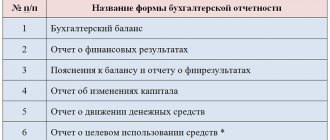

The composition of financial statements is determined by clause 5 of PBU 4/99, and the specific list of forms, deadlines and addresses for submission depend on the duration of the periods covered by the statements.

Interim financial statements consist of a balance sheet and a profit and loss account; annual financial include:

- balance sheet (form No. 1);

- profit and loss statement (form No. 2);

- statement of changes in capital (form No. 3);

- cash flow statement (form No. 4);

- Appendix to the balance sheet (form No. 5);

- explanatory note;

- auditor's report (for organizations subject to mandatory audit).

Small businesses that are not required to conduct an independent audit of the accuracy of their financial statements, in accordance with the legislation of the Russian Federation, have the right not to submit forms No. 3, 4, 5 and an explanatory note as part of the annual financial statements.

Small businesses required to conduct an audit of financial statements, in the absence of relevant data, have the right not to provide Form No. 3, Form No. 4, Form No. 5 as part of the annual financial statements.

Non-profit organizations do not provide a “Report on Changes in Capital” (form No. 3), “Statement of Cash Flows” (format 4), or Appendixes to the Balance Sheet (form No. 5) as part of their annual financial statements. But they are recommended to include in their financial statements a “Report on the intended use of funds received” (Form No. 6).

Public organizations that are not engaged in entrepreneurial activities do not provide forms No. 3,4,5 and an explanatory note as part of their annual financial statements.

If an organization has subsidiaries and dependent companies, then it is obliged, in addition to its own financial statements, to prepare consolidated financial statements that include indicators of the reports of such companies located both on the territory of the Russian Federation and abroad.

Approval procedure

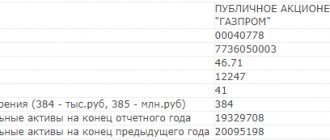

Before reporting can be presented to interested users, it must be approved. So, in accordance with the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies,” the annual reporting of a joint-stock company is approved by the general meeting of shareholders, and of limited liability companies by the general meeting of participants (Federal Law of February 8, 1998 No. 14 - Federal Law “On Limited Liability Companies”).

The annual general meeting of shareholders is held within the time limits established by the company's charter, but no earlier than two months and no later than six months after the end of the company's financial year.

Income tax reporting

No later than March 28, 20221, you must submit an income tax return for 2022 using a new form (Order of the Federal Tax Service of Russia dated September 11, 2020 N ED-7-3 / [email protected] “On amendments to the annexes to the order of the Federal Tax Service dated 09/23/2019 N ММВ-7-3/ [email protected] (hereinafter referred to as Order N 655).

Separate subsections, sheets and appendices need to be included in the annual declaration only if there is information that should be reflected in them (clause 1.1 of the Procedure for filling out the income tax return).

Changes in income tax reporting are relevant, in particular, for organizations paying dividends to individuals.

According to Order No. 655 in para. 6 clause 1.16 of the Procedure for filling out the income tax return, the words “individuals - shareholders and (or)” are excluded and clause 1.17 of the Procedure is declared invalid. Thus, if an organization pays dividends only to individual participants, it does not have the obligation to submit Sheet 03 as part of the income tax return for 2022 (Letter of the Federal Tax Service of Russia for Moscow dated December 17, 2020 N 24-23/4 / [email protected] ). The annual declaration does not include subsection 1.2 of section. 1 (clause 1.1, 4.8 of the Procedure for filling out the income tax return). For reporting periods, this section is completed by taxpayers who pay monthly and quarterly advance payments. With regard to advance payments for income tax, the specifics of 2022 should be taken into account. Federal Law No. 121-FZ dated April 22, 2020 amended the procedure for paying advance payments in 2022. The income limit, under which it was possible to pay only quarterly advances on income tax, was increased from 15 million rubles. up to 25 million rubles (clause 2 of article 2 of the Federal Law of April 22, 2020 N 121-FZ).

