Step-by-step instructions with examples of liquidation of an OP in 2022

A separate division is a structural unit of an organization, which is often opened temporarily to achieve some business goals. If these tasks have already been solved, or have become irrelevant, then the question arises: “ How to close a separate division in 2021? "

Briefly about the separate division

A separate division of a company outside its main address is considered to be separate, where at least one person works for more than a month. Such a structural unit is not an independent legal entity, however, information about it is entered into the Unified State Register of Legal Entities. Previously, information about the EP had to be reflected in the charter, so some organizations had to make changes to the constituent document when closing divisions.

A separate division does not have its own property; its head is appointed by the parent company. The task of branches and representative offices is to represent the main organization and act in its interests.

To close a separate office, you need to prepare documents, fire employees and register changes. This is done in several stages. We propose an algorithm for liquidating a separate division in 2022.

Deciding to close

It all starts with the parent organization deciding to close a separate division. If this is a branch or representative office, then a decision is required from the owners of the parent organization. In limited liability companies, a general meeting of participants should be held for this purpose. The LLC Law does not directly require this, but a meeting must be held when opening such units. Accordingly, when closing, it is better to take care of the collective decision of the company’s owners.

At least 2/3 of the founders must vote for the opening of a separate division. Again, regarding its elimination, there are no requirements for the number of voters. Therefore, a simple majority vote will be sufficient.

How to close an OP that is not a branch or representative office? For this, a decision from the owners is not needed. That is, in an LLC there is no need to hold a meeting of participants - the decision of the head of the main organization will be sufficient.

After the decision is made, a decree or order is issued to terminate the activities of the separate division. It should indicate the date on which it ceases to be valid, designate the persons responsible for closure, and distribute responsibilities between them.

What needs to be done to close

The instructions directly depend on the status of the separate unit. If it is recognized as a branch or representative office, and information about it is included in the constituent documents, then the closure procedure becomes more complicated. If the OP of an organization is closed without a dedicated balance sheet and current account, the procedure is simpler.

Liquidation of a division and liquidation of an organization are completely different procedures. For example, when an enterprise is liquidated, a liquidator is appointed, a notice is published in the media, work with creditors to pay off debts, lay off employees, and approve the liquidation balance sheet. And only after fulfilling all the mandatory conditions, they contact the Federal Tax Service with a request to deregister. For a budgetary institution, an application is submitted to the Ministry of Justice.

Termination of a branch or representative office is different from the closure of another division.

Here are step-by-step instructions on how to close a separate division in 2022 (branch, representative office):

- Make a decision to close by a majority vote of participants.

- Issue an order to liquidate the OP.

- Notify employees about the termination of the OP's activities.

- Pay the state fee if information about the branch or representative office was reflected in the constituent documents.

- Exclude information about the branch or representative office from the constituent documentation.

- Submit a notice of closure to the Federal Tax Service to make changes to the Unified State Register of Legal Entities.

But there are nuances at every step.

Notifying employees about the closure of the OP

Before closing any partition, you need to fire workers. In accordance with Article 180 of the Labor Code of the Russian Federation, they must be informed about the upcoming dismissal at least 2 months in advance. Accordingly, the procedure must be planned taking into account these deadlines. However, closure does not always entail the dissolution of OP employees - they can be transferred to other divisions or the head office.

To notify employees of dismissal, a notice is drawn up, which each of them must read and sign.

Free accounting services from 1C

Dismissal of personnel

So, it is impossible to deregister a separate division in 2022 until all employees are fired.

Dismissal upon closure of an OP occurs according to certain rules. If it is located in the same locality as the main office, then employees should be offered a transfer to other departments. They can be fired only if there are no suitable vacancies. The basis for termination of the contract is reduction in accordance with paragraph 2 of part 1 of Article 81 of the Labor Code of the Russian Federation.

If the company does not have other OPs in the same city or town (village, village), then the contract with the employee is terminated on the basis of clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation, since the division is being liquidated.

