13.08.2019

0

1882

4 min.

There are several reasons why you need a 2nd personal income tax certificate upon dismissal. It may be required for submission to government agencies and banking organizations, and may also be needed at a new job. Usually it is included in the package of documents requested by social institutions that award various types of benefits from the state. The basis for issuance is a simple requirement, and the place is the organization where the citizen worked for a certain period of time. He cannot refuse this request; in these cases, he has the right to involve regulatory authorities. Particular attention is paid to the proper execution of the certificate in accordance with accepted standards.

Terminology and essence of the document

The essence of the document is expressed in its unofficial name “certificate of income”. It is submitted annually to the tax service for each employee. In addition, it may be required when obtaining a loan, as well as for calculating state benefits and social benefits. The issuance of certificate 2 of personal income tax upon dismissal and in other cases is carried out at the request of the citizen. This is one of the features of the document, prescribed in the corresponding order. However, the company does not have the right to refuse an employee such a request.

How to write an application for a 2-NDFL certificate

An employee who wants to receive information about wages and deductions from them writes a statement addressed to the head of the organization, in which he indicates:

- Full name of the applicant;

- the period (measured in years) for which a certificate is required;

- date of compilation.

This is what a sample application looks like:

| To the Director of PPT.RU LLC Petrov P.P. from manager Pepetashin P.I. Statement Please provide 2-NDFL (certificate of income and tax amounts of an individual) for 6 months of 2022. | Pepetashin P.I. |

The certificate is issued as many times as necessary upon the employee’s request within a three-year period for which his income is taken into account. It looks like this:

Certificate of income upon dismissal

The dismissal procedure is regulated by the Labor Code of the Russian Federation, in particular the provisions are spelled out in Art. 84. It is indicated here that some documents are issued in person in any case, and others at the request of the employee. The latter also includes personal income tax certificate 2. Its issuance depends on the will of the citizen and necessity. First of all, we are talking about whether a document is required at the new place of work in order to see the level of income of the new employee and the amount of tax deductions for previous periods. This is necessary for the correct calculation of due payments, compensation and benefits.

Functional purpose

First of all, a personal income tax certificate upon dismissal serves as proof that a person had official income during a certain period of time (for which it is issued), and accordingly he paid taxes on it. Taking into account this function, the document is provided to the following authorities:

- Tax Service;

- Banks, when applying for a loan;

- To a new place of employment, where with its help the employer makes the necessary calculations for sick leave, tax deductions, and compensation payments.

It is important to know! As for the issuance and the requirement for it, upon dismissal you can take the certificate immediately. In the future, this will save you from wasting extra time and effort, since the document may be needed at any time.

Displayed information

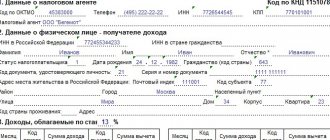

The certificate must take into account several types of information. In particular, correct filling requires indicating:

- The period covered by the document;

- Its serial number and date of compilation;

- Codings of the institution that accepted tax reporting;

- Company data, including its payment details;

- Information about the recipient, including his place of registration (residence), TIN, nationality;

- The estimated rate on the basis of which contributions to the tax authorities were made;

- Monthly income and total amount. This includes wages and income for a certain time;

- Monthly deductions, including taxes, alimony (if any).

As a result, the document is signed by the head of the organization and the chief accountant, a stamp is placed on it and in this form it is transferred to the recipient.

Time frames covered

Typically the time period for which a certificate is issued is 1 year. This is due to the fact that the new company is interested in up-to-date information in order to make the necessary accruals based on it. At the same time, the deadlines may vary - it all depends on the purpose of the document. For example, banks often require quarterly and semi-annual data. In state-owned companies, the period varies depending on the specifics of reporting. In particular, tax authorities request the certificate annually.

Filling Features

The main point is to provide information. This is information about the sources of income on which tax was paid. The form and structure of the document was approved by the Order of the Tax Service of the Russian Federation back in 2015. It contains the main details of the certificate, namely:

- Issuance exclusively to a person who officially received income from the organization;

- The basis is in the form of his appeal;

- Indication of income and deductions in rubles and kopecks;

- Reflection of income tax exclusively in ruble equivalent. Balances above 50 kopecks are rounded to the nearest ruble; smaller amounts are not taken into account.

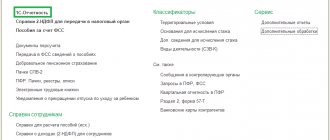

2 personal income tax certificates can be found here.

In this case, the general rules that guide the department or employee providing the certificate are given.

What certificates can you take when leaving your job?