From January 1, 2022, the limit for paying only quarterly advance payments for income tax is again 15 million rubles. on average for the quarter. Therefore, if this limit is exceeded in 2021, monthly advances within the quarter must be additionally calculated and paid.

There is no need to notify the tax office about this (Letter of the Ministry of Finance of Russia dated 03/06/2020 N 03-03-07/16839). This means that taxpayers whose sales income exceeded an average of 15 million rubles in the first, second, third, and fourth quarters of 2022. for each quarter, switch to paying monthly advance payments from the 1st quarter of 2022 (Letter of the Federal Tax Service of Russia dated May 13, 2020 N SD-4-3 / [email protected] ).

The procedure for paying advance payments may change for IT organizations. This is due to the possibility for some companies to apply a reduced income tax rate from January 1, 2022 (3% to the federal budget and 0% to the regional budget). The Ministry of Finance explained that the Tax Code of the Russian Federation does not provide for the specifics of the calculation of advance payments for income tax by such taxpayers. The amount of payment in the first quarter of 2022 is equal to the amount of the monthly payment in the fourth quarter of the previous year. In 2022, when calculating advance payments, the reduced rate was not used and the amount payable for January-March 2022 may be greater than accrued based on the results of the first quarter of 2022.

The resulting overpayment should be offset or returned in the future (Letter of the Ministry of Finance of Russia dated November 17, 2020 N 03-03-06/1/99926).

Order of presentation

According to paragraph 5 of Art. 15 of the Law on Accounting, financial statements can be submitted by an organization directly or through its representative; sent by post with a description of the attachment or transmitted electronically. The procedure for submitting tax and accounting reports in electronic form via telecommunication channels is determined by Order of the Ministry of Taxes of Russia dated April 2, 2002 No. BG-3-32/169, Order of the Ministry of Taxes of the Russian Federation dated December 10, 2002 No. BG-3-32/ [email protected] “On the organization and functioning of the system for submitting tax returns and financial statements in electronic form via telecommunication channels” (as amended on August 8, 2003).

The day of sending the reporting is considered to be the date of sending the postal item or the date of its sending via telecommunication channels or the date of actual presentation of the reporting.

The annual financial statements of organizations are open to interested users, who can familiarize themselves with them and receive copies of them with reimbursement for the costs of copying.

You must provide the tax office with:

- financial statements

- tax reporting

Financial statements

- Composition of financial statements

- Addresses and deadlines for submitting financial statements

- Tax reporting

- Tax return for value added tax

Income tax return

- Property tax return

- Land tax declaration

- Other declarations

- In addition, the organization must provide reporting to extra-budgetary funds and reporting to the Statistics Department

- Calculation of the cost of one-time submission of quarterly reporting of an enterprise

Responsibility for violations of tax legislation of the Russian Federation and accounting legislation

Composition of financial statements

All organizations are required to prepare financial statements based on synthetic and analytical accounting data.

The accounting statements of organizations, with the exception of the statements of budgetary organizations, as well as public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and do not have turnover in the sale of goods (works, services) other than disposed of property, consists of:

- balance sheet;

- profit and loss statement;

- appendices to them, provided for by regulations;

- an auditor's report confirming the reliability of the organization's financial statements, if they are subject to mandatory audit in accordance with federal laws;

- explanatory note.

The composition of the financial statements of budgetary organizations is determined by the Ministry of Finance of the Russian Federation.

The forms of financial statements of organizations, as well as instructions on the procedure for filling them out, are approved by the Ministry of Finance of the Russian Federation.

Other bodies that regulate accounting approve, within their competence, the forms of financial statements of banks, insurance and other organizations and instructions on the procedure for filling them out, which do not contradict the regulations of the Ministry of Finance of the Russian Federation.

The explanatory note to the annual financial statements must contain essential information about the organization, its financial position, comparability of data for the reporting and preceding years, valuation methods and significant items of the financial statements.

