How to create a certificate for employees

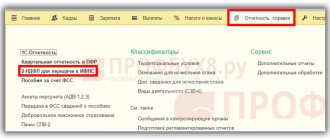

Go to the “Taxes and Contributions” menu. (“Salaries and personnel” in 1C: Accounting).

You need to open the list of documents and click “2-NDFL for employees”.

Important! For each individual employee, a certificate is created separately for each year. Click on the “Create” button.

A window will open where you first need to fill out the header. Be sure to indicate the period (the desired year), employee and organization (if you manage several, you will have to select the one you need).

Once you enter these basic data, the rest will come automatically. To update them, click "Fill".

If you are faced with the task of generating a 2-NDFL certificate in the context of OKTMO/KPP codes and tax rates, then be sure to indicate these values in the “Generate” detail.

By clicking on the “question” to the right of the completed field, find out whether income under the selected code is registered for the employee for whom you are preparing the certificate.

If income data is not registered, the program will tell you about it - the corresponding window will not be filled in.

Next, when you have checked all the filled-in data yourself, run the software check and scan the document.

All that remains is to print the certificate for the employee using the required button.

In the header of the finished printed 2-NDFL certificate, you will see a note that this form is not intended for submission to the Federal Tax Service.

formation of 2-NDFL in 1C: Accounting 8

Formation of 2-personal income tax

in the program 1C: Accounting 8 edition 3.0.

The materials are current as of March 11, 2016.

The examples were made on release 3.0.43.137

Reproduction of the article is permitted with the author indicated and a link to the source.

Many users of 1C programs, when generating a Certificate of Income for Individuals 2-NDFL, were faced with the fact that the salary was paid, personal income tax seemed to be accrued, withheld and transferred, there were no balances on account 70 and 68.01, but in the certificate 2-NDFL the amount of calculated tax was not equal the amount of tax withheld and (or) the amount of tax transferred.

In order to understand how and why this could happen, you first need to understand the personal income tax registers.

A feature of the 1C:Enterprise 8 programs and in particular 1C:Accounting 8 edition 3.0, in terms of personal income tax accounting, is that this tax is recorded not in accounting accounts, but in special accumulation registers. And if, for example, we make a manual entry using the D70 K68.01 operation, then this amount will not only not be reflected in any personal income tax report, but even the wages when generating the payment statement will not decrease by the amount of personal income tax.

In order to understand how the 2-NDFL certificate is filled out in the 1C: Accounting 8 edition 3.0 program, let’s turn to the diagram in Fig. 1.

rice. 1

To record the calculated, withheld and transferred personal income tax, there are 2 main accumulation registers and one “auxiliary” accumulation register.

The main registers are: Taxpayers' settlements with the personal income tax budget and Tax agents' settlements with the personal income tax budget.

Let's consider the order of interaction of these personal income tax registers in the 1C: Accounting 8 edition 3.0 program.

When processing income accrual documents (Payroll, Vacation or Sick Leave), our employees have accrued income and the obligation to pay personal income tax on this income. Data on calculated tax is generated for each employee in the accumulation register Calculations of taxpayers with the budget for personal income tax. The final data for this register for each employee for a certain tax period is reflected in Section 5 of Certificate 2-NDFL as the calculated tax amount.

In accordance with Article 226 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs must not only calculate the amount of personal income tax on the income of individuals, but also withhold these amounts when paying income, and also transfer the withheld amounts to the budget of the Russian Federation as tax agents.

In the 1C: Accounting 8 edition 3.0 program, when paying wages when posting the document Write-off from a current account or an Expense cash order, the program “looks for” income for each employee in the accumulation register Taxpayer settlements with the budget for personal income tax and if it finds it, it makes an entry in this register with the Type of movement Expense for the amount of calculated personal income tax.

With the same document, an entry is made for this amount with the Type of movement Arrival in the accumulation register Calculations of tax agents with the budget for personal income tax.

Those. The taxpayer (employee)’s obligation to pay personal income tax has ended and now, after deducting this tax from the income of employees, the tax agent, i.e., our organization, has the obligation to transfer personal income tax to the budget.

The total amounts of Arrival in the register of Calculations of tax agents with the budget for each employee are reflected in Section 5 of Certificate 2-NDFL as the Amount of tax withheld.

To transfer personal income tax to the budget, the document Write-off from a current account with the Transaction Type Tax Payment is intended.

This document “looks” for the amount of personal income tax withheld for each employee and compares it with the amount of personal income tax that we pay to the budget.

Please note that we transfer personal income tax to the budget in one amount, without indicating the individuals from whom we withheld this tax. Therefore, if there are balances for employees in the Tax Agents’ Accounts with the Budget register, then the amount of personal income tax transferred by the personal income tax payment document will be distributed proportionally among all employees for whom there are balances.

And if we think that we pay personal income tax for a specific employee (who, for example, quits or goes on vacation), then, alas, this is not so. The amount of personal income tax will be distributed among all employees whose personal income tax has been withheld, but has not yet been transferred to the budget.

