Why do you need an income certificate?

The function that a certificate of income of an individual performs is to inform authorized bodies and organizations (for example, banks) about the amount of citizens’ earnings and the amount of tax withheld from it.

Drawing up this document is one of the main tasks of any accountant who deals with payroll issues. Until 2022, this document was called 2-NDFL, and, in addition to handing it over to employees, tax agents annually prepared it and submitted it to the Federal Tax Service for all employees of the organization. Now the situation has changed. There is no longer a separate 2-personal income tax. For reporting purposes, it was included in the 6-NDFL calculation. By Order of the Federal Tax Service No. ED-7-11/ [email protected] dated October 15, 2020, a new form of certificate 2-NDFL was approved in 2022 for delivery to taxpayers. It is called “Certificate of income and tax amounts of an individual.” But the functionality of the document, its purpose and the requirements for its issuance have not changed.

IMPORTANT!

We look at the Order of the Federal Tax Service No. ED-7-11 / [email protected] dated September 28, 2021, what changes are in 2-NDFL in 2022 - from 01/01/2022, an updated form for calculating 6-NDFL and certificates of income and taxes of individuals is in effect. The calculation for the 4th quarter of 2022, together with reference applications, must be submitted using a new form.

ConsultantPlus experts analyzed the latest changes in the 2-NDFL form and compiled new samples. Use these instructions for free.

What documents can confirm the income of an individual entrepreneur?

As a rule, credit institutions offer their clients to confirm the level of income received using one of two documents - a certificate in form 2-NDFL or a certificate in the bank’s form.

If an individual entrepreneur does not have a part-time job, he cannot issue the first type of certificate, because he is a tax agent only in relation to his own employees.

Citizens working on the simplified tax system have the right to contact a financial organization or government agency and clarify whether it is possible to provide a certificate in free form or in the form of a bank instead of 2-NDFL. As a rule, institutions accommodate entrepreneurs halfway.

In addition, an individual entrepreneur using the simplified tax system has the right to use other documents to confirm his solvency, namely:

- KUDiR;

- copies of declarations submitted to the Federal Tax Service in form 3-NDFL;

- primary documentation (for example, contracts, bank statements);

- cash book.

Formally, the legislation does not contain instructions on the form of a document capable of certifying the solvency of a private entrepreneur.

At the same time, not every organization or authority will agree to replace the generally accepted 2-NDFL, so it is recommended to discuss in advance with representatives of these institutions the possibility of issuing another document confirming the level of solvency of the individual entrepreneur. Otherwise, replacement will not be accepted.

How to get an income certificate in 2022

According to the norms of the Labor Code of the Russian Federation, employers are required to issue the employee with a document on income:

- upon dismissal, together with the work book and other documents;

- at any time upon request - 3 days are given for the production of the document after receipt of the application (Article 62 of the Labor Code of the Russian Federation).

Employers have no other grounds for issuing 2-NDFL for an employee in 2022. No bodies or services have the right to request it without bypassing the taxpayer.

IMPORTANT!

Please note that the deadline for submitting 2-NDFL expired on 03/01/2021 and it is no longer necessary to send this document to the Federal Tax Service. It is now included in the 6-NDFL calculation in the form of Appendix No. 1.

The calculation form and its attachments were approved by Order of the Federal Tax Service of Russia No. ED-7-11 / [email protected] dated 10/15/2020. Separate 2-NDFL reporting is not provided for tax agents in 2022.

How this report is filled out is described in detail in the article “How to fill out Form 6-NDFL for the 4th quarter of 2022. Complete Guide."

IMPORTANT!

When an employee, including one who has already been dismissed, requests information about wages and withheld tax for previous periods, the organization issues a document in the form that was in force at that time. Please also take into account the filling procedure in force at that time, which is usually approved by the same order of the Federal Tax Service as the form.

Report submission deadlines

You must fill out and submit 2-NDFL to the tax office no later than March 1 of the year following the reporting year. Since this is the last date when tax agents transmit information about an individual’s income, calculated, withheld and transferred taxes to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). In this case, enter the number 1 in the “Sign” field. In 2022, March 1 falls on a Monday, therefore no transfers are provided.

