Management in LLC

The Civil Code of the Russian Federation directly provides for both the possibility of establishing an LLC by one founder, and the admissibility of the operation of an LLC, initially founded by several persons, later with one participant.

This can happen either as a result of the departure of the remaining founders from the LLC over time, or in the event of one person acquiring 100% of the shares of the LLC (Part 2 of Article 88 of the Civil Code of the Russian Federation). If in business practice the term “founder of an LLC” is usually used, the legislator prefers to use the term “member of an LLC”. From a legal point of view, these terms are almost identical: the founder is the participant who created the LLC. We will not take this minor difference into account below.

Management in an LLC can be:

- Three-level, including:

- general meeting of participants (GMS);

- board of directors (BoD);

- one or more executive management bodies.

- Two-level, without the formation of diabetes. For an LLC with 1 participant, having a board of directors in the management system does not make practical sense; in this case, a two-level management system is used.

Executive power in an LLC can be organized in 3 ways:

- Sole executive body. In practice, this body/position is most often referred to as “general director,” although other names are also found.

- A sole executive body together with a collegial executive body (usually called “board” or “directorate”).

- A management company is another legal entity that performs the functions of an executive body.

If the founder and director of an LLC coincide in one person, the 1st option for organizing the executive body is usually used.

The main governing body of the LLC is the general meeting of participants; it makes decisions on the most important issues of the LLC’s functioning. The competence of the meeting is determined by Art. 33 of the Law “On Limited Liability Companies” dated February 8, 1998 No. 14-FZ (hereinafter referred to as Law No. 14-FZ). A number of issues fall within the exclusive competence of the OSU, i.e. their resolution cannot be transferred to another body of the LLC by the company’s charter. If there is only one participant in the LLC, then he makes decisions on behalf of the general meeting individually. Such decisions must be made in writing. In this case, a number of provisions defined by Law No. 14-FZ in relation to general meetings in an LLC do not apply to one participant (Article 39 of Law No. 14-FZ).

For information on the distribution of profits in an LLC with one founder, read the article by ConsultantPlus. If you do not yet have access to the ConsultantPlus system, you can register for free for 2 days.

The only founder is also the director. Multiply by two

In an LLC, the only founder is appointed by the charter as the general director. An employment contract was concluded between him and the organization and an entry was made in the work book. Currently, work has been suspended and no work is expected in the near future; there is no talk of terminating the activities of the LLC. In parallel, the same person becomes a founder in another LLC and is also appointed general director and again becomes the sole founder, an employment contract is also concluded with him, and a salary is paid monthly.

What to do with entries in the work book? What is the right thing to do in this case? Is it possible to fire him from one LLC and place him in another LLC?

Art. 49 of the Civil Code of the Russian Federation

It has been established that the legal capacity of a legal entity arises at the moment of its creation and terminates at the moment of making an entry about its exclusion from the unified state register of legal entities.

That is, until a legal entity is excluded from the State Register, it is considered to actually exist

and the legal basis for its functioning is regulated by relevant laws and regulations.

The constituent documents of a legal entity must define the name of the legal entity, its location, and the procedure for managing its activities.

legal entity, as well as contain other information provided by law for legal entities of the corresponding type (

Article 52 of the Civil Code of the Russian Federation

).

The procedure for managing the activities of a legal entity is determined upon its establishment.

A legal entity acquires civil rights and assumes civil responsibilities through its bodies

acting in accordance with the law, other legal acts and constituent documents.

The procedure for appointing or electing bodies of a legal entity is determined by law and constituent documents ( Article 53 of the Civil Code of the Russian Federation

).

So, for example, in accordance with Art. 32 of the Federal Law of the Russian Federation dated 02/08/1998 No. 14-FZ “On Limited Liability Companies”, the management of the current activities of the company is carried out by the sole executive body

of the company or the sole executive body of the company and the collegial executive body of the company.

