T. N. Milyutina author of the article, Deputy General Director for Audit of ALT-AUDIT LLC

Lately, organizations often have questions: do situations such as an employee being on a long business trip, leasing equipment with a crew, or a mobile construction site lead to the formation of a separate unit. These issues, as well as the peculiarities of filing tax returns and paying taxes by separate divisions, will be discussed in this article.

According to paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization for the purpose of calculating taxes and fees is understood to be any territorially separate division from it, at the location of which stationary workplaces are equipped.

A division is recognized as separate regardless of whether its creation is reflected or not reflected in other organizational and administrative documents, and regardless of the powers vested in it. In this case, a workplace is considered stationary if it is created for a period of more than one month.

From the definition given in the Tax Code of the Russian Federation it is clear that a division is considered separate if:

- it is territorially isolated from the organization;

- it has stationary workplaces.

The legislation on taxes and fees does not contain a definition of “workplace”. In accordance with paragraph 1 of Art. 11 of the Tax Code of the Russian Federation, institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation, used in the Tax Code of the Russian Federation, are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided by the Tax Code of the Russian Federation.

Thus, to determine the content of the term “workplace” it is necessary to be guided by the provisions set out in Art. 209 Labor Code of the Russian Federation. According to this standard, a workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer.

Based on the above, a number of workplace characteristics can be identified:

- existence of an employment contract between the employee and the employer;

- workplace equipment;

- stationary workplace;

- direct or indirect control of the employer.

However, almost all of these signs are not as simple as they seem at first glance, and their interpretation becomes the cause of numerous disputes between taxpayers and inspectors. Therefore, let's look at each of them in more detail.

Territorial isolation

The concept of “territorial isolation of a unit” is not defined by law, and in accordance with legal and business practice, this means the location of a unit outside the location of the legal entity.

According to paragraph 2 of Art. 54 of the Civil Code of the Russian Federation, the location of a legal entity is determined by the place of its state registration. Similar rules are contained in the Federal Laws on Joint Stock Companies and Limited Liability Companies.

Judicial practice on this matter indicates: “any separate division, the location of which is different from the location of the organization specified in its constituent documents, is a separate division” (Resolution of the Federal Antimonopoly Service of the North-Western Territory of June 21, 2004 N A56-34578/03).

In some court decisions you can find a definition with more stringent conditions. Thus, according to representatives of the Federal Antimonopoly Service of the North-Western and North Caucasus districts, “territorial isolation means the location of a structural unit of an organization geographically separate from the parent organization and outside the administrative-territorial unit of its registration, controlled by one or another tax authority” (see Resolutions FAS North-Western District dated November 2, 2007 in case No. A26-11293/2005, North Caucasus District dated June 20, 2007 N F08-3590/2007-1449A in case No. A63-9693/2006-C4).

For tax purposes, territorial isolation will be recognized if there is any discrepancy between the organization’s address indicated in the constituent documents and in the application submitted to the tax authority and the address of the actual location of the separate division. This is precisely the approach that tax authorities use when identifying signs of a separate division (Letters of the Ministry of Finance of Russia dated January 12, 2010 N 03-02-07/1-6 and dated December 21, 2009 N 03-02-07/1-550, Federal Tax Service of Russia for the city of Moscow dated March 19, 2012 N 17-26/23423).

This means that a division is territorially separate from the parent organization if it is located in the territory where tax accounting and tax control is carried out by a tax authority other than the one with which the organization is registered as a taxpayer.

Previously, in the explanations of financial authorities, it was proposed to recognize a unit as territorially separate if it is located:

- at a different address not indicated in the constituent documents as the location of the taxpayer himself (Letter of the Ministry of Finance of Russia dated July 7, 2006 N 03-01-10/3-149, Resolution of the Thirteenth Arbitration Court of Appeal dated April 7, 2005 in case N A56-48067/2004 );

- at a different postal address (Letters of the Ministry of Finance of Russia dated December 22, 2004 N 03-03-01-04/1/184, dated November 29, 2004 N 03-03-01-02/45, dated November 9, 2004 N 03-03-01 -04/1/103, dated October 21, 2004 N 03-03-01-04/1-78).