The explanatory note must report facts of non-application of accounting rules in cases where they do not allow a reliable reflection of the property status and financial results of the organization, with appropriate justification. Otherwise, non-application of accounting rules is considered as evasion of their implementation and is recognized as a violation of the legislation of the Russian Federation on accounting.

In the explanatory note to the financial statements, the organization announces changes in its accounting policies for the next reporting year.

Accounting statements are signed by the head and chief accountant (accountant) of the organization.

Financial statements are prepared, stored and presented to users of financial statements in the prescribed form on paper. If technical capabilities are available and with the consent of users of financial statements, an organization may present financial statements in electronic form in accordance with the legislation of the Russian Federation.

The reporting year for all organizations is the calendar year - from January 1 to December 31 inclusive.

The first reporting year for newly created organizations is considered to be the period from the date of their state registration to December 31 of the corresponding year, and for organizations created after October 1 - to December 31 of the following year.

Data on business transactions carried out before the state registration of organizations is included in their financial statements for the first reporting year.

Monthly and quarterly reporting is interim and is compiled on an accrual basis from the beginning of the reporting year.

Addresses and deadlines for submitting financial statements

All organizations, with the exception of budgetary ones, submit annual financial statements in accordance with the constituent documents to the founders, participants of the organization or owners of its property, as well as to the territorial bodies of state statistics at the place of their registration. State and municipal unitary enterprises submit financial statements to bodies authorized to manage state property.

Financial statements are presented to other executive authorities, banks and other users in accordance with the legislation of the Russian Federation.

Organizations, with the exception of budgetary and public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services), are required to submit quarterly financial statements within 30 days after the end of the quarter, and annual - within 90 days after the end of the year, unless otherwise provided by the legislation of the Russian Federation.

The submitted annual financial statements must be approved in the manner established by the constituent documents of the organization.

Budgetary organizations submit monthly, quarterly and annual financial statements to a higher authority within the deadlines established by it.

Public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services), submit financial statements only once a year based on the results of the reporting year in a simplified format:

- balance sheet (form approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 N 66n);

- profit and loss statement (form approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 N 66n);

- report on the intended use of funds received (form approved by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 N 66n);

Accounting statements can be presented to the user by the organization directly or transmitted through its representative, sent in the form of a postal item with a list of attachments, or transmitted via telecommunication channels.

The user of the financial statements does not have the right to refuse to accept the financial statements and is obliged, at the request of the organization, to put a mark on the copy of the financial statements about the acceptance and the date of its submission. When receiving financial statements via telecommunication channels, the user of the financial statements is obliged to transfer the acceptance receipt to the organization in electronic form.

The date of submission of financial statements by an organization is considered to be the date of sending a postal item with an inventory of the attachment or the date of its sending via telecommunication channels or the date of actual transmission according to ownership.

Tax return for value added tax

Tax reporting includes tax and fee declarations submitted at various times, as well as information letters. In some cases, if in the reporting period there is no tax base for any tax, then the declaration for this tax may be included in the list of reporting forms that are not submitted to the tax authority.

Tax return for value added tax.

The tax period (including for taxpayers acting as tax agents) is established as a quarter. (Article 163 of the Tax Code of the Russian Federation).

The VAT Declaration form was approved by Order of the Ministry of Finance of the Russian Federation dated October 15, 2009 N 104n (as amended on April 21, 2010 N 36n).

Taxpayers submit a tax return no later than the 20th day of the month following the expired quarter.

When importing goods into the customs territory of the Russian Federation, the amount of tax payable to the budget is paid in accordance with customs legislation.

The amount of tax payable to the budget for sales transactions (transfer, execution, provision for one’s own needs) of goods (work, services) on the territory of the Russian Federation is paid at the place of registration of the taxpayer with the tax authorities.

Tax agents (organizations and individual entrepreneurs) pay the tax amount at their location.

In cases of implementation of works (services), the place of implementation of which is the territory of the Russian Federation, by taxpayers - foreign persons who are not registered with the tax authorities as taxpayers, tax payment is made by tax agents simultaneously with the payment (transfer) of funds to such taxpayers.

