KND form 1110021 is a standard unified form of document that is submitted to the territorial tax service for any transactions performed with cash register equipment. For example, this form is required if:

- the initial registration of the cash register with the tax authority is carried out;

- KKM is re-registered with the tax office;

- the ECLZ unit was replaced;

- The cash register is deregistered with the tax service.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

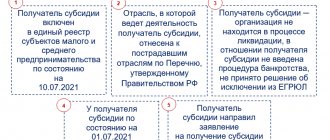

Application for registration of CCP

According to paragraph 4 of Art. 7 of the Law of 07/03/2016 No. 290-FZ, from 02/01/2017, data transfer to the Federal Tax Service is carried out in electronic form through a fiscal data operator, except for the case when the cash register is used in areas inaccessible to communication networks. Therefore, first of all, it is necessary to conclude an agreement with the fiscal data operator.

Step one: filling out an application for registering a cash register.

You can submit an application in two ways:

- in electronic form by filling out a special form in the cash register account on the Federal Tax Service website - clause 4 of the appendix to the Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected] , clause 9 of the procedure for maintaining the cash register office, approved by the Order of the Federal Tax Service of the Russian Federation dated 03/21/2017 N ММВ-7-20/ [email protected] ;

- on paper - by personal presentation or sending by mail to the Federal Tax Service.

The electronic method of filing an application is more convenient, but to use it, you must have a strong, qualified electronic signature. This procedure is established by clause 5 of the appendix to the Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected] and clause 10 of Art. 4.2 of the Law of May 22, 2003 No. 54-FZ.

If you decide to submit an application on paper, you need to fill out the form approved by Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20 / [email protected] (form 1110061). The rules for its preparation are given in Appendix No. 5 to the said order. According to the rules, it is necessary to take into account that:

- an application is filled out for each piece of equipment and can be completed either manually or on a computer;

- any corrections are excluded, as well as double-sided printing of the application;

- All columns must be completed, except for the cases listed in the order in which the application is completed. For example, there is no need to fill out the field “Reason code for re-registration”, as well as the fields of section 4 “Information on generated fiscal documents” of the application (clauses 7, 34 of the filling procedure).

No need to fill in the fields:

OGRN/OGRNIP, if the company is a foreign legal entity (item 2 of the order);

- intended to be filled out by an employee of the Federal Tax Service. Such details include information about the registration of the cash register with the tax office, the number of pages of the application and documents attached to it, as well as the date of submission of the application and its registration;

- line 150, if the organization does not use cash register systems to generate strict reporting forms in electronic form and print them on paper;

- section 3, if the organization uses cash register systems without electronically transmitting fiscal data to the tax authorities. However, in this case, you need to fill out line 170 “TIN of the fiscal data operator”, putting zeros in it.

If the user plans to use one cash register as part of several automatic devices for calculations, then it is necessary to fill out section 2.1 of the application form.

Please note: if a company registers an online machine at the location of a separate division, then it is necessary to take into account the specifics of the application for registering a cash register. Thus, in the “Checkpoint” field at the top of each page of the application, the checkpoint of the separate unit is indicated. In this case, the application is signed by the head of the separate unit.

Front page

Here the filling is standard. First, enter the TIN and checkpoint. Entrepreneurs do not write checkpoints, because he doesn't have them. Then enter the code of the tax authority where this document will be submitted. Next, you need to use a digital code to indicate the type of document that reflects the operation performed with cash register equipment - just below in the form, in a note, the meaning of the digital code is explained in detail.

After this, you need to write down the full name of the organization with the obligatory indication of the organizational and legal status (IP, LLC, CJSC, OJSC), as well as the code of the type of economic activity according to OKVED.

Then you need to put the required number in the box about who provided this application and at the end enter the contact phone number (landline or mobile - it doesn’t matter) in the appropriate cells.

The final stage of this section: enter 003 in the “application completed on “—” pages.”