If the tax agent was unable to withhold tax when paying income and during the entire tax period, then he is obliged to provide the tax report, indicating the number 2 in the “Sign” field. This must be done before March 1 of the next year (clause 5 of Article 226 of the Tax Code RF). Please note that the procedure for providing such information to the tax authorities is presented in Appendix No. 4 to the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/.

For late submission of the report, a liability of 200 rubles is provided. for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation), that is, for a form drawn up for an individual employee. At the same time, liability has been introduced for providing certificates with false information. For each incorrect report you will have to pay a fine of 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation) and it can be avoided only if the tax agent identifies and corrects the error before it is discovered by the tax authority.

Sample application for obtaining information about income

According to the norms of the Labor Code of the Russian Federation, a written statement from an employee requesting information about income is not mandatory. But it is recommended to request it - it is beneficial for both the employee and the employer. The three-day period for issuing the certificate begins from the date of its receipt. If there is disagreement about this, it will be easier to prove that you are right.

It is allowed to write an application for the issuance of 2-NDFL upon dismissal in 2022 in any form, the main thing is that there is the signature of the applicant and the date of preparation. This is what an example sample looks like:

| General Director of PPT.ru LLC Petrov P.P. from forwarder Savelyev S.S. Statement Please give me a certificate of income and personal income tax amounts for January-March 2022. 04/28/2022 Savelyev |

Income and deduction codes

The Federal Tax Service, by Order No. ММВ-7-11/820 dated October 24, 2017, approved a number of income and deduction codes that must be used when filling out an income document (formerly 2-NDFL). They are necessary to indicate operations in a document.

The Federal Tax Service assigned separate codes to citizens’ income from transactions with financial instruments: the investment deduction code “619” appeared. It corresponds to the amount of positive financial result received by the taxpayer from transactions on an individual investment account. The “dividends” income code has not changed; they are still designated 1010.

| Type of income | Code |

| Wage | 2000 |

| Temporary disability benefit (sick leave) | 2300 |

| Payments of vacation pay when taking annual paid leave | 2012 |

| Amount of compensation for unused vacation | 2013 |

| The amount of payment in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in the part that exceeds three times the average monthly salary or six times the average monthly salary for dismissed workers from organizations in the Far North and equivalent regions to them areas | 2014 |

| Prize | 2002 |

| Amounts of fines and penalties paid by an organization on the basis of a court decision for non-compliance with consumer requirements, in accordance with Law No. 2300-1 of 02/07/1992 | 2301 |

| Amount of bad debt written off | 2611 |

| The amount of income in the form of interest (coupon) on circulating bonds of Russian organizations denominated in rubles | 3023 |

More information about income coding: how to reflect sick leave in the 2-NDFL certificate

Tax agents should be careful to ensure that tax deduction codes are entered correctly. For example, the standard deduction for a child is indicated by code 126. If you make a mistake, you will have to prove that the deduction was provided legally and its amount does not exceed that provided for by the Tax Code of the Russian Federation. If the tax agent unreasonably increased the amount of the deduction, he thereby reduced the amount of tax payable, essentially deceiving the budget. In this case, he will be forced not only to return the difference, including penalties according to the provisions of Article 75 of the Tax Code of the Russian Federation, but also to pay a fine of 20% of this amount, according to the provisions of Article 123 of the Tax Code of the Russian Federation.

A complete list of deduction codes is given in the appendix to the Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 09/10/2015.

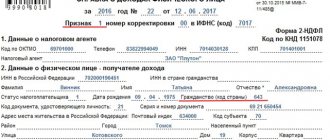

How to fill it out correctly - sample form for an employee

The help consists of 5 sections, each of which contains the necessary information.

Let's look at filling out the form step by step:

Registration begins by indicating the year for which the certificate is issued and the date of issue.

Section 1 contains information about the tax agent who made payments in favor of the employee in the specified tax period.