The total amounts of Expenses in the register of Calculations of tax agents with the budget for each employee are reflected in Section 5 of Certificate 2-NDFL as the Tax Amount transferred.

Well, it remains to figure out why we need an “auxiliary” accumulation register. Payment of personal income tax by tax agents (for distribution).

This register is used if the personal income tax transfer document does not find a sufficient amount in the register Calculations of tax agents with the personal income tax budget. For example, when downloading bank statements from a client bank, it may turn out that the document Write-off from the current account for the payment of personal income tax will be earlier than the document Write-off from the current account for the payment of wages.

In this case, the personal income tax transfer document, without finding the necessary entries in the register Calculations of tax agents with the personal income tax budget, will make an Arrival in the register Payment of personal income tax by tax agents (for distribution).

If there are amounts of personal income tax paid for the same period in this register, then the salary transfer document will make an entry in the register Calculations of tax agents with the personal income tax budget, not only in Income, but also simultaneously in Expense for the amount of personal income tax previously paid by tax agents (for distribution) . Thus, this personal income tax will be reflected in Section 5 of Certificate 2-NDFL both as withheld and as transferred.

Let's look at how it all looks in the 1C: Accounting 8 edition 3.0 program.

Example 1:

The organization began operations in December 2014 and on December 1, 2014, Vladimir Petrovich Saldin was appointed to the position of General Director with a salary of 100,000 rubles.

On December 31, 2014, wages were accrued.

On January 12, 2015, the salary was transferred to the employee’s bank card in full, personal income tax was transferred to the budget.

The Payroll document, in addition to accounting entries D26 K70 and D70 K68.01, will create an entry in the accumulation register Calculations of taxpayers with the budget for personal income tax with the Type of movement Income for the amount of calculated personal income tax 13,000 rubles (see Fig. 2).

rice. 2

The document Statement to the bank does not generate personal income tax postings.

Based on the Statement, we will generate a Payment order to the bank, which also does not generate transactions, and based on the Payment order we will generate a document Write-off from the current account.

The document Write-off from the current account, in addition to accounting entries D70 K51, will generate entries in the accumulation register Calculations of tax agents with the personal income tax budget with the Type of movement Receipt for the Month of accrual December 2014 in the amount of 13,000 rubles and in the accumulation register Calculations of taxpayers with the budget for personal income tax with the Type of movement Expense for the amount of withheld personal income tax 13,000 rubles (see Fig. 3).

rice. 3

To transfer personal income tax to the budget, the document Write-off from a current account with the Type of transaction Payment of tax is intended, which, in addition to the accounting entry D68.01 K51, will generate entries in the accumulation register Calculations of tax agents with the budget for personal income tax with the Type of movement Expense for the amount of the transferred tax and 2 mutually exclusive entries in register Payment of personal income tax by tax agents (for distribution) with the Type of movement Income and Expense (see Fig. 4).

rice. 4

Example 2.

From January 12, 2015, we are hiring Alexey Viktorovich Buldin as chief accountant with a salary of 80,000 rubles.

On January 22, 2015, we pay an advance for February in the amount of 40,000 to each employee through the bank.

01/30/2015 we calculate wages.

On 02/12/2015, the salary was transferred to the employee’s bank card in full, personal income tax was transferred to the budget.

To pay an advance on employee cards in the 1C: Accounting 8 edition 3.0 program, the document Statement to the Bank is used, where we set the Advance in the Pay details.

Based on the Statement, we generate Payment orders for the transfer of wages to the employee, and on the basis of payment orders we generate documents for Write-offs from the current account.

The above documents do not generate entries in the personal income tax registers, since the advance is not the employee’s income.

We enter payroll with the Payroll document, which makes 2 entries in the accumulation register. Calculations of taxpayers with the personal income tax budget with the Type of movement Receipt for the amount of calculated personal income tax for each employee (see Fig. 5)

rice. 5

When paying wages using the documents Write-off from the current account, entries are generated in the registers Taxpayers' settlements with the personal income tax budget with the type of movement Expense and Tax agents' settlements with the personal income tax budget with the movement type Income.

When transferring personal income tax to the budget, the transfer amount is distributed among employees for whom there are balances in the register Calculations of tax agents with the budget for personal income tax (see Fig. 6).

rice. 6.

Let's conduct an experiment:

We will transfer 13,000 rubles to the personal income tax budget for Saldin only.

As you can see, in the register Calculations of tax agents with the personal income tax budget, Expenses for employees and Saldin - 7,222 rubles, and Buldin - 5,778 rubles will be reflected. That is, the amount was still distributed in proportion to the withheld personal income tax for all employees.

Second experiment:

Let’s assume that we made a mistake and in the personal income tax payment document we indicated the tax not for January 2015, but for December 2014.

