An excise tax is a federal indirect tax aimed at certain consumer goods, as well as certain goods transported across the border of the Russian Federation. For the calculation and payment of excise taxes, a tax declaration is submitted, which is a document (according to a single form approved in the Russian Federation), in which the taxpayer declares in written or electronic form about the objects of taxation, the base, benefits, calculated and paid tax amounts. For each tax, depending on its specifics, a separate declaration form has been developed and, depending on the specifics, the procedure for filling it out.

Let's consider the presentation of reports (declarations) on excise taxes.

Payers of indirect tax - excise tax

Art. 181. The Tax Code of the Russian Federation (part two) lists excisable goods.

Art. 179 of the Tax Code of the Russian Federation identifies excise tax payers:

- organizations

- IP

- persons recognized as taxpayers when moving certain goods across the border of the EAEU

The tax period for excise tax payment is 1 calendar month (until the 25th day of the month following the reporting month).

The declaration is submitted:

- personally

- by post

- via the Federal Tax Service website

| For individual entrepreneurs | Federal Tax Service at the place of registration |

| For legal entities and separate divisions | Federal Tax Service at location |

An increase in excise taxes on tobacco and tobacco products will allow an additional 628.2 billion rubles to be allocated to the federal budget in 2022.

Expert of the Legal Consulting Service GARANT E. Ladnova

Why report excise taxes?

Excise taxes were developed as a taxation tool. All producers of consumer goods are required to pay this internal indirect tax. The calculated excise tax is included in the final cost of the product. Excise goods include:

- alcohol;

- tobacco products;

- petrol;

- some imported goods.

Manufacturers are required not only to calculate and pay the excise tax, but also to report on the state of mutual settlements with the budget. Tax reporting on excise duties is submitted to the Federal Tax Inspectorate at the place of registration of the manufacturer. If excisable goods are produced and sold by an individual entrepreneur, he must submit the register to the Federal Tax Service at his place of residence.

The excise declaration is submitted monthly, but only in case of sale of manufactured products. The Tax Code of the Russian Federation explains whether it is necessary to submit an excise tax return if there is no tax base and turnover for the month - no, if the enterprise manufactured but did not sell an excise product, then there is no need to submit a report.

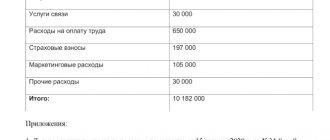

Example of calculating excise tax on beer

The organization sold the beer produced in July 2022 (ethyl alcohol content 6% by volume) in the amount of 100,000 cans of 0.5 liters.

Total volume of beer:

100000 * 0.5 = 50000 liters

The excise tax rate is:

In the second quarter of 2022, the excise tax rate for beer containing ethyl alcohol from 0.5% to 8.6% inclusive is 21 rubles. for 1 liter.

The amount of excise tax that must be paid to the budget:

50,000 * 21 = 1,050,000 rub.

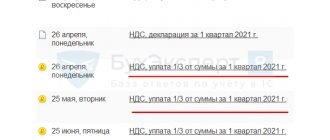

Deadlines for submitting the declaration

Tax return KND 1151090 is submitted to the Federal Tax Service no later than the 25th day of the month following the previous reporting period. For example, for June excise tax is paid and a declaration is submitted no later than July 25.

Legal entities and entrepreneurs producing and selling denatured alcohol submit a declaration no later than the 25th day of the third month following the reporting period. Information is regulated by clause 3.1 of Art. 204 Tax Code of the Russian Federation. For example, excise tax for June is paid until September 25 inclusive.

Example of calculating excise tax on cigarettes

The organization produced 10,000 boxes of filter cigarettes in July 2022. Each pack of cigarettes contains 20 pieces. The maximum retail price of a pack is 80 rubles.