To be filled in:

- OKTMO code;

- phone number for contacts;

- TIN of the organization or individual entrepreneur;

- Checkpoint for organizations (individual entrepreneurs do not indicate it);

- the name of the tax agent in abbreviated form in accordance with the statutory documents (the individual entrepreneur indicates his full name).

Section 2 reflects information about the individual for whom the income certificate is issued.

The following must be filled out:

- TIN of the citizen in accordance with the certificate issued to him;

- Last name, first name and patronymic in full without abbreviations;

- Tax payer status:

- 1 - resident of the Russian Federation;

- 2 - non-resident of the Russian Federation;

- 3 - highly qualified specialist who is not a resident of the Russian Federation;

- 4 - a non-resident of the Russian Federation who is a participant in the program for the resettlement of foreign compatriots to the country;

- 5 - non-resident of the Russian Federation who received refugee status;

- 6 - a foreigner working in the country under a patent.

- Date of Birth;

- Country of citizenship code (set in accordance with OKSM, for Russians - 643);

- Identity document code:

- 21 – Russian passport;

- 10 – foreign passport.

- Series and number of the identity card.

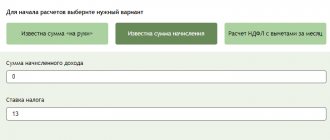

Section 3 is filled out in tabular form, which contains data on income received, broken down by code and month, as well as the code and amount of the tax-free deduction. The principle of filling follows chronology. The form indicates the tax rate at which personal income tax is calculated on the specified income - 13%.

Here are the most common of them:

| Income | |

| Code | Decoding |

| 2000 | Wage |

| 2002 | Amounts of bonus payments |

| 2012 | Vacation payments |

| 2300 | Payment for temporary sick leave |

| 4800 | Other income |

Example . The employee's monthly accrued salary is 32,500 rubles. The premium amount is 5200 rubles. The next vacation was in June, for which 30,260 rubles were accrued. The employee’s 2-NDFL certificate will contain payment codes 2000 (salary), 2002 (bonus), 2012 (vacation).

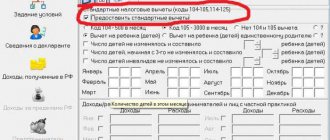

Section 4 contains the codes and amounts of standard, social and property deductions that are provided to the employee at the place of work.

The most common deduction codes:

| Deductions | |

| Code | Decoding |

| 501 | Deduction from the gift amount (no more than 4,000 rubles per year is provided) |

| 503 | Deduction from financial assistance amounts, but not more than 4,000 rubles per year |

All codes and breakdowns of income and deductions are presented in the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11/ [email protected] -

For example , the standard deduction for an employee for three minor children (under 18 years of age) in 2022 was provided under codes 126, 127, 128. It was valid until October, until income reached the limit set at 350 thousand rubles. Section 4 of the 2-NDFL certificate contains the amounts of deductions for 2022: for the first and second child, 12,600 rubles (1,400 rubles × 9 months), for the third – 27,000 rubles (3,000 rubles × 9 months).

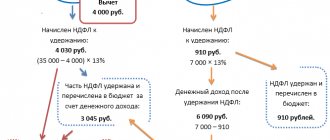

Section 5. The final indicators of the amount of income are summarized and entered into the table. Next, the tax base is determined and tax information is entered:

- OSD - calculated amount for the entire period;

- NB - withheld from income (NB = OSD - deductions);

- the amount of personal income tax transferred to the budget (∑ = NB - 13%).

If during the specified period there were cases of excess tax withheld or not withheld, then these data are entered in the corresponding columns of the table.

The certificate is signed by a representative of the tax agent. Usually this is the accounting employee who compiled it. Signing by the manager himself is allowed. The full name of the representative and his personal signature are entered in the appropriate field.

How to fill out a certificate if the employee’s income was taxed at different rates?