Due to the fact that the location of the organization itself may also differ from the address indicated in its constituent documents, tax authorities and courts increasingly prefer to recognize as separate divisions that have a postal address different from the main one. Accordingly, divisions of an organization located on its territory and having the same postal address, due to the lack of territorial isolation, cannot be considered in the sense of the Tax Code of the Russian Federation as separate (Resolutions of the Federal Antimonopoly Service of the East Siberian District dated September 6, 2006 N A74-1273/06-F02 -4571/06-С1 in case No. A74-1273/06, Moscow District dated 08.21.2007, 08.28.2007 N KA-A40/8267-07 in case No. A40-73186/06-99-353, Volga District dated 06.09 .2006 in case N A65-5878/2005-SA1-23, Ninth Arbitration Court of Appeal dated 04/27/2007, 05/07/2007 N 09AP-4826/2007-AK in case N A40-73186/06-99-353).

Thus, a division that has a different postal address compared to the location of the main organization should be considered territorially separate. For the purposes of accounting and tax control, special attention should be paid to separate divisions of the organization that are located outside the administrative-territorial unit of registration of the main organization and, therefore, controlled by another tax authority. The organization has the obligation to register them with the tax authority (according to the rules of Article 83 and Article 84 of the Tax Code of the Russian Federation).

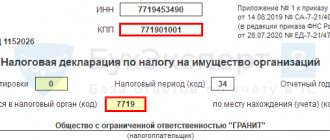

Title page

In the “Tax authority” , indicate the code and name of the tax authority at the location of the organization to which the notification is submitted.

“Russian organization” field reflects the full name of the organization, corresponding to that specified in the constituent documents.

In the “OGRN” , the main state registration number of the organization is indicated, which can be found in the certificate of state registration of a legal entity (from 01/01/2017 in the Unified State Register of Legal Entities).

The “Number of Segregated Subdivisions” field automatically indicates the number of segregated subdivisions in respect of which the notification is submitted.

The appropriate field indicates the code of the selected tax authority for registering the organization at the location of the OP specified in the notification.

To select the tax authority specified in the notification for registration of newly created EP, in the field “Registration of a Russian organization at the location is carried out in the selected NO”, select the code “1” in case of their registration at the location of the previously selected OP or “2” in if they are registered at their location.

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

- Manager - if the notification is submitted by the organization,

- Authorized representative - if the document is submitted by a representative of the organization. In this case, the full name of the representative and details of the document confirming his authority are indicated.

When filling out the “Telephone” , indicate the telephone number at which you can contact the person confirming the accuracy and completeness of the information in the notification.

The date is also automatically indicated on the title page.

Availability of an employment contract

Since the workplace in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation is applied as a category of labor law, the conclusion of a civil contract with an individual, for example a work contract, excludes the possibility of recognizing his place of work as a workplace for tax purposes (Resolution of the Federal Antimonopoly Service of the North Caucasus Region dated December 13, 2005 N F08-5920/05-2345A) .

Thus, the creation of a workplace is evidenced by the conclusion of employment contracts, the signing by the manager of orders for appointment to a position, the drawing up of a staffing table, etc.

In practice, labor relations with employees are often formalized by contract agreements. If a dispute arises related to the qualification of an agreement, one should proceed from its content, and not the name of the agreement. Therefore, if it is established that an employment relationship actually exists between the parties to the contract, the existence of a workplace should be recognized.

The courts recognize the fact of creation of a job due to the fact that there is actual admission to work. For example, in the case when an organization sets up workplaces outside its location, but invites to these places not its own employees, but employees hired under a personnel supply agreement with a third-party organization. As a rule, under such an agreement, employees are in an employment relationship with the providing organization, and the organization receiving the personnel undertakes to provide such employees with jobs and pay a certain amount to the providing organization. And the courts recognize such places as workplaces for tax purposes, based on the fact that the basis for the emergence of labor relations is the actual admission to work with the knowledge or on behalf of the employer or his representative, regardless of whether the employment contract was properly drawn up (Resolution of the Federal Antimonopoly Service of the North-Western Territory dated 04/14/2004 N A66-6278-03).