The number of cigarettes in 10,000 boxes is:

10,000 * 50 blocks * 10 packs * 20 pieces = 100000000 cigarettes in 10000 boxes

In the second quarter of 2022, the rate for filter cigarettes was set at 1,718 rubles per 1,000 pieces + 14.5% of the estimated cost, calculated on the basis of the maximum retail price, but not less than 2,335 rubles per 1,000 pieces

The excise tax amount is:

1718 rub.* 100000000 pieces/1000 pieces = 171800000 rub.

100000000 * 80 rub. * 0.145 / 20 pieces in a pack = 58,000,000 rub.

Let's check whether the share of the estimated cost is less than 2335 rubles per 1000 pieces:

100000000 * 2335 / 1000 = 233500000 rub. the calculated amount is less than the minimum allowable, so we take this calculated amount. The amount of excise tax with a higher value is taken for payment. The excise tax will be:

171800000 + 233500000 = 405300000 rub.

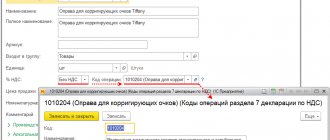

Procedure for filling out an excise tax declaration

Let's consider the procedure for drawing up a declaration on excise taxes on tobacco products, approved by Order of the Ministry of Finance of Russia dated November 14, 2006 N 146n.

In each section of the declaration form, the taxpayer's Taxpayer Identification Number and Taxpayer Identification Number are indicated on each page.

The declaration consists of the following main elements:

- cover page – general information about the taxpayer and acceptance by the responsible person

- section 1 – information on the amount of excise tax according to data calculated by the taxpayer

- section 2 – calculation of indirect tax on tobacco products in accordance with the current procedure

- section 3 – calculated tax on tobacco products, not confirmed by documents on exemption from excise taxes

- section 4 – reimbursement of the amount of excise duty on confirmed exports and for which a bank guarantee was presented

- appendices (1-6) to the declaration, which presents a direct calculation of the tax base for the domestic and foreign markets, their implementation

Important! A separate Appendix 1 must be filled out for each type of tobacco product (for example, for filtered cigarettes, non-filtered cigarettes, etc.)

Line-by-line detailing of the declaration on tobacco products

Filling out the lines of sections and appendices of the TD must comply with the approved procedure. The contents of the rows are indicated in the tables:

Section 1

| Line | Decoding |

| 010 | KBK of excise taxes on tobacco products (order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n) |

| 020 | OKTMO |

| 030 | The amount of excise tax payable is equal to the indicator in column 8 of page 220 of section 2 of the declaration |

| 040 | Enter dashes (this line was filled in under the now no longer valid procedure for paying the “tobacco” excise tax twice a month) |

| 050 | Filled out for the amount of excess of deductions over the accrued excise tax (excise tax for reimbursement from page 230 of section 2) |

Section 2

Subsection 2.1 (calculation of the tax base for cigarettes without a filter and cigarettes, cigarettes with a filter)

| Count | Decoding |

| 2 | Types of tobacco products and operations with them |

| 3 | Line codes from 010 to 100 |

| 4 | Tobacco product codes: 460 - for cigarettes without a filter and cigarettes, 450 - for cigarettes with a filter |

| 5 | Tax base in thousand units. accurate to 3 decimal places (transfer of information from appendices 2 and 3) - to apply a fixed excise tax rate |

| 6 | Tax base in rubles accurate to the 2nd decimal place (transfer of information from Appendices 2 and 3) - for applying an ad valorem tax rate |

| 7 | Tax rate in rubles to the tax base in kind |

| 8 | Tax rate as a percentage of the tax base in monetary terms |

| 9 | Calculated amount of excise tax in rubles accurate to the 2nd decimal place |