Otherwise everything is as usual. It is necessary to pay employees no later than the day of dismissal, and also issue them with properly executed personnel documents. If a reduction is made, they are additionally provided with guarantees in accordance with the Labor Code and the contract.

Dismissal upon liquidation of a separate division

The process of dismissing employees depends on the location of the unit that the employer wants to close. So, there may be several options: a unit that is located in the same area as the organization is closed, or the area is different. Being in the same area should be understood as administrative-territorial boundaries.

Let's consider the first case - employees are dismissed during the liquidation of a division of an enterprise, which is located in the same area as the enterprise itself, for example, in the Tula region. If at the same time the organization itself is not liquidated, then it is impossible to dismiss employees on the basis of liquidation - if the company has jobs, the employees need to be offered them. If there are no vacancies, the employer can lay off workers in accordance with the established procedure.

If dismissal occurs during the liquidation of a structural unit that is located in an area different from the location of the organization, then employment contracts with employees of this unit are terminated according to the rules of liquidation of the organization.

Many employers find it difficult to dismiss an employee on maternity leave during the liquidation of a separate division. If an employee works in a department that is located in another city, then she can be dismissed in the same way as other employees.

Message about the closure of the OP to the Federal Tax Service

Within 3 working days from the date of termination of activity, a message about the closure of a separate division is submitted to the Federal Tax Service (C-09-3-2). You must contact the tax authority at the location of the company's head office.

The first sheet of form S-09-3-2 indicates:

- main codes of the legal entity (head office) - TIN, KPP and OGRN;

- Federal Tax Service code at the location of the company;

- name of company;

- number of separate divisions.

On the second sheet of the message form you need to write:

- sign of a separate unit;

- checkpoint;

- name of the branch/representative office, if any;

- date from the decision to terminate the activities of the OP.

Filling out the fields of form S-09-3-2

This form is machine read, so if you are filling it out by hand, use a black ballpoint pen and write the information in block capital letters. One cell is designed for only one character, so several characters in one field will be an error. Messages with errors and corrections will not be accepted.

Forms submitted electronically must be certified by an electronic signature. The person with the right to sign is either the head of the company (code 3) or an authorized representative (code 4).

Page numbers are indicated in four-digit format, i.e. the title page is 0001, and the first page of the application is 0002. The application can be given on as many pages as the number of representative offices that are planned to be closed. This figure is reflected at the beginning of the document.

The number of closed OPs is equal to the number of pages in the application and is 1 less than the total number of pages in the message:

Note! The checkpoint of the main legal entity is indicated on the first page, and the division to be closed is indicated in the appendix. Always check the data matches so you don't accidentally close a running compartment. In case of an error, you can submit an application to the Federal Tax Service, but there is no guarantee that it will be considered.

The data on the OP must match those indicated in form S-09-3-1 when opening a representative office. Remember the basic principles of filling out documents submitted to tax and other government agencies: one cell - one character.

If the checkpoint of the branch and the TIN of the authorized person are missing, you do not need to fill in the corresponding fields.

Amendments to the charter

This stage is intended only for those legal entities whose charter contains information about a branch or representative office. Closing a separate division reflected in the constituent document implies making changes to it. To do this, you need to prepare an application in form No. P13014.

In addition, you need:

- prepare a new version of the charter or amendments to it - 2 copies;

- pay the state fee in the amount of 800 rubles and keep the original receipt.

Form P13014, the charter and the document on payment of the duty are submitted to the Federal Tax Service at the place of registration of the main company.

Calculation of income tax in “1C Accounting 8 CORP” (rev. 3.0)

Starting from version 3.0.52, 1C:Accounting 8 CORP (rev. 3.0) supports automatic calculation of income tax when deregistering separate divisions due to:

- moving - changing the address at which the activity is carried out;

- termination of the division's activities.