The sole executive body of the company is elected

by the general meeting of the company's participants for a period determined by the company's charter.

one-member society

, decisions on issues within the competence of the general meeting of company participants are made by the sole participant of the company

individually

and are documented in writing.

The sole executive body of the company can be the general director, president, director and others.

Art. 40 of Law No. 14-FZ establishes the obligation of the company to conclude an agreement

between the company and the person performing the functions of the sole executive body.

Sole executive body of the company:

1)

acts on behalf of the company without a power of attorney, including representing its interests and making transactions;

2)

issues powers of attorney for the right of representation on behalf of the company, including powers of attorney with the right of substitution;

3)

issues orders on the appointment of company employees to positions, on their transfer and dismissal, applies incentive measures and imposes disciplinary sanctions;

4)

exercises other powers not assigned by the LLC Law or the company's charter to the competence of the general meeting of the company's participants, the board of directors (supervisory board) of the company and the collegial executive body of the company (Article 40 of Law No. 14-FZ).

Note!

This norm directly states that the director (sole executive body of the company) acts on behalf of the company

.

As a result of appointment to a position or confirmation in a position in accordance with Art. 19 Labor Code of the Russian Federation

labor relations

arise .

The parties to the labor relationship are the employee and the employer.

In this case, an employee is recognized as an individual

that has entered into an employment relationship with the employer, and

the employer

(in your case)

is a legal entity (organization)

that has entered into an employment relationship with the employee.

Thus, regardless of the fact that an individual is the sole founder

organization created by him, if the specified person also performs the functions

of the director

an employment relationship arises

between him and the legal entity .

Features of labor regulation of the head of an organization are established by Chapter 43 of the Labor Code of the Russian Federation

, where it is stated that

the head of an organization is an individual

who, in accordance with the Labor Code of the Russian Federation, other federal laws and other regulatory legal acts of the Russian Federation, constituent documents of a legal entity (organization) and local regulations, manages this organization, including performing functions of its sole executive body.

At the same time, according to Art. 273 Labor Code of the Russian Federation

the provisions of Chapter 43 of the Labor Code of the Russian Federation

do not apply

to the head of the organization, who is

the only participant

(founder), member of the organization, owner of its property.

Rostrud

believes that in a situation where the sole founder of a legal entity is also its director, there is no employer in relation to the general director.

Thus, according to officials, in this case, an employment contract with the general director as an employee is not concluded

.

At the same time, the general director enters into employment contracts with employees, acting as an employer in them. Signing an employment contract by the same person on behalf of the employee and on behalf of the employer is not allowed. The specifics of regulating the work of the head of an organization are provided for in Chapter 43 of the Labor Code of the Russian Federation.

According to Art. 273 Labor Code of the Russian Federation

the provisions of this chapter do not apply to the head of the organization if he is the only participant (founder) of the organization (letter dated December 28, 2006 No. 2262-6-1)

(end of quote)

.

However, Art. 19 Labor Code of the Russian Federation

It is established that

an employer

is an individual or legal entity (organization) that has entered into an employment relationship with an employee.

Consequently, the conclusion of Rostrud that in the situation we are considering in relation to the director his employer is absent is incorrect.

Employer present

. This is a legal entity established by an individual.

The director is not an employer, but acts on behalf of the employer-organization.

In addition, in this case, Rostrud’s reference to Chapter 43 of the Labor Code of the Russian Federation is untenable.

Chapter 43 of the Labor Code of the Russian Federation establishes specific features

regulation of the labor of the head of the organization,

in particular

, concluding a fixed-term employment contract with the head of the organization, additional grounds for terminating the employment contract with the head of the organization, guarantees to the head of the organization in the event of termination of the employment contract, early termination of the employment contract on the initiative of the head of the organization, part-time work for the head of the organization , financial responsibility of the head of the organization.

It is clear that the manager, the sole founder, decides all these issues independently.