A bank servicing a tax agent does not have the right to accept an order from him to transfer funds in favor of specified taxpayers, if the tax agent has not also submitted to the bank an order to pay tax from an account opened with this bank if there are sufficient funds to pay the entire amount of tax.

Income tax return

Taxpayers, regardless of whether they have an obligation to pay tax and (or) advance payments of tax, the specifics of calculation and payment of tax, are required to submit appropriate tax returns at the end of each reporting and tax period to the tax authorities at their location and the location of each separate division.

The declaration form was approved by Order of the Ministry of Finance of the Russian Federation dated December 15, 2010 N ММВ-7-3/ [email protected]

Tax agents are required, at the end of each reporting (tax) period in which they made payments to the taxpayer, to submit tax calculations to the tax authorities at their location.

Taxpayers submit simplified tax returns at the end of the reporting period. Non-profit organizations that do not have obligations to pay tax submit a tax return in a simplified form at the end of the tax period.

Taxpayers (tax agents) submit tax returns (tax calculations) no later than 28 days from the end of the relevant reporting period. Taxpayers who calculate the amounts of monthly advance payments based on the profits actually received submit tax returns within the deadlines established for the payment of advance payments.

Tax returns (tax calculations) based on the results of the tax period are submitted by taxpayers (tax agents) no later than March 28 of the year following the expired tax period.

An organization, which includes separate divisions, at the end of each reporting and tax period submits to the tax authorities at its location a tax return for the organization as a whole, with distribution among separate divisions.

Property tax return

Taxpayers are required, at the end of each reporting and tax period, to submit tax calculations to the tax authorities at their location, at the location of each of their separate divisions that have a separate balance sheet, as well as at the location of each piece of real estate (for which a separate procedure for calculating and paying tax is established). on advance tax payments and tax return.

The tax return form was approved by Order of the Ministry of Taxes and Taxes of the Russian Federation dated February 20, 2008 No. 27n.

In relation to property located in the territorial sea of the Russian Federation, on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and (or) outside the territory of the Russian Federation (for Russian organizations), tax calculations for advance payments of tax and a tax return for tax are submitted to the tax authority at the location of the Russian organization (the place of registration with the tax authorities of the permanent representative office of the foreign organization).

Taxpayers submit tax calculations for advance tax payments no later than 30 days from the end of the relevant reporting period.

Tax returns based on the results of the tax period are submitted by taxpayers no later than March 30 of the year following the expired tax period.

Land tax declaration

Taxpayers - organizations or individuals who are individual entrepreneurs, upon expiration of the tax period, submit a tax return on the tax to the tax authority at the location of the land plot.

The tax return form was approved by Order of the Ministry of Finance of the Russian Federation dated September 16, 2008 N 95n

The tax return form is approved by the Ministry of Finance of the Russian Federation.

Tax returns are submitted by taxpayers no later than February 1 of the year following the expired tax period.

Taxpayers - organizations or individuals who are individual entrepreneurs - make advance tax payments during the tax period.

The tax and advance payments of the tax are subject to payment by taxpayers in the manner and within the time limits established by the regulatory legal acts of the representative bodies of municipalities (laws of the federal cities of Moscow and St. Petersburg).

Responsibility for violations of tax legislation of the Russian Federation and accounting legislation

Heads of organizations and other persons responsible for organizing and maintaining accounting records, in case of evasion from maintaining accounting records in the manner established by the legislation of the Russian Federation and regulations of the bodies regulating accounting, distortion of financial statements and failure to comply with the deadlines for their submission and publication, are subject to prosecution. administrative or criminal liability in accordance with the legislation of the Russian Federation.