A dismissed employee has the right to request from his employer any certificate related to his work activity, both during the period of work and after dismissal.

The basis for termination of an employment contract does not have any impact on the list of certificates issued - it can be either the employee’s own desire or any other reason (for example, the employer’s initiative, agreement of the parties).

List of certificates that an employee has the right to request at the place of former work upon dismissal:

- Salary information for the last 2 years of work. For registration, standard form 182-N is used. This data will be required to calculate sick leave benefits at your next place of employment.

- An indicator of average earnings used to determine unemployment benefits for it. Information on the average salary for the central labor center is compiled for the last 3 months.

- Certificate 2-NDFL about income. It reflects information about income tax paid on the earnings of a particular citizen and personal income tax deductions provided to him.

- Certificates drawn up according to the forms SZV-STAZH, SZV-M, as well as SPV-2, issued when an employee retires, and calculation of insurance premiums (section 3).

If necessary, the outgoing employee has the right to request other certificates, as well as copies of official papers (for example, a copy of management’s order to terminate the employment relationship).

Applications for certificates can be found in this article.

Issuance procedure and deadlines

The dismissal itself is not the basis for issuance and the certificate is not included in the list with other documents. It is compiled and issued only at the request of the recipient. He does not have to be on the company's staff, i.e. in fact, the agreement of the parties may already be terminated. It is enough for a former (current) employee to notify an employee of the accounting department or human resources department about the need to extradite. Sometimes management is approached with a similar request. The deadlines for preparing 2 personal income taxes after dismissal do not differ from the situation when the citizen is still working in the organization. In all cases they are 3 days.

What to show in 2-NDFL

The form includes information about the amounts of money paid to the employee from January of the current year to the day of termination of the contract.

The certificate includes those payments from which income tax was withheld by the employer. If the payment is not taxable, then it is not necessary to show it in 2-NDFL.

What payments are not shown:

- Severance pay within the limits of three monthly earnings;

- State benefits related to pregnancy, childbirth and raising a child (sick leave is not included here);

- Compensation for damage and some other payments provided for in paragraph 1 of Article 217 of the Tax Code of the Russian Federation.

Actions if the document is not issued upon dismissal

It happens that for one reason or another (conflicts, reluctance to part with an employee, accounting errors, excessive “busyness”) the document is not issued. The best way to be on the safe side is to write a statement. The very fact of its preparation already takes the situation out of the ordinary, since in most cases such requests are oral.

The appeal is written in a free format, and the main task of the compiler is to clearly present the request. In addition, it is important to register an application for the issuance of a 2nd personal income tax upon dismissal. The accounting or human resources department may refuse, then you must send the application by registered mail. In this case, refusal will mean a direct violation of the law with all that it entails, in the form of a complaint to Rostrud and (or) the prosecutor's office.

In this case, a fine is provided, reaching 1-5 thousand rubles for officials, and 30-50 thousand rubles for a company. Sanctions are applied in accordance with Art. 5.27 Code of Administrative Offences.

Is the employer obliged to issue them himself?

When an employee quits, his employer returns his work book and finally pays him off. These procedures are carried out directly on the day of dismissal of a working citizen.

If on the day of termination of the employment relationship the employee does not pick up the work book, the employer must send him a notice of the need to receive it.

If a departing employee requires any paperwork related to his employment, he must contact his employer with the appropriate written request. The head of the organization is obliged to satisfy the request by providing the applicant with certified copies of the necessary documents.

These rules are clearly stated in Part 4 of Art. 84.1 of the Labor Code of the Russian Federation, which regulates the general procedure for compliance with formal procedures when dismissing an employee.

It is mandatory that the management of the organization issues the following official documents relating to work activities to the outgoing employee:

- The work record of this citizen.

- Certificate drawn up in form 182-N. It is used to determine the appropriate hospital benefits intended for an individual and reflects information about his earnings (income received) for the previous 2 years.

- Documentary confirmation of pension contributions and other insurance contributions made in favor of a specific employee.

- Certificate 2-NDFL, which shows the income paid to this person, as well as the amount of income tax withheld and transferred from this income.

The employer prepares and issues other documentation requested by the dismissed citizen within 3 days, counted from the date of submission of the relevant request (it is submitted in writing). This requirement is clearly stated in Part 1 of Art. 62 of the Labor Code of the Russian Federation, which regulates the issuance to an employee of papers relating to his work activity.

Form 182n for calculating sick leave benefits

The certificate, which is issued in standard form 182n, contains information about the income received by employees for the previous two-year period before dismissal.

Such data is taken into account to calculate benefits payable to a citizen in connection with his temporary disability (that is, on sick leave), as well as in connection with maternity (maternity leave). The information indicated in this certificate allows you to calculate the average salary of a person, which, in turn, is needed to determine the amount of the benefit.

As you know, the amount of sick leave benefits is determined based on income received in the last two years preceding the year in which this citizen fell ill. It is necessary to ensure that the relevant data is available, since there is a possibility that the employee will need it at the new place of employment. After all, he may get sick or, alternatively, go on maternity leave.

If the worker does not submit 182n to his new employer before handing over the certificate of incapacity for work, the sick leave benefit will be calculated for him according to the minimum wage, that is, it will be minimal. Such a settlement could result in a significant loss of money owed.

That is why the employee must ensure that this certificate is available in a timely manner. If the employer did not independently issue Form 182n for some reason, you need to request it yourself.

The current form 182 is contained in Appendix No. 1 to Order of the Ministry of Labor of Russia No. 182n dated April 30, 2003, as last amended as of January 9, 2017. This form can be downloaded for free from the link below in Word format.

.

2-NDFL on employee income

Form 2-NDFL reflects information about the employee’s taxable income, personal income tax amounts withheld from him and issued income tax deductions for a specific reporting year.

A working citizen will need this form if he will receive deductions through a new employer (if there are appropriate grounds) or directly through a division of the tax department.

If a citizen applies for this deduction, the actually transferred tax amount, which is indicated in the 2-NDFL certificate, will be legally returned to the applicant citizen.

If the employer himself does not issue 2-NDFL upon dismissal, then in order to receive it, the resigning employee submits an appropriate application to him.

The current 2-NDFL form is approved by Order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated 10/02/2018. This download form is presented below.

.

Is SZV-STAZH needed?

It should be noted that the SZV-STAZH documentary template has been used since 2017. This form contains information about the insurance premiums actually paid for a specific employee.

Upon dismissal, SZV-STAZH is issued to the employee directly on the agreed day of departure. You do not need to make a special request to receive this paper.

If the employer does not issue such a certificate, he may be held accountable (company management is punishable by a fine).

The current SZV-STAZH form is approved by the Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p, you can download it below for free in xls format.

.

What to do if they don’t give you documents?

The resigning citizen must receive a paycheck (all due payments), a work book and additional papers related to work on the day of his dismissal from his place of work. The date of such disposal is always determined in advance.

Some documentation is provided to the departing employee without the requirement to submit a written application. To obtain some certificates (papers), an individual still has to make the necessary request in writing, addressing it directly to the management of the organization.

One way or another, the employer’s refusal to issue mandatory documents and satisfy the request of a resigning employee to provide additional certificates is considered unlawful.

If management does not issue certificates upon dismissal, you will have to answer according to the law if the retiring employee, whose rights have been infringed, wishes to implement the appropriate procedure:

- The applicant prepares a written request to receive the required papers and addresses it to the company management. Such a paper can be drawn up in two copies by submitting it through the director’s office. In this case, the applicant’s copy must bear the secretary’s acceptance mark. Another way is to send this request by mail, that is, by registered mail (the sender is notified that this letter has been sent to the addressee).

- If the employer does not respond adequately within three days, the applicant can send a corresponding complaint to the competent authority - the labor inspectorate or the prosecutor's office. Alternatively, you can transfer this complaint to both government agencies at once. The paper can be delivered in person, by mail or online.

- The complaint is considered by the regulatory government agency within 30 days, counted from the date of its receipt.

- After considering the complaint, government agencies will conduct a proper investigation. The employer will be brought to appropriate administrative liability (if his guilt is officially established and confirmed).

Rules for document execution

Before issuing a certificate, you should decide what financial information needs to be included in it. In order not to be confused with which amounts are included and which are excluded from the form, you should understand the main thing - only information that is subject to taxation is recorded.

The following material payments cannot be taken into account:

- A benefit paid in the event of staff reduction or liquidation of an enterprise.

- State compensation for time on maternity leave and parental leave.

- Compensation for moral or physical harm caused.

- Other amounts not subject to income tax.

When filling out the form itself, indicate the following information step by step:

- The year for which information is provided.

- Serial number of the form and date of registration.

- Code of the tax authority where information about the tax paid is submitted.

- Details of the employer as a legal entity.

- Information about the dismissed person, his full name, Taxpayer Identification Number, citizenship and residential address.

- The tax rate at which deductions are made.

- Income monthly and total.

- Deductions made each month from accrued amounts.

The certificate is certified by the chief accountant of the enterprise and its director. The signatures are sealed, after which the document is handed over to the employee.