To reflect these events in the program, you should use the commands available from the Divisions directory element form (from the card of a separate division or branch) - see Fig. 1:

- Deregister;

- Register at the new address.

Rice. 1. Separate unit card

When calculating income tax and filling out the declaration, the requirements of clauses 2.7, 10.2 and 10.11 of the Procedure are taken into account.

The tax base has increased

Let's look at how the 1C: Accounting 8 CORP program, edition 3.0, automatically calculates profit shares and generates tax returns if one of the separate divisions is closed during the year.

Example 1

| The organization Comfort-Service LLC applies OSNO, the provisions of PBU 18/02, and at the end of the reporting period pays only quarterly advance payments. The organization Comfort-Service LLC is registered in Moscow, and has two separate divisions, which are located in St. Petersburg and in Anapa (Krasnodar Territory) and are registered with the Federal Tax Service at their location. Transfer of advance payments (tax) to the budget of a constituent entity of the Russian Federation is carried out by the parent organization (Moscow). At the end of the first half of 2022, the tax base for income tax for the organization as a whole amounted to RUB 381,370. Over 9 months, the tax base increased and amounted to RUB 1,262,645. The income tax rates for the budgets of the constituent entities of the Russian Federation do not differ and amount to 17%. In August 2017, a separate division located in St. Petersburg was deregistered (liquidated). Data for the first half of 2017 are shown in Table 1 (indicators in lines 1 and 2 are rounded). Table 1 Tax base and calculated income tax for budgets and constituent entities of the Russian Federation for the first half of 2022 No.

|

Since the separate division in St. Petersburg was liquidated in August 2022, the last reporting period for it will be the first half of 2022. Figure 2 shows a fragment of Appendix No. 5 to Sheet 02 of the income tax declaration (hereinafter referred to as the Declaration) for the six months of 2022, compiled for a separate division in St. Petersburg.

Rice. 2. Appendix No. 5 to Sheet 02 of the Declaration for a separate division in St. Petersburg for the six months

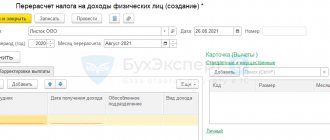

In July 2022, when carrying out the regulatory operation Calculation of income tax included in the processing of Closing the month, standard actions are performed in relation to each separate (including the head) division:

- the share of profit (share of the tax base) is automatically calculated based on labor costs and the residual value of depreciable property;

- based on the calculated share of profit, the tax base is determined;

- Based on the tax base and the tax rate established for a specific constituent entity of the Russian Federation, the amount of tax is calculated;

- Postings are generated in the context of budgets and inspections of the Federal Tax Service of Russia.

In August 2022, the separate division located in St. Petersburg will close.

Therefore, when performing the regulatory operation Calculation of income tax for August, in addition to standard actions with existing divisions, special actions are performed in relation to a closed separate division:

- the share of the tax base (share of profit) is fixed in the amount calculated for the reporting period preceding the quarter in which the separate division was closed (clause 10.11 of the Procedure), that is, for the first half of 2022 (33.0256%). The specified share remains unchanged (“frozen”) until the end of the tax period, that is, until the end of 2022;

- the tax accrued for July is adjusted and fixed in the amount calculated for the first half of 2022 (RUB 21,412). The amount of accrued tax does not change until the end of the year, provided that the tax base for the organization as a whole does not decrease.

Starting from August 2022, in the reference calculation Distribution of profit according to the budgets of the constituent entities of the Russian Federation, the fixed share of the profit of a closed division is indicated separately - in the group Activities ceased (Fig. 3).

Rice. 3. Help-calculation of profit distribution according to budgets for September 2022

According to the calculation certificate, the share of the tax base (profit share) for operating divisions for 9 months of 2022 was:

- at the head office in Moscow - 93.2203%;

- for a separate division in Anapa - 6.7797%.

We will generate a set of tax returns for 9 months of 2022 in the 1C-Reporting service.

