Help 2 Personal income tax - what is it?

This is an official document from the tax service, which indicates the amount of a citizen’s monthly income. This is a tax document; it records both the income itself and the tax withheld from it. That is, in certificate 2 of personal income tax, the bank clearly sees how much a person receives in net income.

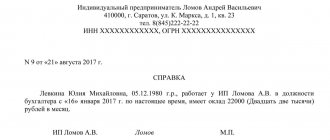

Document 2 of personal income tax reflects the income of an individual. This is a strictly regulated document that is printed on a prescribed form. That is, no matter where you receive it, it will always have an identical appearance. The document is large and reflects a lot of data.

What is indicated in personal income tax certificate 2:

- information about the tax agent, that is, about the employer. This is the name, details;

- information about who is the recipient of the income. Full name, TIN, passport details, place of residence;

- income that is taxed. A table is provided indicating the month, type of income in the form of a code, its amount and how much tax is withheld;

- subtotal for the specified period. That is, total income and how much taxes are withheld;

- certification of the certificate by a tax agent, that is, by the employer.

What is NFDL certificate 2? This is a document that clearly shows the size of a citizen’s official income. But we are talking specifically about official income. A person who works unofficially can take such a document to the Federal Tax Service, but nothing will be reflected there, it will turn out to be empty.

If a citizen receives a salary partly officially, and partly in an envelope, then the 2NFDL certificate will reflect only the income processed through the Federal Tax Service. If you provide it for a loan, then the bank will take into account only what is indicated there.

What is this in simple words

Officially employed workers can confirm their solvency using a 2-NDFL certificate. The document is drawn up at the workplace at the employee’s request and contains data on accrued income, as well as sick pay and financial assistance for a certain period of time. There is also information about withheld personal income tax (NDFL). The certificate is generated for a period of 1 year on a cumulative basis from the beginning of the year or from the month when the employee started working. Data on accruals and deductions must match the information that will subsequently be provided to the tax office.

For what purposes do you order a certificate?

If we consider what a 2NDFL certificate is, we can understand that it is used not only when applying for loans. The income level of Russians also plays a role in determining various social situations. For example, a certificate is ordered if a person claims to receive any benefits and benefits. She will indicate to social authorities the low level of income. Also, personal income tax 2 certificate will be required in the following situations:

- when deciding on the calculation of alimony;

- to obtain a visa, if proof of funds for this trip is required;

- during legal proceedings, if they require information about a citizen’s income;

- to provide to a new employer for the purpose of calculating any benefits or benefits;

- registration of tax deductions of any kind: for study, purchase of real estate, mortgage, treatment.

In the banking industry, personal income tax certificate 2 is provided only to confirm the income level of a potential borrower. Often the lender asks to support it with a copy of the employment document certified by the employer. This requirement arises if we are talking about a large amount.

Who should prepare the certificate and within what time frame?

An individual receives a certificate of income at their place of work. To do this, an application is written to the employer to provide such a certificate. Questions about whose name the application is drawn up (manager, chief accountant, head of department) and to which department it is transferred (personnel, accounting or other) are regulated by the internal regulations of the organization or individual entrepreneur. Three days are allotted for drawing up the certificate. If possible, it can be prepared faster.

If everything is clear with hired employees - the employer issues a certificate for them based on data on accrued wages, then what should entrepreneurs, lawyers, and notaries do? On the basis of what information is a self-employed person’s income certificate for social protection generated? Individual entrepreneurs, private practitioners and other self-employed persons issue such a certificate independently. Supporting documents for this may include bank statements for current accounts, extracts from the ledger of income and expenses, etc.

Why do banks need this certificate?

Banks give people money at interest with the condition of repayment. And they need confirmation that the person can actually repay the loan if it is approved. Taking your word for it is a big risk, which is why you need a certificate. This is an official document that you can trust.

Advantages of having 2-NDFL for the borrower:

- possibility of receiving a large sum. If you need to receive more than 200-300 thousand rubles, then you cannot do without this document;

- interest rate reduction. The fewer risks the bank bears, the more favorable the lending conditions become. Without certificates you can get a loan at 25-30%, with them - at 15-20%;

- increasing the level of bank loyalty. There is more trust in such clients, and therefore the likelihood of approval increases significantly.

You can get a loan without a certificate, but it will be small and expensive in terms of interest rates.

Personal income tax - what it is and basic concepts

Personal Income Tax is an abbreviation of the name of the tax, which stands for “ Personal Income Tax ”. Calculated as a percentage of the total income for the tax period minus the expenses incurred to obtain this income.

Personal income tax is a federal tax and is paid to the state treasury.

All details of tax formation, its payment and reporting forms are regulated by the Tax Code (TC) of the Russian Federation. Article 207 of the Tax Code indicates that personal income tax payers are 2 categories of individuals. persons (who is this?):

- Tax residents of the Russian Federation, i.e. persons staying in Russia for at least 183 days per calendar year.

This period begins from the moment you cross the border of our state. Persons permanently residing in the Russian Federation are a priori considered tax residents of our country and are required to pay tax on the income received here. Important: the above applies to both citizens of the Russian Federation and foreigners, and stateless persons. At the same time, Russians permanently residing abroad are not tax residents of the Russian Federation for income tax if they did not have income in Russia during the reporting period. - Persons who are not tax residents of the Russian Federation, but at the same time receive one-time or permanent income in Russia.

The personal income tax rate for residents and non-residents is different:

- residents must pay 13% of income received;

- non-residents – 30%.

Personal income tax is calculated and paid either by a tax agent or an individual. face yourself.

A tax agent is an individual or legal entity who, by virtue of an agreement or legislation, is obliged to calculate and pay tax for a specific individual. face.

For example, by registering official employment, the employer becomes the tax agent of the hired employee. That is, the employer (or accountant) calculates the employee’s income tax, deducts it from the salary and transfers it to the budget.

Another example: an individual enters into an agreement with a legal entity for the commission sale of a car. The agreement must indicate who is the tax agent for this transaction. If this clause is not in the contract, then the individual who handed over his car for sale is obliged to pay personal income tax on his own.

Therefore, it is important to carefully read the documents you sign so as not to be in violation of tax laws.

Where to get 2-NDFL

The legislation has imposed an obligation to issue documents of this type on tax agents, that is, on employers. This is an accounting document; accordingly, you need to contact the accounting department to obtain it. There is nothing complicated here: write an application, within 2-3 working days you will receive a document. If the organization is small, they can provide it on the day of application.

It happens that the accounting department is located in one city, and the place of work is in another. In this case, receipt may take a little longer. The application is usually submitted remotely by email, followed by the provision of the original through an established delivery channel. Help comes through the same channel.

You can apply for the document directly to the Federal Tax Service through your personal account or by personal visit. But there is an important nuance here - the employer submits information about employees to the tax office at the end of the year, so the document may be incomplete.

Where they may require

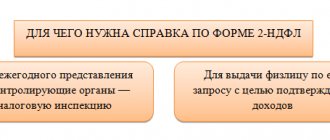

The 2-NDFL certificate is generated in 2 cases: at the request of the employee or for submission to the tax authorities. In the first case, the document is issued at any time, as a rule, upon a written application from the employee for the specified periods, taking into account the actual time worked. That is, if an employee needed a certificate in July for personal needs, the accounting department will generate data on earnings and withheld tax from January (or from the month of starting work) to June.

In addition, certificates for all employees are submitted to the Federal Tax Service annually at the end of the working year. Based on them, the tax office checks the completeness of accrued and paid income tax for the enterprise as a whole. Both documents are identical to each other. Why does the employee need a certificate? The need arises when it is necessary to show the level of income, including to confirm the status of the poor. Also, 2-NDFL can serve as proof of a sufficient level of solvency of a citizen. In some cases, the purpose of the receipt is to show the amount of income tax transferred from earnings.

Who can request a 2-NDFL certificate? The document is generated to provide:

- To banks and other credit institutions to obtain borrowed funds.

- To government bodies (social protection and others) to register a number of benefits and payments in favor of the poor.

- In stores and shopping centers when making an expensive purchase on credit.

- To receive tax deductions (refund of previously paid tax).

- To confirm previously received income at a new place of work.

Bank requirements for a certificate

Banks know very well what they indicate in personal income tax certificate 2, the form is fixed, there are no requirements for this part. But there is a deadline requirement. For example, most often banks ask that the document indicate income for 6 months. If the loan is large, for example, with a mortgage, they may ask for 1 year, but this is rare.

It happens that the borrower works unofficially or has an income that is understated according to documents. In this case, you need to look for a bank that allows you to provide not 2NDFL, but a certificate in the bank’s form. You take the form and give it to the employer to fill out. There standard information about the employee is indicated: position, length of service, salary.

But not every employer will agree to provide such a document. Therefore, most often such potential borrowers have to look for a loan that is issued without certificates.

Results

Certificate 2-NDFL is a document submitted by a tax agent from 2021 to the Federal Tax Service as part of the calculation of 6-NDFL, as a report on income paid to the employee and the tax withheld (or not withheld) from this income. The certificate may also be required by the employee in respect of whom it was drawn up for submission to the Federal Tax Service, a bank, or another employer. To form in 2022, use the certificate form from the Federal Tax Service order No. ED-7-11 dated October 15, 2020 / [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Confirmation of income through State Services

If previously only 2NDFL certificates could indicate the amount of a citizen’s income, now there is another method for banks to obtain information - through the State Services portal. Confirmation comes through a request to the Pension Fund. The bank gets access to information about a citizen’s pension contributions, which allows it to determine the level of income.

Employers make transfers to the Pension Fund on a monthly basis, so the information is always up to date.

Confirming income in this way is especially convenient when applying for a loan online. A person fills out an application for a loan and, after providing information about himself, goes from the application to the State Services portal and logs in. Next, you need to allow the bank to receive information; confirmation is performed by entering a code sent to your phone. Afterwards, the document is automatically sent to the bank.

Another scheme is also possible. You generate a statement on State Services and redirect it to the email address specified by the bank. This income confirmation option is an excellent replacement for 2 personal income taxes; many banks use it. As a result, you do not need to order a document and wait for it to be received; loan processing is faster.

5 / 5 ( 3 voices)

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Who is obliged to pay personal income tax on their own and when?

- entrepreneurs (individual entrepreneurs) must pay tax for themselves and for hired workers (in this case, the individual entrepreneur becomes a tax agent in relation to his employee);

- Individuals earning money through private practice . These include notaries, lawyers;

- Individuals who sold property that belonged to them by right of ownership. This applies to housing that has been owned by a person for less than 5 years, and other real estate (garages, non-residential real estate), the ownership of which came less than 3 years ago;

- Individuals who rent out their property to legal entities or rent to individuals. At the same time, it does not matter in which state the property being rented is located;

- Individuals who received income in the form of a gift (but not from close relatives). It is important that the gift must be officially formalized, that is, a gift agreement must be drawn up and signed;

- Individuals who have received monetary compensation from other individuals or legal entities (provided that they do not act as tax agents). For example, if a teacher gives private lessons for a fee and a document (contract or agreement) has been drawn up about this, then he is obliged to pay tax;

- Individuals who received winnings as a result of legal cash or clothing lotteries.

Some lottery organizers are tax agents for a fixed amount of winnings; for winnings over that, the lucky person must pay the tax themselves. For example, this is what the organizers of the lottery did in the Pyaterochka chain of stores when conducting the New Year's lottery promotion for 2022 - 2019. Other lottery organizers place the responsibility for paying income tax entirely on the person who received the winnings. A 35% tax is imposed on winnings exceeding 4 thousand rubles; - individuals receiving royalties from copyright for objects of copyright (inventions, artistic works, etc.) as heirs;

- Individuals whose income (in the form of interest) is from bank deposit exceeded the interest rate of the Central Bank (CB), increased by 5% for deposits in rubles and increased by 9% for deposits in foreign currency.

This means that if you, say, on December 1, 2022, deposited 50 thousand rubles into a deposit account. at 13% per annum, the key rate of the Central Bank at that moment was 7.5%, then you will have to pay income tax after receiving interest (income). The tax base will be the difference in the amount between 13% and (7.5% + 5%), i.e. between 13% and 12.5% (0.5%).In our example, this is 0.5% of 50 thousand rubles, which is 250 rubles. Personal income tax on deposits is 35%. Thus, you will have to pay tax = 87.5 rubles. (35% of 250 rub.).

Important: there is no need to pay personal income tax for property received by inheritance and used by heirs. If the inherited property is sold less than 5 years (residential real estate) or 3 years (other property) after inheritance, then personal income tax is subject to payment.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Michael

04/14/2020 at 10:30 How compensation is paid and where it is received

Reply ↓ Anna Popovich

04/14/2020 at 15:38Dear Mikhail, please clarify what kind of compensation you mean?

Reply ↓