Accounting under the simplified tax system

Accounting in organizations using the simplified tax system is mandatory.

Most often, they belong to small businesses (SMB), and have the right to carry out accounting in a simplified form. In addition, they keep books of income and expenses, which for this taxation system are tax registers. Read about the nuances of accounting under the simplified tax system in the article “Procedure for maintaining accounting under the simplified tax system (2020)”

An accounting register, which is an attribute of both complete ordinary and complete simplified accounting, is understood as a document in which all transactions are systematized by accounts and recorded in chronological order. For example, in account 51, a register is needed so that it can be seen for what purposes the funds were used.

The register forms are approved by the director of the company (Clause 5, Article 10 of Law No. 402-FZ).

The information summarized in the registers is transferred to the turnover sheet, and then to the financial statements. To record information in full simplified accounting, simplified accounting forms can be used - statement forms (Appendices 2–11 to Order of the Ministry of Finance dated December 21, 1998 No. 64n).

When using abbreviated or simple simplified accounting, instead of registers, they use a book for recording the facts of economic activity (Appendix 1 to the order of the Ministry of Finance dated December 21, 1998 No. 64n), and to record wages - form B-8 (Appendix 8 to the order of the Ministry of Finance dated December 21, 1998 No. 64n).

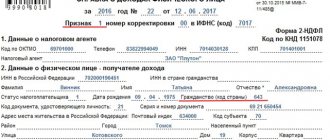

The report on the simplified tax system is prepared in a declaration in the form approved by order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/ [email protected]

For information about when you need to submit a “simplified” declaration, read the article “What are the deadlines for submitting a declaration under the simplified tax system?” .

For the declaration form and a sample of how to fill it out, see the article “Declaration under the simplified tax system for the year - how to fill it out?”

Before calculating tax in an accounting program, it is important to calculate it correctly. ConsultantPlus experts explained in detail how to do this. Full trial access to K+ is available for free. If you apply the simplified tax system “income”, this ready-made solution will help you, and if “income minus expenses” - then this material is for you.

When are “simplifiers” required to pay the minimum tax?

The obligation to pay the minimum tax is provided only for “simplified” people who have chosen the object of taxation “income minus expenses”, so further we will talk only about this part of organizations and individual entrepreneurs using the simplified tax system.

The procedure for calculating the minimum tax is established by Art. 346.18 Tax Code of the Russian Federation.

All “simplifiers” are required to calculate the minimum tax. Then it is necessary to compare the amount of tax accrued in the general order with the amount of the minimum tax: the larger of them is subject to payment to the budget. Thus, the minimum tax is paid in the case when for the tax period the amount of tax calculated in the general manner is less than the amount of the calculated minimum tax.

Note:

The taxpayer has the right in the following tax periods to include the amount of the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner into expenses when calculating the tax base, including increasing the amount of losses that can be carried forward to the future.

Let us recall the basic rules for calculating the minimum tax:

- the minimum tax is calculated only for the tax period, which is a calendar year;

- tax rate – 1%;

- tax base – income determined in accordance with Art. 346.15 Tax Code of the Russian Federation.

There is one exception to this rule.

By virtue of para. 1 clause 4 art. 346.20 of the Tax Code of the Russian Federation, the laws of the constituent entities of the Russian Federation may establish a tax rate paid in connection with the application of the simplified tax system in the amount of 0% for taxpayers - individual entrepreneurs registered for the first time after the entry into force of these laws and carrying out entrepreneurial activities in production, social and (or) scientific fields, as well as in the field of consumer services to the population.

The named taxpayers have the right to apply a tax rate of 0% from the date of their state registration as individual entrepreneurs continuously for two tax periods. The minimum tax provided for in paragraph 6 of Art. 346.18 of the Tax Code of the Russian Federation, in this case it is not paid.

Since a number of constituent entities of the Russian Federation have adopted relevant laws, individual entrepreneurs who meet the stated requirements have the right not to pay the minimum tax based on the results of the tax period (letters of the Ministry of Finance of Russia dated August 27, 2015 No. 03-11-11/49542, dated February 16, 2016 No. 03-11 ‑11/8498).

For organizations and individual entrepreneurs that do not fall under the exception, we will continue talking about the minimum tax.

From the above rules it is clear that the minimum tax is payable at the end of the tax period in the following cases:

- when a loss is received, that is, there is no tax base - income taken into account under the simplified tax system is less than the expenses taken into account under the simplified tax system;

- when there is neither profit nor loss, that is, the tax base is zero - income is equal to expenses;

- when there is a taxable base, but the excess of income over expenses is insignificant.

Let us illustrate what has been said with specific examples.

Example 1.

An organization applying the simplified tax system with the object of taxation “income minus expenses” received the following results for 2015 (income and expenses were calculated according to the rules established by Chapter 26.2 of the Tax Code of the Russian Federation):

- income – 5,500,000 rubles;

- expenses – 5,700,000 rub.

Tax rate – 15%.

Is it necessary to pay a minimum tax in this case?

The tax calculated in the general manner is equal to 0 rubles, since a loss was incurred.

There is no tax base: (5,500,000 - 5,700,000) rub. < 0

Minimum tax: RUB 5,500,000. x 1% = 55,000 rub.

A minimum tax of 55,000 rubles is subject to payment to the budget.

Example 2.

An organization applying the simplified tax system with the object of taxation “income minus expenses” received the following results for 2015 (income and expenses were calculated according to the rules established by Chapter 26.2 of the Tax Code of the Russian Federation):

- income – 5,500,000 rubles;

- expenses – 5,500,000 rub.