Responsibility for committing administrative offenses in the field of taxes and fees (Chapter 15 of the Code of Administrative Offenses of the Russian Federation)

| Types of offenses | Subjects of responsibility | Amount of fine | Base |

| Violation by a taxpayer of the established deadline for filing an application for registration with a tax authority or a body of a state extra-budgetary fund | officials, with the exception of citizens carrying out entrepreneurial activities without forming a legal entity | from 500 to 1,000 rubles | Art. 15.3 Code of Administrative Offenses of the Russian Federation |

| The same offense associated with conducting activities without registering with a tax authority or a body of a state extra-budgetary fund | from 2,000 to 3,000 rubles | ||

| Violation of the established deadline for submitting information about opening or closing an account with a bank or other credit organization to the tax authority or the body of a state extra-budgetary fund | officials, with the exception of citizens carrying out entrepreneurial activities without forming a legal entity | from 1,000 to 2,000 rubles | Art. 15.4 Code of Administrative Offenses of the Russian Federation |

| Violation of the deadlines established by the legislation on taxes and fees for submitting a tax return to the tax authority at the place of registration | officials, with the exception of citizens carrying out entrepreneurial activities without forming a legal entity | from 300 to 500 rubles | Art. 15.5 Code of Administrative Offenses of the Russian Federation |

| Failure to submit, within the period established by the legislation on taxes and fees, or refusal to submit to the tax authorities, customs authorities and bodies of the state extra-budgetary fund documents and (or) other information necessary for the implementation of tax control, drawn up in accordance with the established procedure, as well as the submission of such information incompletely or in a distorted form, except for the cases provided for in Part 2, Art. 15.6 Code of Administrative Offenses of the Russian Federation | citizens | from 100 to 300 rubles | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

| Gross violation of the rules of accounting and presentation of financial statements, as well as the procedure and terms of storage of accounting documents | officials, with the exception of citizens carrying out entrepreneurial activities without forming a legal entity | from 2,000 to 3,000 rubles | Art. 15.11 Code of Administrative Offenses |

Responsibility for committing tax offenses (Chapter 16 of the Tax Code of the Russian Federation)

| Types of offenses | Subjects of responsibility | Amount of fine | Base |

| Violation by the taxpayer of the deadline established by the Tax Code of the Russian Federation for filing an application for registration with the tax authority for the period: | Organizations or individuals | 10,000 rubles | Art. 116 Tax Code of the Russian Federation |

| Conducting activities without registering with the tax authority on the grounds provided for by the Tax Code of the Russian Federation | Organizations or individual entrepreneurs | 10% of income received during the specified time as a result of such activity, but not less than 40 thousand rubles | |

| Violation by the taxpayer of the deadline established by the Tax Code of the Russian Federation for submitting information to the tax authority about opening or closing an account in any bank | Organizations or individuals | 5,000 rubles | Art. 118 Tax Code of the Russian Federation |

| Failure by the taxpayer to submit a tax return to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees | Organizations or individuals | 5 percent of the unpaid amount of tax subject to payment (surcharge) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles | Art. 119 Tax Code of the Russian Federation |

| Gross violation of the rules for accounting for income and (or) expenses and (or) taxable items, if these acts: | Organizations | Art. 120 Tax Code of the Russian Federation | |

| - committed during one tax period | 10,000 rubles | ||

| – committed during more than one tax period | 30,000 rubles | ||

| - resulted in an understatement of the tax base | 20% of the amount of unpaid tax, but not less than 40,000 rubles | ||

| Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other illegal actions (inaction), committed: | Organizations or individuals | Art. 122 Tax Code of the Russian Federation | |

| - by negligence | 20% of the unpaid tax (fee) amount | ||

| - intentionally | 40% of the unpaid tax (fee) amount | ||

| Unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) within the period established by the Tax Code of the Russian Federation of tax amounts subject to withholding and transfer by the tax agent | Organizations or individuals | 20% of the amount subject to withholding and (or) transfer | Art. 123 Tax Code of the Russian Federation |

| Failure to submit within the prescribed period by the taxpayer (payer of the fee, tax agent) to the tax authorities documents and (or) other information provided for by the Tax Code of the Russian Federation and other acts of legislation on taxes and fees | Organizations or individuals | 200 rubles for each document not submitted | Art. 126 Tax Code of the Russian Federation |

| Failure to provide the tax authority with information about the taxpayer, expressed in the refusal of the organization to provide the documents it has, provided for by the Tax Code of the Russian Federation, with information about the taxpayer at the request of the tax authority, as well as other evasion from providing such documents or providing documents with knowingly false information, if such an act is not contains signs of violation of the legislation on taxes and fees provided for in Art. 135.1 Tax Code of the Russian Federation | Organizations | 10,000 rubles |

