by the number of calendar days of maternity leave according to sick leave: 140, 156 or 194 days.

To calculate average earnings in 2022, the base established for calculating insurance premiums for 2022 and 2020 is taken.

These bases are:

- for 2022 – 865,000 rubles;

- for 2022 – 912,000 rubles.

Hence the maximum size

The average daily earnings is

2,434.25 rubles

. ((912,000 rub. + 865,000 rub.) : 730 days).

Maximum amount of maternity payments in 2022

If the employee did not write an application to postpone the pay period, we take 2022 and 2022 to calculate average earnings.

Taking into account the maximum values of the base, the maximum average daily earnings will be 2,434.25 rubles. ((912,000 rub. + 865,000 rub.) : 730 days).

The amount of maternity benefit cannot exceed the following values:

- RUB 340,795 - if the duration of leave under the BiR is 140 days;

- RUB 379,743 - if the duration of leave under the BiR is 156 days;

- RUB 472,244.5 - if the duration of leave under the BiR is 194 days.

The minimum benefit for a full calendar month is RUB 12,792. If there are regional coefficients in the region, they must be taken into account when calculating.

List of documents for receiving maternity benefits:

- sick leave;

- application for maternity leave in any form (Article 255 of the Labor Code).

The company's accounting department is obliged to accrue benefits no later than 10 calendar days from the moment the employee wrote and submitted the application.

Benefit for registration in early stages of pregnancy in 2021

The basic benefit amount is 300 rubles. This amount increases by the indexation coefficient and the regional coefficient for work in the Northern areas.

In January 2022, the benefit will be 675.15 rubles.

From February 1, 2022, by Decree of the Government of the Russian Federation dated January 28. 2021 No. 73, the benefit has been indexed.

If sick leave for maternity leave was issued on February 1, 2021 or later, the woman will receive benefits in the amount of 708.23 rubles.

Documents for payment of benefits:

- a certificate issued by a medical institution (drawn up in free form),

- employee statement.

An employee can submit documents within 6 months after the end of maternity leave.

Child care benefit up to 1.5 years in 2022

The mother of the child or the one who actually cares for the child has the right to receive child care benefits for a child under 1.5 years of age (Part 4, Article 11.1 of Law No. 255-FZ of December 29, 2006).

Minimum benefit

for child care up to 1.5 years for those who do not work in January 2022 will be

6,752.00 rubles.

(Article 24 Federal Law No. 166-FZ dated 06/08/2020).

From February 1, 2021

Decree of the Government of the Russian Federation dated January 28.

2022 No. 73, child care benefits up to 1.5 years old are indexed. The minimum size is RUB 7,082.85

. per month, regardless of the number of children.

Maximum size

monthly childcare benefit for a child up to 1.5 years old in 2021 will be

29,600.44 rubles.

| (912,000 (maximum FSS base in 2022) | + | 865,000 (maximum base for the Social Insurance Fund in 2022) | / | 730 days (in 2019-2020)) | × | 30,4 | × | 40% |

To calculate child benefits in 2022, a new calculation period is taken - 2022 and 2022.

Basic amounts for insurance premiums:

- 2019 – RUB 865,000.

- 2020 – 912,000 rub.

The maximum allowance for child care up to 1.5 years in 2022 is 1,615.77 rubles. more than in 2022 (RUB 27,984.66).

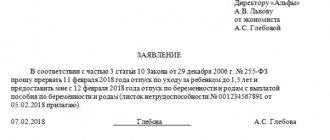

List of documents for receiving benefits for child care up to 1.5 years

- application for benefits,

- birth (adoption) certificate of the child and its copy,

- child adoption certificate and its copy (if a child is adopted),

- extract from the decision to establish guardianship over the child (for the guardian),

- birth or adoption certificate of previous children and a copy;

- a certificate from the other parent’s place of work stating that he does not use parental leave and does not receive a monthly allowance;