Tax rate – 15%.

Is it necessary to pay a minimum tax in this case?

Tax calculated in the general manner: (5,500,000 - 5,500,000) rub. x 15% = 0 rub.

Minimum tax: RUB 5,500,000. x 1% = 55,000 rub.

A minimum tax of 55,000 rubles is subject to payment to the budget.

Example 3.

An organization applying the simplified tax system with the object of taxation “income minus expenses” received the following results for 2015 (income and expenses were calculated according to the rules established by Chapter 26.2 of the Tax Code of the Russian Federation):

- income – 5,600,000 rubles;

- expenses – 5,500,000 rub.

Tax rate – 15%.

Is it necessary to pay a minimum tax in this case?

Tax calculated in the general manner: (5,600,000 - 5,500,000) rub. x 15% = 15,000 rub.

Minimum tax: RUB 5,500,000. x 1% = 55,000 rub.

A minimum tax of 55,000 rubles is subject to payment to the budget.

From the above examples it is clear that the amount of the minimum tax does not actually depend on the financial results obtained as a result of entrepreneurial activity and is of a fiscal nature.

“Simplers” tried to challenge the constitutionality of paragraph 6 of Art. 346.18 of the Tax Code of the Russian Federation, filing a complaint with the Constitutional Court (Determination of the Constitutional Court of the Russian Federation dated May 28, 2013 No. 773-O). According to the taxpayer, the contested legal provision establishes the obligation to pay the minimum tax when using the simplified tax system, thereby not taking into account the real results of business activities and imposing an excessive tax burden.

But the Constitutional Court rejected the applicant, noting that the contested norm of the Tax Code of the Russian Federation, being aimed at creating an appropriate regulatory framework for taxpayers to fulfill their constitutional obligation to pay tax (in this case, the minimum tax levied in connection with the use of the simplified tax system), cannot in itself be considered as violating the constitutional rights of the applicant.

Representatives of the Federal Tax Service share a similar opinion in Letter No. SA-4-7/23263 dated December 24, 2013, recalling that the transition to the simplified tax system is voluntary for the taxpayer.

Thus, “simplified” people who have chosen the object of taxation “income minus expenses” are obliged to calculate the minimum tax at the end of the tax period, compare it with the tax calculated in the general manner, and pay the larger of them to the budget.

Accounts used in transactions for calculating tax under the simplified tax system

The reliability of the compiled balance sheet depends on the correctness of the reflection of the company’s economic activities in the accounting documents. This is ensured by accounting entries accompanying each financial transaction. Each fact of the company’s economic life must be recorded in its own way. This will create a perfect balance.

To organize using the simplified tax system, you need to correctly reflect costs and income in accounting. To generate transactions for the accrual and payment of income tax (for both options), the following accounts are used:

- account 51 - all transactions on receipt and debit of funds are recorded on it;

- account 68 - accrue income tax, including quarterly advances on it; records for other taxes are also made here;

- account 99 - reflects the amount of accrued simplified tax.

When calculating the simplified tax system, the following posting is used:

Dt 99 Kt 68.

For completeness of accounting, this entry must be recorded on December 31 of the reporting year so that it is included in accounts payable in the balance sheet at the end of the reporting year.

The tax has been calculated according to the simplified tax system - we make the posting

Upon completion of each business transaction, the accountant reflects this fact with an accounting entry. The accounts used depend on the chart of accounts adopted by the company.

To keep records of various taxes, subaccounts are allocated in account 68. Their list must be specified in the accounting policy, guided by clause 4 of PBU 1/2008.

Account 68 can be divided into several sub-accounts, for example:

68.1 - calculations for the simplified tax system;

68.2 - calculations for personal income tax, etc.

A situation is possible when, at the end of the year, the total income tax turns out to be either more than the actual tax amount or less. In the first case, the tax amount must be added, in the second, it must be reduced. The wiring is as follows:

- simplified tax system accrued (posting for advance tax payment) - Dt 99–Kt 68.1;

- tax advance is transferred - Dt 68.1 - Kt 51;

- for the year, additional tax was accrued to the simplified tax system - posting Dt 99 - Kt 68.1;

- the tax according to the simplified tax system for the year was reduced (the excessively accrued advance was reversed) - reversal Dt 99 Kt 68.1.

The total amount of tax accrued for the year according to the declaration must be equal to the amount reflected in the accruals for the same period in accounts 99 and 68.1. If more advances are transferred than the tax accrued for the year, then the overpayment amount can be returned.

For information on how to write an application for a refund of overpaid tax, read the article “Sample application for a refund of overpaid tax .

How an LLC uses the simplified tax system to keep records of income and expenses, as well as what kind of reporting to submit, read in the Typical situation from ConsultantPlus. And if you are close to losing the right to use the simplified tax system, find out how the limits have changed since 2022 by studying the explanations of ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

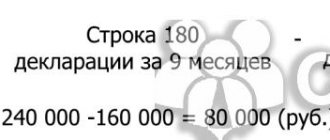

Tax calculation 2nd quarter - example with advance payment

Let's look at an example of calculation for the next quarter.

The amount of the advance payment of the previous quarter already appears here - this is the amount of tax for the previous period.

We calculate using the same algorithm, additionally subtracting the advance payment.

Results

Reflection in accounting of accrued tax under the simplified tax system is reflected in synthetic accounts 99 and 68. To maintain analytical accounting for synthetic accounts 68, 99, separate sub-accounts are opened, which must be indicated in the working chart of accounts and approved by the head of the organization (clause 4 of PBU 1/2008 ).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.