Responsibility for committing crimes related to violation of the legislation on taxes and fees (Chapter 22 of the Criminal Code of the Russian Federation) (Only a sane individual who has reached the age established by the Criminal Code of the Russian Federation is subject to criminal liability)

| Corpus delicti | Type of punishment | Base |

| Evasion of taxes and (or) fees from an individual by failure to submit a tax return or other documents, the submission of which is mandatory in accordance with the legislation of the Russian Federation on taxes and fees, or by including knowingly false information in a tax return or such documents, committed: | Art. 198 of the Criminal Code of the Russian Federation | |

| - on a large scale | a fine in the amount of 100,000 to 300,000 rubles or in the amount of wages or other income of the convicted person for a period of 1 to 2 years, or arrest for a term of up to 6 months, or imprisonment for a term of up to 1 year | |

| - on a particularly large scale | a fine in the amount of 200,000 to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of 1 to 2 years, or imprisonment for a term of up to 3 years | |

| Evasion of taxes and (or) fees from organizations by failure to submit a tax return or other documents, the submission of which is mandatory in accordance with the legislation of the Russian Federation on taxes and fees, or by including knowingly false information in a tax return or such documents, committed: | Art. 199 of the Criminal Code of the Russian Federation | |

| - on a large scale | a fine in the amount of 100,000 to 300,000 rubles or in the amount of wages or other income of the convicted person for a period of 1 to 2 years, or arrest for a term of up to 6 months, or imprisonment for a term of up to 2 years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years or without it | |

| The same act committed: - by a group of persons by prior conspiracy - on an especially large scale | a fine in the amount of 200,000 to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of 1 to 3 years, or imprisonment for a term of up to 6 years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to 3 years or without it | |

| Failure to fulfill, in personal interests, the duties of a tax agent to calculate, withhold and transfer taxes and (or) fees that are subject to calculation, withholding from the taxpayer and transfer to the appropriate budget (non-budgetary fund) in accordance with the legislation of the Russian Federation on taxes and fees, committed: | Art. 199.1 of the Criminal Code of the Russian Federation | |

| - on a large scale | a fine from 100,000 to 300,000 rubles or in the amount of wages or other income of the convicted person for a period of 1 to 2 years, or arrest for a term of up to 6 months, or imprisonment for a term of up to 2 years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years or without it | |

| - on a particularly large scale | a fine from 200,000 to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of 2 to 5 years, or imprisonment for a term of up to 6 years with or without deprivation of the right to hold certain positions or engage in certain activities for a term of up to 3 years | |

| Concealment of funds or property of an organization or individual entrepreneur, at the expense of which, in the manner prescribed by the legislation of the Russian Federation on taxes and fees, the collection of arrears on taxes and (or) fees must be made by the owner or head of the organization or other person performing managerial functions in this organization, or an individual entrepreneur on a large scale | a fine in the amount of 200,000 to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of 18 months to 3 years, or imprisonment for a term of up to 5 years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to 3 years or without it | Art. 199.2 of the Criminal Code of the Russian Federation |

Reporting to the Statistics Department

Legal entities, their branches and representative offices, citizens engaged in entrepreneurial activities without forming a legal entity are required to submit to the State Statistics Committee of Russia, its territorial bodies and organizations under its jurisdiction, as well as other federal executive authorities responsible for the implementation of the federal statistical work program, their territorial bodies and subordinate organizations statistical information necessary for conducting state statistical observations, according to the forms of state statistical observation free of charge.

The main requirements for the presentation of statistical information necessary for conducting state statistical observations are completeness, reliability, and timeliness.

The composition and methodology for calculating indicators, the range of entities submitting statistical information, addresses, terms and methods of its presentation, which are indicated on the forms of state statistical observation and in the instructions for filling them out, are mandatory for all reporting entities.