For example

, the rules on the financial responsibility of the manager cannot apply to him, since, being the only founder, he causes losses to himself and, accordingly, either compensates for them or does not compensate for them.

Other labor law norms in full

apply to the manager - the sole founder.

In Art. 11 Labor Code of the Russian Federation

a list of persons who

are not covered

labor legislation has been established.

not named

in this list .

Consequently, from the point of view of the Labor Code of the Russian Federation, the director of an LLC is an ordinary employee who is subject to labor law standards, including rules governing the procedure for formalizing labor relations.

Accordingly, the founding director is subject to labor law regulations governing remuneration.

An employment contract must be concluded with the head of the organization - the sole founder - and he must be paid a salary

at least twice a month and not below the minimum wage.

Thus, until the company is excluded from the State Register (that is, has not officially ceased to exist), it is recognized as valid and legally capable.

The company must have an executive body (in your case, a sole executive body - director), which is recognized as an employee in relation to the legal entity - the employer.

In accordance with labor legislation, the employee must be paid wages.

It is not clear from your question how labor relations are formalized in the two organizations.

According to Art. 276 Labor Code of the Russian Federation

The head of an organization can work

part-time

for another employer only with the permission of the authorized body of the legal entity or the owner of the organization’s property, or a person (body) authorized by the owner.

Since both the only authorized body of the organization and the only owner of its property is the sole founder of the organization, he does not require permission to work part-time.

In accordance with Art. 66 Labor Code of the Russian Federation

The work book is kept only

at the main place of work

.

At the request of the employee, information about part-time work is entered into the work book at the place of main work on the basis of a document confirming part-time work.

That is, an individual recognized as an employee under an employment contract can have only one work book.

Part-time work is the performance of another paid job, in addition to the main one, for another employer with the conclusion of a separate employment contract

.

Consequently, in one LLC the work of a director will be his main job, in another - a part-time job.

The work book is one and must be kept at the main place of work.

Until the LLC is liquidated, it must have a sole executive body, that is, a director.

In your situation, you can offer two options for solving the problem.

First

- take advantage of the recommendations of Rostrud (the above letter) that are not entirely correct, but beneficial for you, and

terminate the director’s employment contract with the first LLC

.

In this case, the director will remain the director of the LLC based on the decision of the sole participant of the company, but without an employment contract and, accordingly, without mandatory payroll.

In the second LLC, the employment contract for part-time work is also terminated and an employment contract is concluded at the main place of work with the corresponding entries being made in the work book.

Option two

- at the place of work in the first LLC, the director sends himself on leave without pay.

However, this raises the issue of tax returns.

In accordance with Art. 80 Tax Code of the Russian Federation

a person recognized as a taxpayer for one or more taxes, who does not carry out transactions that result in the movement of funds in his bank accounts (at the organization's cash desk), and who does not have objects of taxation for these taxes, is obliged to submit a

single (simplified)

tax return , the form of which was approved by order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62n.

When confirming the accuracy and completeness of the information specified in the declaration submitted by the organization, the signature of the head of the organization

, which is certified by the seal of the organization. In this case, the full last name, first name, and patronymic are indicated and the date of signing the declaration is indicated.

If the manager is on leave without pay, he cannot sign the declaration.

But there is still a way out of this situation.

Clause 2 Art. 8 of the Law on LLC states that in addition to the rights provided for by the Law, the charter of the company may provide for other rights

(additional rights) of the participant

(s) of the company. These rights may be provided for by the charter of the company upon its establishment or granted to a participant (participants) of the company by decision of the general meeting of participants of the company, adopted unanimously by all participants of the company.

Consequently, the only participant in society can give himself an additional right

, putting it in writing.

Thus, the founder may decide that he, along with the sole executive body, can act without a power of attorney on behalf of the company.

In this case, for tax legal relations he will be recognized as the legal representative of the taxpayer-organization.