When creating a new version of the Income Tax Declaration report, the default title page sets the details of the head office (Moscow), namely:

- in the Submitted to the tax authority (code) field—indicate the code of the tax authority in which the head office is registered (7718);

- in the field at the location of the registration (code) - indicate the code: 214 (At the location of the Russian organization that is not the largest taxpayer).

The main sheets and indicators of the Declaration, including Appendix No. 5 to Sheet 02, are filled out automatically according to tax accounting data (Fill button).

The income tax declaration, which is submitted at the location of the head office, includes Appendix No. 5 to Sheet 02 in the amount of 3 pages, corresponding to the number of registrations with the Federal Tax Service from the beginning of the year (for the head office and 2 separate units, including closed ones).

Let us first consider how the program fills out Appendix No. 5 for a closed, separate division in St. Petersburg (Fig. 4).

Rice. 4. Appendix No. 5 to Sheet 02 of the Declaration for 9 months for a closed separate division

In the Calculation compiled (code) field, the value will be indicated: 3 - for a separate division closed during the current tax period. The following line indicators are filled in automatically:

- The tax base for the organization as a whole (line 030) is RUB 1,262,645;

- including without taking into account separate divisions closed during the current tax period (line 031) - RUB 1,136,695. This indicator corresponds to the difference between lines 030 for 9 months of 2017 and 050 for the first half of 2022 of Appendix No. 5 to Sheet 02 for a closed separate division (RUB 1,262,645 - RUB 125,950);

- Share of the tax base (%) (line 040) - 33.0256% (the fixed share of the tax base for a closed separate division corresponds to line 040 of Appendix No. 5 to Sheet 02 for the half year 2022);

- Tax base based on share (line 050) - RUB 125,950. The difference between the indicators on lines 030 and 031 must correspond to the indicator on line 050 for a closed, separate division (clause 10.2 of the Procedure);

- Tax rate to the budget of a constituent entity of the Russian Federation (%) (line 060) - 17%;

- Tax amount (line 070) - 21,412 rubles. This indicator corresponds to the indicator in line 070 of Appendix No. 5 to Sheet 02 for the first half of 2022.

Line 080 (Tax accrued to the budget of a constituent entity of the Russian Federation) is filled in manually by the user - RUB 21,412. (line 070 of Appendix No. 5 to Sheet 02 for the first half of 2022). Under the conditions of Example 1, the amount of tax to be paid additionally (line indicator 100) is zero.

Appendix No. 5 to Sheet 02 Declarations drawn up for the head division and for a separate division in Anapa are filled out based on the tax base for the organization as a whole, excluding closed separate divisions and the share of the tax base calculated for 9 months. Figure 5 shows a fragment of Appendix No. 5 to Sheet 02 of the Declaration drawn up for the head unit. In the Calculation compiled (code) field, the value 1 will be indicated - for the organization without its separate divisions. The field assigning the obligation to pay tax to a separate division must be filled in manually (specify the value 1 - assigned).

Rice. 5. Appendix No. 5 to Sheet 02 of the Declaration drawn up within 9 months for the parent unit

The indicators of lines 030-070 are filled in automatically as follows:

| Line of Appendix No. 5 to Sheet 2 of the Declaration | Data |

| 030 | RUB 1,262,645 |

| 031 | RUB 1,136,695 (tax base for 9 months of 2022 minus the indicator of line 050 of Appendix No. 5 to Sheet 02 for the first half of 2017 for a closed separate division: RUB 1,262,645 - RUB 125,950) |

| 040 | 93,2203 % |

| 050 | RUB 1,059,631 (line 031 indicator multiplied by line 040 data) |

| 060 | 17 % |

| 070 | RUB 180,137 (line 050 indicator multiplied by line 060). The sum of lines 070 of Appendix No. 5 for the parent organization and for each separate division is transferred to line 200 of Sheet 02 (clause 10.4 of the Procedure) |

Line 080 is filled in manually by the user and must correspond to the indicator in line 070 of Appendix No. 5 to Sheet 02 for the first half of 2022 for the parent division. Line 100 (Amount of tax to be paid additionally) is calculated automatically as the difference between lines 070 and 080.

