We won’t teach you how to become a financial director in one article, but we tried to include the basics as a starting point.

Financial analysis is the study of key indicators and ratios that provide an objective assessment of the current financial condition of organizations for the purpose of making management decisions.

By calculating financial indicators, you can learn about the current state of affairs at the enterprise, problems and assess its capabilities and prospects in the future.

A competent analysis allows you to correctly build a development strategy, improve the mechanism for managing assets and attracted funds of the company.

Groups of financial analysis indicators

More than 200 ratios are used in financial analysis.

All these ratios characterize four main aspects - indicators of the financial activity of any organization, namely:

- liquidity;

- profitability;

- asset turnover;

- market price.

For each of these groups of indicators, their own financial ratios are calculated.

The coefficients are calculated depending on the task of financial analysis and the circle of users for whom the information on the company’s financial activities is intended.

Financial ratios and financial performance indicators

Here are the main financial ratios for each group of performance indicators:

The group of liquidity indicators includes the ratios:

- absolute liquidity;

- current liquidity;

- quick liquidity.

The group of profitability indicators includes the following coefficients:

- profitability of working capital;

- profitability of sales;

- return on assets;

- return on net assets;

- return on equity.

The group of asset turnover indicators includes the following ratios:

- asset turnover;

- turnover of current assets;

- inventory turnover;

- turnover of receivables (payables).

The group of market indicators includes the following coefficients:

- earnings per share;

- dividend income;

- share price growth;

- payments;

- market (real value) of the enterprise;

- price/earnings per share.

Liquidity indicators

A company's ability to pay off its obligations through the sale of current assets is one of the conditions for its financial stability.

Liquidity ratios allow you to assess the stability of an organization.

Liquidity is the ability of assets to be quickly sold at a price close to the market price.

The easier and faster you can get the full value of an asset, the more liquid it is.

The rate of sale of assets can be:

- High - in relation to property that does not need to be sold (cash) and that property that will be sold quickly enough (cash equivalents, for example, highly liquid debt securities);

- Fast - for property that requires some time for sale, but not very much (short-term debt of debtors);

- Medium - for property that will not be sold very quickly and may lose part of its value during the sale process (inventory, of which work in progress may be difficult to sell).

In practice, a distinction is made between highly liquid, low liquid and illiquid assets.

In the Russian balance sheet, the company's assets are arranged in descending order of liquidity.

They can be divided into the following groups:

- Highly liquid assets (cash and short-term financial investments);

- Quickly realizable assets (short-term receivables, i.e. debt for which payments are expected within 12 months after the reporting date);

- Slowly selling assets (other current assets not mentioned above);

- Hard-to-sell assets (all non-current assets);

In accordance with the classification of property by speed of sale, there are 3 main types of liquidity indicators:

- Absolute - for property with a high rate of sale;

- Fast, which can also be called urgent, strict, intermediate, critical, or called the intermediate coverage ratio, - for property that has a high and rapid rate of sale;

- Current - for property whose sales rate corresponds to the sum of all 3 listed rates.

Liquidity ratios are calculated based on balance sheet data (Form No. 1).

The higher the liquidity ratios, the higher the company's solvency.

Note that each of the liquidity ratios reveals information of a different nature.

Thus, the current liquidity ratio is primarily of interest to investors, the absolute liquidity ratio is useful for suppliers of goods (works, services), and the quick liquidity ratio is necessary for creditors.

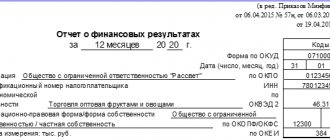

How accounting is built

Accounting is based on the financial calculation formula. results: FR = FRp + FRpr - N + SHE - IT - ShP , where:

- FR – final financial. result;

- FRp – profit (loss) from sales;

- FRpr - the same from other types of activities;

- N – tax (on profit);

- OTA – deferred tax assets;

- IT – the same thing – obligations;

- ShP – the amount of sanctions for violation of legislation in the field of NU.

Instructions for using the chart of accounts require taking into account profits and losses on account 99 BU . The debit will reflect the company's expenses and losses, and the credit will reflect the company's income and profit. Comparing debit and credit turnovers, we obtain a financial result. If a profit is made, it will be recorded under credit 99. This profit must be reduced by the amount of the corresponding tax and the amount of sanctions (if they were applied to the organization). The indicated amounts are recorded as debit 99.

On a note! PBU 18/02 R.4 defines the amount of income tax as a conditional expense (income), depending on the amount from which it was determined: profit or loss.

The main entries for account 99 reflect:

- Dt 90 (99) Kt 99 (90) – write-off of profit (loss);

- Dt 91 (99) Kt 99 (91) – write-off of the balance of profit (loss) on other income and expenses.

In addition, in accordance with the formula, conditional expenses associated with income tax, tax sanctions, liabilities, and income tax recalculations may be reflected here.

Account 99 corresponds at the end of the year with account 84 (“Retained earnings/uncovered loss”), depending on the financial receipts. result (page 2400 of the Financial Results Report):

- Dt 99 Kt 84 - if profit is made;

- Dt 84 Kt 99 - if there is a loss.

The company's main activity, by default, brings in the lion's share of income that affects profit.

To record business transactions during the year, account 90 “sales” is used here, and subaccounts are opened for it, specifying the accounting. Credit 90 reflects sales revenue at sales prices, and debit:

- cost of products sold;

- VAT on goods sold;

- excise taxes.

Subaccounts of account 90: 1 - revenue, 2 - cost of sales, 3 - VAT, 4 - excise taxes, 9 - profit (loss) from sales. Monthly revenue and the amount of expenses (cost, VAT, excise taxes) are compared with each other and a financial result is revealed, which is reflected in subaccount 9 and written off every month to profit (loss): Dt 90/9 Kt 99 - profit, Dt 99 Kt 90/9 - loss.

Let's give an example of reflecting transactions on account 90 “Sales”. Let (conditionally): revenue for the period amounted to 2,000,000 rubles, VAT - 20%, including the cost of products - 900,000 rubles, sales costs - 50,000 rubles. Income, according to the accounting policy, is recognized on shipment.

Postings:

- Dt 62 Kt 90/1 - 2000000.00 - sales revenue is taken into account.

- 2000000:1.2 = 1666666.67. 2000000-1666666.67= 333333.33. Dt 90/3 Kt 68 - 333,333.33 - VAT charged.

- Dt 90/2 Kt 43 (or 41) - 900,000.00 - cost written off.

- Dt 90/2 Kt 44 - 50,000.00 - selling expenses.

- 333333.33 + 900000.00 + 50000.00 = 1283333.33. 2000000.00 – 1283333.33 = 716666.67. Dt 90/9 Kt 99 716666.67 - profit from sales is taken into account.

Other income/expenses are accounted for in account 91. Subaccounts are usually used here: 1 - income, 2 - expenses, 9 - balance of income/expenses, and the financial result is determined by comparing credit turnover in subaccount 1 and debit in subaccount 2.

The monthly postings will be as follows:

- Dt 91/1 (91/9) Kt 91/9 (91/2) – the balance of other income (expenses) is written off.

- Dt 91/9 (99) Kt 99 (91/9) – at the end of the month, profit (loss) from other activities was recorded.

Income tax is calculated and transferred using a separate subaccount. 68:

- Dt 99 Kt 68/profit;

- Dt 68/profit Kt 51.

By analogy, the sanctions mentioned above are also taken into account.

Analytics on financial accounts. results is formed in order to ensure transparency of the data necessary to work with the profit and loss account and balance sheet indicators. To increase analyticality, for example, separate accounts can be opened on account 99: 1 - profits/losses from ordinary activities, 2 - similarly from operating activities (identified on account 91), 3 - from non-operating transactions (also identified on account 91), 6 – income tax payments, sanctions, etc.

All these points must be reflected in the accounting policy, and a working chart of accounts must be adopted. It would be useful to indicate in this document how to use the resulting net profit:

- consolidation of authorized capital;

- dividend payment;

- capital investments;

- repayment of losses from previous periods, etc.

They are reflected in various entries, for example: Dt 84 Kt 84 - the loss of previous years is repaid; Dt 84 Kt 75 (or 70 if we are talking about an employee) - dividends are reflected.

Losses are covered by reserve, additional capital, and attraction of deposits from participants under Kt 84 accounts.

Current liquidity

The current liquidity ratio is one of the main calculated characteristics that assess the solvency of a company.

This is the most common and frequently used liquidity indicator.

The current liquidity ratio reflects the company's ability to pay off current (short-term) obligations using only current assets.

Thus, the current liquidity ratio shows to what extent the current assets available to the company, when sold at the market price, will cover the short-term liabilities of the enterprise.

Current (total) liquidity ratio is a financial ratio equal to the ratio of current (current) assets to short-term liabilities (current liabilities).

Data are taken to determine the current liquidity ratio from the balance sheet of the enterprise compiled as of any of the reporting dates.

This is usually the annual balance sheet, but interim statements can also be used.

To see the nature of changes in this indicator over a number of periods, several determinations are made for different reporting dates.

Current ratio formula:

Current liquidity = Current assets / Current liabilities

Since the data for calculating the indicator in question is taken from the balance sheet, the current liquidity formula in relation to the lines of the current form of this report will look like this:

From the entire amount of section V (i.e. from the entire amount of short-term liabilities):

Current liquidity = line 1200 / line 1500Where:

- Page 1200 — line number of the total of section II “Current assets” of the balance sheet;

- Page 1500 - line number of the total of section V “Short-term liabilities” of the balance sheet.

The higher the indicator, the better the solvency of the enterprise.

A ratio value of at least 1 is considered normal.

That is, it is necessary that the total value of current assets be greater than the amount of short-term liabilities.

A value below 1 indicates a high financial risk associated with the fact that the company is not able to reliably pay current bills.

A value greater than 3 may indicate an irrational capital structure.

How the total financial result is formed: description of lines 2400, 2510, 2520 fin. report No. 2

So, a significant share of the total result is net profit (NP). It is subject to adjustment for the results of revaluations, which contain lines 2510 and 2520. Therefore, in addition to the emergency situation, these two indicators should also be taken into account. Let's consider the relationship between these three indicators and some features of their display in reporting.

The first indicator. Profit for the current year is shown by account. 90 (sales) and 91 (other income with expenses). The latter are then written off to the account. 99 (profit, loss), which at the end of the current reporting year is closed on the account. 84 (retained earnings).

The second indicator. As for the revaluation of VA, today it is carried out on the last day of the outgoing reporting year. If by this time there are no amounts of additional capital from a previously carried out revaluation, the markdown is shown in other words. spending. When carrying out an additional assessment as part of a previous revaluation, the amounts of which have already been included in the financial. As a result, this revaluation is shown in other things. income, but page 2510 is then left blank. If amounts of additional capital are involved, they are registered on page 2510 in section. "For reference."

The third indicator. This is another ambiguous indicator that appears in the calculation of the SFR - the result from others. operations (page 2520). What is noteworthy is that, within the framework of the applicable standards, it is not defined exactly what kind of operations we are talking about here. There are no strict regulations on this part. As practice shows, this indicator often includes the difference that arises when recalculating the value of existing assets.

For example, when a Russian organization operates in another country and, when using assets, recalculates their value in foreign currency into denominations. rubles When recalculating, the difference is obtained, which is further displayed using additional capital (in relation to PBU 3/2006, approved by Order of the Ministry of Finance of the Russian Federation No. 154n dated November 27, 2006).

In addition to the above, there is an opinion that the third indicator under consideration also includes the amount of errors for the previous year, which were identified by the time the accounts were formed and approved. reporting. In fact, comparable values of indicators for previous periods are adjusted when compiling accounts. reporting with disclosure of information in the relevant explanations. Errors are corrected in the manner indicated in clause 9, part II of PBU 22/2010 (approved by Order of the Ministry of Finance of the Russian Federation No. 63n dated June 28, 2010).

Taking into account the above, the general formula for calculating the SFR can be presented as follows:

Interpretation of indicators: PE - net profit, Y - loss, RPVA - the result from the revaluation of VA, not included in the PE, RPO - the result from other things. operations not classified as an emergency.

Quick liquidity

Quick liquidity ratio is a financial ratio equal to the ratio of highly liquid current assets to short-term liabilities (current liabilities).

The quick liquidity ratio depends on the rate of sale of highly and quickly liquid property, which includes:

- Short-term debt of debtors (sold quickly);

- Short-term financial investments (highly liquid);

- Cash (does not require sale).

The essence of the quick liquidity ratio is to calculate the share of current (short-term) debt that a company can repay using its own property over a short period of time, turning this property into cash.

The source of data is the company’s balance sheet, most often the annual balance sheet, but calculations based on interim reporting are also possible.

Quick ratio formula:

Quick liquidity = (Short-term accounts receivable Short-term financial investments Cash) / Current liabilities

Based on the line numbers of the balance sheet, the formula for the quick ratio on the balance sheet can be displayed as follows:

Quick liquidity = (line 1230 line 1240 line 1250) / (line 1510 line 1520 line 1550)

Where:

- Page 1230 - short-term debt of debtors;

- Page 1240 - short-term financial investments;

- Page 1250 - cash balance;

- Page 1510 - balance of short-term borrowed funds;

- Page 1520 - short-term debt to creditors;

- Page 1550 - other short-term liabilities.

A quick ratio of at least 1 is considered normal.

If the quick ratio is equal to or greater than 1, then the company is able to ensure rapid full repayment of its current debt using its own funds. Moreover, part of these funds (if the coefficient is greater than 1) will still remain with the organization.

When the quick ratio is less than 1, the company will not be able to quickly pay off all its current debt with its own funds.

At the same time, a quick liquidity ratio in the range of 0.7–1 is considered acceptable, since it is common practice to run a business with debts.

A quick ratio of less than 0.7 indicates an unfavorable situation, especially if the numerator accounts for the bulk of the amount in receivables, among which there may be doubtful ones.

Absolute liquidity

The absolute liquidity ratio shows what proportion of existing short-term debts can be repaid from the company's funds in the shortest possible time, using the most easily salable property.

Determine the initial data for calculating the absolute liquidity ratio based on the balance sheet compiled as of a specific reporting date, or according to reporting for a number of dates, if you need to track the dynamics of changes in this indicator.

Absolute liquidity ratio is a financial ratio equal to the ratio of cash and short-term financial investments to short-term liabilities (current liabilities).

Absolute liquidity ratio formula:

Absolute liquidity = (Cash short-term financial investments) / Current liabilities

Based on the line numbers of the balance sheet, the formula for the absolute liquidity ratio on the balance sheet can be displayed as follows:

Absolute liquidity = (line 1250 line 1240) / (line 1510 line 1520 line 1550)

Where:

- Page 1250 - line number of the balance sheet for cash;

- Page 1240 - line number of the balance sheet for financial investments;

- Page 1510 — balance sheet line number for short-term borrowed funds;

- Page 1520 - line number of the balance sheet for short-term debt to creditors;

- Page 1550 - balance sheet line number for other short-term liabilities.

A coefficient value of at least 0.2 is considered normal, that is, it is in the range from 0.2 to 0.5.

This means that the company is able to repay from 0.2 to 0.5 short-term debts in the shortest possible time upon the first demand of creditors.

Accordingly, a higher value of the indicator indicates a higher solvency.

Exceeding the value of 0.5 indicates unjustified delays in the use of highly liquid assets.

Accounting for deferred income

In accordance with the Regulations on accounting and financial reporting in the Russian Federation (clause 81), income received in the reporting period, but relating to subsequent reporting periods, is called deferred income.

Deferred income is accounted for in account 98 “Deferred income” - a passive balance sheet account. The credit of the account records all types of income related to future periods, and the debit accounts for their write-off.

4 sub-accounts can be opened for account 98:

- “Income received for deferred periods.”

- "Gratuitous receipts."

- “Upcoming collections of debt for shortfalls identified in previous years.”

- “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables.”

The following income can be taken into account in subaccount 98/1: rent or apartment fees, utility bills, subscription fees for the use of communications equipment, etc.

When reflecting amounts of income relating to future reporting periods, the following entries are made:

D-t 50, 51, 52, 55 K-t 98/1 - for the amount of income received relating to future reporting periods;

Dt 58 “Financial investments” Kt 98/1 - for the amount of accrued payments against future income.

As the reporting period approaches, the amounts recorded on the credit of account 98/1 are transferred to the appropriate accounts:

D-t 98/1 K-t 90 “Sales” - for the amount of income of future periods (for example, payments received in advance for utilities, etc.) included in the proceeds from the sale of the reporting period to which they relate.

D-t 98/1 K-t 91 “Other income and expenses” - for the amount of future income (for example, rent) included in other income.

Example.

In the reporting period, 000 “Don” received quarterly rent for premises in the amount of 7,080 rubles, relating to the future period, including VAT of 1,080 rubles. The following entries will be made in the accounting:

D-t 76 K-t 98/1 - 7080 rub. - the amount of accrued rent for future periods;

D-t 51 K-t 76 - 7080 rub. - the amount of rent received into the current account for the quarter;

D-t 98/1 K-t 68 - 1080 rub. - the amount of accrued VAT.

The payment amount excluding VAT is subject to write-off to operating income;

D-t 98/1 K-t 91 - 2000 rub. (6000: 3) - the amount of the quarterly payment for one month of the quarter.

The value of assets received by the organization free of charge is recorded in subaccount 98/2. The accounting procedure for such transactions is set out in the relevant topics.

The movement of upcoming debt receipts for shortfalls identified in the reporting period for previous years is reflected in subaccount 98/3.

Example.

By decision of the court, the amount of the deficiency in the amount of 2,500 rubles, identified in the reporting period for previous years, was awarded to be recovered from the guilty person. The shortfall must be reimbursed to the cashier in full.

The following entries will be made in the accounting:

D-t 94 K-t 98/3 - 2500 rubles - for the amount of the debt for the shortage awarded by court decision;

D-t 73/2 K-t 94 - 2500 rub. - the amount of the shortage;

D-t 50 K-t 73/2 - 2500 rub. - for the amount of the shortfall deposited into the cash register;

D-t 98/3 K-t 91 - 2500 rub. — for the amount of the received debt (after payment)

Subaccount 98/4 takes into account the difference between the amount recovered from the guilty parties for missing valuables and the value listed in the organization’s accounting records.

The identified amount of the difference is reflected in the accounting records as follows: D-t 73/2 K-t 98/4.

Example.

The organization discovered a shortage of materials that were damaged due to the fault of the financially responsible person. The actual cost of materials is 20,000 rubles, the market value is 25,000 rubles. When purchasing materials, VAT was paid - 4000 rubles. By order of the manager, the shortage must be compensated in the amount of the market value of the materials. The following entries will be made in the accounting:

D-t 94 K-t 10 - 20,000 rub. - by the amount of actual cost;

D-t 73/2 K-t 94 - 20,000 rub. - the amount of the shortage is attributed to the financially responsible person at the actual cost;

D-t 73/2 K-t 68 - 3600 rub. - the amount of VAT attributed to the guilty person;

D-t 73/2 K-t 98/4 — 50,000 rub. - the amount of the difference between the market and actual cost of materials;

D-t 70 K-t 73/2 - 28,600 rub. - for the amount of the shortage withheld from the wages of the guilty person;

D-t 98/4 K-t 91 - 5000 rub. — the amount of the difference between the market and actual cost of materials is included in income.

Analytical accounting for account 98 is organized in the reserve of each open subaccount.

Profitability indicators

Enterprise profitability ratios reflect the degree of profitability of various types of assets and the efficiency of use of material, labor, monetary and other resources.

They are calculated as the ratio of net profit to the amount of assets or flows from which it was obtained.

For this purpose, accounting data is used (Form No. 1 and No. 2).

The higher the values, the more efficiently the analyzed enterprise resources are used.

Owners and shareholders are interested in profitability indicators.

Profitability ratios play an important role in developing a company's investment, personnel, and marketing strategies.

Financial result profit – postings

At the end of the month, the company received revenue in the amount of 525,000 rubles, the cost of goods shipped was 305,000 rubles, VAT was 70,000 rubles. The amount of additional costs amounted to 2500 rubles. What will be the financial result from sales - the posting of the total amount will appear only after the income and expense sub-accounts are closed:

- the revenue formed the credit balance of account 90.1, it is subject to write-off by debiting account 90.1 with simultaneous crediting of account 90.9 in the amount of 525,000 rubles;

- when the cost of sold assets is reset to zero, correspondence D-t 90.9 – K-t 90.2 is drawn up in the amount of RUB 305,000;

- decrease in profit due to VAT in the amount of 70,000 rubles. reflected by the entry D-t 90.9 – K-t 90.3;

- the financial result from the sale of products has been determined - a posting with a debit movement in account 90.9 and a credit entry in account 99 in the amount of 150,000 rubles. (525,000-305,000-70,000);

- Other expenses in the amount of RUB 2,500 were included in the loss. – D-t 91.9 – K-t 91.2;

- the resulting loss from related expenses is reflected in the entry D-t 99 – K-t 91.9 – 2500 rubles;

- The financial result from the sale of products is written off - the posting is made in the amount of 147,500 rubles. (150,000-2500) between debit 99 and credit 84.

Return on working capital

The profitability of working capital reflects the effectiveness of their use in the manufacturing process.

The profitability of working capital will be greater, the fewer resources the company spends to increase profits.

Formula for return on working capital:

Return on working capital = Net profit/current assets

If we use the lines of financial statements, then:

Return on working capital = line 2400/line. 1200Where:

Page 2400 - line of the income statement (company’s net profit);

Page 1200 - balance sheet line (cost of working capital).

The higher the obtained indicator, the more efficiently your own working capital is used.

The standard value of return on working capital is more than 1.

A return on working capital ratio with a total of more than one means the effective use of working capital and indicates that the enterprise is making a profit.

A negative result demonstrates improper organization of production.

Return on sales

Return on sales shows whether an enterprise is profitable or unprofitable.

The sales profitability ratio determines the share of profit in each ruble earned and is calculated as the ratio of net profit (profit after tax) for a certain period to the sales volume expressed in cash for the same period.

Sales return ratio formula:

Return on sales = Net profit / Revenue x 100%

To calculate the profitability of sales, information from the financial results report is used (form No. 2):

Return on sales by gross profit = line 2100 / line 2110 × 100Return on sales for operating profit = (line 2300 line 2330) / line 2110 × 100

Return on sales for net profit = line 2400 / line 2110 × 100

There are no special standards for profitability of sales.

Average statistical values of profitability by industry are calculated.

For each type of activity, its own coefficient is considered normal.

In general, a coefficient ranging from 1 to 5% indicates that the enterprise is low-profitable, from 5 to 20% is medium-profitable, and from 20 to 30% is highly profitable.

A ratio of over 30% indicates super-profitability.

How to calculate the net profit of an enterprise: formulas

The formula by which the enterprise's net profit is calculated (from sales or manufacturing of products) does not change its economic meaning, although various initial data can be used in it.

There are several ways to calculate net profit (NP):

- PE = revenue – taxes – expenses (administrative, production, transport, etc.) – cost of goods.

- PE = profit (before taxes) – taxes.

- PE = total profit (gross, financial, operating) – tax deductions.

- PE from sales = gross profit – selling expenses – administrative costs for selling goods.

The value of this indicator is determined by a number of factors:

- total company revenue;

- cost of production;

- the amount of taxes;

- the size of other costs and income.

In addition to net profit, accounting also uses the opposite indicator - net loss, or negative profit. Many enterprises are unprofitable at the end of the reporting year, although during this time they function quite successfully. It also happens that even in the absence of a large turnover, a business brings a huge net profit.

No matter what formula you use to calculate net profit, you end up with the same number. Typically, in practice, PE is calculated using a simplified formula, filling out the financial activity report line by line and receiving the required net profit in the final line.

How to calculate net profit using a simplified formula? Like this:

PP = B – SS – UR – KR + PD – PR – NP

In this formula:

- B - revenue;

- CC - cost of sales;

- UR, KR - administrative, commercial expenses;

- PD, PR - other income and expenses;

- NP - income tax.

All required source data is contained in the organization's financial performance report for the period of interest.

Thus, having access to data from financial statements, calculating net profit is not difficult at all. By this indicator you can judge how productive the company is. Of course, business owners and top managers are interested in any ways to increase net profit: expanding production volumes, reducing costs, etc. The sharp dynamics of this indicator (by large leaps) may arouse suspicion among potential investors and partners.

We recommend

“Profit maximization: the golden rule and methods of implementation” Read more

Return on assets

Return on assets shows the ability of a company's assets to generate profit and is an indicator of the efficiency and profitability of the company's activities.

The return on assets ratio is calculated as the ratio of profit to the average value of the enterprise's assets and reflects the amount of net profit from each ruble invested in the organization's assets.

To do this, the indicator from Form No. 2 “Income Statement” is divided by the average value of the indicator from Form No. 1 “Balance Sheet”.

Return on assets, like return on equity, can be considered as one of the indicators of return on investment.

Return on assets ratio formula:

Return on assets = profit for the period / average assets for the period x 100%The profit indicators for the numerator of the return on assets formula should be taken from the financial results statement:

profit from sales - from line 2200;

net profit - from line 2400.

The denominator of the formula must be the average value of the value of current assets.

If the profitability of all assets is considered, then the balance sheet is taken (line 1600).

If the profitability of current assets is considered, then the result of section II of the balance sheet asset is taken (line 1200).

If you are interested in their separate type, information from the corresponding line of the second section.

When calculating the profitability of non-current assets, the denominator needs to reflect the total for section I - line 1100. Then we will get the profitability of all existing non-current assets.

If necessary, you can analyze the profitability of a particular type of asset, for example, fixed assets or a group of non-current assets (tangible, intangible, financial).

In this case, the data on the lines that reflect the corresponding property is substituted into the formula.

The higher the indicator, the more effective the entire management process is, since the return on assets indicator is formed under the influence of all the company’s activities.

For a financial organization, an indicator of 10% or more is considered normal, for a manufacturing company - 15-20%, for a trading company - 15-40%.

Analysis of the financial results of an enterprise using a specific example

Let us show with an example how to analyze the financial and economic activities of an enterprise in terms of financial results. We outlined the stages above. In accordance with them, we will make calculations and write conclusions. Let's take the annual reports of Aeroflot PJSC for 2018 as a basis.

Stage 1

The table below shows all four types of profit from the income statement. We did not add retained earnings from the balance sheet to them. Reason: it is shown as a date. Therefore, we will not generalize interval and point indicators.

Table 4. Horizontal analysis of financial results

| Indicator, billion rubles. | 2017 | 2018 | Growth rate, % |

| 1 | 2 | 3 | 4 (3 ÷ 2 × 100 – 100) |

| Gross profit (2100 OFR) | 46,4 | 5,0 | -89,2 |

| Loss on sales (2200 OFR) | -1,5 | -38,6 | 2418,5 |

| Profit before tax (2300 OFR) | 35,2 | 4,1 | -88,4 |

| Net profit (2400 OFR) | 28,4 | 2,8 | -90,2 |

The most important financial results presented are the second and fourth. Profit (loss) from sales is an indicator of the effectiveness of the main business. Net – the final characteristic of the ratio of all income and expenses. Therefore, in our conclusions we will focus on them.

For PJSC Aeroflot, 2022 was unfavorable from the point of view of its key activity - air passenger transport. In 2022, the situation became completely catastrophic. Reason: loss from operating activities.

Further, in the course of factor analysis, we will understand why this is so. In the meantime, let’s find the answer: how the company ultimately managed to gain profit. It is clear that these are some other transactions that have formed a positive balance of other income and expenses. Which ones exactly? The answer is given in the notes to the balance sheet and income statement. It follows from it that the largest share in 2022 belonged to other income from:

- missed passengers due to their failure to show up for the flight – 15.5%;

- profits of previous years, which were revealed in the reporting year - 10.3%;

- refund of excise tax on fuel – 10.1%;

- operations with fixed assets and other assets – 8.5%;

- fines and penalties for violation of contract terms – 8.3%.

Please note: everything, with the exception of the excise tax refund, is some random factor. They may not recur in the future at all or may recur to a much smaller extent. And then other operations will cease to be life-saving in bringing the company to a net profit.

In any case, the current situation is abnormal. Loss from sales is one of the most alarming calls in any business.

Loss from sales is one of the most alarming calls in any business.

Stage 2

We will divide the vertical analysis into two parts. Let's create separate tables for financial results from the balance sheet and the “second” form.

Table 5

. Vertical analysis of financial results on the balance sheet

| Index | 31.12.2016 | 31.12.2017 | 31.12.2018 | |||

| billion rubles | beat weight, % | billion rubles | beat weight, % | billion rubles | beat weight, % | |

| Share in equity | ||||||

| Retained earnings (1370 BB) | 68,2 | 97,9 | 77,3 | 98,2 | 65,8 | 109,3 |

| Capital and reserves (1300 BB) | 69,7 | 100,0 | 78,7 | 100,0 | 60,3 | 100,0 |

| Share in liabilities | ||||||

| Retained earnings (1370 BB) | 68,2 | 38,3 | 77,3 | 41,9 | 65,8 | 38,4 |

| Total passive (1700 BB) | 178,4 | 100,0 | 184,5 | 100,0 | 171,7 | 100,0 |

From the point of view of vertical analysis of retained earnings, the situation at PJSC Aeroflot is quite optimistic. Own capital consists almost entirely of it, and in the balance sheet currency its share is more than 1/3. This is a good “cushion” of financial security and stability. However, with a systematic net loss, it runs the risk of quickly melting away.

Let us especially explain the value of the share in capital and reserves as of December 31, 2018. It is above 100% and this is not an error. The reason is as follows: as of this date, the company had its own shares purchased from shareholders. Their acquisition price is entered in section III of the balance sheet with a minus sign. Because of this subtraction, the composite component may be larger than the final value, as in this case.

Table 6.

Vertical analysis of financial results according to the “second” form

| Index | 2017 | 2018 | ||

| billion rubles | beat weight, % | billion rubles | beat weight, % | |

| Share in revenue | ||||

| Gross profit (2100 OFR) | 46,4 | 10,4 | 5,0 | 1,0 |

| Loss on sales (2200 OFR) | -1,5 | × | -38,6 | × |

| Revenue (2110 OFR) | 446,6 | 100,0 | 504,7 | 100,0 |

| Share in total income | ||||

| Profit before tax (2300 OFR) | 35,2 | 6,9 | 4,1 | 0,7 |

| Net profit (2400 OFR) | 28,4 | 5,6 | 2,8 | 0,5 |

| Total income (2110 OFR + 2310 OFR + 2320 OFR + 2340 OFR) | 507,4 | 100,0 | 573,4 | 100,0 |

For every ruble of revenue in 2022 there was only 10 kopecks of gross profit. And in 2022 – only 1 kopeck. This means that the cost of sales at PJSC Aeroflot is very significant in relation to the main income. Moreover, in 2022 there was a significant increase of 24.8%. Explanations for reporting disclose why. The most important reasons:

- an increase in material costs by 42.0%, including costs for aviation fuels and lubricants - by 49.0%;

- increase in leasing payments by 19.7%;

- an increase in costs for code-sharing operations (joint operation of overhead lines) by 18.9%.

Against the background of revenue growth of only 13%, such dynamics in the area of expenses is extremely negative. As noted above, the situation can only be saved by a positive balance of other income and expenses. This means that the profitability situation at PJSC Aeroflot is very unstable.

The share of profit before tax and net profit in the company's total income is also small. Moreover, in 2022, negative dynamics are clearly expressed. Of the earned 573 billion rubles. Income from net profit accounts for only 0.5 kopecks from each ruble. It is obvious that with such a size and dynamics of income, the company’s expenses require significant optimization.

Note: we did not calculate the share of profit from sales. There is no point in finding the fraction of a negative number in a positive one.

Stage 3

Let's evaluate the financial results of PJSC Aeroflot through relative profitability indicators. We will make calculations based on net profit.

Table 7.

Values and dynamics of profitability

| Index, % | 2017 | 2018 | Growth rate, % |

| Return on assets | 15,7 | 1,6 | -90,0 |

| Return on equity | 38,3 | 4,0 | -89,5 |

| Return on debt capital | 26,5 | 2,6 | -90,3 |

| Return on sales | 6,4 | 0,6 | -91,3 |

Profitability by all indicators in 2022 was only about 10% of the previous year. An average reduction of 90% is a catastrophic situation. Here its main reason is an almost tenfold drop in net profit. It turns out: every ruble of assets, capital and revenue in 2022 was given to the business 10 times less than in 2022.

However, even such a negative scenario is not the worst. If we calculated profitability based on the operating financial result, we would get completely negative values. Let us remind you: in this case, this is no longer profitability, but unprofitability.