According to Art. 27 Tax Code of the Russian Federation

Legal representatives of a taxpayer-organization are persons authorized to represent the specified organization on the basis of the law or its constituent documents.

A Art. 26 Tax Code of the Russian Federation

it is provided that the taxpayer can participate in relations regulated by the legislation on taxes and fees through

a legal

or authorized representative.

The authority of the representative must be documented.

In accordance with the procedure for filling out a single (simplified) tax return

when confirming the accuracy and completeness of the information in the declaration, the taxpayer's representative indicates the last name, first name, patronymic (in full) of the individual - the taxpayer's representative in accordance with the identity document.

When confirming the accuracy and completeness of the information specified in the declaration, an individual representative of the taxpayer puts a signature

individual and

the date

of signing is indicated.

the document is also indicated

, confirming the authority of the taxpayer’s representative.

In this case, a copy of the specified document

.

Thus, the sole founder

may sign a tax return as a legal representative of the taxpayer organization, attaching to the declaration a copy of the decision of the sole founder of the organization on acquiring rights and accepting responsibilities on behalf of the organization.

However, the second option is less profitable

, since working as a director of the second LLC on an external part-time basis, the director will lose wages.

After all, according to Art. 284 Labor Code of the Russian Federation

The duration of working hours when working part-time should not exceed four hours a day.

And although on days when the employee is free from performing job duties at his main place of work, he can work part-time full time (shift), within one month (another accounting period) the duration of working time when working part-time should not exceed half a month working time standards (working time standards for another accounting period).

And remuneration for persons working part-time is made in proportion to the time worked.

Consequently, it is more profitable for the director to act in accordance with the first option.

Can a founder be a director of an LLC?

A direct and positive answer to this question is contained in Part 2 of Art. 88 of the Civil Code. Note that when the director and founder are one person, the management system in the LLC does not become single-level. Although all decisions at any levels of management in such an LLC are made by the same person, from a legal point of view this is a two-level management system. The issue of delimitation of competence is resolved as follows:

- the powers of the participant are determined by the charter of the LLC;

- all other issues are resolved by the General Director on a residual basis (if there is no board of directors in the management system).

For an LLC with one participant (aka director), the rules of Law No. 14-FZ on interested-party transactions and major transactions do not apply (part 1, paragraph 5, article 45 and part 1, paragraph 9, article 46 of the said law).

In an LLC with a single participant, there is no conflict of interest; it is easy to administer and, from a management point of view, resembles an individual entrepreneur. However, legally there are significant differences between an individual entrepreneur and such an LLC.

IMPORTANT! The advantage of an LLC over an individual entrepreneur is limited liability. When creating an LLC, an individual transfers part of his property to him, and with this property the LLC is liable for its debts. When an individual entrepreneur is formed, an individual is liable with all his property for the debts of the individual entrepreneur. At the same time, in entrepreneurship, individual entrepreneurs have their advantages over LLCs. This question is discussed in detail in the article “What is better to open - an individual entrepreneur or an LLC (nuances)?”

Acting General Director

When a director goes on vacation or goes on a business trip, the procedure for replacing him is determined based on the company’s charter. If the charter does not provide for the director’s right to transfer his duties to another employee, then this issue is agreed upon with the shareholders or founders, who may or may not allow this to be done. If the founders decide to appoint one of them as acting director, then he is temporarily accepted into the company’s staff, that is, an employment relationship is formalized with him during the absence of the general director. Upon the return of the director, the temporary employee is fired (

Founder and CEO rolled into one: employment contract

One of the main issues that arise in practical life is the issue of an employment contract (EA) with the director. The features of drawing up a TD in this case are discussed in the article “Employment contract with the general director of an LLC (sample).” Chapter 43 of the Labor Code of the Russian Federation (LC) is devoted to issues of employment contracts with the director (as well as members of the board). However, in the event of a coincidence between an LLC participant and its director, its regulation does not apply (Part 2, Article 273 of the Labor Code). At the same time, the director of the LLC is not included in the list of persons who are not subject to the regulation of the Labor Code and with whom an employment contract is not concluded (Part 8 of Article 11 of the Labor Code). There is some legal uncertainty.