Appendix No. 5 to Sheet 02 for a separate subdivision in Anapa is filled out in the same way.

Subsection 1.1 of Section 1 of the Declaration for the head unit will be automatically filled in according to the declaration data.

Line 010 of Subsection 1.1 of Section 1 indicates the OKTMO code of the municipality in whose territory the head office is located.

Now it is necessary to fill out declarations for separate divisions: active (Anapa) and closed (St. Petersburg).

When filling out a tax return, which is submitted at the location of a separate division in the city of Anapa, on the Title Page, the user must indicate the appropriate code of the tax authority, selecting it from the list of registrations, and the code for the place of submission of the declaration: 220 (At the location of the separate division of the Russian organization) .

By clicking the Fill button, the program will automatically generate a set of Declaration sheets for a separate subdivision in Anapa.

Appendix No. 5 to Sheet 02 is filled out similarly to the corresponding page of Appendix No. 5 to Sheet 02 of the Declaration, which is submitted at the location of the head unit.

Filling out an income tax return for a closed division has its own peculiarities.

When creating a new version of the Income Tax Declaration report on the title page, the user must perform the following sequence of actions:

- in the Submitted to the tax authority (code) field - indicate the code of the tax authority of the closed separate division by selecting it from the list of registrations (7801);

- in the field at the location of the accounting (code) - indicate the code: 223 (At the location (accounting) of the Russian organization when submitting a declaration for a closed separate division);

- confirm your actions (the Yes button) to the program warning (Attention! Before entering the filling mode for separate departments, all sections (sheets) of the report will be cleared. Continue the operation?).

As a result, the details on the Title Page (Sheet 01) of the Declaration are dynamically refilled and take on the following values in accordance with clause 2.7 of the Procedure:

- in the field Submitted to the tax authority (code) - indicate the code of the tax authority of the head division (7718), where it is now necessary to submit a declaration for a closed separate division;

- in the checkpoint field - indicate the checkpoint of a closed separate subdivision (780132001).

By clicking the Fill button, the program will automatically generate a set of Declaration sheets for a closed, separate division.

Appendix No. 5 to Sheet 02 is filled out similarly to the corresponding page of Appendix No. 5 to Sheet 02 of the Declaration, which is submitted at the location of the head unit.

On line 010 of subsection 1.1 of Section 1, the 1C: Accounting 8 CORP program, edition 3.0, will indicate the OKTMO code of the municipality on the territory of which the closed, separate division was located (clause 4.1.4 of the Procedure).

The tax base has decreased

Deregistration of a branch or representative office

When will the OP be closed? Deregistration occurs within the following periods:

- at the location of the branch or representative office - after the Unified State Register of Legal Entities receives information about the liquidation of this division;

- at the location of the OP - within 10 working days from the date of receipt by the Federal Tax Service of the notice of termination of activity.

So, we considered closing a separate division. It must be taken into account that the liquidation process takes time, mainly due to the need to fire or transfer employees. Otherwise, this procedure is quite simple and does not require a lot of time and financial costs.

Step-by-step instructions for closing a separate division

The law does not provide for any special procedure for terminating the activities of a unit, but there are regulations that cannot be violated. In addition, there is a certain discrepancy with the timing, due to the fact that the tax office must be informed about the closure three days after the decision is made, and employees must be notified of the dismissal two months in advance.

Documents for closing a separate division:

- Order to close a separate division (sample)

- Notice of closure of a separate division (form S-09-3-2)

Step 1. Resolve personnel issues.