Tax authorities quite often recognize the places of work of employees who live and work separately from the parent organization (in other cities) as separate divisions. In this case, the tax authorities directly indicate that the conclusion of civil, rather than employment, contracts with them was made in order to avoid recognition of the places of work of such employees as separate divisions, which may entail the collection of sanctions under Art. 116 of the Tax Code of the Russian Federation.

The conclusion between the parties of a civil law rather than an employment contract (for example, a work contract) allows the organization to claim that the job was not created. The tax authorities will be forced to additionally prove in court that an employment relationship actually took place between the parties to the contract, and if a dispute arises related to the qualification of the contract, one should proceed from its content, not its name. Tax authorities are not vested with the right to independently reclassify this type of agreement from a civil law agreement to a labor agreement.

Thus, if a company decides to conclude civil contracts with individuals hired to perform work, then it should pay serious attention to the compliance of the wording of the concluded contracts with the norms of the Civil Code of the Russian Federation, as well as the absence in such contracts of features inherent exclusively to employment contracts.

In our opinion, the relationship between an organization and an individual involved in the systematic performance of certain functions over a long period, not depending on the specific (stipulated by contract) result accepted by the organization (customer), should be considered as an employment relationship (in this case, the result is understood identifiable result of actions carried out by an individual during the performance of his obligations under the contract). In this case, we proceed not so much from the possible form of the concluded contract, but from the actual relationship between the parties (performance of a labor function by the employee and payment by the employer of the employee’s labor in accordance).

Registration of another separate division

Dynamically developing companies are actively expanding through territorial branches. Based on current legislation, an office, commercial premises, or warehouse opened outside the location of the organization are subject to state registration as separate divisions.

Types of separate divisions

The Tax Code of the Russian Federation (Article 11, paragraph 2) classifies as separate divisions any parts of the company that are not located at the legal address of the company, and also if they

· open for more than a month;

· have stationary workplaces (1 or more).

Unlike branches and representative offices, separate divisions are not completely independent, but operate on the basis of separate regulations and have their own property and management bodies. Let us note significant nuances: the opening of a branch, as a rule, is reflected in the charter; An organization that has branches loses the right to apply a simplified taxation system.

The opening of a separate division is within the competence of the head of the organization and does not require amendments to the charter. There is also no need to provide the new branch with its own current account, develop regulations on a separate division, or appoint a manager. Accounting for this division is maintained centrally. After opening, it is enough to simply register the unit with the Federal Tax Service inspection where the legal entity is registered. The separate division applies the same taxation system as the main organization. If the department has its own balance sheet, it can pay contributions to extra-budgetary funds and transfer taxes (income, property, transport, personal income tax) on its own by submitting the necessary reports to the local authorities of the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund.

A separate division is registered with the state within 30 days. Violation of this deadline, as well as the operation of the branch without notifying the tax authorities, threatens the legal entity with fines (Article 116 of the Tax Code of the Russian Federation):

· 10,000 rubles for late payment;

· 40,000 rubles or more (in the amount of 10% of the income received by the separate division) - for lack of registration.

· 2000 - 3000 rubles (Administrative Code, Article 15.3, Part 2) - administrative liability of the official who committed the violation.

According to the law, the actual date of opening of the unit can be considered the day the first employee was admitted to the unit - from that moment the deadline for filing an application begins.

The procedure for registering a separate division of a legal entity consists of tax registration with the Federal Tax Service at the location of the branch being opened (clause 1 of Article 83 of the Tax Code of the Russian Federation). To register a separate division with the tax office, you must fill out an application message in form C-09-3-1 (approved by Order of the Federal Tax Service No. ММВ-7-6 / [email protected] dated June 9, 2011). The application can be sent by letter or via the Internet using the electronic digital signature of the manager. A letter with application S-09-3-1 sent via Russian Post must have a receipt confirmation.

Theoretically, an organization must register with the inspectorates of all municipalities in which it opens its separate divisions, but in practice it is enough to submit an application to the Federal Tax Service Inspectorate at the legal address of the company, and then the information is transferred to the Federal Tax Service Inspectorate of the relevant municipalities within 5 days. After 5 days, as a result of the steps taken, a notification about the registration of a separate unit is received.

When completing the registration of a separate division, they transmit information about the opening of the division to the branch of the Pension Fund of the Russian Federation and the Social Insurance Fund at the place of registration of the company within 10 days. Required documents: application in any form, notarized copies of the certificate of state registration of the legal entity and its registration with extra-budgetary funds, order to create a remote unit. If the branch is opening its own account, register the branch with a local pension fund. Attach a letter about opening an account to the specified list of documents. The list of documents required for registration with the FSS also includes a notice of registration of the company as an insurer and a notice of tax registration of the unit.

This procedure applies to all separate divisions that are not assigned the functions of a branch or representative office. To avoid accusations of illegally opening a branch or representative office, legal entities should not grant broad powers to remote units.

Following a clear action plan agreed with specialists when opening a separate division will only bring progress in development to the company without additional financial risks.

Lawyers and financial experts at KlinBukh will help you develop a scheme for opening a separate division for your company or will take on the entire documentation burden for the preparation and registration of such a division so that your company can continue to follow the development strategy dynamically in the future, without wasting time on routine.

Workplace equipment

A workplace should be considered equipped if it is functionally adapted to carry out the type of activity for which it is created and suitable for an employee to be in this place.

The equipment of the workplace can be confirmed, incl. documents on financial responsibility containing indications of specific property entrusted to the employee. Property necessary for work can be transferred under the employee’s report and according to an inventory report.

If special requirements are imposed on the equipment of workplaces, without which compliance with activities is impossible (prohibited), in the absence of documents established by law, the presence of equipped stationary workplaces does not in itself lead to the formation of a separate division of the organization.

At the same time, some courts continue to insist on the following: the equipment of stationary workplaces in a separate unit means not only the creation of all the conditions necessary for the performance of labor duties, but also the very performance of such (labor) duties (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 20.06. 2007 N F08-3590/2007-1449A in case N A63-9693/2006-C4, Ninth Arbitration Court of Appeal dated 10/08/2007 N 09AP-10255/07-AK in case N A40-10267/07-141-57).

Stationary workplace

Workplace in accordance with clause 2 of Art. 11 of the Tax Code of the Russian Federation is considered permanent if it is created for a period of more than one month.

Recognition of a workplace as stationary does not depend on the frequency of visits by the employee and the time spent at it.

The form of organization of work (rotation work or business trip) and the period of stay of a specific employee at a stationary workplace created by the organization have no legal significance. This, with reference to judicial practice, is indicated in Letters of the Ministry of Finance of Russia dated November 13, 2015 N 03-02-07/1/65879 and dated May 24, 2013 N 03-02-07/1/18634, dated October 12, 2012 N 03- 02-07/1-250.

Thus, the fact that an organization is present with its personnel and material and technical means in a separate territory for a month is a sufficient sign of stationarity, regardless of the actual duration (continuity) of the direct implementation of production activities.

Employer control

A mandatory feature of a workplace is control (direct or indirect) over it by the employer. Let's try to figure out what this means. It seems that this should be understood as the employer’s right:

- legally enter the premises in which the workplace is equipped; equip this place in accordance with its functional purpose (in compliance with labor protection rules);

- directly exercise control over the activities of the employee, for which he must be in an employment relationship with the latter, formalized in the manner prescribed by law.

When considering disputes about the presence (absence) of a separate division, arbitration courts, first of all, pay attention to this point. For example, if an organization provides services on the territory of a customer who provides all conditions for the work of the organization’s seconded employees, then in this case a separate division of the organization is not formed. Indeed, in such a situation, stationary workplaces are under the control of the customer, but the organization itself does not create them (Resolution of the AS of the West Siberian District dated June 11, 2015 N F04-20325/2015).

Thus, taking into account the above features, the following comprehensive definition of the concept of a stationary workplace can be applied for tax purposes.

A stationary workplace is a place created for a period of more than one month, where an employee must stay or where he needs to arrive in connection with his work, and which is directly or indirectly under the control of the employer.

The absence of any sign of a separate unit listed in paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, does not lead to the creation of a separate division by the organization (Appendix to the Letter of the Federal Tax Service of Russia dated December 29, 2006 N ШТ-6-09/ [email protected] ).

Having understood the main signs of the emergence of a separate unit, we will apply them to practical situations.

Situation 1: Long business trip

In order to provide audit services, the contractor sends its employees on a long business trip (more than 1 month) to another city. The contract for the provision of audit services provides for an audit to be carried out at the customer’s office. According to the terms of the contract, the contractor during the inspection is subject to the internal labor regulations and working hours of the customer. The customer undertakes to provide the contractor’s representatives with conditions for timely and high-quality audit.

In this case, all conditions for the work of seconded employees are provided not by the contractor, but by the customer. Consequently, it is the customer who controls these jobs. And since the contractor himself does not create stationary jobs at the place of business trip, he does not have a separate division there.

So that in such a situation the contractor does not have disagreements with the tax authorities, it is advisable to indicate in the contract with the customer that it is he who is entrusted with the responsibilities for creating all the conditions necessary for the performance of work by the contractor’s employees.

Arbitration courts confirm that if there is such a condition in the contract, the contractor does not form a separate unit at the place of business trip (Resolutions of the Federal Antimonopoly Service of Moscow dated December 20, 2010 N KA-A41/15744-10, dated March 2, 2009 N KA-A40/817-09 and Northwestern dated February 15, 2010 in case No. A05-9705/2009 districts).

However, it must be taken into account that regulatory authorities also express a different opinion on this issue. Thus, the Russian Ministry of Finance believes that the actual place of work is the place where the employee performs most of his work duties. And if for a long time an employee performs a significant part of his functions outside his place of permanent work, for example abroad, then a business trip cannot be considered a business trip (Letter of the Ministry of Finance of Russia dated April 28, 2010 N 03-03-06/1/304).

In addition, the sending organization may be faced with the need to register its separate unit if at the place of business trip it has equipped stationary workplaces for its posted workers (Letter of the Ministry of Finance of Russia dated April 10, 2009 N 03-02-07/1-176).

Situation 2: Providing rental equipment with a crew

Under a rental agreement for equipment with a crew, the lessor organization provides the lessee with construction equipment for a fee for temporary possession and use and provides its own services for the management and technical operation of the provided equipment.

Based on Art. 635 of the Civil Code of the Russian Federation, crew members are employees of the lessor. They are subject to the lessor's instructions regarding the management and technical operation, and the lessee's instructions regarding the commercial operation of the vehicle.

In this situation, in our opinion, there is no such sign of a separate unit as the creation of stationary workplaces due to the fact that the equipment itself cannot be a stationary workplace.

A similar opinion is expressed in the Resolution of the Arbitration Court of the North-Western District dated September 16, 2015 N F07-7313/2015 in case N A05-9557/2014. The judges, guided by the concept of a workplace, came to the conclusion that dump trucks could not be a stationary workplace.

When considering disputes regarding the obligation to register a separate unit, the arbitrators indicate the need for documentary evidence of the creation of stationary jobs. Thus, the Arbitration Court of the North-Western District, in Resolution No. F07-7313/2015 dated September 16, 2015 in case No. A05-9557/2014, refuted the tax authority’s argument that the presence of the Company’s employees at the construction site for a long period of time already indicates creation of stationary jobs outside the location of the company. According to the judges, the mere conclusion of a subcontract agreement and sending employees on a business trip for a period of more than a month does not indicate the creation of a separate division by the company, since sending employees on a business trip without creating stationary jobs does not lead to the formation of a separate division. The main reason for rejecting the tax authority’s argument was the tax authority’s failure to prove the creation of stationary jobs by the company. Similar conclusions were made in the Resolutions of the Arbitration Court of the North-Western District dated June 17, 2015 N F07-3858/2015 in case No. A05-7419/2014 and dated May 27, 2015 N F07-2939/2015 in case N A05-11564/2014

Situation 3: Mobile construction site

The organization carries out construction and installation work on the gas pipeline. The territory where the gas pipeline is located belongs to different constituent entities of the Russian Federation and is under the jurisdiction of different Federal Tax Service Inspectors. The construction site is constantly moving as work progresses.

Since the construction site is constantly moving, the organization, in our opinion, does not create stationary jobs. And, accordingly, there are no grounds for recognizing the place where such work is carried out as a separate division of the organization. A similar opinion was expressed by the Russian Ministry of Finance in its Letter dated 08/08/2006 No. 03-02-07/1-212. Arbitration practice confirms this opinion. Thus, the Arbitration Court of the North-Western District in Resolution No. F07-2270/2016 dated 03/02/2016 in case No. A42-8726/2014 came to the conclusion that the Company did not create stationary jobs, since the controversial work was of a field, traveling nature , it is not possible to establish whether an employee is assigned to a particular place of work under these circumstances as a stationary workplace.

If the construction site does not move for more than one month, then the organization has the obligation to register a separate division, since jobs are created that have signs of stationarity.

In accordance with paragraph 9 of Art. 83 of the Tax Code of the Russian Federation, if an organization has difficulty determining the place of registration of a separate division, the decision is made by the tax authority on the basis of the data presented.

In addition, to resolve the issue of the presence or absence of signs of a separate division of an organization at the place of its activities, tax authorities take into account the nature of the relationship between the organization and its employees and other actual circumstances of the organization’s activities outside its location. This position was expressed by the Russian Ministry of Finance in Letter dated March 17, 2010 No. 03-02-07/1-114.

Therefore, in our opinion, if the obligation to register a separate division arises, the organization should provide the tax authority with information about the location of the work, taking into account its long-term nature. When moving a construction site, there is no need to deregister with one tax authority and register with another.

Registration of a separate division

Neither branches nor representative offices of the company, like other divisions, are independent legal entities. They cannot be located at the same address as the parent company; they must have stationary workplaces for work for at least one month. The “head” endows them with property, appoints managers, issues powers of attorney to them, and also develops regulations on the basis of which they act (Article 11 of the Tax Code of the Russian Federation, Article 55 of the Civil Code of the Russian Federation).

Registration of separate divisions of a company is carried out by the Federal Tax Service at their location. After the decision to create is made, no more than a month is allotted for this (clause 1 of Article 83 of the Tax Code of the Russian Federation):

- If a company opens a representative office or branch (Article 55 of the Civil Code of the Russian Federation), the Federal Tax Service, along with a package of necessary documents, submits an application for registration of a separate division - Application for state registration of changes in the constituent documents of a legal entity (form No. P13001) and Notification of amendments (Form P13002), for entering divisions into the Unified State Register of Legal Entities;

- When creating other separate divisions, the “head” sends only one document to its Federal Tax Service - Message in form No. S-09-3-1 (approved by Order of the Federal Tax Service of the Russian Federation dated 06/09/2011 No. ММВ-7-6/362);

- Notification in form No. 1-6-Accounting (Order of the Federal Tax Service of the Russian Federation dated August 11, 2011 No. YAK-7-6/488) is submitted along with the notification of establishment if the organization opens several divisions on the same territory - in one city or municipality, but at the same time they fall under the jurisdiction of different Federal Tax Service Inspectors. There is an exception for such cases: when a new branch, representative office, etc. opens in an area where the company has already registered a previously created division, it can be registered with the same inspection; also, when opening several divisions in one city at once, all of them can be registered at the location of one of them (clause 4 of Article 83 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated September 28, 2011 No. PA-4-6/15886).

Having received the documents, the inspectorate within five days sends the legal entity a notice of registration of a separate division indicating the checkpoint assigned to it. Not being separate legal entities, the divisions use the TIN of the parent organization, so it is not assigned to them.

Registration

The answer to the question from what moment a separate division of an organization should be considered created is important for the correct fulfillment of the organization’s responsibilities as provided for in the Tax Code of the Russian Federation:

notify in writing the tax authority at the location of the organization about all separate divisions created on the territory of the Russian Federation (clause 3, clause 2, article 23 of the Tax Code of the Russian Federation).

According to some courts, a separate division can be considered created from the moment when a stationary workplace is equipped (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 10, 2008 N KA-A40/2751-08 (left in force by the Supreme Arbitration Court of the Russian Federation dated July 31, 2008 N 9752/ 08), FAS Far Eastern District dated October 13, 2009 N F03-5338/2009).

You can confirm the creation of a stationary workplace, for example:

- order on job creation (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated 06.08.2008 N F03-A24/08-2/2535);

- a signed lease agreement for the premises in which the workplace will be located (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated 06.08.2008 N F03-A24/08-2/2535);

- an order to hire the head of a separate division (Resolution of the Federal Antimonopoly Service of the North-Western District dated 02/05/2010 N A56-10280/2008).

In Letter dated 02/19/2016 N 03-02-07/1/9377, the Russian Ministry of Finance expressed a different point of view, according to which the period is calculated from the beginning of the organization’s activities through the corresponding separate division.

In our opinion, using the universal rule, the date of creation of a separate division should be determined by the earliest document in date that recorded the presence of all the signs established by Art. 11 of the Tax Code of the Russian Federation.

We inform the tax office about the opening of a separate division

According to Article 83(1) of the Tax Code of the Russian Federation, organizations must register for tax purposes at the location of each of their separate divisions. An additional requirement to report to the tax inspectorate about all separate divisions (within a month) and changes in information about them (within three days) is established by Article 23(3) of the Tax Code of the Russian Federation.

Thus, when creating a separate division (that is not a branch or representative office), the LLC must:

- report this to your tax office using form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated 09/04/2020 No. ED-7-14/ [email protected] ;

- register with the tax authorities at the location of this unit, if it was created in a territory under the jurisdiction of a tax office other than the one in which the head office is registered.

The tax inspectorate at the place of registration of the head office, to which message No. S-09-3-1 was submitted, itself reports this fact to the Federal Tax Service at the location of the created separate division (Article 83(4) of the Tax Code of the Russian Federation), that is, from the LLC you do not need to register yourself.

If several separate divisions are located in the same municipality, but in territories under the jurisdiction of different tax inspectorates, registration can be carried out at the location of one of the separate divisions, at the choice of the organization. For example, if in one city an LLC has several stores open in the territories of different Federal Tax Service, you do not need to register with each of them, you can select one inspection, indicating this choice in the message.

If you change the address of a separate division, you do not need to close it and open it again, but only submit a message on form No. S-09-3-1 to the tax office at the place of registration of the division indicating the new address.

Closing a separate division

In order to remove a closed (liquidated) separate division from tax registration, you must submit a message in form N C-09-3-2 to the Federal Tax Service at the location of the organization itself. This must be done within three working days from the date:

- making a decision on the liquidation of a branch or representative office (clause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation). Such a decision can be made by the board of directors (collegial executive body) of a JSC or the general meeting of participants (sole participant) of an LLC (clause 14, clause 1, article 65 of Law N 208-FZ, article 5, clause 2, clause 2, article 33 , Article 39 of Law No. 14-FZ);

- issuance by the head of the organization of an order to close an OP that is not a branch or representative office (clause 3.1, clause 2, article 23 of the Tax Code of the Russian Federation).

What is a separate division

In Russian legislation there are two approaches to the concept of a separate division: civil law and the approach adopted in tax law.

From the point of view of civil law, this is either a representative office or a branch. Both of these types are located outside the location of the legal entity; the activities of the representative office are aimed at protecting the interests of the person or representing him in another geographical region. The branch carries out the functions of a legal entity partially or completely in another geographical region. The concept, types and legal status of separate units from the perspective of civil law are fixed in Art. 55 Civil Code of the Russian Federation. Tax legislation interprets the concept of a division more broadly: these include branches, representative offices, and all other types of separately located parts of a legal entity that operate outside its location and have stationary workplaces. A stationary workplace is a place organized for at least one month. This position is reflected in Art. 11 of the Tax Code of the Russian Federation.

A separately functioning part of a company is not a separate legal entity either in the understanding of civil law or in the understanding of tax law. This is the same legal entity; it is not assigned a TIN, only its own checkpoint. Information about branches and representative offices is entered into the Unified State Register of Legal Entities. It is enough for a legal entity to inform the tax office about the existence of other separate parts by submitting a message in form No. S-09-3-1.