An additional complexity is the following: if an LLC enters into a TD with the director, then who signs it on behalf of the employer?

It turns out to be a kind of legal paradox: the TD must be signed by the same individual both on behalf of the employee and on behalf of the employer. Note that in this case, an individual is in a different status: in one case, he acts on his own behalf (employee), and in the other, he is a representative of a legal entity. Note that the prohibition on concluding transactions for a representative in relation to himself as an individual is contained in clause 3 of Art. 182 of the Civil Code. But the regulation of the Civil Code does not apply to labor relations, and there are no such prohibitions in the Labor Code.

CEO salary

Even if the CEO receives dividends from the organization's profits, he is entitled to a salary. Since he, like other employees, performs a certain labor function. According to Article 57 of the Labor Code of the Russian Federation, in the contract with the general director, as with any other employee, it is necessary to specify the amount of remuneration. In case of violation of labor legislation, a fine will be imposed on both the organization and the official (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

- 1,000 – 5,000 rubles – for individual entrepreneurs and officials;

- 30,000 – 50,000 rubles – for organizations.

Law enforcement practice: TD with a director in an LLC with one participant (aka director)

As a result, different law enforcement officials expressed different views on this subject and formed different law enforcement practices in their activities. Let's consider the points of view expressed.

- Rostrud, in letter No. 177-6-1 dated March 6, 2013, stated that an employment contract with the director in this case is not concluded.

- On the website onlineinspektsiya.rf (information portal of Rostrud) on March 10, 2015, the answer was given that the TD (and no other agreement) in such a situation is not concluded, the director’s salary is not accrued, and contributions to the Pension Fund and Social Insurance Fund are not made. But on March 17, 2016, the opposite answer was given to the same question: the TD is concluded, the salary is accrued.

- The Ministry of Health and Social Development believes that in this case, labor relations arise regardless of whether the TD is concluded or not (order No. 428n dated June 8, 2010). In this case, the director is subject to compulsory social insurance. Let us note that this department does not currently exist, and its legal successor, the Ministry of Labor, has not given an official explanation (there are only the above-mentioned consultations from Rostrud, a service subordinate to the Ministry of Labor and Social Protection).

- The Ministry of Finance believes that in this situation the TD is not concluded (letters dated 02/19/2015 No. 03-11-06/2/7790, dated 10/17/2014 No. 03-11-11/52558). At the same time, accrued wages cannot be included in expenses that reduce the tax base. The first of these letters is applicable to organizations that are on the simplified taxation system (simplified taxation system), the second - for enterprises paying the Unified Taxation System (Unified Tax System) (agricultural tax).

- The judicial authorities are of the opinion that in such a situation, labor relations arise (resolution of the FAS ZSO dated November 9, 2010 in case No. A45-6721/2010 and a number of other precedents). The important ruling of the Supreme Court of the Russian Federation dated February 28, 2014 No. 41-KG13-37 concluded that such labor relations are regulated by the general provisions of the Labor Code (remember that Chapter 43 of the Labor Code does not regulate them). This point of view is confirmed in paragraph 1 of the Supreme Arbitration Court Resolution No. 21 dated June 2, 2015). A number of court decisions concluded that labor decisions arise on the basis of the decision of a single participant, and registration of a TD is not required (Determination of the Supreme Arbitration Court of June 5, 2009 No. VAS-6362/09).