Subsection 2.2 (to reflect the tax base for tobacco, excluding tobacco used as raw material for the production of tobacco products, as well as for cigars and cigarillos)

| Count | Decoding |

| 2 | Types of tobacco products (tobacco, cigars and cigarillos) and operations performed with these products |

| 3 | Line codes 110–190 |

| 4 | Tobacco product codes: 411 - tobacco, 430 - cigars, 440 - cigarillos |

| 5 | Unit of measurement of the tax base (thousand pieces, kg, etc.) |

| 6 | The size of the tax base for each tobacco product in physical terms (up to the 3rd decimal place); the indicators of column 5, page 130 of Appendix 1 are transferred to pages 120, 150 and 180 of this column; pages 130, 160 and 190 are filled out if tobacco products are sold for export and a bank guarantee for them is not provided |

| 7 | Excise tax rate |

| 8 | The amount of excise tax (accurate to the 2nd decimal place) as a result of multiplying gr. 6 per gr. 7 |

Subsection 2.3 (calculation of excise tax payable to the budget)

| Line | Decoding |

| 200 | Accrued amount of excise tax for the reporting month |

| 210 | Amount of tax deductions |

| 220 | Filled in if line 200 > 210 (excise tax payable) |

| 230 | Filled in if line 200 < 210 (excise duty for reimbursement) |

Section 3 (when performing export transactions exempt from excise duty, if the right to exemption is not documented)

Unconfirmed exports are reflected in the TD during the period of actual shipment of tobacco products (this fact is reflected in the updated TD).

| Rows and graphs | Decoding |

| Column 2 | |

| pp. 020–160 | Types of tobacco products sold for export |

| pp. 080–120 | |

| Column 4 | Codes of types of tobacco products: 411 - tobacco, 430 - cigars, 440 - cigarillos, 450 - cigarettes with filter, 460 - cigarettes and cigarettes without filter |

| Box 5 | Tax base in kind or value terms |

| Box 6 | Excise tax rate in effect on the date of sale of tobacco products for export |

| Column 7 | Calculated amount of excise tax (gr. 5 × gr. 6) |

| page 010 | Amount of excise tax on tobacco products exported to the countries of the Customs Union (sum of lines 020, 030, 040, 050, 060, column 7) |

| p.070 | the amount of excise tax on tobacco products exported to countries outside the Customs Union (sum of lines 080, 090, 100, 110, 120, column 7) |

| p.130 | Total amount of excise tax (line 010 + line 070) |

Section 4 (when carrying out excise-exempt export of tobacco products)

| Line | Decoding |

| 010–100 | The amount of excise tax claimed for reimbursement for each type of tobacco product (with documentary confirmation of the fact of export) |

| 110 | Total amount of excise tax refundable |

| 120–210 | The amount of excise tax on tobacco products, the fact of export of which is documented |

| 220 | Total amount of excise tax on confirmed exports |

Appendices 1–6 to the TD are filled out in accordance with the approved procedure. An example of filling out the TD is in the next section.

Rules for filling out excise tax declarations

The declaration is submitted to the Federal Tax Service on the prescribed form for the corresponding tax period.

The declaration must also be submitted if the calculated amount of excise tax is 0 or the calculated value is negative.

Information is entered legibly in ink or using a computer. Each cell is intended for only one indicator; if they are absent, a dash is placed.

When correcting errors, you must follow the rules for correcting errors: the incorrect value is crossed out, the correct one is entered and signed by the persons who signed the declaration, putting the seal of the organization, as well as the date of correction.

If, upon filing, it is discovered that information or errors were not indicated or not fully reflected, the taxpayer is obliged to make corrections and submit an updated declaration to the Federal Tax Service.

Where to submit the declaration

The completed tax return is submitted to the local tax office within the established time frame. If the company has branches, then the document is submitted to the Federal Tax Service at the actual location of the company. Step-by-step instructions for submitting a report:

- .

- Fill out the excise duty declaration on ethyl alcohol.

- Take the declaration to the local Federal Tax Service.

Both the head of the enterprise and an authorized representative can report by presenting a power of attorney.

The second method of submission is electronic format. Step-by-step instructions for submitting an electronic report:

- Fill out the declaration in .xls format.

- Place an enhanced electronic digital signature (EDS).

- Send the document by email.

The third method is submission by Russian post:

- Print the form.

- Fill in the form.

- Apply signatures and seals.

- Send by registered mail.