In this case, the program will not find the amounts withheld from employees for December 2014 (we withheld all personal income tax for December 2014 and transferred it to the budget back in January) and instead of entries in the register Tax agent settlements with the personal income tax budget, an entry will be made in the Payment register Personal income tax by tax agents (for distribution) with the Type of movement Income.

Where it leads?

This will lead to the fact that this amount will never be included in Certificate 2-NDFL, since there is no movement on it in the register Calculations of tax agents with a personal income tax budget with the type Expense and will never be, since the register Payment of personal income tax by tax agents (for distribution ) will be waiting for a document for payment of wages for December 2014, but we have already paid everything for December 2014.

At the same time, please note that for both account 70 and account 68.01, everything closed beautifully.

Example 3

In February, Vladimir Petrovich Saldin writes an application to provide him with a deduction for a child from 01/01/2015.

02/20/2015 we pay the planned advance.

02/27/2015 we calculate salaries

03/12/2015 the salary was transferred to the employee’s bank card in full, personal income tax was transferred to the budget

In this example, I want to draw attention to the reflection of the Standard Child Deduction, if we have not taken this deduction into account over the past months.

Since the standard deduction is provided for all months of the tax period from the beginning of the year, it turns out that Vladimir Petrovich Saldin’s personal income tax was overcalculated, withheld and transferred to the budget (13,000 rubles were withheld, but in fact the tax for January amounted to (100,000 - 1 400) x13% = 12,818, i.e. the difference is 182 rubles).

And since this difference relates to income for January 2015, then in the document Calculation of salaries for February on the personal income tax tab we will see these minus 182 rubles (see Fig. 7).

rice. 7

After completing Example 3, let's look at how you can view movements in personal income tax registers for a certain period, both by employee and by month of accrual.

To do this, you can use the Universal report (Menu Reports - Standard reports - Universal report)

In order to see whether we have properly retained everything from our employees, we need to build a Universal report on the accumulation register Calculations of taxpayers with the personal income tax budget.

Let's set the Period from 01/13/2015 to 04/29/2015.

By clicking on the Show settings button on the Groupings tab, you need to add the fields Individual and Date of receipt of income (see Figure 8).

rice. 8

As a result, we see the total amounts for employees in the Income column, which will be reflected in Section 5 of the 2-NDFL certificate as the calculated tax amount.

rice. 9

Next, we will generate a Universal report on the accumulation register Calculations of tax agents with the personal income tax budget, grouped by Individuals and Month of the tax period.

In this report, in the Income column, we will see the amounts of personal income tax withheld from employee income and in the Expense column, the amount of transferred personal income tax broken down by employees and months of the tax period.

rice. 10

It is from these reports that one can understand why for some employees the amounts of accrued, withheld and transferred tax in the 2-NDFL certificate are not equal, although for accounts 70 and 68.01 everything agrees.

There can be many reasons for this inequality. But the most common is a violation of the document entry sequence (entering or changing documents retroactively without re-entering later related documents).

Let's conduct an experiment.

Let's make the document Payroll for January not posted, then we'll forward all the documents through Group re-posting of documents, after which we'll post the document Payroll for January.

Now if we look at the balance sheets for accounts 70 and 68.01, we will see that everything is fine with us: all wages have been paid, all personal income tax has been withheld and transferred to the budget, there is no balance on accounts 70 and 68.01.

But if we generate a Universal report on the accumulation register Calculations of taxpayers with the budget for personal income tax, grouped by Individuals and Date of receipt of income, we will see that the withheld tax for January is not withheld. And in the 2-NDFL certificate we will see the same thing. (see Fig. 11).

rice. eleven

In our experiment, everything will fall into place after the start of processing Group re-processing of documents.

But unfortunately, reprocessing documents using this processing will not always give a positive result, and sometimes, on the contrary, it can confuse previously verified personal income tax data.

This is due to the fact that there are cases when it is necessary not only to re-enter documents in strict sequence, but also to refill the documents.

And one more important point that leads to an error in personal income tax accounting: this is the correct entry of initial balances into the program for account 68.01.

If we start keeping records in the 1C: Accounting 8 program not from the beginning of the organization’s activities, then it is necessary to enter the initial balances for accounts and registers.

To do this, use the Initial Balance Entry Assistant.

But unfortunately, when entering account balances 70 and 68.01, this one does not make entries in the salary and personal income tax registers.

So, in particular, if on December 31 we have accrued wages for December and calculated personal income tax, then in addition to balances on account 70 by employee and balance on account 68.01 in total, it is necessary to manually enter balances in the salary registers and balances in the register Calculations of taxpayers with the personal income tax budget for each employee. If this is not done, then the salary payment document in January simply will not see the calculated personal income tax for December.

In addition to this article, I recommend video materials on personal income tax issues in salary programs, in particular Salary and Personnel Management 2.5. Some of the problems covered may also arise in 1C: Accounting programs editions 2.0 and 3.0.

Video materials provided by ProfBukh8

I wish you success,

Sergey Golubev