How to account for expenses

In general cases, accrued wages can be taken into account as part of labor costs (clause 1 of Article 255 of the Tax Code of the Russian Federation). What about the salary of the director - the sole founder? In our opinion, this clause of the Tax Code is also applicable in this case, even if a written agreement with the general director - the sole founder - was not concluded. After all, labor relations take place, since the employee is actually allowed to work, regardless of whether the contract is concluded “on paper” or not (Part 2 of Article 16, Article 19, Part 2 of Article 67 of the Labor Code of the Russian Federation).

Important

There is no need to draw up an employment contract with the director - the sole founder. After all, there should not be the same signature on both sides of the agreement, and the organization does not have another owner (letter from the Ministry of Health and Social Development of Russia dated August 18, 2009 No. 22-2-3199)

Paragraph 1 of Article 255 of the Tax Code determines that labor costs include any accruals to employees in cash and in kind related to the maintenance of these employees, provided for by the laws of the Russian Federation, labor or collective agreements. This paragraph refers, in particular, to established legal norms. And the basic norms of legislation in the field of labor relations and labor contracts are enshrined in the Labor Code.

In addition, in accordance with paragraph 1 of Article 252 of the Tax Code, all expenses must be economically justified and documented. Labor costs, in the absence of an employment contract, can be confirmed by any documents indicating the existence of an employment relationship between the manager and the organization. This could be a staffing table, employment orders, pay slips, and so on. That is, this once again confirms that the expenses for the salary of the general director - the only founder - can be taken into account in tax expenses.

And yet, it is necessary to take into account that during the inspection the Federal Tax Service may not agree with such conclusions and this position will have to be defended in court. But there is positive judicial practice for the taxpayer (resolutions of the Federal Antimonopoly Service of the North-Western District dated October 11, 2007 No. A42-5270/2006, East Siberian District dated October 10, 2007 No. A33-15270/06-F02-6504/07, North-Western District dated April 23, 2010 in case No. A13-5979/2009).

O. O. Kruzhilina,

for the magazine “Practical Accounting”

Help in solving practical situations

Since 2001, the Practical Accounting magazine has published articles with specific solutions and recommendations. The publication is now also available in electronic form. Get full access to all materials >>

If you have a question, ask it here >>

Founder and director are one person: risks

What should an entrepreneur do in such a situation? There is no clear answer. But we believe that the risk of adverse consequences is much higher in the absence of a TD with the director. Rostrud, which is a control body in the labor sphere and is authorized to conduct inspections and impose administrative penalties, as mentioned above, often changes its point of view on this issue.

At the same time, the courts have developed a stable practice of recognizing relations with the founding director as labor relations. Let us remind you that for violations of labor legislation on the basis of clause 1 of Art. 5.27 of the Code of Administrative Offences, a fine of 30,000 to 50,000 rubles is imposed. from a legal entity. Before registering a TD with a director, it is necessary to create a decision of the sole participant of the LLC on the appointment of a director. The article “Employment contract with the general director of an LLC (sample)” talks about the features of such a solution.

Calculation of insurance premiums and reporting: are there any options?

We will separately dwell on the question of whether it is necessary to accrue insurance premiums for payments to the director - the sole founder and to include information about him in the reporting on contributions. Naturally, in the case when the manager is paid a salary on the basis of an employment contract, it is necessary to calculate insurance premiums and provide personalized information. But in practice there are situations when the above question is not so clearly resolved. Let's consider such situations.

The first situation: an employment contract has not been concluded with the director, and no payments are made in his favor (except for dividends).

In this case, it is obvious that the obligation to pay insurance premiums does not arise, since there is no taxable base (clause 1 of Article 419 of the Tax Code of the Russian Federation).

As for the presentation of reports, it must be taken into account that, according to the position of the Ministry of Finance of Russia (letter dated June 18, 2018 No. 03-15-05/41578), an organization that during the reporting (settlement) period did not make accruals at all in favor of individuals, all equally obliged to submit zero reports. As officials explained, the policyholder thereby declares the absence of payments and remunerations that are subject to insurance premiums, and, accordingly, the absence of paid contributions (see “The founding director does not receive a salary: is it necessary to indicate this information in the zero DAM?” ).