First of all, it is necessary to comply with the requirements of the Labor Code for the dismissal or transfer of employees, because, as we said above, there is at least one permanent workplace at the place of activity of the OP.

| ☑ The dismissal procedure depends on where exactly the workplace was located - in the same locality where the parent organization is registered, or in another city. |

Non-resident employees must be notified of dismissal due to the liquidation of a company division 2 months in advance and against signature. Next, you need to pay those dismissed a severance pay in the amount of one month’s salary. Please also keep in mind that employees retain the right to an average monthly salary for the period of employment - up to three months. If the employee agrees, he can be transferred to the staff of the head office or another division.

The situation is different with the OP personnel who worked in the same city as the parent organization. The fact is that it is not necessary to indicate the department as the place of work in the employment contract. In this case, if there are other jobs in the same locality, the employee’s relocation is formalized without changing the employment contract. If there are no vacancies, such personnel are dismissed due to staff reduction, also with a two-month notice period.

The difference between closing a non-resident division and one that is located in the same locality where the head office is registered is that in the first case, you can fire any employee, including a pregnant woman.

Well, in the second case, due to staff reduction, dismissal is not allowed:

- Pregnant women;

- Mothers with children under 3 years old;

- Parents with many children;

- Single parents with children under 14 years of age or disabled children under 18 years of age.

The employer needs to know about this in advance, and if there are such categories of personnel, ensure their employment.

Considering that they must be warned in advance about the dismissal of employees, it is possible to issue an internal administrative document in advance in which those responsible for personnel issues are appointed.

Step 2. Make a decision to close the structural unit.

The decision to terminate the activities of a separate division is made by the general meeting of participants. Based on this decision, the head of the company issues an order confirming the fact of closing the OP.

Download the order to close a separate unit (sample)

Step 3. Prepare documents for reporting to the tax office.

According to Article 23 of the Tax Code of the Russian Federation, the closure of a branch, representative office or other separate division must be reported to the Federal Tax Service within three days after such a decision is made.

A special form C-09-3-2 has been developed for the message, approved by Order of the Federal Tax Service dated 06/09/2011 No. ММВ-7-6/ [email protected] This is an easy-to-fill out document consisting of two sheets. The first sheet indicates the registration data of the organization (TIN, KPP, OGRN), the corporate name of the LLC and the number of divisions being closed. On the second sheet is the address of the OP and the date of the decision to close it.

If several structural units of the company are closed at once, then the second sheet is filled out for each of them, and their corresponding number is entered on the first sheet.

In addition, you must fill out a registration form for amending the charter or the Unified State Register of Legal Entities. Until September 1, 2014, information about the existence of a branch or representative office was mandatory to be included in the charter, but now this information is reflected only in the state register.

Accordingly, if the charter contains information about the existence of a separate division, then the text of the constituent document will have to be changed in form P13001. If, when closing the OP, the charter does not change, then form P14001 is filled out.

In total, the following documents are submitted to the inspection within three days from the date of the decision:

- The decision of the participants to terminate the activities of a structural unit of the company;

- Completed message form C-09-3-2;

- Registration form P13001 or P14001, depending on whether the information in the charter is changed;

- The Charter in a new edition or an amendment to it;

- A document confirming payment of the fee for registering changes in the charter for 800 rubles (when submitting form P13001).

Step 4. Submit reports on the activities of the unit.

The reporting includes tax returns in accordance with the selected taxation system and reports on employees. If you have a separate current account, it must be closed.

Step 5. Receive a notice of deregistration from the tax office.

Until the Federal Tax Service has not sent a notice of deregistration of a separate division from tax registration, the procedure for its closure cannot be considered completed. The fact is that although a period of ten working days is provided for this, it can be extended if the inspectorate orders an on-site inspection of the activities of a branch, representative office or division.

As for the deregistration of a unit from the funds, after the transfer of responsibilities for administering insurance premiums for employees to the Federal Tax Service from 2022, there is no need to independently notify about this.

If unfavorable circumstances arise for the business, you can suspend the activities of the LLC; read how to do this here.

Subscribe to the newsletter and announcements of new articles will be sent to your email: