Let's study how to correctly account for input VAT when purchasing fixed assets in 1C 8.2 using an example.

Let’s say that CJSC “PK Shtorkin Dom” acquires fixed assets that will later be used in business activities. One fixed asset is immediately put into operation. Two other facilities remain uncommissioned at the end of the current quarter. All documents for capitalization of fixed assets are available, and invoices are also available. The organization, in turn, if all conditions are met, can claim such “input” VAT for deduction. It is necessary to calculate the VAT deductible and check the VAT entries. You should also check the entries in the VAT accumulation registers, create a purchase book and check the VAT calculation. To do this, in 1C 8.2 you need to formalize the following operations:

- Operation No. 1 for the acquisition of OS, registration of the “input” invoice.

- Operation No. 2 to commission the OS.

- Operation No. 3 for the acquisition of OS, registration of the “input” invoice.

- Create a purchase book and check its completion.

Parameters for operation No. 1:

Parameters for operation No. 2:

Parameters for operation No. 3:

Features of filling out documents for the receipt of fixed assets in 1C 8.2

Features of filling out the document “Receipt of goods and

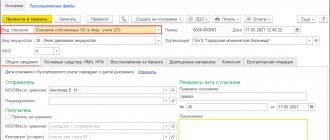

Features of filling out the document “Invoice received”

register an “input” invoice by clicking on the link Enter an invoice in the lower field of the document Receipt of goods and services . The Reflect VAT deduction is not selected upon receipt of fixed assets, intangible assets, and equipment:

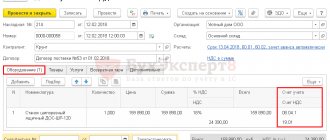

Postings for VAT accounting when purchasing fixed assets in 1C 8.2

According to accounting

Invoice document upon capitalization of fixed assets does not create postings and movements in VAT accumulation registers. The necessary entries for accounting for “input” VAT are generated by the document Receipt of goods and services:

For tax accounting

The following entries were created in the VAT accumulation register:

- Entry by movement type Receipt in the VAT register presented – event Presented by VAT supplier . This entry is a potential purchase ledger entry:

- Entry by the type of movement Receipt in the VAT register for acquired assets , type of value of fixed assets - for tax amounts accepted for accounting related to a specific batch of fixed assets:

- Entry by the type of movement Receipt in the VAT register for fixed assets, intangible assets , type of value of fixed assets . The tax amounts accepted for accounting on purchased fixed assets are registered in order to track the conditions under which these tax amounts can be accepted for deduction:

Current rules for deducting VAT on fixed assets

To claim a deduction for purchased fixed assets, you must register them. The company is entitled to a refund of entry fee under the OS if it is for the use of taxable transactions.

If you plan to use the object in both taxable and non-taxable transactions, separate accounting should be maintained. In addition, you should have well-executed primary documentation.

The contribution made by the supplier when purchasing the property can be claimed for compensation. It is necessary to accept objects for accounting under account 08. When purchasing real estate for which registration of ownership is required, in order to deduct the tax, you do not have to wait for the moment of registration. When purchasing equipment that requires assembly, a return can be made after accepting the item on account 7.

When organizing a refund for these types of funds, it is recommended to take into account the provisions of the current legislation. If incorrect data is submitted to the Federal Tax Service, you should send a clarifying letter.

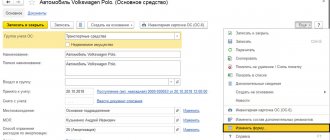

Postings for commissioning of fixed assets in 1C 8.2

According to accounting

When commissioning fixed assets, VAT accounting entries are not created:

For tax accounting

The following entries were created in the VAT accumulation register:

- Entry by type of movement Expense in the VAT register for fixed assets, intangible assets , type of value of fixed assets . The tax is written off from the register, because the conditions for accepting “input” VAT for deduction are met:

- in the VAT register for acquired assets with the movement type Expense , type of asset value. VAT is written off from the register at the time of commissioning:

How to distribute VAT on fixed assets?

For clarity, let’s look at the example of the distribution of VAT when purchasing an operating system.

Example

On August 05, 2021, Zarnitsa LLC purchased a car for the head of the commercial department for RUB 1,357,000, including VAT = RUB 226,167.67.

What nuances need to be taken into account when purchasing a car, see our article “Transport tax in 2022 - 2022 for legal entities” .

The share of non-taxable transactions in the total revenue of Zarnitsa LLC for August 2022 was 22%.

The company's accounting policy reflects the following elements of VAT regulations:

- VAT on fixed assets is accounted for in subaccount 19/1-2 “VAT on fixed assets used in operations subject to and non-taxable to VAT.”

- VAT related to fixed assets purchased in the first two months of the quarter is distributed monthly;

Distribution of VAT on purchased fixed assets:

- RUB 49,756.89 (226,167.67 × 22%) - this amount increases the cost of the OS;

- RUB 176,410.78 (226,167.67 × (100% – 22%)) - this amount is included in VAT deductions.

Entries on distributed VAT in the accounting of Zarnitsa LLC:

- Dt 08 “Investments in non-current assets” Kt 19/1-2 “VAT on fixed assets used in operations subject to and non-taxable with VAT” - RUB 49,756.89;

- Dt 68/2 “VAT” Kt 19/1-2 “VAT on fixed assets used in operations subject to and non-taxable with VAT” - RUB 176,410.78.

As of 08/31/2021, the initial cost of the car is calculated as follows: 1,180,590.22 rubles. (RUB 1,130,833.33 + RUB 49,756.89).

Input VAT when purchasing fixed assets in the purchase book in 1C 8.2

Creating and filling out the document “Creating purchase ledger entries”

- Creating a document in the menu: Purchase – then select Maintaining a purchase book – then Generating purchase book entries;

- In the From – the end date of the tax period. Because The tax period is a quarter, then in our example the document date is 03.2013. ;

- When registering in the purchase book of invoices for received fixed assets from suppliers, the tab Deduction of VAT on purchased assets .

“Input” VAT on fixed assets that have not been put into operation will not be deducted, and these VAT amounts will not be included in the purchase book.

In our example, three fixed assets were capitalized, of which only one object, the Ford Tourneo Connect, was put into operation in the first quarter . Thus, the “input” VAT only for this object will be reflected in the purchase book. For the second object, the “input” VAT will be written off, and for the third object there will be a balance of “input” VAT at the end of the quarter:

- Accounting system: by debit of account 19.01;

- Well: VAT accumulation register, is a potential entry in the purchase book:

Features of separate accounting when leasing property

Let's consider the features of the RU if the OS:

- entered into the organization under a leasing agreement;

- used both in VAT-taxable and non-taxable activities;

- under the terms of the agreement: taken into account on the balance sheet of the lessee, becomes the property of the organization upon expiration of the agreement, the redemption price of the leased asset is not separated from the total amount of payments under the agreement.

In such a situation, it is necessary to take into account that the receipt by an organization of fixed assets under a leasing agreement is not a transfer of property, but a service, the payment for which is leasing payments.

It is possible to deduct VAT on the amount of such a service as soon as the lessee receives invoices after leasing payments are reflected in the accounting records - subclause. 1 item 2 art. 171, paragraph 1, art. 172 of the Tax Code of the Russian Federation.

Taking into account the above, when organizing RU it is necessary to take into account that:

- the entire amount of “input” VAT as part of the lease payment is distributed between taxable and non-taxable transactions;

- When determining in the accounting policy the duration of the tax period for calculating the VAT proportion, the taxpayer has no choice - it is set equal to a quarter, since leasing payments are a payment for services in the interpretation of clause 5 of Art. 38 of the Tax Code of the Russian Federation, and not by acquiring fixed assets;

- non-deductible VAT amounts are included in the cost of the purchased service, not the fixed asset, and are expensed when calculating income tax (will be an element of leasing payments that do not increase the cost of the leased asset).

For accounting features and other nuances of leasing operations, please read the materials posted on our website:

- “Operations under a leasing agreement in accounting”;

- “Transactions for leasing a car from the lessee”.

Postings for accepting “incoming” VAT for deduction when commissioning the OS in 1C 8.2

According to accounting

When you include in the document Formation of purchase ledger entries records on the acceptance of “input” VAT for deduction on transactions of receipt and commissioning of OS in 1C 8.2, transactions are created for the debit of account 68.02: Dt 68.02 Kt 19.01 – for the amount of “input” VAT accepted for deduction :

For tax accounting

The following entries were created in the VAT accumulation registers:

- in the VAT register presented with the type of movement Expense. The “input” VAT is written off from the register at the time it is included in the purchase book:

- in the VAT Purchases , which generates the lines of the Purchase Book report:

01 invoice required for deduction

For a long time, tax authorities and the Russian Ministry of Finance unanimously argued that the right to deduction appears after property is reflected in account 01. Officials explained their position with the following arguments.

Deductions of VAT amounts presented by sellers to the taxpayer upon acquisition of fixed assets are made in full after the registration of these objects. This rule is established by paragraph 1 of Art. 172 of the Tax Code of the Russian Federation.

According to the Chart of Accounts, the generated initial cost of fixed assets accepted for operation and registered in the prescribed manner is taken into account on account 01 “Fixed Assets”. The accounting unit for fixed assets is an inventory item, which is assigned the corresponding inventory number (PBU 6/01).

It is allowed to accept for accounting as fixed assets with allocation on a separate sub-account to account 01 real estate objects for which:

- capital investments have been completed;

- the corresponding primary accounting documents for acceptance and transfer have been drawn up;

- documents have been submitted for state registration;

- objects actually in operation.

About this - in paragraph 52 of the Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n. Thus, fixed asset objects are considered registered in the tax period in which the primary accounting documents confirming the date the object was put into operation were drawn up.

Consequently, deductions of “input” VAT amounts when purchasing a fixed asset, accepted for accounting as an independent inventory item, are made in the tax period in which the following conditions are simultaneously met:

- accepting an object for registration as a fixed asset;

- availability of an invoice for this object, drawn up in accordance with the requirements provided for in paragraphs 5 and 6 of Art. 169 of the Tax Code of the Russian Federation.

In this regard, in the case of the acquisition of fixed assets, tax deductions are made after they are registered as fixed assets, that is, to account 01 “Fixed assets”.

You will find such explanations in Letters of the Ministry of Finance of Russia dated October 28, 2011 N 03-07-11/290, dated August 2, 2010 N 03-07-11/330, dated September 21, 2007 N 03-07-10/20.

Tax officials express a similar opinion (Letters of the Federal Tax Service of Russia dated 04/05/2005 N 03-1-03/530/ [email protected] , Federal Tax Service of Russia for Moscow dated 10/02/2007 N 19-11/093494).

It should be noted that there are court decisions supporting this position. Thus, in Resolution dated February 22, 2012 N A40-56010/11-91-242, the Moscow District Federal Antimonopoly Service indicated that the company had the right to deduct after putting objects into operation and transferring them from account 08 “Investments in non-current assets” to account 01 "Fixed assets". It is at this moment that the conditions established by Art. Art. 171, 172 of the Tax Code of the Russian Federation, to submit VAT for deduction:

- there were invoices;

- fixed assets are registered;

- facilities have been put into operation;

- their use has begun to carry out transactions subject to VAT.

The same conclusions are contained in the Resolution of the Federal Antimonopoly Service of the Volga Region dated September 30, 2010 N A12-24919/2009.

Checking the calculation of “input” VAT for deduction when purchasing fixed assets in 1C 8.2

Step 1. Reconciliation of the balance of “input” VAT on fixed assets that have not been put into operation, in the context of accounting records

When purchasing fixed assets, assets are debited to account 08.04. When putting the operating system into operation, they transfer their value from the credit of account 08.04 to the debit of account 01.01. Thus, for fixed assets that have not been put into operation, at the end of the period there remains an account balance of 08.04.

In order to view the balance on account 08.04, you can create a turnover balance sheet for the account in the context of fixed assets. From the SALT it is clear that two fixed assets have not been put into operation, therefore the “input” VAT, which was recorded on account 19.01 for these objects, should also be recorded as a balance on this account.

To check, we will create a balance sheet for account 19.01 for counterparties and receipt documents. You can reconcile the balance of “input” VAT on operating systems that have not been put into operation in different ways: by reconciling with primary documents; arithmetic way, etc.

Let's check the data using our example:

- Let's check the balance of the “input” VAT on account 19.01 arithmetically:

- Account balance 08.04 = 46,525.42 rubles. - price without VAT;

- Calculation of “input” VAT = 46,525.42 * 18% = 8,374.58 rubles.

- The account balance of 19.01 at the end of the period is the same.

- According to the accounting system, operations to deduct “input” VAT on purchased fixed assets are reflected correctly.

Step 2. Reconciliation of the balance of “input” VAT on fixed assets that have not been put into operation, in the context of NU

Potential purchase ledger entries are generated in the VAT accumulation register presented

.

When the OS was received, an entry was made in this register with the form Receipt.

An entry with the type

Expense

is made at the moment the “input” VAT is included in the deduction or the “input” VAT is written off as expenses. Therefore, there must be a balance for “input” VAT on fixed assets that have not been put into operation at the end of the period.

We will generate information reflected in the VAT accumulation register presented

(menu

Reports

–

Other

–

List \ cross-table

– VAT accounting section

presented

). Let's check the data from our example:

- According to the NU, the amount of the balance in the VAT register presented is equal to the balance on account 19.01 according to the accounting system

- NU = BU = 8,374.58 rubles.

- “Input” VAT on received fixed assets in the first quarter was taken into account correctly.

On the PROFBUKH8 website you can read other free articles and video tutorials on the 1C Accounting 8.3 (8.2) configuration:

Full list of our offers:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

What to follow

Initially, the List of technological equipment, components and spare parts for it, analogues of which are not produced in the Russian Federation and the import of which is not subject to value added tax, was approved by Decree of the Government of the Russian Federation dated April 30, 2009 No. 372.

By virtue of Decree of the Government of the Russian Federation dated May 27, 2021 No. 796, from July 2, 2022, this list is valid in a new edition. We'll tell you what changes and whether there are new positions.