If during the tax period there was income that is subject to different personal income tax rates (13, 15, 30 and 35%), then sections 3-5 are filled out separately for each of them. Since all information must be reflected in one certificate, it may not fit on one sheet. In this case, the data is transferred to the second sheet, where:

- the header will contain the page number;

- Sections 1-2 are not completed;

- Sections 3-5 are filled out in the same way as the first sheet, with the obligatory signature of each sheet of the form.

What does a certificate look like in 2022?

For issuance to employees, it is not 2-NDFL for 2022 for the employee, but a certificate of income and tax amounts. Its form is no different from the abolished 2-NDFL. This is what a sample of the new form looks like:

Algorithm for filling out the document:

- Specify the period and date of issue of the 2-NDFL certificate for employees (income certificate).

- Enter the details of the tax agent (organization) - name, OKPO code, INN, telephone number, address.

- Reflect the taxpayer's data - full name, tax identification number, date of birth, details and identification document code, taxpayer status code.

- Give the current tax rate - in the example, the standard 13%.

- Provide in Section 3 the codes of income received by the taxpayer for each month (in the example, salary - code 2000).

- Report the deductions used, indicating their codes.

- Indicate the total amounts of payments and tax withheld.

The accountant who compiled it certifies the certificate with his personal signature.

Who submits 2-NDFL for 2022?

Certificate 2-NDFL is drawn up and submitted to the Federal Tax Service by tax agents who paid income subject to personal income tax to their employees during the tax period. These include, in particular (Article 226 of the Tax Code of the Russian Federation):

- organizations;

- IP;

- notaries, lawyers and other private practitioners;

- separate divisions of foreign organizations in the Russian Federation.

Who doesn't submit 2-NDFL?

You do not need to submit 2-NDFL if:

- The income was paid to an individual entrepreneur under a GPC agreement or to a self-employed citizen (payer of professional income tax).

In this case, they pay the tax themselves.

- During the tax period, no income was paid to employees.

If during the year employees were on unpaid leave and did not receive income, there is no need to prepare a certificate for them.

- The organization has only a director, who is the founder, with whom an employment contract has not been concluded and income to whom is not paid.

If there is no activity and the director does not receive a salary, there is no need to draw up a “zero” certificate for him.

- Income paid by one individual to another.

In this case, the recipient of the income fills out not a 2-NDFL certificate, but a declaration in the 3-NDFL form and submits it to the Federal Tax Service at the place of registration at the end of the year in which he received the income. The one who paid him the income does not submit anything to the tax office, since he is not a tax agent.

More information about the need to fill out and submit zero 2-personal income tax for 2019 can be found in this article.

Error correction

If the reference documents as part of the 6-NDFL calculation contain an error, the tax agent draws up an updated form. In the “No.” field, you must indicate the number of the original certificate (in which the error was made). The registration date is set to the current one. In the “Adjustment number” field, you must indicate code 01 or 02, etc. (depending on the account adjustment).

IMPORTANT!

If an error is made in the reference document, the full updated form 6-NDFL is submitted, and not one sheet. If corrections are made only in the calculation of 6-NDFL, it is not necessary to submit taxpayer certificates as part of the adjustment.

Requirements for filling out 2-NDFL

A complete list of requirements for filling out the 2-NDFL certificate submitted to the Federal Tax Service is given in Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] We list the most important of them:

- If the certificate is filled out by hand, the data is entered into it from left to right, starting from the first left acquaintance. If on a computer, then the values of numerical indicators need to be aligned to the right.

- If there is no data in a certain field or line, you need to put a dash in it.

- If there is no value in the field in which the amount is indicated, you must enter “0” in it.

- There should be no negative values in the certificate.

- Help pages are numbered consecutively and the number is indicated in the format “001”, etc.

- Data in 2-NDFL is entered in printed capital letters.

- When filling out a document by hand, you can only use black, blue, and purple ink. When filling out on a computer, you must use Courier New font with a height of 16–18 points.

- Errors cannot be corrected using putty or other corrective means. If you admitted it, it is better to redo the certificate.

- Double-sided printing is not allowed, as is stapling sheets.