Responsible for the presentation of statistical information necessary for conducting state statistical observations (compliance with the procedure for its presentation, as well as the presentation of reliable statistical information) is the head of the organization, its branch and representative office, as well as a person engaged in entrepreneurial activity without forming a legal entity.

Forms of state statistical observation are signed by the head of the organization, its branch and representative office (in his absence - by the person replacing him), a person engaged in entrepreneurial activity without forming a legal entity.

Statistical information on the forms of state statistical observation can be submitted by reporting entities directly or transmitted through their representatives, sent in the form of a postal item with a list of attachments, or transmitted via telecommunication channels.

Statistical information is compiled, stored and presented by reporting entities according to established forms of state statistical observation on paper. In electronic form, statistical information can be submitted by the reporting entity if it has the appropriate technical capabilities and in agreement with the territorial body (organization) of the State Statistics Committee of Russia.

Statistical information submitted to the State Statistics Committee of Russia, its territorial bodies and organizations under its jurisdiction in electronic form is necessarily confirmed by a copy on the form within a month from the date of transmission of statistical information. In this case, the following requirements must be ensured: the identity of statistical information provided by reporting entities in electronic form with paper media; compliance with the file structure established for reporting entities by a territorial body or an organization under the jurisdiction of the State Statistics Committee of Russia. If these requirements are not met, statistical information is considered not provided.

The date of submission of statistical information according to the forms of state statistical observation is the date of sending the postal item with an inventory of the contents or the date of its sending via telecommunication channels or the date of actual transmission according to ownership.

If the last day of the deadline for submitting statistical information by reporting entities according to state statistical observation forms falls on a non-working day, the end of the deadline for submitting reports by reporting entities is considered to be the next working day following it.

Territorial bodies and organizations under the jurisdiction of the Goskomstat of Russia are obliged, at the request of the reporting entity, to put a mark on the copy of the state statistical observation form they received on acceptance and the date of its submission, or when receiving statistical information via telecommunication channels, transfer the receipt of acceptance in electronic form to the reporting entity.

The presentation of unreliable statistical information is considered to be the incorrect reflection of reporting statistical data in state statistical observation forms due to violation of current instructions for filling out state statistical observation forms, arithmetic or logical errors.

Reporting entities that have admitted the facts of presenting unreliable statistical information, no later than three days after the discovery of these facts, submit corrected statistical information to territorial bodies and organizations under the jurisdiction of the State Statistics Committee of Russia and other bodies and organizations specified in the address part of the forms, with copies of documents containing justification for making corrections.

If the federal executive bodies responsible for the implementation of the federal statistical work program and their territorial bodies identify facts of violation of the procedure for submitting statistical information necessary for conducting state statistical observations, or the presentation of unreliable statistical information, they can, if necessary, submit to the State Statistics Committee of Russia and its territorial bodies proposals to bring violators to administrative responsibility.

When reorganizing or liquidating a legal entity, its branches or representative offices, terminating the activities of an individual entrepreneur, statistical information is provided to territorial bodies and organizations under the jurisdiction of the State Statistics Committee of Russia according to the forms of state statistical observation: annual - for the period of activity in the reporting year until the moment of liquidation (termination of activity) ; current (monthly, quarterly, semi-annual, etc.) - for the period of activity in the reporting period until the moment of liquidation (termination of activity).

Violation by an official responsible for the presentation of statistical information necessary for conducting state statistical observations of the procedure for its presentation, as well as the presentation of unreliable statistical information, shall entail the imposition of an administrative fine in accordance with Article 13.19 of the Code of the Russian Federation on Administrative Offenses shall entail the imposition of an administrative fine in the amount of three thousand to five thousand rubles.

Reporting to extra-budgetary funds

Payers of insurance premiums submit the following reports quarterly to the body monitoring the payment of insurance premiums at their place of registration:

no later than the 15th day of the calendar month following the reporting period, to the territorial body of the Social Insurance Fund - calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to the Social Insurance Fund of the Russian Federation, as well as on expenses for the payment of compulsory insurance coverage for the specified type of compulsory social insurance, made on account of the payment of these insurance contributions to the Social Insurance Fund of the Russian Federation, in the form approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field social insurance

no later than the 15th day of the second calendar month following the reporting period, to the territorial body of the Pension Fund of the Russian Federation - calculation of accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to compulsory medical insurance funds. The calculation form and the procedure for filling it out are approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field of social insurance. Together with the calculation of accrued and paid insurance premiums provided for in this paragraph, the payer provides information about each insured person working for him, established in accordance with Federal Law of April 1, 1996 N 27-FZ “On individual (personalized) accounting in the mandatory system pension insurance".

Responsibility for violations of the legislation of the Russian Federation on insurance premiums and liability for their commission

| Types of offenses | Subjects of responsibility | Amount of fine | Base |

| Failure by the payer of insurance premiums to submit calculations for accrued and paid insurance premiums to the body monitoring the payment of insurance premiums at the place of registration within the deadline established by this Federal Law: | Organizations, individual entrepreneurs, individuals (from the age of sixteen) | Art. 46 Federal Law N 212-FZ | |

| within less than 180 calendar days | 5 percent of the amount of insurance premiums subject to payment (surcharge) based on this calculation, for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 100 rubles | ||

| For more than 180 calendar days | 30 percent of the amount of insurance premiums payable based on this calculation, and 10 percent of the amount of insurance premiums payable based on this calculation, for each full or partial month starting from the 181st calendar day, but not less than 1,000 rubles | ||

| Non-payment or incomplete payment of insurance premiums as a result of understating the base for calculating insurance premiums, other incorrect calculation of insurance premiums or other unlawful actions (inaction) of insurance premium payers: | Organizations, individual entrepreneurs, individuals (from the age of sixteen) | Art. 47 Federal Law N 212-FZ | |

| - by negligence | 20% of unpaid insurance premiums | ||

| - intentionally | 40% of the unpaid amount of insurance premiums | ||

| Refusal or failure to submit to the body monitoring the payment of insurance premiums the documents necessary to monitor the payment of insurance premiums | Organizations, individual entrepreneurs, individuals (from the age of sixteen) | 50 rubles for each document not submitted | Art. 48 Federal Law N 212-FZ |

Share on social networks:

Publication of financial statements

In cases provided for by the legislation of the Russian Federation, organizations no later than June 1 of the year following the reporting year must publish their financial statements and the final part of the audit report. In accordance with the order of the Ministry of Finance of the Russian Federation dated November 28, 1996 No. 101, open joint-stock companies are required to publish:

- balance sheet;

- Profits and Losses Report.

One of two options can be adopted:

- fully. Must include the full text of the final part of the auditor's report;

- according to reduced requirements. Must contain the opinion of an independent audit firm on the reliability of the financial statements.

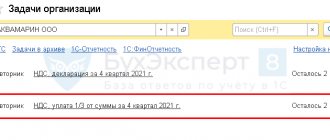

Preparation of quarterly accounting reports

Quarterly reporting is prepared according to rules similar to those for the annual report. It includes two mandatory forms - the balance sheet and the “Report on Financial Results” (approved by Order of the Ministry of Finance No. 66n dated July 2, 2010, as amended on April 19, 2019). Additionally, legal requirements, founders or accounting policies may provide for the preparation of a “Cash Flow Statement” and other forms, as well as explanations for reporting, in order to get a more complete picture of the company’s financial condition and the results of its operations.

The company can use the annual forms approved by the Ministry of Finance or draw up its own forms on their basis, recording them in its accounting policies.

Indicators in the quarterly balance sheet and reports are reflected on the corresponding reporting date - the last day of the quarter. In this case, you need to take into account some nuances - for example, the loss at the end of the reporting period is not written off to account 84, but remains on account 99 until the end of the year (there is no balance sheet reformation), there is no need to carry out an inventory before preparing reports, etc.