In the cells for providing copies, enter 000 - when filling out the form as standard, copies are usually not required, since, as a rule, they are presented only after a request from a tax specialist to confirm any information entered.

Next, only the left part of the page is filled out, since the right and bottom are completed by the tax inspector. First, it is indicated by a number who is submitting the application - the head of the organization himself or his representative, and then his full name (without abbreviations). The last thing that is written on the title page is the applicant’s signature and the date the form was filled out.

OFD for registering cash registers

To work with online cash register systems, a company must enter into an agreement with a fiscal data operator (FDO). The list of operators is on the Federal Tax Service website at: https://www.nalog.ru/rn77/related_activities/registries/fiscaloperators/.

At the same time, you must select an operator and conclude an agreement with him before contacting the tax office for the purpose of registering a cash register.

In Law No. 54-FZ, OFD is understood as an organization created in accordance with the legislation of the Russian Federation, located on the territory of our country and received permission to process fiscal data.

Data exchange will take place according to established protocols and within the framework of the concluded agreement between the cash register user and the fiscal data operator. Federal Law No. 54-FZ establishes requirements for them. Note that the operator can be, for example, a bank, an electronic document management operator or a telecommunications company. At the same time, such companies can form package offers, subsidize the purchase and maintenance of cash registers for their clients, or offer a wide range of additional services.

Entrepreneurs independently give preference to one or another operator. The deadline for concluding an agreement is not provided for by law, but it is worth noting that without such an agreement, the cash register will not be registered.

Section 2. Information on using CCP

Here you need to indicate whether you use CCP in some special cases. Enter “1” if you use it, “2” if you don’t.

These points are on pages five and six of the application. Even if you put “2” everywhere, that is, “no”, these pages must be filled out and attached to the application - without them it will not be accepted.

CCP registration report

Within the next day after receiving the registration number, the user must generate a cash register registration report.

Step three: generate and send a cash register registration report.

To generate a report, you need to enter the following information into the fiscal drive:

- CCP registration number;

- full name of the user;

- data on cash registers, fiscal storage and other necessary information.

The report must be sent to the Federal Tax Service through the cash register office, the fiscal data operator, or submitted in paper form.

Section 3. Information about the OFD

Information about the fiscal data operator through which you send checks to the tax office. This section does not need to be completed and attached to the application if you work in hard-to-reach regions.

Here you need to indicate the name and TIN of your fiscal data operator. Take the data from the contract, not from the website - the official name and public name may differ. For example, “First OFD” is a brand name, and the official name is JSC “ESK”, and this is what must be indicated in the application.

This ends page 9 and the third section.

Cash register registration card

Within 10 working days from the date of receipt of the application, fiscal officials must send the organization a card in the form approved by Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected]

Step four: receive a cash register registration card.

Please note: you cannot punch checks until you receive the card.

The procedure for receiving a card depends on how the user sent the tax application (form 1110061). If the document is provided electronically, the card will be sent through your personal account or through a fiscal data operator.

To receive a card in paper form, you need to submit the appropriate application in any form. Fiscal officials will issue the document within 5 working days after receiving the application.

Section 2.1. About automatic devices

This section must be completed if you intend to use the cash register in an automatic device. For example, a vending machine. If you are not going to do so, you don’t have to fill it out, print it out or attach it.

In the “number” column you need to indicate the serial number from the documents for the automatic device. The location address of the automatic device is filled in the same way as the cash register location address.

Pages 7 and 8 of the application are reserved for automatic devices. They can accommodate two automatic devices. If there are more devices connected to one cash register, you can print more pages to list them all.

Section 2 ends here.

How to check the registration of a cash register with the Federal Tax Service

Law No. 54-FZ does not allow registration with the tax authorities of a cash register, information about which is not in the Federal Tax Service register. Please note that registers of cash register equipment and fiscal storage devices are posted on the website of the Federal Tax Service of the Russian Federation (https://www.nalog.ru/rn77/related_activities/registries/).

Thus, a cash register, information about which is not in the register, cannot be used.