Failure to submit an excise tax return

In accordance with Art. 15.5 Code of Administrative Offenses of the Russian Federation and Art. 119 Tax Code of the Russian Federation :

Failure to submit within the deadline established by the Federal Tax Service - imposition of a fine on the organization in the amount of 5% of the unpaid amount of tax based on the submitted declaration, for each month of failure to submit from the established day for submission, but not more than 30% of the amount noted in the declaration and not less than 1000 rubles ( Tax Code of the Russian Federation).

For officials - punishment in the form of a warning or the imposition of an administrative fine in the amount of 300 to 500 rubles (Administrative Offenses Code).

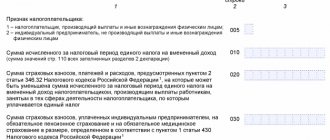

Section 1. The amount of excise tax on excisable goods subject to payment to the budget (reimbursement from the budget)

Section 1 is completed by all excise taxpayers.

Line 010 indicates OKTMO of the municipality in whose territory the excise tax is paid.

Line 020 indicates the budget classification code (BCC), according to which the amount of excise tax is credited. It is selected from the classifier according to the corresponding type of excisable goods.

Line 030 indicates the amount of excise tax payable to the budget according to the BCC indicated on line 020 . In this case, it must correspond to the amount of excise tax reflected in subsection 2.4 of section 2 under indicator code 40001 or the amount of excise tax reflected on line 110 in section 3 (according to the corresponding BCC).

Line 040 indicates the amount of excise tax accrued for reduction (if tax deductions exceed the calculated amount of excise tax). Moreover, it must correspond to the amount of excise tax reflected in subsection 2.4 of section 2 under indicator code 40002 .

Line 050 indicates the amount of excise tax accrued for reduction in accordance with Art. 203.1 of the Tax Code of the Russian Federation (in case tax deductions exceed the calculated amount of excise tax). Moreover, it must correspond to the amount of excise tax reflected in subsection 2.4 of section 2 under indicator code 40004 .

Line 050 is filled in with certain categories of taxpayers who are subject to a special procedure for the reimbursement of excise taxes established by Art. 203.1 Tax Code of the Russian Federation. Such taxpayers include persons who have certificates for processing straight-run gasoline, for transactions with benzene, paraxylene, etc.

Line 060 indicates the amount of excise tax claimed for reimbursement. Moreover, it must correspond to the amount of excise tax reflected in subsection 2.4 of section 2 under indicator code 40003 .

If for different types of excisable goods the amount of excise duty is subject to credit to the same BCC, then lines 030-060 indicate the final result of settlements with the budget for the corresponding BCC.

Error when applying for advance payment exemption

The advance payment must be made no later than the 18th of the reporting period.

If an organization applies for an exemption from paying an advance, then it is necessary:

- indicate the date of purchase

- calculate the payment (Article 194 of the Tax Code of the Russian Federation)

- notice is given

- bank guarantees are provided

To be exempt from advance payment of excise taxes, it is submitted to the Federal Tax Service at the place of registration, but no later than the 18th day of the current tax period, and 4 copies are submitted (including 1 in electronic form)

Who delivers and when?

179 of the Tax Code of the Russian Federation stipulates who submits the excise tax declaration on tobacco and other excisable goods - organizations and individual entrepreneurs paying excise taxes. Those enterprises that transport products across the borders of the EAEU must also report.

Reports are submitted to the Federal Tax Service inspection at the location. If there are separate divisions, reporting is sent to the Federal Tax Service at the location of this division. Submission deadlines are limited; the excise tax return is submitted to the tax authority by the 25th of the next month. But only those organizations that actually pay excise tax to the budget after selling excisable products report monthly.

The delivery format is paper (if the number of employees allows) and electronic (for those who employ more than 100 people). The indirect tax return must be submitted by the 20th day of the following month.

Accrued excise taxes are paid on the same dates - no later than the 25th of the next month. The reporting person is advised to file the return and make payments at the same time to avoid warnings and subsequent penalties.