In addition, officials insist that for a director with whom an employment contract has not been concluded, the SZV-M form must be submitted (letter from the Pension Fund of the Russian Federation dated 03.29.18 No. LCH-08-24/5721 and the Ministry of Labor of Russia dated 03.16.18 No. 17-4/ 10/B-1846; see “SZV-M for directors: the Pension Fund of Russia requires submission of reports even for those founding directors with whom there is no employment contract”). And although in both letters the reasoning used by the departments is not convincing enough, failure to submit reports will most likely lead to a conflict with inspectors. o An employment contract must be concluded with the manager.

Arbitration practice is not in favor of payers. The Pension Fund of Russia won the dispute, proving that even in the absence of an employment contract, it is necessary to submit forms SZV-M and SZV-STAZH for the director-sole founder (Resolution of the AS of the West Siberian District dated November 29, 2019 No. A75-7182/2019).

Fill out, check and submit the SZV-M via the Internet Submit for free

IMPORTANT. What about the report in the SZV-TD form? Is it necessary to hand it over to the sole founder with whom an employment contract has not been concluded? No no need. This is what the Ministry of Labor thinks (letter dated March 24, 2020 No. 14-2/B-293; see “The Ministry of Labor informed whether it is necessary to submit a SZV-TD for the director - the sole founder”).

Second situation: an employment contract has been concluded with the manager, but wages are not accrued to him

All the conclusions made above are also relevant for the situation when an employment contract has been concluded with the manager, but wages are not accrued to him. The difference in this situation will be the even more precarious position of the organization in the event of initiation of legal proceedings. After all, if there is an employment contract, salary calculation is mandatory (Article of the Labor Code of the Russian Federation).

True, in 2022, a ruling of the Supreme Court of the Russian Federation dated 02.17.17 No. 309-KG16-20570 appeared, in which the judges recognized: if there is an employment contract with the director and in the absence of a salary accrued to him, contributions may not be paid (see “Supreme Court: if the organization does not pay the director a salary, she is not obliged to pay insurance premiums").

However, it is possible that inspectors will seek payments in favor of the director. And when they find it, they will try to justify that these payments are in the nature of remuneration for labor. If they succeed, the organization will be assessed additional fees, penalties and fines.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden Determine for free

Third situation: the organization does not operate

This situation is a variation of the first or second situation, but with the condition that the organization does not carry out any activities (that is, we are talking about a “sleeping” organization).

Tax officials insist that the Tax Code of the Russian Federation does not relieve payers of insurance premiums from the obligation to submit calculations if they do not conduct financial and economic activities and do not pay remuneration to individuals during a particular settlement (reporting) period. Therefore, a “sleeping” company is obliged to submit the DAM with zero indicators (letter of the Federal Tax Service of Russia dated November 16, 2018 No. BS-4-21 / [email protected] ; see “The LLC does not pay salaries and does not conduct business: is it necessary to submit a zero DAM?” ).

There is arbitration practice that is positive for the Federal Tax Service. Tax officials convinced the judges that blocking an account for an unsubmitted RSV in relation to the director-sole founder is legal (resolution of the Arbitration Court of the Ural District dated September 28, 2020 No. F09-5374/20; see “Can tax authorities block an account for failure to submit a zero RSV for a founding director : position of the court").

Fill out, check and submit a zero RSV for free via the Internet

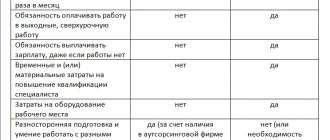

The only founder is the general director in 2 companies

The legislation does not contain prohibitions on the sole LLC participant holding the position of director in 2 or more such LLCs. But only one AP in this case is the main one. In other LLCs, the director must draw up a TD on part-time work. All part-time contracts are subject to the rules of Chapter. 44 of the Labor Code, including the norm on the duration of the working day not exceeding 4 hours (Article 284 of the Labor Code) and the norm on the calculation of wages in proportion to the established working hours (Article 285 of the Labor Code).

IMPORTANT! The rule on the need for permission to work part-time from the higher management body of the LLC, contained in Art. 276 of the Labor Code does not apply to the founding director, since it is in Ch. 43 of the Labor Code, and this chapter does not apply to this situation.

Please note that a large number of simultaneously held director positions is a reason for inspection by the tax inspectorate. Thus, one of the criteria for the possible unreliability of information included in the Unified State Register of Legal Entities is the combination of more than 5 such positions in different organizations by an individual holding a director position (letter of the Federal Tax Service dated August 3, 2016 No. GD-4-14 / [email protected] ).

An LLC with one participant (aka director) is a very common and convenient practical instrument of entrepreneurship in business life.

To avoid problems with government regulatory authorities, we recommend (for now) concluding an employment contract with the director of such an LLC. Before creating a TD with the director, you need to formalize a written decision of the sole participant of the LLC on his appointment. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Powers of the Deputy Director

The temporary transfer of powers of the director is formalized by order or power of attorney. If the deputy is tasked with performing only internal company tasks, then an order will be sufficient. If, in addition to internal issues, the deputy is entrusted with solving external issues, then a power of attorney will be required. Internal issues mean the conclusion of an employment contract with employees, their dismissal, hiring and other personnel issues. External means concluding commercial transactions, communicating with counterparties, etc.

Important! A power of attorney allows the deputy director to represent the interests of the company to third parties.

Contents of the employment contract with the manager-individual entrepreneur

The contract with the manager must be drawn up in such a way that it cannot be regarded as an employment contract.

The subject of such an agreement is the provision of paid services for the management of the organization. It can be concluded for any period.

Firstly, an individual entrepreneur should not receive a fixed remuneration. It must be tied to specific indicators and results. You shouldn’t pay him 1 million rubles a month for no reason. The contract must include:

- a report form on the work done - as an annex to the contract;

- deadlines and procedure for submitting the report;

- tasks and goals that the individual entrepreneur must achieve;

- how the achieved results and remuneration are interconnected - you can write out the calculation of remuneration in the form of a formula;

- when is remuneration paid?

Secondly, it is not recommended to stipulate in the contract the working hours, lunch, availability of a workplace and any social packages. Such provisions are only relevant in an employment contract.

Thirdly, the contract with the individual entrepreneur needs to spell out his responsibilities in detail. Under a civil contract, an entrepreneur can be held responsible for the results of the organization’s work with all his property.

Disadvantages of working with an individual entrepreneur

Saving is both an advantage and a disadvantage of working with an individual entrepreneur manager. After all, such optimization attracts the attention of tax authorities.

Unscrupulous companies often hire an individual entrepreneur to save on taxes. In fact, the management contract hides the usual employment relationship, as with a hired manager. Therefore, the tax office first of all studies the facts that will allow the contract with the individual entrepreneur to be reclassified as an employment contract.

The following circumstances indicate that the relationship with the managing individual entrepreneur is a labor relationship:

- The individual entrepreneur was previously the general director or is the founder of the organization;

- the registration of the individual entrepreneur was carried out almost at the same time as the registration of the LLC;

- the contract does not contain a clear algorithm for calculating the remuneration of the individual entrepreneur and does not depend on the results of the organization’s work;

- The contract with the individual entrepreneur contains provisions characteristic of an employment contract: the daily routine, conditions for vacations, and so on are specified.

At the same time, working with an individual entrepreneur can be quite justified. For example, if an individual entrepreneur has extensive experience and skills.

It will be great if the managing individual entrepreneur manages several companies at once and has the appropriate OKVED codes - 70.22, 69.10 and 69.20. In this case, it will be easier to prove that the contract is not an employment contract.