To check that a cash register is included in the Federal Tax Service register, you need to go to the website of the cash register verification service: https://kkt-online.nalog.ru/. Next, you should select the cash register model, which is indicated in the passport of the smart terminal, and click the “Check” button.

If the user received the answer: “The cash register is included in the register, not registered with the tax authorities,” then the device can be used. Otherwise, you need to check the serial number of the cash register in your passport and on the smart terminal in the “Settings-Cashier Maintenance” section. If the CCP number matches, then you should send a request to support with a passport photo and a photo of the model attached.

Step six: check the registration of the cash register with the Federal Tax Service.

If it is necessary to check the registration of the used model of cash register equipment, the user can contact the inspectorate at the place of registration as a taxpayer to obtain the relevant information. The inspection is carried out in accordance with the administrative regulations of the Federal Tax Service, approved by Order of the Ministry of Finance of the Russian Federation dated October 17, 2011 No. 132n.

Section 1. Information about CCP

Here you need to enter the details of the cash register that you are registering or re-registering. Only one cash register can be re-registered in one application. If there are several cash desks, fill out several applications.

Name and details

Enter the name of the cash register and fiscal drive as they are indicated in the cash register register and the financial fund register. You cannot write the name from the box or from the instructions.

CCP Register FN Register

Factory numbers include those indicated on the box or in the warranty card.

Installation address and place of application

Installation address.

The specific address where the cash desk is located most of the time. This could be a space you rent. Or the legal address of the company, if there is no specific premises.

The address is divided into two pages - the district and city are on the third, the rest is on the fourth.

Place of application. Place of settlements. There are several options for filling here:

- Installation address from the section above if you accept payment directly to this address. For example, if you have a store on the ground floor of a residential building.

- Name of the shopping center or business center where you work, floor, section and location. There is no need to rewrite the address from the installation address.

- Website address if you accept payment via the Internet.

- Make, model and number of the car if you are selling from a car.

- “Courier”, if payment is accepted by the courier.

Here you need to indicate whether you are using a mode that allows you not to transfer data to the OFD. This mode is only available to those who work in hard-to-reach areas. Each region has its own list of such areas; it is approved by regional authorities.

The fourth page of the statement and the first section end here.

Timing and main stages of registering an online cash register with the Federal Tax Service

CCP is subject to mandatory registration with the Federal Tax Service. The law does not contain specific deadlines for this procedure - you just need to know that you cannot use the cash register without registration. Therefore, the actual registration completion deadline is the day before the first sale is made at the checkout. With this in mind, you need to register the cash register with the tax office.

The methodology for registering a cash register with the Federal Tax Service involves the following main steps:

- Preparatory.

- The stage of sending an application for registering a cash register to the Federal Tax Service.

- Stage of fiscalization (activation of the fiscal drive).

- Registration completion stage.

Video - step-by-step instructions for registering an online cash register with the Federal Tax Service through the taxpayer’s personal account:

Let's take a closer look at them.

What is the preparation?

That:

- A cash register, in fact, will need to be purchased (together with a fiscal storage device).

- The owner of the cash register must enter into an agreement with the Fiscal Data Operator (except for the scenario in which the cash register can legally be used in a mode without transferring data to the OFD - that is, when located in a locality with a population of no more than 10 thousand people).

- You need to register in your personal account on the official website of the tax service nalog.ru (if at the time of registering the cash register, the individual entrepreneur or legal entity does not yet have an account on the Federal Tax Service website).

- The owner of the cash register system needs to issue a qualified electronic signature for document flow with the Federal Tax Service and integrate it in the manner regulated by the certification center that issued the signature with a personal account on the tax service website (we recommend that you read the article How to obtain a free digital signature from the tax office for individual entrepreneurs and legal entities).

- The registered cash register must be connected to a PC, with the help of which the cash register will be registered.

Afterwards, we proceed to the stage of submitting an application for registration of an online cash register with the Federal Tax Service.

Video - how to register a cash register online using the example of the Atol fiscal registrar: