Grounds for closing an individual entrepreneur

The grounds for closing an individual entrepreneur can be divided into two categories:

- By the decision of the entrepreneur himself. If for some reason an individual entrepreneur no longer wants to run his own business, he can close it. To do this, you will have to pay off all debts, fire employees and complete the necessary documents.

- By decision of the government authority:

- Tax Service - tax authorities do not yet have such powers, however, as of September 1, 2020, changes to the legislation come into force. The Federal Law “On Amendments...” dated November 12, 2019 No. 377-FZ will supplement the Law “On State Registration...” dated August 8, 2001 No. 129-FZ with Article 22.4, which gives the Federal Tax Service the right to exclude an entrepreneur from the Unified State Register of Individual Entrepreneurs if he does not submit reporting period for 15 months or more and at the same time has an outstanding tax debt.

- Court - an appropriate decision is made, for example, if an individual entrepreneur cannot pay off his debts on his own, and therefore the court declares him bankrupt.

Is it possible to close an individual entrepreneur in another city or region?

It is permitted to liquidate an activity while in another city or another region. To do this, you can use the help of a person with a power of attorney, sending documentation by mail or a government services website (tax service).

The procedure for liquidating an activity itself is prescribed by Article 22.4 of Federal Law No. 128-FZ and obliges the implementation of the following instructions:

- pay off all debts and taxes;

- dismiss and pay off all employees (if any);

- pay insurance premiums for yourself;

- close all reporting periods, including partial quarters;

- deregistration from the bailiff service and the Pension Fund;

- cancellation of the entrepreneur's bank account;

- deregistration of a cash register, if any;

- payment of state duty.

- Submitting a form for liquidation of an individual entrepreneur to the tax service.

For your information! Closing an individual entrepreneur remotely will not be difficult. The main thing is to collect the entire package of documents and have it certified by a notary (except for the state duty check).

In order not to be denied liquidation, you need to check several times whether everything is collected correctly. Before closing, it is imperative to fulfill all the requirements prescribed by law.

*Prices are as of July 2022.

How to prepare for the closure of a sole proprietorship

To close an individual entrepreneur, you need to put things and documents in order - the tax office will exclude the enterprise from the Unified State Register of Individual Entrepreneurs only if it has no outstanding debts. Before contacting the Federal Tax Service you need:

- Make a decision to terminate activities as an individual entrepreneur. It is not necessary to document it - the law does not contain any instructions in this regard.

- Within a month from the date of the decision to abolish the individual entrepreneur, transfer information about the employees of the enterprise to the territorial office of the Pension Fund (you will have to fill out forms SZV-M, SZV-STAZH and SZV-TD).

- Notify the employment service about the upcoming dismissal of employees due to liquidation (at least two weeks before dismissal - clause 2 of article 25 of the law “On Employment...” of April 19, 1991 No. 1032-1) and warn the employees themselves about this ( no less than two months before dismissal - Part 2 of Article 180 of the Labor Code of the Russian Federation).

- Calculate the amount of insurance premiums for employees and pay off underpayments (if any). The calculation and form 6-NDFL are submitted to the tax office.

- Send an application for deregistration to the territorial office of the Social Insurance Fund, as well as copies of orders for the dismissal of employees (subparagraph 3, paragraph 3, article 6 of the federal law “On Mandatory...” dated July 24, 1998 No. 125-FZ). In addition, you will need to fill out form 4-FSS.

- Close your bank account.

- To deregister an online cash register (if you registered it) - to do this, you need to submit a corresponding application to the tax office.

- Pay contributions to the Pension Fund and Social Insurance Fund for yourself, submit tax returns and other reports, pay taxes.

- Prepare a package of documents necessary to close an individual entrepreneur and submit them to the Federal Tax Service.

All of the above actions need to be performed only if you have employees. If there are no employees, you skip steps aimed at interacting with funds.

ConsultantPlus has many ready-made solutions, including the article “Beware, the individual entrepreneur is closing.” If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

How to close an individual entrepreneur if you have debts

After the termination of the activities of an individual entrepreneur, its creditors can collect debts:

- through the court and the FSSP,

- by selling debt to collectors,

- through bankruptcy of the debtor.

Be careful with employee debts. For violation of the terms of payment of earnings, the individual employer may be brought to administrative or criminal liability.

How to close an individual entrepreneur with tax debts

Tax debt does not prevent the voluntary liquidation of an individual entrepreneur.

But after exclusion from the Unified State Register of Individual Entrepreneurs, the former entrepreneur may be sued. For the entire period, penalties will be accrued according to the Tax Code of the Russian Federation. Additional penalties are imposed for failure to submit reports, understatement of the tax base, and other violations.

As a creditor, the tax authority can file for bankruptcy or enter into an already opened case.

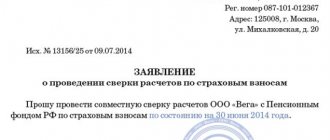

With debts to extra-budgetary funds (PFR, Social Insurance Fund)

Debts to the Pension Fund or the Social Insurance Fund will also not entail refusal to liquidate the business. Since the tax department has been administering insurance premiums since 2016, demands and lawsuits for debt collection will be filed by the Federal Tax Service.

If you comply with the law on submitting reports to the Pension Fund, there will be no problems with the voluntary closure of an individual entrepreneur.

Loan debts

Loan debt can be collected both before and after the termination of the individual entrepreneur’s activities. When applying to the Federal Tax Service, they will not check credit debts, so a refusal will not be issued on such grounds.

Debts to employees

Payments to employees before dismissal are the responsibility of the entrepreneur. If you officially dismiss employees, you must notify the staff about the upcoming dismissal due to liquidation within the period specified in the employment contract. For individual entrepreneurs this is usually 2 weeks.

An individual entrepreneur is not required to warn employees 2 months in advance about layoffs and pay severance pay.

Pay attention to the memo for employers on the state portal onlineinspektsiya.rf.

An important point is late wages, vacation pay, and severance pay.

Unlike other debts of an entrepreneur (to the budget, banks, suppliers, etc.), salary arrears are not written off in bankruptcy

.

Therefore, if you see that the amount of unpaid loans is already greater than your assets, and even if you sell personal property, equipment, or a car, you will not be able to pay off, you need to pay off debts to employees as a priority.

How to behave as an entrepreneur with salary debts before bankruptcy, you can ask our lawyers for free.

What documents will be needed

To close an individual entrepreneur, you will need the following documents:

- Application for registration of termination of activities as an individual entrepreneur, drawn up in form P26001. We will tell you how to fill it out below.

- A document confirming payment of the state duty (it only needs to be paid if you submit documents directly to the tax office on paper).

- A certificate from the Pension Fund stating that you have provided them with information about the insured persons (needed only if you have employees). You don’t have to submit the certificate - in this case, the tax authorities will make a request to the Pension Fund on their own.

Fire employees if you have them.

This must be done by law - notify employees in advance, at least two weeks in advance, unless otherwise provided by the employment contract. According to the law, when liquidating an individual entrepreneur, employees do not need to pay severance pay; this is stipulated in Part 2 of Art. 307 Labor Code of the Russian Federation. Exception: compensation specified in the contract.

Everyone will have to be fired, including pregnant women, disabled citizens and those on vacation. Be sure to do this in writing.

Additionally, you need to send a notification to the Employment Center at your place of registration.

Insurance premiums and 4-FSS contributions must be paid within 15 days from the date of submission of the calculation.

If there are no employees, we skip this step. You can immediately proceed to removing cash register equipment (CCT) from registration and collecting the necessary documents.

Filling out an application on form P26001

The application form for liquidation of individual entrepreneur R26001 is unified - it is fixed by order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14 / [email protected] The new form is valid from November 25, 2020. It can be filled out on a computer or by hand - in black ink, legibly and without corrections. The application indicates the applicant's phone number and email address - the result of the application to the tax office will be sent to it. Section 3 of the form does not need to be filled out - tax officials will do this when they receive the document.

You can see and download the form and sample of such an application in our material.

Close your current account

Until you close your individual entrepreneur, the bank will not cancel your account, no matter how hard you try. Therefore, wait 6 or 11 days, after which contact the bank where the current account is opened. Usually it is enough to write an application in free form and submit it in a convenient way - in person at a bank branch, by email or via online chat. It is better to transfer money to your personal account before closing.

If you have cards linked to your current account, hand them over to the bank and pay for the service.

The term for closing a current account is up to seven days. There is no need to notify the Federal Tax Service, Pension Fund and other government organizations. The bank will automatically send them information about account closure.

Read about how to close your individual entrepreneur debts here.

Payment of state duty

In accordance with sub. 7 clause 1 art. 333.33 of the Tax Code of the Russian Federation, the amount of the state duty that must be paid when closing an individual entrepreneur is 160 rubles (20 percent of the amount of the fee charged when registering an individual entrepreneur; its amount is 800 rubles). You can save money by submitting documents not on paper, but via the Internet - in this case you will not have to pay (subclause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation).

The payment document must be attached to the application in form P26001 - the tax office will accept (clause 3 of Article 333.18 of the Tax Code of the Russian Federation):

- payment order with a mark of execution, if paid by non-cash method;

- bank receipt if paid in cash.

A receipt for payment can be generated on the Federal Tax Service website - to do this, use the “Payment of state duty” service.

Calculate mandatory contributions

One of the unpleasant moments for any person. The individual entrepreneur is required to pay fixed contributions for the actual days of work. Let's say you closed on October 15th. You need to pay for nine full months and 15 days.

We count:

- Pension contributions: (32,448 / 12) x 9. It turns out 24,336 rubles. Now let’s calculate the tax amount for 15 days: (32,448 / 12) x (15 / 31) = 2,704 rubles. x 0.48 = 1,298 rub. As a result, you need to pay insurance premiums: 24,336 + 1,298 = 25,634 rubles.

- Contributions for compulsory medical insurance: (8,426 / 12) x 9 = 6,318 rubles. for a full nine months. Now let’s calculate how much you need to pay for 15 days: 702 × 0.48 = 337 rubles. Total amount: 6,655 rub.

If your income for 2022 is more than 300 thousand rubles, you must pay an additional 1% on the excess amount. For example, you developed 850,000 rubles. This means that from the amount of 550 thousand rubles. you will have to pay a tax of 55 thousand rubles.

It is important to pay fixed fees within 15 calendar days from the date of closure of the individual entrepreneur.

Methods for submitting documents

Documents are submitted to the tax office at the place of residence. You can find the inspectorate that services your address on the Federal Tax Service website. You can transfer documents in different ways:

- By visiting the tax office in person or by submitting documents through a representative (in this case, you will need to issue a power of attorney in the name of the representative and have the entrepreneur’s signature on the application certified by a notary).

- Through the MFC - also in person or through a representative.

- Through a notary. He can certify the application with his electronic signature and submit it for consideration via the Internet (paragraph 3, paragraph 1, article 9 of Federal Law No. 129). The service is paid - it is better to check the cost with the notary himself in advance.

- By mail. The documents must be sent by a valuable letter with a list of the contents and a notification of delivery to the addressee.

- Through a special service on the Federal Tax Service portal. To close an individual entrepreneur through the taxpayer’s personal account, an electronic signature will be required. You can use an account from the State Services portal.

- Through the portal "State Services". This is another way to close an individual entrepreneur online - go to the portal and fill out the registration form.

How to Apply Online

This can be done in different ways:

Government services website

How to find out whether an individual entrepreneur is closed at the tax office and via the Internet

After collecting all the documents and their certification, there is little left.

For your information! You must fill out an electronic application on the government services website.

Below are step-by-step instructions for filling out the application:

- First, you need to choose a method for sending your application. It all depends on the personal wishes of the ex-businessman, as well as on whether he has an electronic signature. By the way, with its help you can liquidate an individual entrepreneur on the government services website for free. If there is no signature, then you need to pay a tax of 160 rubles. Once you have chosen the submission method, you need to fill out all the information.

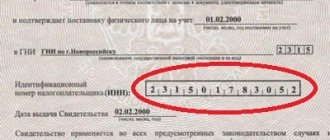

- Next, indicate your personal email and OGRNIP number located in the State Register. To find out the OGRNIP, you need to go to the official website of the tax service and find out the TIN number.

- Enter the mobile number and select the notification method: in person, through a person with a power of attorney or by mail. Most people choose to visit the tax office in person. If it is not possible to visit the service yourself to pick up the liquidation certificate, then you can receive it by mail. After entering the information, the site will check it, if everything is in order, then you can continue filling it out.

- On the next page you need to study the preliminary application form and pay a state fee of 160 rubles. You cannot proceed to the next steps until the tax is paid. Next, fill out the form and submit the application.

Individual entrepreneur closure forms

There is another way to close an individual entrepreneur - on the website of the tax inspectorate, it can be found at nalog.ru. It is important that the entrepreneur is registered as a taxpayer there. An electronic digital signature can be obtained on the tax service website. The actions are almost no different from the liquidation method on the government services portal. You will also need an application and a package of documents with signatures.

For your information! Using the same method, you can close an individual entrepreneur through the MFC.

Sending documents by mail

If a person is unable to visit the tax office in person or experiences difficulties with this, then documents on the liquidation of an individual entrepreneur can always be sent by mail.

When sending, you need to remember the most important rules:

- the signature on the form must be certified by a notary office (clause 1.2 of Article 8 of Federal Law No. 128-FZ);

- the documentation is sent by a valuable letter with an inventory of the attachment (clause 1, article 8 of Federal Law No. 128-FZ);

- the date for submitting documentation is the day when the letter is received by the tax service (clause 2 of article 8 of Federal Law No. 128-FZ), therefore the 5-day period will be counted from this time;

- a receipt for receipt of documentation is also sent by mail to the name indicated in the application within 24 hours from the moment the documents are received by the tax service.

If the receipt has not arrived by mail, then you can apply for an extract from the register on the liquidation of the entrepreneur’s activities on the seventh working day from the moment the tax service received the documents by mail.

Do I need to visit foundations?

If the entrepreneur had employees, after the closure of the individual entrepreneur he will have to notify all the funds to which he made contributions.

Thus, information about employees who worked for the individual entrepreneur must be transferred to the Pension Fund within a month from the date of the decision to close (paragraph 5, paragraph 2, article 9 of the federal law “On Individual..." dated 04/01/1996 No. 27-FZ ). If this is not done, it will not be possible to close the individual entrepreneur through the tax office - the tax authorities will reject the application for liquidation (see, for example, the resolution of the Federal Antimonopoly Service of the Central District dated November 26, 2012 in case No. A14-745/2012).

After the dismissal of the last employee and registration of the fact of closure of the individual entrepreneur, an application for deregistration with the Social Insurance Fund is submitted to the tax office. Copies of the order(s) on termination of employment contracts with employees must be attached to it. Within 14 days from the date of receipt of the documents, the FSS will deregister the former entrepreneur (subclause 3, clause 3, article 6 of Federal Law No. 125).

Business Closing Process

The procedure is as follows:

- Dismiss and pay off all employees. They must be notified in writing about this 2 months in advance. The basis for dismissal is paragraph 1 of Article 81 of the Labor Code of the Russian Federation - termination of the activities of an individual entrepreneur. In addition, you must notify the employment center 14 days before dismissal. A sample application is posted on the official website of the department. How to close an individual entrepreneur without employees? In this case, we immediately move on to the second point.

- Deregister the cash register. To do this, you need to submit a tax application using the KND form 1110062. Attach a report on the closure of the fiscal accumulator to it. It takes about 10 days to review documents.

- Close the entrepreneur's current account. Each bank has a slightly different service. For example, in Sberbank you just need to download an application on the website and send it through online banking. The decision will come to your phone in 5 days.

- Submit documents to the tax office. There are many ways to apply: in person, through a representative by proxy, by mail, electronically, with the help of a notary. But more on that below.

- Pay your dues. This must be done no later than 15 calendar days from the date of entering information about the closure of the individual entrepreneur into the register. Contributions are calculated separately for compulsory medical insurance and compulsory medical insurance based on days worked per year. In addition, contributions are paid in the amount of 1% of profits that exceed 300 thousand rubles.

- Submit reports and pay accrued taxes. It all depends on the tax regime. If you worked on a simplified basis, declarations are submitted no later than the 25th day of the next month after the closure of the individual entrepreneur. For example, if they closed in May, you need to file a declaration and pay taxes by June 25th.

Prepare an application to close an individual entrepreneur online

Use the convenient service to prepare an application for closing an individual entrepreneur online. No mistakes.

Prepare an application

The law does not prohibit re-registering an individual entrepreneur after closure. For example, an entrepreneur decided to suspend operations during the epidemic in order to save on insurance premiums. Whether it is necessary to close individual entrepreneurs now, when state business support programs are in place, everyone decides for themselves.

note

Law No. 377-FZ came into force. Now an individual entrepreneur can be closed by decision of the tax service if two conditions are simultaneously met: the entrepreneur has not submitted reports for more than a year and a half and does not pay taxes.

Results

So, in order to close an individual entrepreneur, you need to put the documents in order and fire the employees (if any).

After this, you can contact the tax office - in person or online. An application to close an individual entrepreneur is considered within five days. If an entrepreneur has no outstanding debts, information about the enterprise will be excluded from the Unified State Register of Individual Entrepreneurs. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Providing liquidation reporting and closing a current account

Individual entrepreneurs using the general taxation system must submit a 3-NDFL declaration to the Federal Tax Service within five days after the closure of the individual entrepreneur.

The VAT return must be submitted no later than the 25th day of the month following the quarter in which the individual entrepreneur was liquidated. The declaration under the simplified tax system is submitted no later than the 25th day of the month following the month of deregistration. The UTII declaration is submitted no later than the 20th day of the first month following the month of closure of the individual entrepreneur. Pay insurance premiums within 15 days after the closure of the individual enterprise.

The amount of mandatory contributions to the budget in the absence of employees is calculated based on the number of months worked. The calculation of 1% in case of income exceeding 300 thousand rubles is carried out as usual.

After repaying all the debt, the entrepreneur must visit his bank branch and close the current account.